Mortgage rates prepare for data double whammy 📊👷♂️💸

The Week Ahead

WEEK AHEAD 🗓️

----------------

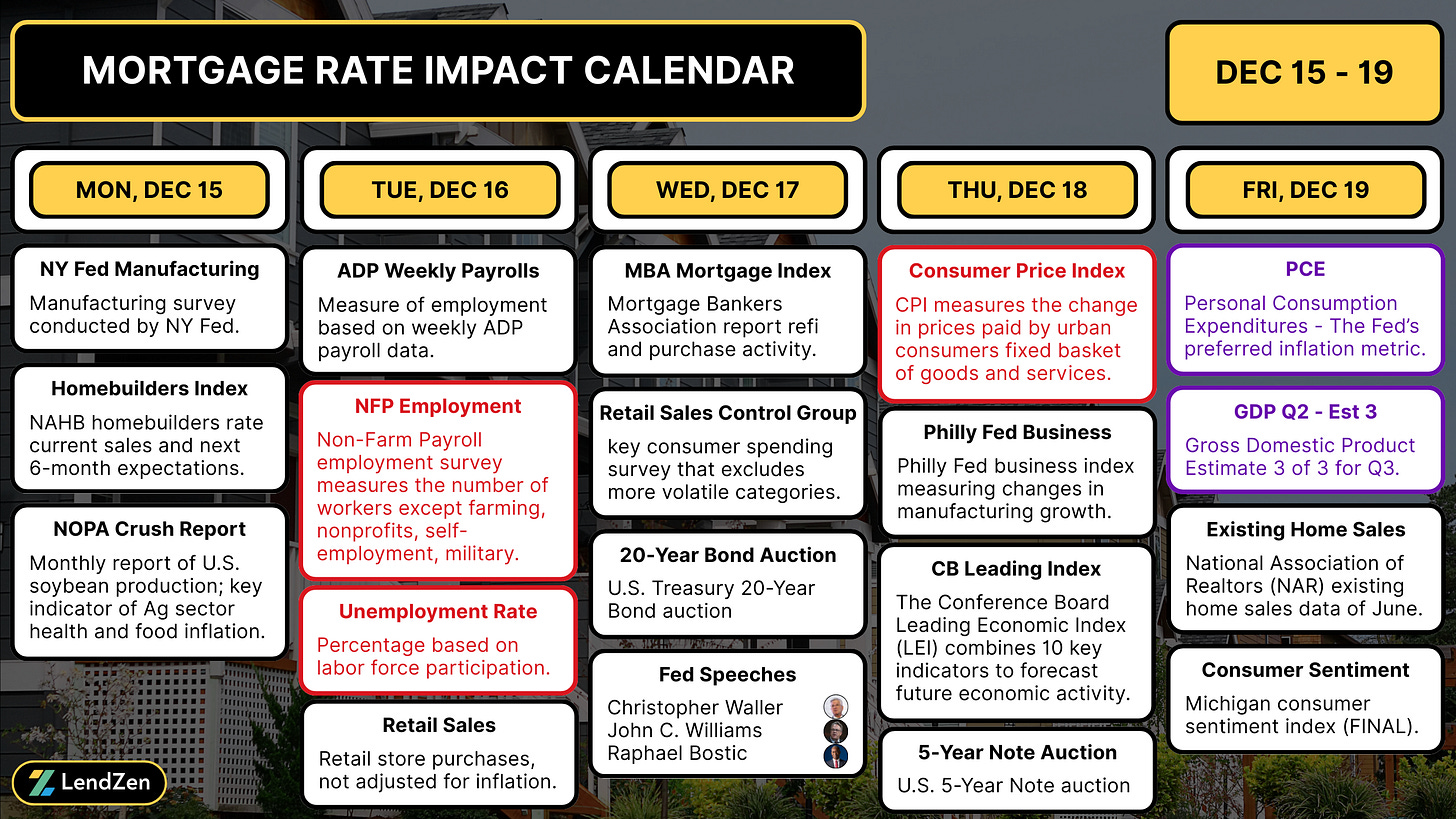

The December Non-Farm Payroll report (November data) was originally due last week but was rescheduled to this Tuesday.

NFP is followed by the Consumer Price Index (CPI) on Thursday, creating a double whammy of employment and inflation data in the same week.

