Mortgage rates quietly approach the best levels of 2025 🤫📉🎉

Midweek Market Update

Included in this update are the following:

Shop real-time mortgage rates anonymously and get instant qualification results at LendZen.com

MIDWEEK RECAP ⏪

-------------------

It’s been a mildly positive start to December.

Bonds rebounded after a soft Monday, notching two straight days of gains as traders brace for next week’s FOMC meeting.

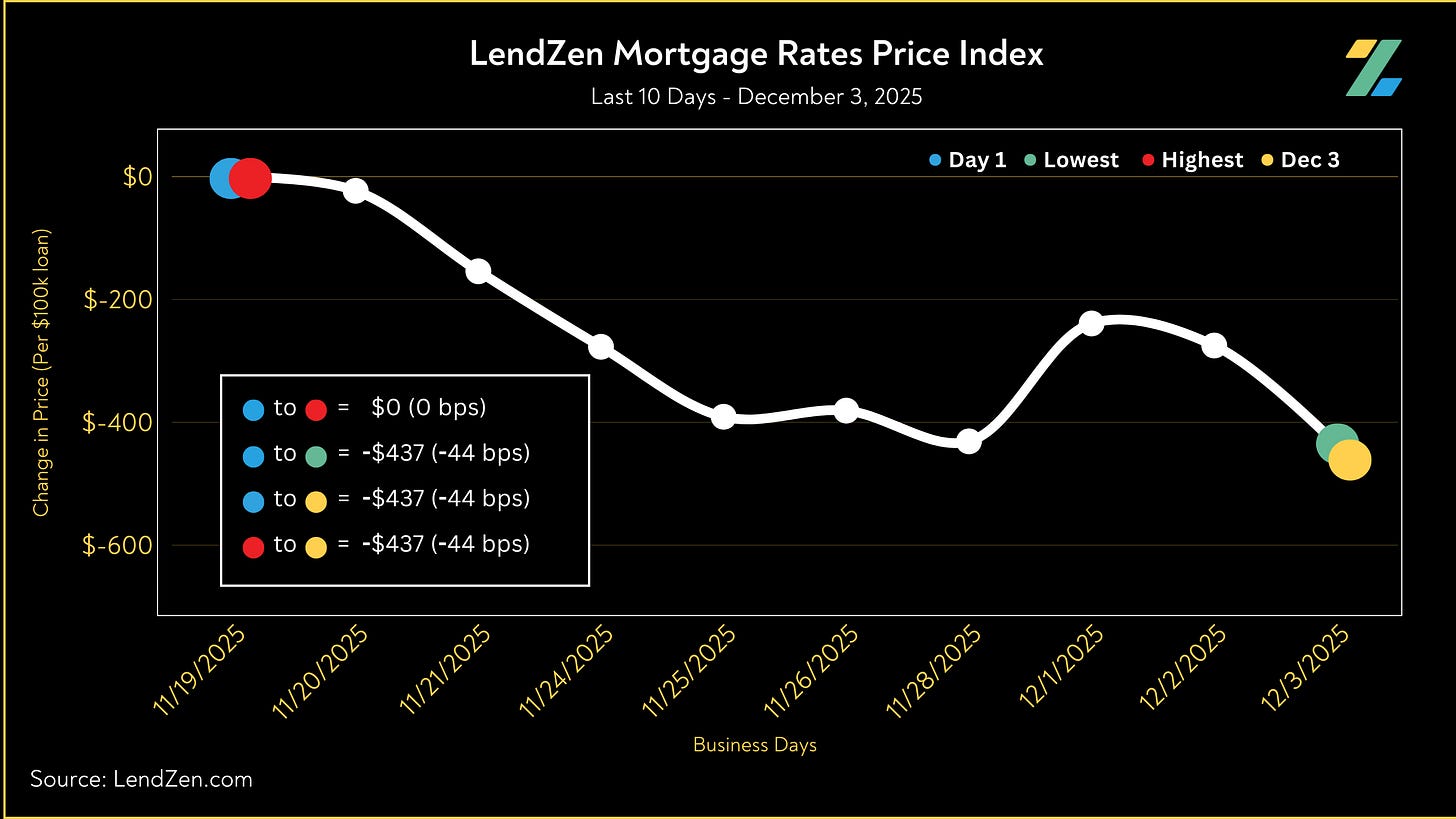

