The Fed will ____ rates this week

Is the Fed going to surprise markets on Wednesday?

Despite tensions in the Middle East, which was discussed in greater detail in the most recent Weekly Kut, the bond market was relatively flat today.

Read more about the recent trends in mortgage bonds and the exact impact this has on the cost of getting a mortgage by visiting the LendZen Index Substack.

Oil futures (+15%) and equity prices (+1%) are both up since the last Fed rate decision, and the U.S. unemployment rate unchanged.

Therefore, when the FOMC meeting concludes on Wednesday, the Federal Reserve is expected to keep their benchmark overnight lending rate (The Fed Funds) at 4.25 - 4.50%.

The relationship between the Fed Funds and Mortgage Rates is often misunderstood.

Financial media implies Fed rate cuts are a good thing for the housing market, but the timing of the cuts is critical.

Mortgage bonds determine mortgage rates, not the Fed Funds.

During recessions investors buy bonds for safety, in what is called a "risk-off" move.

Fed rate cuts usually come well after this shift in investor sentiment is already underway.

Although cuts help add fuel to the bond rally, which further improves the price of mortgage rates, the Fed's rate policy is not the necessarily "the why" mortgage rates are better.

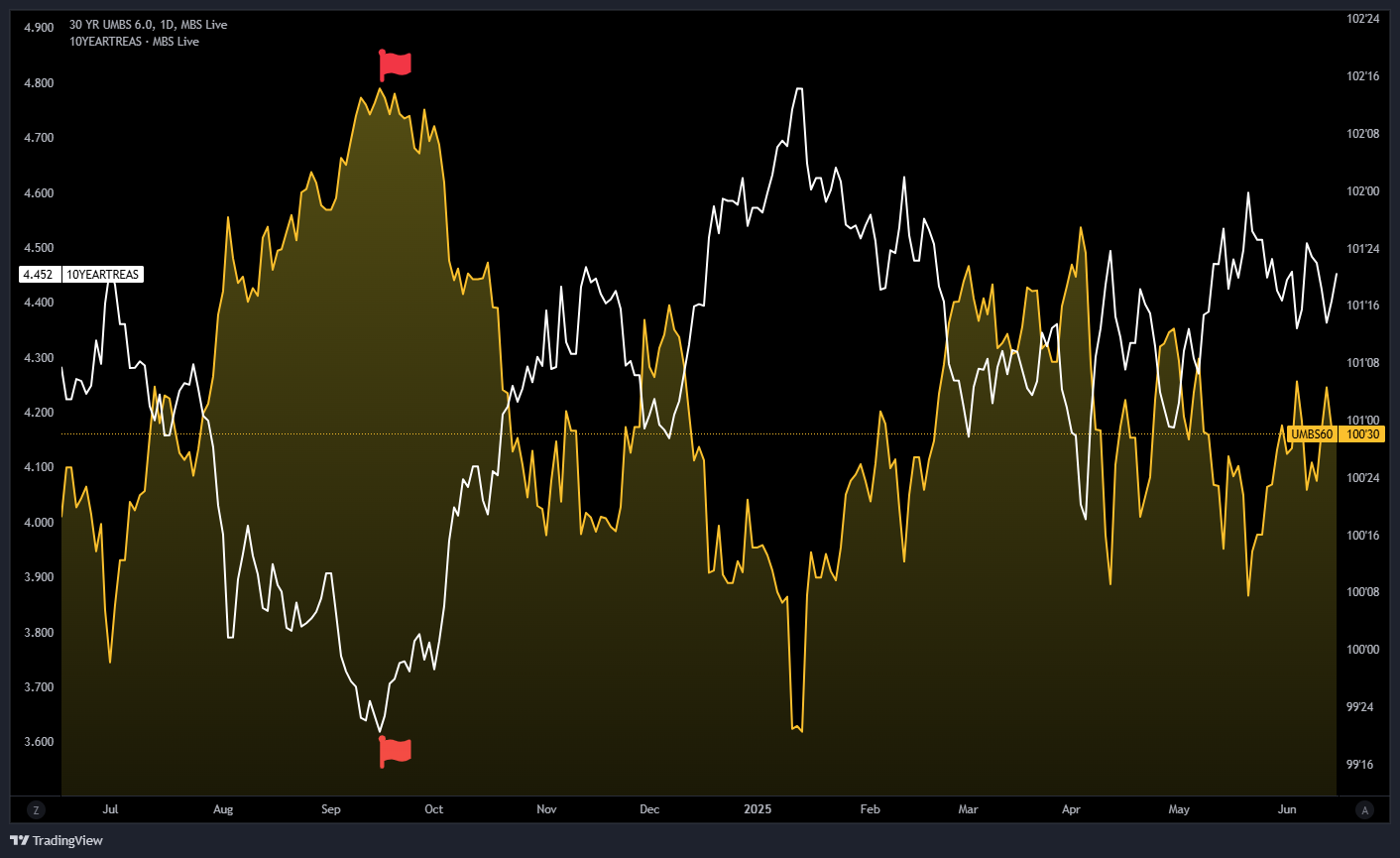

For example, the Fed made multiple cuts prior to the election last year, with the first following the September FOMC meeting (red flags on chart).

This shift in Fed policy was viewed as poorly timed and potentially inflationary, which resulted in a bond sell-off.

In the US, mortgage rates do not rise or fall.

Instead, the cost of each rate changes based on the daily fluctuation in the price of mortgage bonds (MBS).

Think of it as a permanent menu of rates, but every item on that menu changes in price for all banks and lenders based on the buying and selling of mortgage-backed securities (MBS).

As you can see in the chart below (yellow shaded area) when the Fed announced the rate cut mortgage bond prices fell, as investors sold, resulting in the cost of mortgage rates rising.

What do you think the Fed will decide on Wednesday?

Share your thoughts in the comments.