🏦 The Fed Lies – here is how to predict their next move 🔮😲

Pulling back the curtain on The Fed and their true master.

The NFP Jobs Report heard ‘round the world landed Friday morning.

Markets reacted dramatically to the weaker than expected headline number and the significant revisions to the previous two months.

Not only do employment conditions give us a sense of how the economy is doing, but it also tells us how The Fed is doing.

The Federal Reserve Bank, an independent bank that is as “Federal” as FedEx, has a dual mandate from Congress to maintain price stability and maximum employment.

If employment in the U.S. is weakening then The Fed will need to reconsider their economic policies, including the range of their overnight lending rate, the Fed Funds.

The Fed acts like they are the “all powerful Oz”, but when we pull back the curtain a different story is revealed.

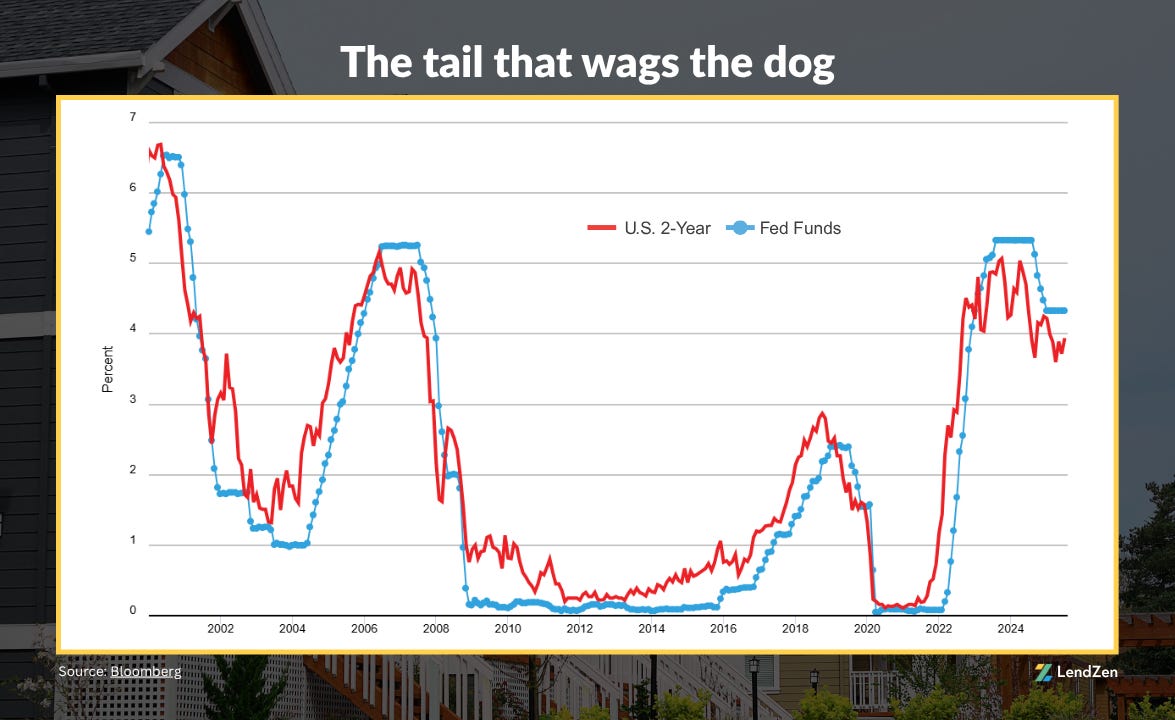

The truth is the bond market leads the way, and The Fed follows.

Specifically, the U.S. 2-Year Treasury Bond is the pace car for The Fed and the rest of the bond market.

When the FOMC adjusts the Fed Funds Rate, it is in 0.25% increments.

