Week Ahead – Mortgage rates try to survive the Fed 📅✂️💀

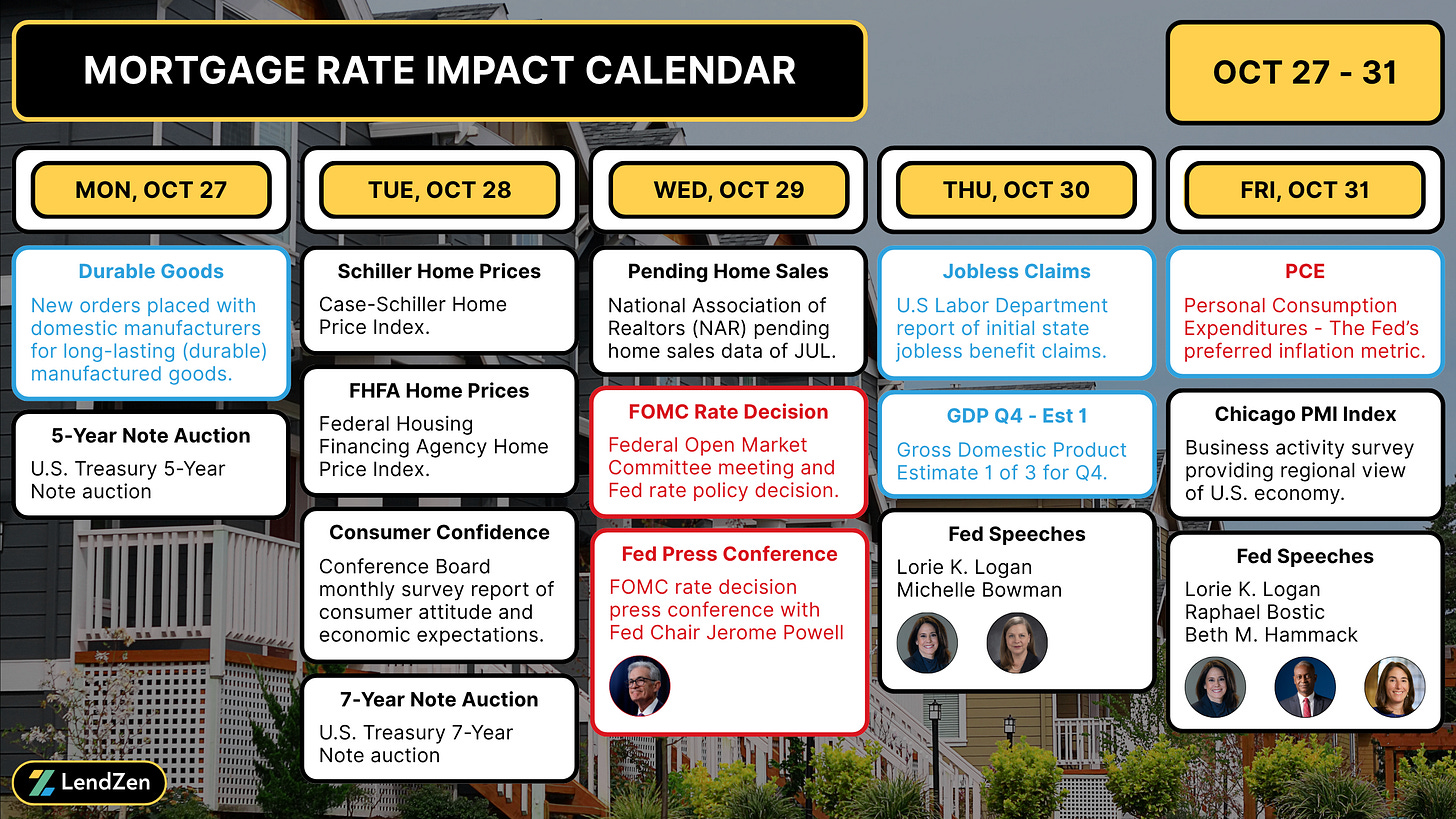

WEEK AHEAD 🗓️

----------------

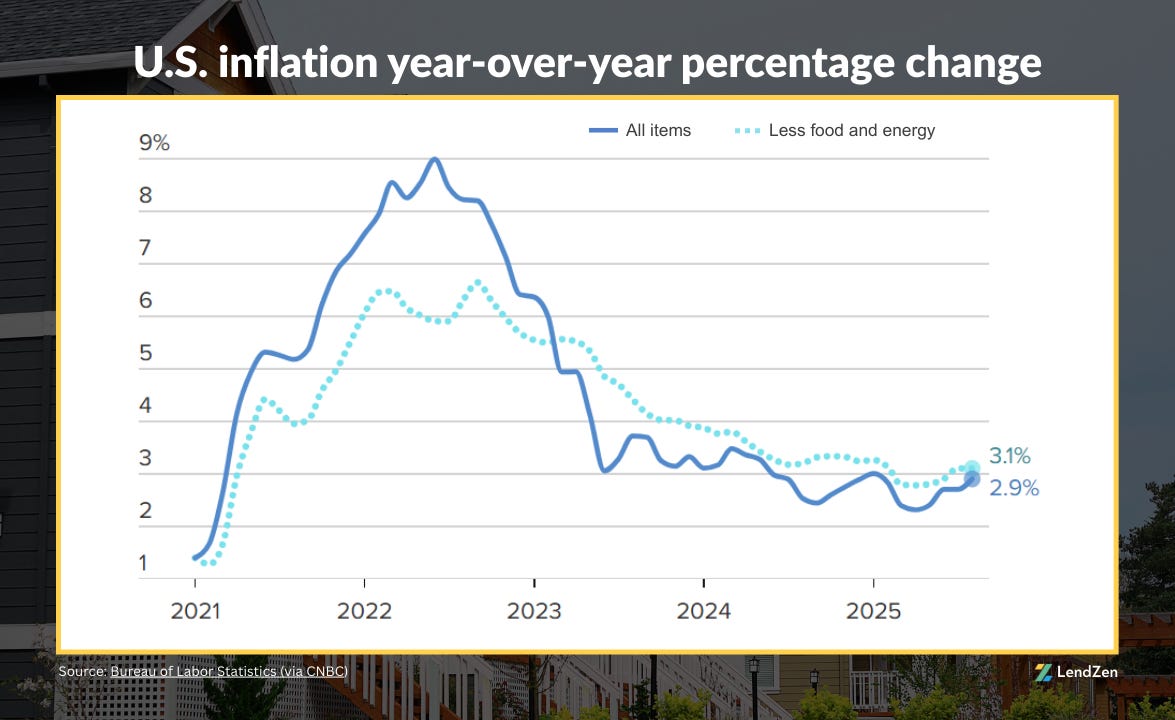

As the shutdown continues the Fed rate decision feels like a foregone conclusion, especially after last week’s CPI inflation data was “good enough” to give them room for further policy normalization (rate cut).

Although there is no wrong way to eat an Oreo, markets will be focused this week on the creamy middle.

With a Wednesday 25-basis point cut already priced in, much greater emphasis will be placed on the dot plot which shows the committee members future rate policy projections.

Meanwhile, the biggest mover of the day is likely to be Powell’s press conference and how investors interpret his comments.

The cookie outside starts with Treasury auctions and home price data earlier in the week.

Yet, PCE inflation and GDP, which would normally put a crunchy cap on a fuller calendar than usual, are both likely to be delayed due to the shutdown.

This will leave investors with less to chew on heading into November.

