Mortgage rates wished Powell would "zip it"

Midweek Market Update

THE STORYLINE – OCT 29

-----------------------------

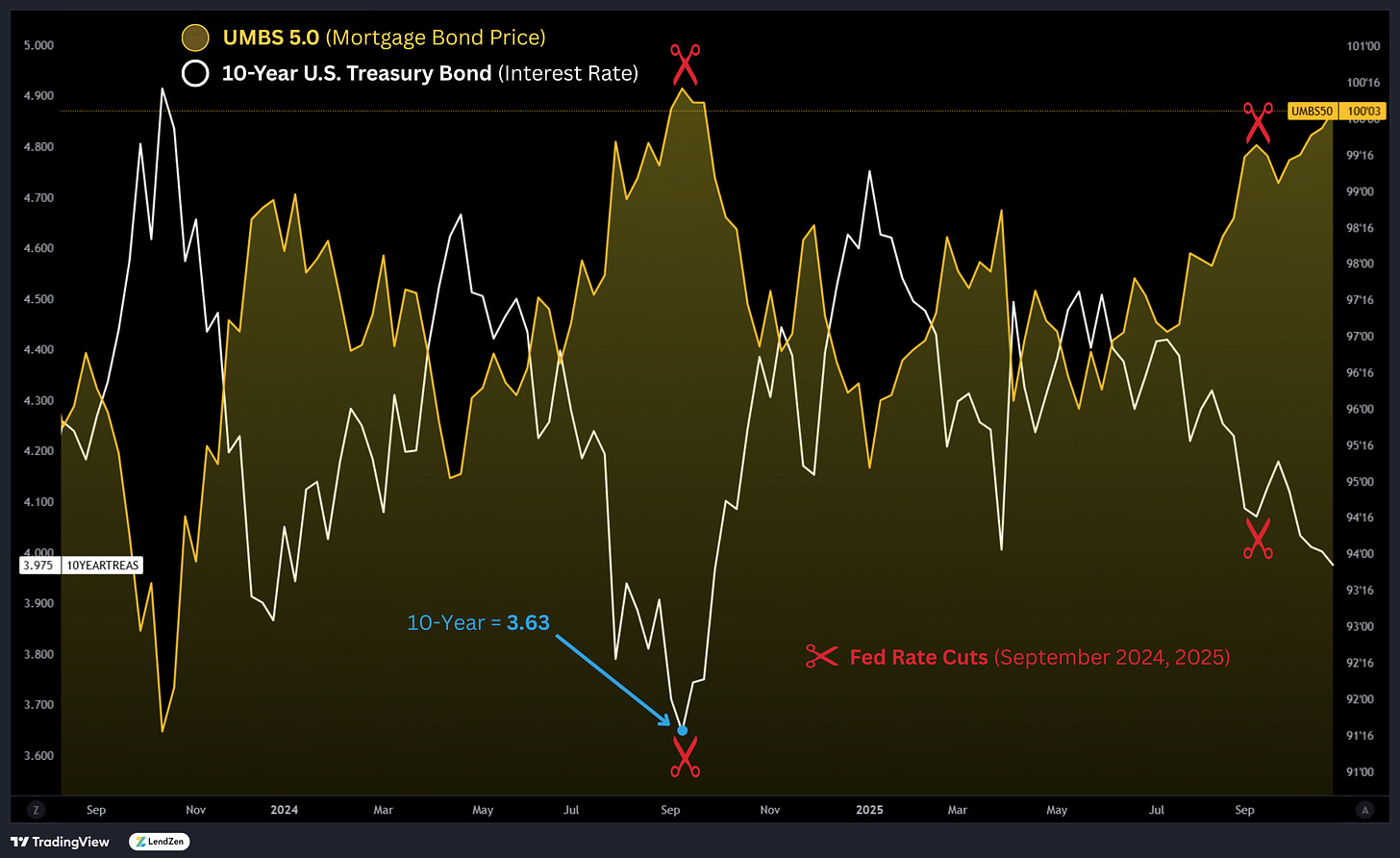

As expected, The Fed cut 25 bps and announced the end to their balance sheet reduction (Quantitative Easing), with proceeds from MBS being reinvested into Treasuries.

The FOMC announcements had little impact on markets, but the same could not be said for the press conference that followed.

