Mortgage rates finally join the party after record year 🥳🏠💰

Midweek Market Update

Included in this update are the following sections:

MIDWEEK RECAP ⏪

-------------------

That’s a wrap - 2025 is officially in the books!

After three painful years, bonds and mortgage rates finally have something to celebrate.

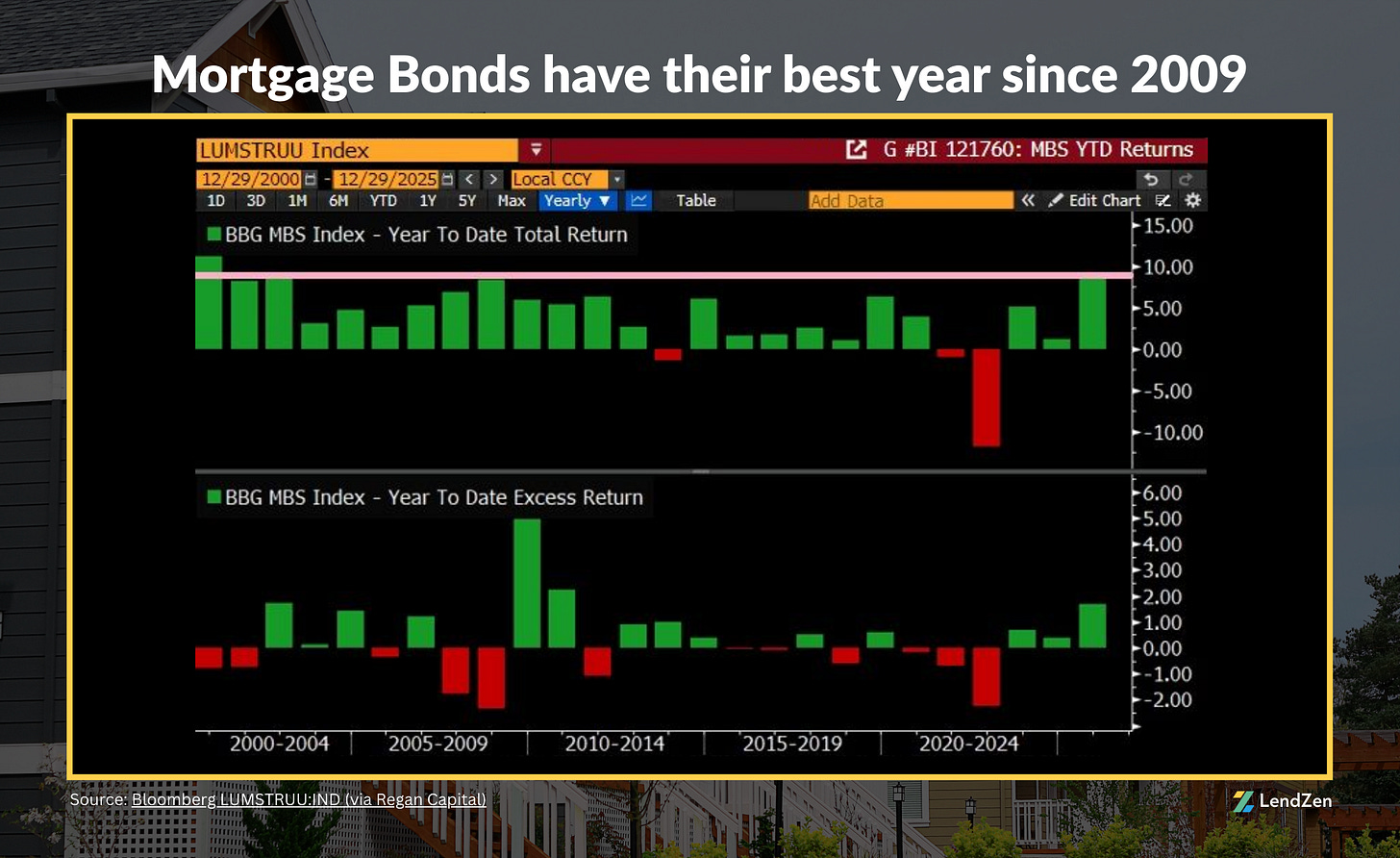

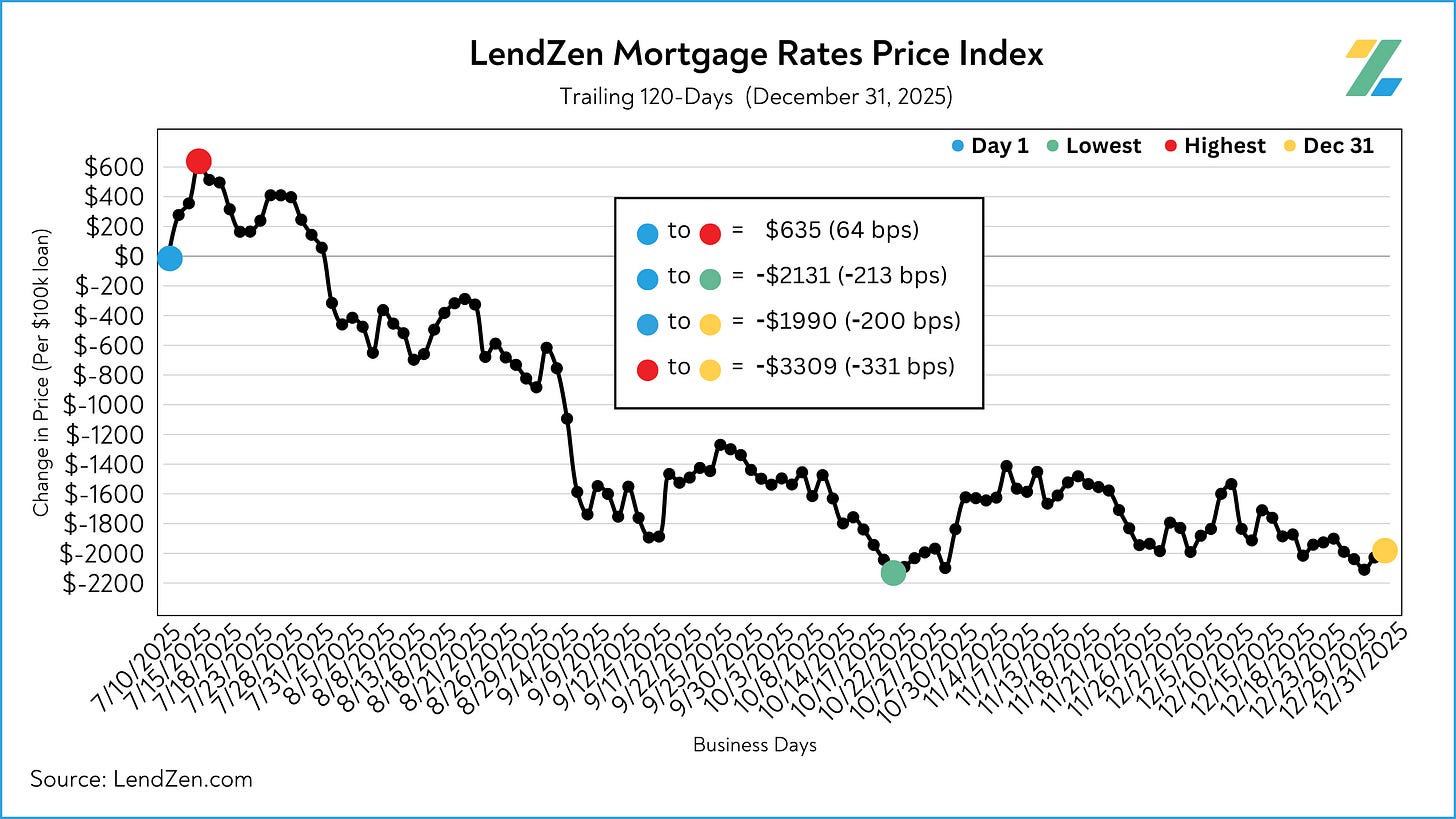

