The Fed "rate cut" FINAL BOSS 😎💰

Will Jerome Powell crash the mortgage rate party?

On Friday, Fed Reserve Chairman Jerome Powell's Jackson Hole speech was interpreted as "Dovish".

Dovish = prioritize economic growth by lowering interest rates

Hawkish = hawkish policies prioritize controlling inflation by raising interest rates

In weeks prior, the NFP jobs report and CPI inflation data showed a weakening economy.

The bond market's response to this data implied The Fed was behind the curve by as much as 50 basis points.

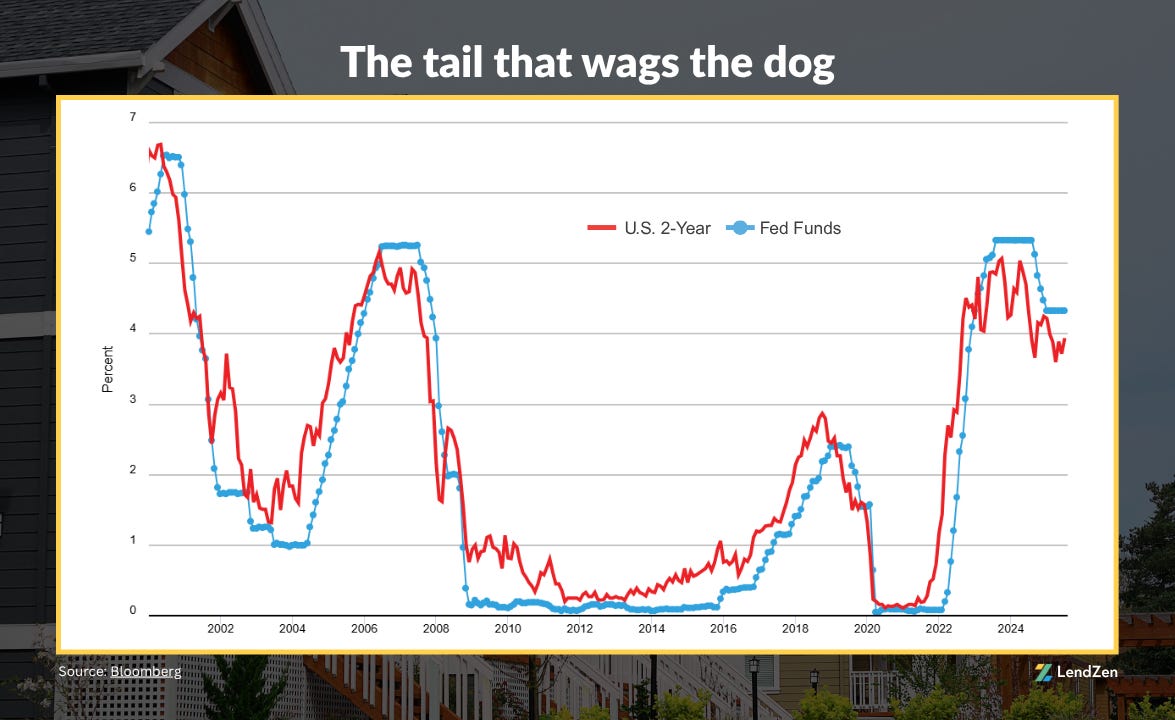

In this previous Substack post I explain the Fed is a reactionary mechanism, and why the market is the "tail that wags the dog".

This is also why the bond market rally after Jerome's Friday speech was muted in comparison to how bonds responded to recent economic data - the rate cut appears to be mostly priced in already.

The last boss to fall was Powell, and now that it seems he has accepted the will of the market, the only questions that remain are:

How big of a cut will the Fed announce?

How will bonds react if it's 0.50% instead of a token 0.25%?

Although Fed rate policy does not directly control mortgage rates, how bond investors interrupt those policy decisions does.

The size of the cut will be what impacts mortgage rates the most.

