Mortgage rates prepare for a Fed rate cut death blow 🥊📉😵

The Week Ahead

WEEK AHEAD 🗓️

----------------

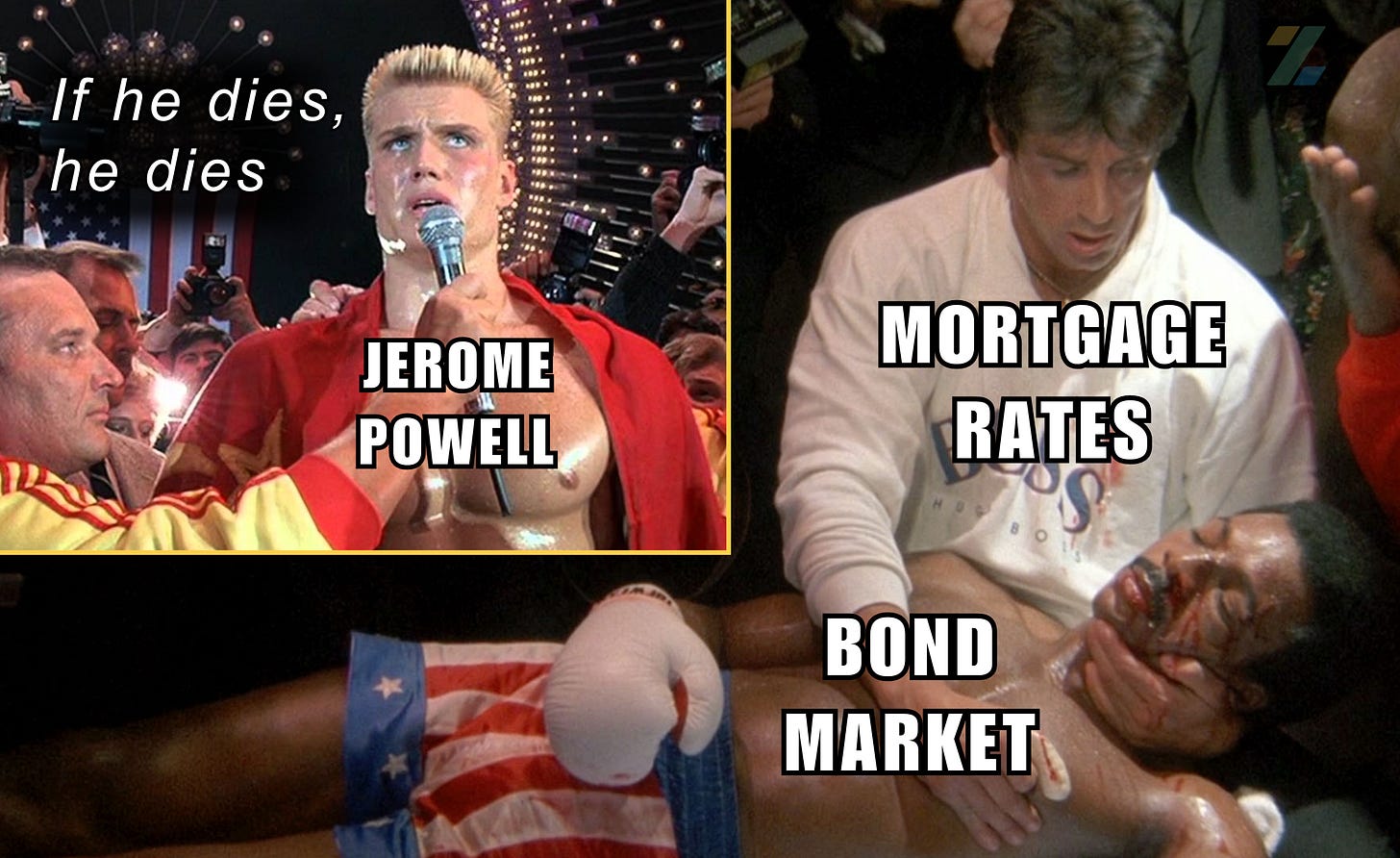

Markets have all eyes on the Fed with expectations of another 25-bps cut.

