The Fed rate cut and its impact on mortgage rates 🏦😱

The countdown to a Fed rate decision has begun

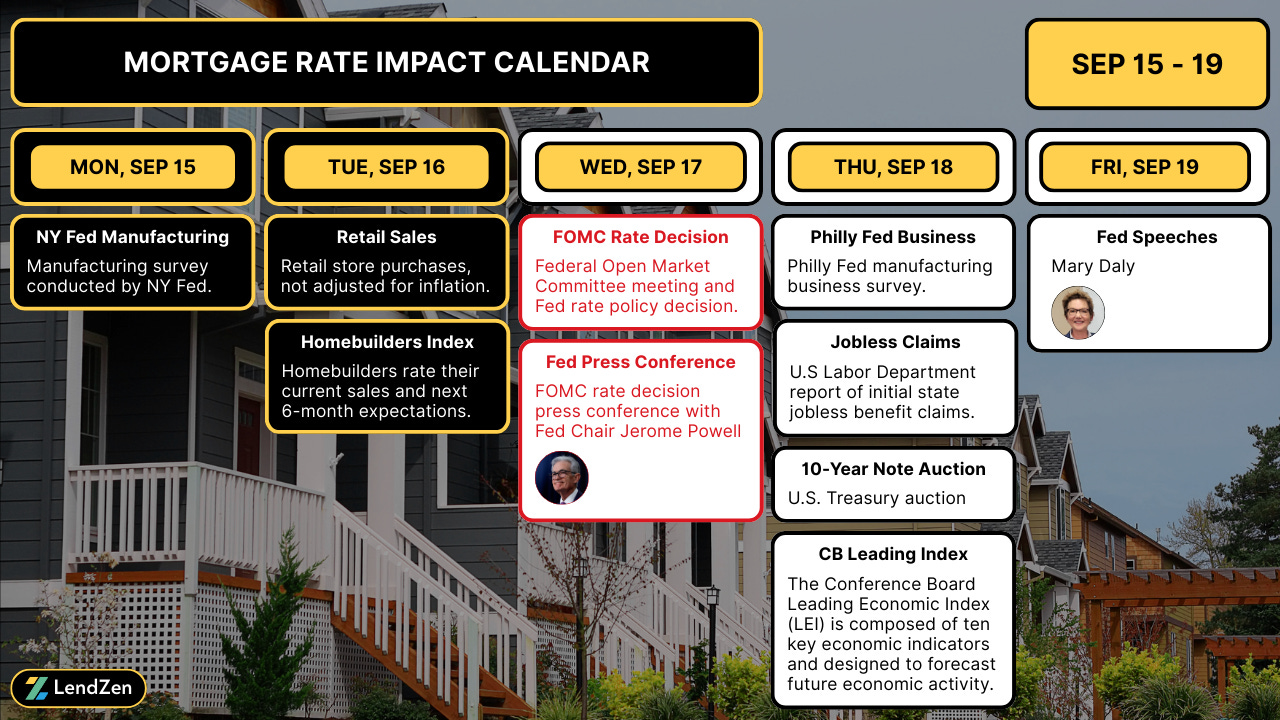

Today the Federal Open Market Committee (FOMC) will announce their latest policy decisions.

The Fed is widely expected to cut by 0.25%, putting the focus on committee rate projections and how Powell answers questions during his post-FOMC press conference.

The Federal Reserve has a dual mandate to maintain price stability and full employment.