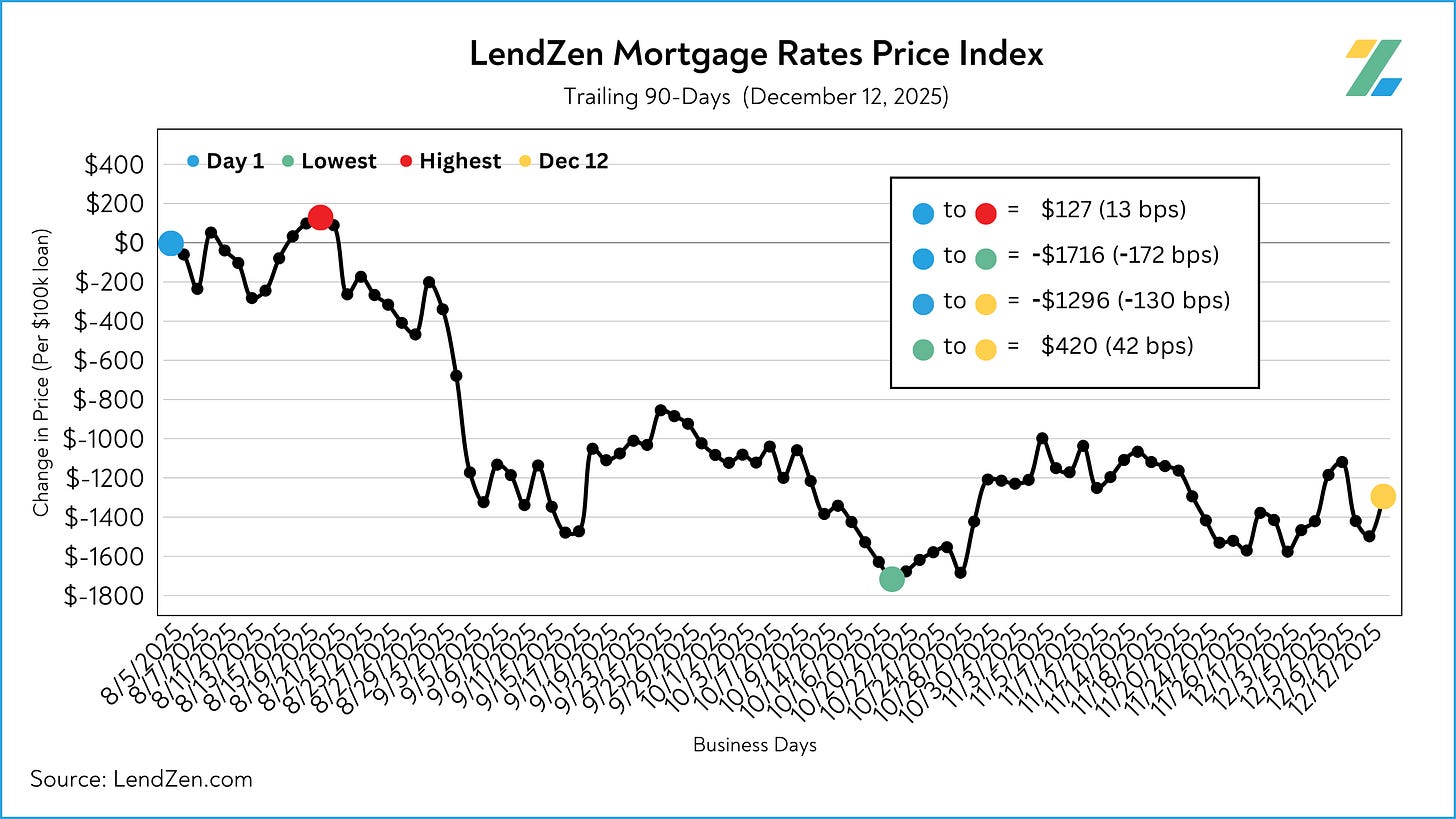

This is probably the last hope for mortgage rates to recover ground lost since the October 21 low.

There is no guarantee that the data will be bond friendly, but The Fed likely snuck a peak at the reports.

It’s hard to see why they would have cut rates again if employment and inflation data contradicts that decision.

The Personal Consumption Expenditures was also planned this week, but as a result of the government shutdown the BEA has it listed as To Be Rescheduled.

PCE isn’t alone – the 3rd and final estimate of Q3 GDP was also postponed until Thursday, January 22, 2026.

Even absent both PCE and GDP, there is still massive market moving potential from NFP and CPI landing within 48 hours of each other.

However, if this week happens to prove uneventful and we continue to trend sideways, there should still be a collective sigh of relief.

