Mortgage spreads – fact, fiction, and hoping for better rates 🙏💰

Are mortgage spreads predicting lower mortgage rates?

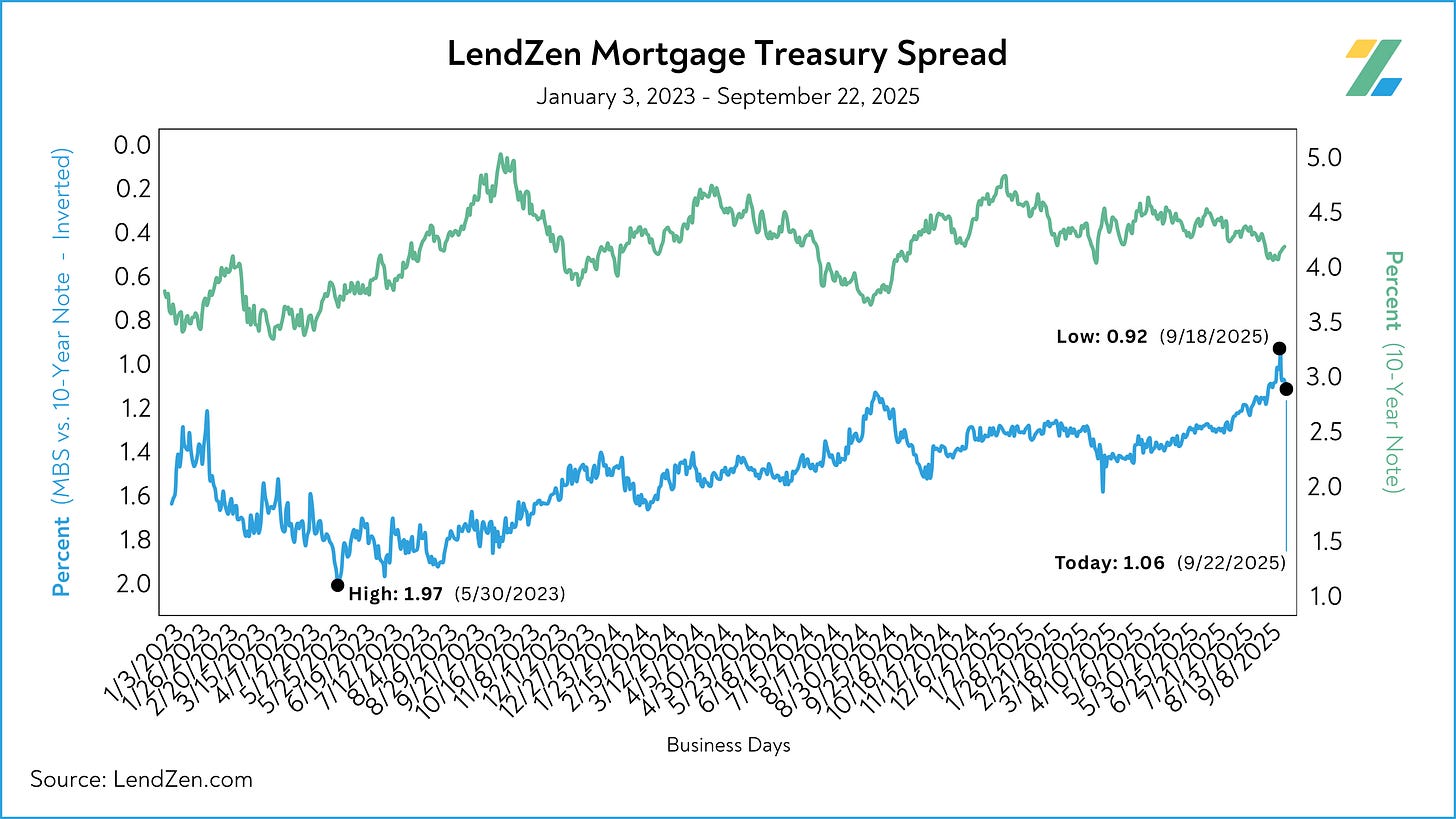

The “spread” between the U.S. 10-Year and Mortgage Bonds tells a story.

