You’re Fired

What this week’s employment data means for mortgage rates and the housing market as some worrying trends appear.

It’s a new month, so let’s review the impact May had on mortgage rates, and recent activity in the housing market, as we get ready for the week ahead.

Adding additional insight to this week’s article is the launch of the LendZen “Mortgage Rates Price Index”.

This NEW index gives borrowers a real-time pulse on how the cost of getting a mortgage changes every day.

🌪️ Calm Before the Storm

Last week, mortgage rates saw modest improvements, influenced primarily by Personal Consumption Expenditures.

The PCE index, the Federal Reserve's preferred inflation metric, rose by 0.1%.

This aligned with expectations, suggesting stable inflation trends.

However, investor sentiment did sway in response to inflation data as the Federal Reserve is now anticipated to delay any interest rate cuts until later in the year.

Meanwhile, there was a brief stir when a court ruling temporarily blocked certain tariffs proposed by the Trump administration.

The market quickly dismissed this as inconsequential, leaving minimal impact on bond yields or the price of mortgage rates.

It was an otherwise quiet week on the economic data front due partly to the Memorial Day holiday.

📆 The Week Ahead

Several significant economic reports are scheduled for release this week that could influence mortgage rates:

ISM Manufacturing Data (Monday) — The Institute for Supply Management will release its Manufacturing Purchasing Managers' Index (PMI), providing insights into the manufacturing sector's health.

MBA Mortgage Applications (Thursday — The Mortgage Bankers Association will report on mortgage application activity, offering a glimpse into housing demand trends.

Non-Farm Payroll Employment Report (Friday) — The Bureau of Labor Statistics will publish employment data for May, a critical indicator of economic strength and a potential driver of interest rate expectations.

Additionally, several Federal Reserve officials are again scheduled to speak throughout the week. Their commentary, often referred to as "jawboning", can jolt markets unexpectedly and should be monitored.

🔎 Big Picture Outlook

MORTGAGE RATES:

Recent economic data has shown a mixed picture.

While inflation appears to be stabilizing, housing costs remain elevated. The shelter component of the Consumer Price Index rose by 4% year-over-year, indicating persistent pressure on housing affordability.

HOUSING MARKET:

