Mortgage rates prepare for a data flood 🌊⚠️📉

Midweek Market Update

THE STORYLINE – NOV 12

-----------------------------

Markets coasted early in the week as traders waited to see if D.C. would reopen.

Good news on that front, as the longest-ever government shutdown ended tonight with the passing of a stop gap spending bill through January.

News of the pending vote gave bonds a small lift Wednesday, helped also by weekly ADP payroll data that continued to show labor market weakness.

Equities stayed flat, but silver stole the spotlight at $53/oz – up 4% on the day, and 10% in the last 5 days.

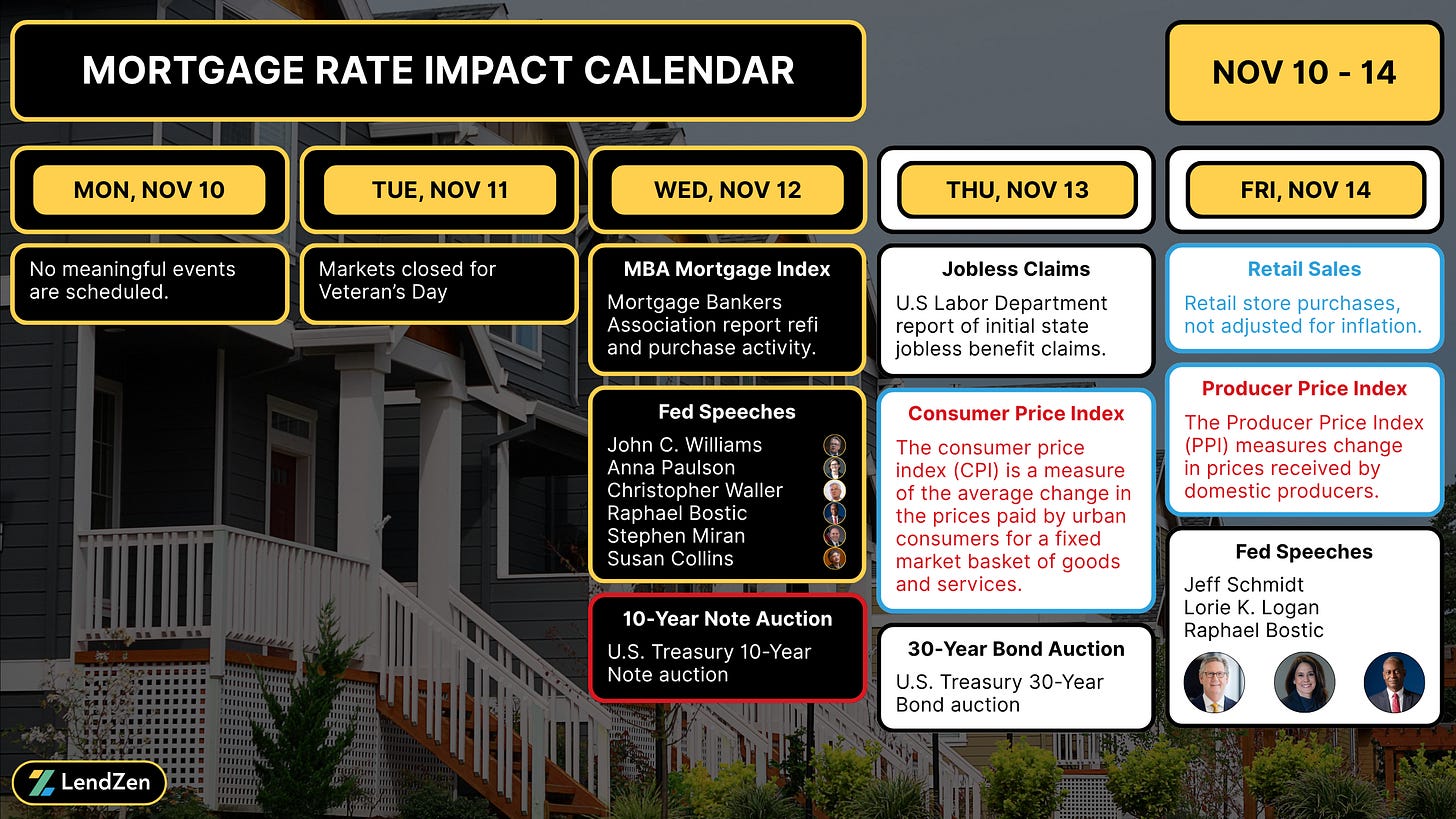

Once the government reopens there will be a flood of economic data that investors will need to navigate, the most important for mortgage rates will be the two months of non-farm payroll employment data and the latest inflation data.

