Mortgage Rate Data Deluge 🏠📉🔒 (JAN 19)

Here is a deluge of mortgage rate data to start your week!

Included this week are the following sections:

MARKET RECAP ⏪

------------------

Last week mortgage rates bounced off multi-year lows but held their ground well in the face of inflation data and geopolitical drama.

Despite the slight pullback, mortgage rate prices are still hovering 14-bps below the 2025 low set on October 21.

See more in the Rate Price Index section below.

PRICE IN-STABILITY 💰

------------------------

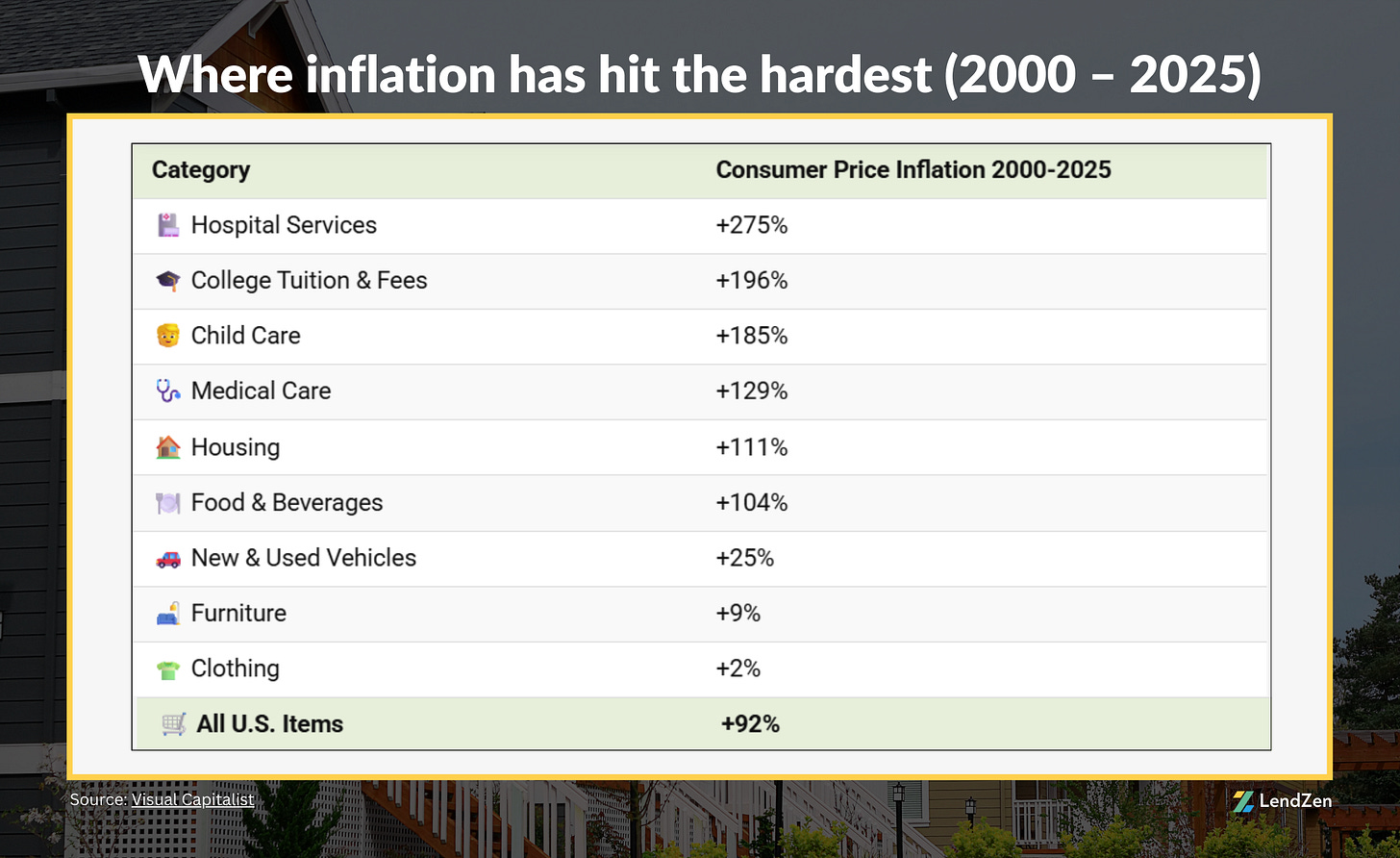

The Federal Reserve has a dual mandate to maintain price stability and maximum employment.

If The Fed considers 2% annual inflation to be “stable” then how do they explain this. 👇

