Too Quiet

Markets remained calm last week, despite The Fed and geopolitical tensions, but that’s likely to change starting Monday.

The outlook for mortgage rates this week will be clearer in the next 24 – 48 hours, depending on how Iran responds to the U.S. bombing of their nuclear facilities over the weekend.

The main focus is the Strait of Hormuz, and the role it plays in transporting oil.

War, especially one that risks sending oil prices skyrocketing, can have significant impact on inflation expectations.

The unfolding of events in the Middle East are in addition to the Fed’s preferred inflation report, Personal Consumption Expenditures (PCE), which will be released on Friday.

Let’s look closer at last week’s events and what else lies ahead that could disrupt the modest winning streak bonds (and mortgage rates) have enjoyed recently.

One thing is for sure … “It’s the wrong week to stop sniffing glue”

🤐 No News, is Good News

Last week saw a shortened holiday week with the Juneteenth closure, but not before The Fed made a rate policy decision.

The FOMC meeting on Wednesday ended with the Fed keeping their overnight lending rate unchanged, while notably increasing their rate projections for 2026 and 2027.

Despite the shift in their forecasts, bond markets remained calm while Trump did not…

The President escalated his criticism of Jerome Powell calling him "stupid" for delaying rate cuts and labeling him "Too Late Powell".

Although it made for a good news story, it had no material impact on markets.

Equally unphased were mortgage rates.

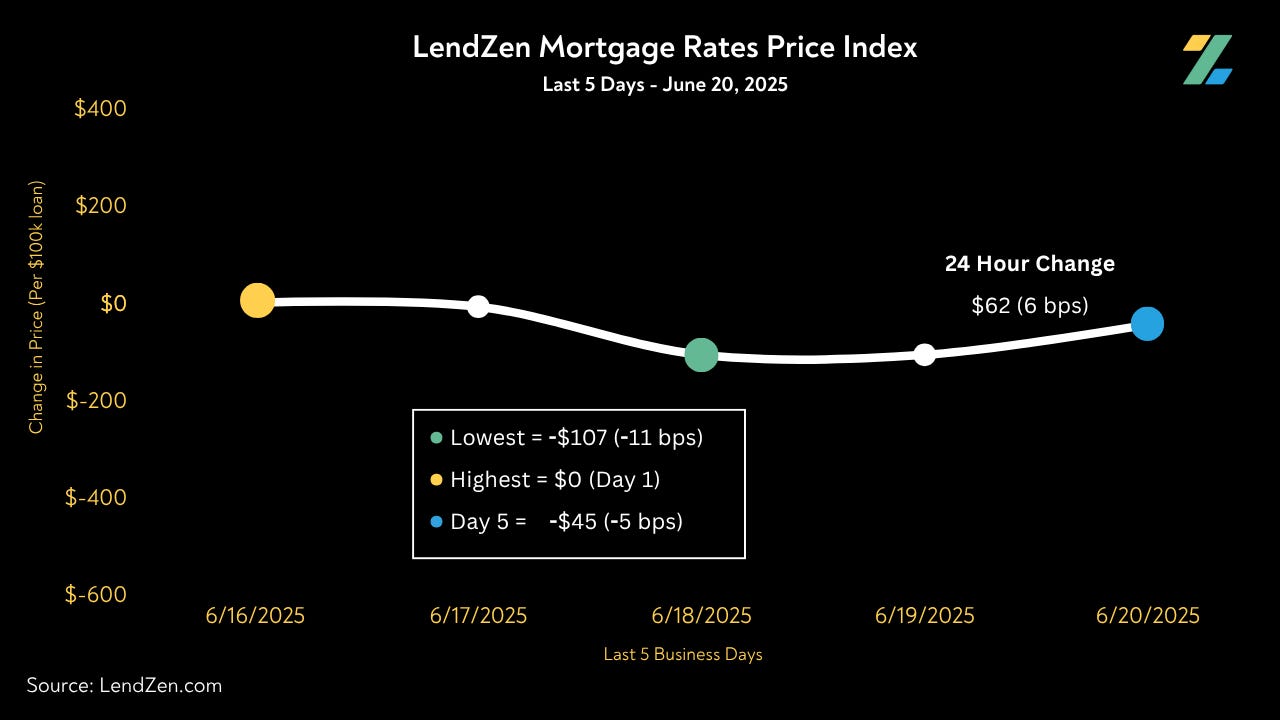

The LendZen Index showed only a 5 bps drop in the last 5-days.