Shop real-time mortgage rates anonymously and get instant qualification results at LendZen.com

**Events marked blue could be delayed as a result of the shutdown

LENDZEN INDEX

-------------------

Learn more about the LendZen Index and explore the full data series at LendZen.substack.com

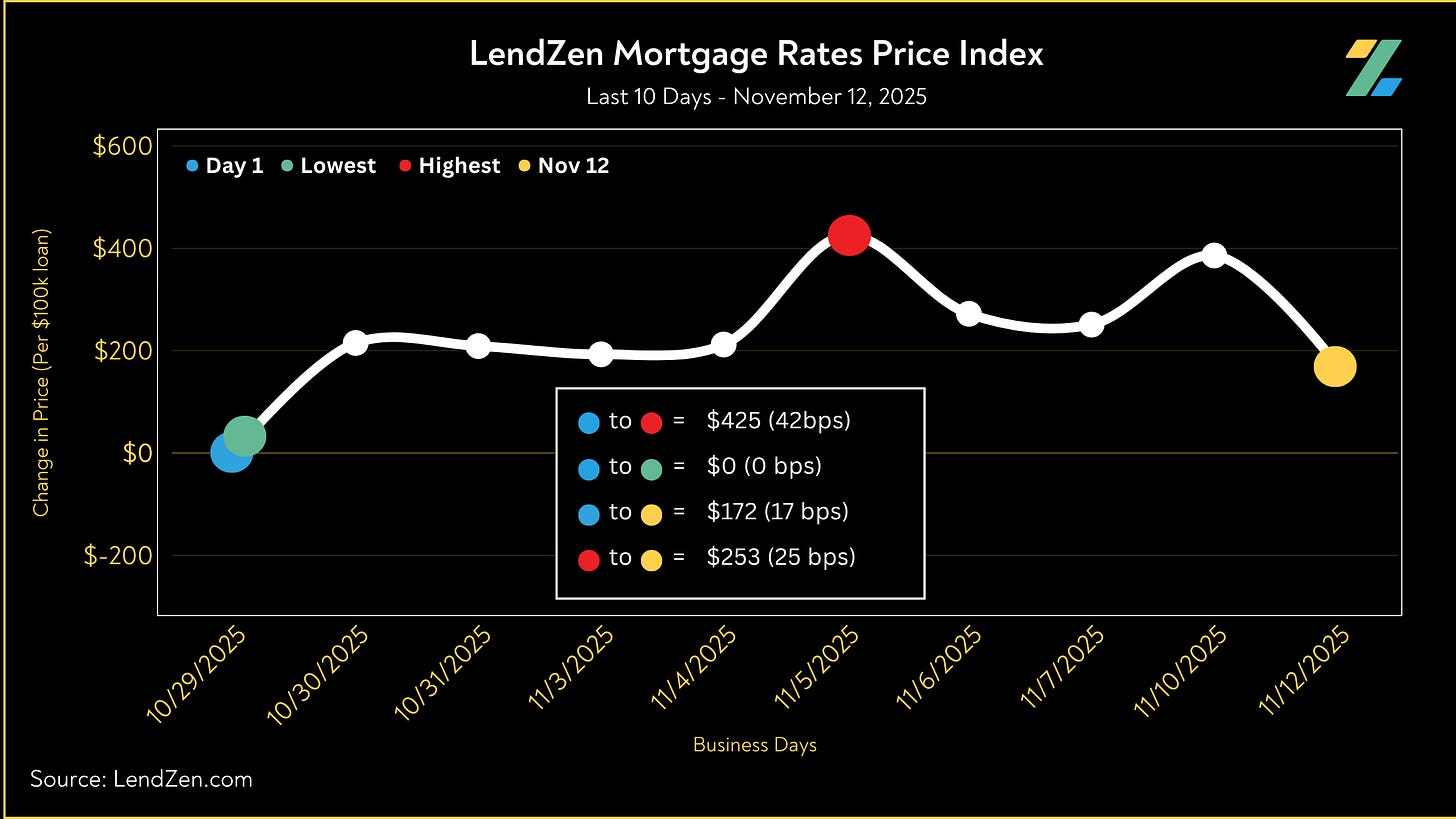

24-Hour: -21 bps

5-Day: -25 bps

10-Day: +17 bps

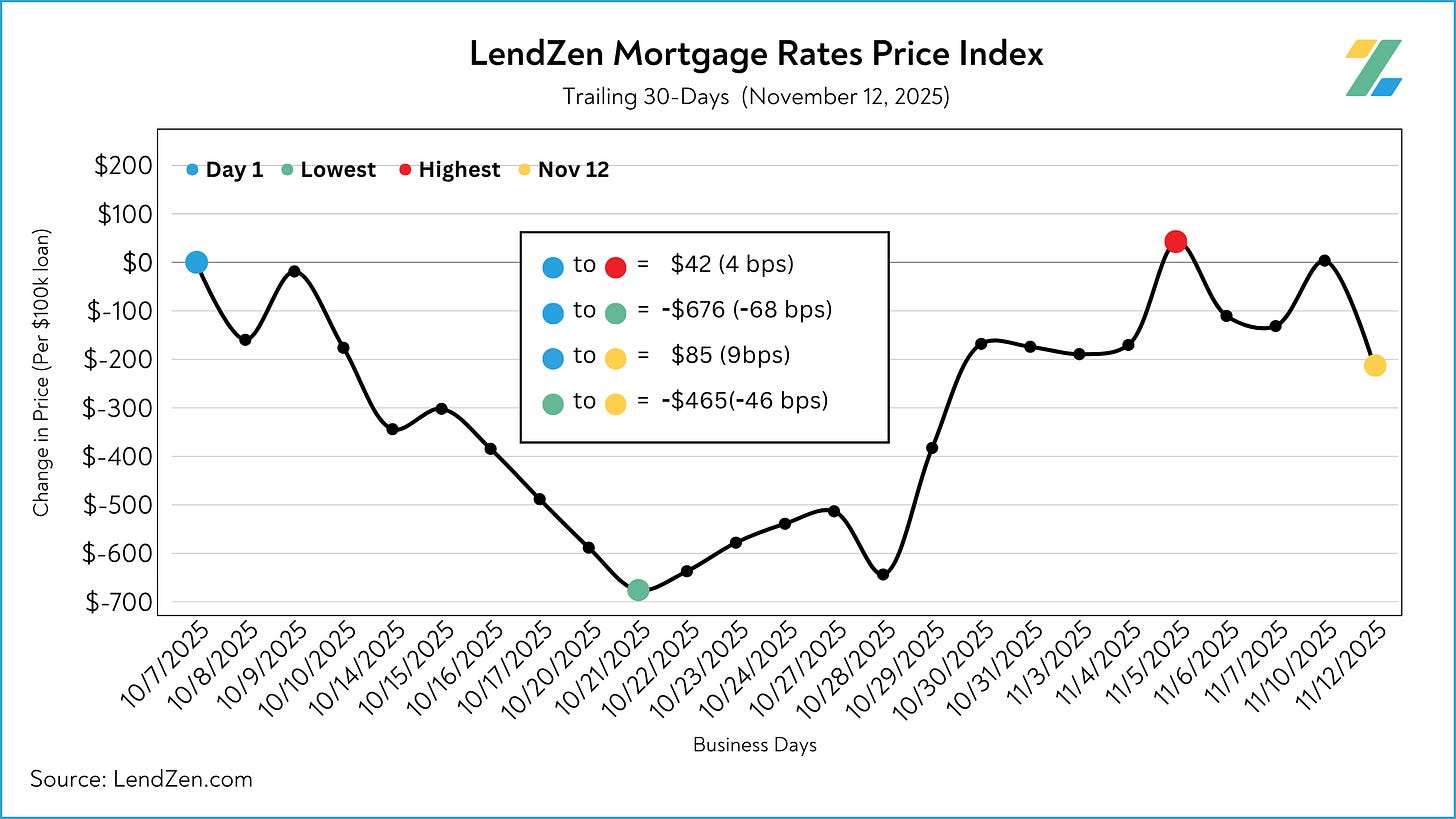