RATE PRICE INDEX 📉

----------------------

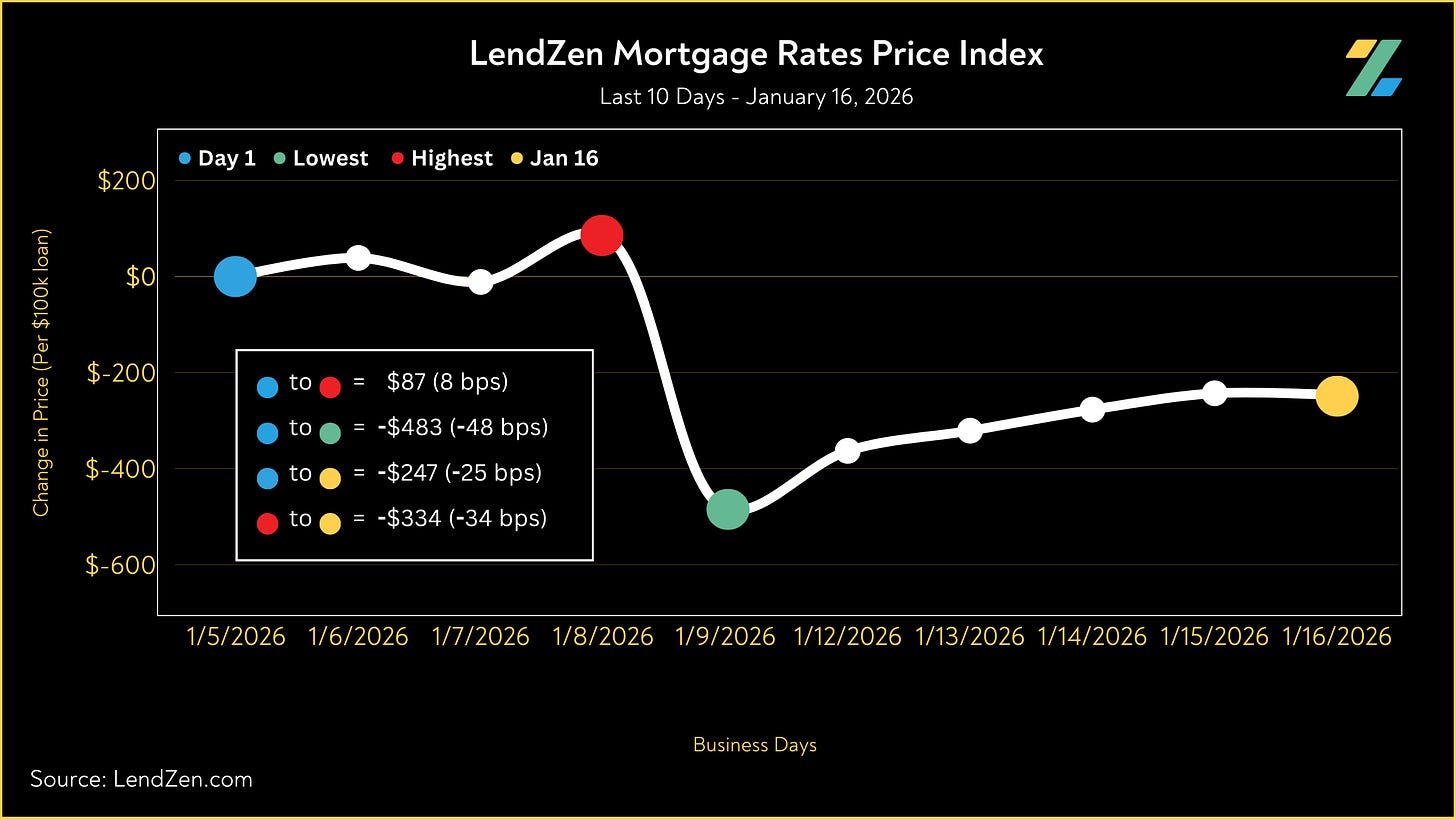

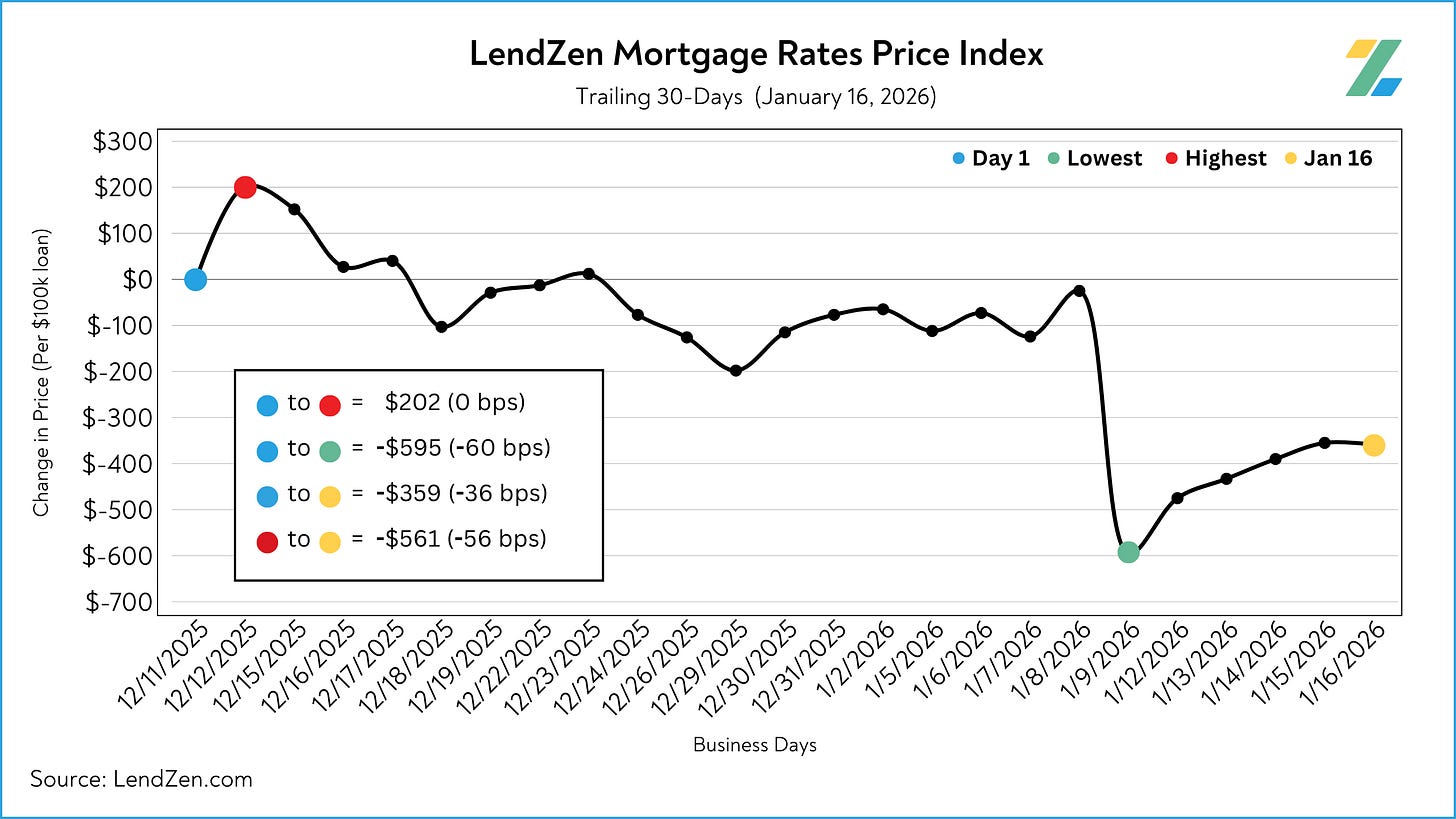

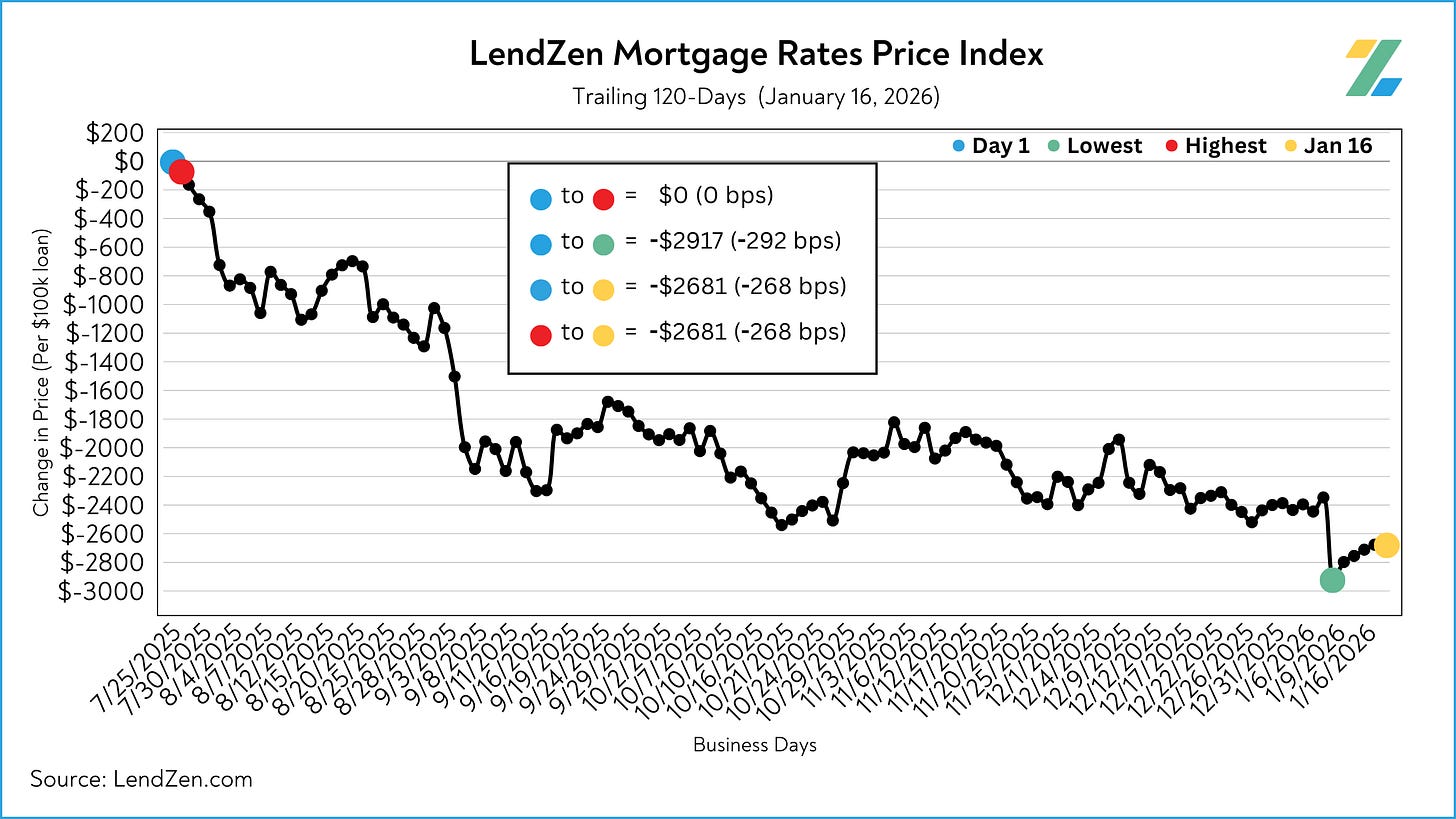

Mortgage rates DO NOT rise or fall.

The full range of rates is always available, and instead the price of each rate changes based on the trading of individual mortgage bonds.

The LendZen Index calculates a daily change in the price of mortgage rates by tracking a spectrum of mortgage-backed securities (MBS).

This provides borrowers with a more specific measurement of how the cost to obtain a mortgage is changing, regardless of the lender, rate, or credit score.

-----------

01/16/2026

-----------

24-Hour: -1 bps (-$4 per $100K)

5-Day: +12 bps ($116)

10-Day: -25 bps (-$247)

30-Day: -36 bps (-$359)

60-Day: -14 bps (-$141)

120-Day: -268 bps (-$2681)

Mortgage rate prices inched higher last week after reaching a multi-year low on January 9.