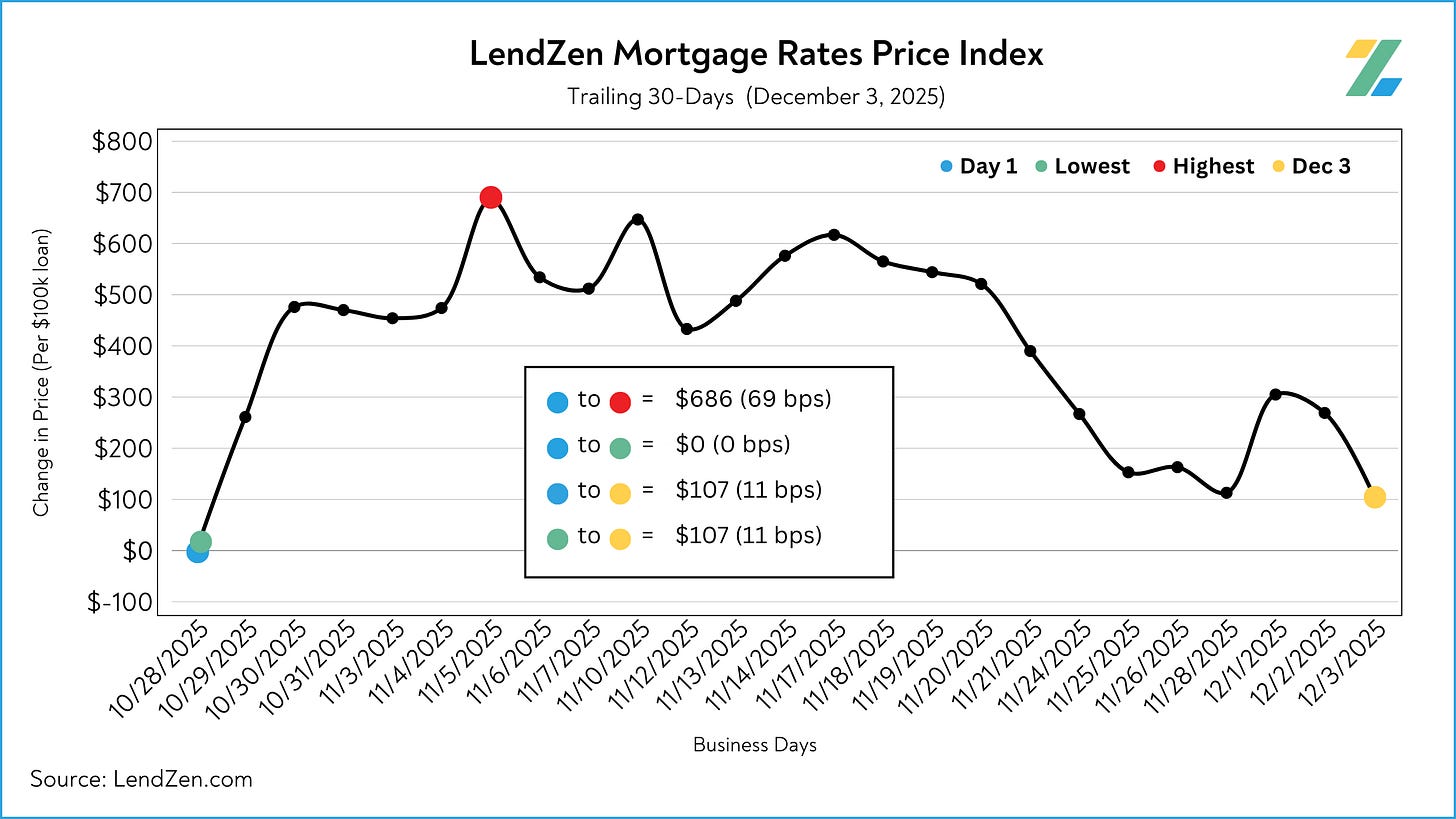

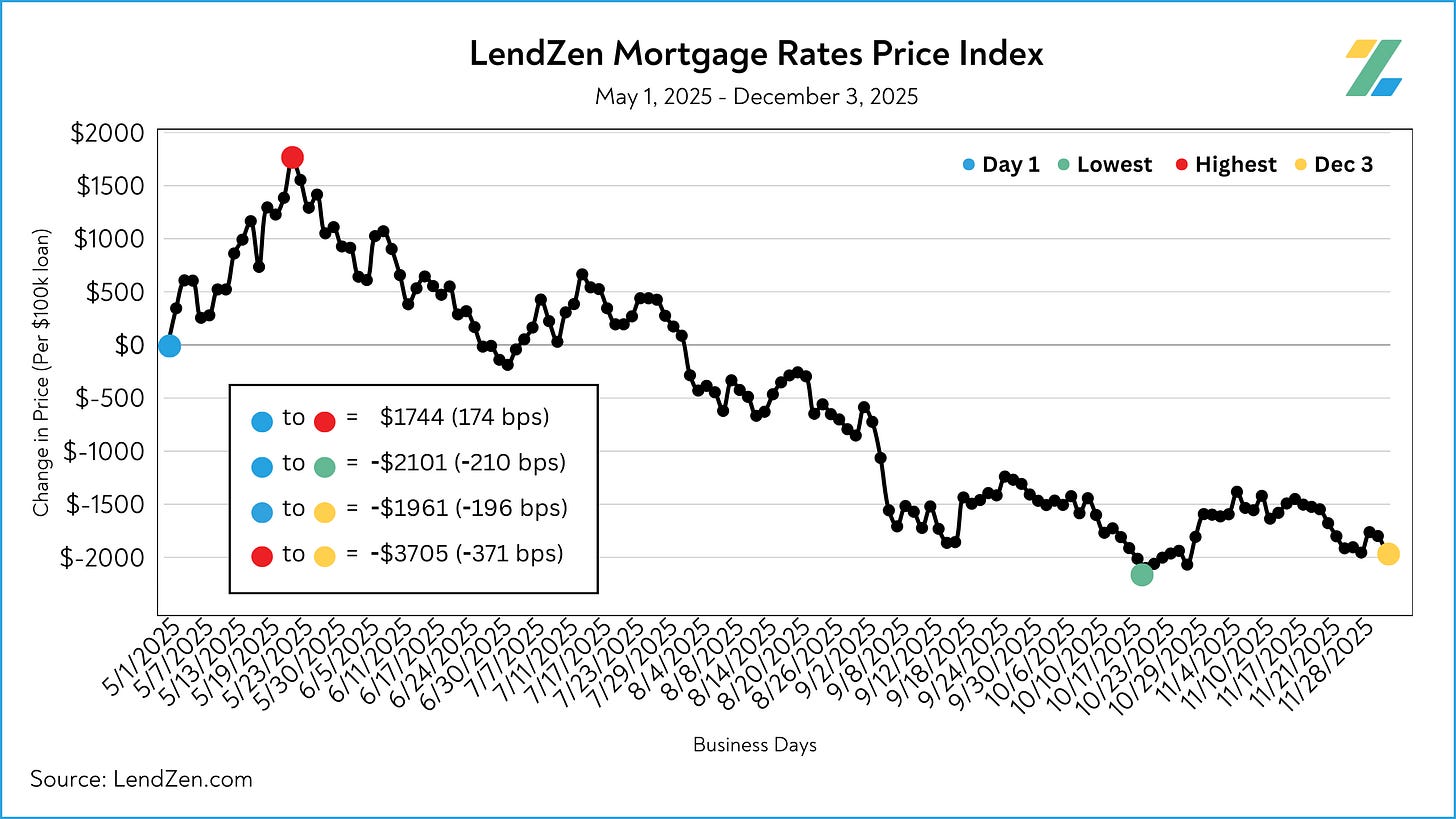

Mortgage rate prices are now within 14 bps of the October 21 low, when bonds abruptly reversed course following the Fed’s last cut.