30-Day: -21 bps

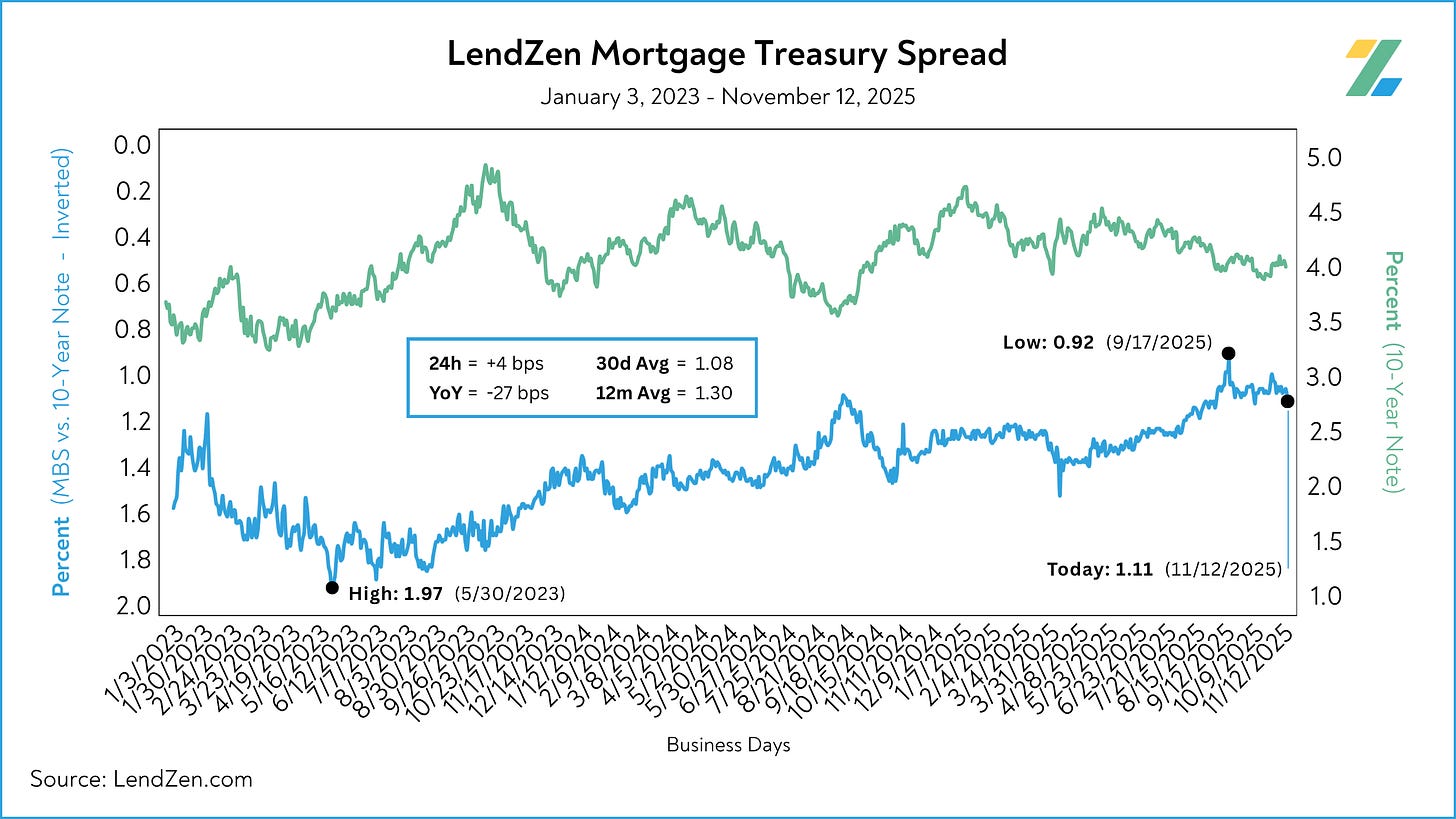

LENDZEN MORTGAGE-TREASURY SPREAD

----------------------------------------------

The LMTS is posted daily with the LendZen Index.

