Mortgage rates try to stay calm as chaos unfolds 😬🧶📉

Midweek Market Update

Included in this update are the following sections:

MIDWEEK RECAP ⏪

-------------------

The dust is settling after mortgage bond spreads collapsed to multi-year lows following Trump’s Thursday social post about using the Fannie/Freddie cash pile ($200B) to buy mortgage bonds.

You can read more on this announcement, and its potential longer-term impact on mortgage rates in the “Week Ahead” Substack post.

Mortgage rate prices also improved significantly on the news, but momentum has cooled a bit in the last two days.

See more in the Rate Price Index section below.

Major geopolitical events are also unfolding at a dramatic pace.

Whether it’s the U.S. capture of Venezuelan President Nicolas Maduro, increased tensions with Iran (threats, tariffs, protests), or the various military conflicts that continue to smolder throughout the eastern hemisphere, the spill over into financial markets is becoming more noticeable.

While foreign government bond yields set new all-time highs (Japan), U.S. bonds have seen strong overseas demand as the “flight to safety” looks like it could be a theme for 2026.

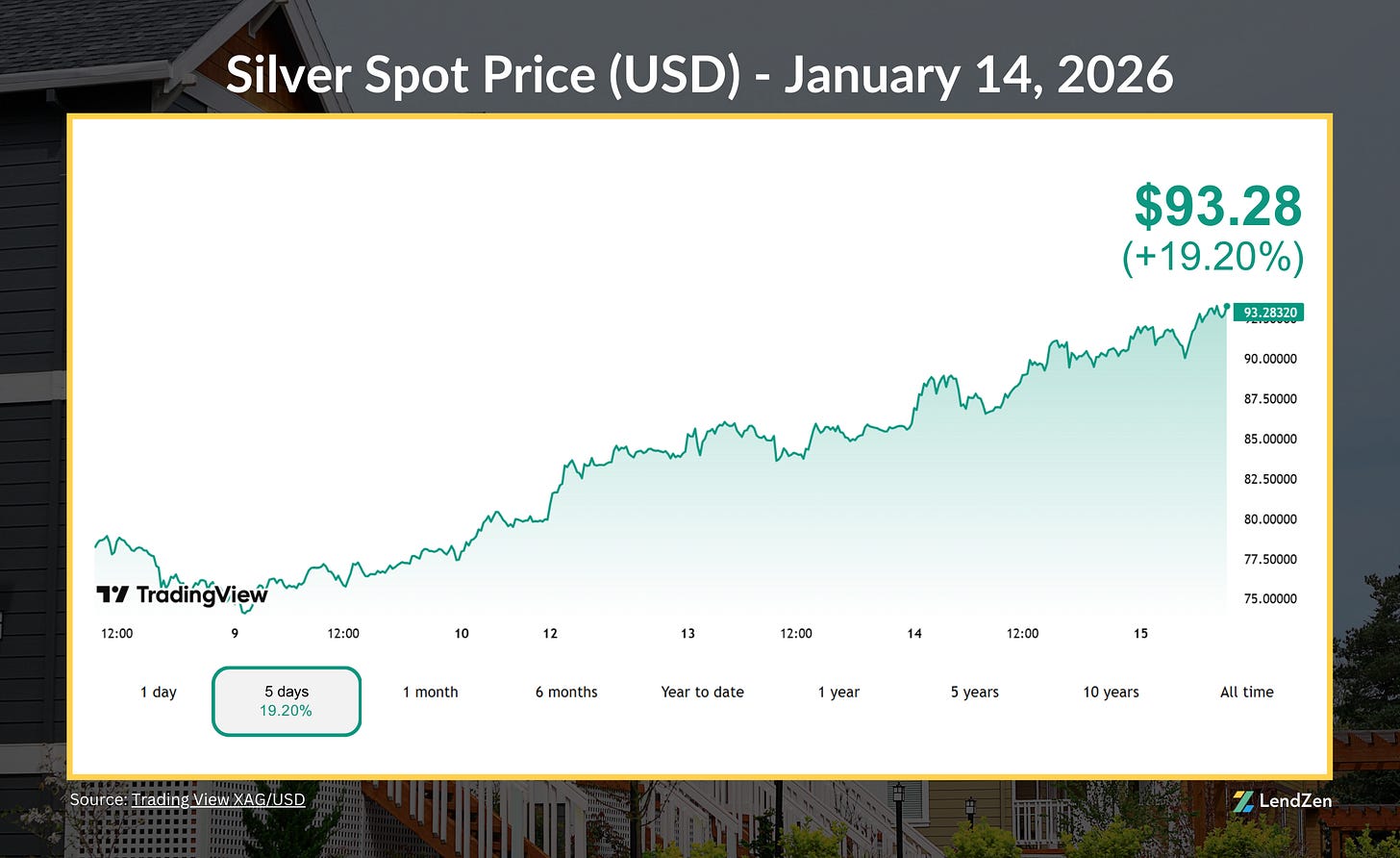

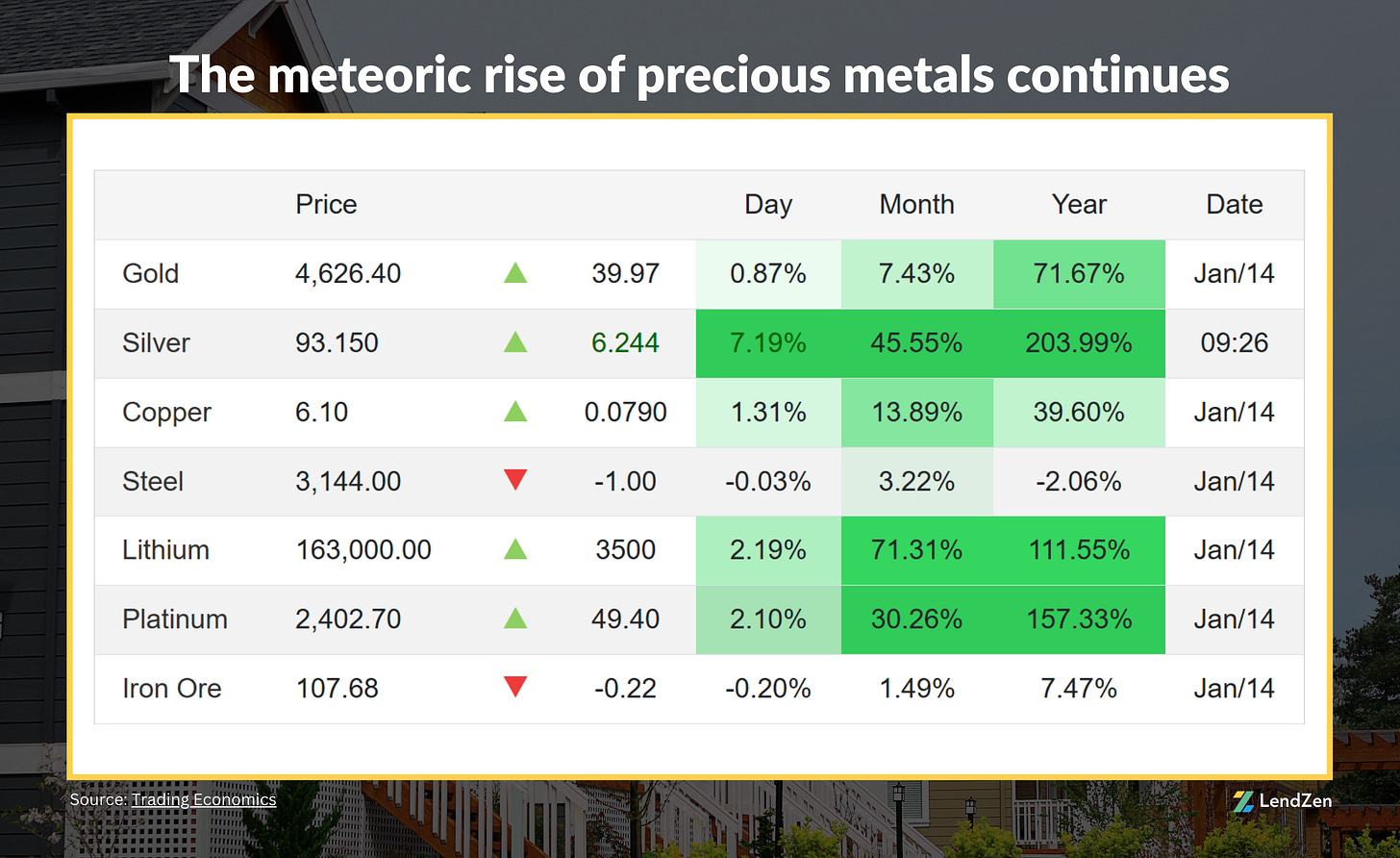

The meteoric rise in Silver is another example, as it surpassed $90 per oz this week for the first time ever.