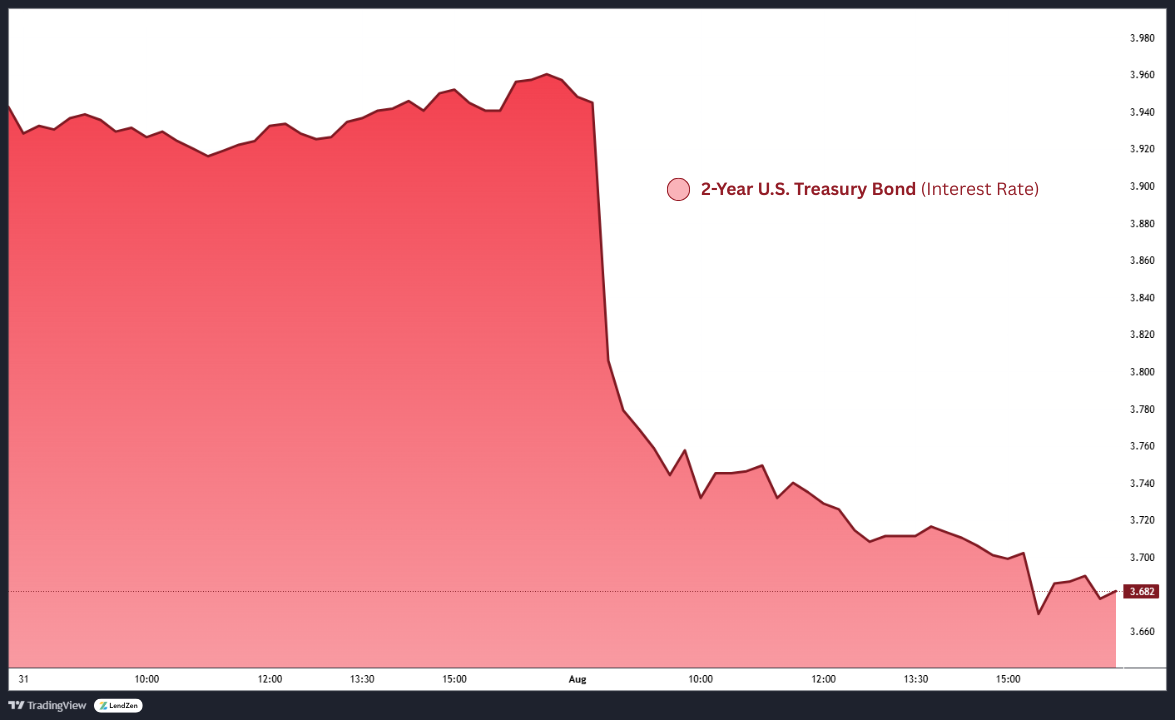

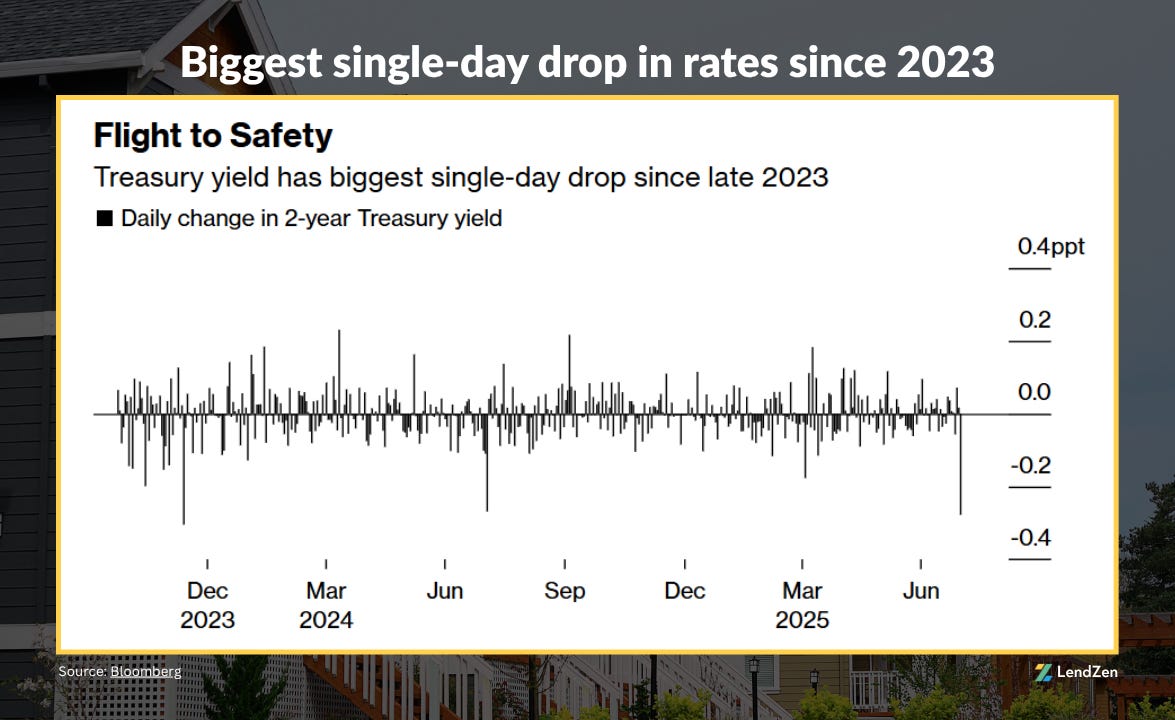

It is no coincidence then that the 2-Year declined exactly 25 basis points on Friday.

This was also the biggest single-day decline since 2023.

The Fed Funds is now 50+ bps above the 2-Year, and the tail is telling the dog, "time to cut".

Just keep in mind markets trade on expectations.

If The Fed does cut at the next FOMC meeting (September) they will be catching up to expectations and their decision might have no additional impact on bond prices.

Most notably for mortgage bonds, which determine mortgage rates for all banks and lenders.

However, mortgage rates in the U.S. do not rise or fall.

The full range of rates is always available, and instead the price of each rate is what changes as bond prices change.