Markets don’t like uncertainty, and that was exactly what Powell delivered when asked about a December rate cut – his “not a foregone conclusion” comment was poorly received, particularly by bond markets.

Lower coupon UMBS sold off the most, leading to a jump in mortgage rate prices which is how the day ended.

The Friday PCE inflation data is likely delayed due to the Government Shutdown, so markets will have two-days to process Powell’s remarks, along with those provided by other Fed presidents.

**Events marked blue could be delayed by the shutdown

LENDZEN INDEX

-------------------

Learn more about the LendZen Index and explore the full data series at LendZen.substack.com

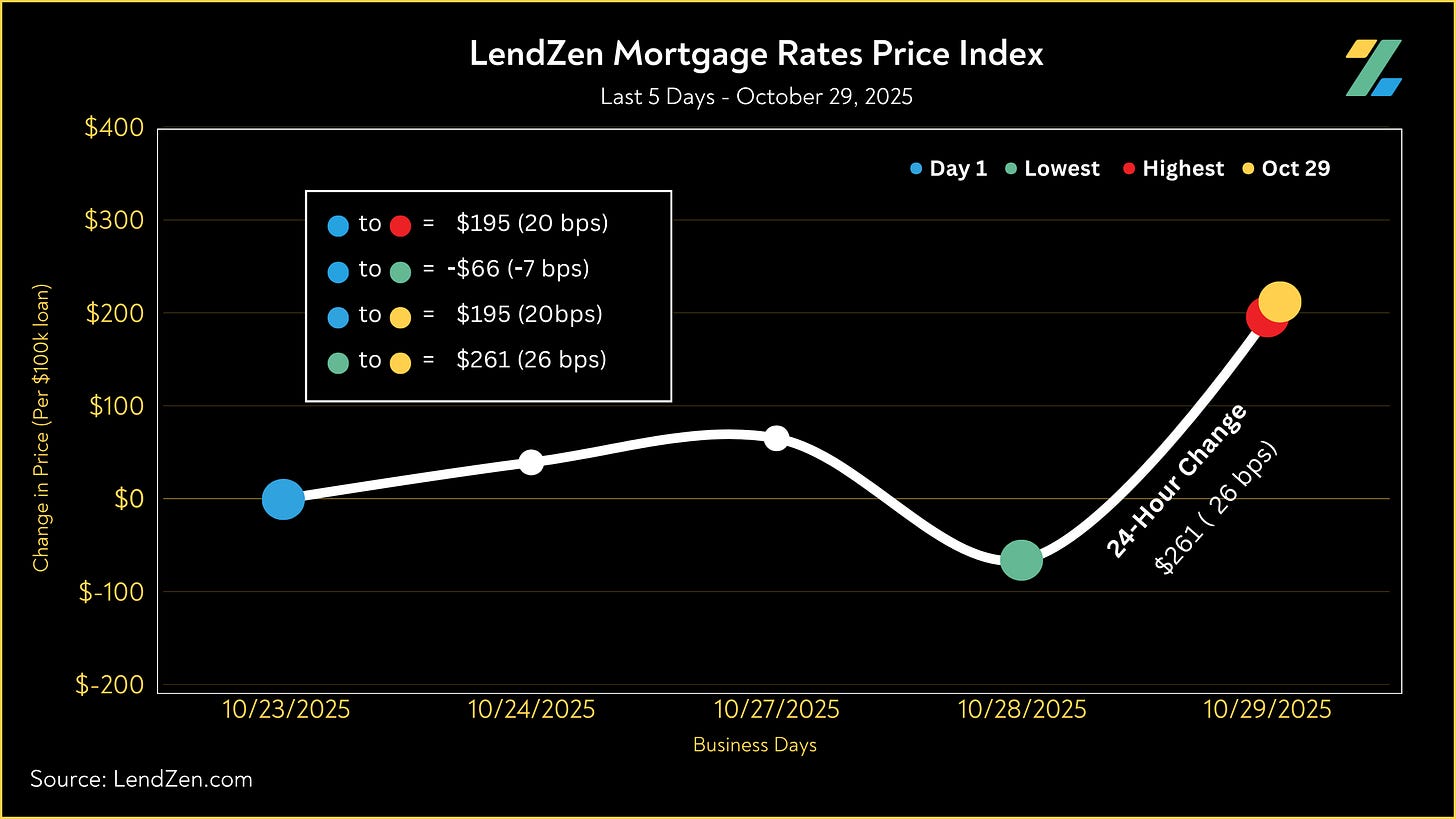

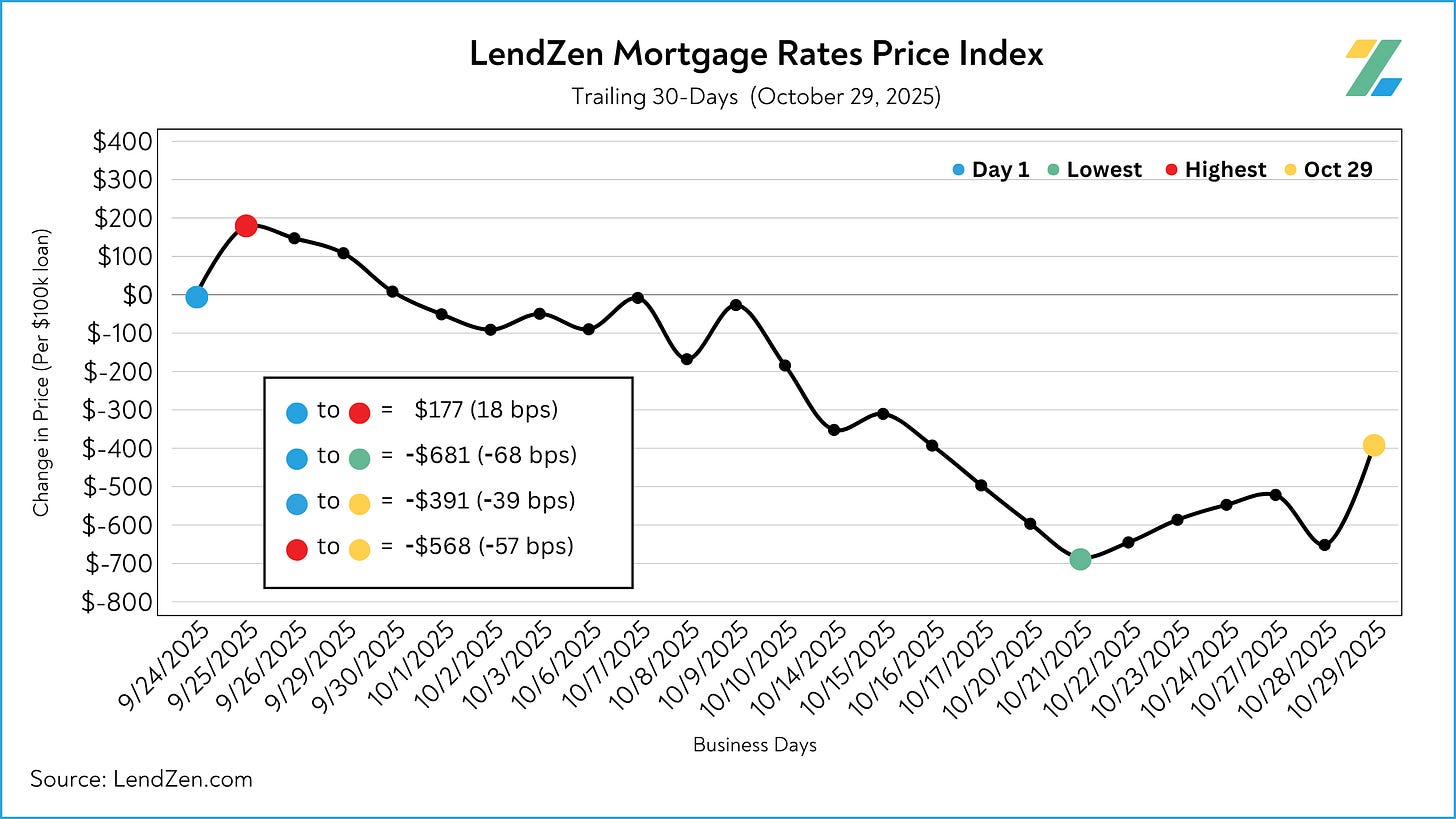

24-Hour: +26 bps

5-Day: +20 bps

30-Day: –39 bps

LENDZEN MORTGAGE-TREASURY SPREAD

----------------------------------------------

The LMTS is posted daily with the LendZen Index.

