Week Ahead – Mortgage rates want to know; will you float too!? 📅 🎈🤡

WEEK AHEAD 🗓️

----------------

October saw mortgage rates improve to their best levels in over a year before experiencing an almost full reversal in the final days of the month, thanks to Jerome “Pennywise” Powell.

More on the impact of Powell’s remarks in this Substack post.

This week hinges on whether the lockdown ends and the Non-Farm Employment data is released (Friday).

Job Openings (JOLTS) and select Manufacturing data might also be on hold, leaving ADP with all the attention.

Otherwise, we might see more of the sideways grind that dominated recent weeks whenever meaningful data was absent.

**Events marked blue could be delayed by the shutdown.

Borrowers who decided to float into Wednesday now regret “IT”.

With bond markets already spooked and little hope for rate friendly data this week, the only question is do you accept the pain and lock now or … will you float too!?

Monday I will take a deeper look at how mortgage rate prices, bond spreads, and longer-term trends are unfolding in my Mortgage Rate Data Deluge.

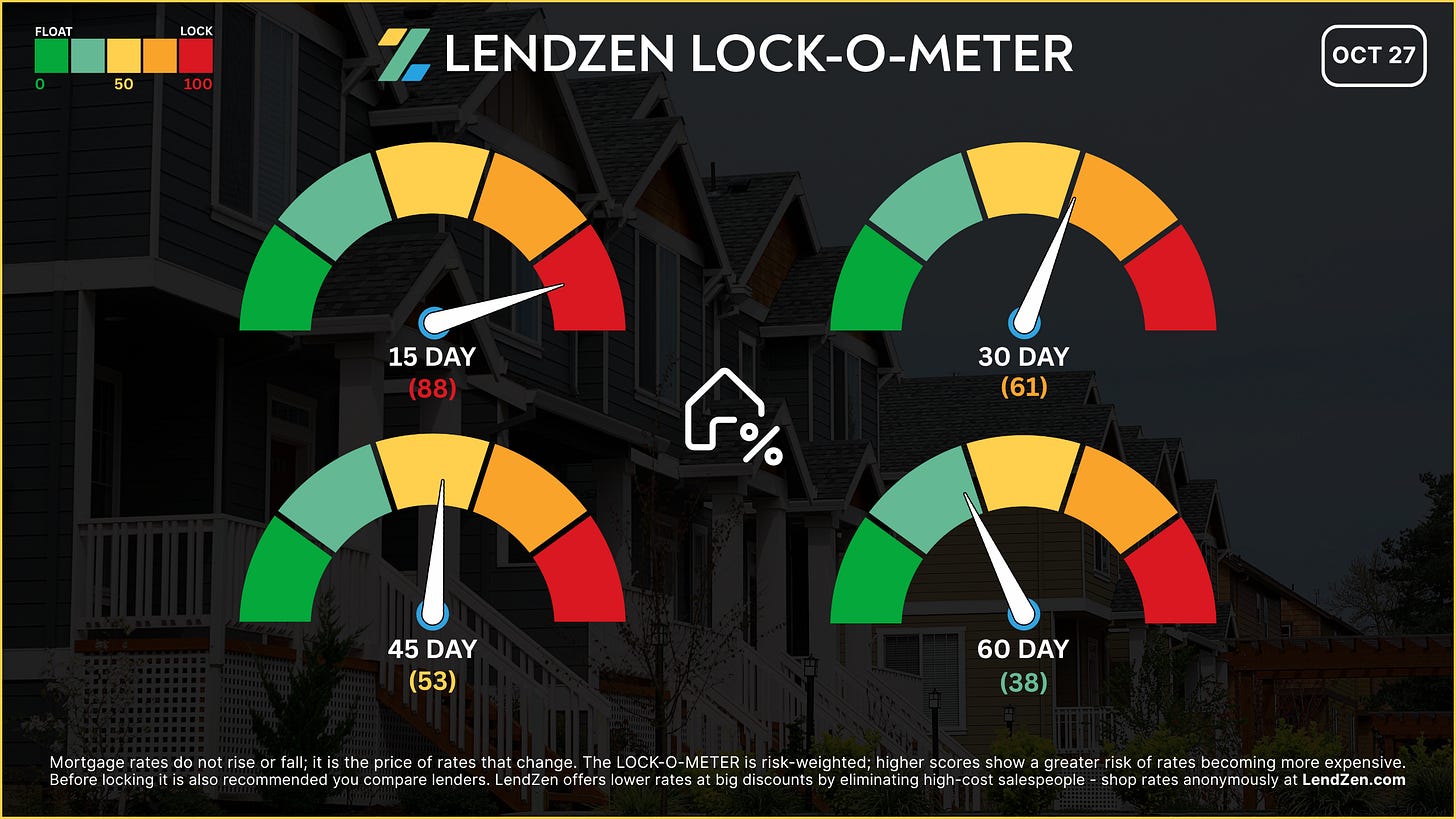

The latest Lock-O-Meter risk scores and rate lock recommendations will be posted with it.

Thanks for reading.

If you are interested in more mortgage insights, then I suggest checking out this recent Substack article.