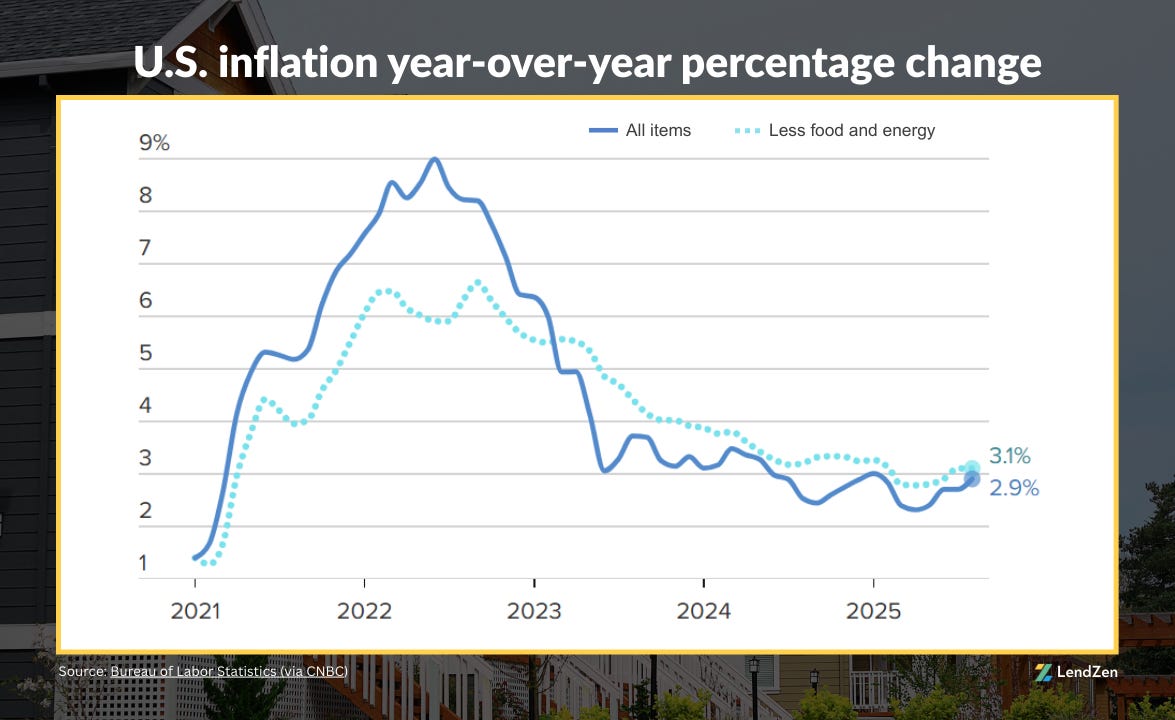

The Fed considers prices to be stable when annual inflation is near 2%; a policy target they adopted in 2012 but haven’t achieved since 2019.

Last week’s CPI report showed inflation is still running closer to 3%, with a slight uptick month-to-month.

That is not the type of report that supports a rate cut, and some argue a rate hike is more appropriate.

