Mortgage rates time travel back to September in bond sell-off 🕰️📈🏠

Whether the blame falls on the delayed employment data, Fed rate cuts amidst sticky inflation, slightly better than expected service-sector data, or just a big bond rebalancing after months of improvements, the result is the same…

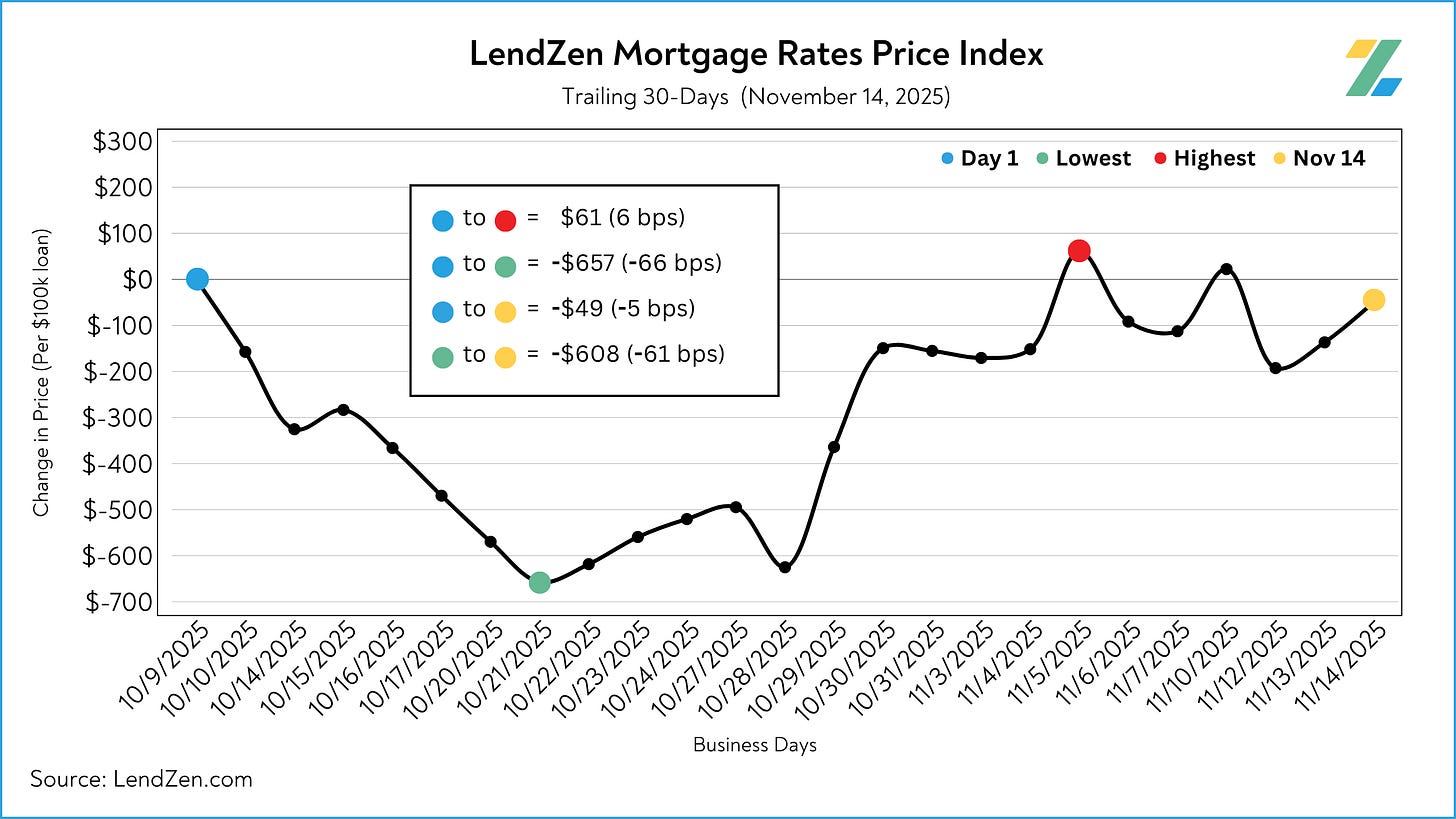

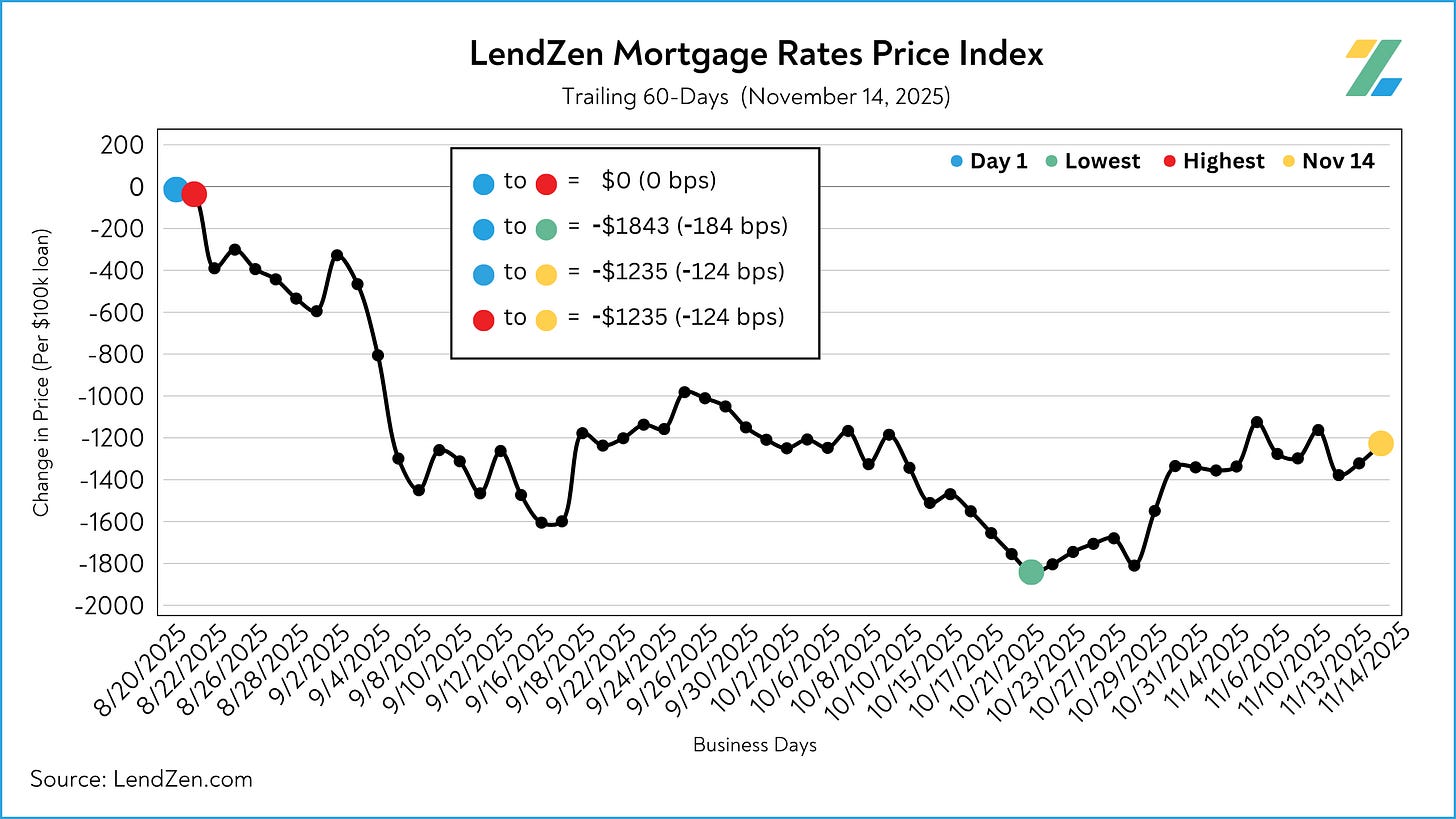

After reaching the best level in years, mortgage rates have given back all of the October gains.

The dip in early October was only a modest continuation of a much bigger bond rally that started in August, after NFP employment data missed expectations.

Fortunately, mortgage rates are still sitting at the bottom of that larger move.

It is important to understand that mortgage rates DO NOT rise or fall.

The full range of rates is always available, and instead the price of each rate changes daily based on the trading of individual mortgage bonds.

The LendZen Index tracks the price of each mortgage rate across a spectrum of publicly traded MBS.