Nov 12: 1.11

24h: +4 bps

12m Avg: 1.30

YoY: -27 bps

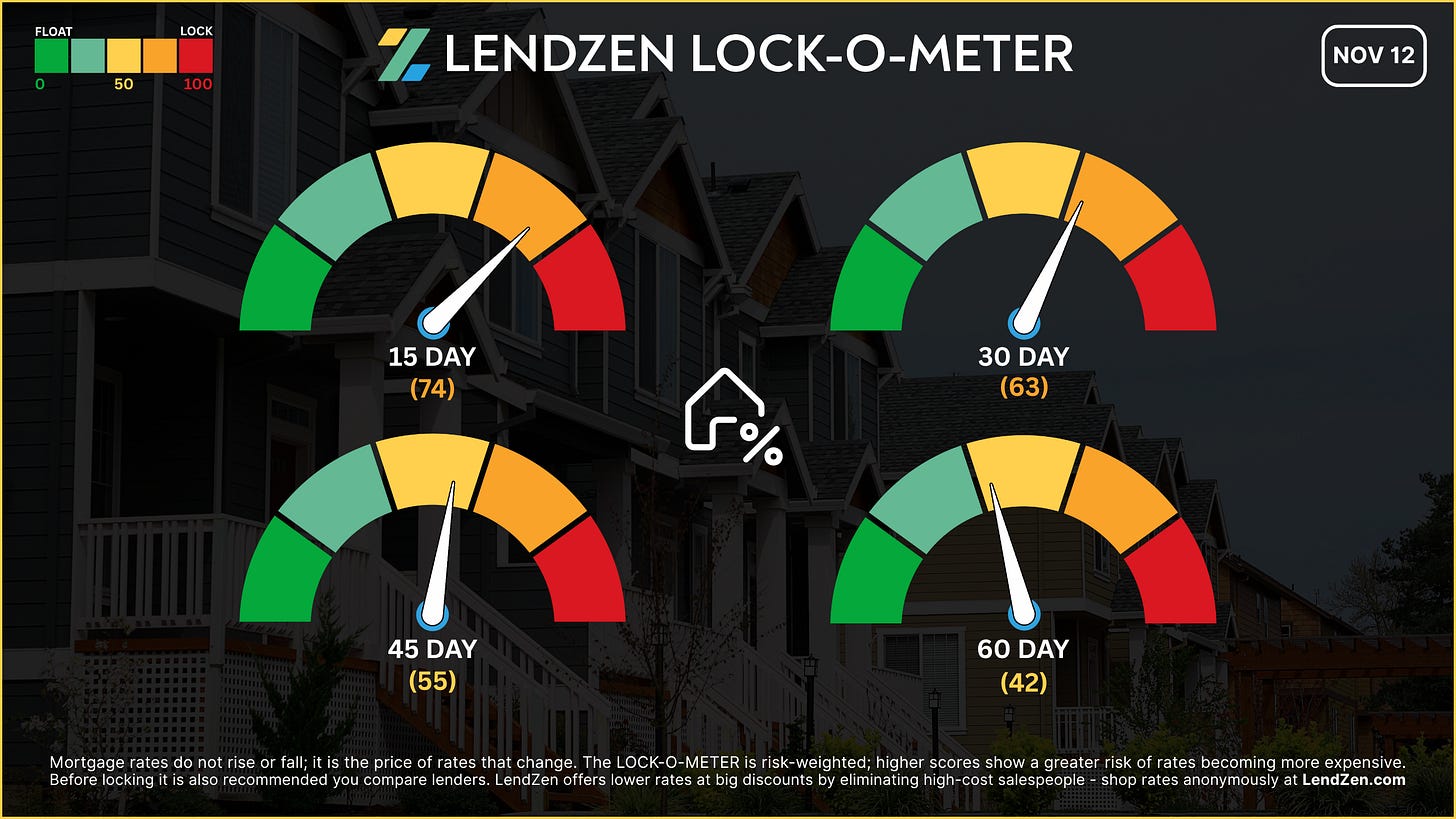

LOCK-O-METER

------------------

Learn more about the Lock-O-Meter and when to lock your rate in this Substack post.

15 Days — 74 🟠

Short-term volatility persists despite today’s bond relief. Any surprises with the shutdown vote or the next batch of inflation data, could not only erase today’s gains but quickly shift sentiment.

30 Days — 63 🟠

A mild improvement in bonds trims risk slightly, but without CPI or PPI clarity, last month’s momentum is now fragile and on the cusp of an official reversal.