Prior to Trump’s MBS purchase proposal mortgage rates were sideways and looking for new direction.

When we zoom out further there has been a lot of bullish momentum for bonds that suggests the current range has staying power.

THE TRACKER 🔭

----------------

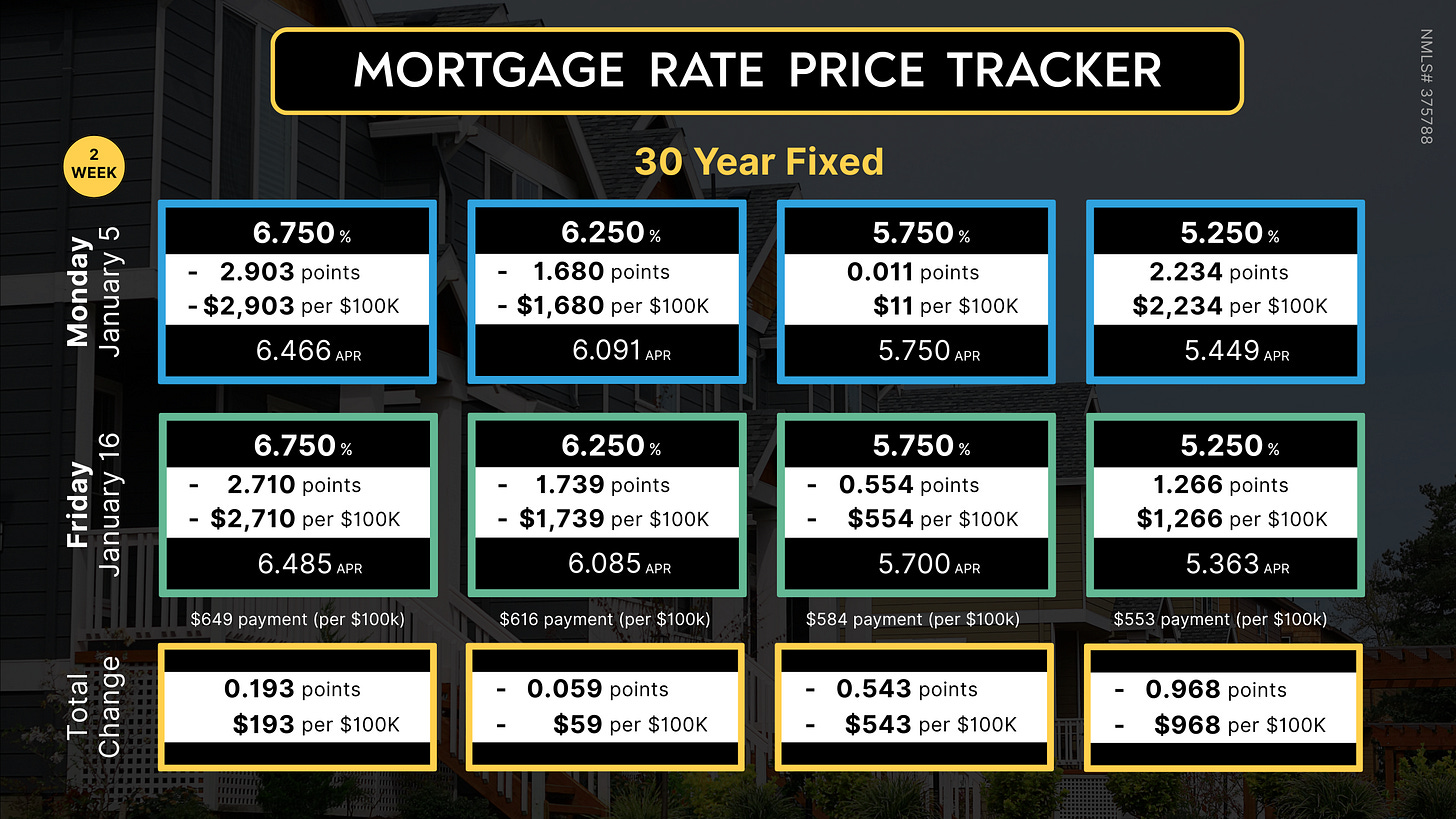

The LendZen Index monitors the change in price across a broad set of rates and mortgage bond coupons, whereas the Mortgage Rate Price Tracker is more “rate and loan program” specific.

Both are an example of how mortgage rates do not rise or fall, but instead it is their price that changes.

Since the LendZen Index has a variety of time series, the MRPT focuses on the current month’s activity.

You can explore the full results from January Week 2 on this Substack post.