See today’s index chart in the Mortgage Rate Prices section below.

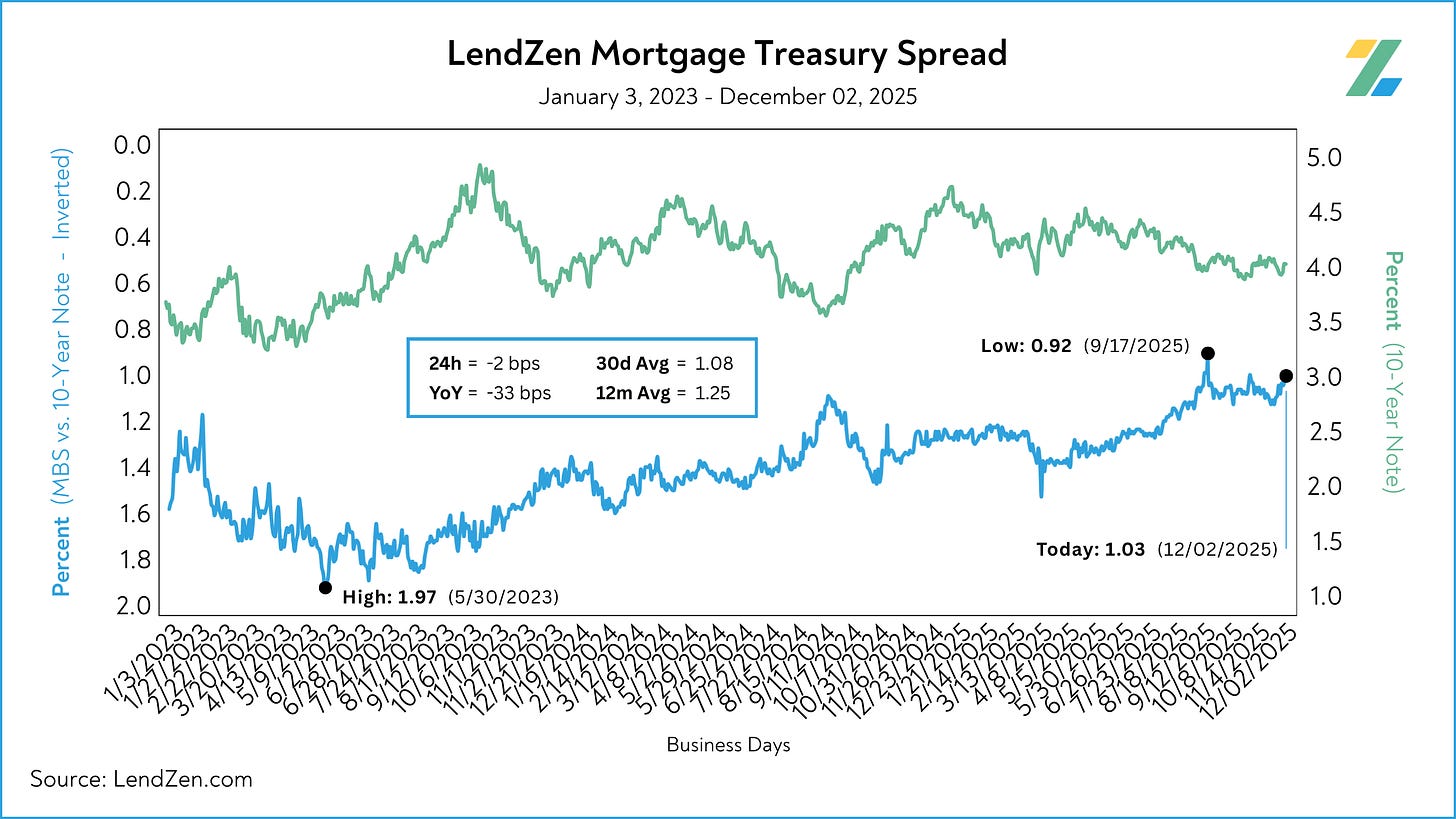

A big part of the mortgage rate story this year has been the tightening of mortgage spreads.