But to understand the message we must be able to distinguish fact from fiction, and most of what is written online about spreads is the latter.

Mortgage rates are currently at their best level in years, if only the spread would improve, then rates would be even better. Right?

In this post I explain what is likely ahead for mortgage rates, based on a mortgage spread calculation that is more accurate than the one you probably read.

Mortgage rates do not rise or fall, the price of rates change based on the price of different mortgage-backed securities (MBS).

MBS coupons (bonds) trade in half-percent increments (4.5, 5.0, 5.5, 6.0, etc.)

Whether the price of a bond is above or below par (100-00) impacts its yield (return).

Although a 5.5 is paying a higher interest than a lower coupon, it will have a higher price.

For example, as of Tuesday, September 23 the price of the 5.5 is 100.29.

Meanwhile, the 5.0 is 99.10.

The result of this price dynamic is the 5.5 is yielding less (5.38%) than its coupon rate and the 5.0% yields more (5.09%).

This dynamic is also what helps attract more liquidity to lower coupons, effectively making lower mortgage rates LESS EXPENSIVE.

Meanwhile, the shift in liquidity between different coupons can disproportionality affect the price of mortgage rates.

This is because the Note rate of a mortgage needs to be higher than the coupon, so that the company servicing the loan can make a profit.

For example, your 6.0% mortgage rate cannot be packaged into a 6.0 MBS.

Even though the rate is close to a 6.125% or 6.250%, the 6.00% rate will reflect the price gap of the lower coupons.

Again, mortgage rates are not rising or falling - the same rate options are available, it is the price of each that is changing.

This applies to the majority of mortgages in the U.S., especially loans that meet conforming guidelines.

The only difference between what each lender offers is not the rate, but the fees they charge on top.

Because of this FACT, there is no such thing as an “average” rate, only an “average of costs” for any given rate.

It also means quoting mortgage spreads between an arbitrary “average” and the U.S. 10-Year Note is a fairytale story.

Not to mention, MBS are amortizing “pass-through” securities. They don’t wait 10 years to pay par; principal comes back monthly from scheduled payments and prepayments.

This means the true yield depends on the prepayment model applied.

If prepays are high, principal is paid back faster - this changes reinvestment risk, the effective duration, and the final yield of the original investment.

However, if we simply look at the two coupons that currently straddle par (100-00), and interpolate the two, we can more clearly depict what mortgage bonds could yield versus a 10-Year Note.

