Week Ahead – This is a big deal for mortgage rates 📅 🫣🍸

WEEK AHEAD 🗓️

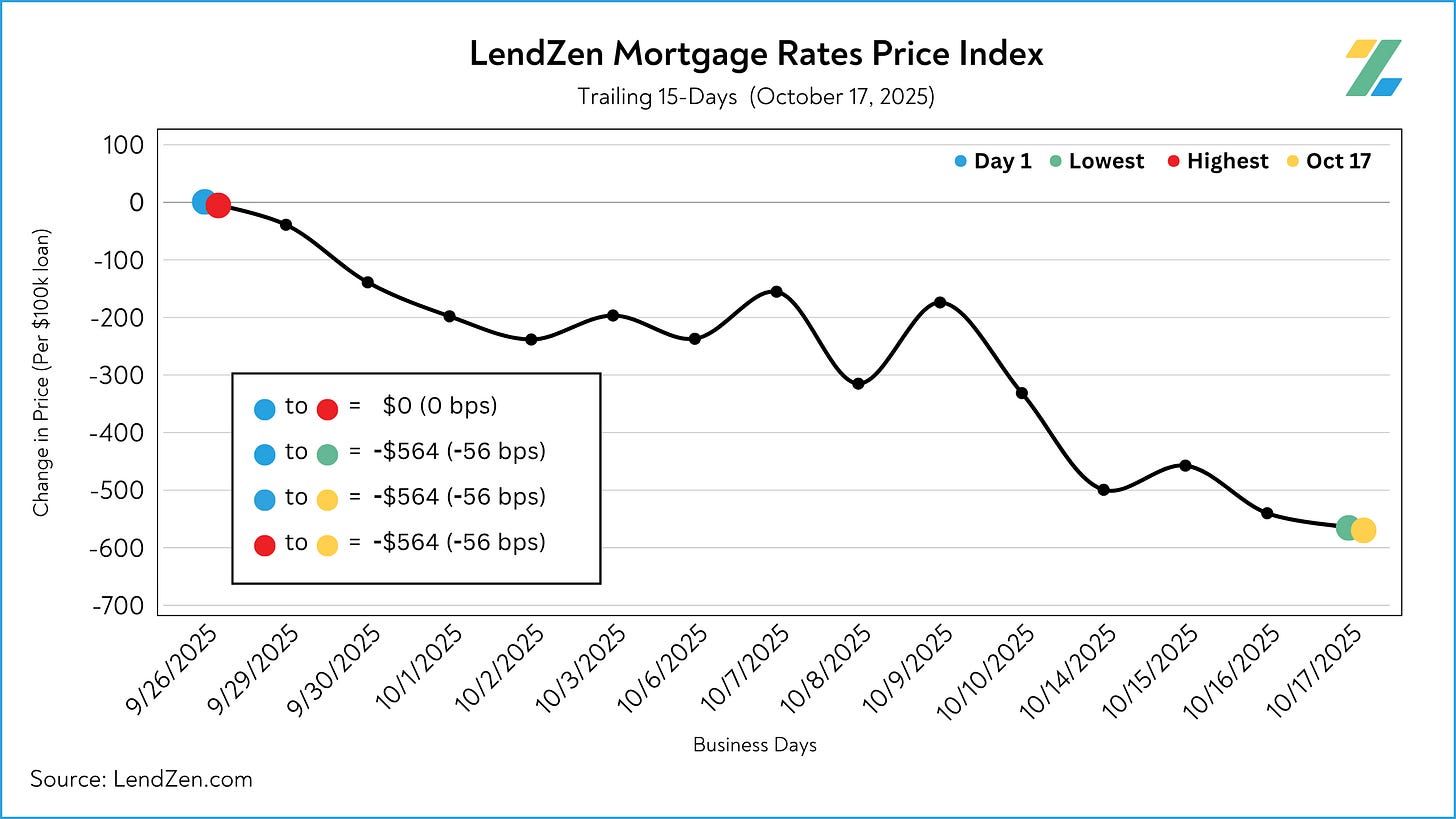

Quiet, calm, but consistently better – that’s the story of mortgage rates the last two weeks.

Monday I will take a deeper look at how mortgage rate prices, bond spreads, and longer-term trends unfolded in my Mortgage Rate Data Deluge.

However, the calm could end Friday.

Although government econ data has been delayed due to the shutdown, the Labor Department called back select staff last week to prepare the Consumer Price Index.

Scheduled to be released on Friday, the CPI inflation report is “kind of a big deal”.

President Trump has been extremely vocal about his desire for more rate cuts from the Fed.

However, the U.S. Central Bank is supposed to act independently, focusing purely on its dual mandate of price stability (inflation) and maximum employment.

Recent data hasn’t provided sufficient top-cover for The Fed to silence the political pressure by cutting more aggressively.

Yet, the urgency from the current administration to have the CPI report published might suggest inflation is cooler than expected, favoring additional rate cuts.