See more in the Precious Metals section below.

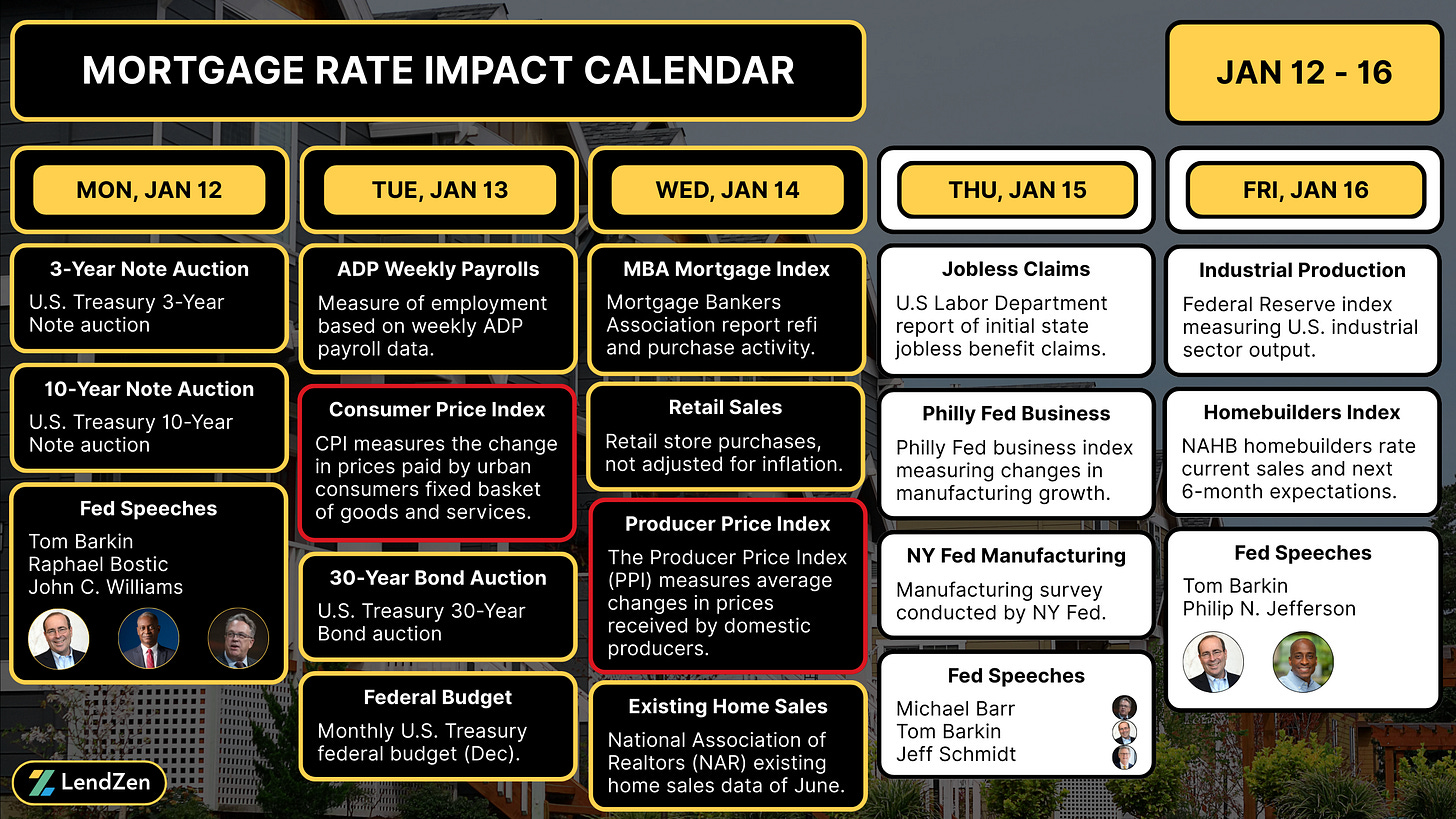

IMPACT CALENDAR 📅

-----------------------

The feud between the Trump Admin and The Fed ratcheted higher over the weekend when the DOJ served the central bank with a grand jury subpoena, to which Fed Chairman Powell posted a spirited video rebut.