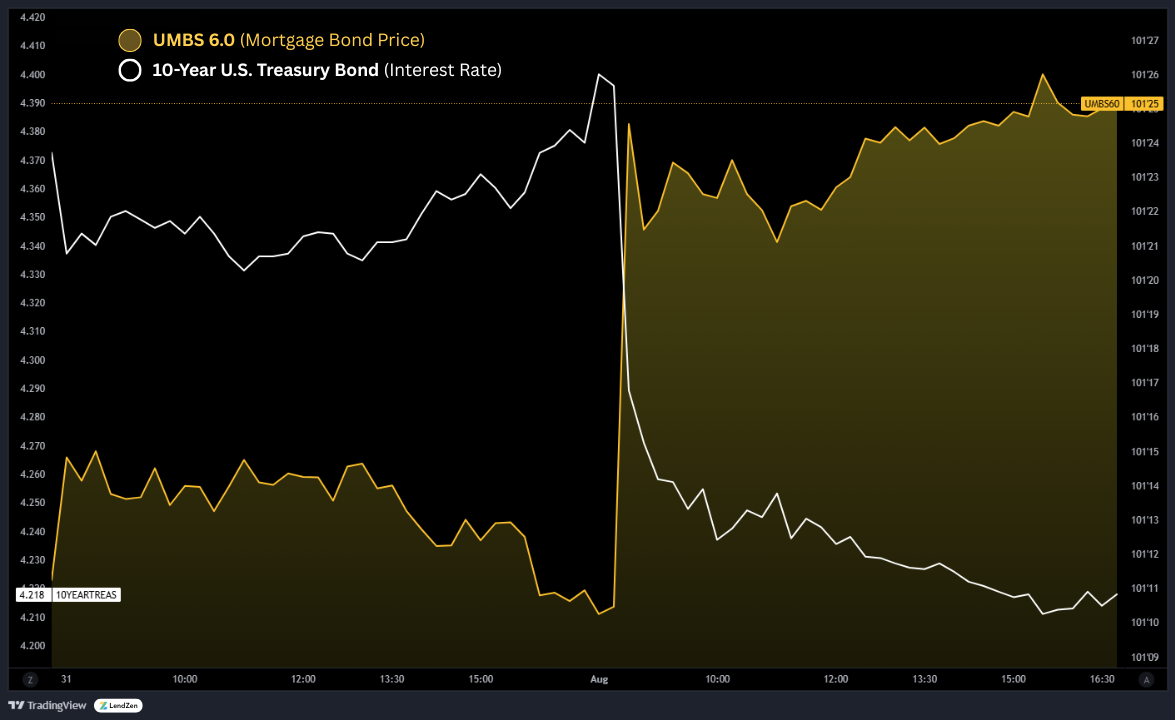

The sharp move higher in the yellow line below is the price of a mortgage-backed security increasing after the jobs data on Friday.

When the PRICE of mortgage bonds increase, the PRICE of mortgage rates decrease.

This is often described incorrectly as “lower mortgage rates”.

