Mortgage Rate Price Tracker 🏠📉🔍 (JAN 5 – 16)

Monitoring the change in price of specific mortgage rates

Included in this post are the following:

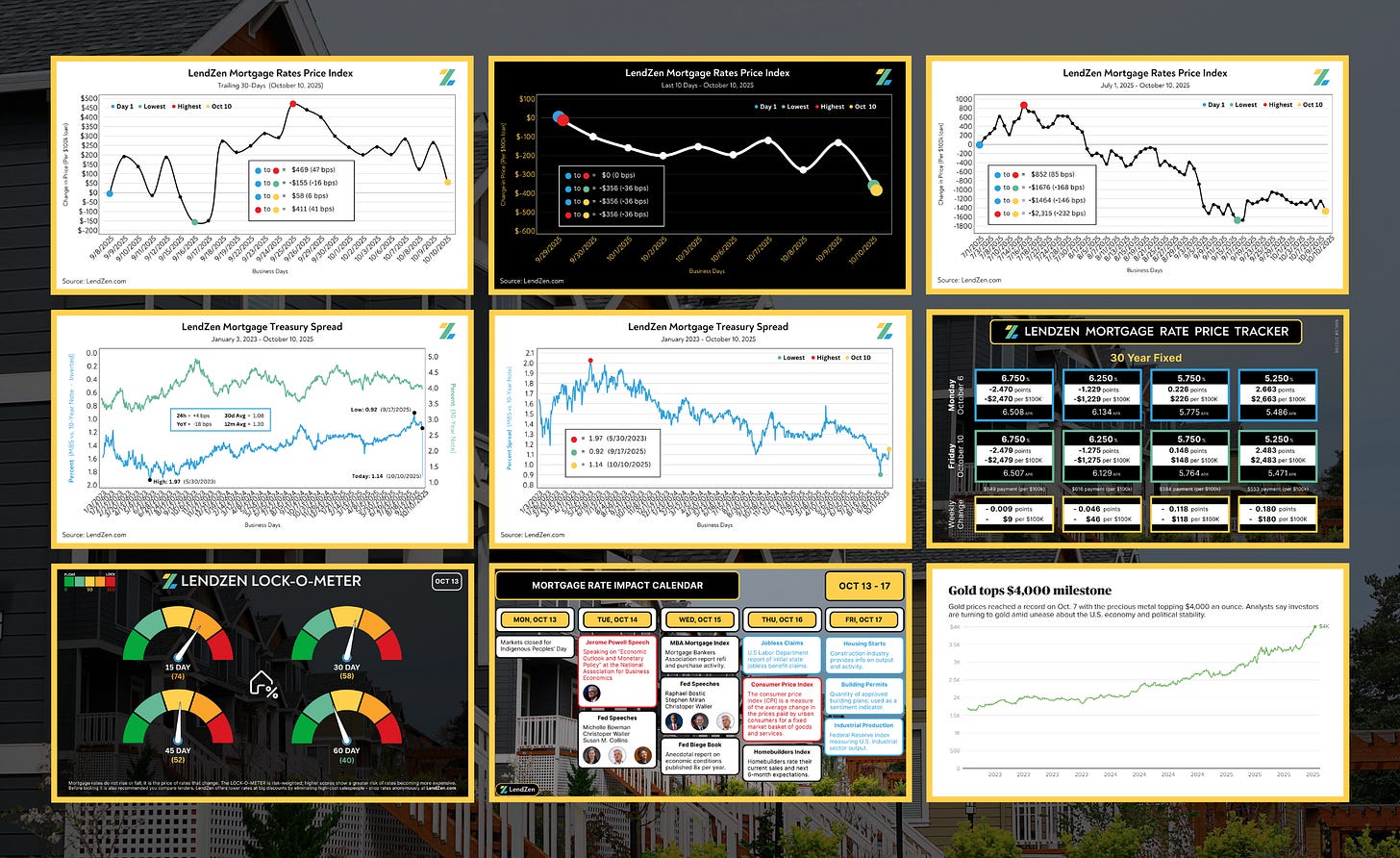

THE TRACKER 🔭

----------------

Most mortgages are sold into mortgage-backed securities (MBS) and the price of these bonds determines rates for all banks and lenders.