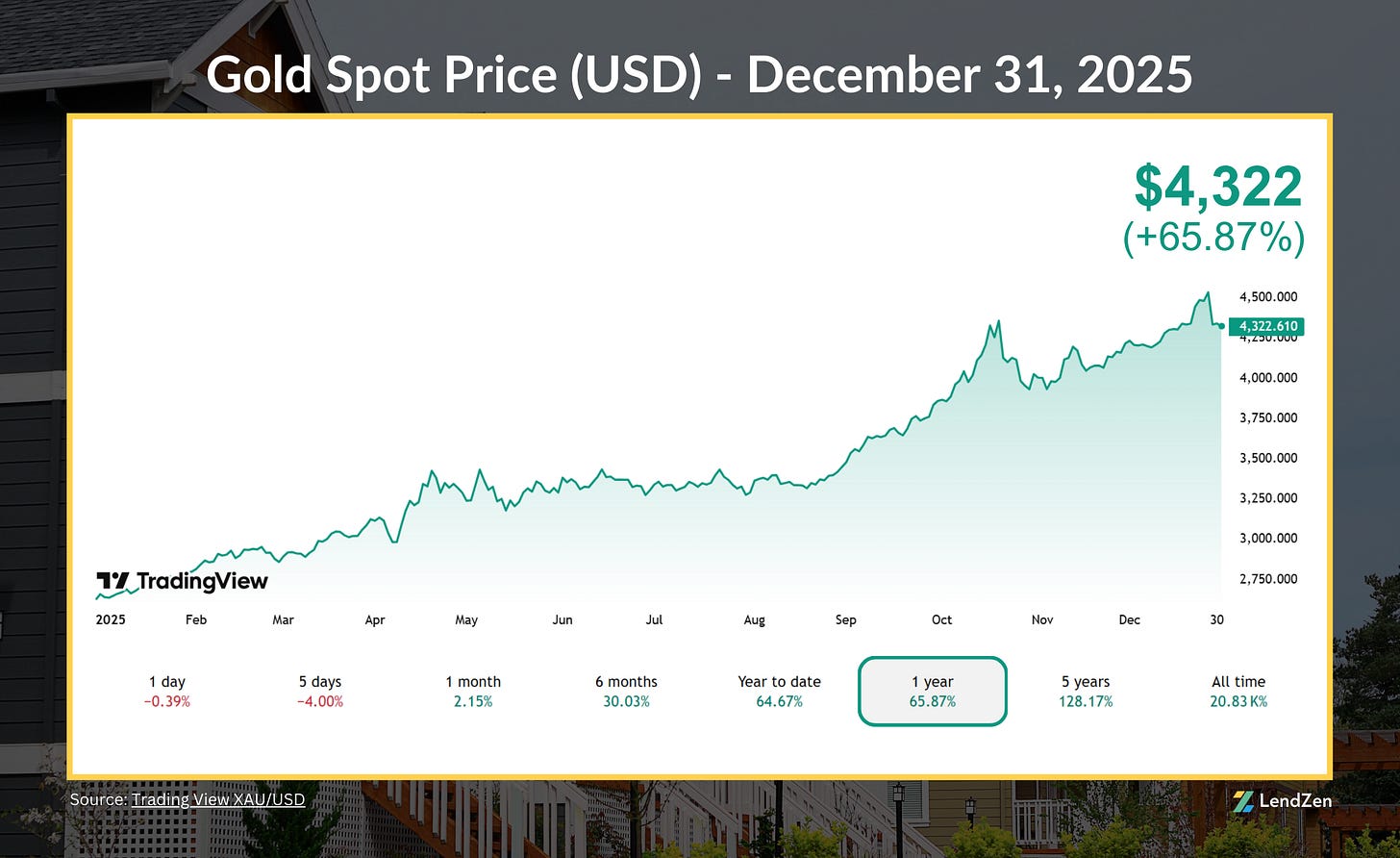

Although precious metals stole the show this year with triple-digit returns, mortgage rates had their best performance since 2020 as MBS delivered total returns not seen since 2009.