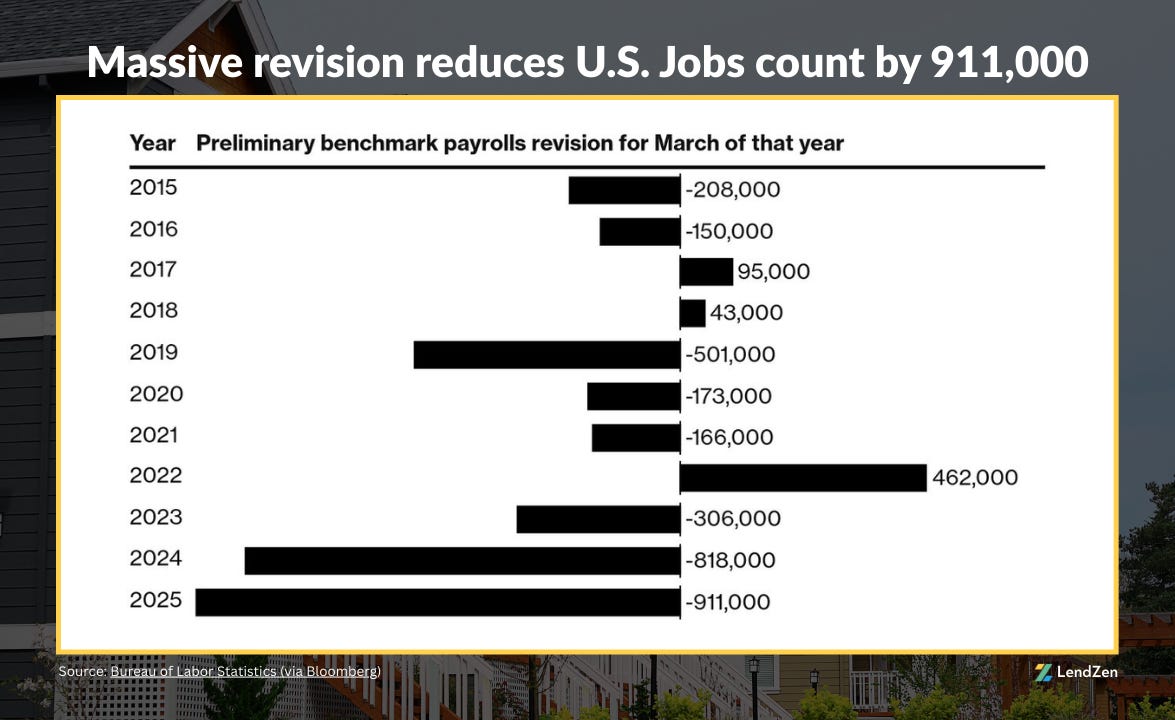

However, the employment mandate seems to be the bigger focus after multiple downward revisions to previous jobs data suggests the labor market isn’t as strong as previously believed.

But although employment is showing signs of weakness, it isn’t in contraction.

Meanwhile, other indicators suggest the economy is even running a little hot.

So, why is the Fed going to cut? Jerome will have to answer that one in a few hours.

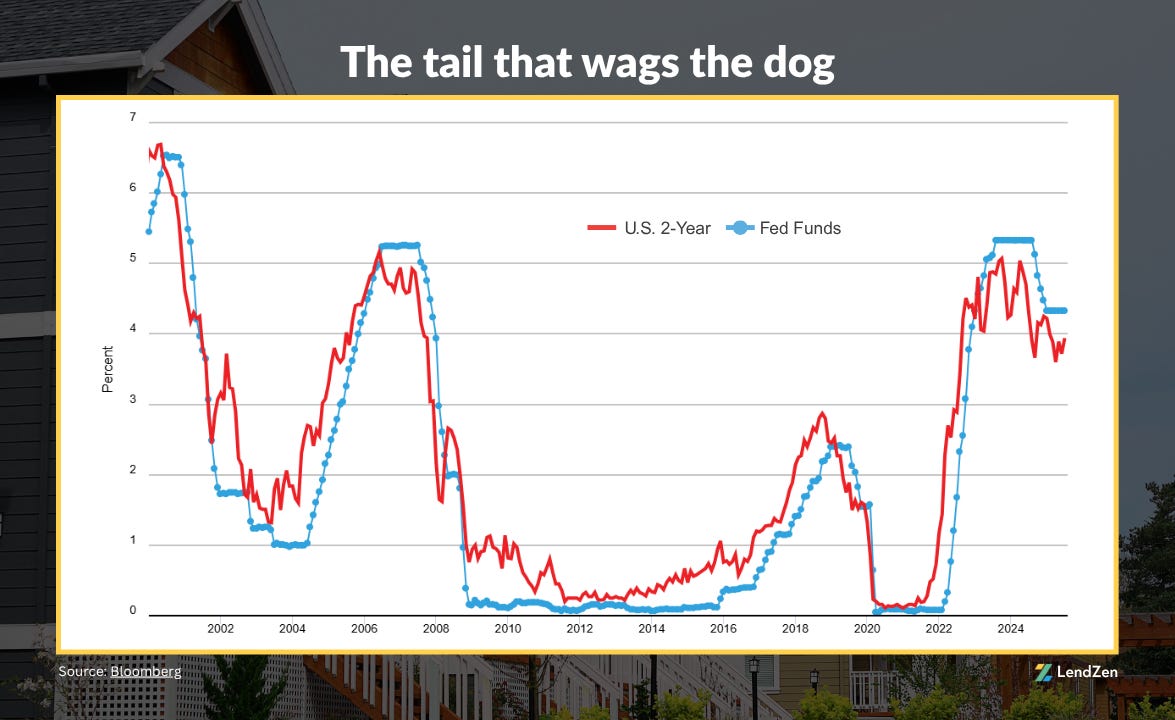

However, what we do know is bond markets have given The Fed permission for a 25 basis point cut.

Investors have been digesting the same data as central bankers and bond prices have been rising consistently since the middle of July.