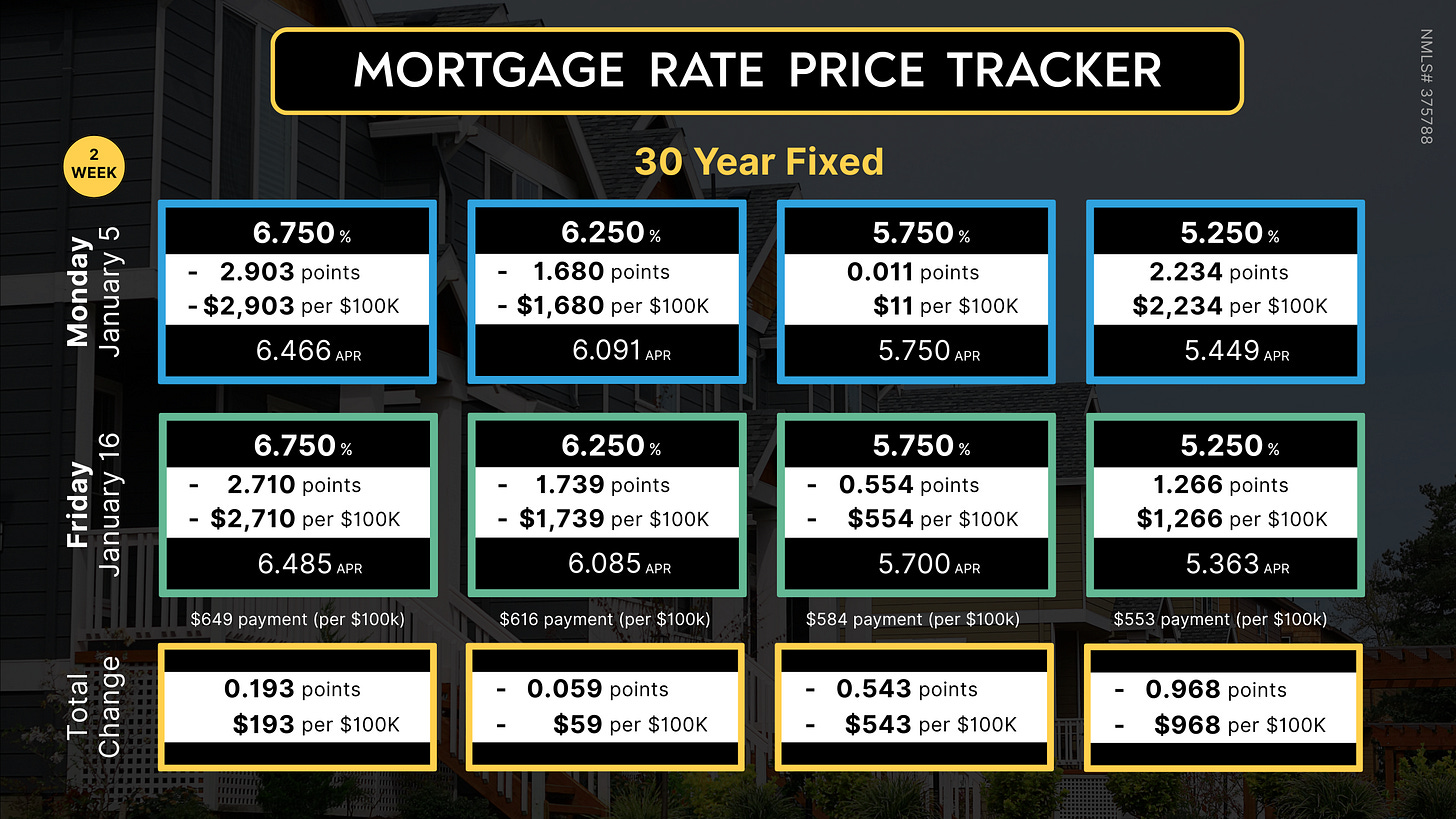

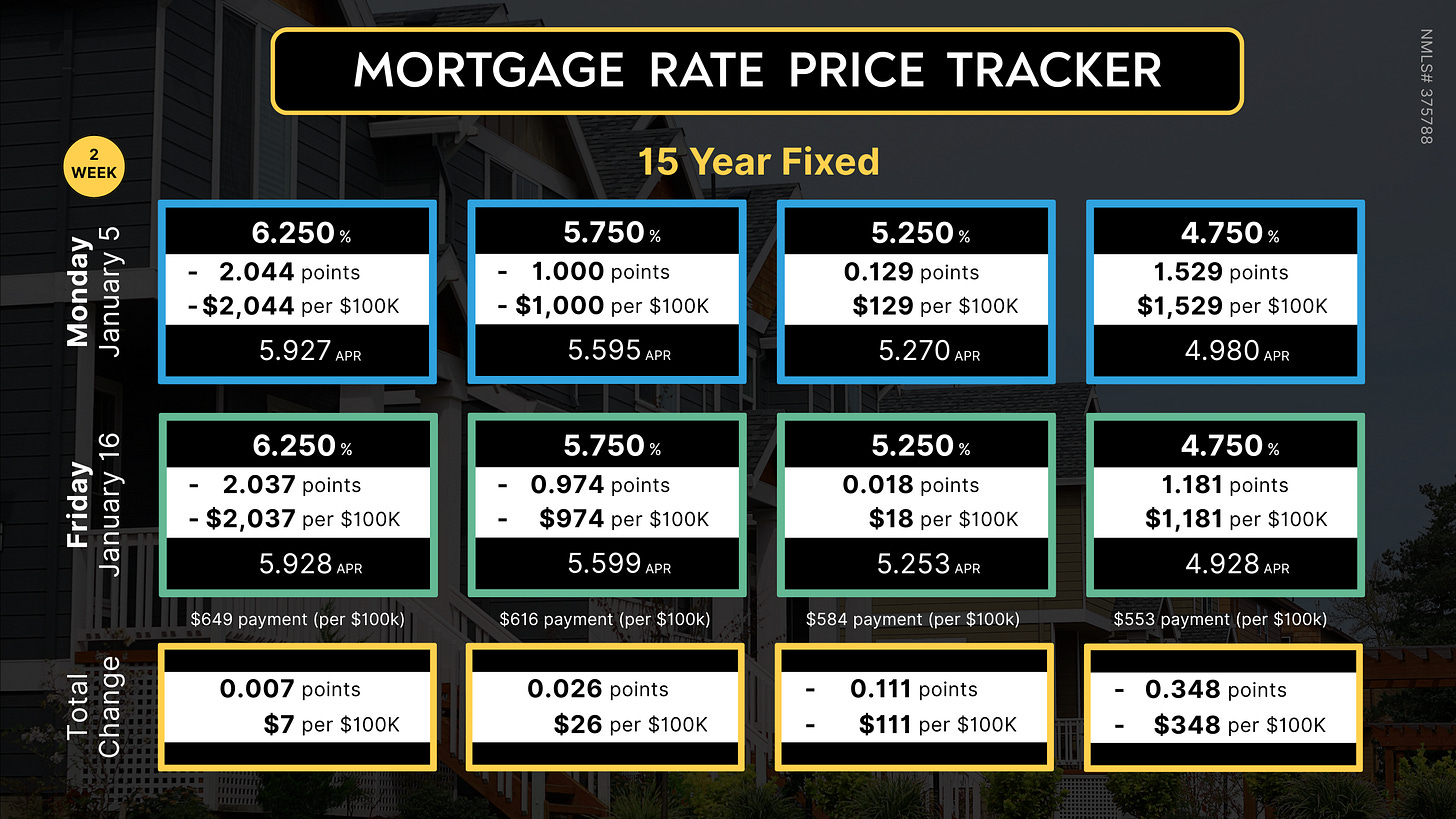

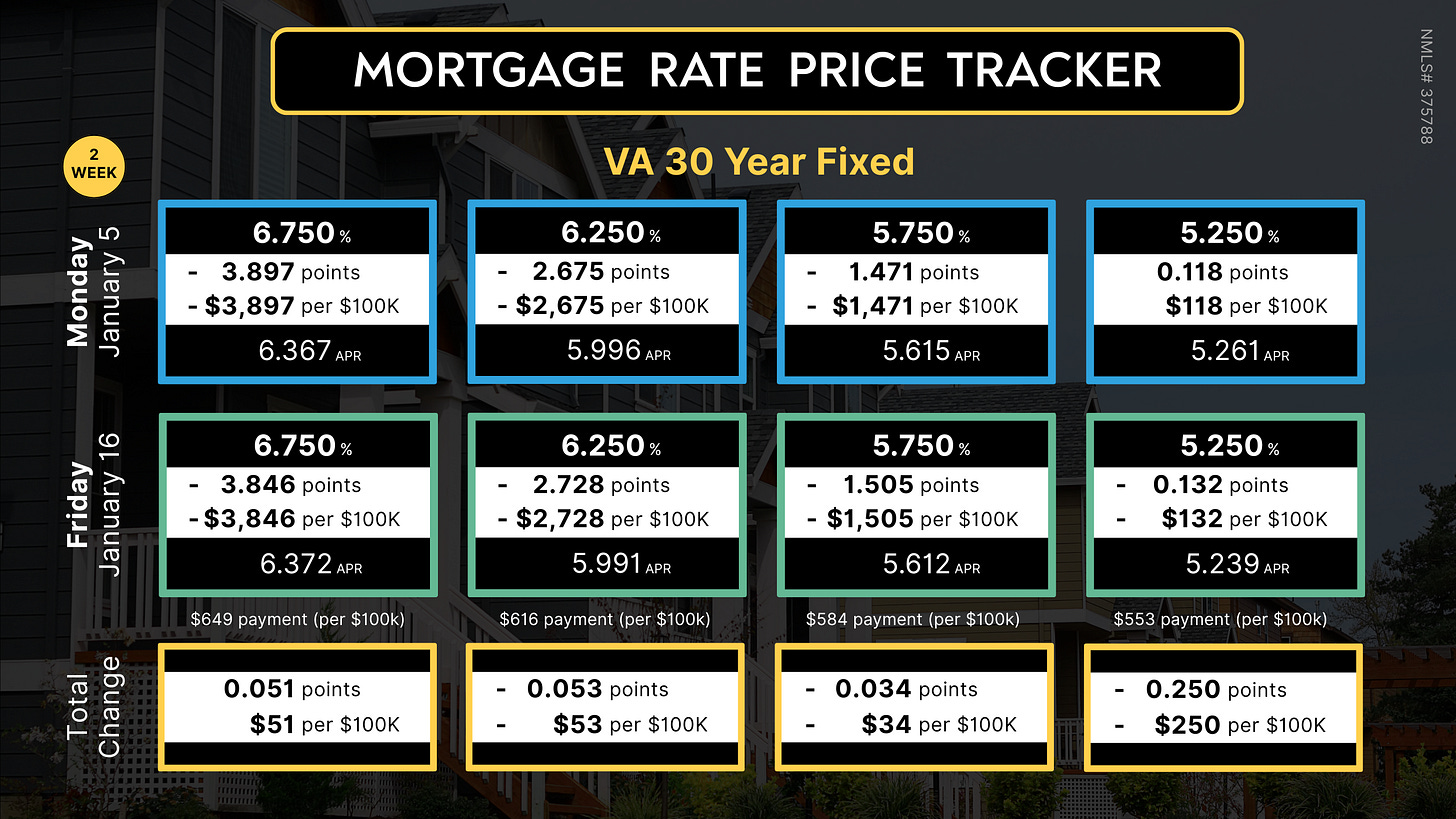

However, mortgage rates DO NOT rise or fall. Instead, the price of each rate changes while the rates available to you remain the same.