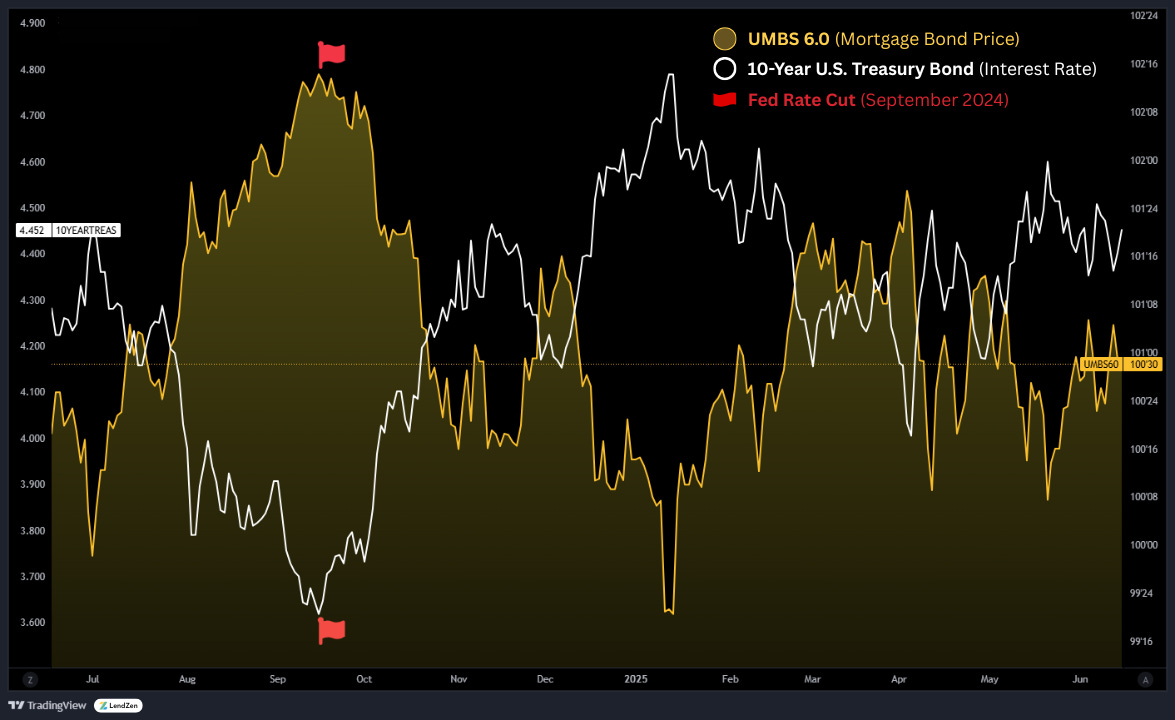

In Sep 2024, the Fed cut rates for the first since they started their hiking cycle in 2022.

The policy decision was deemed inflationary and not well received by the bond market (inflation erodes the principal value of a bond).

The result was bonds sold off significantly, reversing what was the strongest bond rally in years.