MBS PRICING 🏦

----------------

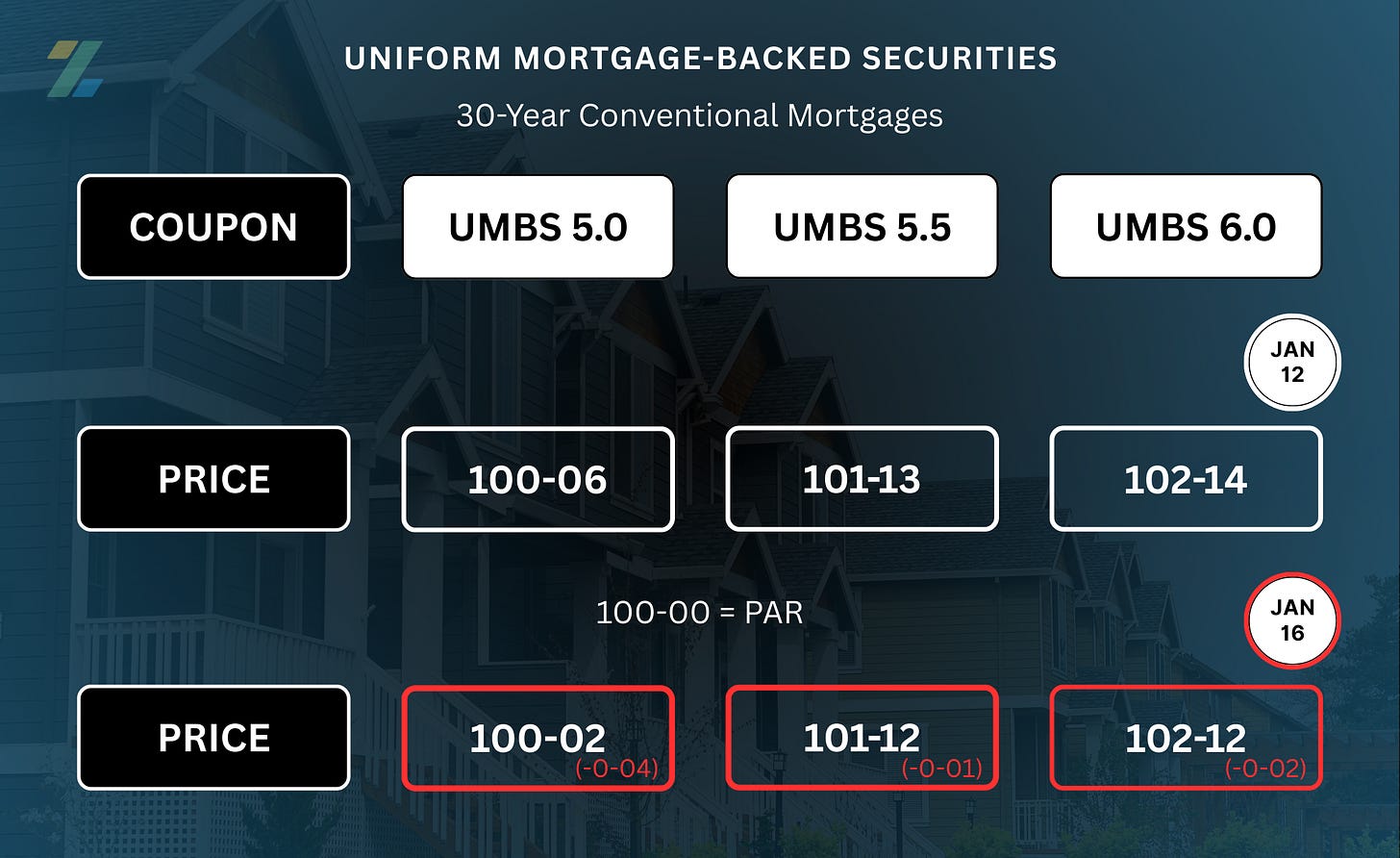

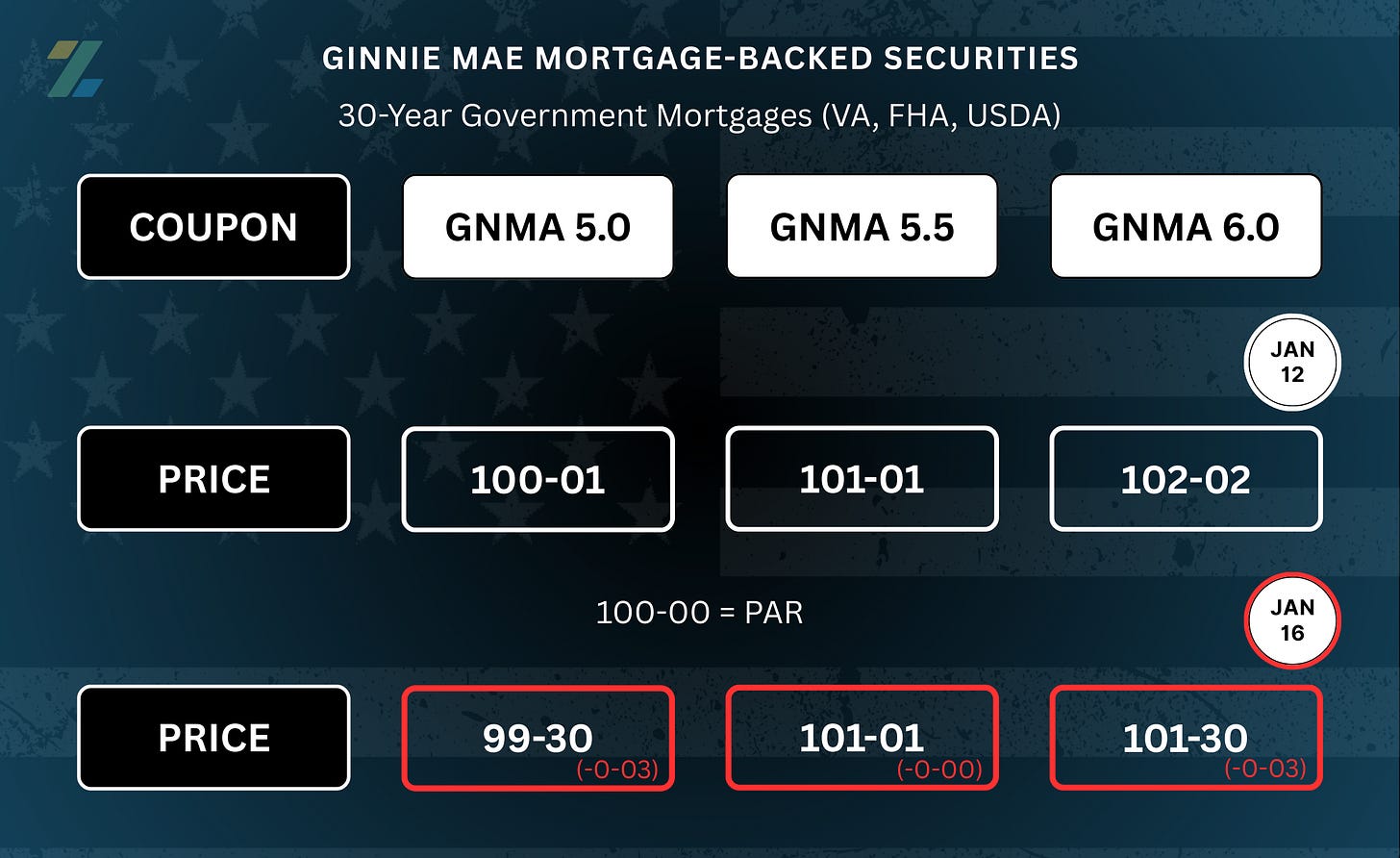

MBS coupons are sold at half-percent increments, while their price moves in 32nds (ticks).

ex. (0-04) = 4/32 = 12.5 bps

100-00 acts as the starting line, also referred to as PAR.

The higher the coupon price, the less expensive the rates will be that are sold into that security.

Therefore, an increase in the price of mortgage bonds is good for mortgage rates.

Learn more about the dynamics of MBS pricing and how it impacts your mortgage options in any of the bi-weekly “Rate Snapshot” Substack posts.

Bond prices drifted slightly lower last week, which is why the LendZen Index shows a slight uptick in the price of mortgage rates.

