Mortgage rates zone out as inflation data looms 🥱📅⚠️

Midweek Market Update

Included in this update are the following:

Shop real-time mortgage rates anonymously and get instant qualification results at LendZen.com

MIDWEEK RECAP ⏪

-------------------

The December Non-Farm Payroll report (November data) was originally due last week but was rescheduled to yesterday (Tuesday).

Inflation, employment, and The Fed make up my “Big 3” market movers.

Inflation (CPI/PCE)

The Fed (FOMC/Minutes)

Employment (NFP/ADP)

Despite the hope that a softening labor market would push mortgage rates back to the October lows, the NFP data was a mixed bag that only nudged bond prices slightly higher.

Read more in yesterday’s “Rate Snapshot” Substack post.

Today was even more uneventful, with a mostly flat session for all sectors, although crypto continues to lose ground while precious metals have taken over as the preferred hedge.

IMPACT CALENDAR 📅

-----------------------

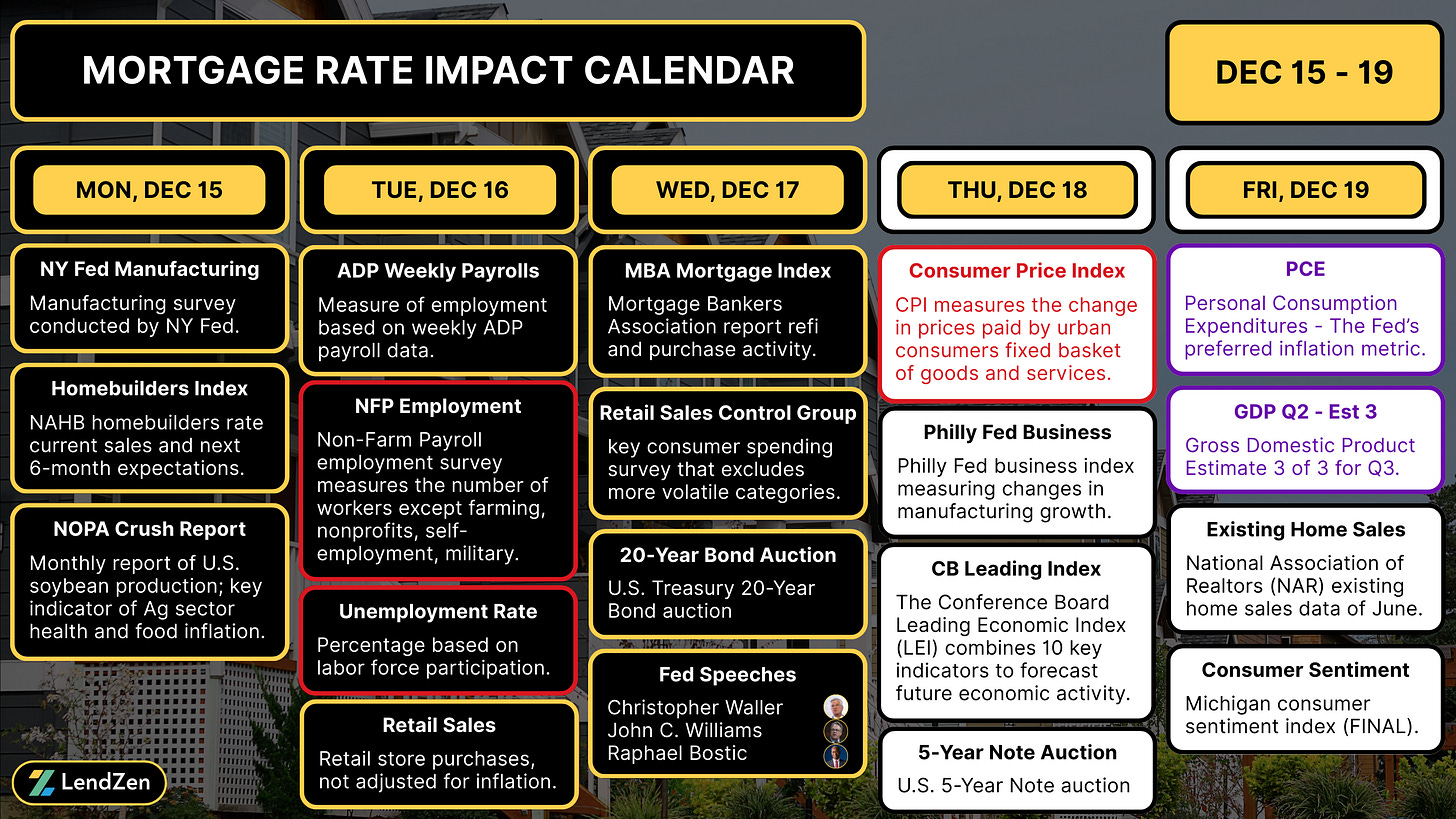

This is a double whammy week with another Big 3 data set on deck tomorrow, the Consumer Price Index (CPI) inflation report.

This is the last major report before investors likely completely check out for the year.

However, if this week does prove uneventful, and we continue to trend sideways into the new year, there should still be a collective sigh of relief.

Finishing off the month unscathed will put 2025 as the best year for mortgage rates since 2020.

Read more in the Rate Price Index section below.

RATE PRICE INDEX 📉

----------------------

Mortgage rates DO NOT rise or fall.

The full range of rates is always available, and instead the price of each rate changes based on the trading of individual mortgage bonds.

The LendZen Index calculates a daily change in the price of mortgage rates by tracking a spectrum of mortgage-backed securities (MBS).

