Mortgage rates prepare for battle as risks escalate 🏠📊💣

The Week Ahead

WEEK AHEAD 🗓️

----------------

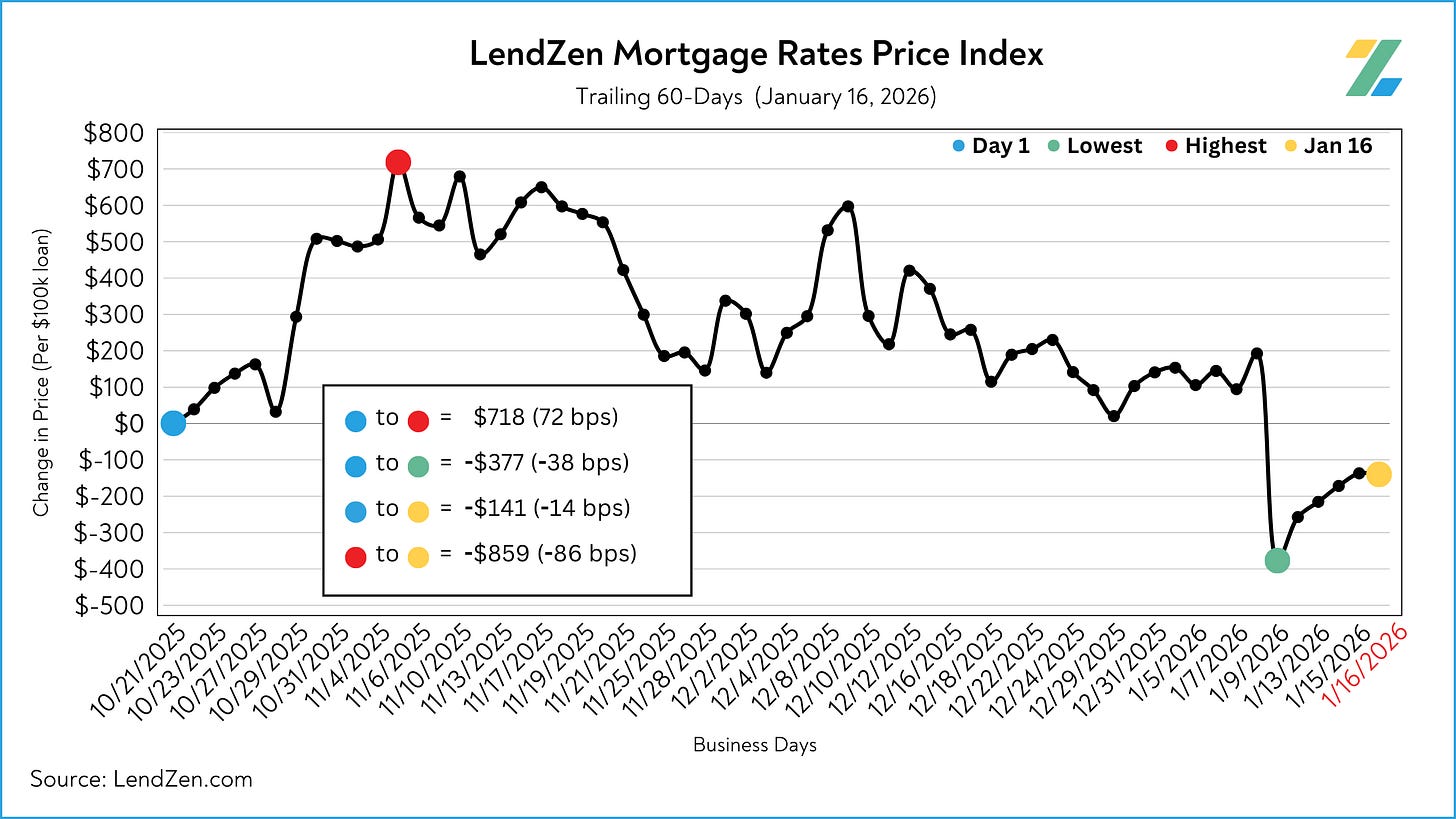

Mortgage rates are having a hot start to 2026 but need to keep their head on a swivel as risks continue to escalate.