MORTGAGE SPREADS 🧈

-------------------------

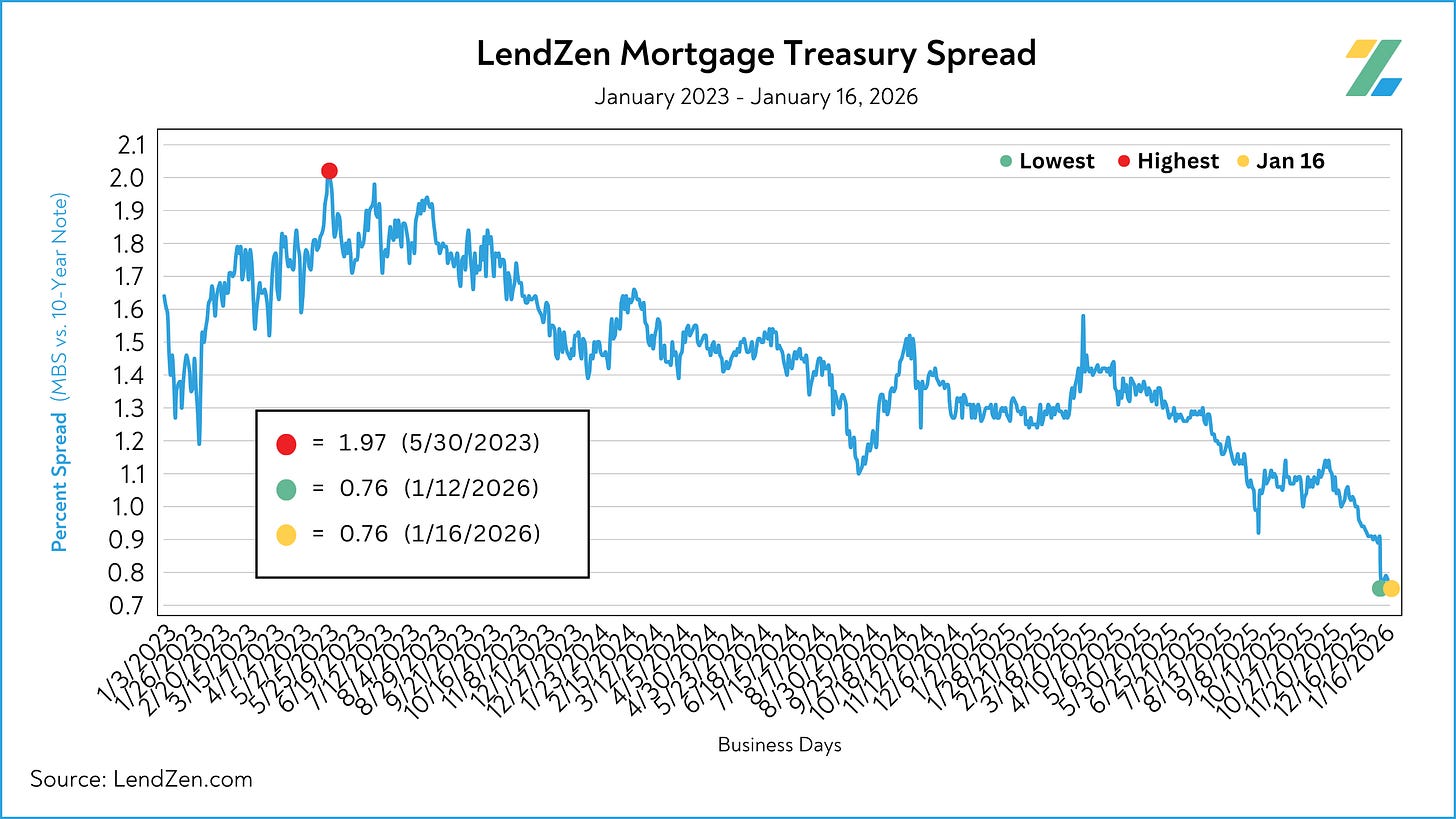

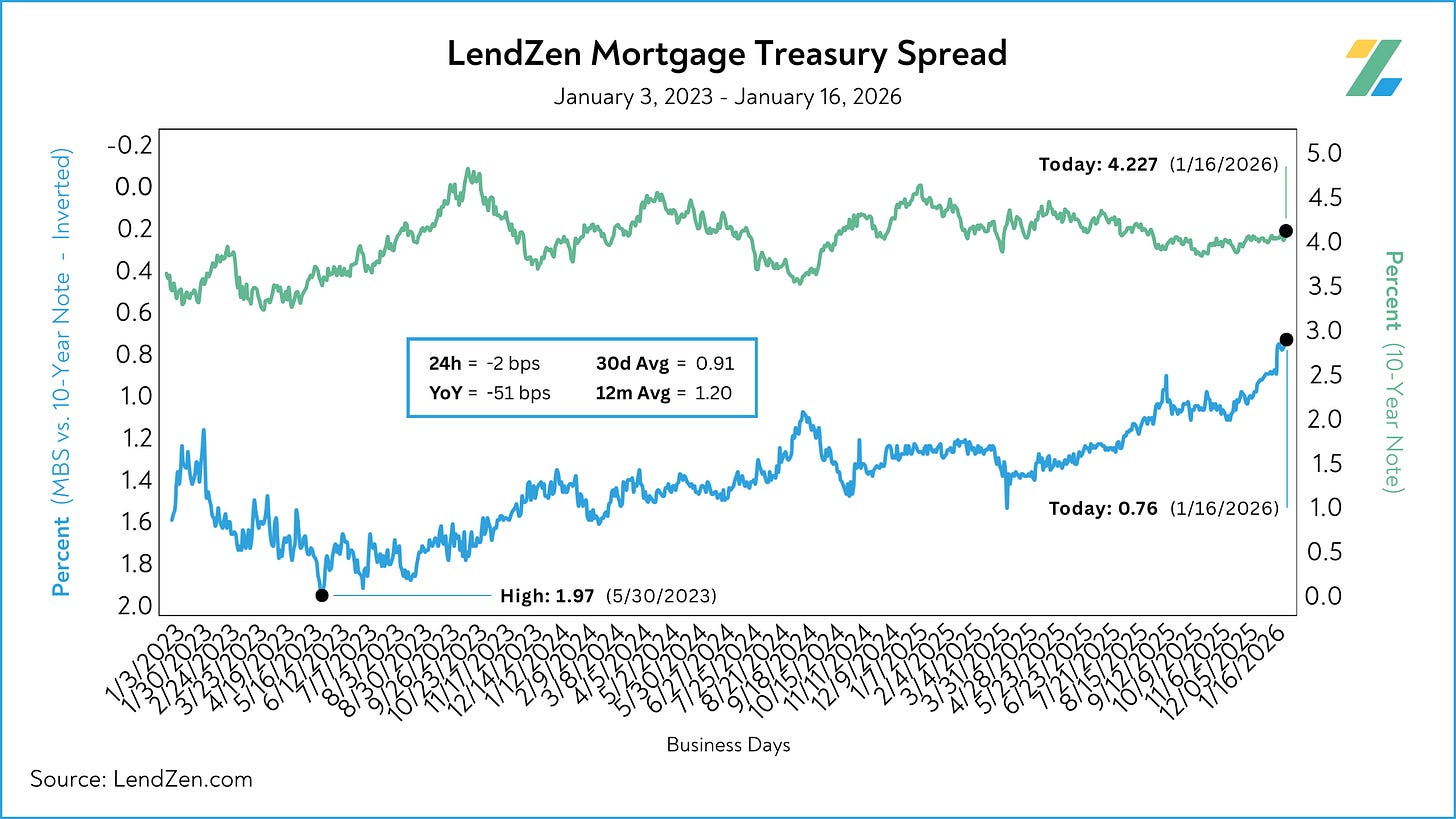

Published daily with the LendZen Index is the LendZen Mortgage-Treasury Spread.

The LMTS uses actual bond yields to create a historically consistent, and reliable, data set.

Learn more about the importance of accurately calculating spreads on this Substack post.

The spread between mortgage bonds and the U.S. 10-Year was unchanged during the week, holding onto a multi-year low.

Jan 16: 0.76

Jan 12: 0.76

5d: -0 bps

30d Avg: 0.91

12m Avg: 1.20

YoY: -51 bps

MBS-Treasury spreads have compressed significantly since Trump’s “$200B” announcement, tightening to the lowest levels in years despite the 10-Year’s reluctance to fall below 4%.