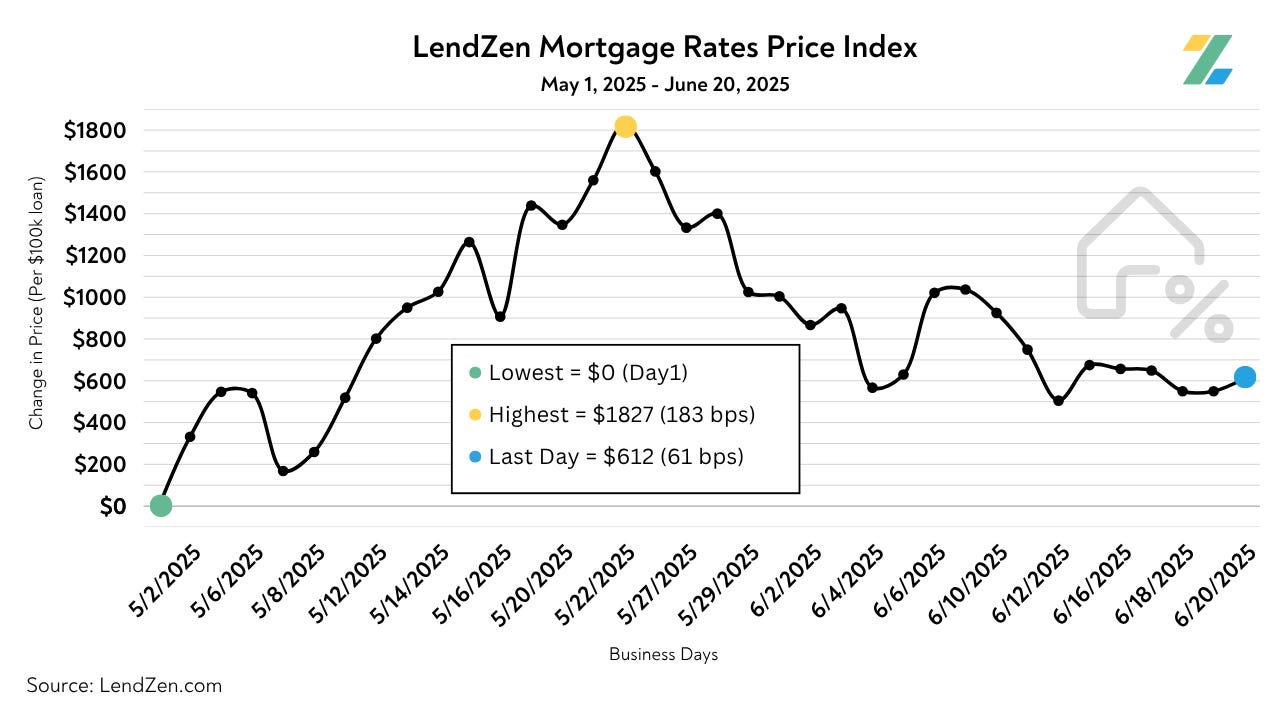

Although mortgage rates are 61 bps more expensive since May 1, there has been a 122 bps decline from the peak price on May 22nd.

The LendZen Index tracks the change in mortgage rate prices across a spectrum of mortgage bonds.

It gives borrowers a clearer picture of how the cost to obtain a mortgage has changed, regardless of which rate they are considering.

The index also helps put into context how quickly previous rate quotes can become obsolete, and by how much.

📆 The Week Ahead

This week, markets will closely watch the following:

Geopolitical Shock: Bombing of Iran Nuclear Sites — The weekend’s U.S. airstrikes on Iranian nuclear facilities have reignited geopolitical uncertainty.

As discussed in my recent article, oil supply shocks bring unwelcome volatility to bond markets.

Powell Testimony (Tuesday–Wednesday) — Chair Powell faces Congress for two days of testimony amid Fed policy scrutiny, emphasized by Trump’s public disapproval. Powell’s tone, and tone-deafness to political pressure, could sway markets.

Core PCE Release (Friday) — The Fed’s preferred inflation gauge arrives Friday. Any signs that inflation is reversing course could further delay Fed rate cuts. However, the impact inflation has on bonds, and bond sentiment, will be the more immediate trigger for mortgage rate volatility.

🔎 Big Picture Overview

MORTGAGE RATES:

Fed policy trajectory: Higher rate projections into 2026 – 27 suggest stubborn inflation.

Geopolitical risk: Tensions within Iran risk triggering oil supply shocks, pressuring bonds and rates.

Inflation data: With core PCE on deck, investors remain cautious while awaiting the results and additional cues from The Fed.

HOUSING MARKET NEWS:

Home Sales: Existing and new home sales continue to show regional variation. Inventory is gradually rising, particularly in Sun Belt markets, easing some affordability pressure.

Foreclosures: Delinquency rates remain low but watch for regional upticks, especially where employment is more sensitive to residential construction.