**events marked blue could be delayed by the shutdown

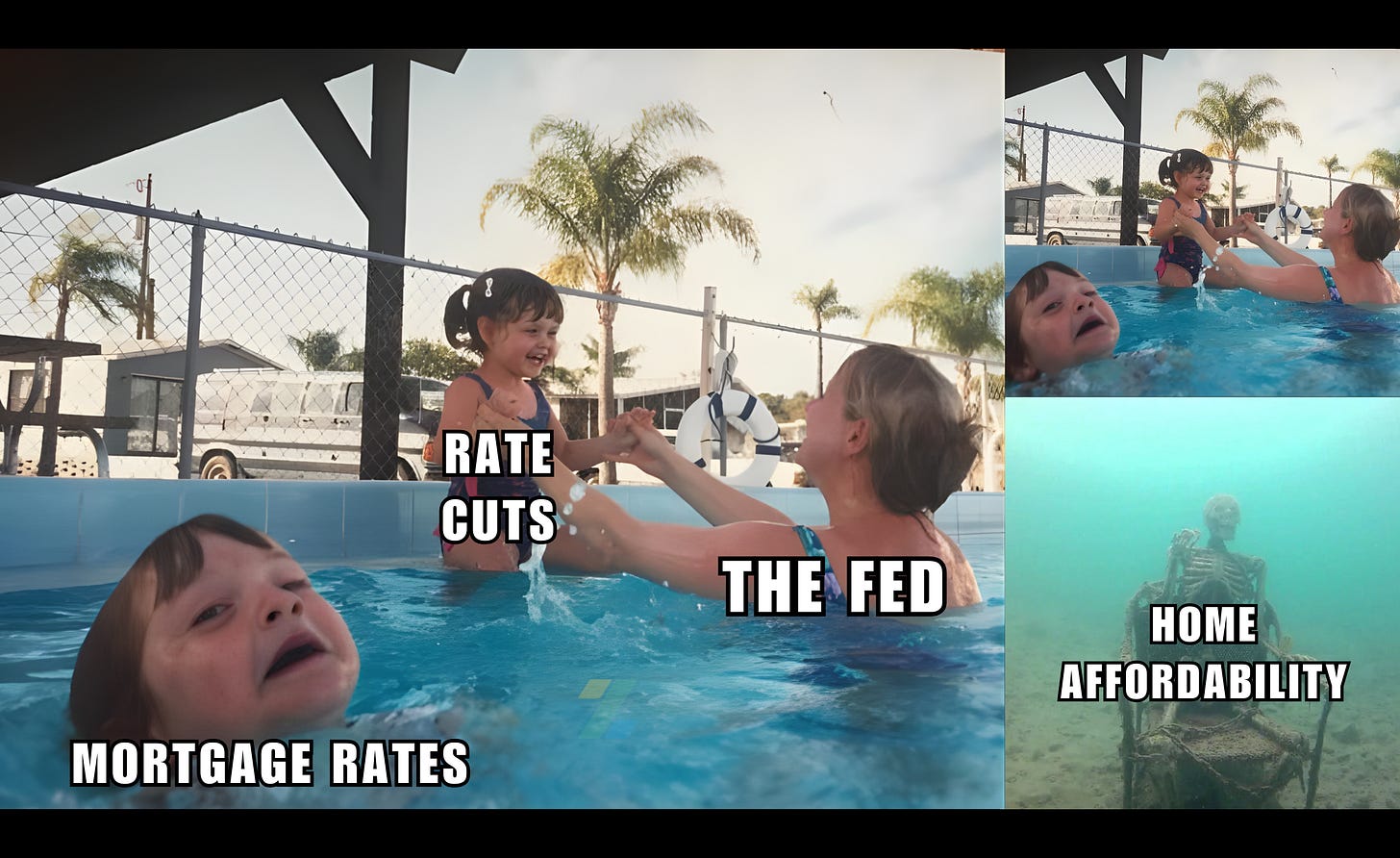

It is important to remember that Fed rate cuts do not directly change mortgage rates, but the potential impact does, especially when it comes to inflation.

Bonds have so far tolerated rate cuts and Fed forecasts, but at some point attempting to thread the needle between political pressure and price stability (inflation) is going to get rejected by the bond market.

The 3% YoY inflation is still above the Fed’s target rate of 2% and considering major asset classes (stocks, bitcoin, gold, etc.) are still trading within all-time highs, this is probably the last time the Fed can cut without bonds throwing a tantrum.

But who is to say the Fed even cares about mortgage rates and home affordability?

After all, it was their heavy-handed response in 2020-21 that resulted in 40-year high inflation and the bond market meltdown.