This all happened ahead of what was expected to be another critical week for bonds and mortgage rates with the CPI inflation report scheduled for Tuesday.

Both CPI and today’s PPI did little to surprise markets, so mortgage rates can finally catch their breath as the rest of the week should “hopefully” be less volatile.

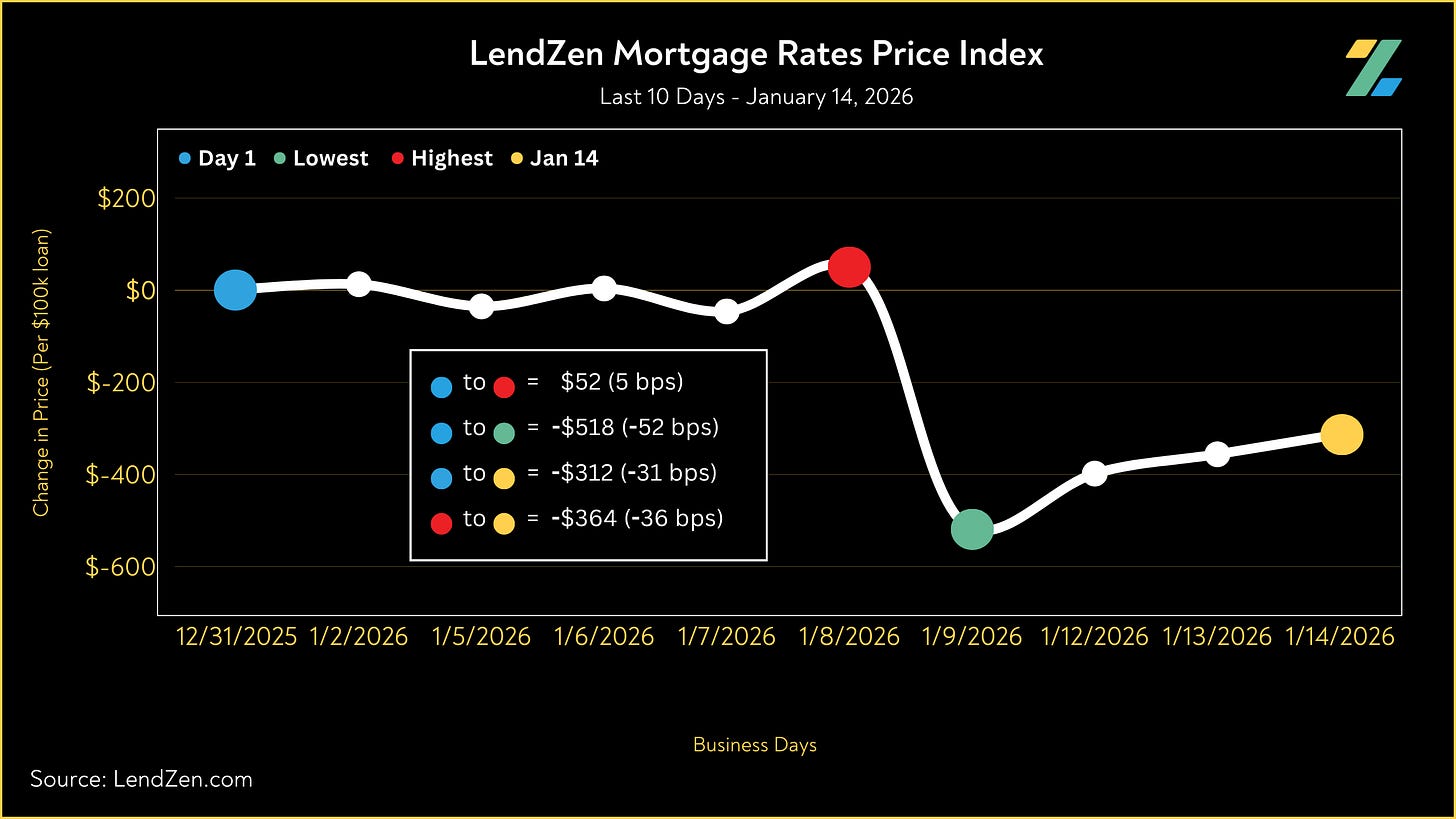

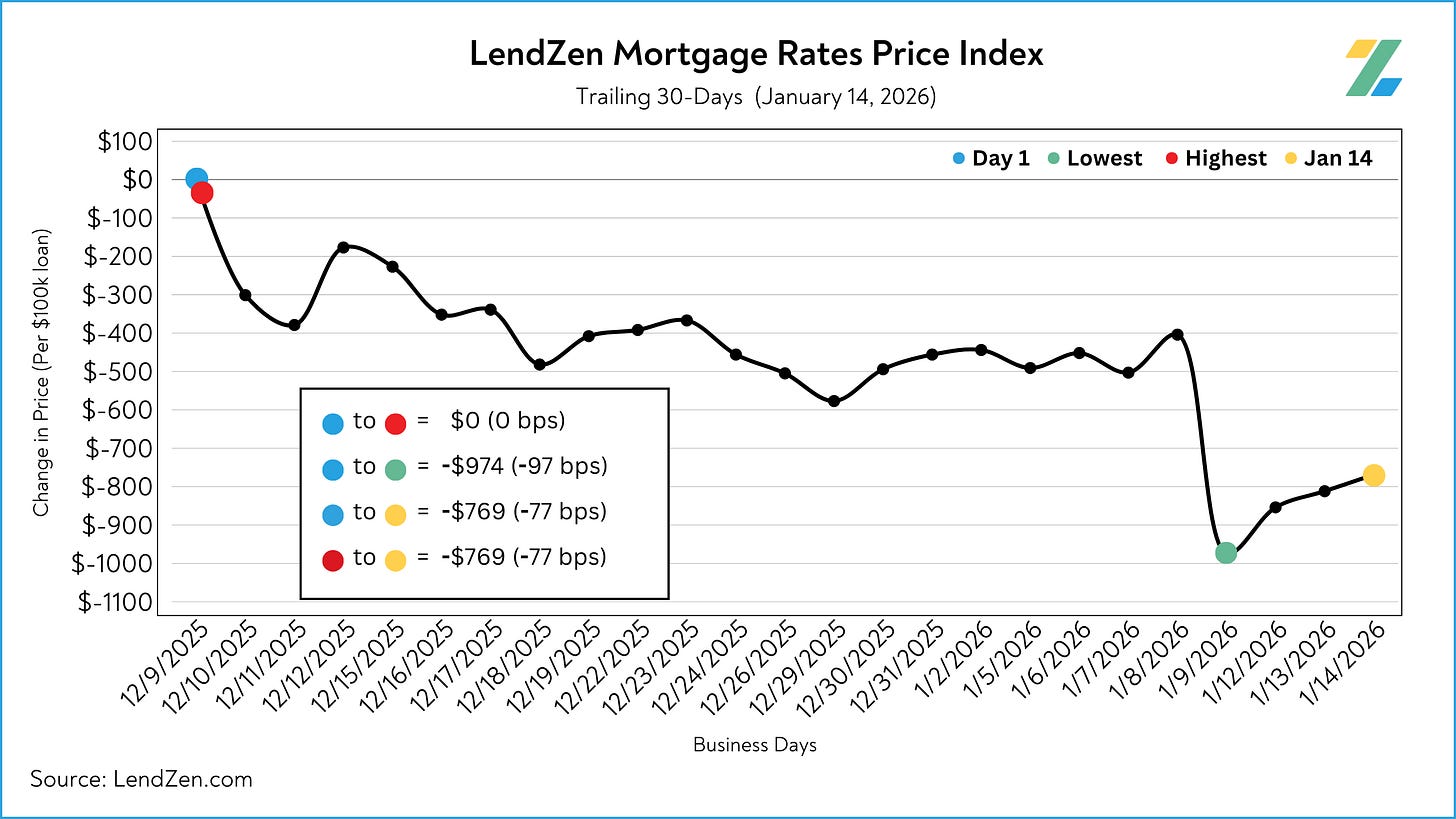

RATE PRICE INDEX 📉

----------------------

Mortgage rates do not rise or fall, instead the PRICE of rates change.

The LendZen Index calculates a daily change in the price of mortgage rates by tracking a spectrum of mortgage-backed securities (MBS).