The Mortgage Rate Price Tracker (MRPT) illustrates this dynamic by showing how the price of each rate changed within the time series.

The higher the rate, the lower the fee (points). Some higher rates pay a rebate; this is illustrated on the tracker with negative (-) points.

When the “total change” is negative it means a reduction in the price of the rate.

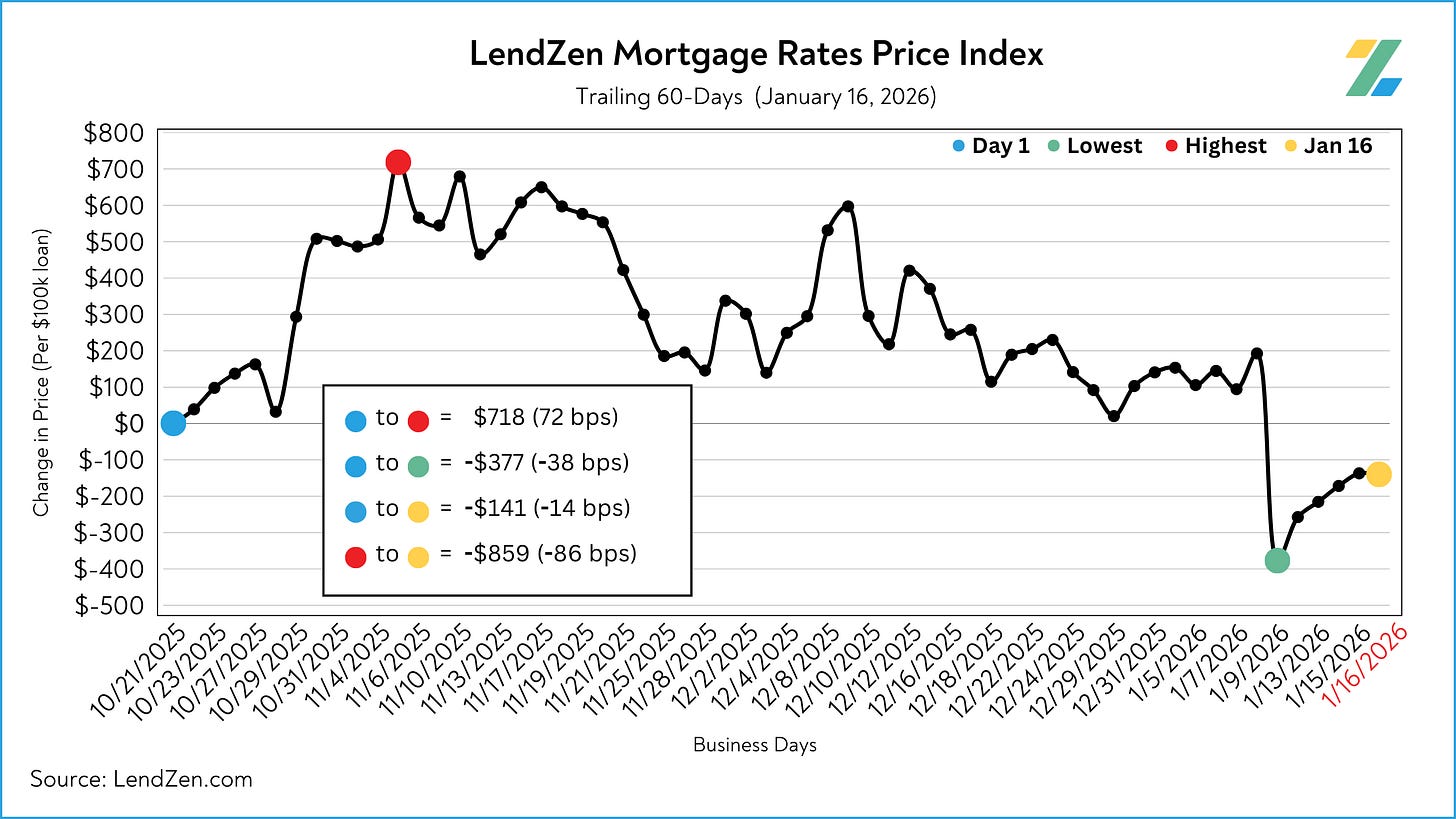

The MRPT is a more “rate and loan program” specific example of the LendZen Index, which monitors a much broader set of rates and mortgage bond coupons.