I provide more details about the “tail wags the dog” relationship between the Fed and bond markets in this Substack post.

Fed rate policy also has a unique relationship with mortgage rates.

Although they do not directly control mortgage rates, how bond investors interrupt Fed policy decisions does.

It’s also important to note that Mortgage rates in the U.S. do not rise or fall - the full range of rates is always available, and instead the PRICE of each rate is what changes.

This means “daily rate averages” are misleading at best and have no meaningful use for borrowers who are actually shopping for a mortgage.

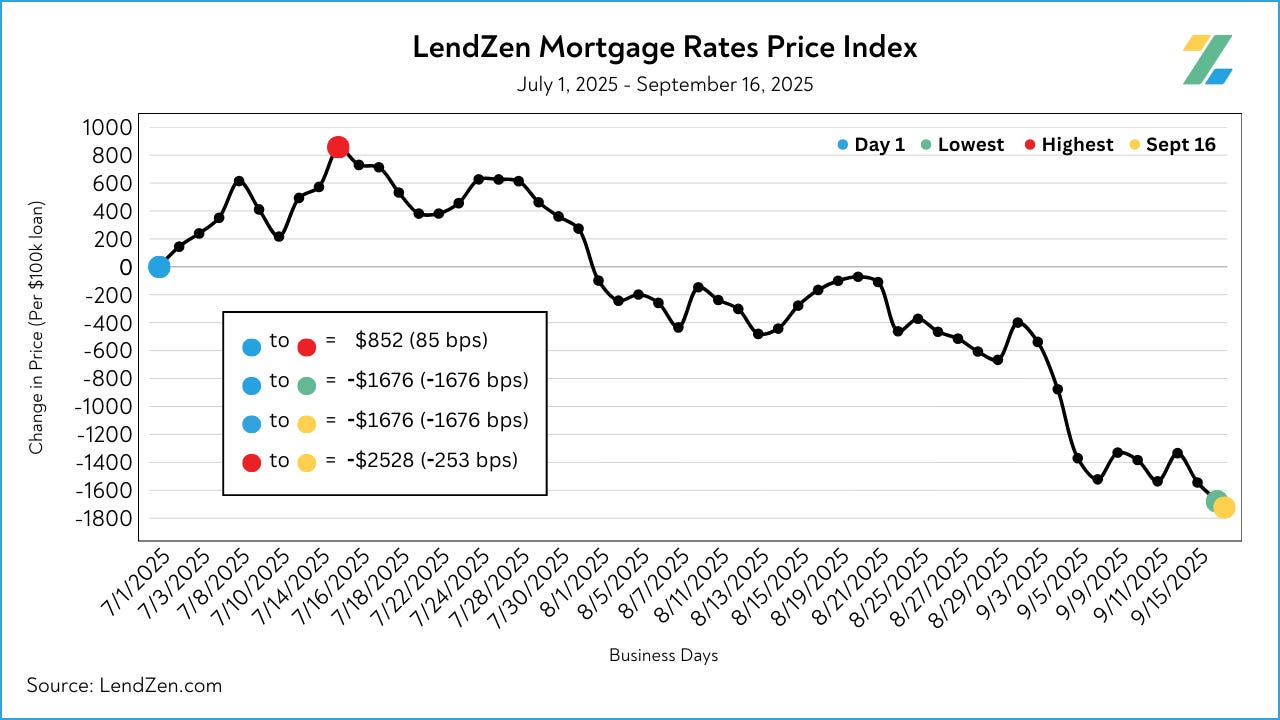

To provide you with a clearer picture of how the cost to obtain a mortgage changes each day we created the LendZen Index.

This index tracks daily changes in the price of mortgage rates, across a spectrum of publicly traded mortgage-backed securities.

As a result of the current bond rally, the price of mortgage rates has declined as much as 253 basis points since July 15th.

That means the cost to obtain a $500,000 mortgage at a specific rate is $12,650 less expensive today than it was two months ago.

Falling mortgage rate prices make lower rates more economical, that is why refinancing is currently in vogue.

Have mortgage rates reached the borderline, or will Jerome shine a ray of light on bonds and keep the celebration going?

The countdown to a Fed rate cut announcement has begun...