-----------

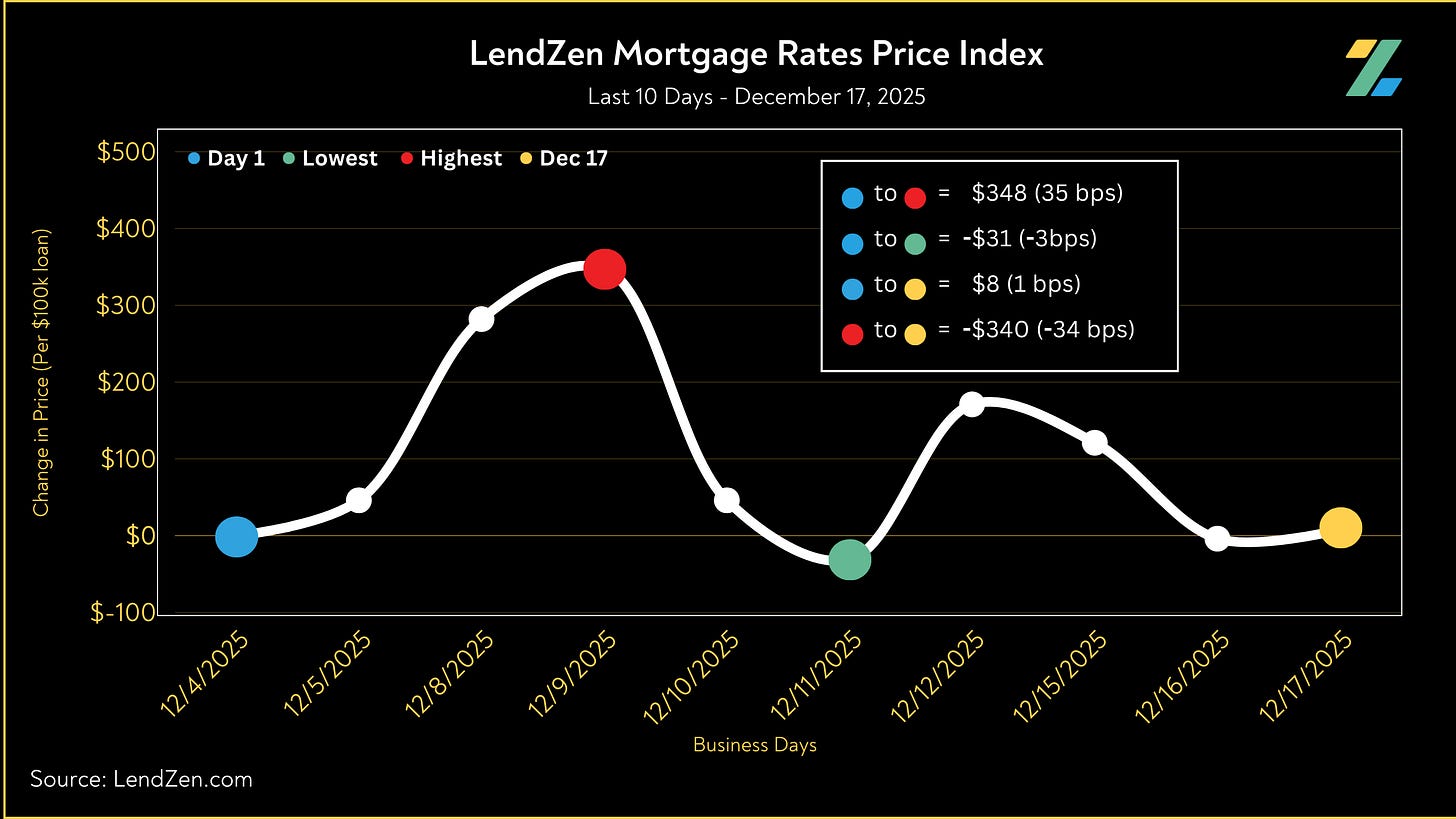

24-Hour: +1 bps (+$13 per $100K)

5-Day: +4 bps ($40)

10-Day: +1 bps ($8)

30-Day: -21 bps (-$207)

60-Day: -25 bps (-$248)

Learn more about the LendZen Index and explore the full data series at LendZen.substack.com

