Spot the rip-off and find the BEST mortgage deal instantly 🏠🔍

Make sure you do this before choosing a mortgage company

The biggest, most profitable mortgage companies thrive in the veil of confusion that surrounds mortgages.

If there was a more transparent, straight-forward way for mortgage borrowers to see what each lender was offering the big names would be exposed for their rip-off.

These companies spend enormous amounts on brand awareness (i.e., sponsoring sports arenas) because name familiarity is a profitable sales tactic - just as long as they can keep customers in the dark about how to actually shop for a mortgage.

CompareLE.com ends the confusion and levels the playing field for all borrowers.

In this post you will learn the 3 simple steps that guarantees you get the best deal on your mortgage.

But first, let’s expose the truth about mortgage rates …

THE TRUTH ABOUT MORTGAGE RATES

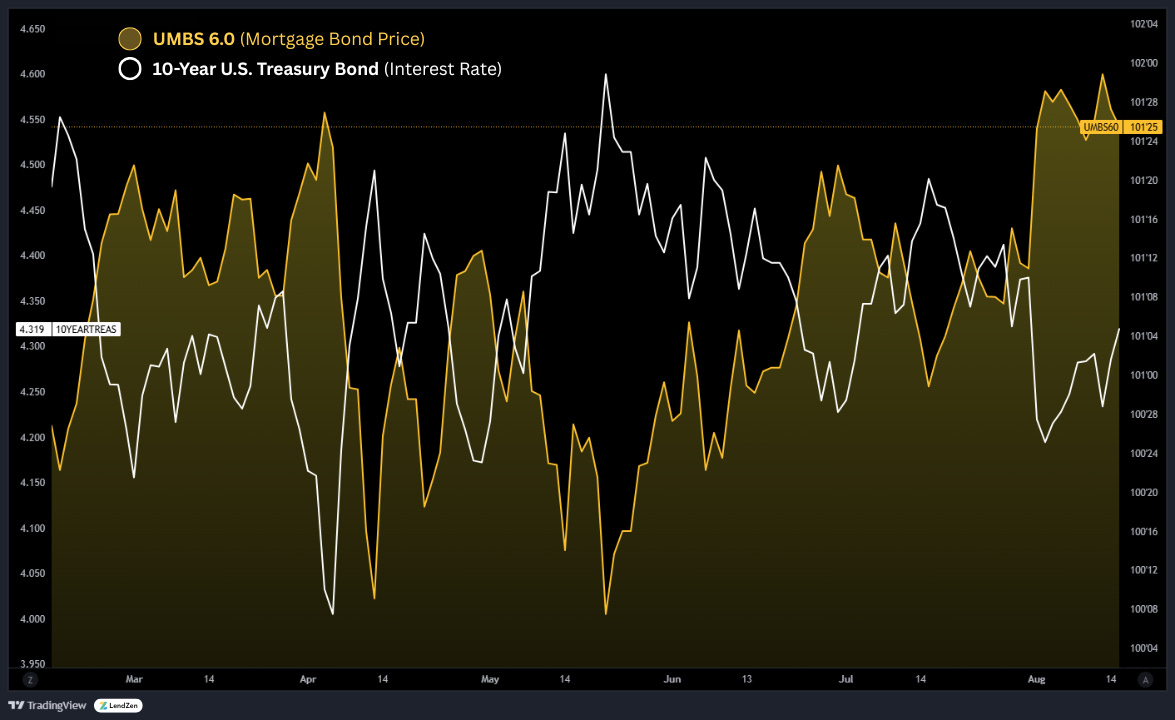

Most mortgages are sold into mortgage-backed securities (MBS). The price of these bonds determines rates for all banks and lenders.

However, mortgage rates DO NOT rise or fall.

The full range of rates is always available, and instead the price of each rate is what changes.

When shopping for a mortgage, it’s not the rate that you need to compare, but instead the fees each company charges for the SAME RATE.

However, the twist is that mortgage bond prices change daily.

This means in addition to comparing the same rate, borrowers also need estimates from the SAME DAY.

This is extremely challenging because loan originators are both reluctant and slow to provide borrowers with full transparency of what they can offer.

They also use unofficial rate quotes that further obfuscate the truth of how they match up with other companies.