45 Days — 55 🟡

Markets are cautiously leaning positive on a shutdown resolution. Float windows beyond one month start to gain some breathing room.

60 Days — 42 🟡

Long-term disinflation expectations remain the anchor. Even a modest bond bounce keeps this horizon comfortably in float territory.

EQUITIES (5-Day)

----------

DJIA: 48,261 (+3.12%)

S&P 500: 6,850 (+2.31%)

NASDAQ: 25,501 (-+2.13%)

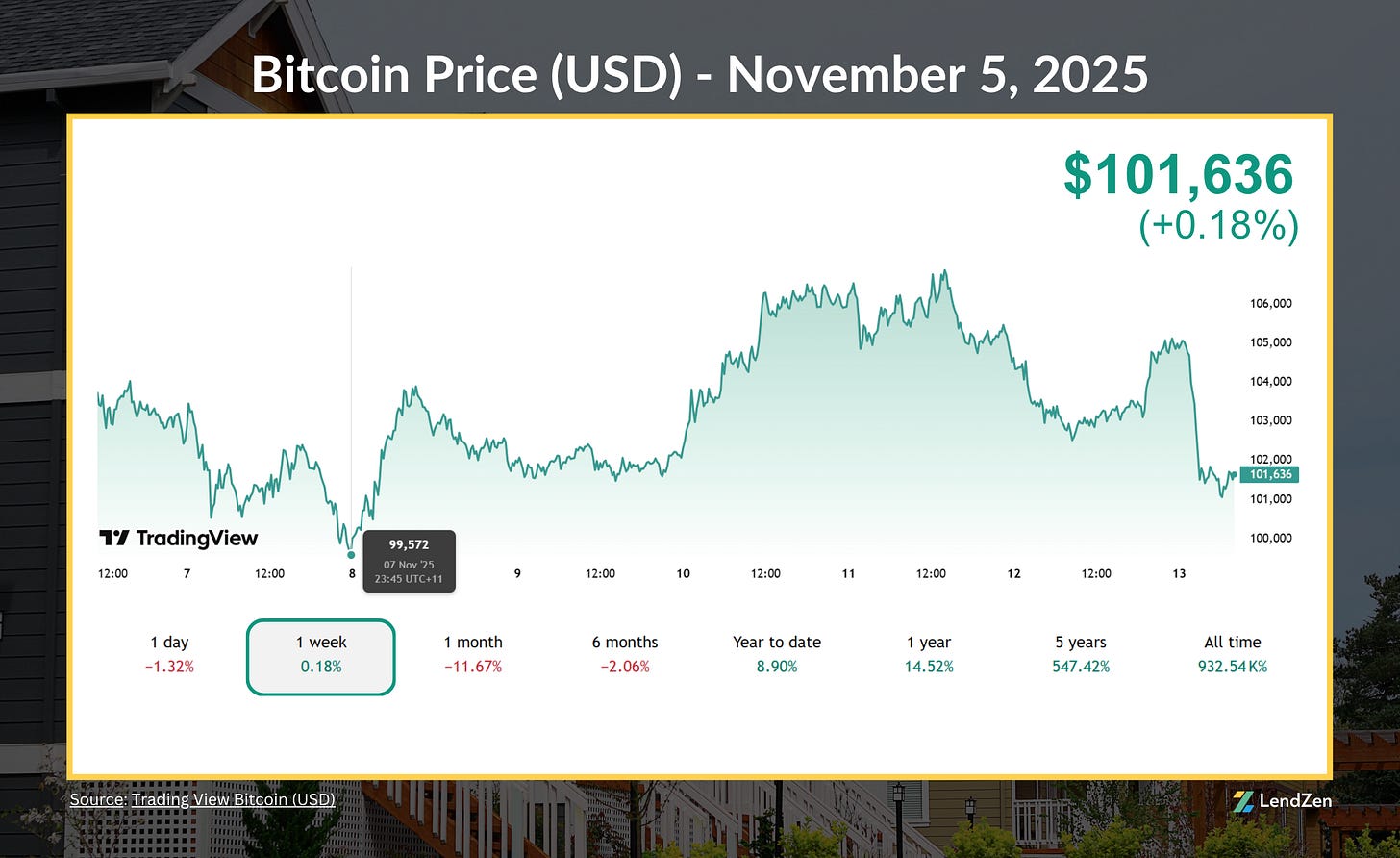

CRYPTO (1-Week)