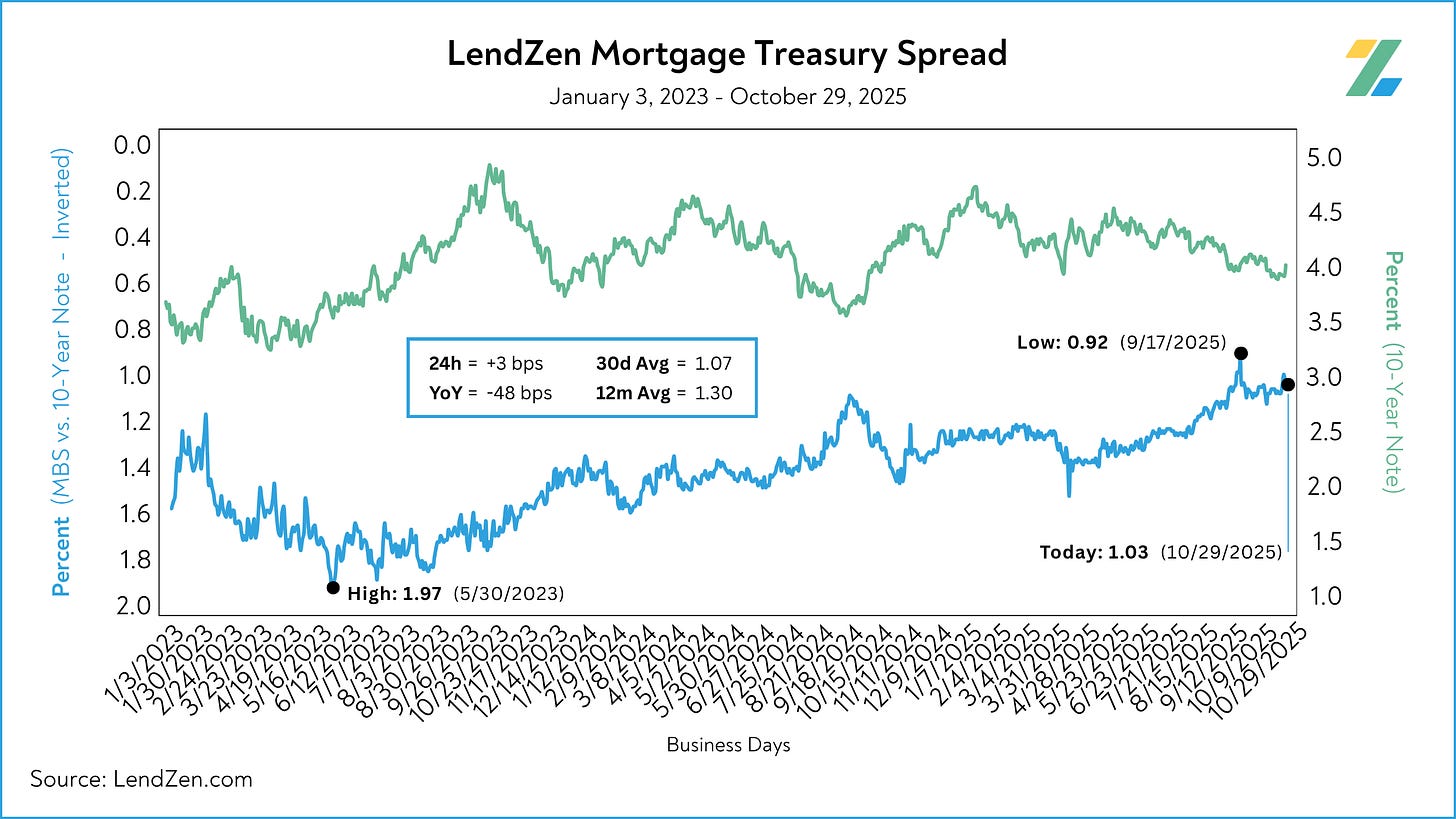

Oct 29: 1.03

24h: +3 bps

12m Avg: 1.30

YoY: –48 bps

LOCK-O-METER

------------------

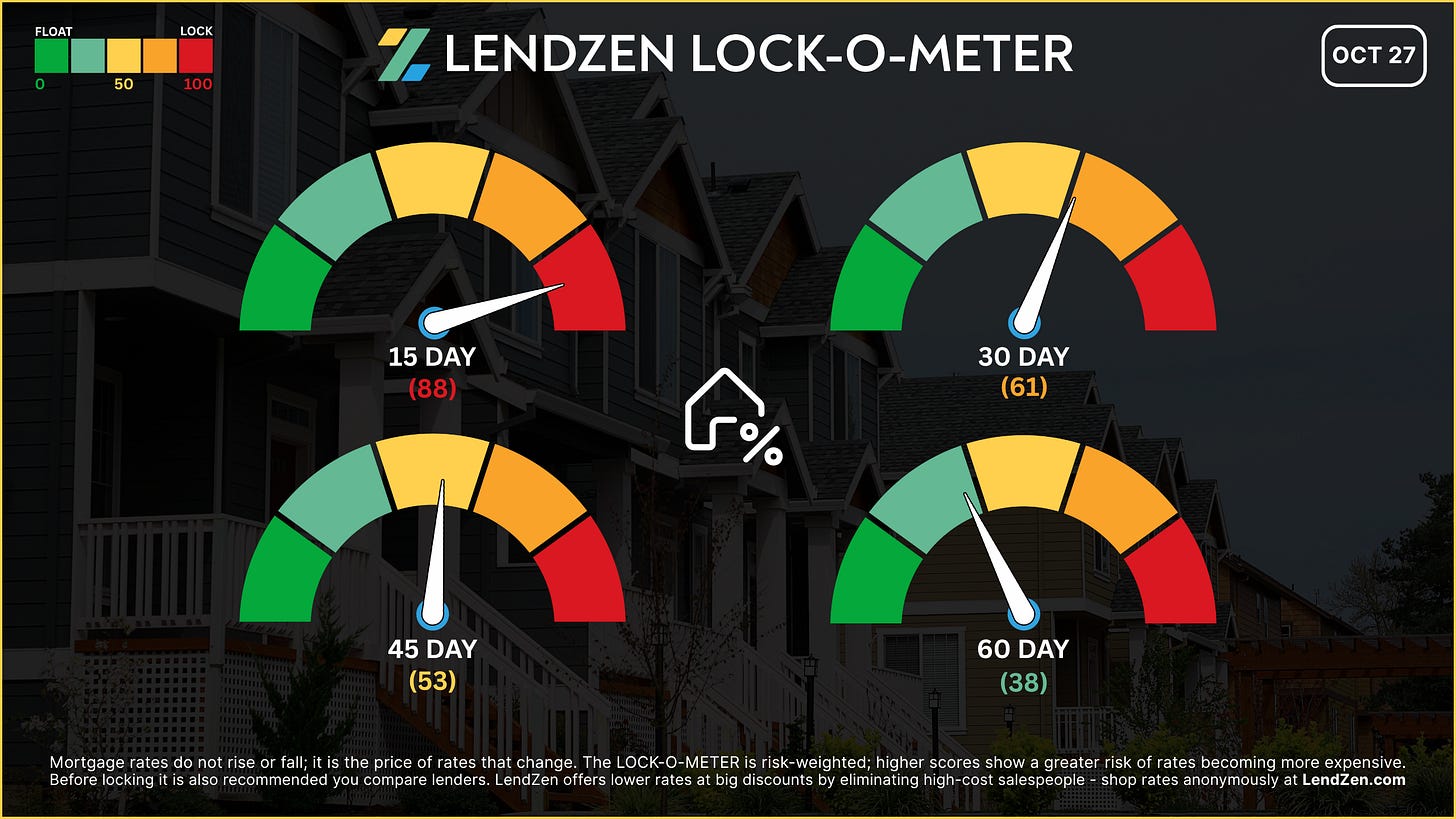

The changes are based on October 27 risk scores posted in the Monday Data Deluge.

15-Day: 90 (+2)

30-Day: 61 (+0)

45-Day: 53 (+0)

60-Day: 38 (+0)

Learn more about the Lock-O-Meter and when to lock your rate in this Substack post.

