Mortgage rates get a JOLT from bad news ⚡📰

Is the U.S. heading towards recession?

Bad news usually means good news for bond prices and mortgage rates.

During times of uncertainty investors tend to prefer cashflow more than capital appreciation (asset prices rising).

As a result, bonds are traditionally considered a safe haven and the preferred hedge when there are growing concerns that the economy is slowing.

Remember, mortgage rates do not rise or fall, instead the price of rates change as a result of the fluctuation in mortgage bond prices.

This is why mortgage rates love popping open a tasty recession - as bond prices rise from the surge in demand, lower mortgage rates become less expensive.

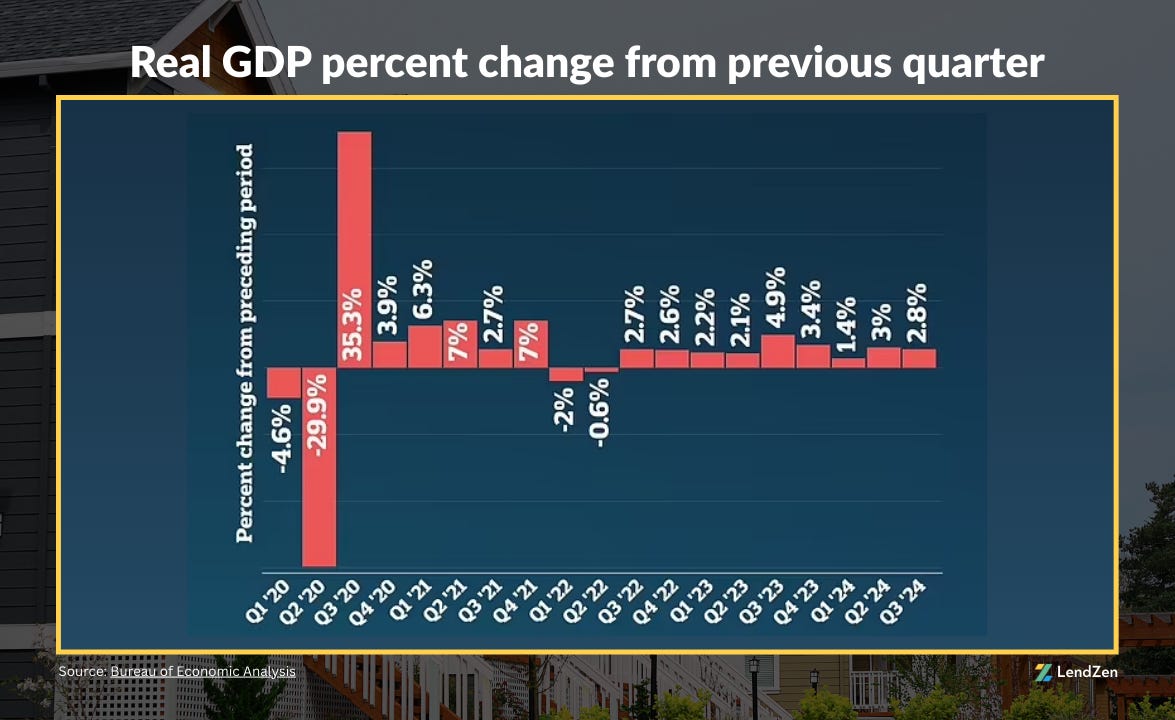

A recession is defined as two consecutive quarters of negative GDP, but some argue this contraction needs to coincide with an increase in unemployment.

The last time the U.S. experienced two quarters of negative growth was in Q1 and Q2 of 2022 – but this was not officially declared a recession as the labor market remained strong.

Although there does not appear to be immediate risks of negative growth in the broader economy, there are cracks appearing in the labor market.