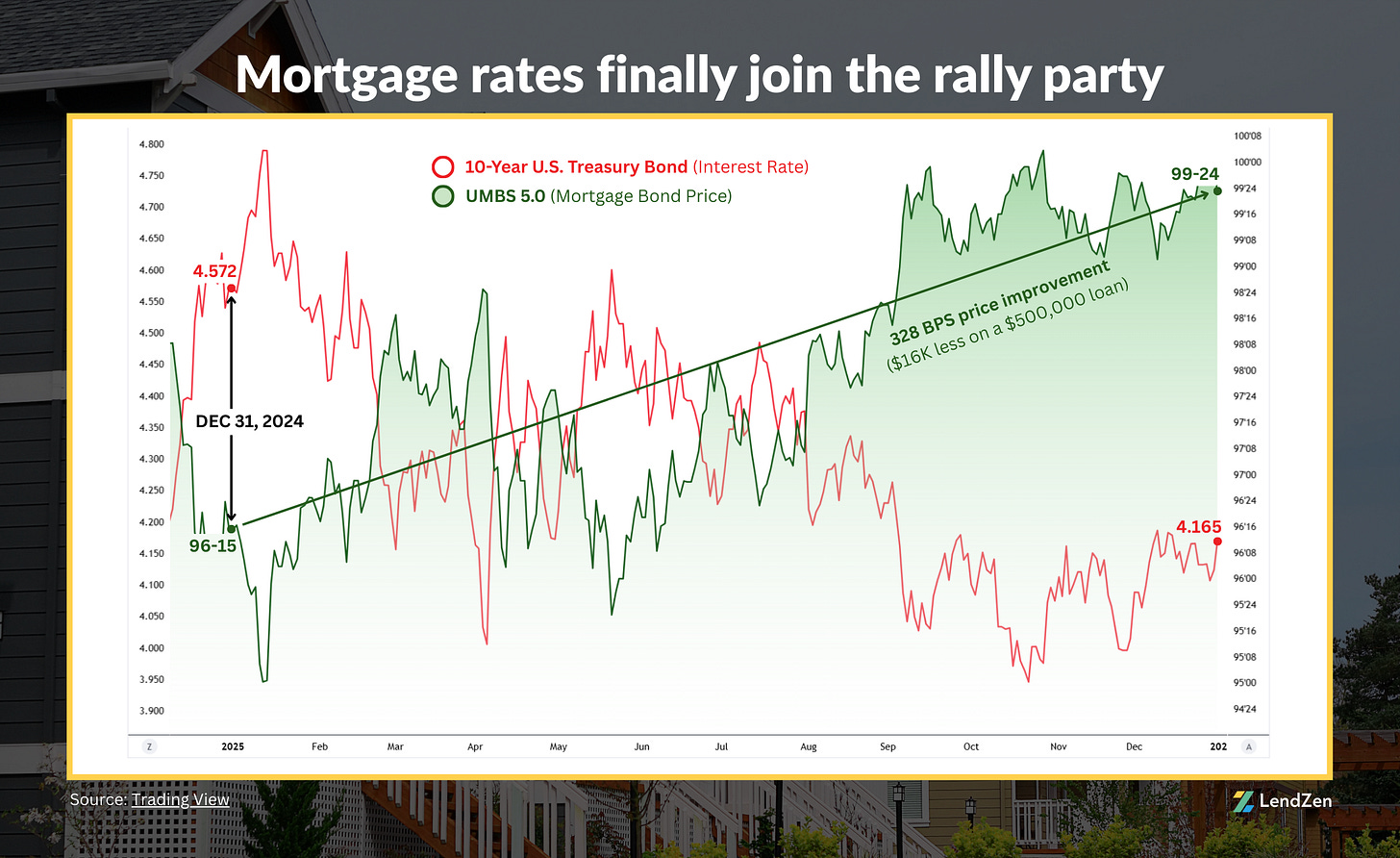

In the last 12 months, mortgage bond prices rose 328 basis points.

That means the cost of getting a $500k mortgage is $16,400 cheaper today than at the same time last year.

See more in the Rate Price Index section below.