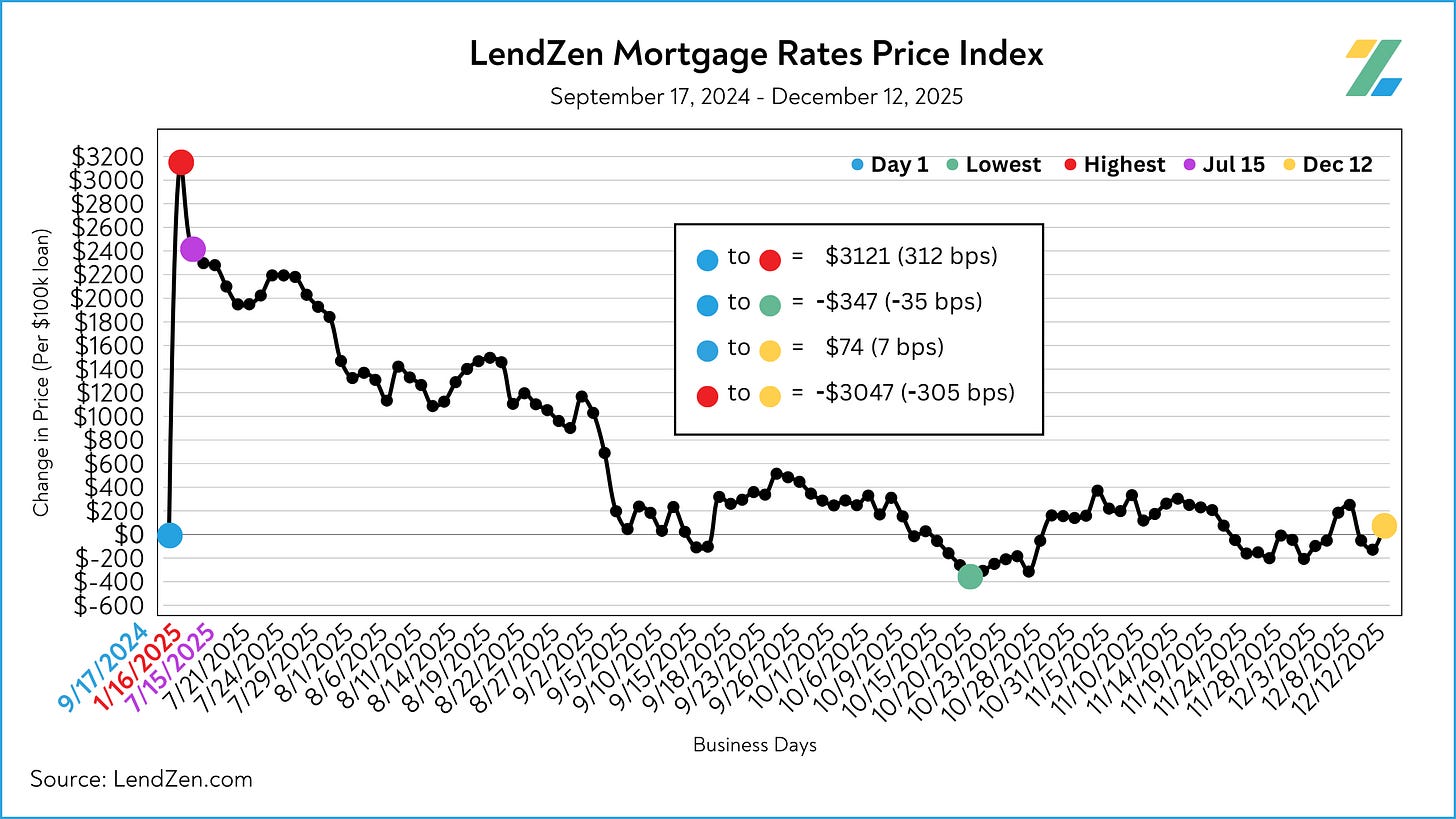

Since peaking on January 16, mortgage rate PRICES have declined by over 300 basis points.

That means the cost of getting a $500k mortgage (regardless of rate) is $15,000 cheaper today than at the start of the year.