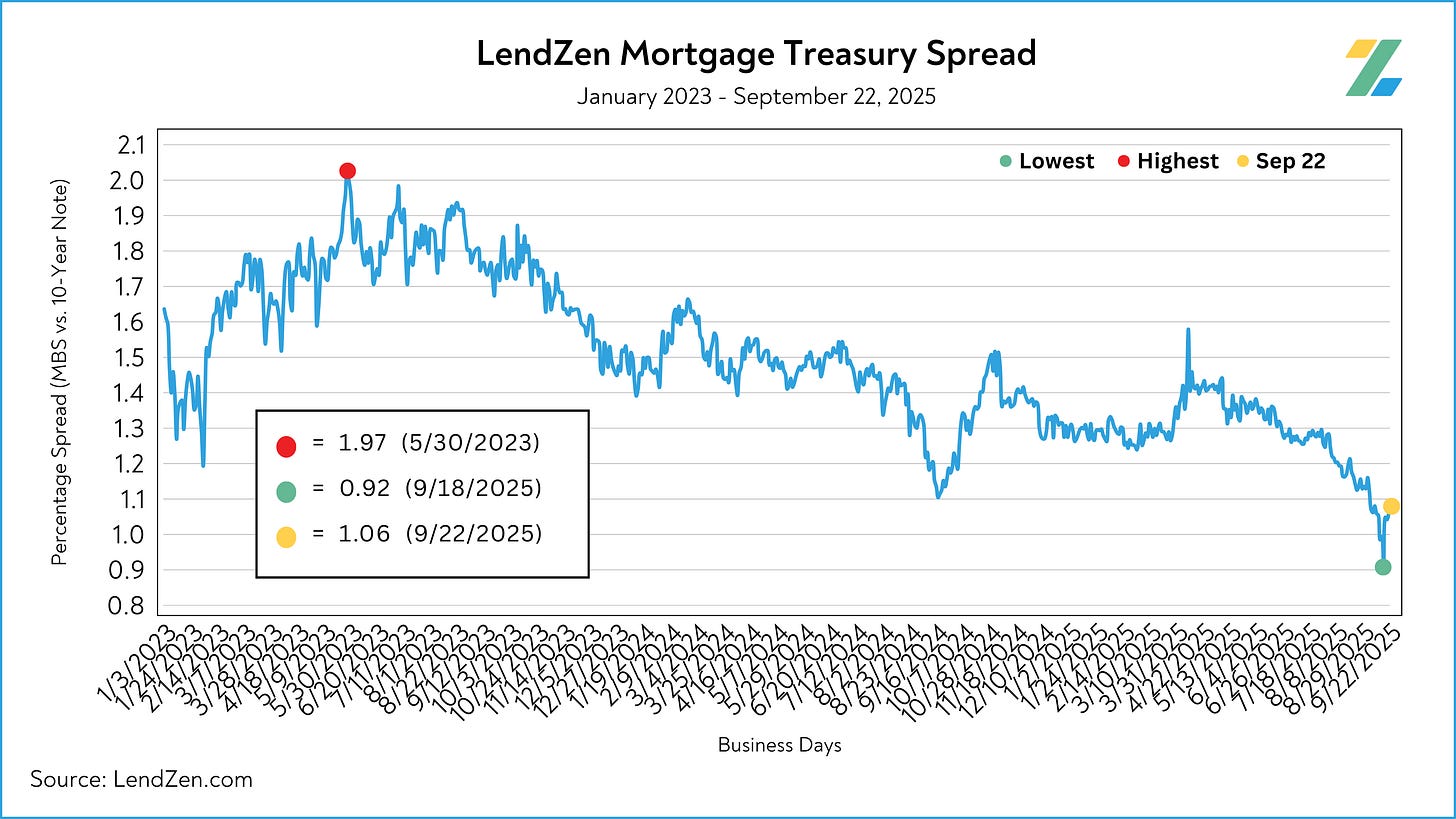

The LendZen Mortgage Treasury Spread (LMTS) does exactly that and provides a more accurate picture of investor demand for MBS.

As we can see in the LMTS chart above, spreads have tightened by over 50% in the last two years and even fell below 100 bps last week.