It’s not that the lower rates are suddenly available, it’s that the price (discount fee) of lower rates is now more economically feasible for borrowers to pay, so lenders start promoting them.

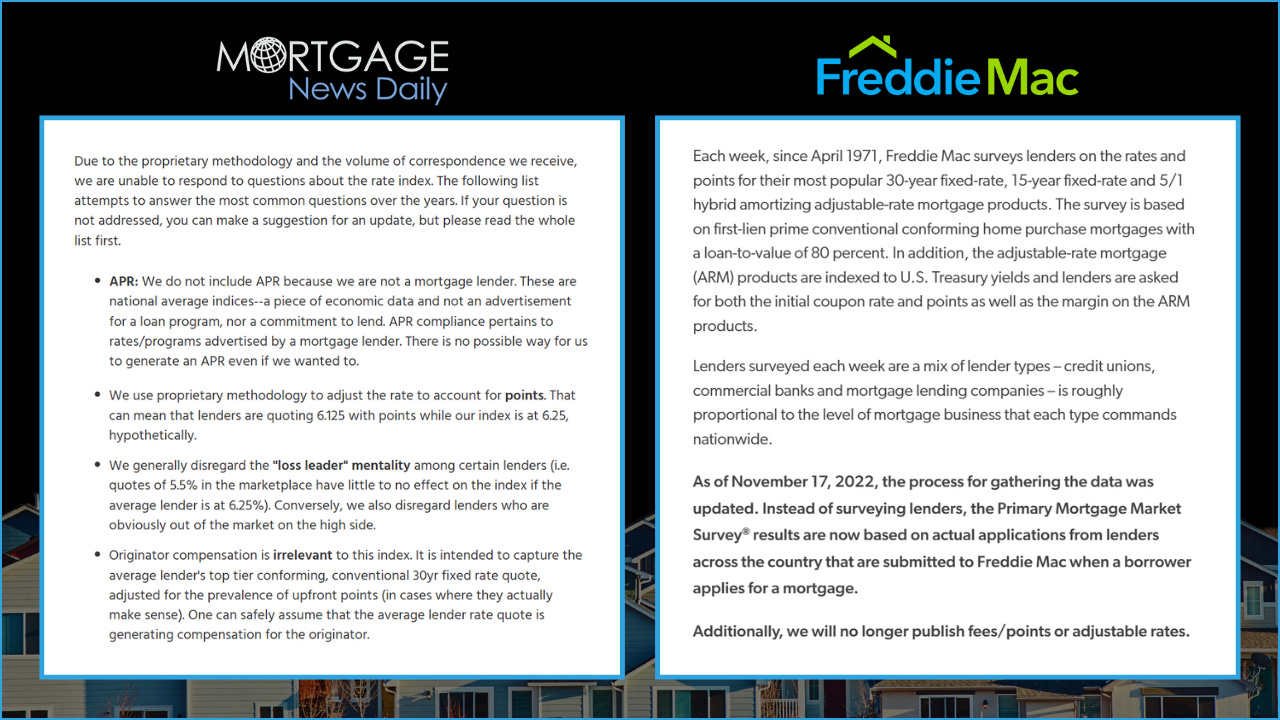

Unfortunately, traditional mortgage indices falsely suggest rates are changing by posting a daily “average” they conjure up from incomplete data.