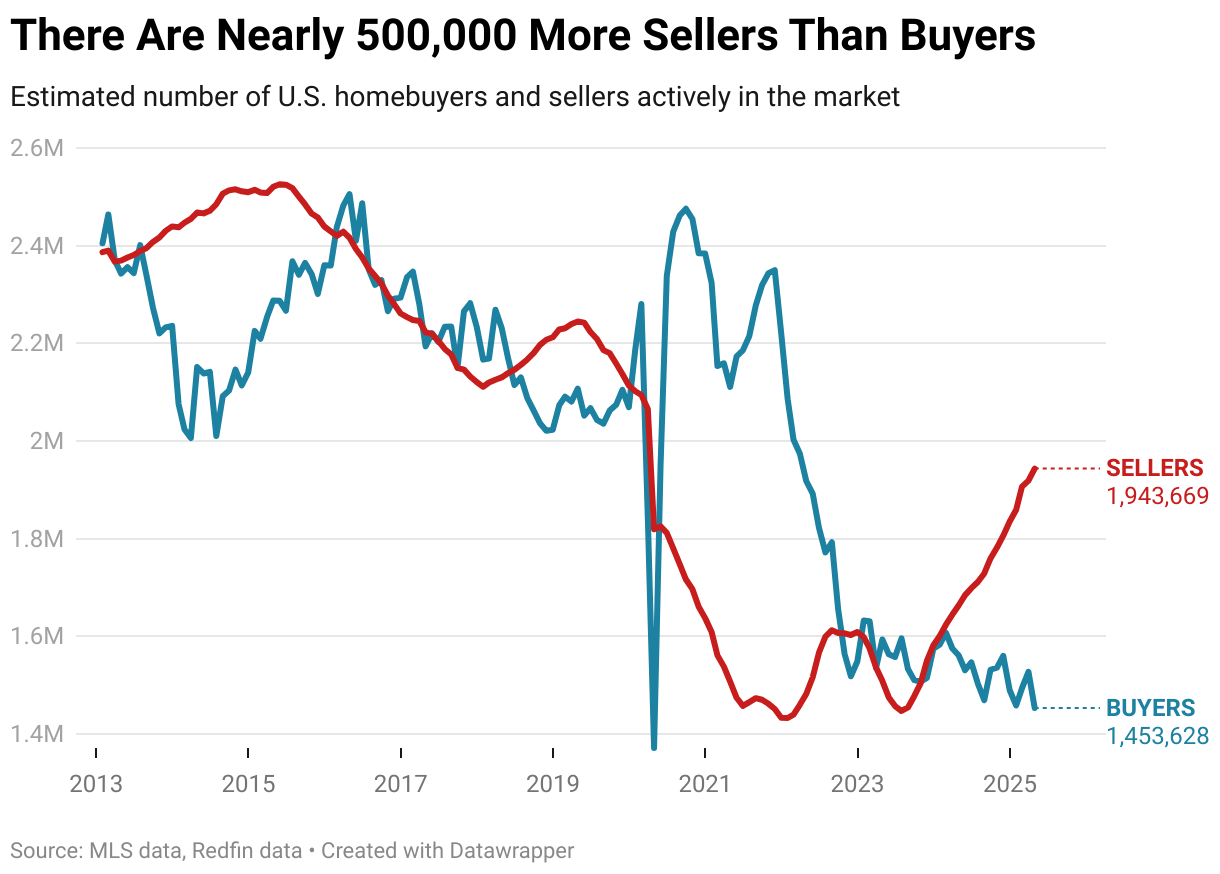

For the first time since 2013, the number of home sellers has surpassed buyers, leading to an increase in housing inventory.

It might sound worrying, but despite the gap home prices continue to rise with the median existing-home price reaching a record $414,000 in April.

However, the growing imbalance between supply and demand may lead to price adjustments in the coming months … subscribe to the newsletter for timely updates.