MORTGAGE SPREADS 🧈

-------------------------

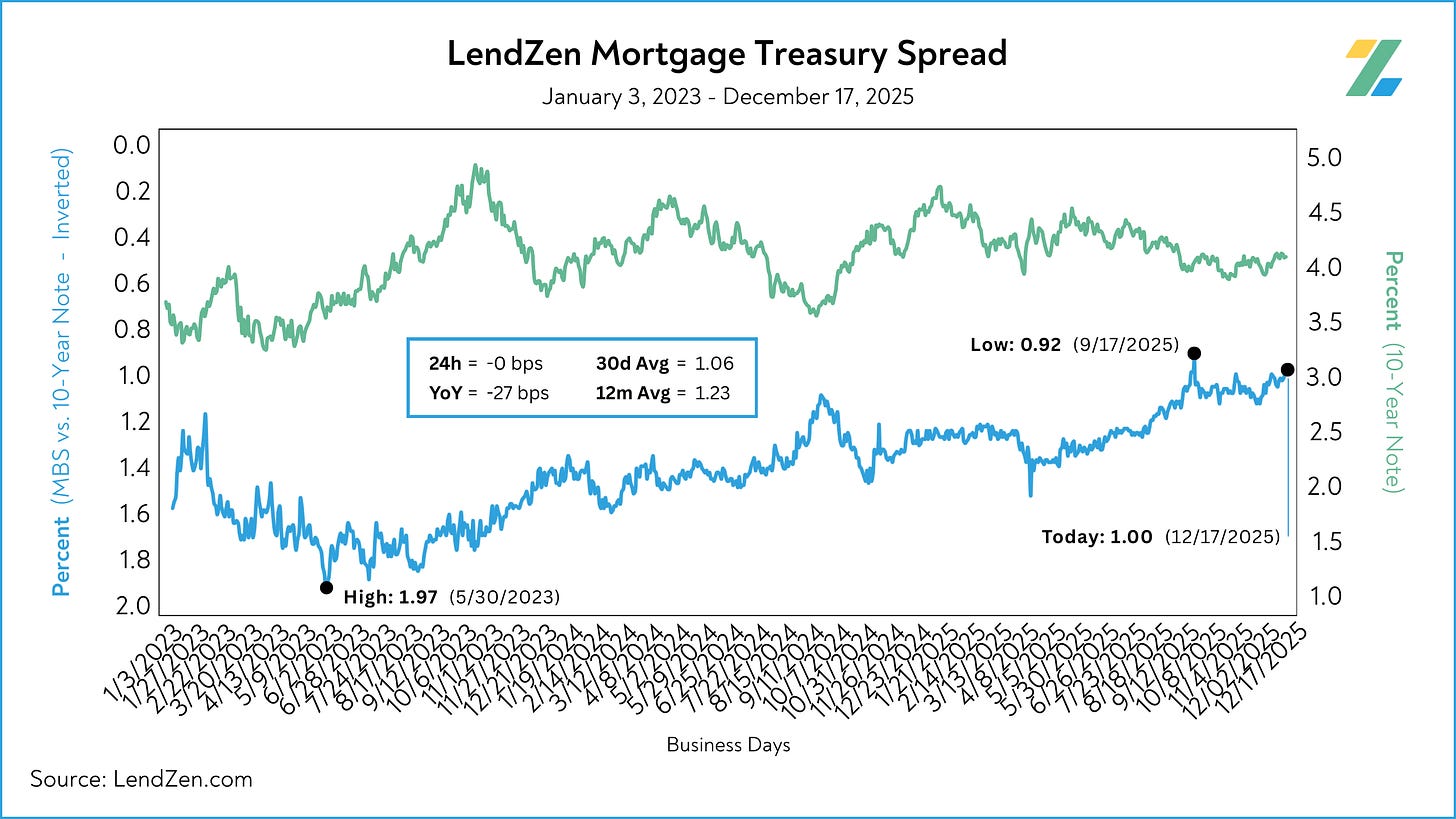

Published daily with the LendZen Index is the LendZen Mortgage-Treasury Spread.

The LMTS uses actual bond yields to create a historically consistent, and reliable, data set.

-----------

Dec 11: 1.02

Dec 17: 1.00

24h: 0 bps

5d: -2 bps

12m Avg: 1.23

YoY: -27 bps

Learn more about the importance of mortgage spreads on this Substack post.