-----------

24-Hour: +4 bps (+$44 per $100K)

5-Day: -36 bps (-$364)

10-Day: -31 bps (-$312)

30-Day: -77 bps (-$769)

Learn more about the LendZen Index and explore the full data series at LendZen.substack.com

MORTGAGE SPREADS 🧈

-------------------------

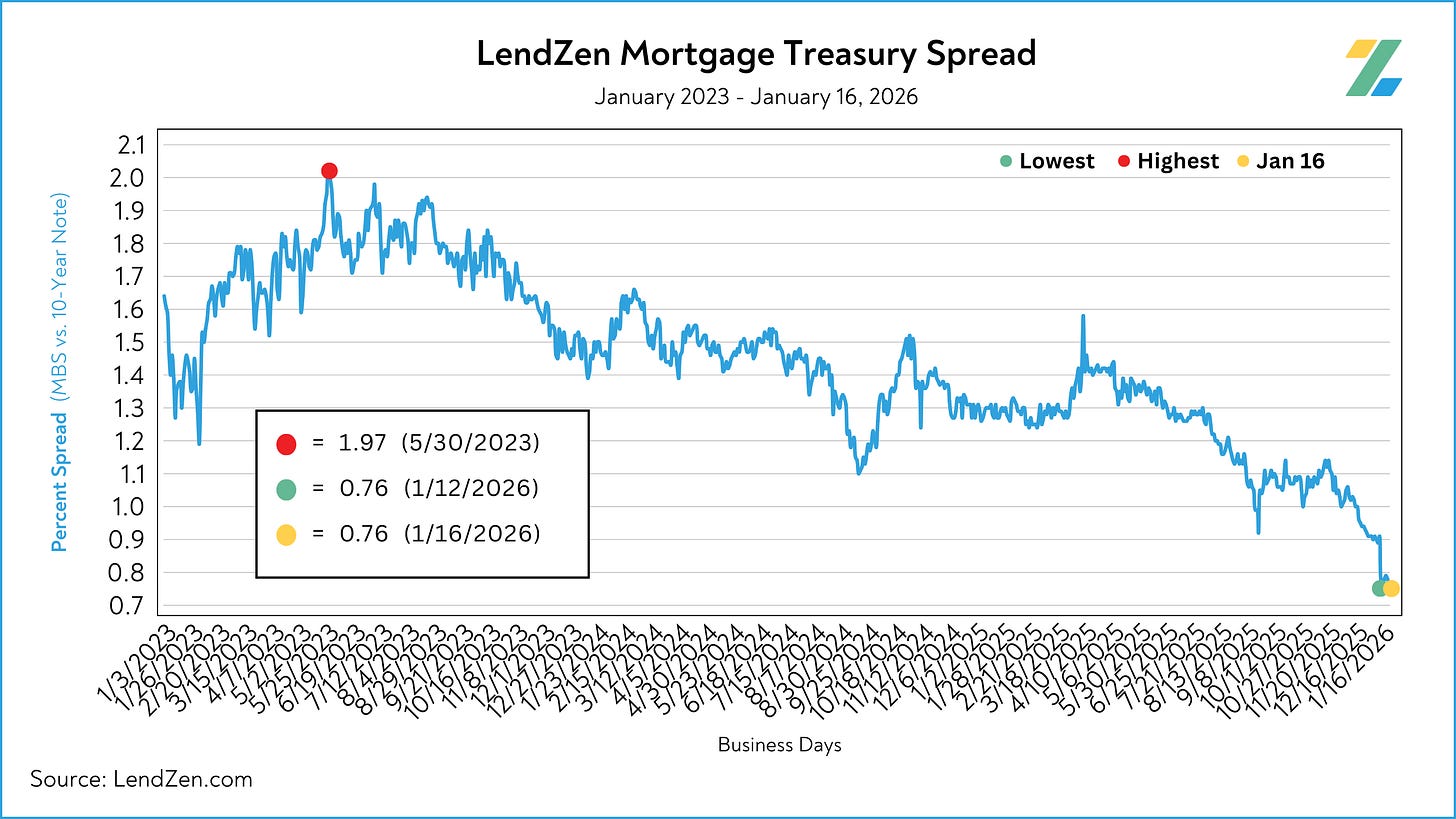

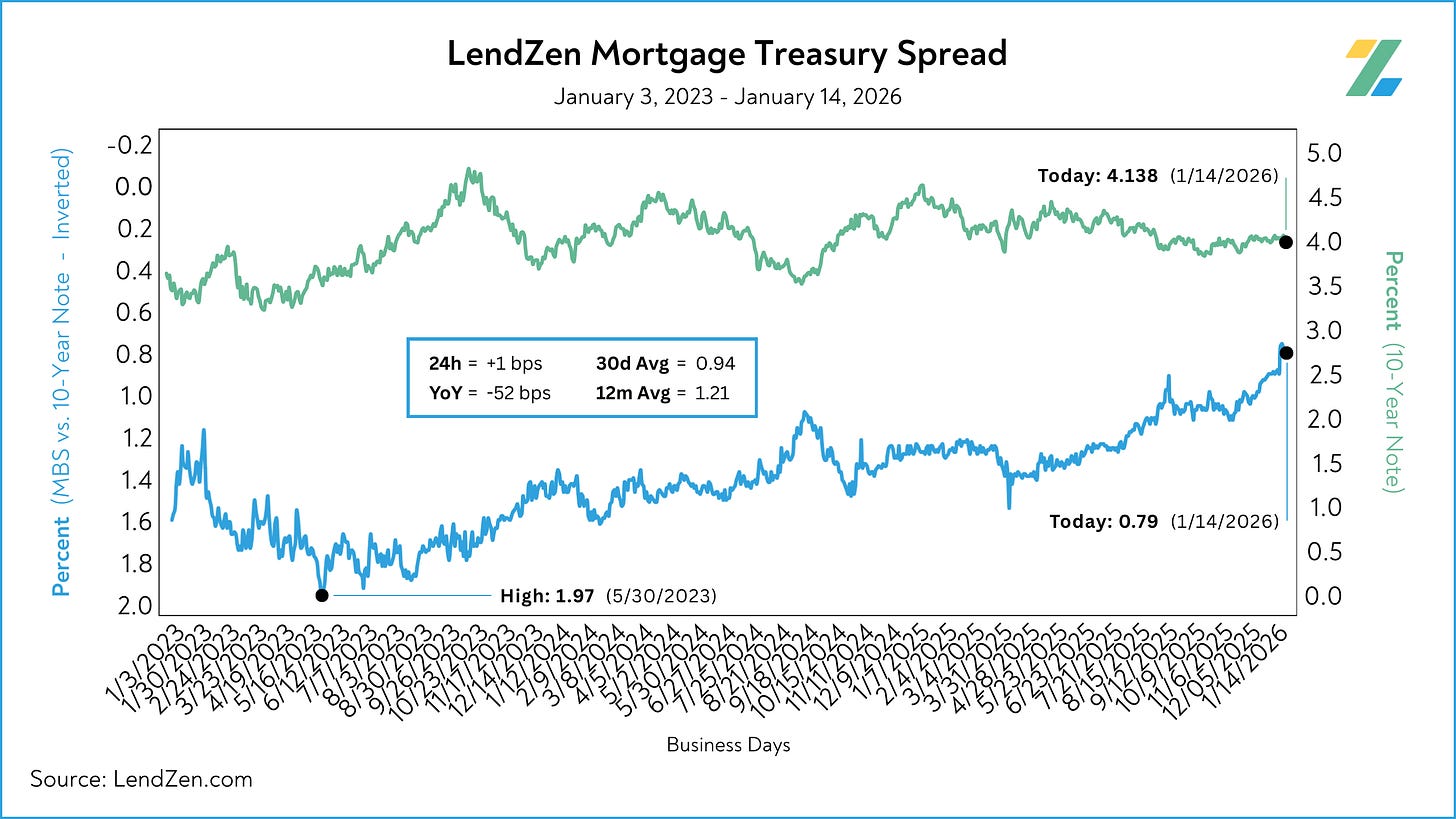

Published daily with the LendZen Index is the LendZen Mortgage-Treasury Spread.

The LMTS uses actual bond yields to create a historically consistent, and reliable, data set.

-----------

Jan 7: 0.89

Jan 14: 0.79

24h: +1 bps

5d: -10 bps

12m Avg: 1.21

YoY: -52 bps

Learn more about the importance of mortgage spreads on this Substack post.

Although a lot of emphasis is put solely on Treasury Bonds when it comes to mortgage rate trends, spreads are what truly matters.

Following Trump’s “$200B” comments the 10-Year Treasury didn’t budge, but mortgage bond spreads collapsed 14 bps in a single day, to a multi-year low.