Finishing off the month unscathed will put 2025 as the best year for mortgage rates since 2020.

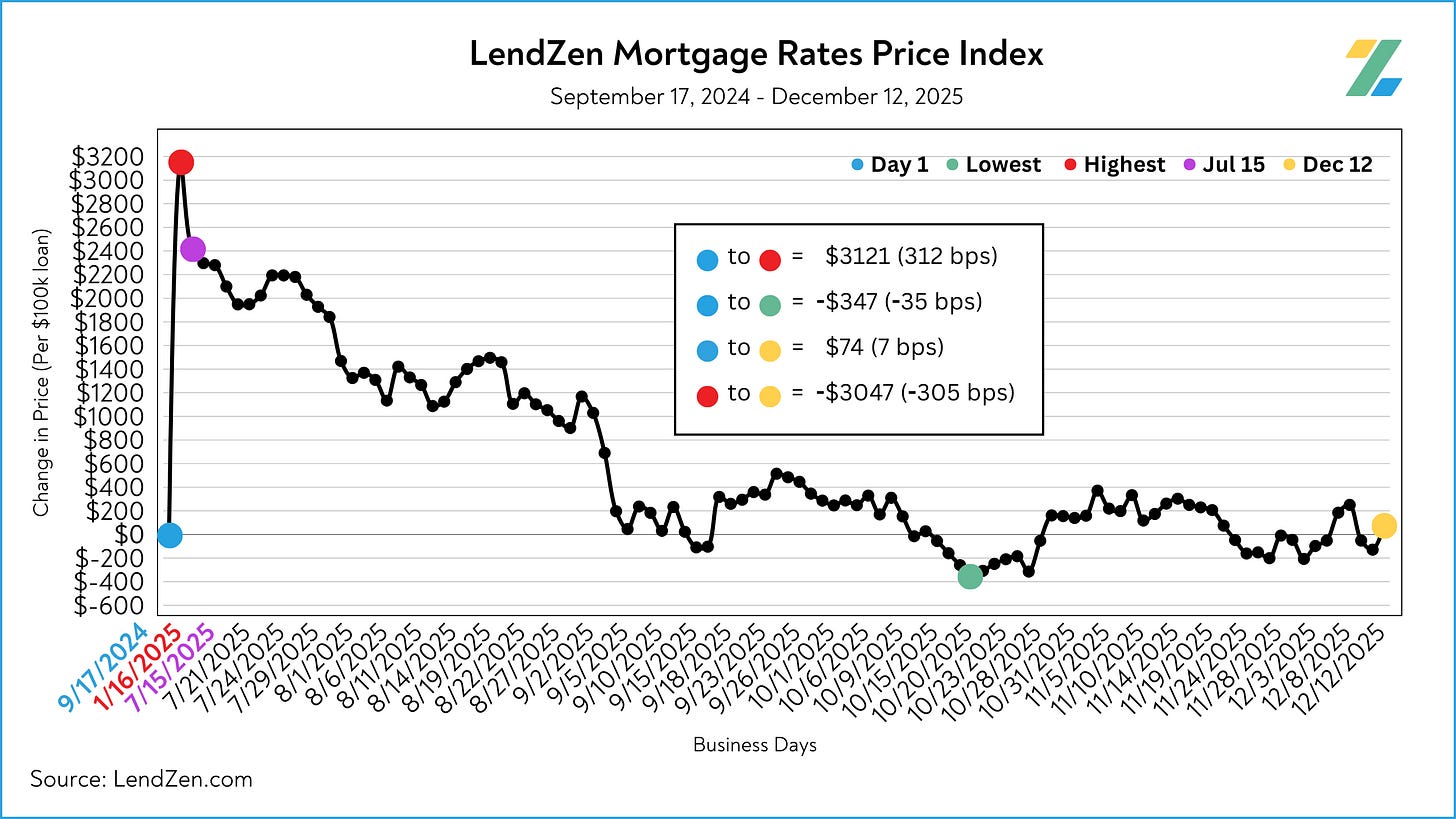

Since peaking on January 16, mortgage rate PRICES have declined by over 300 basis points.

That means the cost of getting a $500k mortgage (at any rate) is $15,000 cheaper today than at the start of the year.

Monday I will take a deeper look at how mortgage rate prices, bond spreads, and longer-term trends are unfolding in my Mortgage Rate Data Deluge.

The latest Lock-O-Meter risk scores and rate lock recommendations will be posted with it.

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.