RATE LOCK GUIDE 🔒

---------------------

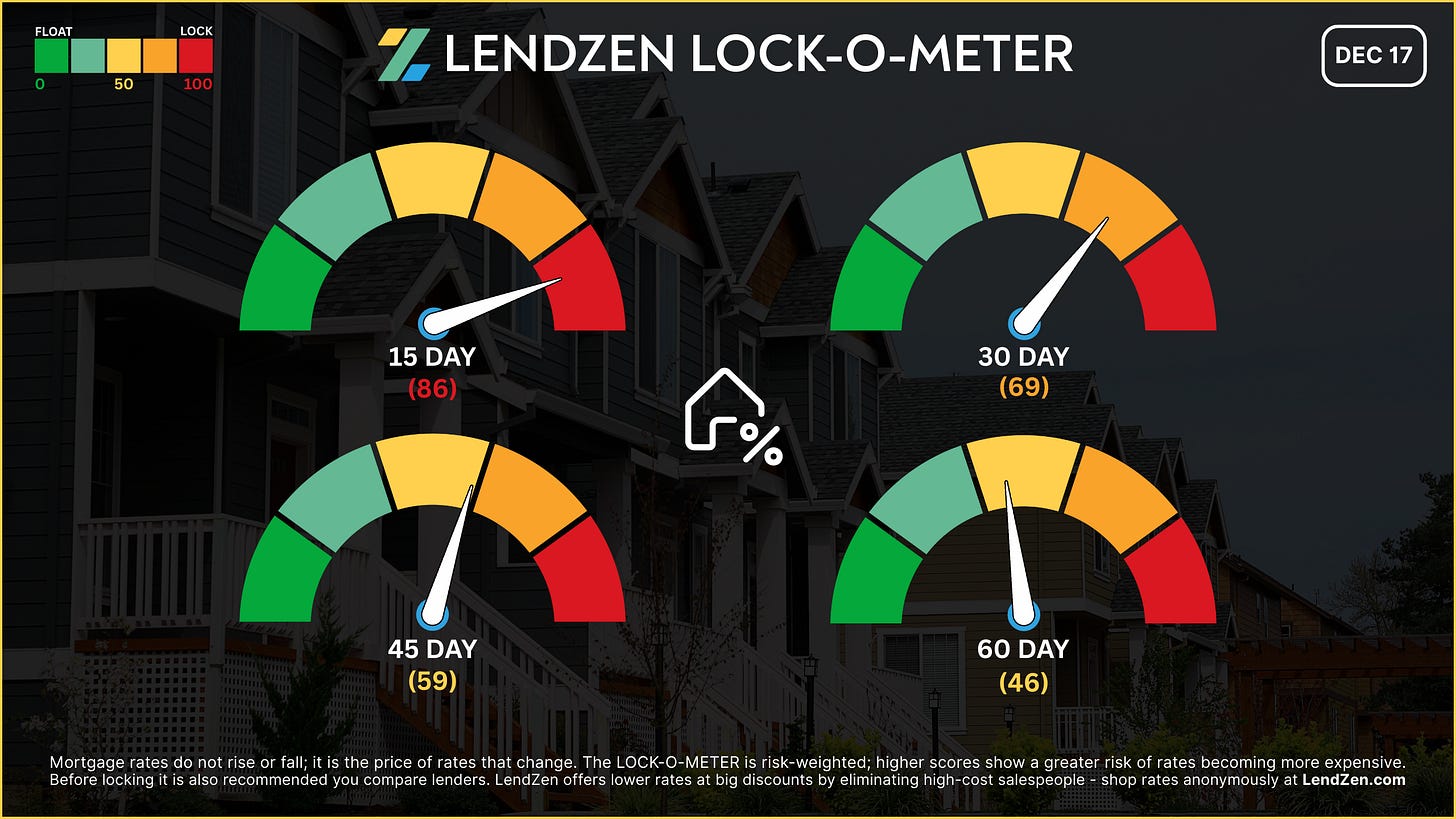

The LendZen LOCK-O-METER provides borrowers with a risk-weighted score based on how various macroeconomic events, including market data, central bank announcements, and geopolitics, each historically impacts the price of bonds.

higher risk scores = lean towards locking

------------------

Closing Window

------------------

[ 15 Days ] — 86 🔴

NFP failed to meaningfully help bonds and CPI risk is now concentrated into a single release. Short-term lock risk inches higher as the window narrows.

[ 30 Days ] — 69 🟠

With CPI tomorrow’s wild card, there’s little buffer left before year-end. Any upside inflation surprise would be difficult to recover from in this timeframe.

[ 45 Days ] — 59 🟡

The medium-to-longer-term window is steady, but direction hinges on whether CPI confirms or disrupts the disinflation narrative.

[ 60 Days ] — 46 🟡

Longer-term optimism remains intact after NFP came and went without impact. Assuming CPI doesn’t derail bonds either, early-2026 pricing will still benefit from 2025’s strong rate improvement.

Learn more about the Lock-O-Meter and when to lock your rate in this Substack post.