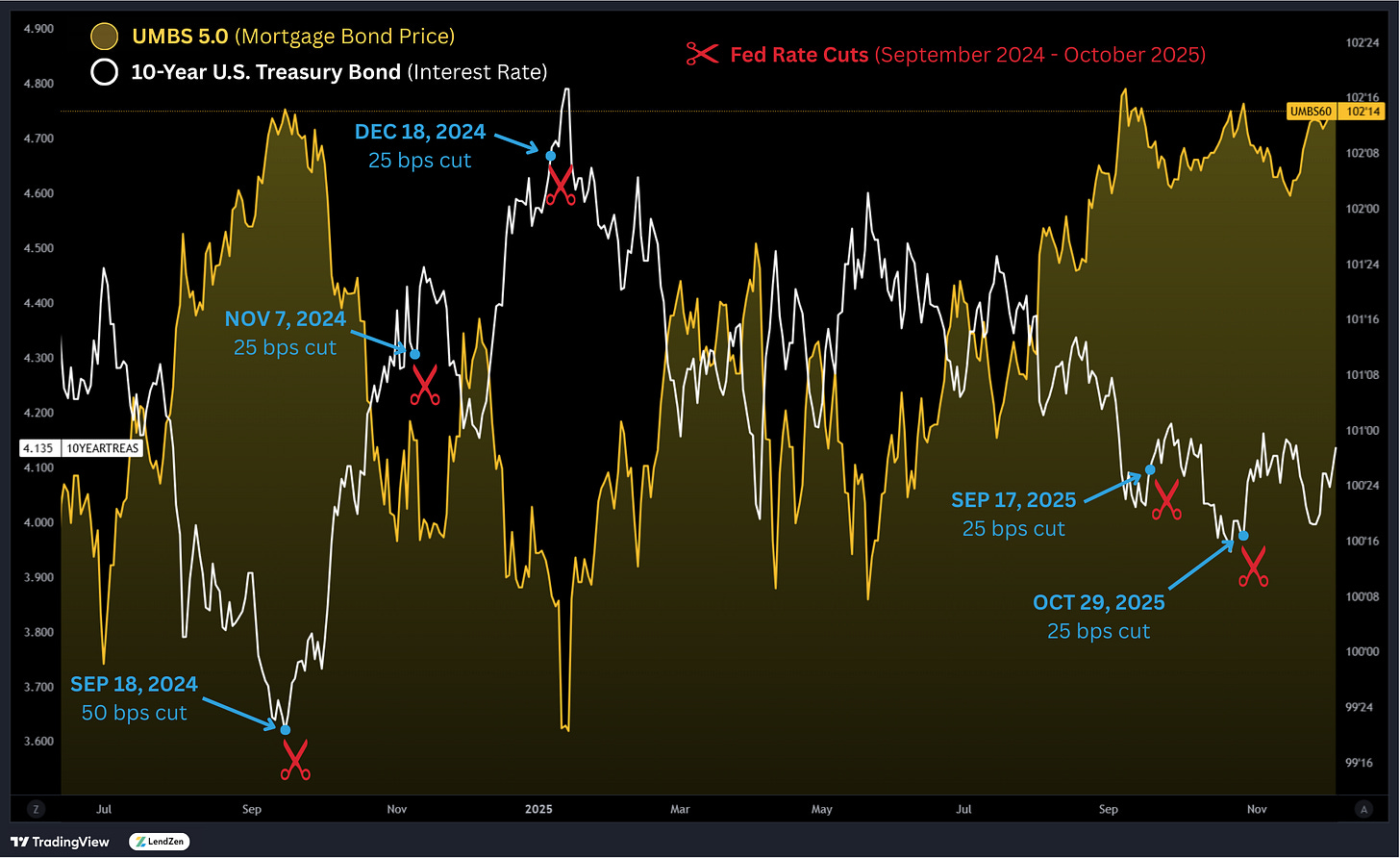

However, the last 5 rate cuts have all resulted in a bond sell-off (higher mortgage rate prices).

Although bonds have recently found some footing, mortgage rates have not yet fully recovered from the October Fed cut jump and are still 20-bps higher in price than 60 days ago.

This vulnerability means another cut could deliver an end of the year death blow.

If bonds take a hit like they did in 2024, and investors throw in the towel, the most mortgage-rate-friendly-year since 2021 could end with a T.K.O.