Both are effective for visualizing how the PRICE of mortgage rates has changed, while the LendZen Index is published daily at LendZen.substack.com

WEEK 2 📉

---------

Since the LendZen Index has a variety of time series, the MRPT will focus on just the current month’s activity.

Attached are the results for January Week 2.

You can also explore the results for Week 1 on this previous Substack post.

MBS PRICING 🏦

----------------

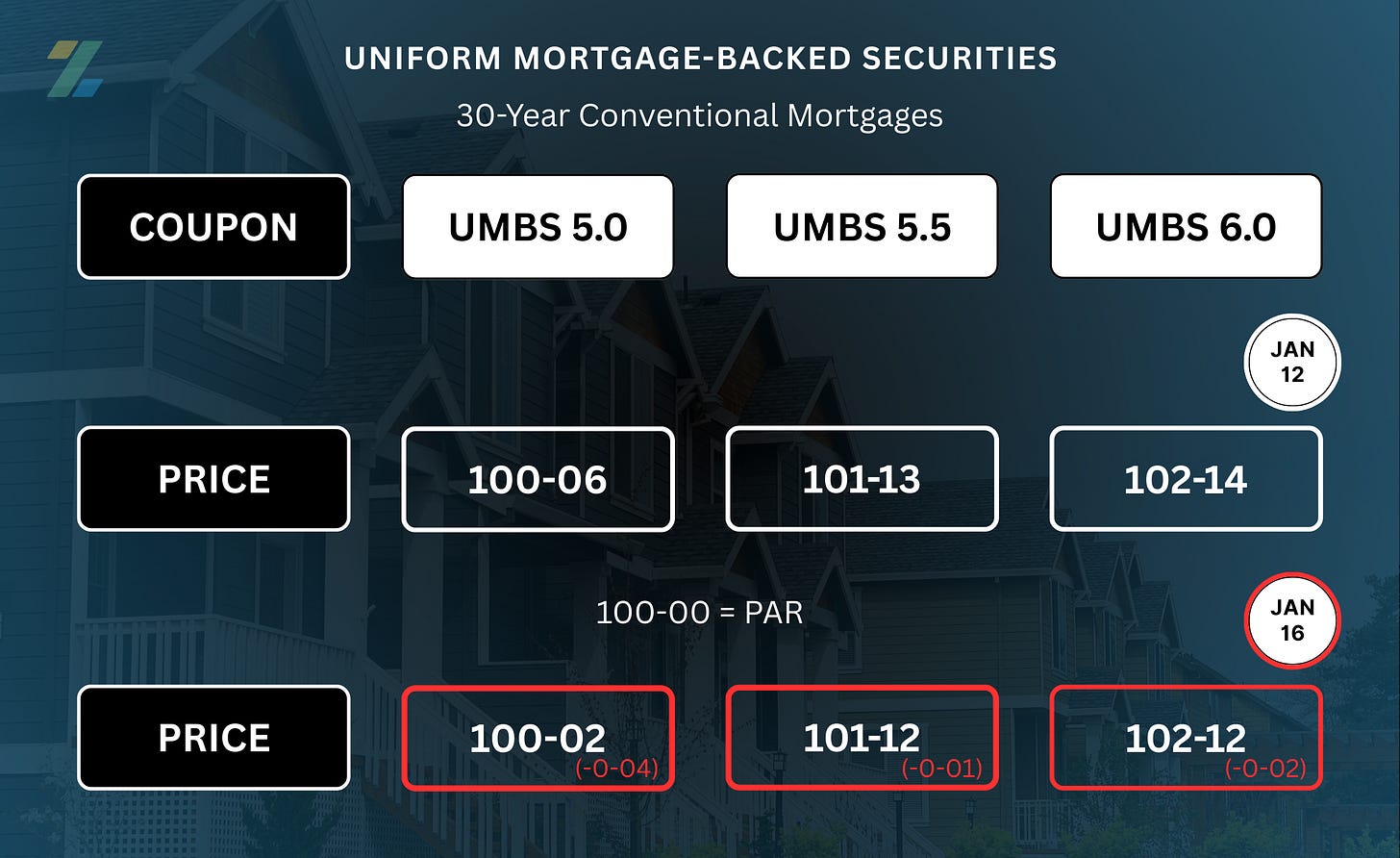

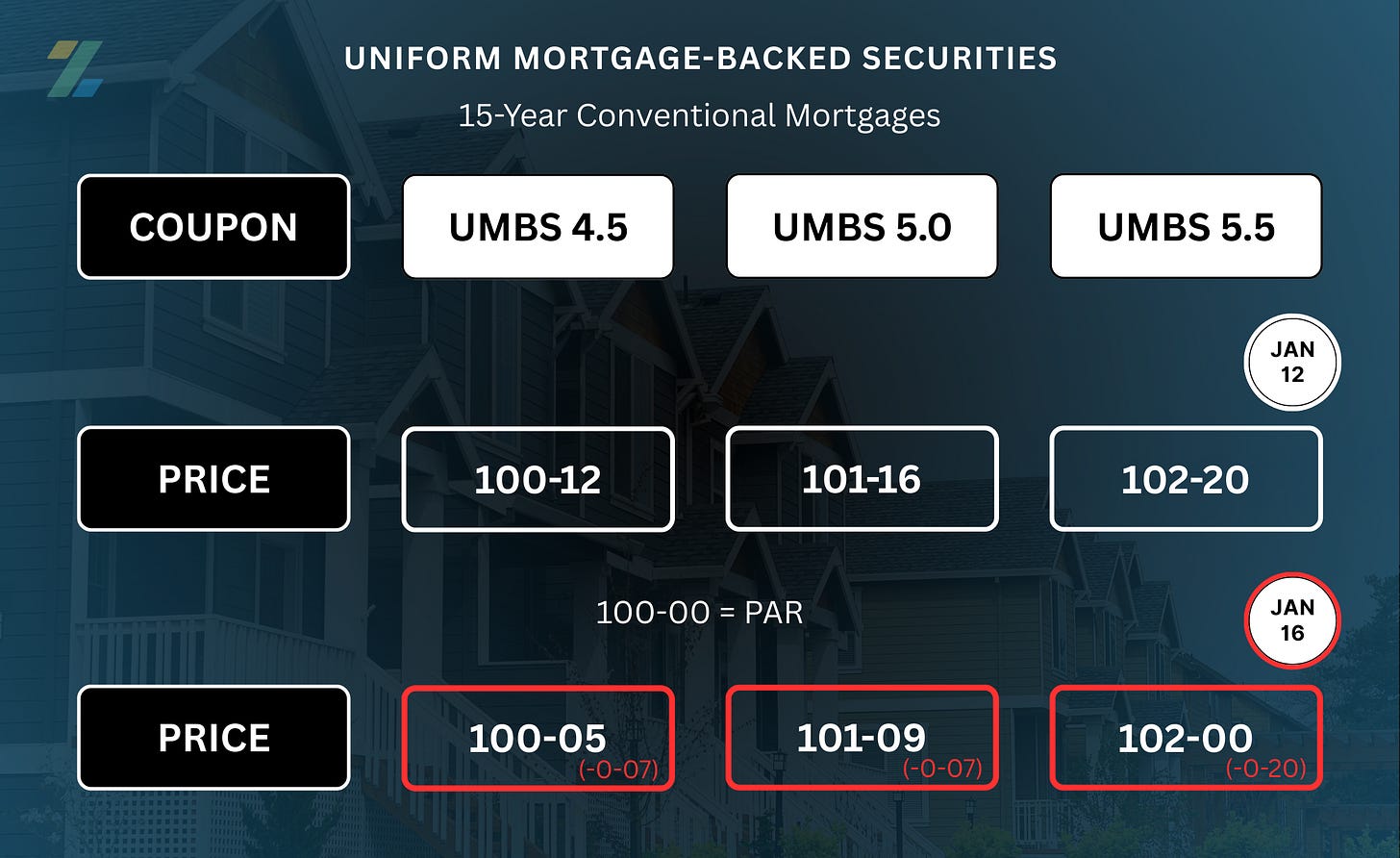

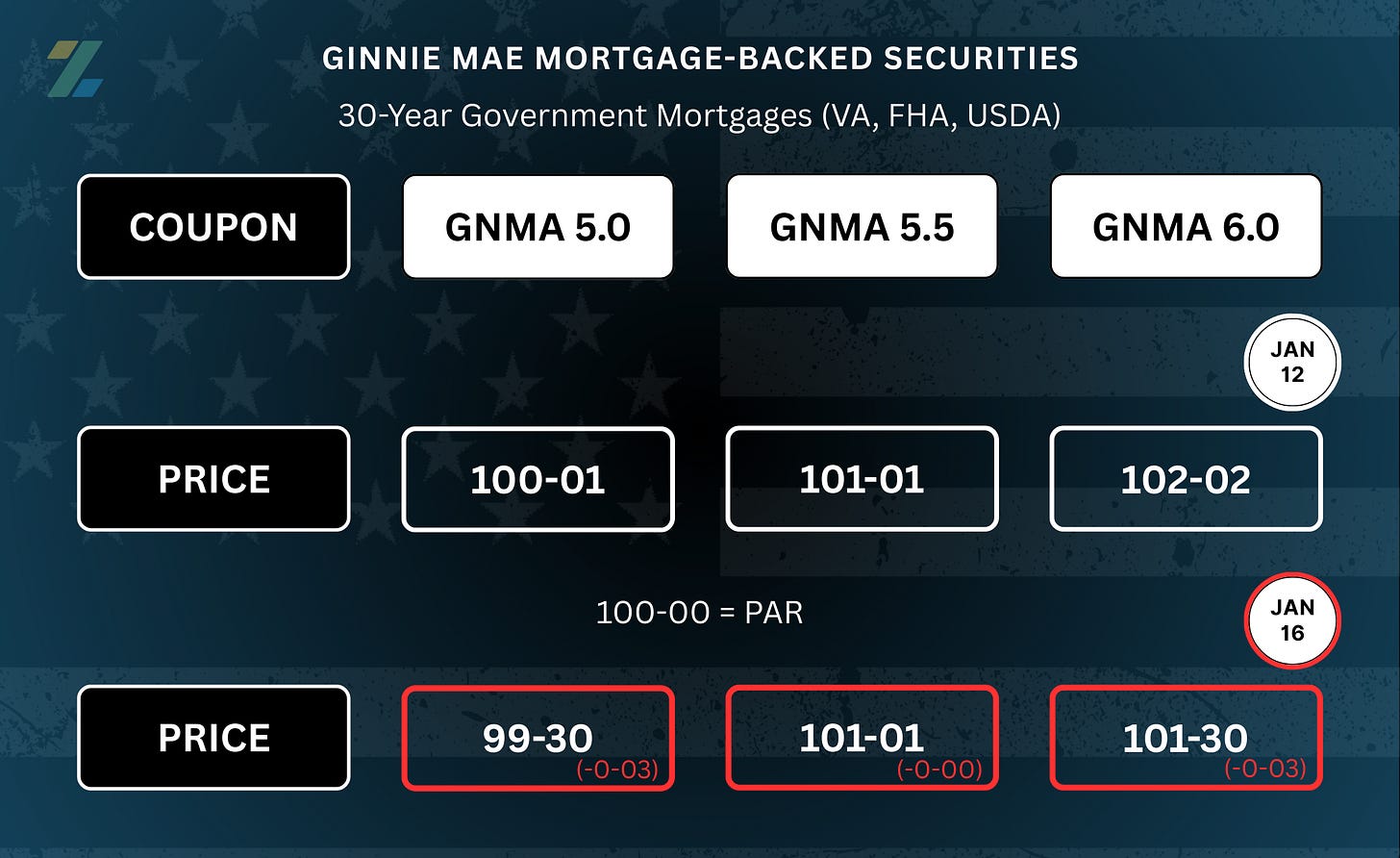

Also included are the current week’s MBS coupon price changes.

MBS coupons are sold at half-percent increments, while their price moves in 32nds (ticks).

ex. (0-04) = 4/32 = 12.5 bps

100-00 acts as the starting line, also referred to as PAR.

The higher the coupon price, the less expensive the rates will be that are sold into that security.

Therefore, an increase in the price of mortgage bonds is good for mortgage rates.

Learn more about the dynamics of MBS pricing and how it impacts your mortgage options in any of the bi-weekly “Rate Snapshot” Substack posts.