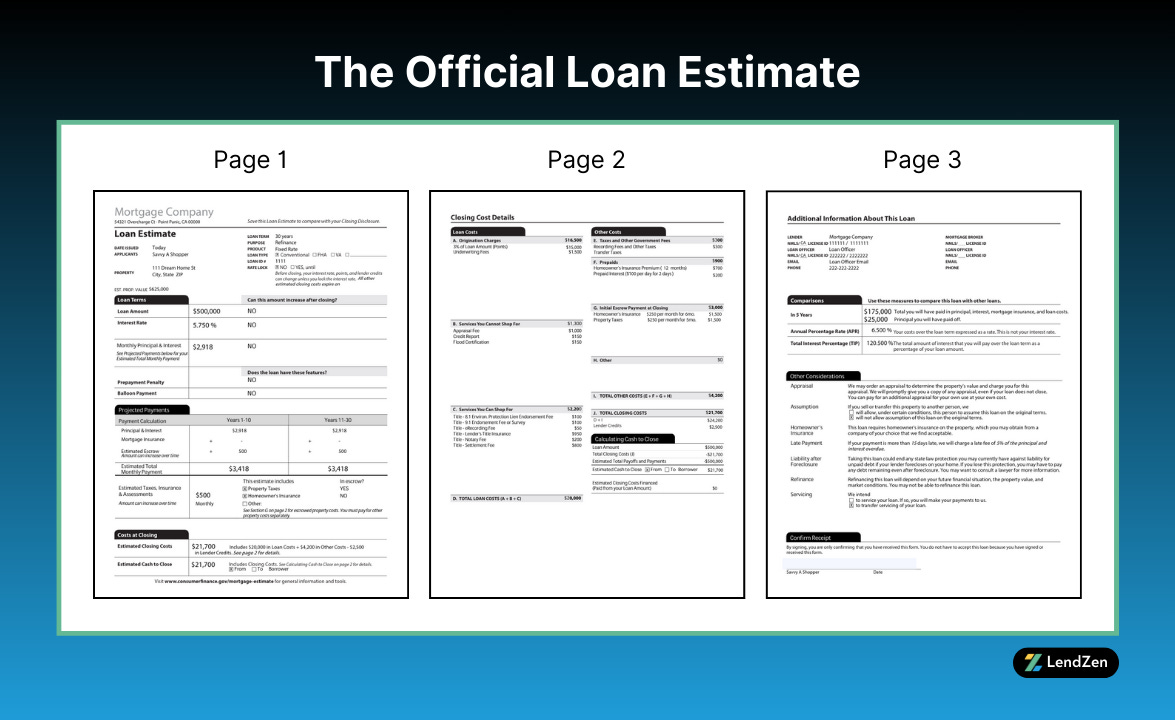

THE LOAN ESTIMATE

The only way to get a clear picture of what someone is offering is with an “official” Loan Estimate.

The LE is a standardized, 3-page disclosure that limits the ability for a mortgage company to misrepresent their fees.

Ignore other types of rate quotes, including fees worksheets, and avoid anyone who is difficult about providing you with an LE.

You don’t need to apply for a loan, or have your credit pulled, to receive an LE.

At a minimum, originators can issue a “draft” version of the Loan Estimate without triggering other disclosure requirements.

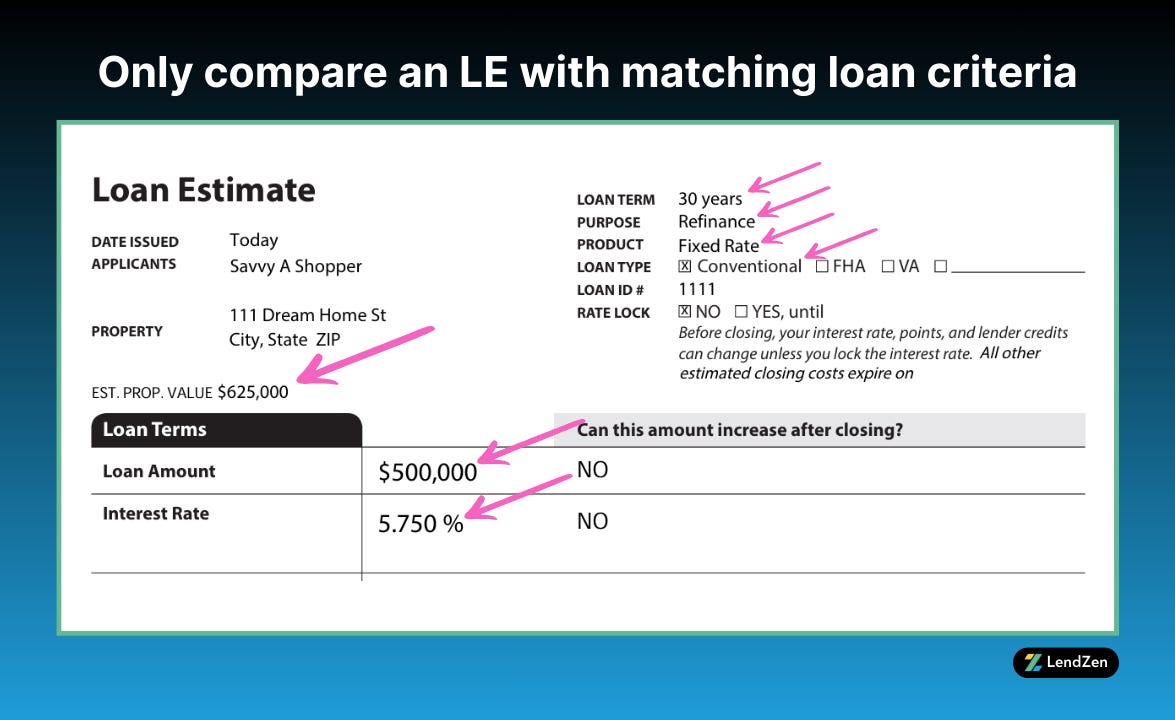

When comparing estimates from different companies it is absolutely necessary that each LE is for the SAME RATE.