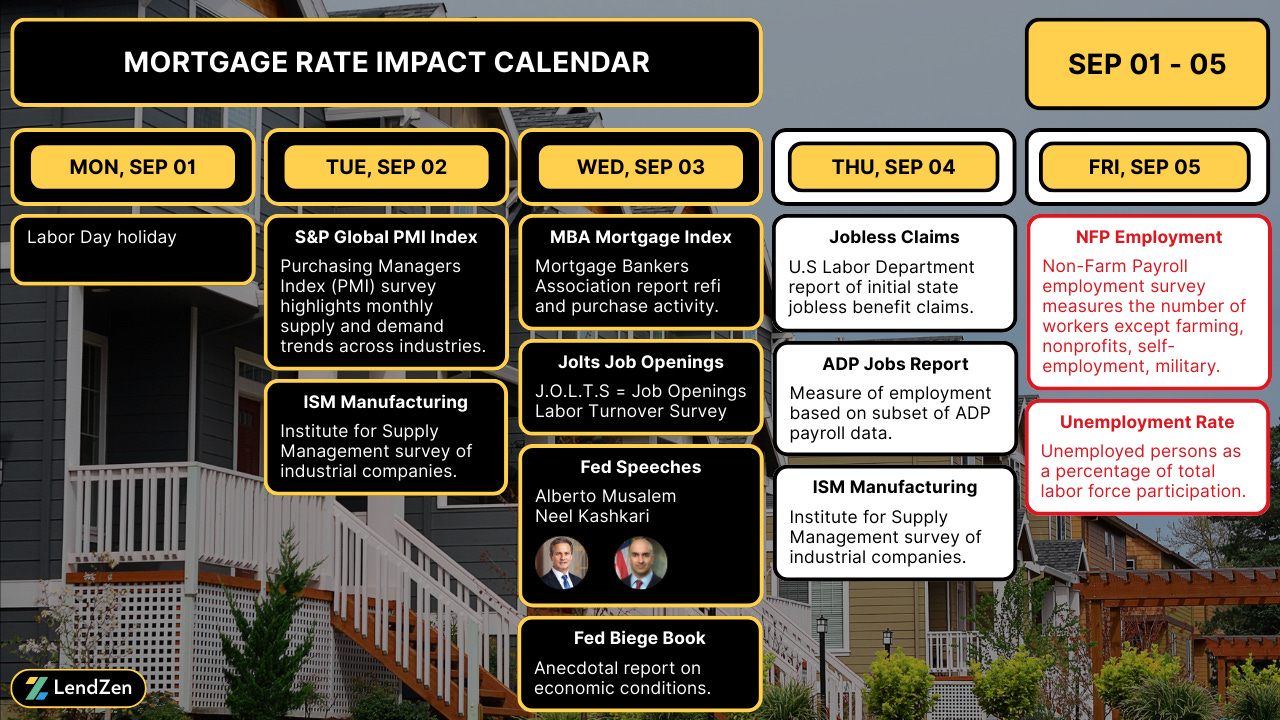

Take Wednesday’s JOLTS report as an example - for the first since April 2021 the Job Openings and Labor Turnover Survey reported that there are more unemployed than available jobs.

In fact, current job openings (7.18M) are near their second-lowest point since the 2020 crash.

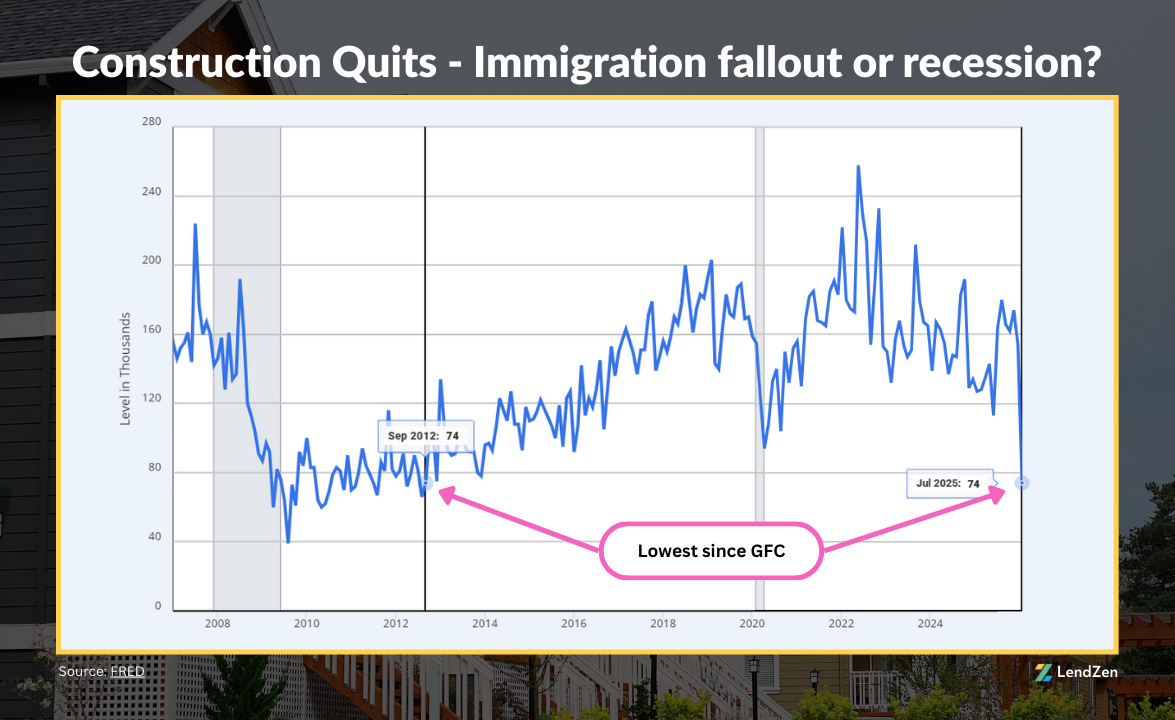

Is this also showing up in the construction quits number?