IMPACT CALENDAR 📅

-----------------------

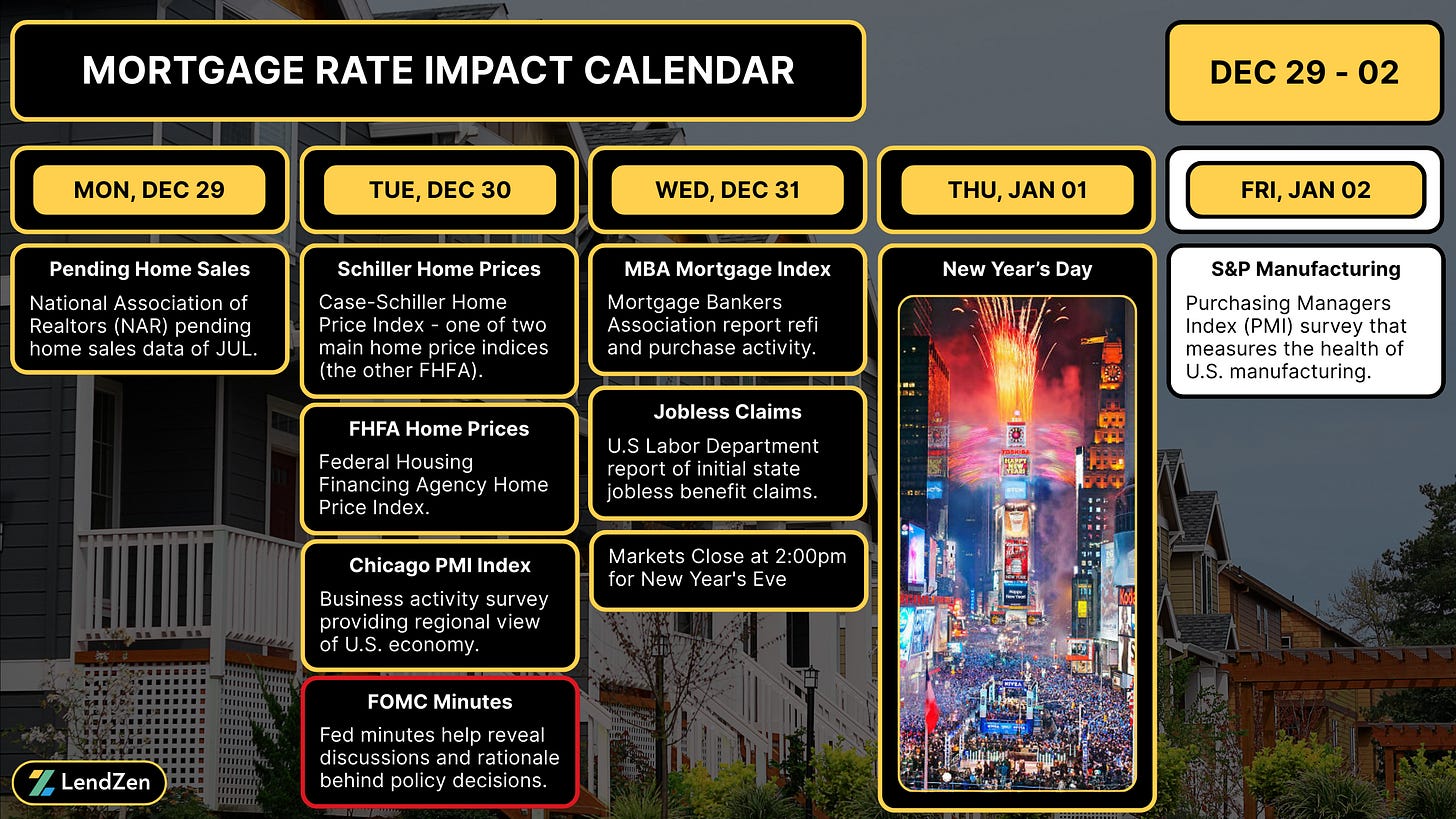

It was another short week with the New Year holiday kicking off 2026 on Thursday.

The early week data came and went without any fireworks - hopefully the same cannot be said for your New Year’s Eve celebration.