While the 10-Year seems determined to stay above 4.00%, with the occasional dip below, mortgage bonds have continued to grind out gains.

The LendZen Mortgage Treasury Spread came in at 100-bps today, creeping in on the 3-year low of 92 bps from September.

See today’s LMTS chart in the Mortgage Spreads section below.

IMPACT CALENDAR 📅

-----------------------

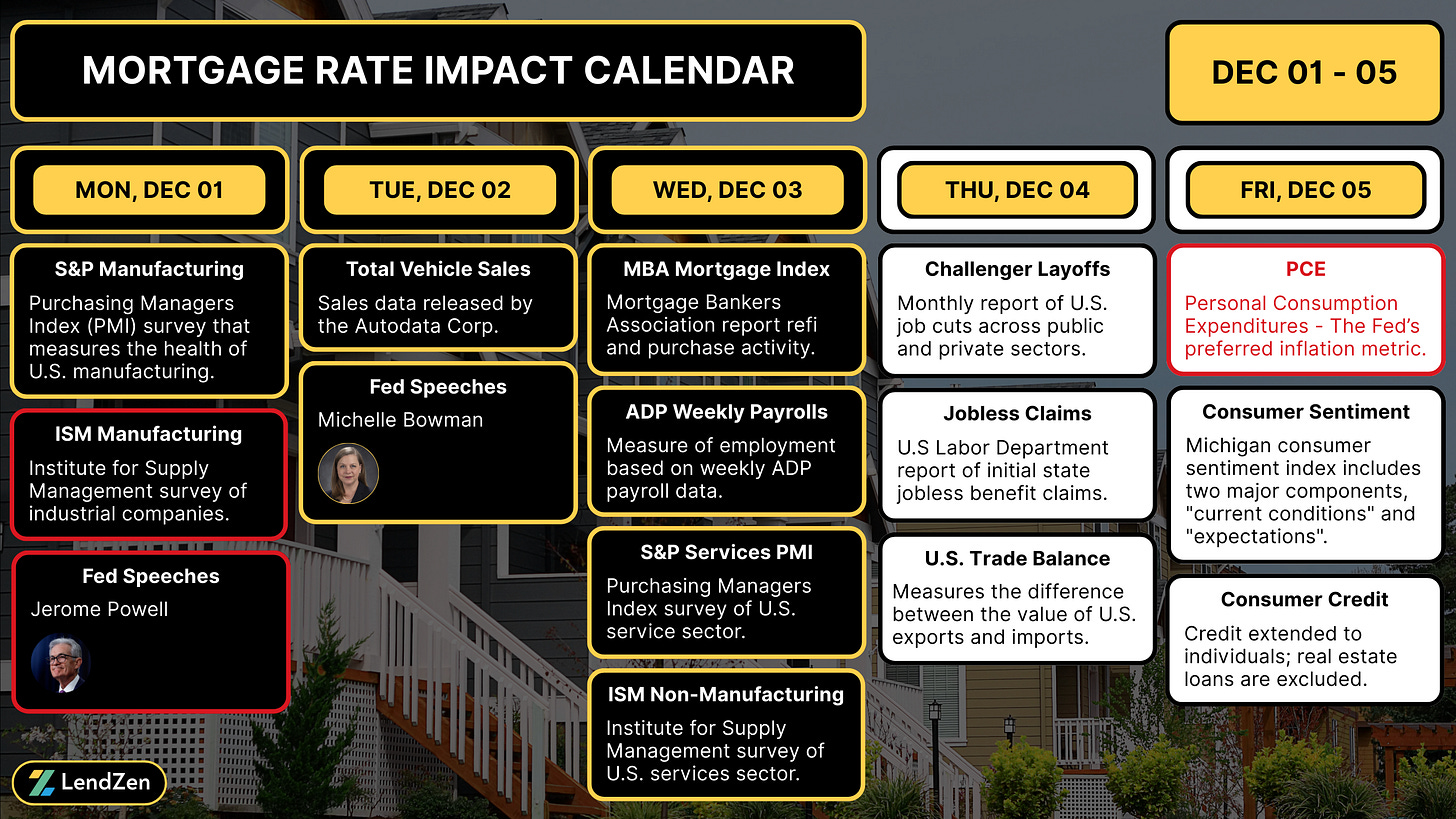

Bonds gained modestly with two positive sessions after Monday’s weakness, driven by softer ISM Manufacturing and weaker ADP payrolls.

Thursday’s jobless claims, Challenger layoffs, and Revelio payroll data could help push mortgage rates to the best levels of 2025 if they show further weakness in the labor market.

Equally as important is the Friday PCE inflation data, The Fed’s preferred inflation gauge.

By the end of the week, it will be much clearer what markets think the Fed will do next Wednesday.

MORTGAGE RATE PRICES 📉

-----------------------------

Mortgage rates do not rise or fall, instead the PRICE of rates change.

The LendZen Index calculates a daily change in the price of mortgage rates by tracking a spectrum of mortgage-backed securities (MBS).

-----------

24-Hour: -16 bps (-$162 per $100K)

5-Day: -6 bps (-$56)

10-Day: -44 bps (-$437)

30-Day: +11 bps ($107)

60-Day: -196 bps (-$1,961)

Learn more about the LendZen Index and explore the full data series at LendZen.substack.com

MORTGAGE SPREADS 🧈

-------------------------

Published daily with the LendZen Index is the LendZen Mortgage-Treasury Spread.

The LMTS uses actual bond yields to create a historically consistent, and reliable, data set.

-----------

Nov 26: 1.09

Dec 03: 1.00

24h: -3 bps

5d: -9 bps

12m Avg: 1.25

YoY: -37 bps

Learn more about the importance of accurately calculating spreads on this Substack post.