---------

Bitcoin: $101,636 (+0.18%)

Ethereum: $3,424 (+4.15%)

Solana: $154 (-0.77%)

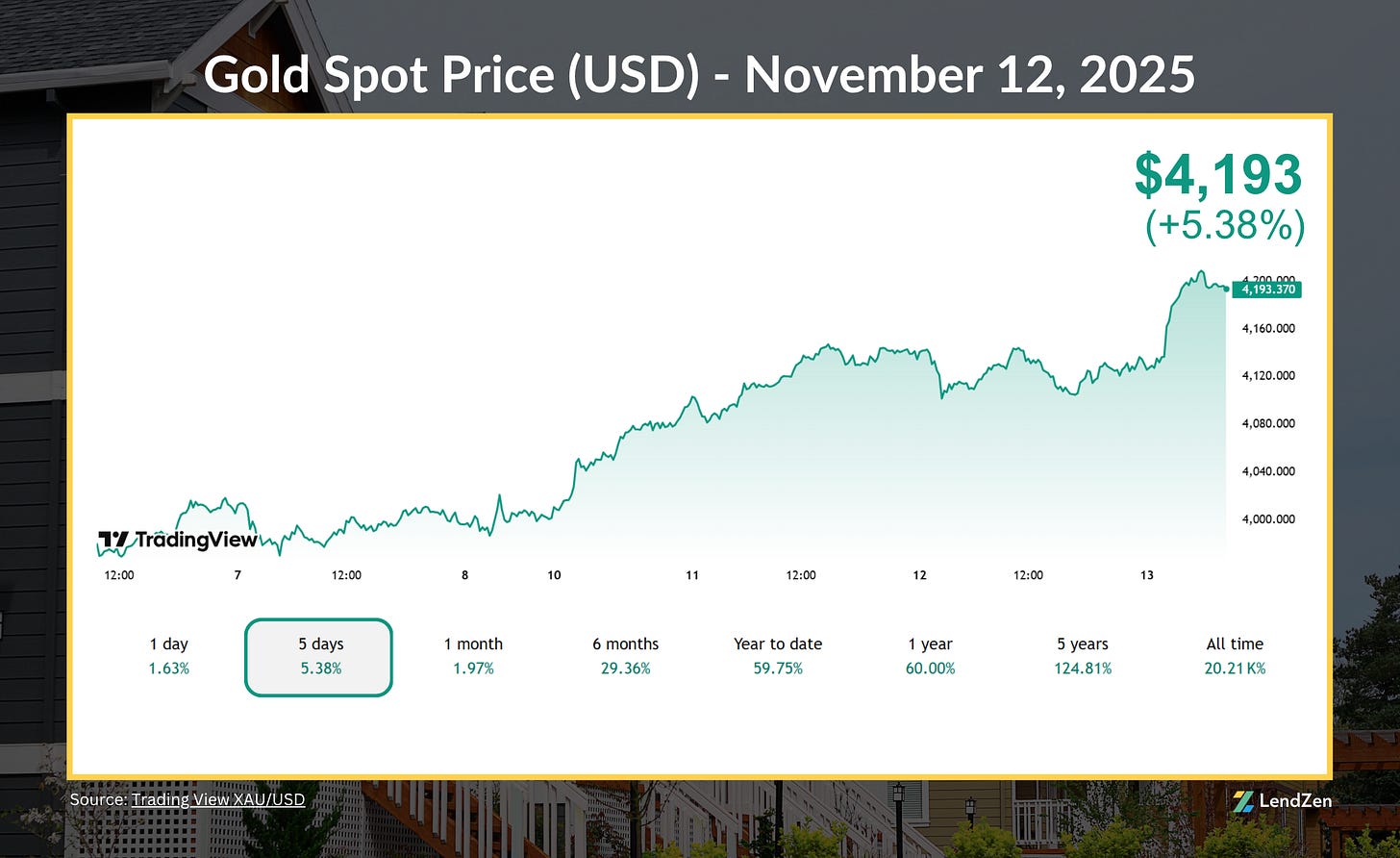

PRECIOUS METALS (5-Day)

----------------------

Gold: $4,193 (+5.38%)

Silver: $48.03 (+10.73%)

Platinum: $1,549 (+4.55%)

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.