The Fed, spreads, and why mortgage rates could lose after the cut.

The real story behind the "best" mortgage rates in over a year.

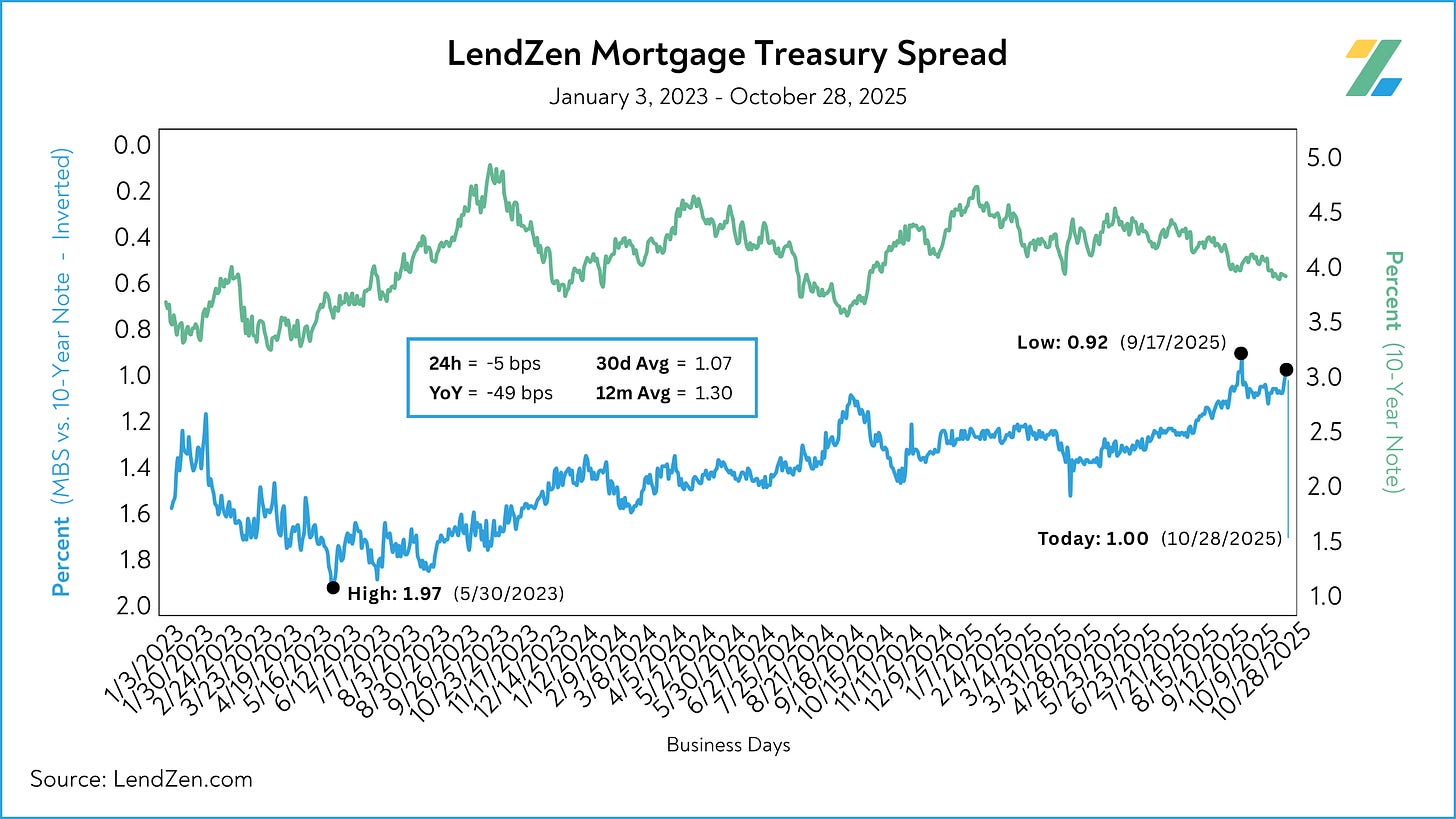

