Mortgage rates tumble to multi-year low but new Fed drama could trigger reversal 📉🏦🥊

The Week Ahead

WEEK AHEAD 🗓️

----------------

— MORTGAGE BOND RALLY —

In the first week of 2026 mortgage rates looked content to stay in their holiday coma awaiting the Friday Non-Farm Payroll report.

That is, until Thursday afternoon when President Trump posted on his Truth Social that he was instructing Fannie/Freddie to spend their $200B cash pile on mortgage bonds.

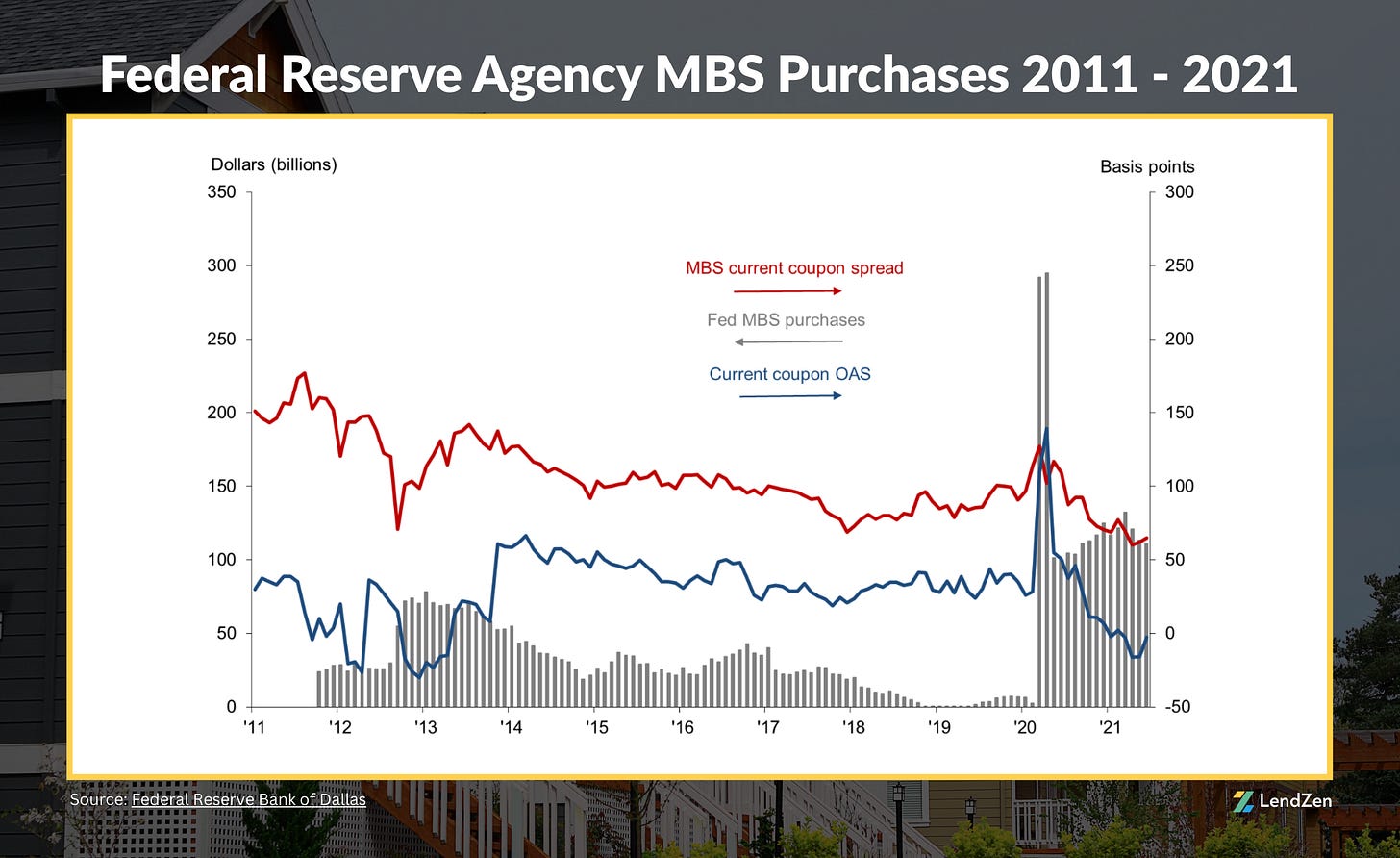

More on this as it unfolds, but keep in mind the Fed purchased a total of $580 billion in agency MBS during the two-month period of March - April 2020 and continued buying $40B per month for a full year after (June 2021).

Even $20B per month, half of what the Fed spent monthly, would exhaust those funds before the end of 2026.

In the short term, $200B would provide a stable buyer of MBS, further tightening spreads.

This was on display Friday.