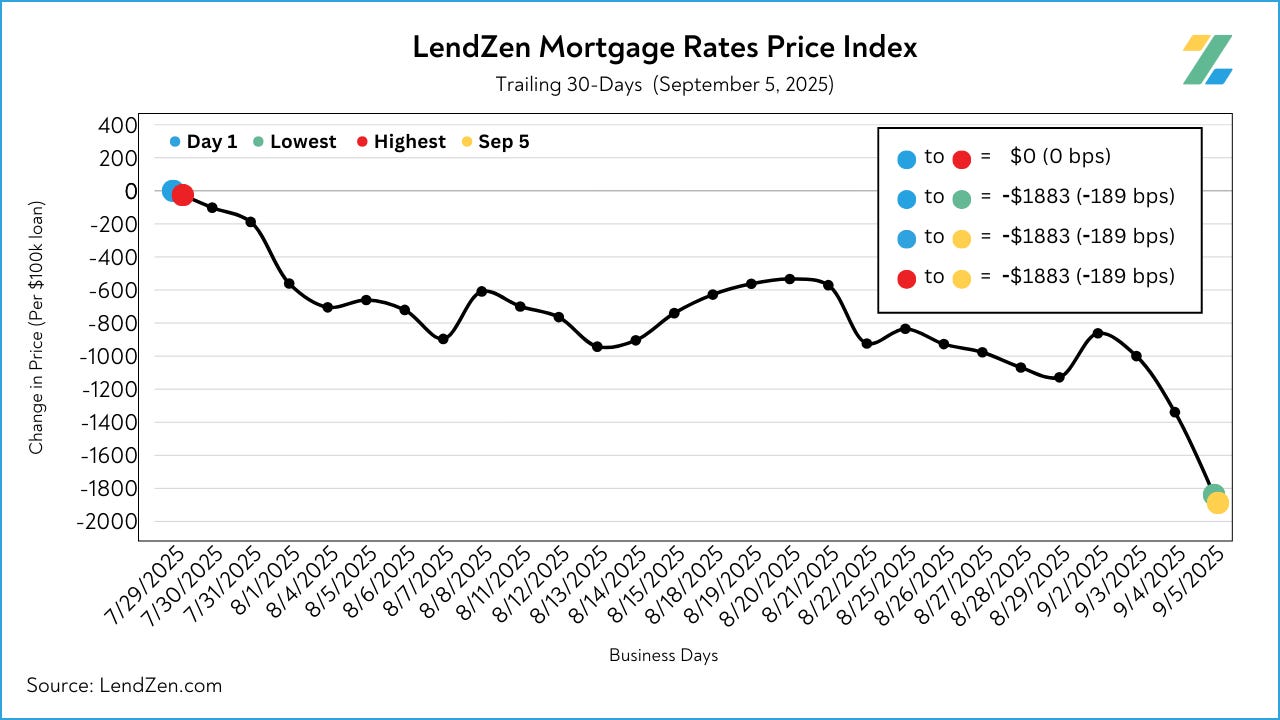

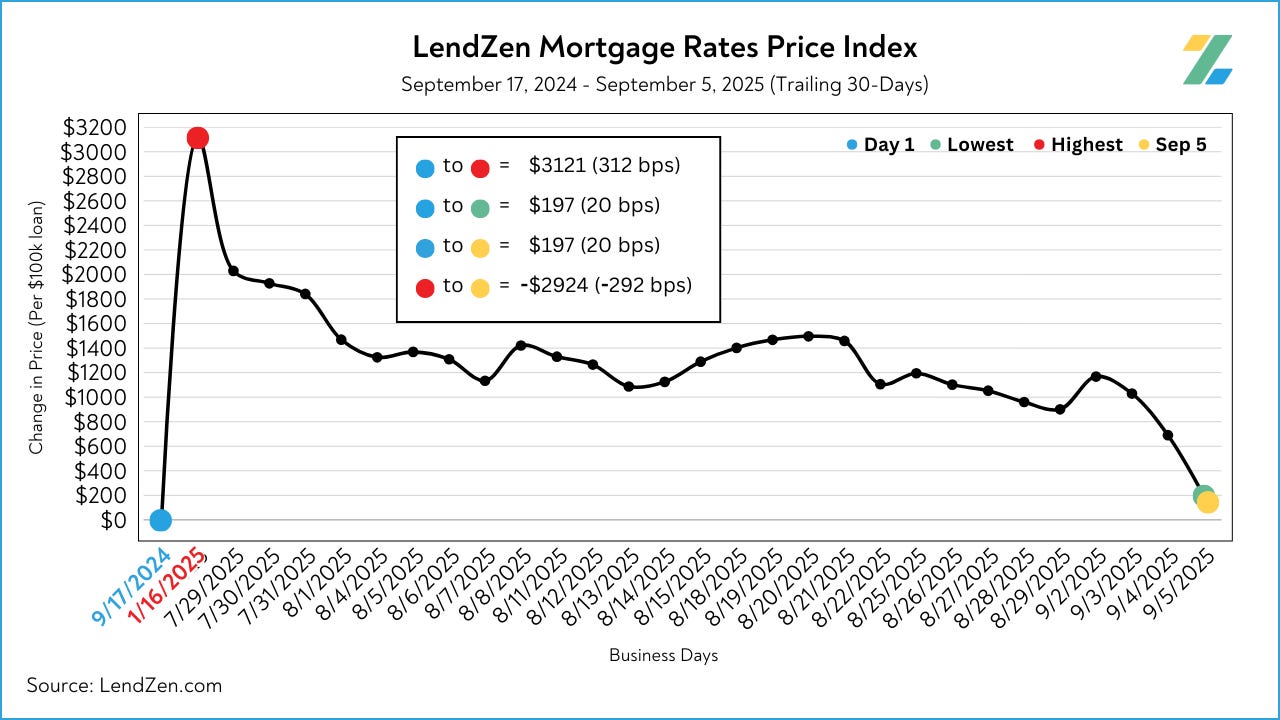

Meanwhile, the PRICE of the actual mortgage rates has fallen by over 300 basis points since the high in January, most of the improvement transpired in August.