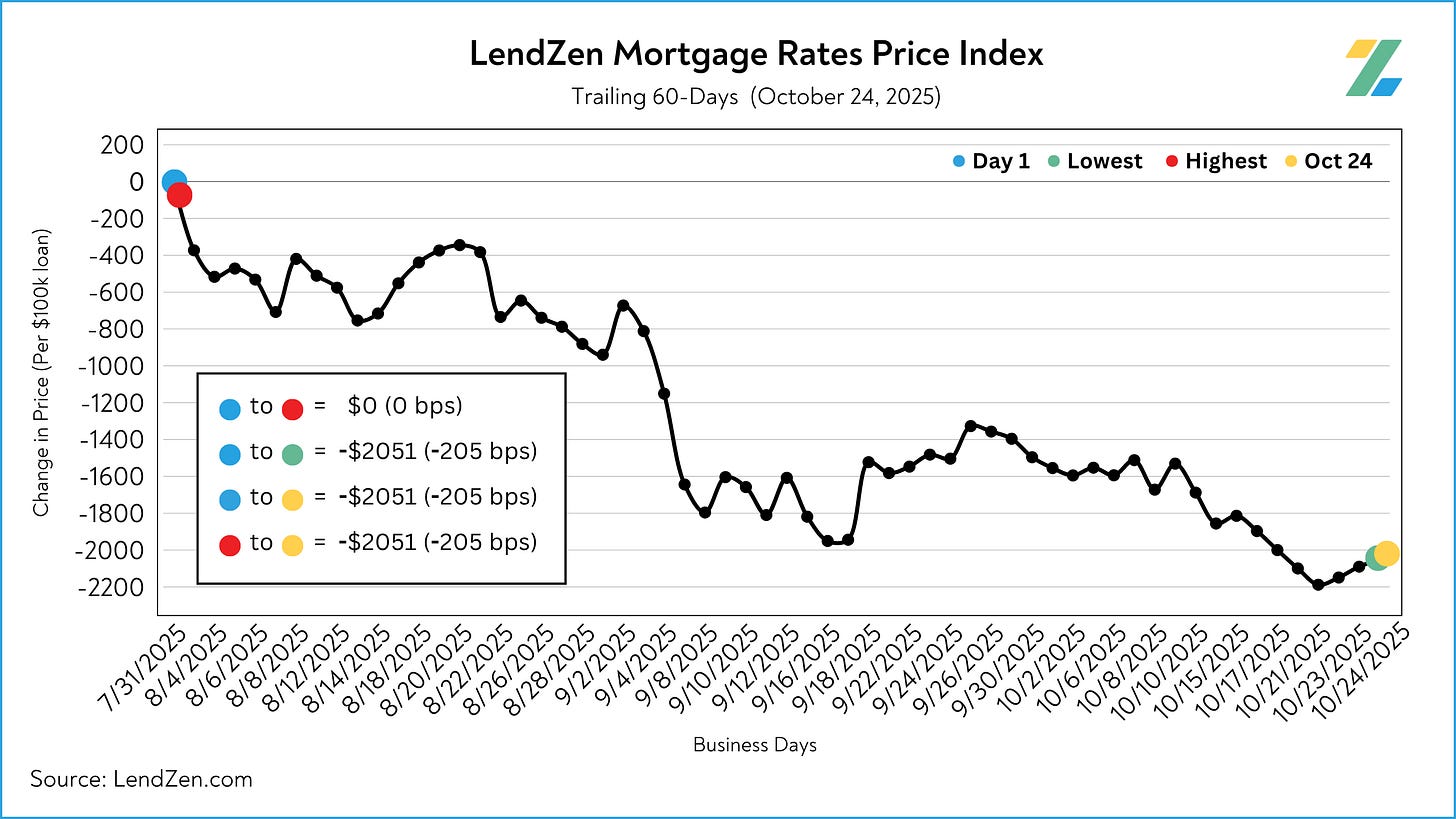

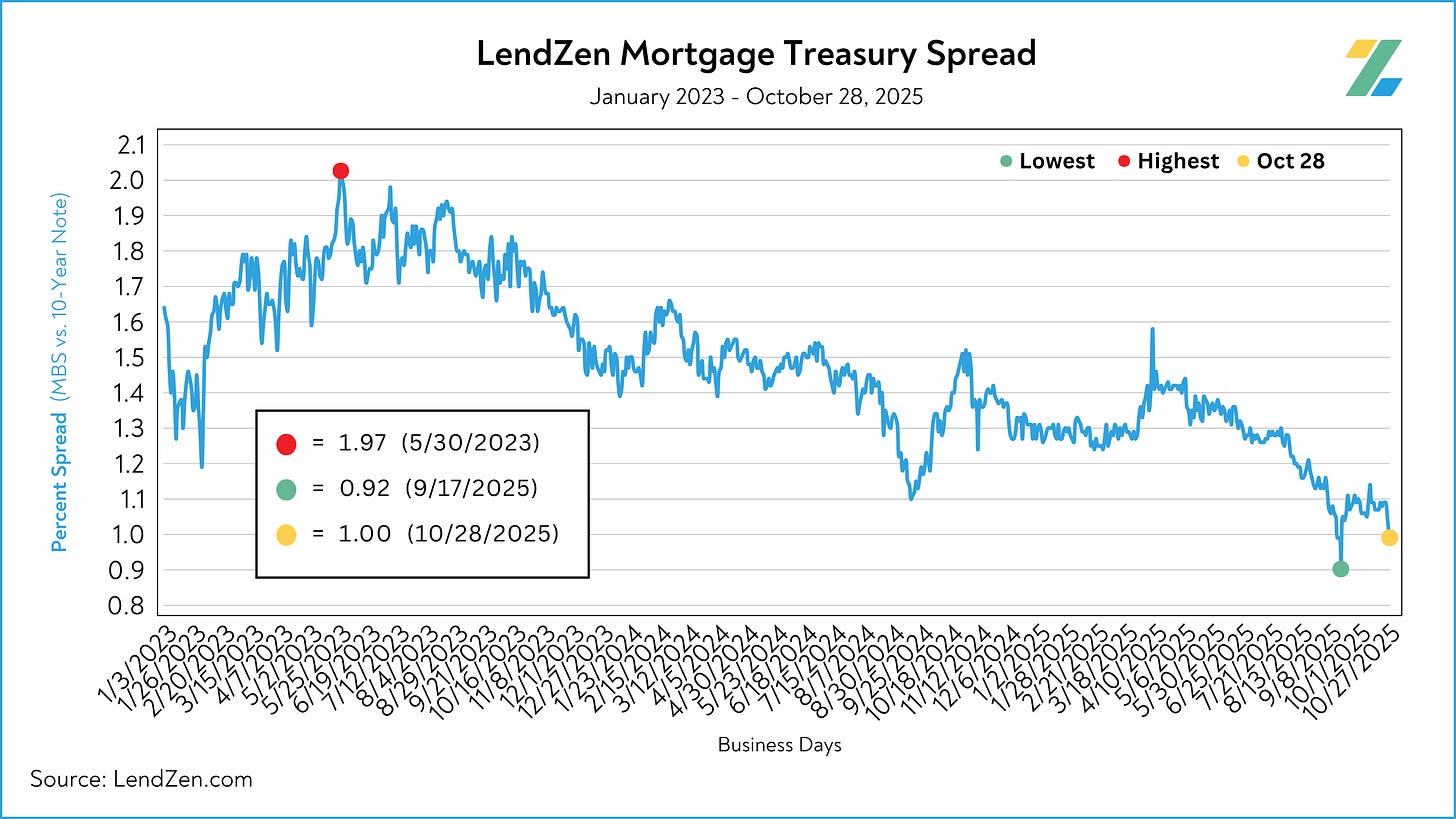

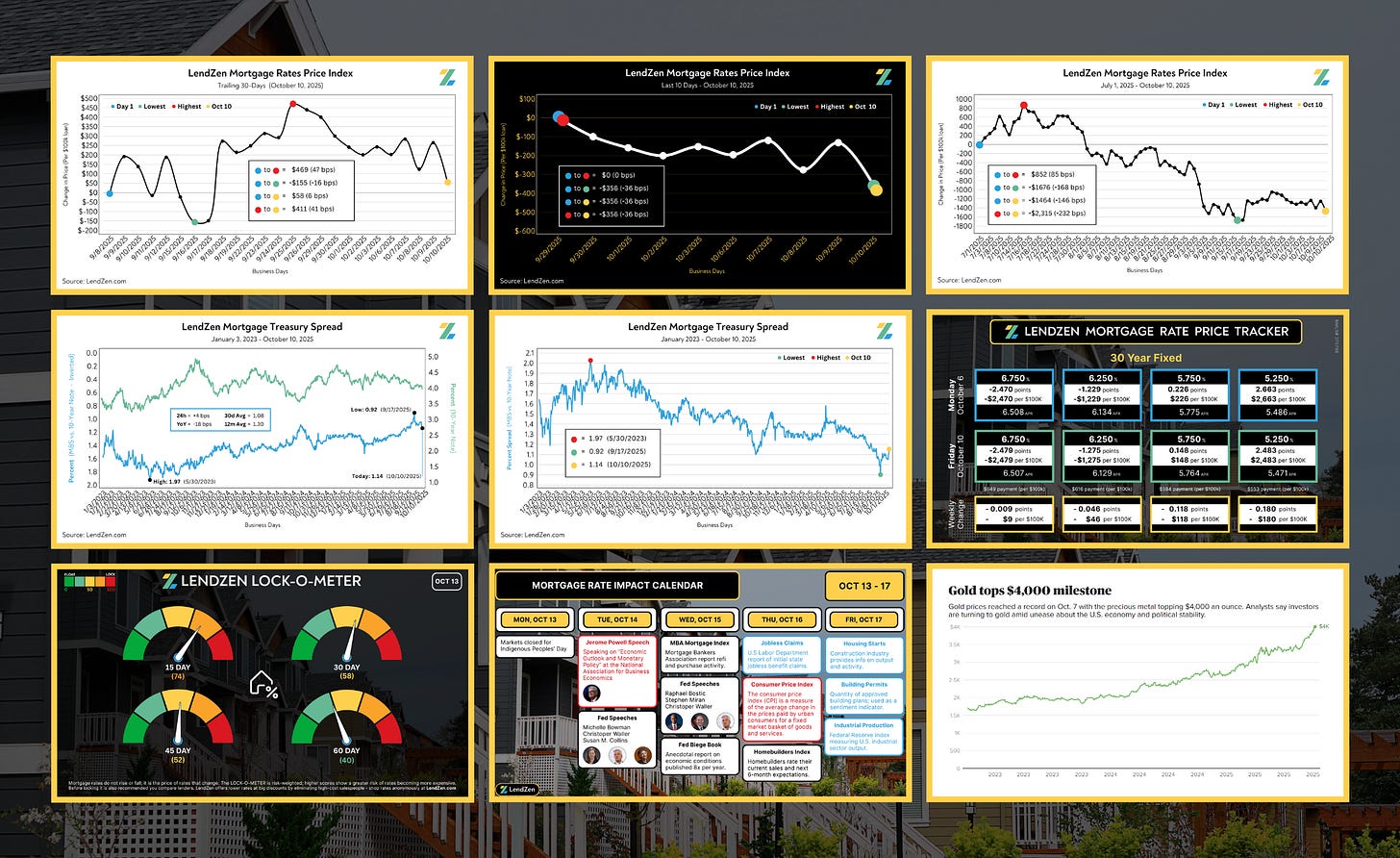

The spread between the 10-Year and MBS has tightened 50 bps since last year.

This is why borrowers shopping for a mortgage are seeing similar options today as they did just before the SEP 2024 Fed rate cut ... even though the 10-Year Treasury Note yield then was near 3.60 vs. 4.00 today.

It is also why the “hype” recently about the 10-year falling below 4% is not that meaningful in the context of why mortgage rate prices are better the last few months.