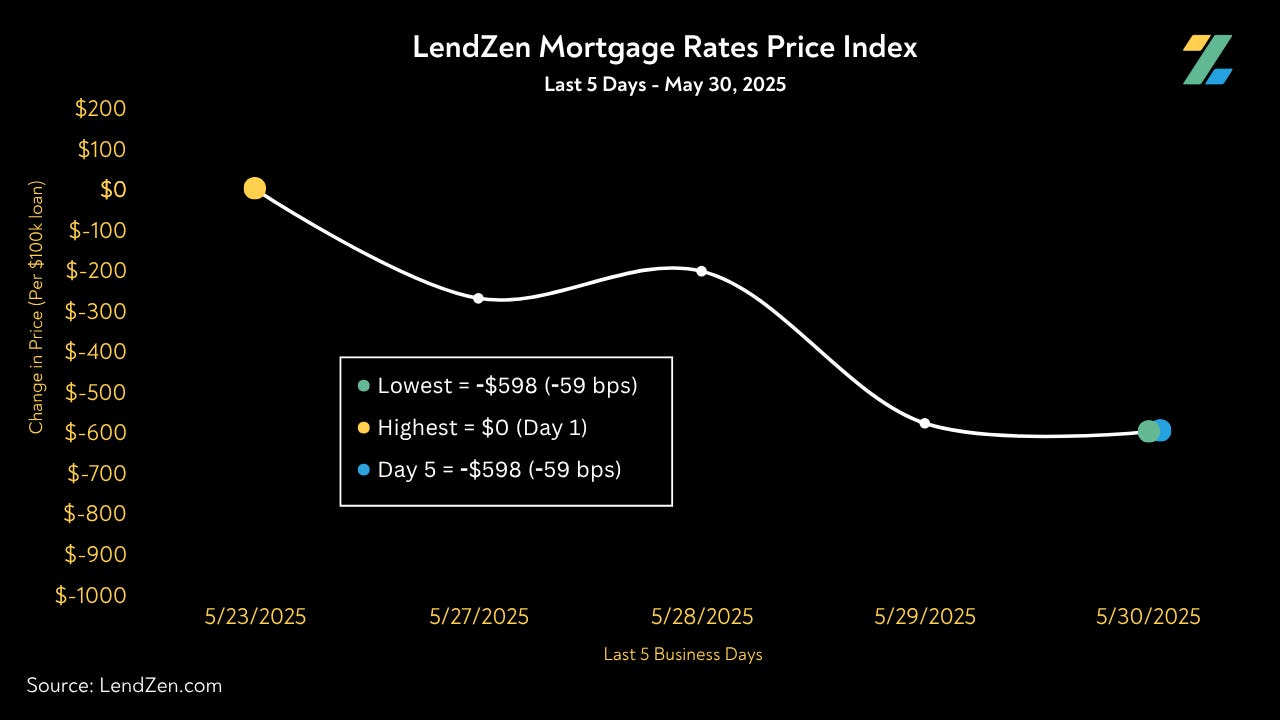

📊 NEW Mortgage Rates Index

The LendZen Mortgage Rates Price Index was just launched to provide a more accurate reflection of mortgage rate trends and the direct impact it has to borrowing costs.

It is important to remember mortgage rates do not rise or fall in the USA. Instead, the cost of each rate changes based on the daily fluctuation in the price of mortgage-backed securities (MBS).

Unlike traditional average rate indices, which can be misleading due to their flawed composition, the LendZen Index tracks the change in mortgage rate prices across a spectrum of mortgage bonds.

This approach offers borrowers a clearer understanding of how the cost to obtain a mortgage changes daily, irrespective of the specific rate they are considering.

The LendZen index also puts into context how quickly previous rate quotes can become obsolete, and in some cases by how much.

For example, in the Month of May chart below, we can see that at one point the cost of mortgage rates had increased $1,495 per $100,000 of loan amount, or 149 basis points (0.0149).

Fortunately, the cost of rates retreated towards the end of the month, finishing May only up 67 basis points.

This means for a $500,000 loan, regardless of what rate a borrower was quoted on May 1, the cost to get that mortgage increased $3,350 (500000 x 0.0067) by the end of the month.

As you can see the basis-points cost approach is much more relatable and useful for borrowers looking to buy or refinance.

This index also helps to illustrate the point I make regularly:

“It is not that lower rates are suddenly unavailable, it’s that the cost to get a loan at those lower rates is no longer economically feasible for borrowers to pay. As a result, lenders refrain from promoting them.”

Because mortgage lenders don’t publicly share the actual fees associated with each rate, only an obscure APR, creating this type of index was unimaginable before.

However, LendZen.com provides anonymous access to mortgage rates in real-time as bond prices change, and with full transparency of costs upfront.

This now makes it viable to prepare and publicly validate a Mortgage Rates Price Index.

In follow-up to the Month of May chart above, here are the “Last 5-Days”.

This data gives us hope that a new trend is forming towards less expensive mortgage rates.

You can read more on the relationship between mortgage bonds (MBS), loan originators, and the cost of rates, in this recent Substack article.

🔑 Rate Lock Recommendations

SHOULD YOU LOCK OR FLOAT?

15 Days: ✅ Lock Now

With upcoming economic reports and potential market volatility, securing current rates is advisable.

However, the LendZen “Last 5-Days” Index (chart above) illustrates how being brave in the face of adversity can payoff; mortgage rates became less expensive last week by 60 bps, a $3,000 reduction in borrowing costs on a $500,000 loan amount.30 Days: ⚠️ Consider Locking

Given the uncertainty surrounding the NFP employment report, and Federal Reserve commentary, locking in rates mitigates any risk.60 Days: 🕒 Float Cautiously

While there may be opportunities for rate improvements, especially if the NFP report misses expectations, the market remains unpredictable. Stay informed and be prepared to lock if favorable conditions arise.

Want to check customized, real-time mortgage rates instantly?

LendZen gives you anonymous access to mortgage rates that update as bond prices change.

Get full transparency of costs upfront and instant qualification results without any signup or human interaction required.

See for yourself and customize your own loan scenario at LendZen.com