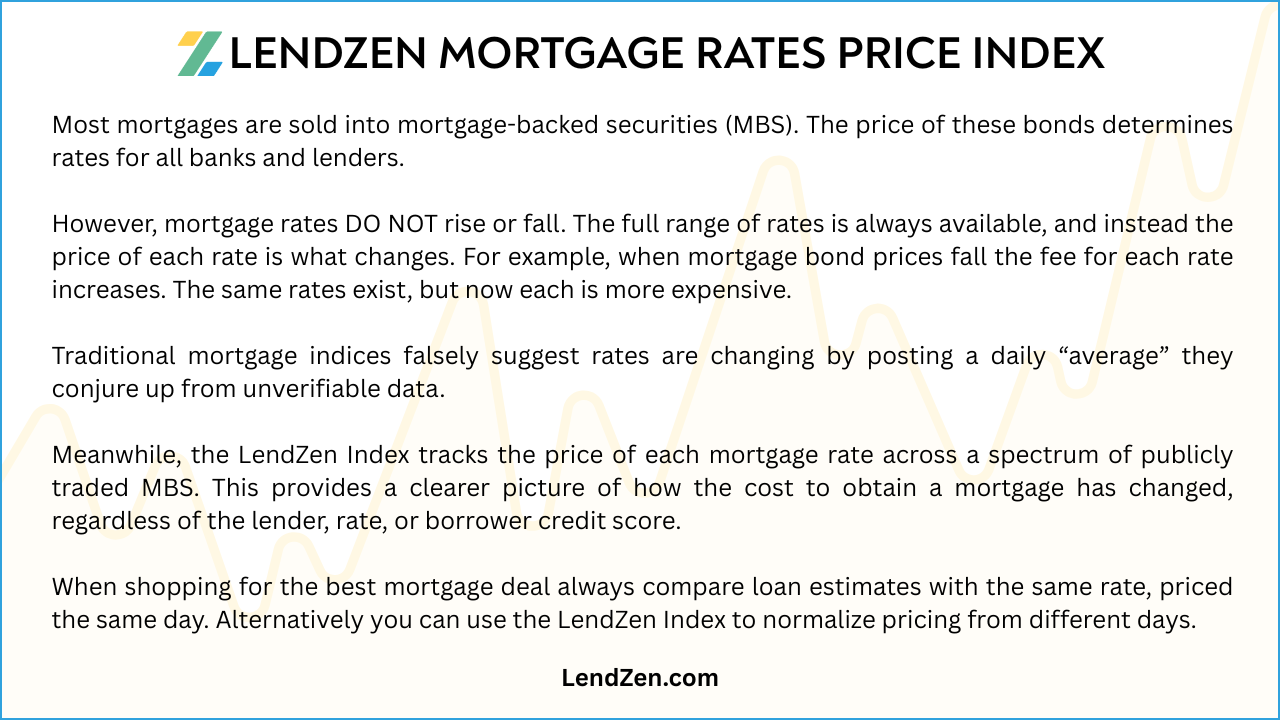

Mortgage rates do not rise or fall, instead the price of rates changes daily based on the fluctuation in mortgage bond prices (MBS).

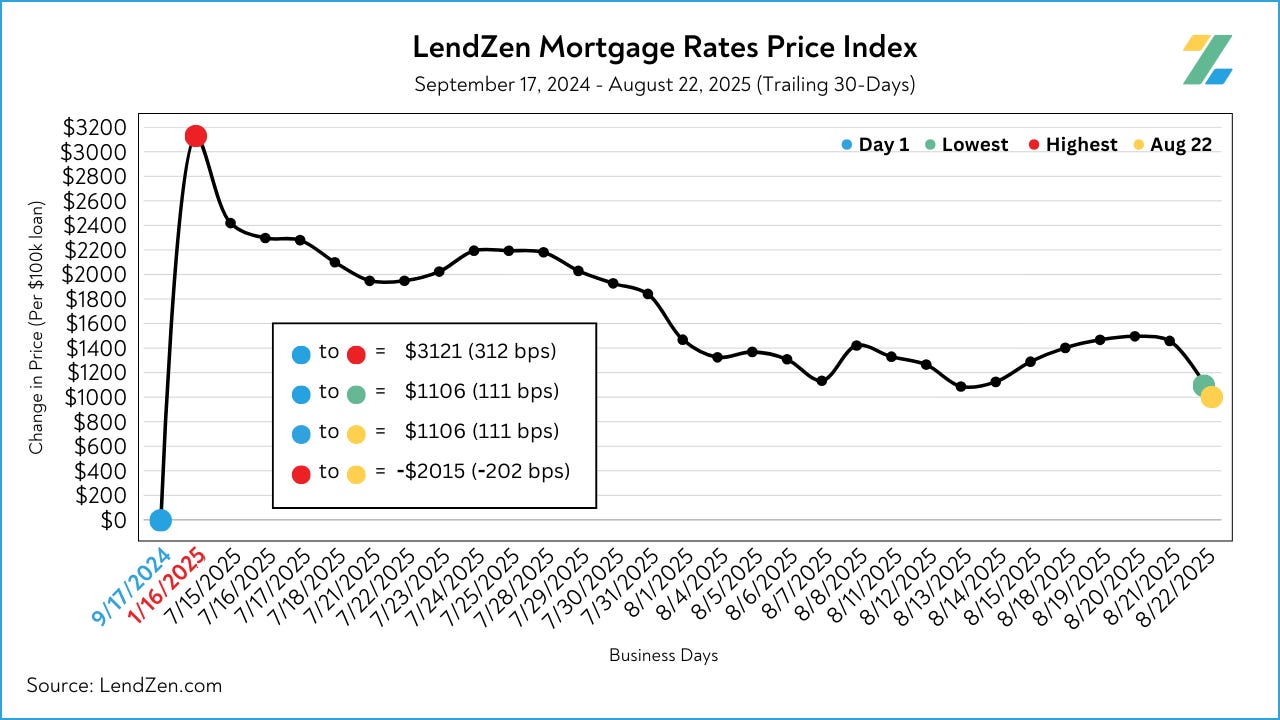

The LendZen Index was created to show you the daily change in mortgage rate prices, across a full spectrum of mortgage-backed securities (bonds).