This provides a clearer picture of how the cost to obtain a mortgage has changed, regardless of the lender, rate, or borrower credit score.

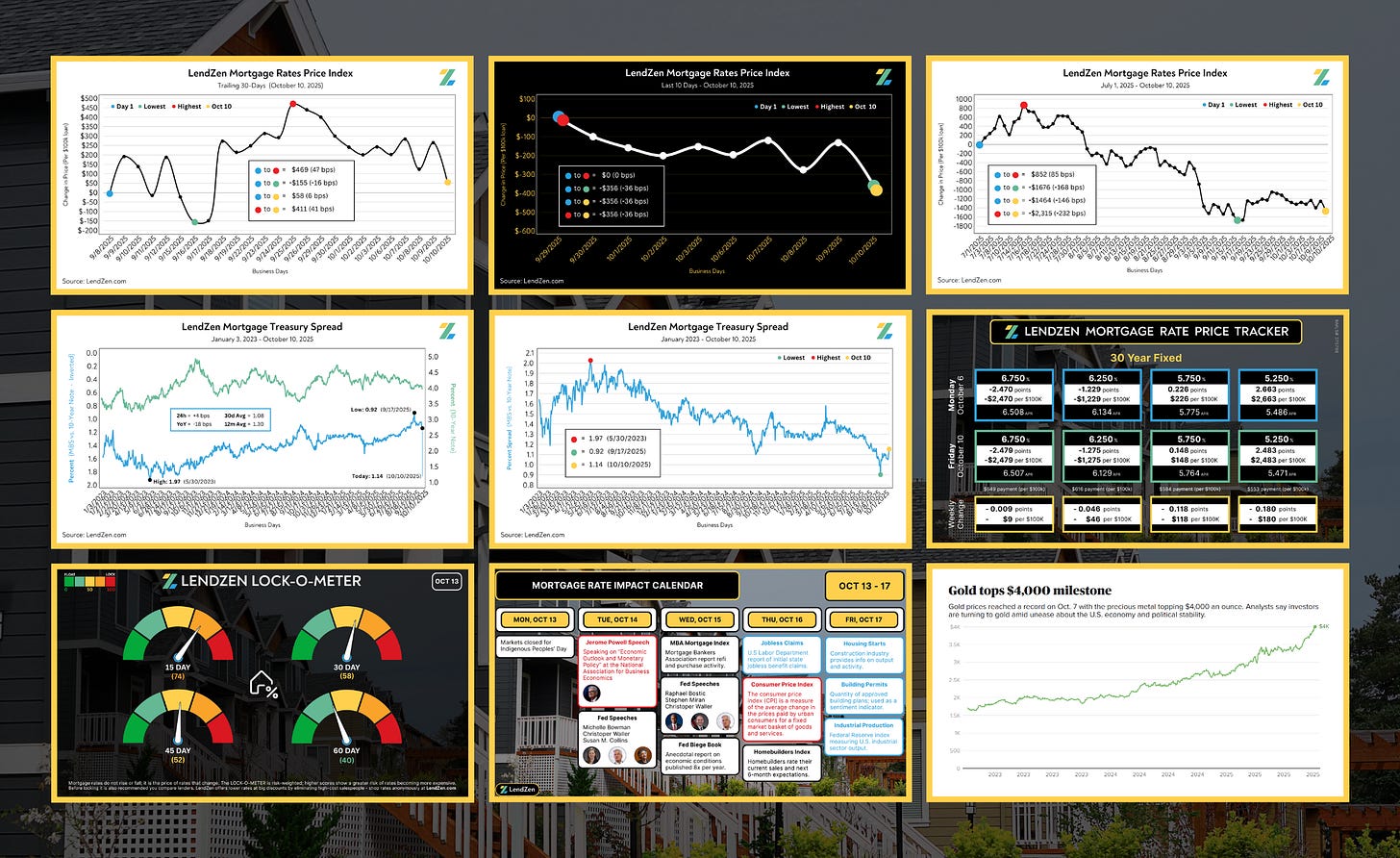

With the government shutdown now over, economic data releases can get back to their regularly scheduled programming.

Stayed tuned this weekend for three additional updates:

Mortgage Rate Price Tracker (Saturday)

Week Ahead and Rate Impact Calendar (Sunday)

Mortgage Data Deluge (Monday)

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.