Refinance now or wait? 🏠💰 (OCT 31)

Deciding when to refinance is not just about a lower rate

October saw mortgage rates improve to their best levels in over a year before experiencing an almost full reversal in the final days of the month, thanks to Jerome Powell.

More on the impact of Powell’s remarks in this Substack Post.

Given recent volatility, and with November already here, it is a good time to reevaluate your refinance options.

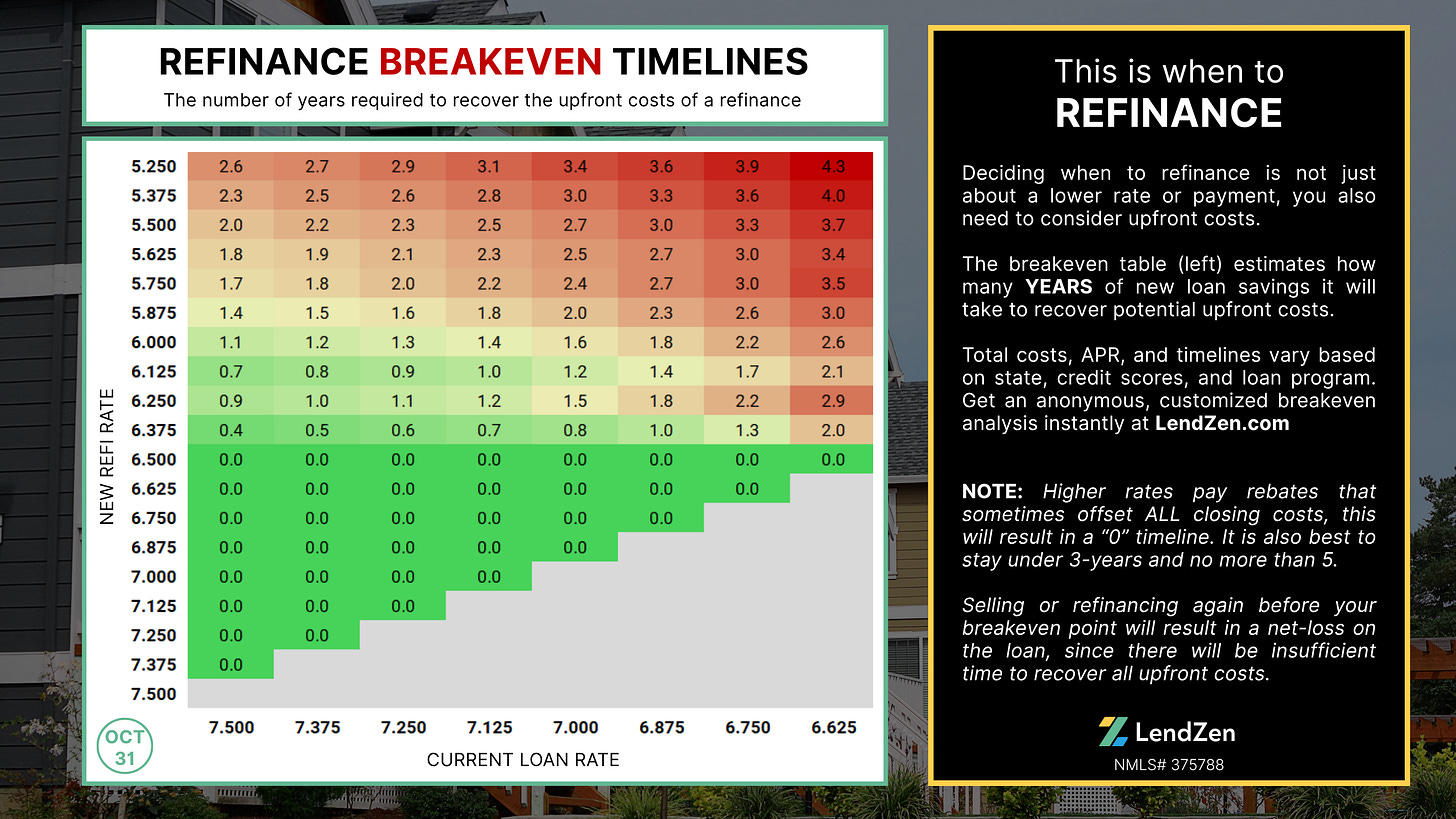

3-STEPS TO KNOW IF YOU ARE IN RANGE FOR A REFINANCE

Find your current NOTE rate in the horizontal x-axis

Compare it with any of the refinance rates listed in the y-axis

Decide if the breakeven timeline (years) fits your objectives

The breakeven table “estimates” how many years of new loan savings it will take to recover potential upfront costs.

