Whiplash

A wild week in markets, and a wild weekend in the streets, left more questions than answers as investors and mortgage borrowers prepare for inflation data.

Last week brought sharp moves in mortgage rates, driven by a mix of unexpected developments in the economic and political landscape — setting the stage for a critical week ahead in both data and market sentiment.

📊 From Rally to Reversal

Mortgage rates experienced significant volatility last week.

Wednesday was the largest single-day improvement in over a month following the ADP employment report, which showed only 37,000 private-sector jobs added in May— well below the forecasted 111,000.

However, Friday's Non-Farm Payroll (NFP) report tempered this optimism.

The U.S. economy added 139,000 jobs in May, surpassing expectations and suggesting continued labor market resilience.

This stronger-than-expected data led to a reversal in bond markets, erasing the gains from earlier in the week.

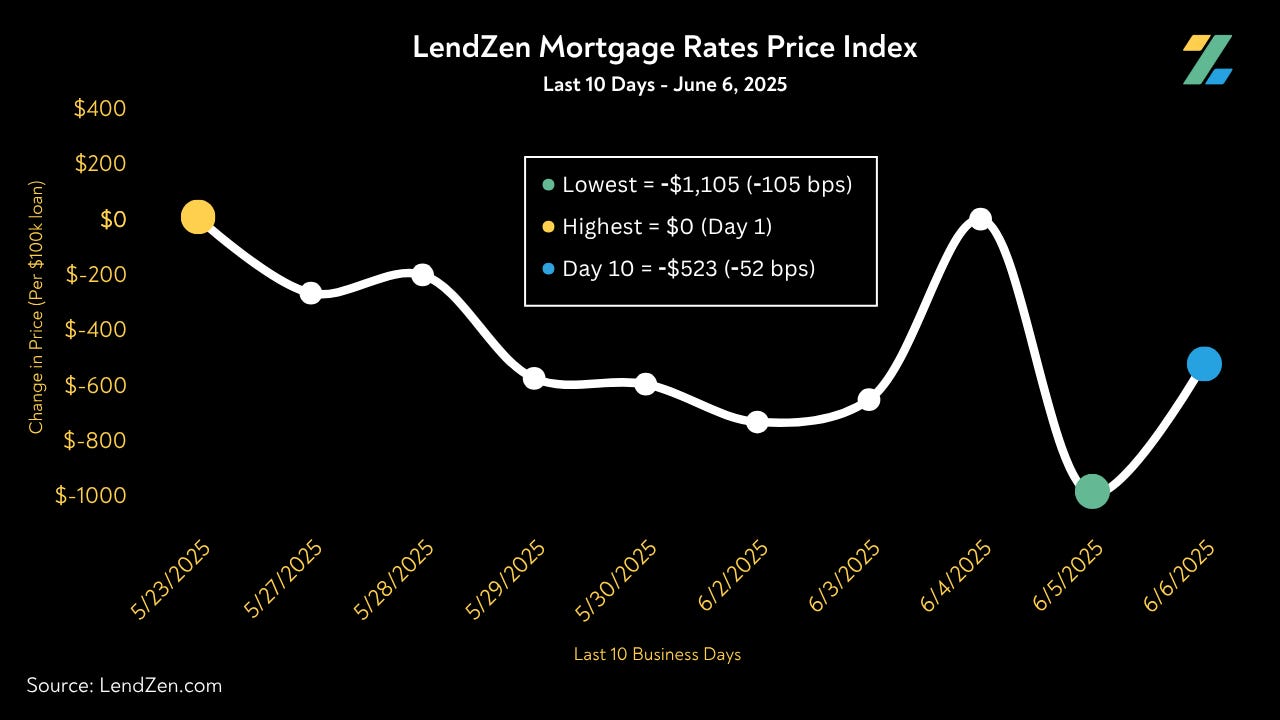

Despite the setback, mortgage rates in the last 10-Day have declined in price by 52bps based on the LendZen Index.

🔥 Elon vs. Trump

The escalating tension between Elon Musk and Donald Trump has drawn widespread media attention.

While it’s more of a political spectacle at this stage, equity investors may grow concerned if Trump decides to take retribution through policies that negatively affect key sectors tied to Musk, such as EVs, AI, or space.

It’s currently more noise than market-moving signal, and not something the bond market is noticing.

🧨 Riots in LA

This weekend’s riots in Los Angeles, sparked by large-scale ICE operations and deportation protests, are unlikely to directly impact bond or mortgage markets in the short term.

However, broader civil unrest tied to immigration enforcement can influence investor sentiment, particularly if it escalates and fuels concerns about political stability or future policy disruptions.

Markets are generally more sensitive to systemic risks, but this kind of social flashpoint can become a tail risk if it leads to wider unrest or appears to have a psychological impact on voters that could linger until the midterms.

📆 The Week Ahead

This week, markets will closely watch the following economic indicators:

Consumer Price Index (CPI) Report — Due Wednesday, this report will reveal inflation trends for May. Investors will scrutinize the data for signs of persistent price pressures, particularly in shelter, electricity, automotive, and apparel sectors.

University of Michigan Consumer Sentiment (Preliminary June Data) — Scheduled for release on Friday, June 13, this report will provide insights into consumer confidence and inflation expectations.