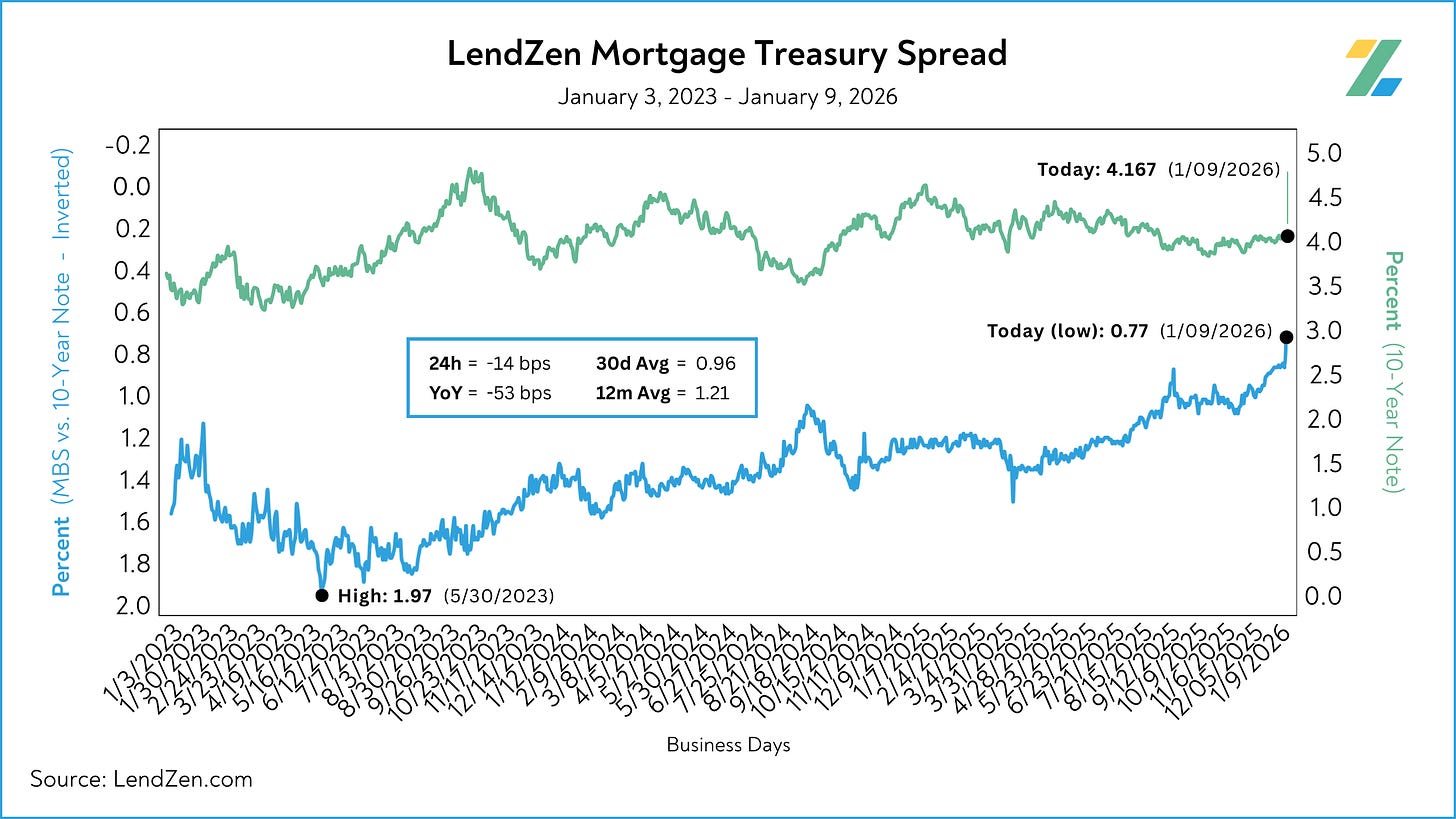

The 10-Year Treasury didn’t budge but MBS prices soared, massively compressing the spread by 14 bps.

Meanwhile mortgage prices reached the best levels since Covid, down 292 basis points from July.

That means the same rate a borrower would have paid 3-points for last summer is 0-points today.

In other words, the cost of getting a $500k mortgage is now $14,600 less expensive.

— NEW FED DRAMA —

It seems like the Trump Administration was only getting warmed up Thursday.

On Friday, the U.S. Department of Justice served the Federal Reserve with grand jury subpoenas related to the ongoing renovations of the Fed’s headquarters and congressional testimony about the matter provided by Fed Chairman Jerome Powell last June.

Powell didn’t mix words in a video statement posted Sunday, where he called out the threat of criminal indictment as an intimidation tactic and “should be seen in the broader context of the administration’s threats and ongoing pressure”.

The U.S. Central Bank is an independent entity with a dual mandate from Congress to maintain price stability (inflation) and maximum employment.

Chairman Powell directly calls out the “threaten of criminal charges” as a “consequence of the Federal Reserve setting interest rates based on their best assessment of what will serve the public, rather than following the preferences of the President.”