Selling or refinancing again before your breakeven point will result in a net-loss on the loan, since there will be insufficient time to recover all upfront costs.

Higher rates sometimes offset ALL closing costs; this will result in a “0” timeline.

It is also best to stay under 3-years and no more than 5.

Current note rates lower than 6.625% are less likely to breakeven within that timeframe.

Total loan costs, APR, and exact timelines will vary based on state, credit scores, and loan program chosen.

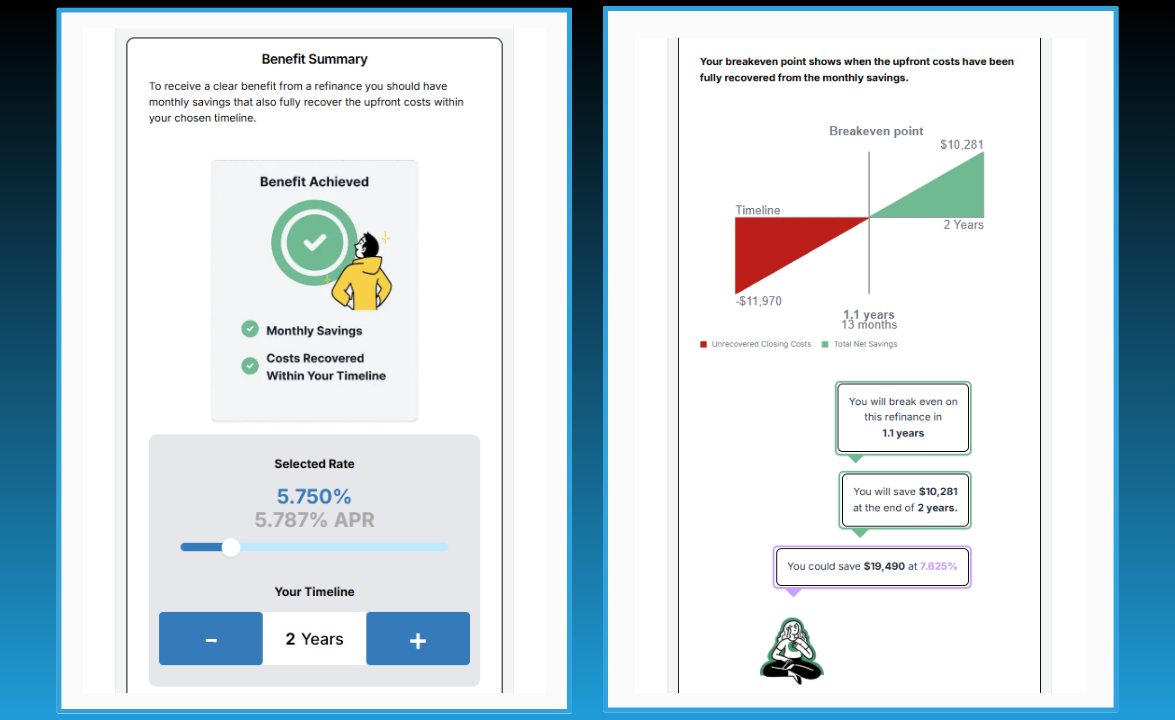

INSTANT BREAKEVEN ANALYSIS

Get an anonymous, customized breakeven analysis, instantly at LendZen.

Click the link below for an interactive rate quote and scroll down to the Benefit Summary section to see the breakeven analysis.

You can MODIFY any of the loan parameters from that screen or customize your own from the home page.

Use the “Save this Scenario” option to receive a private link and check rates for your exact criteria anytime with just one-click.

INTERACTIVE REAL-TIME RATE QUOTE

🏠 👆

UNDERSTANDING THE MODERN MORTGAGE MACHINE

Most mortgages are sold into mortgage-backed securities (MBS) - the price of these bonds determines rates for all banks and lenders.

However, mortgage rates DO NOT rise or fall.