This is visualized by the LendZen Index, which tracks the change in PRICE of mortgage rates using similar MBS data.

Given the current goldilocks scenario of both higher bond prices and tighter spreads, what will it take for lower mortgage rates to become LESS expensive?

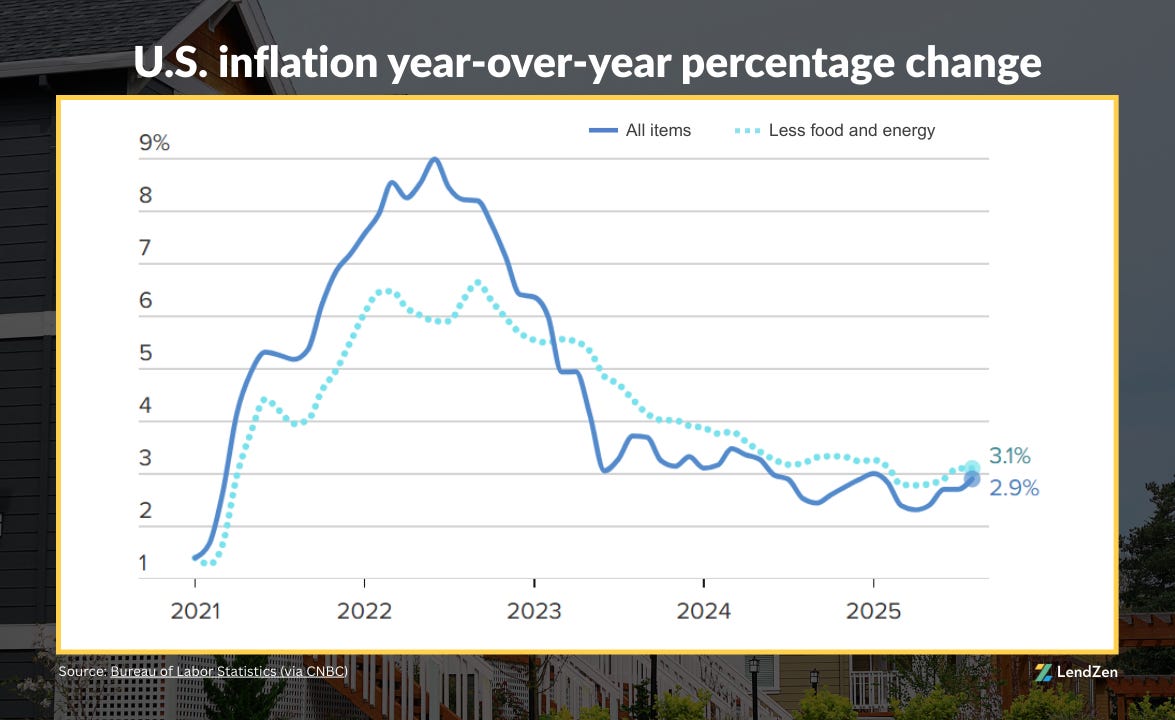

The latest CPI inflation data was above 3% year-over-year, and as a result the latest Fed rate cut was barely tolerated by the bond market.

There are policy changes that can help improve spreads further, such as reducing Fannie/Freddie Guarantee Fees.

The Fed could also maintain the size of their current balance sheet by reinvesting in new MBS when currently held securities mature or get paid off.

However, absent a deflationary shock (recession), it’s hard to see how the invisible hand of markets is going to push bond prices higher, or tighten spreads further.

Bottomline, the spread between mortgage-backed securities and the U.S. 10-Year is a meaningful part of the mortgage rate story.

The LendZen Mortgage Treasury Spread gives you a measurement of that spread using fact, not fiction.

So far it has been a great year for bonds.

With spreads also tighter, the path ahead for mortgage rates now rests in the hands of the 10-Year Note.

Plan accordingly but remember, hope is not a plan.