HOUSING DATA 🏠

------------------

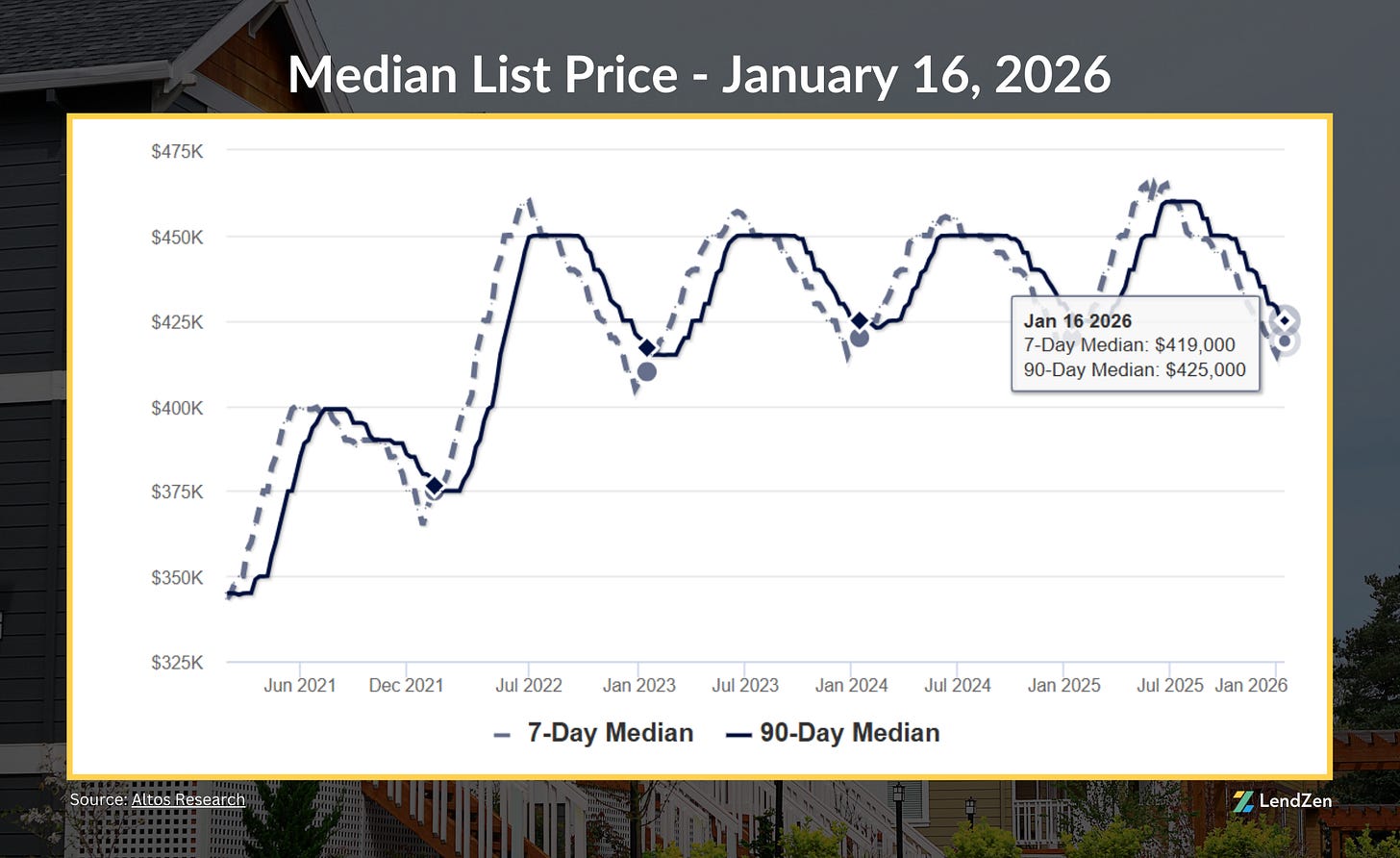

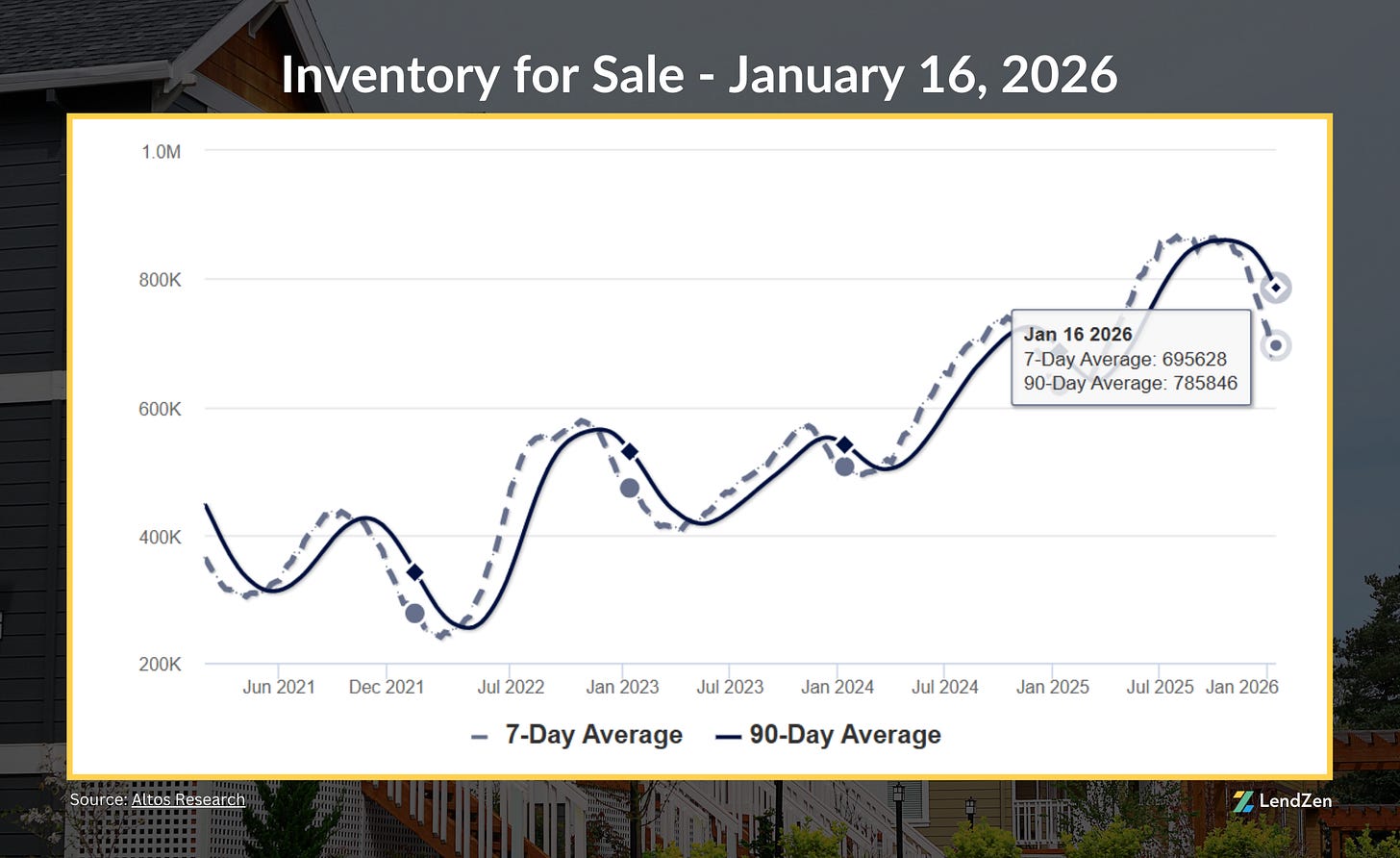

Here are the latest housing market stats, with trends from the last 90 days.

The U.S. median list price is $419,000, up by 1-percent (0.96%) since the beginning of the year.

Inventories continue to shrink, down 19% (167K units) in the last 90-days.

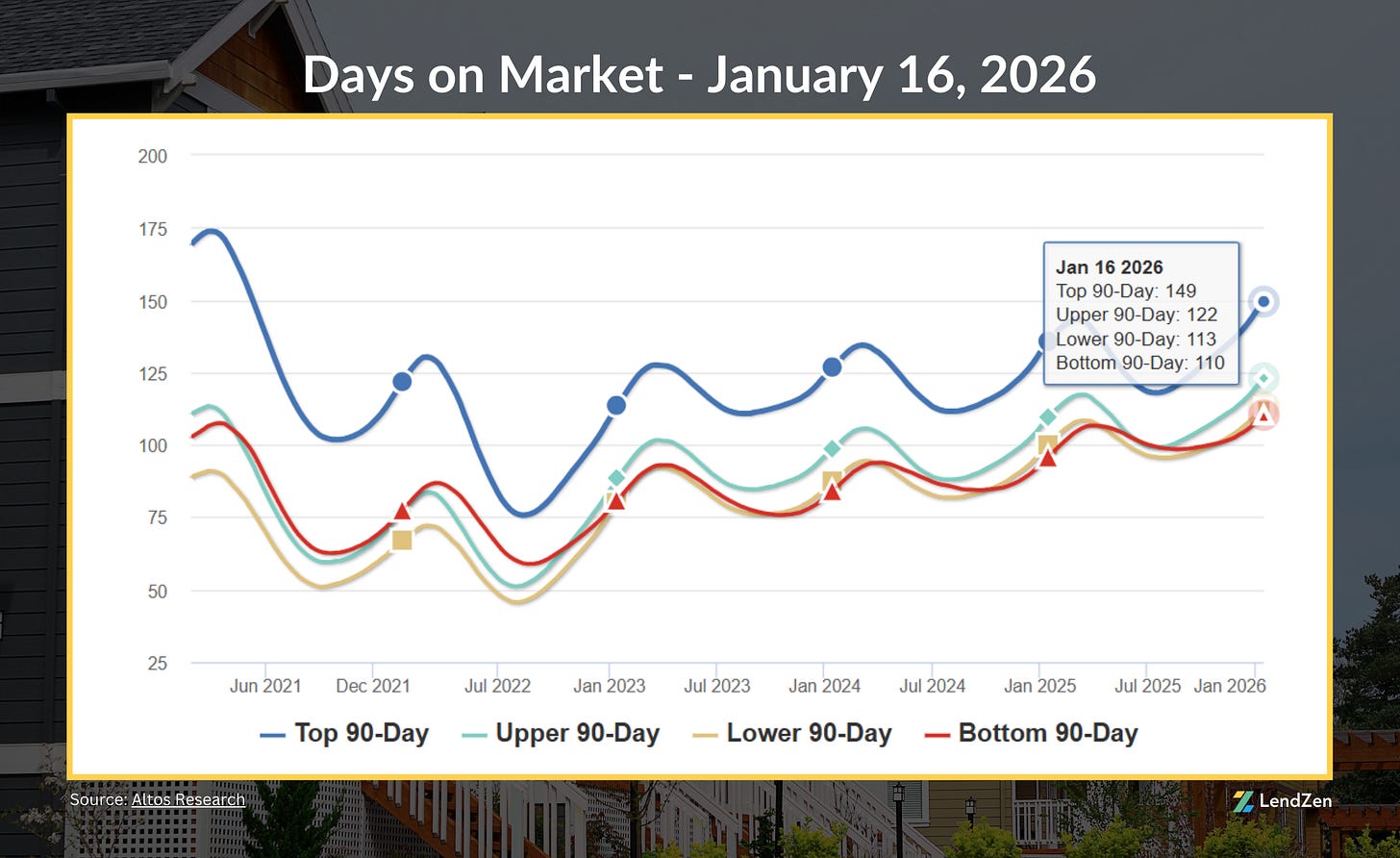

Days on market is down 3 days from the first week of January, with an average of 133.