Normally this is a recession indicator, but is the recent plummet in quits more an isolated effect of illegal immigrant deportations or part of a broader softening in the labor market?

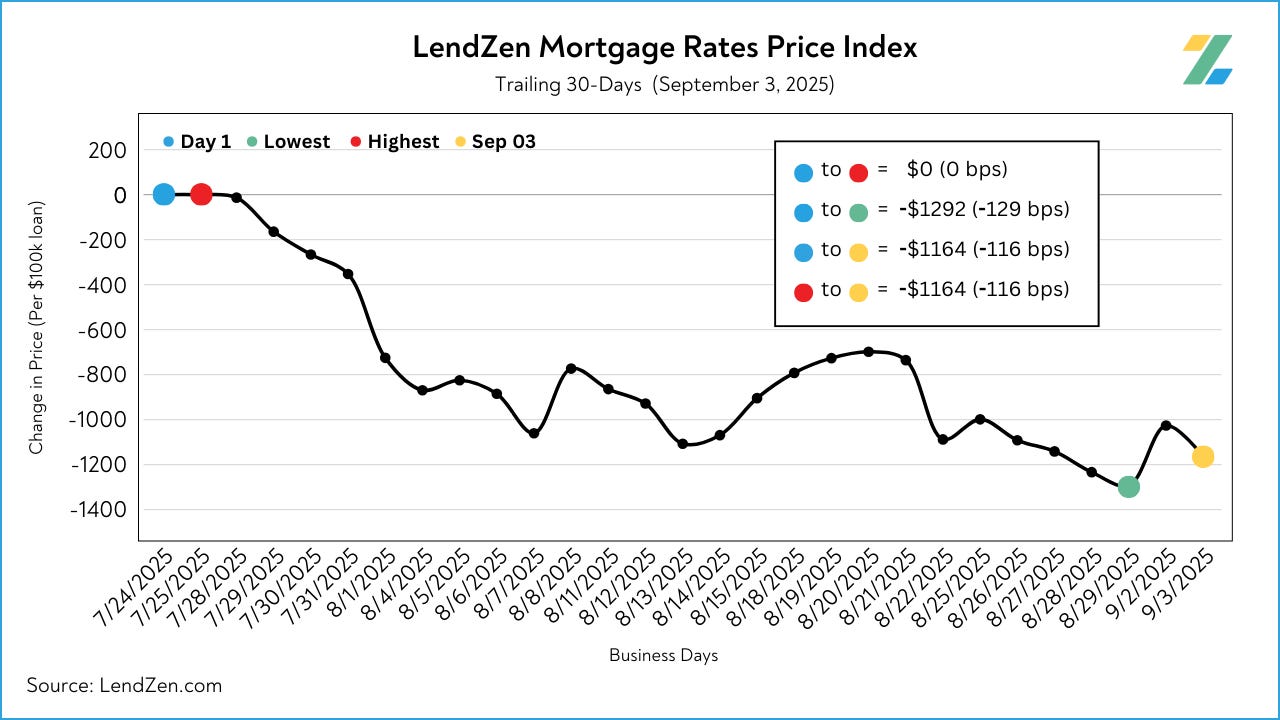

Mortgage rate PRICES have improved on average 116 basis points in the last 30-days.

This applies to all rates and means a $500,000 mortgage is now $5,800 less expensive.

The biggest reason is the July Non-Farm Payroll (NFP) data.

Not only did it miss expectations, but the negative revisions to the May and June numbers were the largest since Covid.

Yesterday’s JOLTS data reignited concerns about the health of the labor market.

Today the ADP payroll data will be released.

Although not as important as Friday’s NFP report, it could still add to the recent recession head rush that has helped mortgage rates ease to their best levels since this time last year.

In preparation for the NFL season opener today, Philadelphia was lit green ... let's hope the bond market lights up the same color today and on Friday.

Want to check customized, real-time mortgage rates instantly? 🧮

LendZen (NMLS# 375788) gives you real-time access to mortgage rates that update as bond prices change.

The detailed loan summaries have an interactive rate slider that shows all current mortgage rates and full transparency of costs upfront.

All information can be viewed anonymously and without any sign-up requirements or human interaction. This makes exploring the full range of rate options hassle-free.

See for yourself and customize your own loan scenario at LendZen.com