— ECON CALENDAR —

It is not clear yet how far this will escalate, but neither side seems to have any intent of backing down.

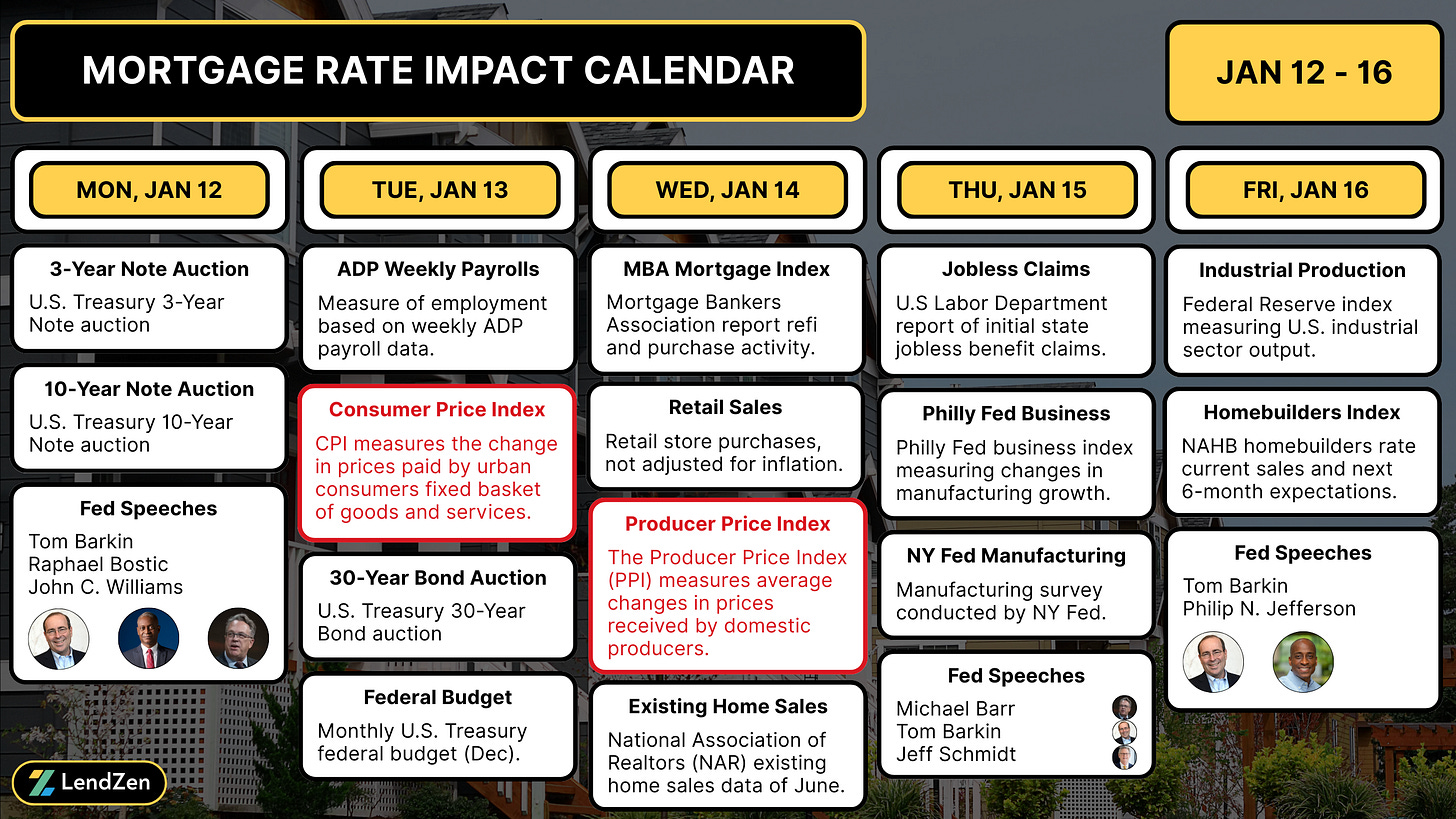

What we do know is investors don’t like uncertainty and the week ahead already promised plenty of its own with multiple bond auctions and key economic reports scheduled daily.

On top of Tuesday’s Consumer Price Index (CPI), we also get a backlog of inflation related data on Wednesday with the Producer Price Index (PPI) and Retail Sales - both were previously postponed due to the government shutdown.

Given the latest escalation between Trump and The Fed, it is also worth noting the different Fed speeches throughout the week; maybe Powell won’t be the only central banker with some choice words to share.

There will be no Data Deluge this week.

However, the latest Mortgage Rate Price Tracker was loaded with charts and should satisfy the appetite of any data junky.

Stay tuned for a possible Flash Update depending on how mortgage rates react to the weekend drama and upcoming inflation data.

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.