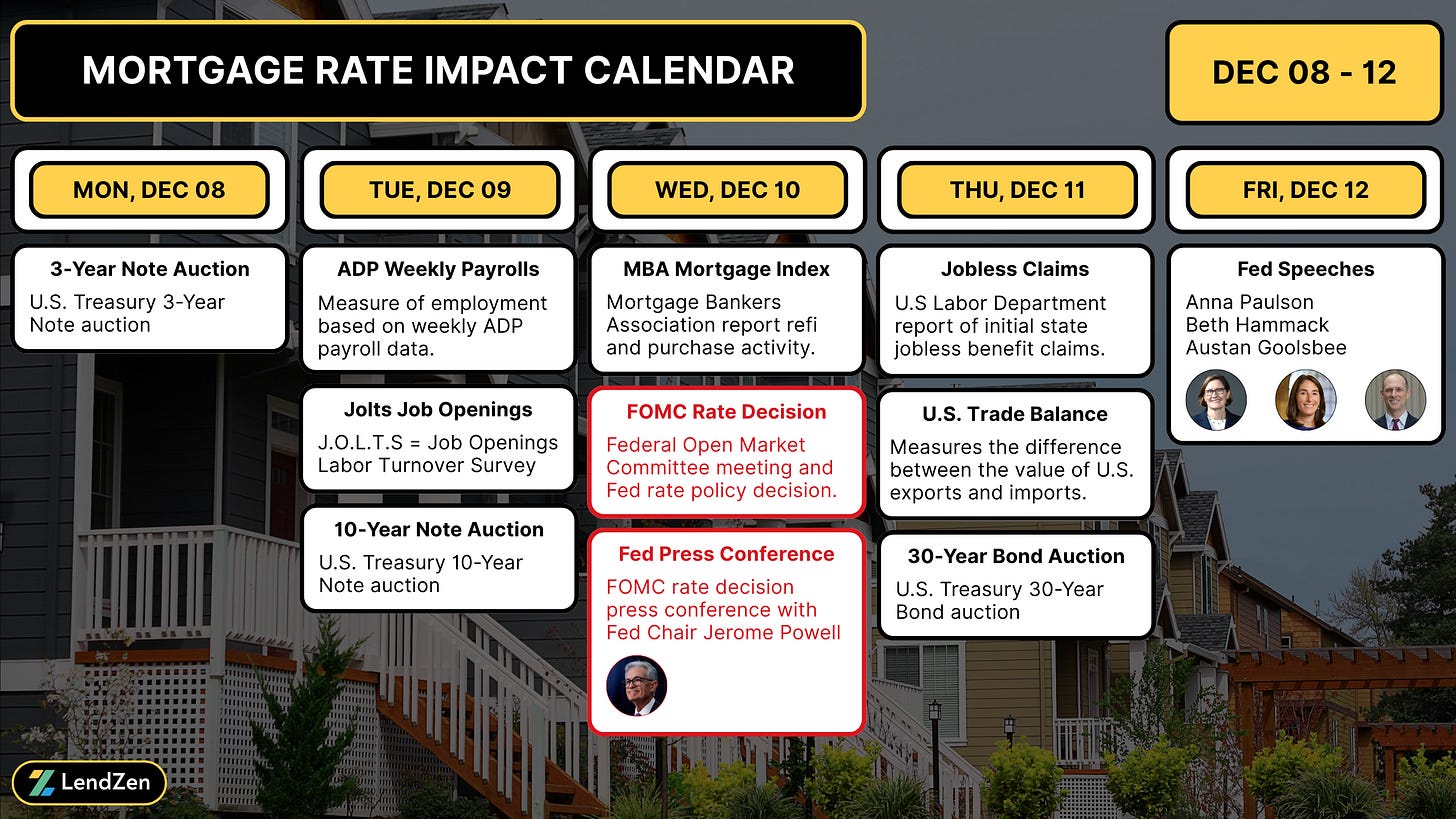

This week is all about the Federal Open Market Committee’s rate decision on Wednesday, but Tuesday preludes the Fed meeting with a rescheduled job openings report (JOLTS) and a 10-Year note auction.

The Producer Price Index was originally scheduled for Thursday, but as a result of the government shutdown it appears the BLS does not intend to provide any further PPI data this year.

Looking ahead to the following week, we will get a rescheduled Non-Farm Payroll employment report on Tuesday, December 16.

Monday I will take a deeper look at how mortgage rate prices, bond spreads, and longer-term trends are unfolding in my Mortgage Rate Data Deluge.

The latest Lock-O-Meter risk scores and rate lock recommendations will be posted with it.

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.