STOCK MARKETS (5-Day) 📊

-----------------------------

DJIA: 49,151 (-0.17%)

S&P 500: 6,926 (-0.02%)

NASDAQ: 25,475 (-0.21%)

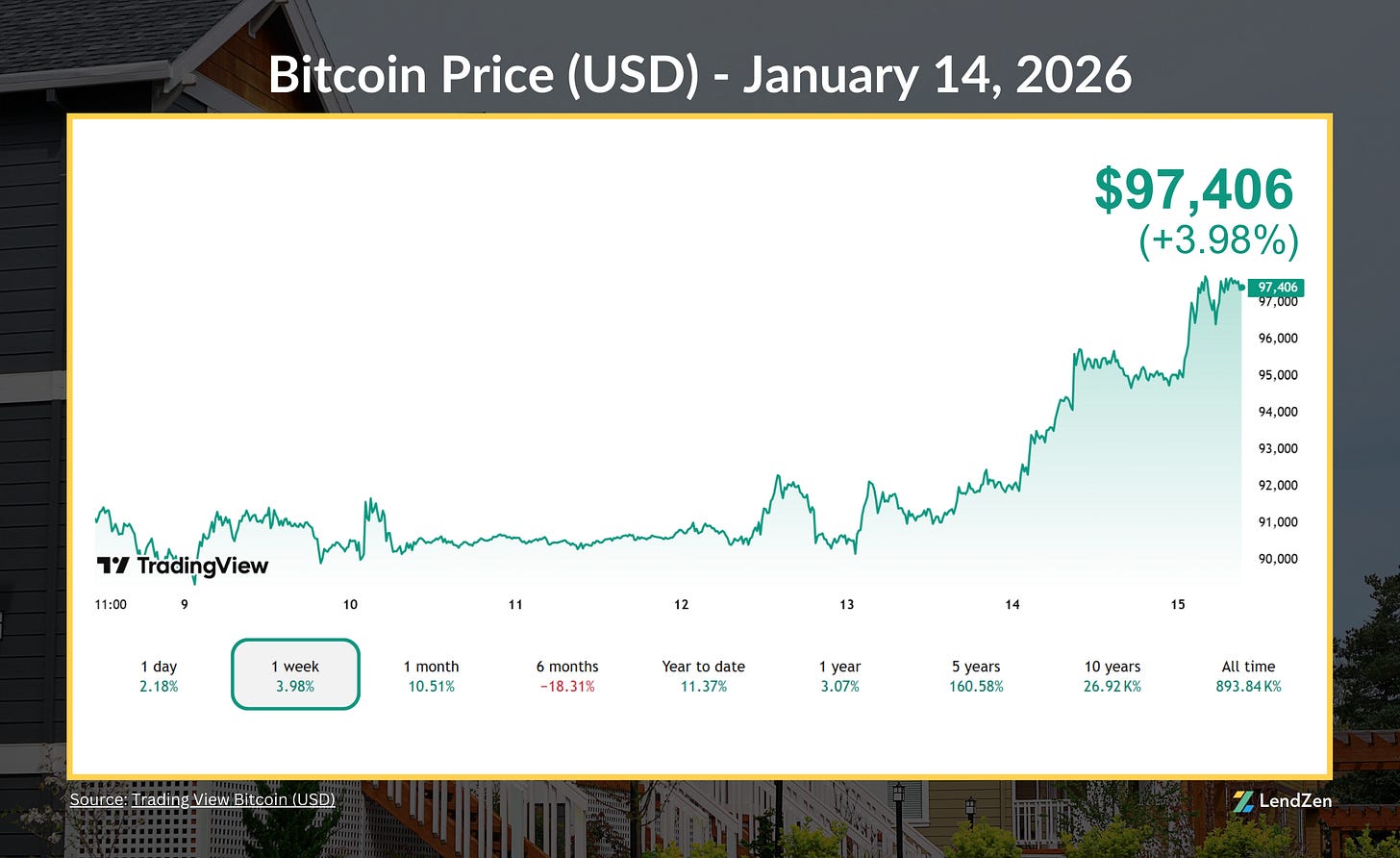

CRYPTO (1-Week) 🧮

--------------------

Bitcoin: $97,406 (+3.98%)

Ethereum: $3,362 (+2.04%)

Solana: $146.55 (+3.98%)

PRECIOUS METALS (5-Day) 🪙

-------------------------------

Gold: $4,627 (+3.35%)

Silver: $93.28 (+19.20%)

Platinum: $2,402 (+5.17%)

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.