EQUITIES (5-Day)

----------

DJIA: 47,639 (+1.75%)

S&P 500: 6,890 (+1.75%)

NASDAQ: 26,128 (+3.21%)

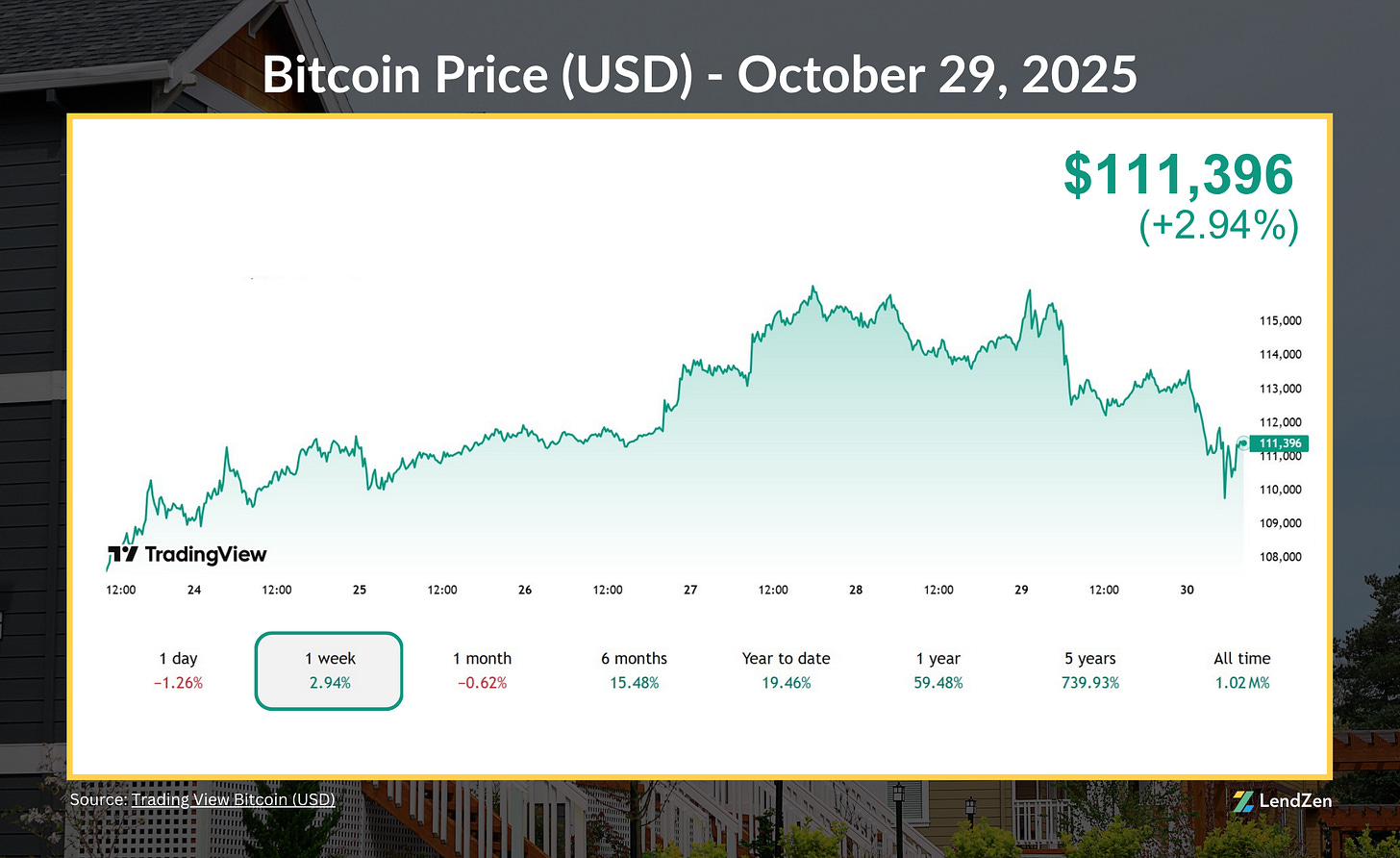

CRYPTO (5-Day)

---------

Bitcoin: $111,396 (+2.94%)

Ethereum: $3,953 (+2.04%)