Despite a slight pull back last week, mortgage rate prices are still hovering 14-bps below the 2025 low set on October 21.

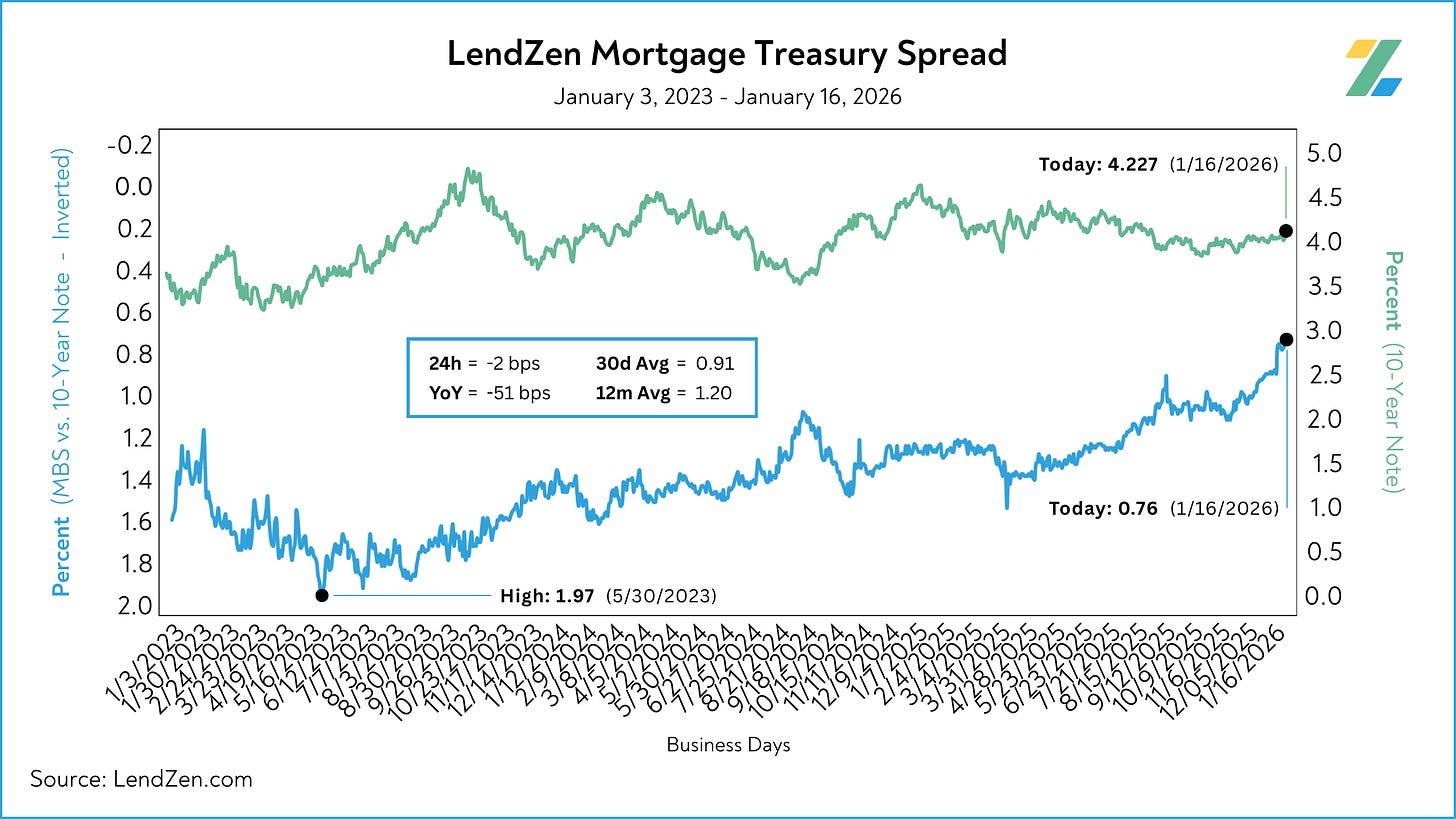

In addition to the already bond friendly macro environment, Trump’s proposal to spend the Fannie/Freddie cash pile of $200B has been a big contributor to the rally in mortgage bonds.