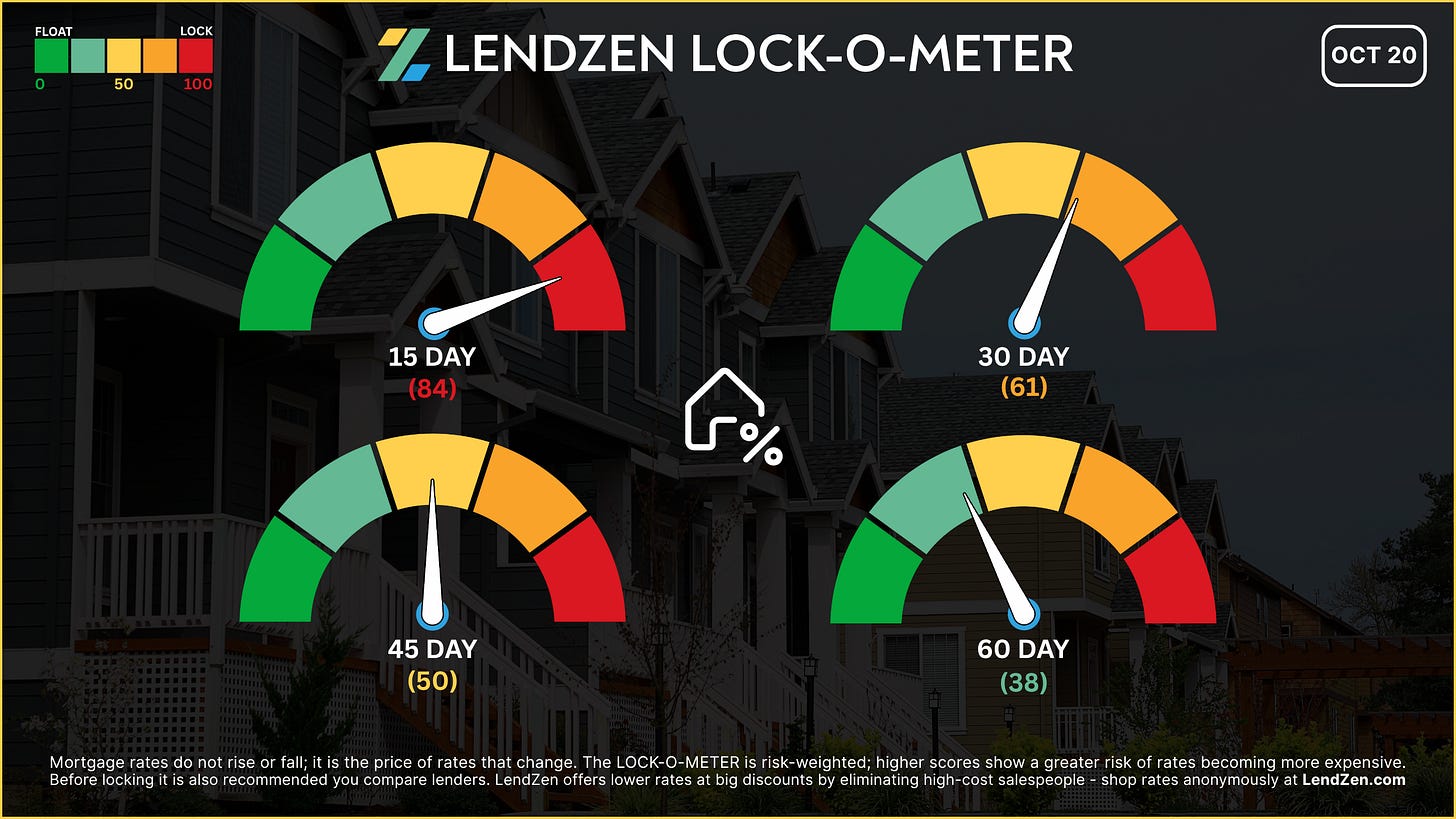

The good news is the PRICE of mortgage rates has improved 330 basis points since the 2025 peak on January 16.

However, this still has many homeowners and would be homebuyers gasping for air...

Monday I will take a deeper look at how mortgage rate prices, bond spreads, and longer-term trends are unfolding in my Mortgage Rate Data Deluge.

The latest Lock-O-Meter risk scores and rate lock recommendations will be posted with it.

Thanks for reading.

If you are interested in more mortgage insights, then I suggest checking out this recent Substack article.