The U.S. is Feeling Moody

What the U.S. Credit Downgrade means for bonds, mortgage rates, and the housing market

Late on Friday, May 17, 2025, Moody’s downgraded the U.S. credit rating from "Aaa" to "Aa1" – citing a $36 trillion debt pile and rising interest costs. While the U.S. still holds a “high grade” rating this move raises red flags 🚩 about America’s rising debt and the sustainability of its fiscal policy. The downgrade may not trigger immediate panic, but it signals deeper tremors in the global financial system, especially for bonds, interest rates, and ultimately the cost of borrowing for consumers and businesses alike. Let's look closer at what the downgrade could mean ahead of Monday's market open.

✂️ The Downgrade in Context

Moody’s cited persistent budget deficits and growing interest burdens as reasons for the cut.

Although the U.S. dollar and Treasury bonds remain safe-haven assets, their perceived safety is now being called into question subtly, but meaningfully.

Rating agencies like Moody’s help investors assess risk, and when that risk rises, so do expectations for higher returns.

This is particularly relevant for foreign investors, who hold more than $7 trillion in U.S. Treasury debt. 💰

As Bianco Research pointed out on X, if the U.S. credit profile continues to erode, foreign buyers may begin to demand higher yields – or worse, reduce their purchases.

A reduction in foreign demand can not only push yields higher but also redirect capital flows out of the U.S., undermining key pillars that have historically supported risk assets like equities and real estate.

This was the result after the 2011 downgrade.

💵 Bond Market Repercussions

The bond market is often the first to respond to a credit rating change.

When investors perceive more risk, they demand more compensation, which drives bond prices down and yields up.

This puts upward pressure on borrowing costs across the board.

In particular, the 10-year U.S. Treasury yield, often referred to as a benchmark for mortgage rates, ended the week higher at 4.48% with an almost 5 basis point spike just prior to the close.

If the downgrade sparks further panic from bond investors, we could see the cost of mortgage rates climb painfully higher in the weeks and months ahead.

🏛 The Truth About Mortgage Rates

Mortgage Bond prices have fallen significantly since the all-time highs in 2020-21.

Bond prices fall when there are more sellers than buyers, and this lack of demand results in less capital bidding for lower yielding mortgage-backed securities (MBS).

In the face of 40-year high inflation (2022 - 2024) investors demanded higher yields, which meant liquidity moved into higher yielding MBS coupons.