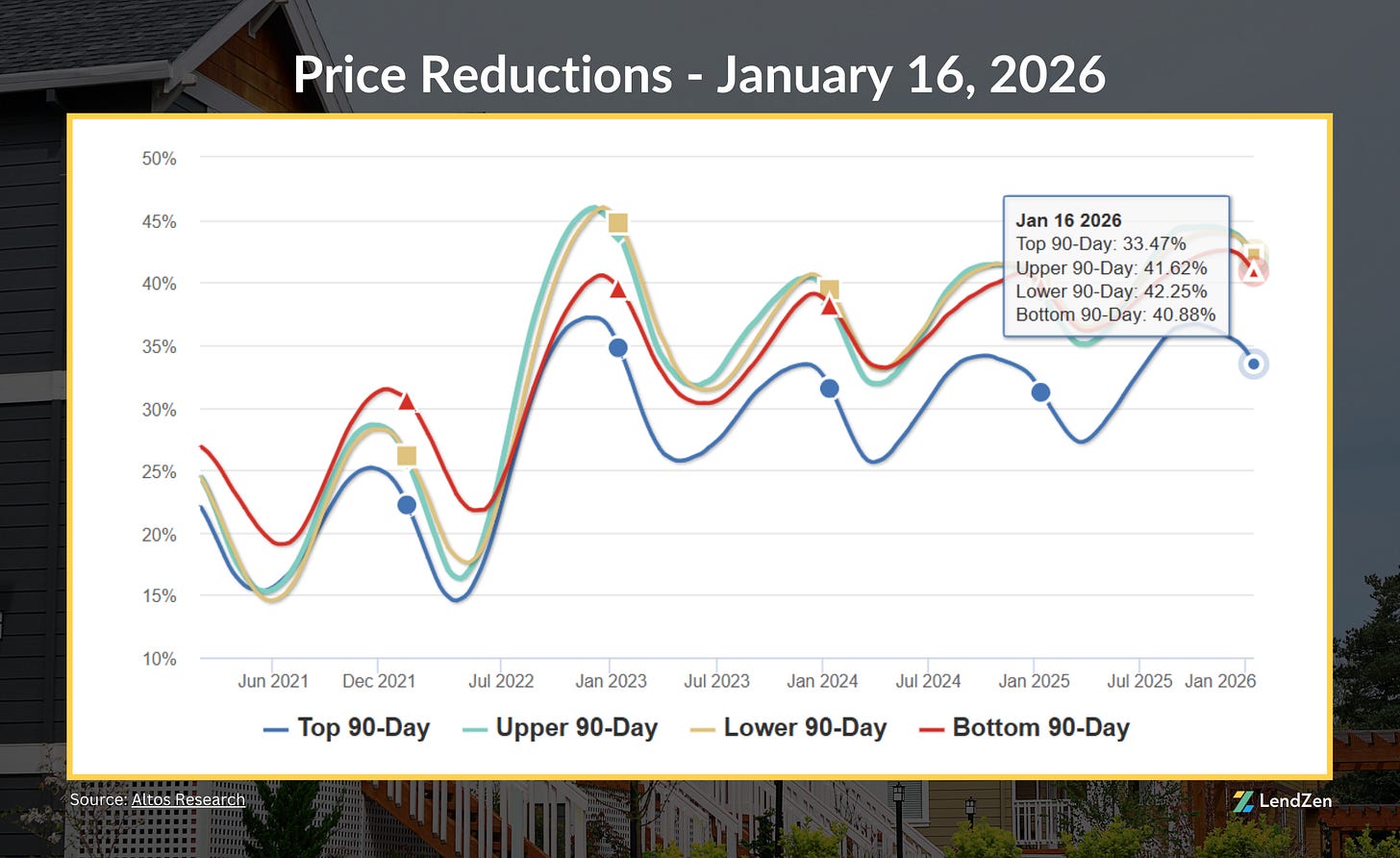

Price reductions continued to slow with a 90-day national average of 34%.