The FOMC doesn’t meet again until the following week Oct 28-29, but bond markets could react negatively to a CPI report that implies another rate cut is on the horizon.

The last 4 rate cuts were not well received, resulting in lower bond prices, which increases the PRICE of mortgage rates.

Inflation, employment, and The Fed make up my “Big 3” market movers.

Inflation (CPI/PCE)

The Fed (FOMC/Minutes)

Employment (NFP/ADP)

There is usually a bit of breathing room between each, but the government shutdown has caused a backlog, which could add to volatility when it’s time to play catch-up.

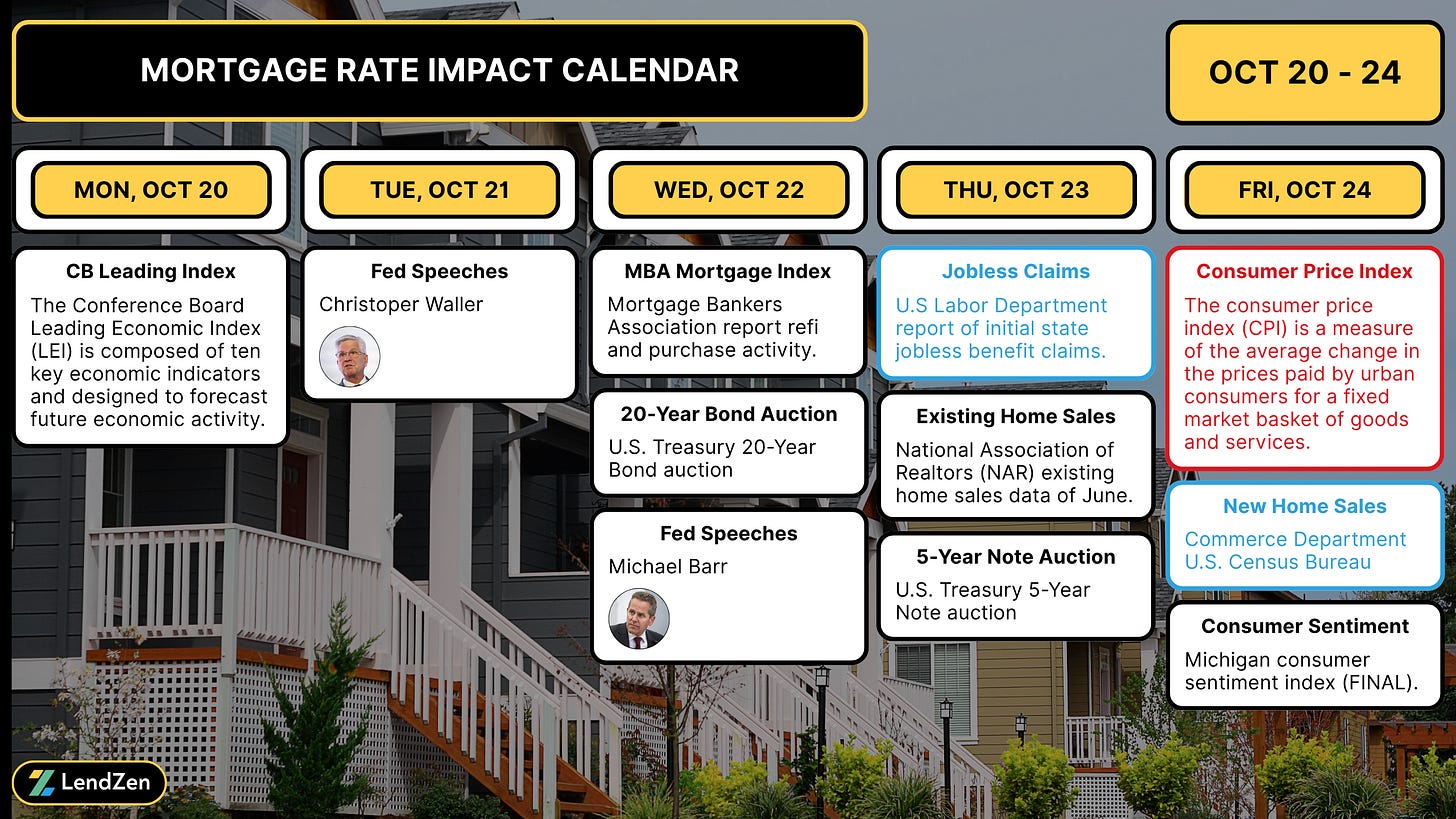

In the meantime, while the political circus continues the economic calendar is pretty light this week, outside of Friday’s CPI.

Buyers closing within 15-days are probably taking an unnecessary risk by remaining unlocked, but refinance borrowers with room to wiggle might be emboldened to roll the dice.

The latest Lock-O-Meter risk scores and rate lock recommendations with be posted tomorrow in the Data Deluge.

See the attached Mortgage Rate Impact Calendar – events marked blue could be delayed by the shutdown; CPI is expected regardless.

Thanks for reading.

If you are interested in more mortgage insights, then I suggest checking out this recent Substack article.