Meanwhile, the LendZen Index tracks the price of each mortgage rate across a spectrum of publicly traded MBS.

This provides a clearer picture of how the cost to obtain a mortgage has changed, regardless of the lender, rate, or borrower credit score.

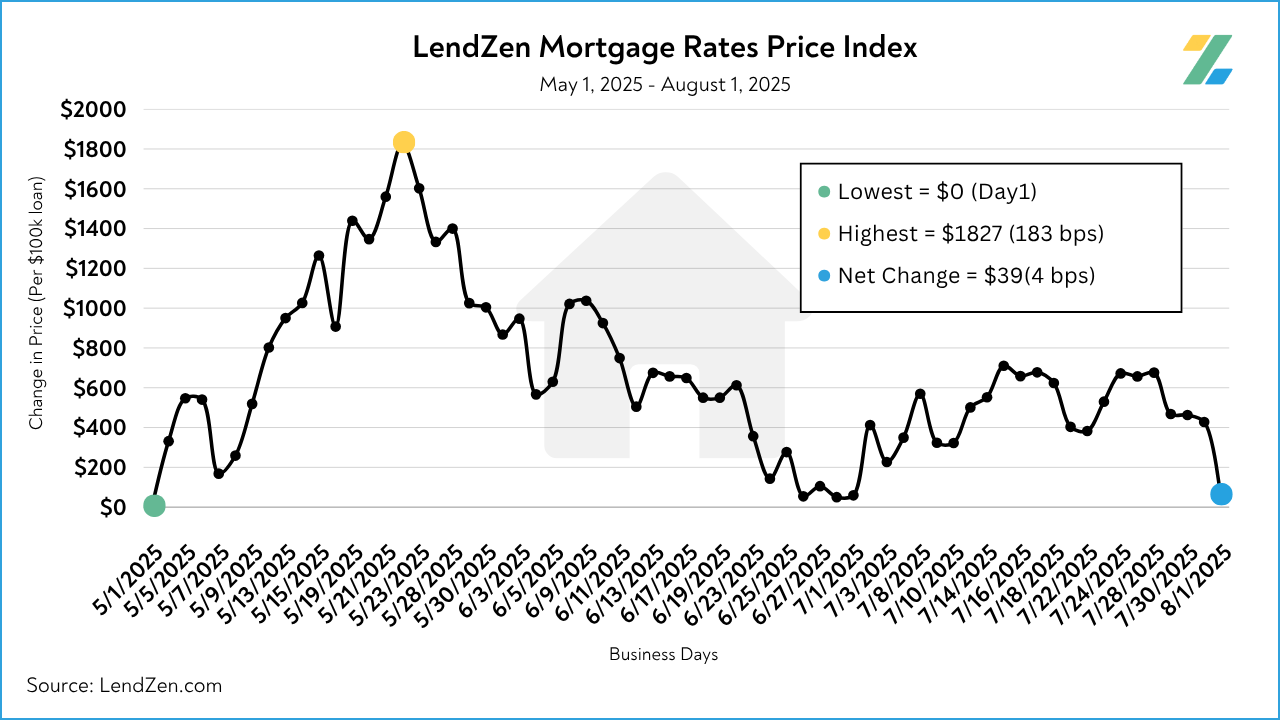

For example, below is the change in mortgage rate prices over the last two months.

At one point, the cost to get a mortgage increased 183 basis points, which equates to $1,827 per $100K, or $9,150 on a $500K loan.

However, since this high on May 22, the price of rates has almost fully recovered, bringing us back within 4 basis points of the two-month low on May 1.

In addition to the LendZen Index, you can also check real-time mortgage rates without any human interaction.

LendZen.com (NMLS# 375788) provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

This eliminates the need for the salespeople who make mortgages so expensive at other lenders.

Customize your own loan in under a minute and get instant qualification results for your exact scenario that you can revisit daily with just one click.

In conclusion, The Fed lies, and truth in rates comes from the bond market. Meanwhile, the truth in mortgage rate prices comes from LendZen.