Mortgage rates prepare for big week in 2026 debut 📅🫣🏠

The Week Ahead

WEEK AHEAD 🗓️

----------------

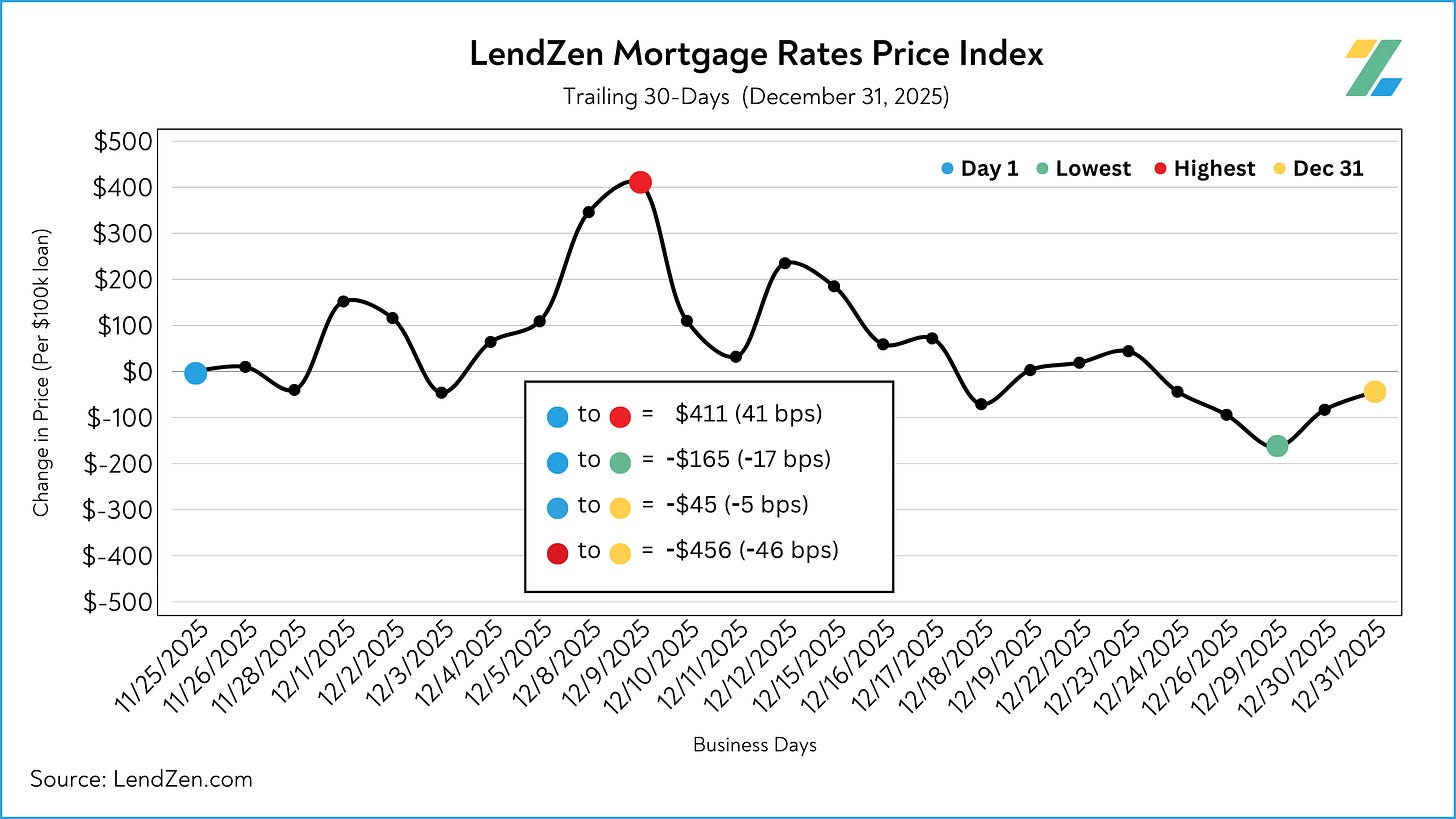

Mortgage rates have enjoyed a peaceful end to a record year after mortgage bonds traded sideways since the last time a Non-Farm Payroll employment report dropped back on Dec 16.