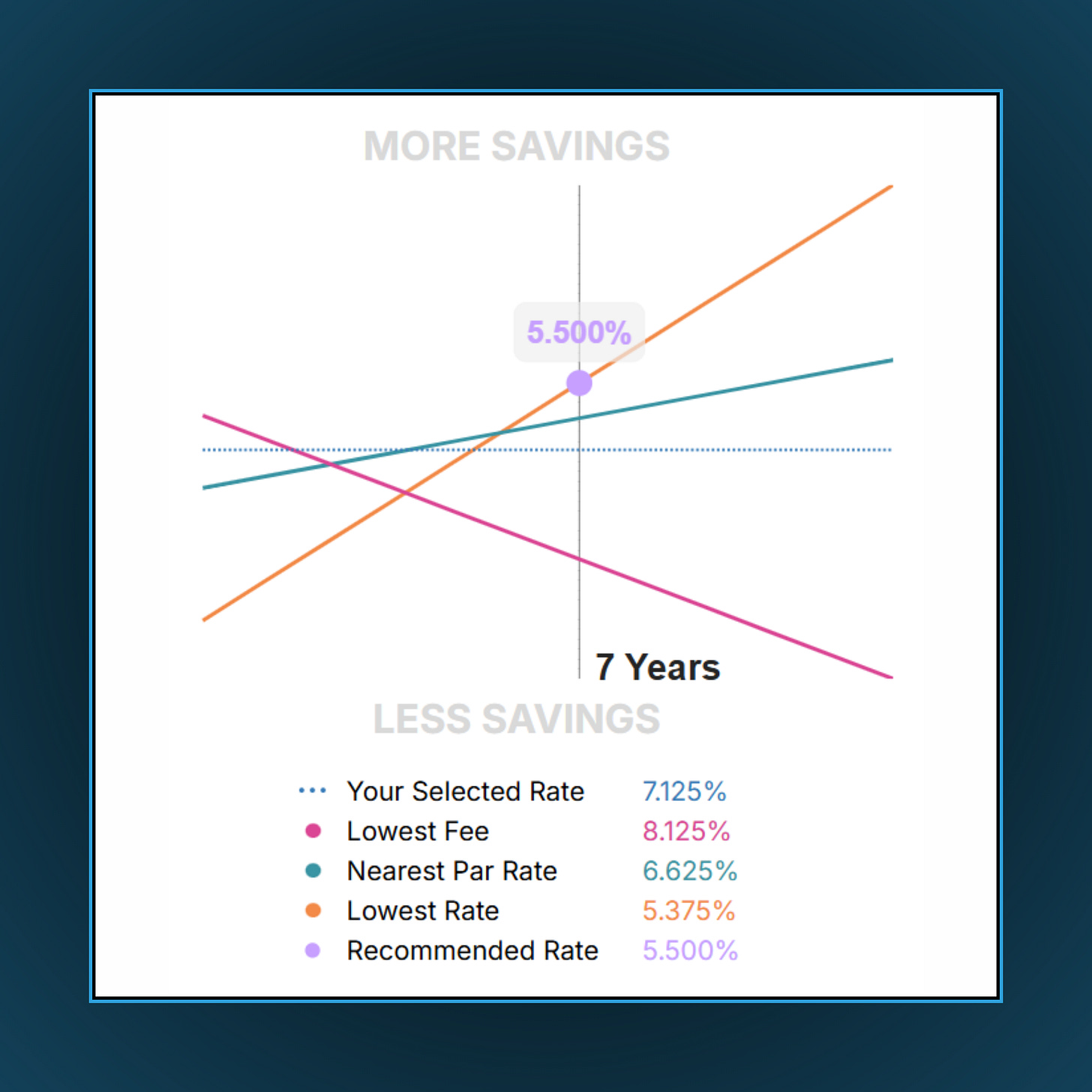

It is important to remember, in the USA mortgage rates do not rise or fall. Instead, the cost of each rate changes based on the daily fluctuation in the price of mortgage bonds ... and the cost of each rate is a factor of the shifts in MBS liquidity.

Lenders are not choosing mortgage rates, instead they merely charge fees on top of what the bond market is willing to pay for each MBS coupon, which trade at half-percent increments (4.5, 5.0, 5.5, 6.0, 6.5, 7.0, etc).

The mortgage loans that are bundled into each MBS will generally have a NOTE rate of 0.25 - 0.75 higher than the coupon, and that spread is retained as a servicing fee.

The demand for higher yields from bond investors meant a drought of liquidity in lower MBS coupons, causing them to trade at a discount (below par).

It’s not that lower mortgage rates are no longer available, it’s that the cost (discount fee) of those rates, plus lender fees, is no longer economically feasible for borrowers to pay.

The result is lenders advertise higher mortgage rates, that get sold into higher MBS coupons currently trading at a premium (above par).

That premium (rebate), paid by bond investors to lenders, is used to offset their origination expenses, making the total cost of getting a mortgage more palatable to borrowers.

To summarize:

Mortgage rates do not rise or fall, instead the price of rates change as the price of each mortgage bond rises or falls.

The price of a given mortgage bond dictates the discount fee or premium for all lenders.

Borrowers are not shopping for rate, but instead for the least expensive lender when comparing the SAME RATE on the SAME DAY

🏡 Housing Affordability

Another big drop in U.S. Treasury Bond prices would further exacerbate the liquidity issues in MBS and intensify home affordability issues as the cost of lower rates moves even further out of reach.

This creates a feedback loop: higher borrowing costs slow demand, which can depress home values, stall new construction, and tighten overall housing activity.

However, in today’s uncertain rate environment at least there are resources like LendZen.com - with LendZen you get anonymous, real-time access to all mortgage rates with full transparency of costs upfront and no signup or human interaction required.

With rates reacting daily to bond market volatility, knowing exactly where you stand can help you time your decisions wisely.

🌍 Global Implications: Capital Flows and Risk Assets

One underappreciated angle is how this downgrade affects global capital allocation.

U.S. financial markets have long benefited from robust foreign capital inflows, supporting everything from Treasury auctions to stock market rallies.

If international investors grow wary of U.S. fiscal health, they may reduce exposure to dollar-denominated assets.

This would not only pressure bonds but also deflate valuations in equities and other risk assets.

Put another way: the downgrade doesn’t just touch Washington. It ripples out to Wall Street, your mortgage lender, and the price tag on your next home.

🔍 Bottom Line

Moody’s downgrade is more than just a headline – it’s a warning shot.

While the U.S. remains a cornerstone of the global financial system, even small cracks in that foundation can have large-scale consequences.

From rising mortgage rates to shifting capital flows, the effects of this credit reappraisal are already starting to move through the system.

Whether you're a homebuyer, investor, or simply trying to understand where the economy is headed, now is the time to stay alert, informed, and proactive.

Mortgage rates are not just about home loans anymore, they’re a real-time barometer of global trust in U.S. fiscal credibility.