The poorly timed rate cuts last September, and the lower bond prices that followed, meant that ALL rates became significantly more expensive.

This makes the time to breakeven of a refinance longer, which for a lot of people made a refinance no longer economically justified.

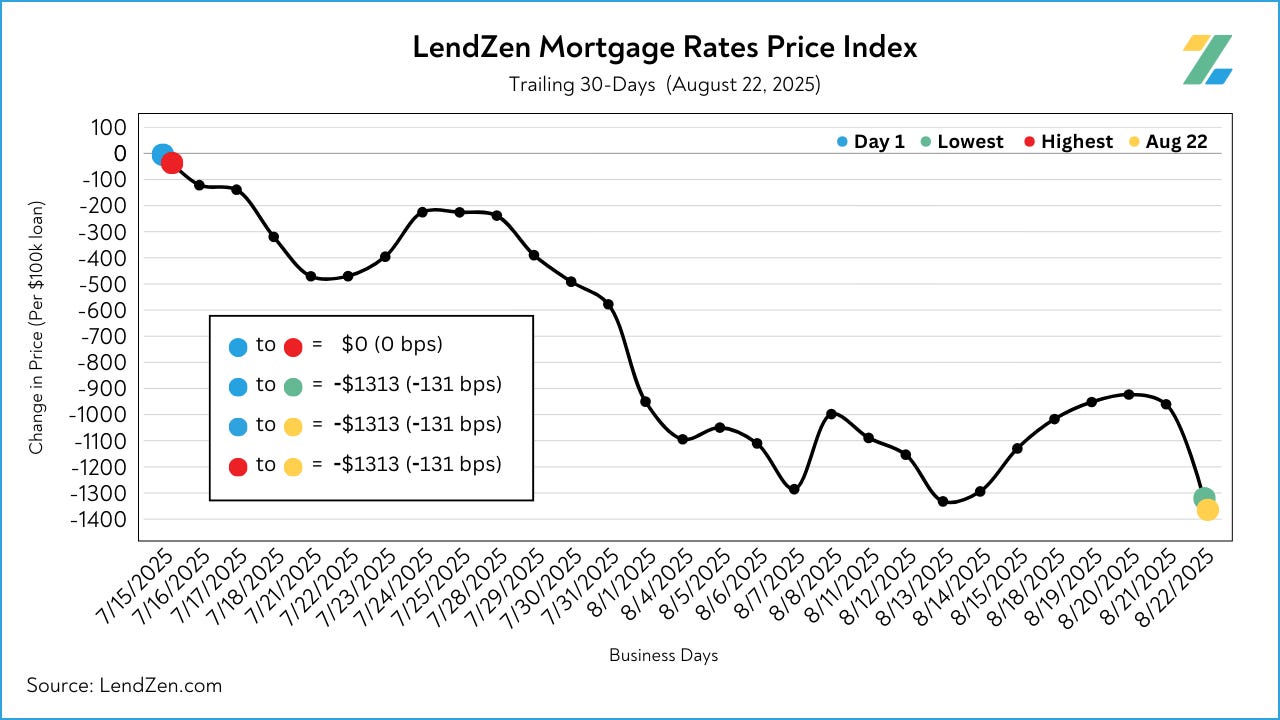

August has been a positive month, with the price of mortgage rates declining 130 basis points in the last 30-days.

However, if you were contemplating a refinance in September 2024, the price of rates still has not returned to those levels.

Leading up to this year's September FOMC meeting (Sep 16-17), there is another NFP jobs report (Sep 5) and CPI inflation data (Sep 11).

The results of NFP and CPI will do more to help the price of mortgage rates decline further than The Fed announcing a rate cut.

Although it looks like the bond market has conquered the final boss, Jerome can still ruin the party by being too aggressive and causing a similar reaction to Sep 2024.

Want to check customized, real-time mortgage rates instantly? 🧮

LendZen (NMLS# 375788) gives you real-time access to mortgage rates that update as bond prices change.

The detailed loan summaries have an interactive rate slider that shows all current mortgage rates and full transparency of costs upfront.

All information can be viewed anonymously and without any sign-up requirements or human interaction. This makes exploring the full range of rate options hassle-free.

See for yourself and customize your own loan scenario at LendZen.com