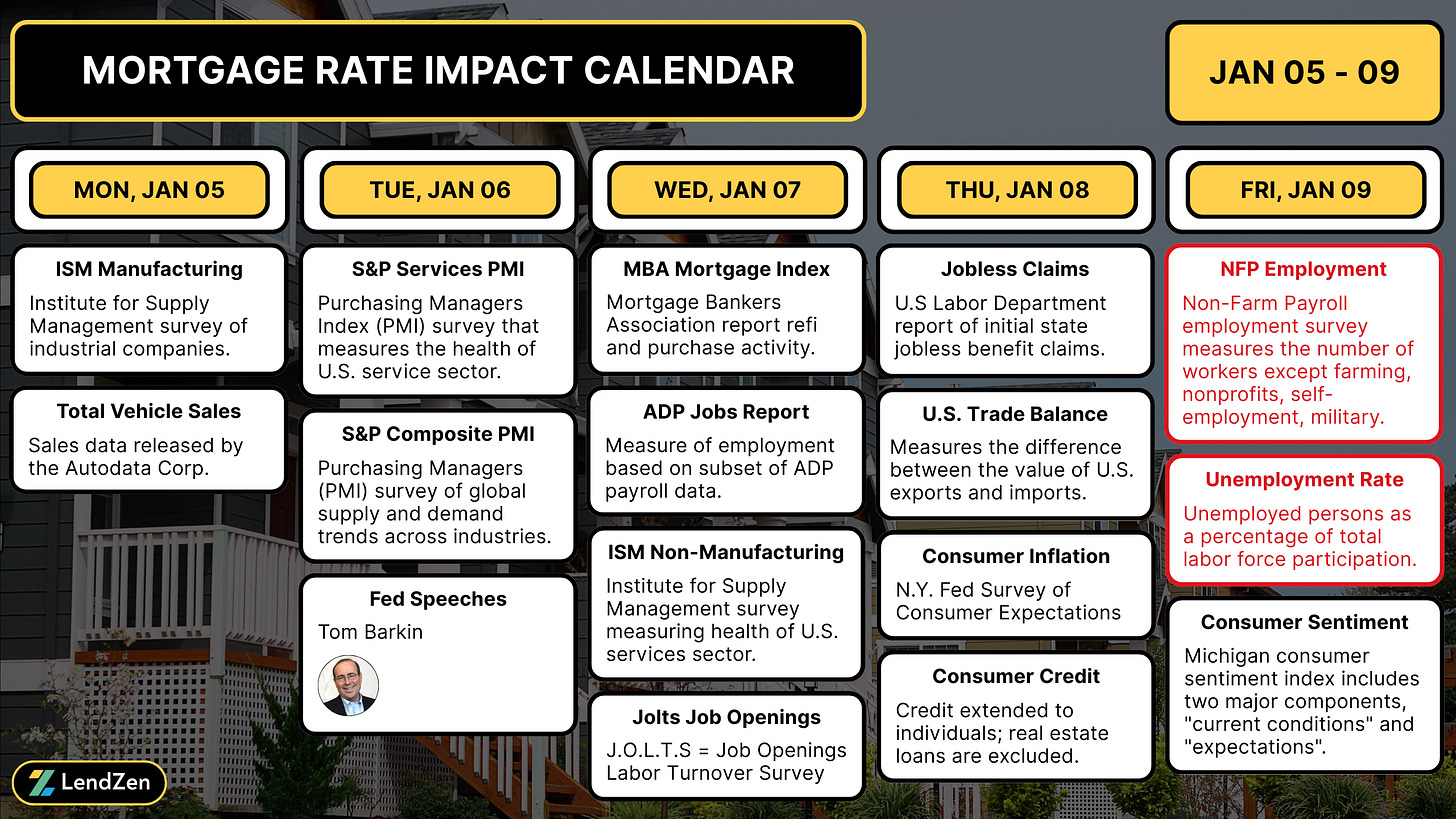

In the first week of 2026 markets prepare for a full calendar, including the latest NFP report, one of my “Big 3” market movers.

The Big 3

Inflation (CPI/PCE)

The Fed (FOMC/Minutes)

Employment (NFP/ADP)

Also on deck in the employment category is the Jobs Opening Labor Turnover Survey (JOLTS) and the Monthly ADP payrolls report.

Plus, a double-double of manufacturing and service sector PMI surveys, along with consumer sentiment insights from both the NY Fed and the University of Michigan.

With this full stack of economic data, we won’t need to wait long to see if bonds are going to continue the epic run from the last two quarters of 2025.

Monday I will take a deeper look at how mortgage rate prices, bond spreads, and longer-term trends are unfolding in my Monday Data Deluge.

The latest Lock-O-Meter risk scores and rate lock recommendations will be posted with it.

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.