Solana: $196 (+5.61%)

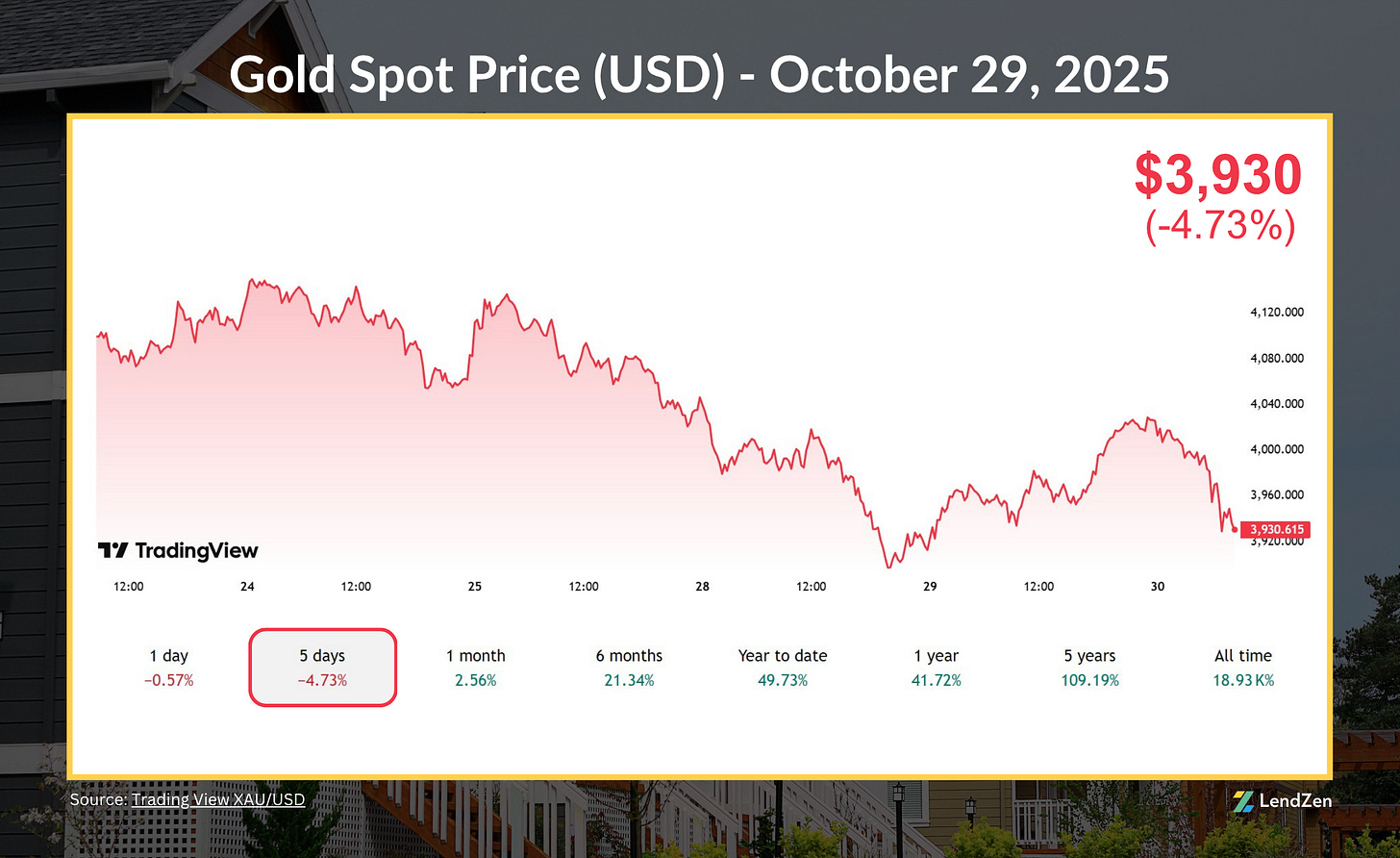

PRECIOUS METALS (5-Day)

----------------------

Gold: $3,930 (-4.73%)

Silver: $47.56 (-1.92%)

Platinum: $1,568 (–0.51%)

Thanks for reading.

If you are interested in more mortgage insights, then I suggest checking out this recent Substack article.