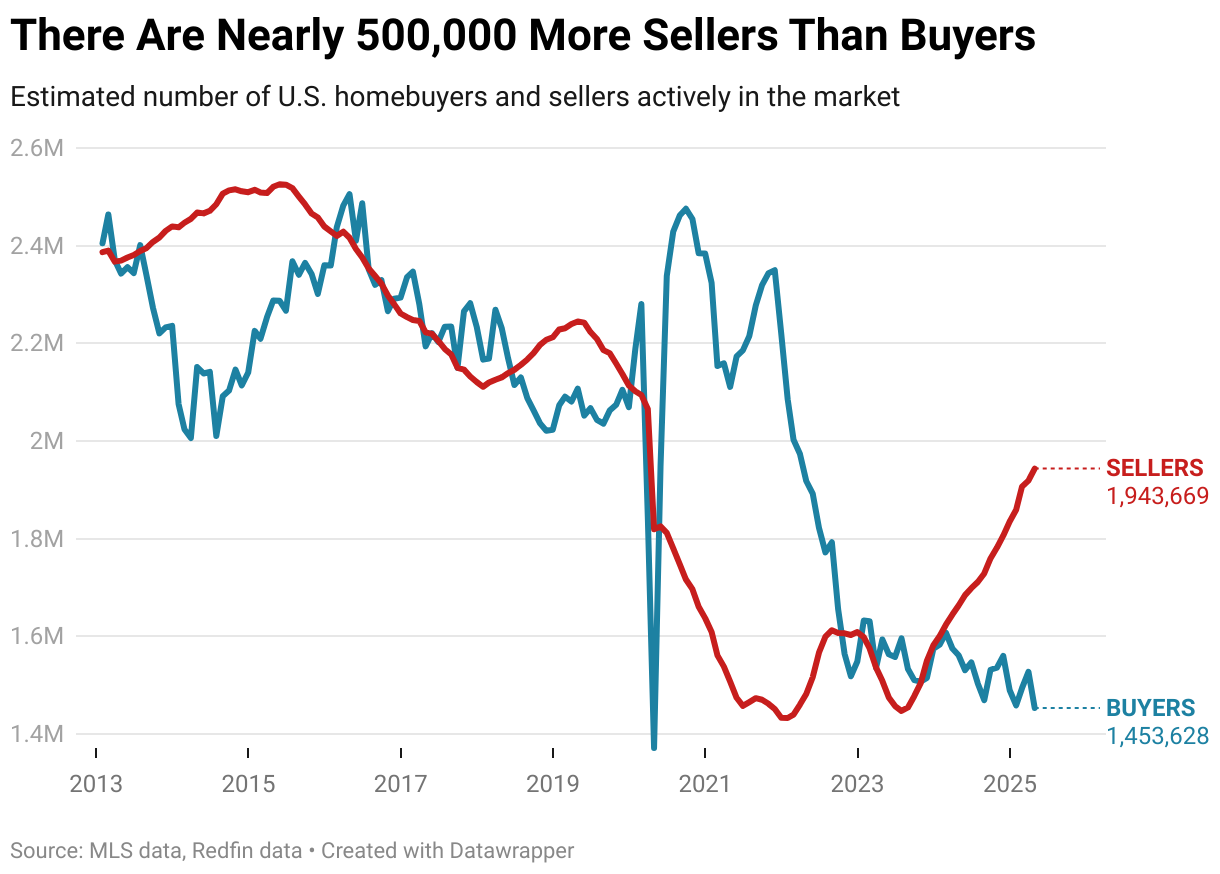

Buyer / Seller Gap: While Redfin data suggests a record 33.7% gap between the number of buyers and sellers, this is driven mostly by the Sun Belt where the ratio is over 120% in a handful of cities.

🔒 Rate Lock Recommendations

15-Day Closing Window:

Recommendation: ✅ Lock Now

Rationale: Short term volatility from both geopolitical and policy developments suggest securing rates quickly is prudent.

30-Day Closing Window:

Recommendation: ⚠️ Consider Locking

Rationale: With Powell’s testimony and PCE on deck, sharp swings in rates is possible. Locking may hedge against getting caught off guard with only a few weeks left to make up lost ground.

60-Day Closing Window:

Recommendation: 🕒 Float Cautiously

Rationale: If inflation shows signs of easing and geopolitical tensions subside, bond markets could shift their focus back to hard economic data and the possibility of recession. This could help reduce the cost of mortgage rates if investors shift towards a more bond-friendly "risk-off" mindset.

Want to check customized, real-time mortgage rates instantly? 🧮

LendZen (NMLS# 375788) gives you real-time access to mortgage rates that update as bond prices change.

The detailed loan summaries have an interactive rate slider that shows all current mortgage rates and full transparency of costs upfront.

All information can be viewed anonymously and without any sign-up requirements or human interaction. This makes exploring the full range of rate options hassle-free.

See for yourself and customize your own loan scenario at LendZen.com