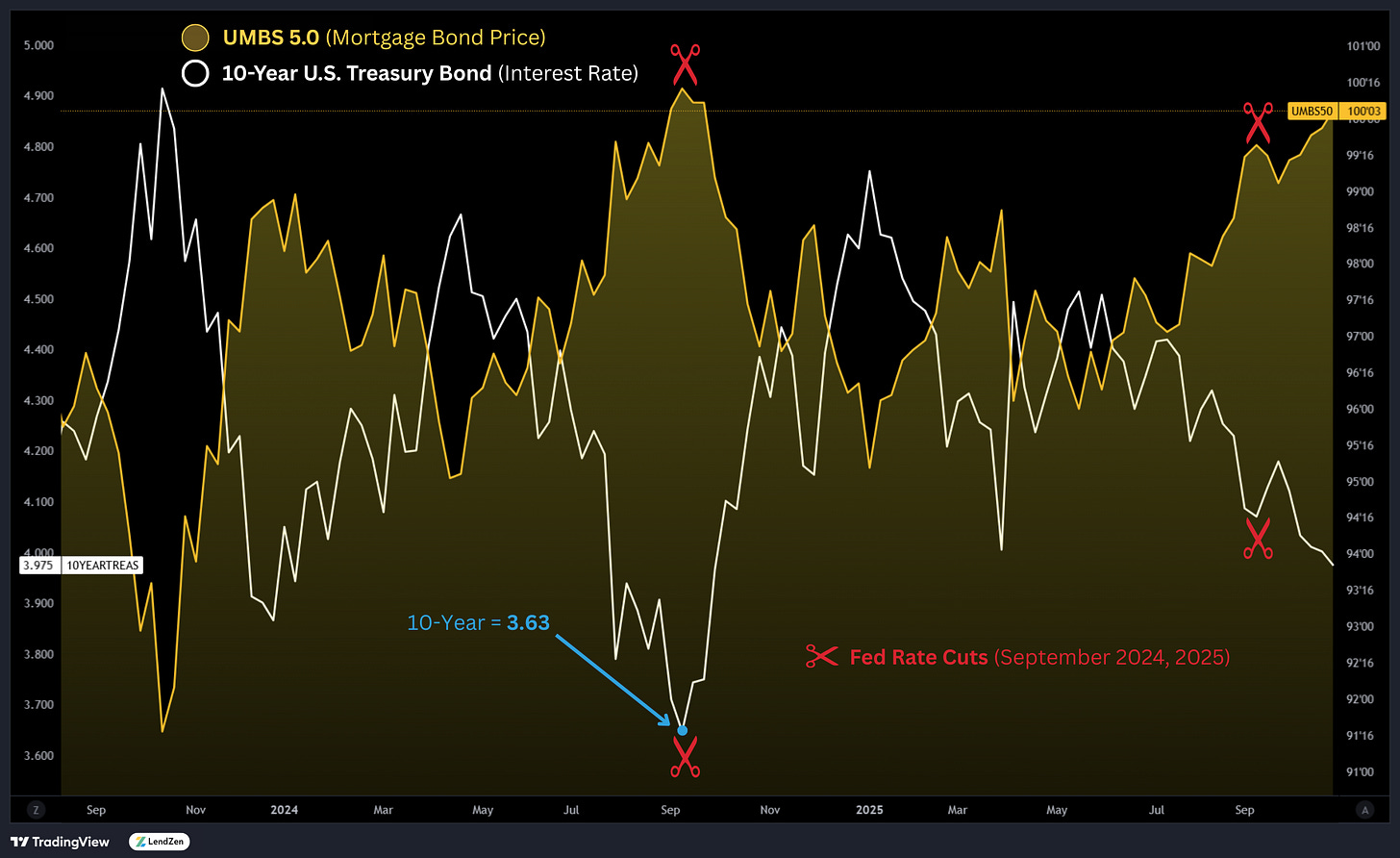

Bond markets have not been a fan of the last 4 Fed rate cuts - after each the price of mortgage rates increased and MBS spreads widened.

The argument is often “the rate cut is already priced in” ... but is it??

Even if the general reaction tomorrow is muted, and U.S. Treasury prices remain flat, mortgage borrowers could lose out if spreads widen.

Considering “the spread” is near the lowest in 3 years, and tightened 9 bps in two days, MBS might be what underperforms tomorrow.

This means when mortgage shoppers read that the Fed “cut rates” it will be a surprise to many when their rate options haven’t improved.

Meanwhile, the fallback argument is a cute story about how mortgage rates follow the 10-Year.

That story might not hold up tomorrow ... at least now you will know why. 👇

The LendZen Mortgage Treasury Spread (LMTS) is calculated and posted daily, along with the LendZen Index, at LendZen.substack.com

Thanks for reading.

If you are interested in more mortgage insights, then I suggest checking out this recent Substack article.