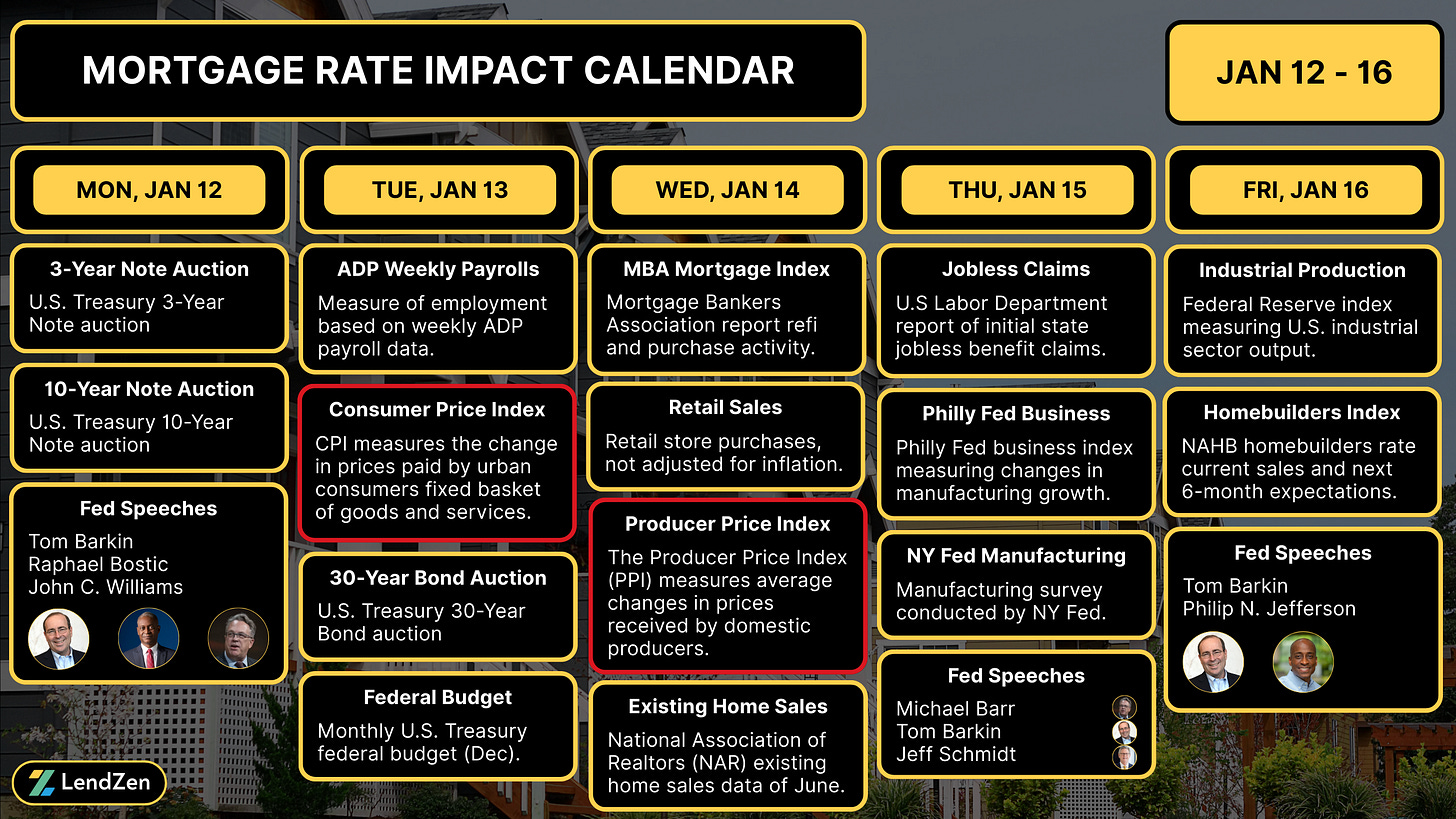

WEEK AHEAD 📅

----------------

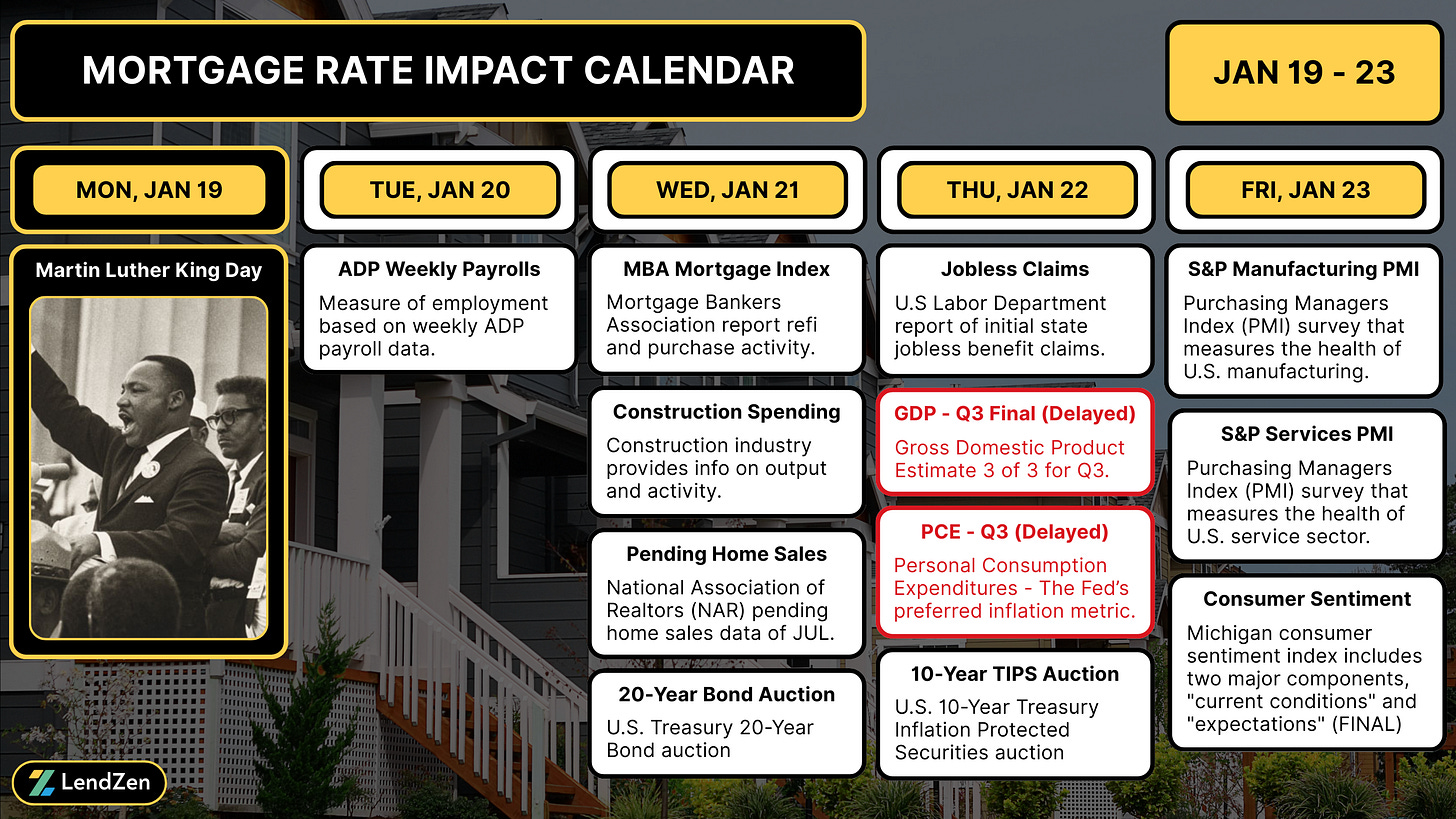

Martin Luther King Jr. Day is on Monday, shortening the week with very little on deck until Thursday, which includes a previously delayed Personal Consumption Expenditures report from Q3.

PCE is the Fed’s preferred inflation gauge, so it will provide most of the week’s volatility.

Read more in yesterday’s Week Ahead.

RATE LOCK GUIDE 🔒

---------------------

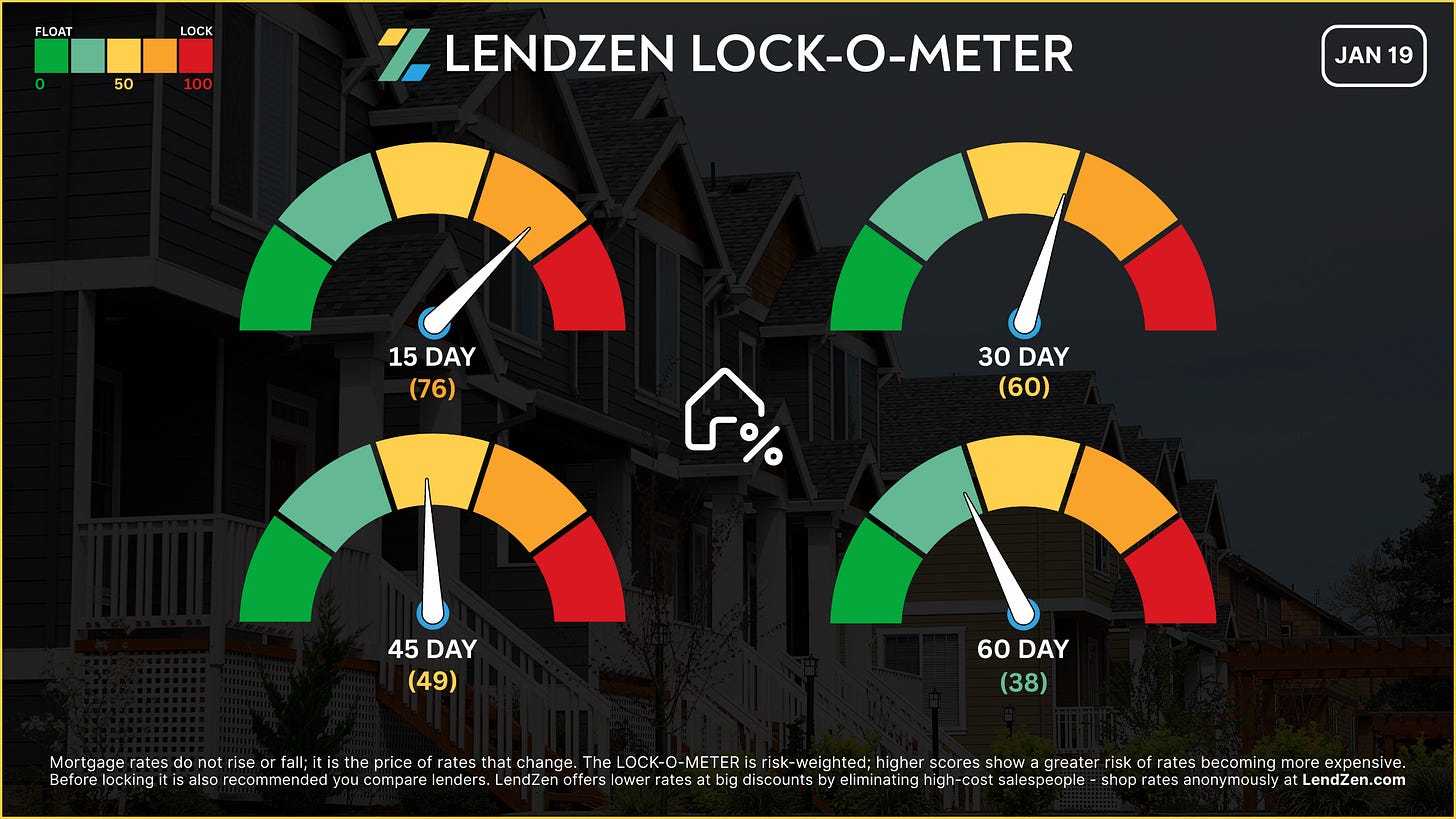

The LendZen LOCK-O-METER provides borrowers with a risk-weighted score based on how various macroeconomic events, including market data, central bank announcements, and geopolitics, each historically impacts the price of bonds.

higher risk scores = lean towards locking

------------------

Closing Window

------------------

[ 15 Days ] -- 76 🟠

The Fed-preferred inflation gauge (PCE) and Q3 GDP data could break the calm, especially after last week’s bond shakiness. This combined with the uptick in geopolitical turmoil elevates risk short-term.

[ 30 Days ] -- 60 🟡

MBS-Treasury spreads remain favorable, but again geopolitics and inflation data creates some uncertainty, but risks are moderate from the current macro perspectives.

[ 45 Days ] -- 49 🟡

The trend continues to support floating for borrowers with more time to play the market, but do so with caution as geopolitics is likely to remain an outlier.

[ 60 Days ] -- 38 🟢

The big picture bond rally is well intact despite some small technical speed bumps, which exist mostly on Treasury bond charts. Trump back peddling on the $200B MBS purchase proposal is one of a few things that could send mortgage rates scrambling enough to pose a threat to the poise bonds have shown since Q3.

If you are already in a strong position locking generally makes the most sense, especially for shorter windows, since the focus should be on making a savvy rate choice based on your longer-term rate outlook.

I expand on this “long game” approach in this Substack post.

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.