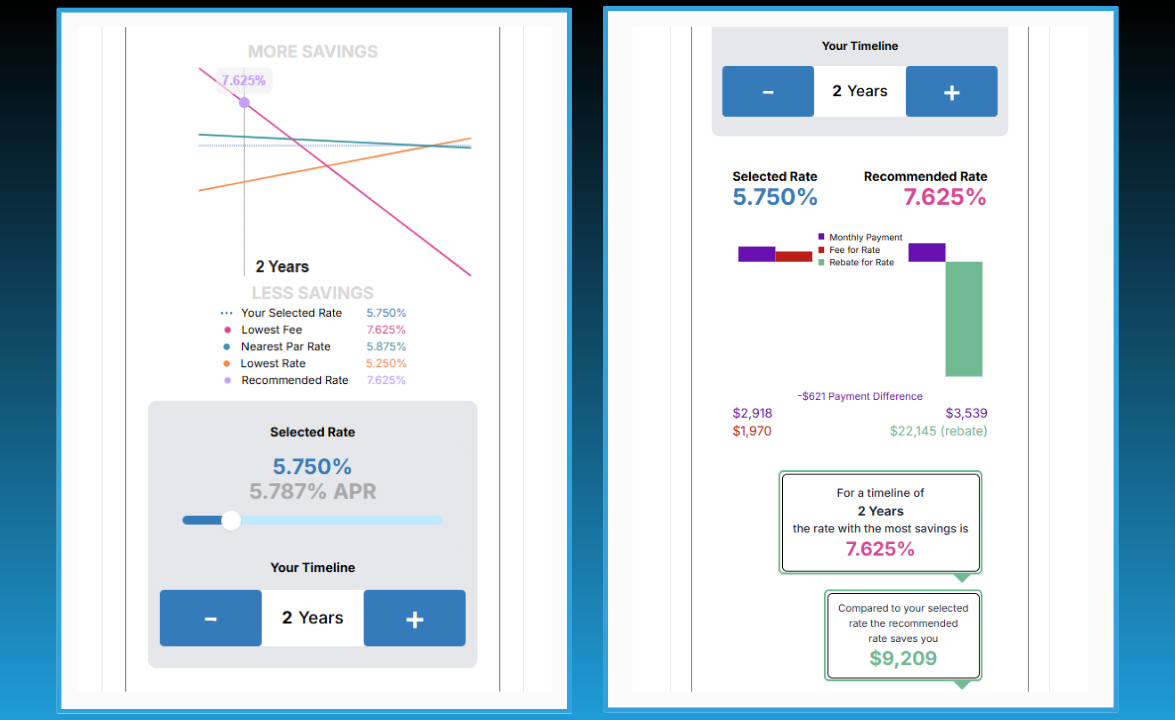

The full range of rates is always available, and instead the price of each rate is what changes.

The lower the rate, the more you pay upfront for it - this is often referred to as points but is more accurately known as a “discount fee”.

However, when mortgage bond prices rise the price of ALL mortgage rates decline.

This makes it “feel like” lower mortgage rates are suddenly available even though they always existed; the higher bond prices simply made them more affordable.

This rate-price dynamic also means the higher you go in rate, the lower the discount fee.

Some rates will even pay a rebate, and that rebate increases as you go higher in rate.

Rebates and discount fees change daily, based on the fluctuation in mortgage bond prices.

Every Monday I post a “Data Deluge” with charts and analysis that help visualize these concepts - see the most recent compilation at this Substack post.

HOW TO KNOW IF A REFINANCE IS WORTH IT

Deciding if a refinance is worth it depends on two things:

The timeline you predict to be in the loan, before selling or refinancing again

The breakeven point for the rate you choose falls within that timeline

Multiple rates might breakeven within your timeline, but the BEST rate is not necessarily the lowest.

Instead, choose whichever rate provides the most net-savings at the end of your selected timeline.

When you are offered a “No Points” loan, the rate offered has enough rebate to offset the fees normally charged by that lender in Section A of the Loan Estimate disclosure.

This is VERY different than a “No Cost” loan, which means the rate chosen has enough rebate to eliminate all costs of doing the loan.

Although the “no cost” rate will be higher, the savings are immediate because there are no upfront costs to recover.

This type of approach usually provides the most benefit (net-savings) for borrowers considering shorter timelines.

The “timeline” is not about the loan term (15-Year, 30-Year, etc.) and in many cases isn’t necessarily about how long you plan to be in the home.

When choosing a timeline, you need to also consider how long before you think mortgage rates will become less expensive and choose the shorter of the two timelines.

Timeline is the only subjective part of deciding which rate to choose.

The rest is derived mathematically, with only one rate that provides the most benefit for that timeline.

Want to check customized, real-time mortgage rates instantly? 🧮

LendZen (NMLS# 375788) gives you real-time access to mortgage rates that update as bond prices change.

The detailed loan summaries have an interactive rate slider that shows all current mortgage rates and full transparency of costs upfront.

All information can be viewed anonymously and without any sign-up requirements or human interaction. This makes exploring the full range of rate options hassle-free.

To instantly and anonymously find the rate with the most benefit for your exact loan criteria visit LendZen.com