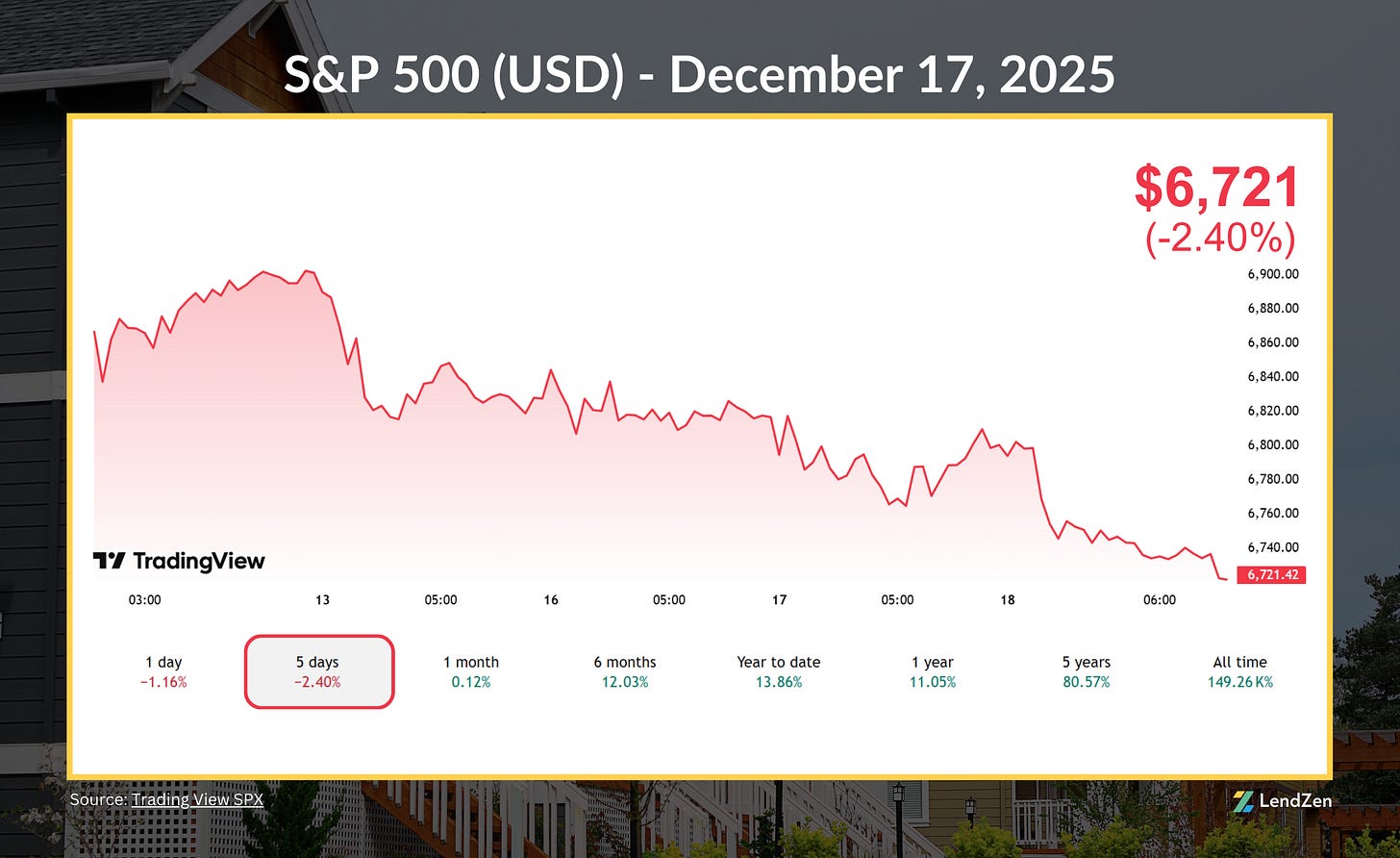

STOCK MARKETS (5-Day) 📊

-----------------------------

DJIA: 47,886 (-1.70%)

S&P 500: 6,721 (-2.40%)

NASDAQ: 24,647 (-3.46%)

CRYPTO (1-Week) 🧮

---------------------

Bitcoin: $85,801 (-7.43%)

Ethereum: $2,819 (-15.06%)

Solana: $122.24 (-11.34%)

PRECIOUS METALS (5-Day) 🪙

-------------------------------

Gold: $4,345 (+1.44%)

Silver: $66.41 (+7.44%)

Platinum: $1,921 (+15.86%)

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.