RATE LOCK GUIDE 🔒

---------------------

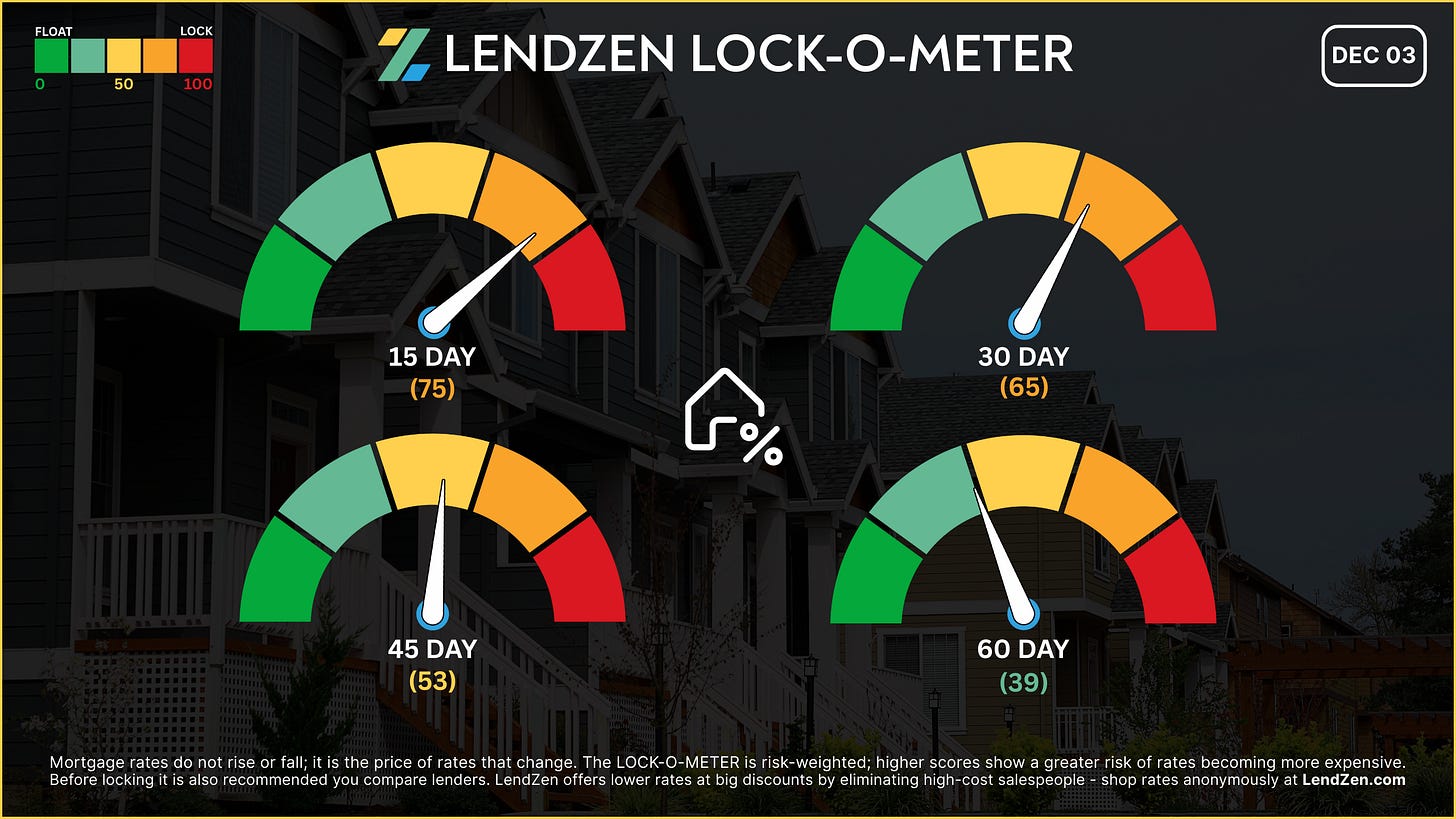

The LendZen LOCK-O-METER provides borrowers with a risk-weighted score based on how various macroeconomic events, including market data, central bank announcements, and geopolitics, each historically impacts the price of bonds.

higher risk scores = lean towards locking

------------------

Closing Window

------------------

[ 15 Days ] — 75 🟠

Event-driven risk dominates this short window. Bonds have remained steady, but Friday could swing sentiment before the FOMC. Risk reward favors locking.

[ 30 Days ] — 65 🟠

Bond sentiment has improved in the last two weeks, but just enough to recover the losses following the October Fed rate cut. The last 5 Fed cuts have resulted in a bond sell-off. Therefore, floating into next week’s FOMC decision seems like an unnecessary gamble considering mortgage rate prices are hovering near the best levels in years.

[ 45 Days ] — 53 🟡

Rate momentum has stabilized after a wild October end. Barring any upside surprises in inflation, there’s more flexibility beyond the Fed meeting, but the risk of reversal is still present.

[ 60 Days ] — 39 🟢

The broader trend stays supportive. Disinflation narratives and soft labor signals favor floating into early 2026 if the remaining December events/data cooperate.

Learn more about the Lock-O-Meter and when to lock your rate in this Substack post.

STOCK MARKETS (5-Day) 📊

-----------------------------

DJIA: 47,882 (+0.84%)

S&P 500: 6,849 (+0.40%)

NASDAQ: 25,606 (+1.17%)

CRYPTO (1-Week) 🧮

--------------------

Bitcoin: $93,326 (+6.82%)

Ethereum: $3,150 (+6.45%)

Solana: $142 (+2.72%)

PRECIOUS METALS (5-Day) 🪙

-------------------------------

Gold: $4,208 (+1.17%)

Silver: $58.55 (+9.77%)

Platinum: $1,672 (+5.49%)

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.