MBS-Treasury spreads have compressed significantly since the announcement, helping mortgage rates reach their best levels in years despite the 10-Year’s reluctance to fall below 4%.

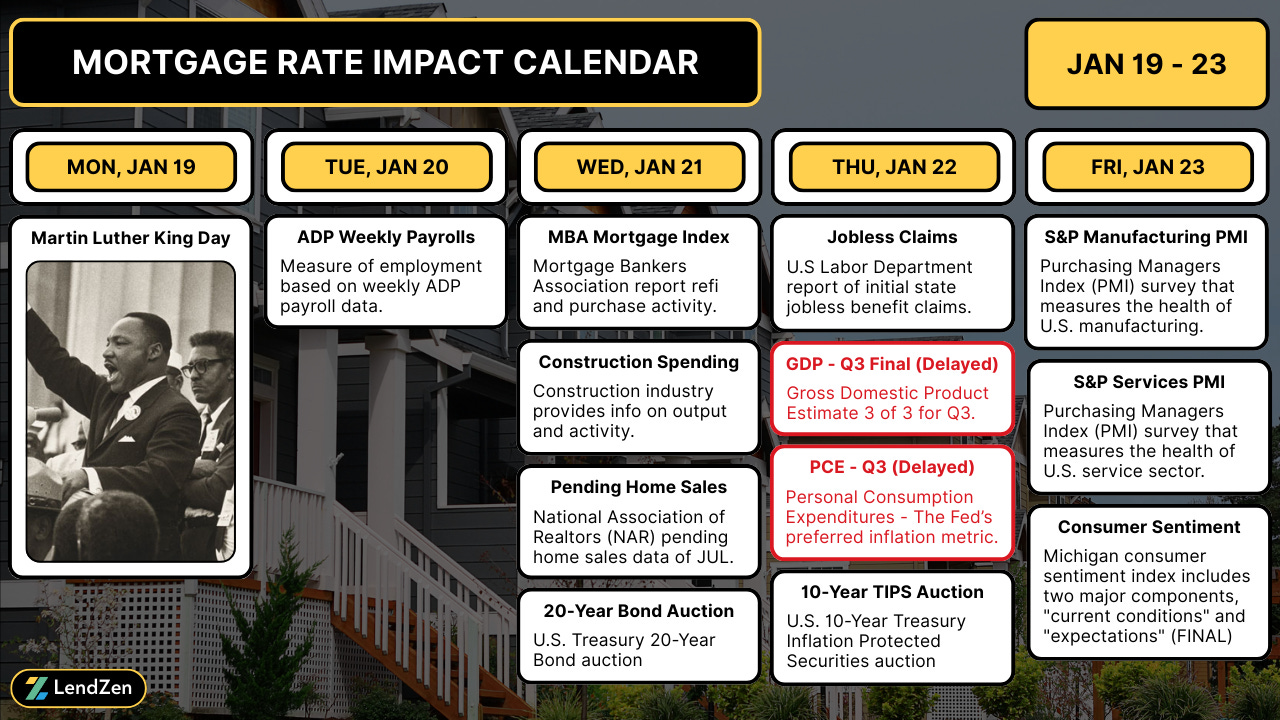

Martin Luther King Jr. Day is on Monday, shortening the week with very little on deck until Thursday, which includes a previously delayed Personal Consumption Expenditures report from Q3.

PCE is the Fed’s preferred inflation gauge, so it will provide most of the week’s volatility.

The upcoming GDP data is the third and final for Q3, another delayed data set due to last year’s government shutdown.

GDP is of course meaningful but given the age of this release its impact should be less dramatic.

However, what can’t be understated at the moment are the geopolitical unknowns.

Whether it’s the U.S. capture of Venezuelan President Nicolas Maduro, increased tensions with Iran (threats, tariffs, protests), Greenland “negotiations”, or the various military conflicts that continue to smolder throughout the eastern hemisphere, the spill over into financial markets is becoming more noticeable.

The unpredictable nature of the current geopolitical environment is exactly why the Lock-O-Meter uses a risk-weighted score to help with rate lock decisions.

Monday I will take a deeper look at how mortgage rate prices, bond spreads, and longer-term trends are unfolding in my Monday Data Deluge.