Additionally, ongoing trade talks between U.S. and Chinese officials in London may influence market sentiment, especially concerning tariffs and supply chain issues.

🔎 Big Picture Outlook

MORTGAGE RATES:

The trilogy of economic events that occur each month continue to have the most influence over bond prices, and therefore mortgage rates.

The three are:

1) FOMC (The Fed) rate decision

2) Consumer Price Index (CPI) inflation report

3) Non-Farm Payroll (NFP) employment report

HOUSING MARKET:

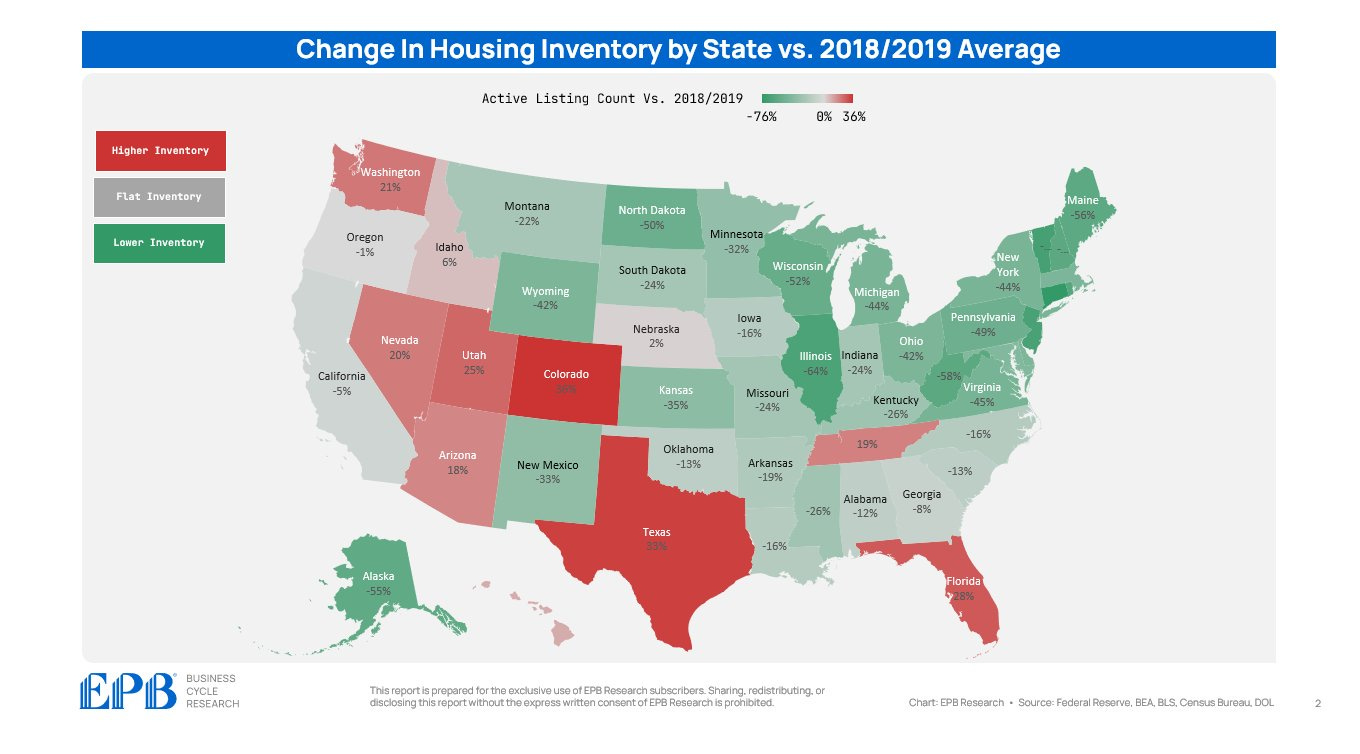

The U.S. housing market is showing signs of cooling.

While home prices continue to rise in some regions, increased inventory and affordability challenges are causing buyers to pull back.

Cleveland stands out as one of the few remaining seller's markets, thanks to its relatively low median home prices — 68% below the national average.

In contrast, Florida's housing market is experiencing a downturn, with declining home prices and reduced demand due to high insurance costs and overdevelopment.

🔑 Rate Lock Recommendations

SHOULD YOU LOCK OR FLOAT?

15-Days: ✅ Lock Now

With upcoming inflation data and potential market volatility, securing current rates is advisable.

30-Days: ⚠️ Consider Locking

Given the uncertainty surrounding the true direction of the U.S. economy and its conflicting indicators, plus hesitation from the Federal Reserve to cut their overnight lending rate, locking now is the safest approach. However, the less price sensitive borrower might consider testing their luck with Friday’s CPI inflation report.

60-Days: 🕒 Float Cautiously

While there may be opportunities for rate improvements, the market remains unpredictable. Stay informed and be prepared to lock if favorable conditions arise or should volatility increase.

Want to check customized, real-time mortgage rates instantly?

LendZen gives you anonymous access to mortgage rates that update as bond prices change.

Get full transparency of costs upfront and instant qualification results without any signup or human interaction required.

See for yourself and customize your own loan scenario at LendZen.com