RATE RECAP ⏪

--------------

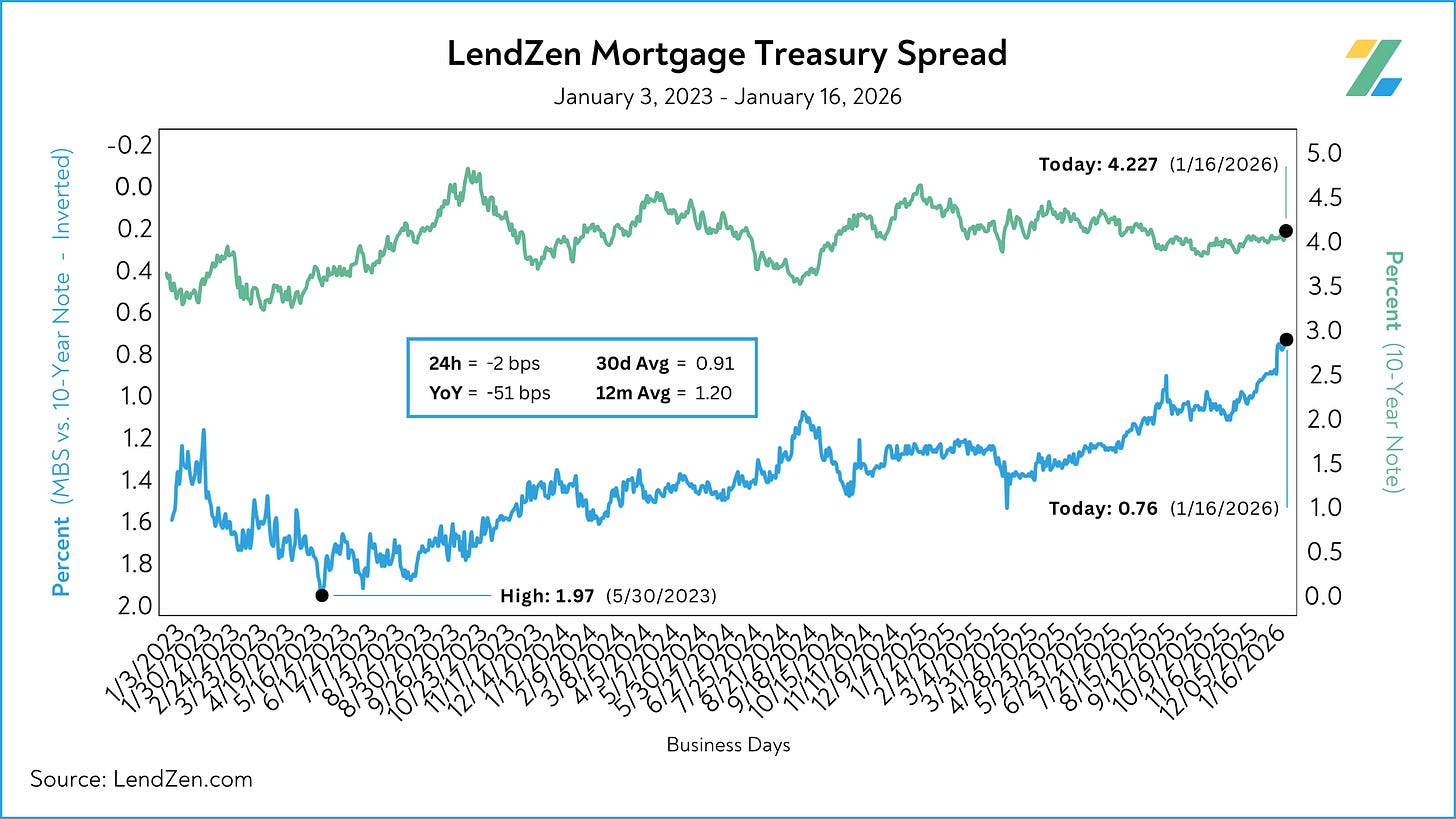

There is still little known about the purchase of $200B in Agency Mortgage-Backed Securities (UMBS) proposed by Trump that ignited last Thursday’s bond rally – more on that in this Substack post.

This week mortgage rates bounced off those multi-year lows but held their ground well in the face of inflation data and geopolitical drama.

In the last 5-days mortgage rate prices inched higher but still remain 14 bps better than the 2025 low from October 21.

In the day following the $200B announcement mortgage spreads tightened 14-bps, as Treasury bonds held felt and mortgage bond prices spiked (good for mortgage rates).

Spreads danced a bit this week but finished at the same level as last Friday.

CLOSER LOOK 🔍

----------------

You will notice in the MRPT that lower rates made big moves, but higher rates were unchanged.

The varying price of each mortgage-backed security will have a unique and sometimes disproportionate impact on a close range of mortgage rates.

The disparity is because of the price gaps between different MBS coupons, and the servicing restrictions that limit which rates can be securitized into each.

This is also why so-called “average rate” indexes are misleading at best and should not be used to calculate the current mortgage-treasury spread.

There are other dynamics, such as ever-changing lender margins, that make “average rate” data unusable for historic comparisons.

Learn more about the importance of accurately calculating mortgage spreads on this Substack post.

Tracking the price of mortgage rates and MBS coupons is not merely academic.

When the data is reliable it can be a valuable part of the loan shopping experience, especially when making a rate lock decision.

Holding out for a certain rate might sound logical to a borrower, but market dynamics could mean those expectations are wildly unrealistic.

UP NEXT 🗓️

----------

Martin Luther King Jr. Day is on Monday, shortening the week with very little on deck the remaining days besides Thursday’s Personal Consumption Expenditures.

PCE is the Fed’s preferred inflation gauge, so it will provide the most volatility for this week’s calendar.

However, what can’t be understated at the moment are the geopolitical unknowns.

Whether it’s the U.S. capture of Venezuelan President Nicolas Maduro, increased tensions with Iran (threats, tariffs, protests), Greenland “negotiations”, or the various military conflicts that continue to smolder throughout the eastern hemisphere, the spill over into financial markets is becoming more noticeable ... and more unpredictable.

More insight into next week’s events, along with the latest Rate Impact Calendar, will be posted in Sunday’s Week Ahead.

Meanwhile, the latest Lock-O-Meter risk scores and detailed rate lock recommendations with be posted Monday in the Data Deluge.

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

DISCLOSURES

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.