Otherwise, it’s like comparing apples-to-oranges, making it nearly impossible to determine the best deal.

As previously mentioned, the estimates should also be issued on the SAME DAY because the price of rates change daily.

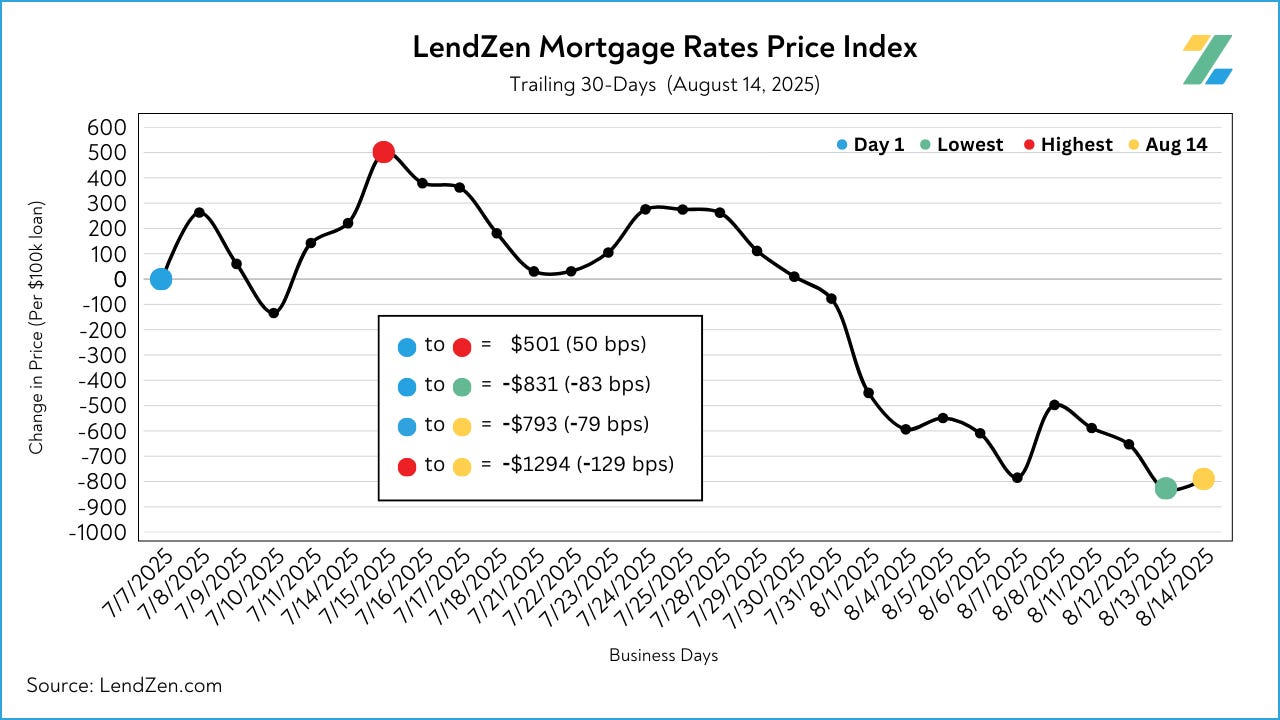

However, Compare LE removes this inconvenience by using the LendZen Index to normalize each estimate as if they were issued the same day.

This gives you the ability to make a clear apples-to-apples comparison using estimates with the SAME RATE but from different days.

3 STEPS TO FINDING THE BEST DEAL

1) Request Loan Estimates

Shop around and request Loan Estimates from the lenders that seem to be the most competitive.

You can shop mortgage rates anonymously at LendZen.com and request an LE with one-click for the exact pricing you see on the website.

Make sure each lender that provides you with an LE is using the same loan criteria, including estimated property value.

The only difference between what each company offers will be the total fees they charge.

This is easily distinguishable when comparing estimates with matching criteria.

2) Upload the Loan Estimates to Compare LE

Upload the Loan Estimates to Compare LE for a free, instant analysis.

You can also upload a single LE for a more simplified breakdown of what is being offered.

3) Review your comparison report to see which LE is the best deal

Once uploaded, Compare LE instantly analyzes both estimates.

Next, it creates a private report that simplifies the details of each LE and finds the best deal for you.

Because mortgage rates change daily, loan estimates should be issued on the same day.

However, Compare LE removes this inconvenience by using the LendZen Index to normalize each estimate as if they were issued the same day.

Without the index, comparing loan estimates is an almost impossible task and a big reason why a tool like Compare LE hasn’t existed before.

That's it!

You are now ready to shop for a mortgage, avoid getting ripped off, and instantly know who is offering you the best deal by using CompareLE.com

Want to check customized, real-time mortgage rates instantly? 🧮

LendZen (NMLS# 375788) gives you real-time access to mortgage rates that update as bond prices change.

The detailed loan summaries have an interactive rate slider that shows all current mortgage rates and full transparency of costs upfront.

All information can be viewed anonymously and without any sign-up requirements or human interaction. This makes exploring the full range of rate options hassle-free.

See for yourself and customize your own loan scenario at LendZen.com