The latest Lock-O-Meter risk scores and rate lock recommendations will be posted with it.

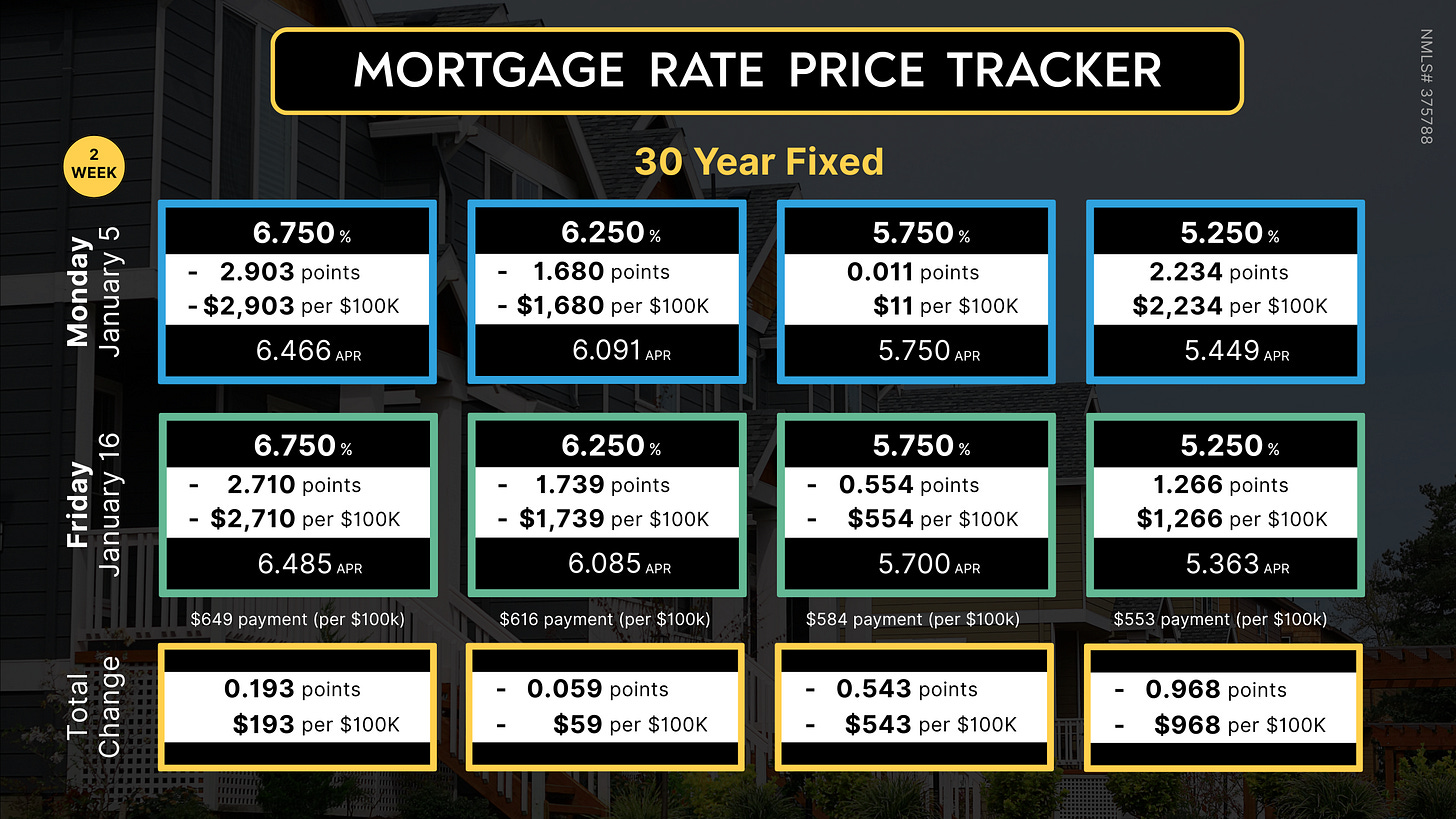

In the meantime, check out this week’s Mortgage Rate Price Tracker for a closer look at how mortgage rate prices have been reacting to recent drama.

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.