There is nothing of importance scheduled on Friday besides a manufacturing survey, but the new year begins with earnest on Monday, January 5th.

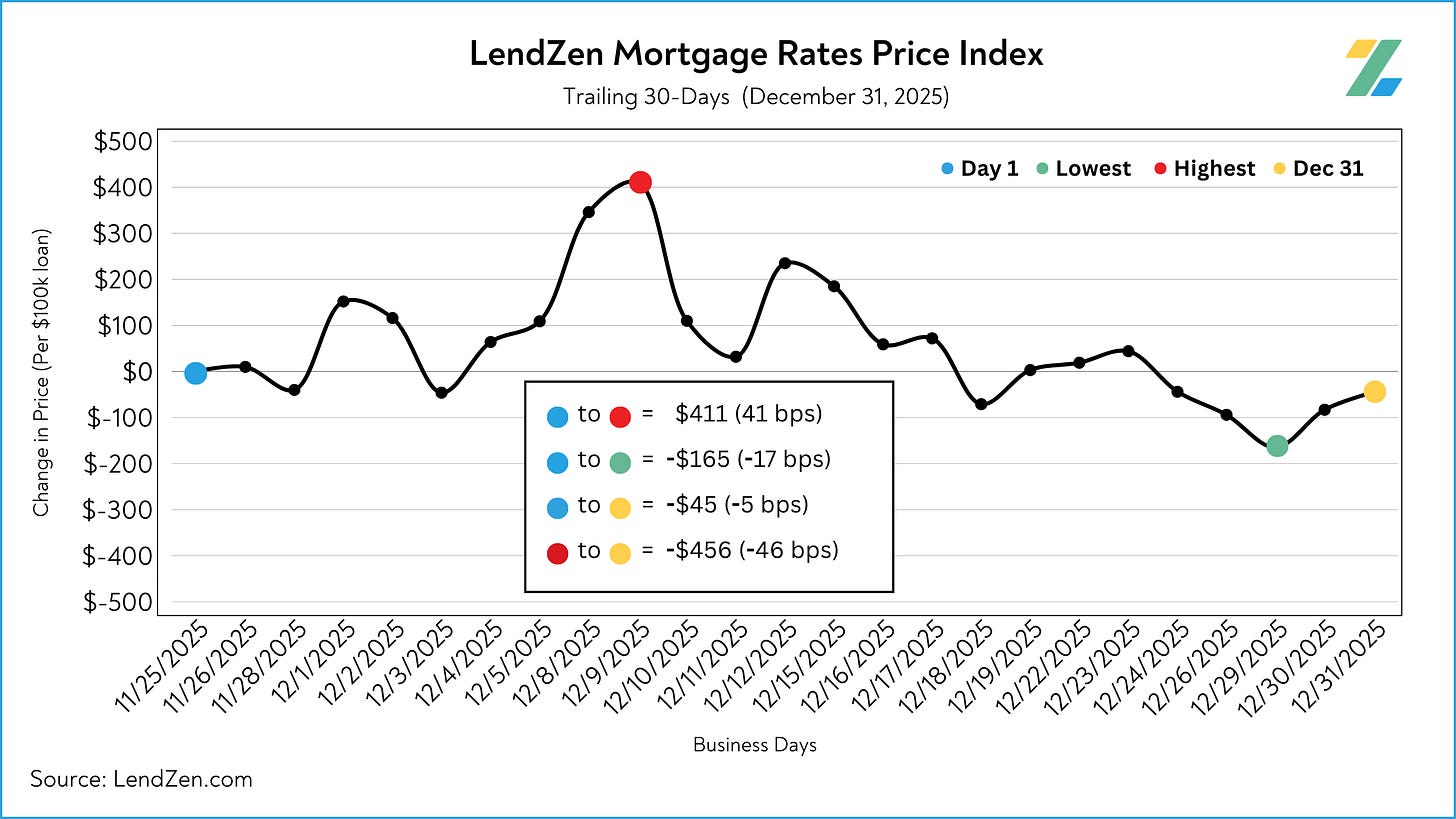

RATE PRICE INDEX 📉

----------------------

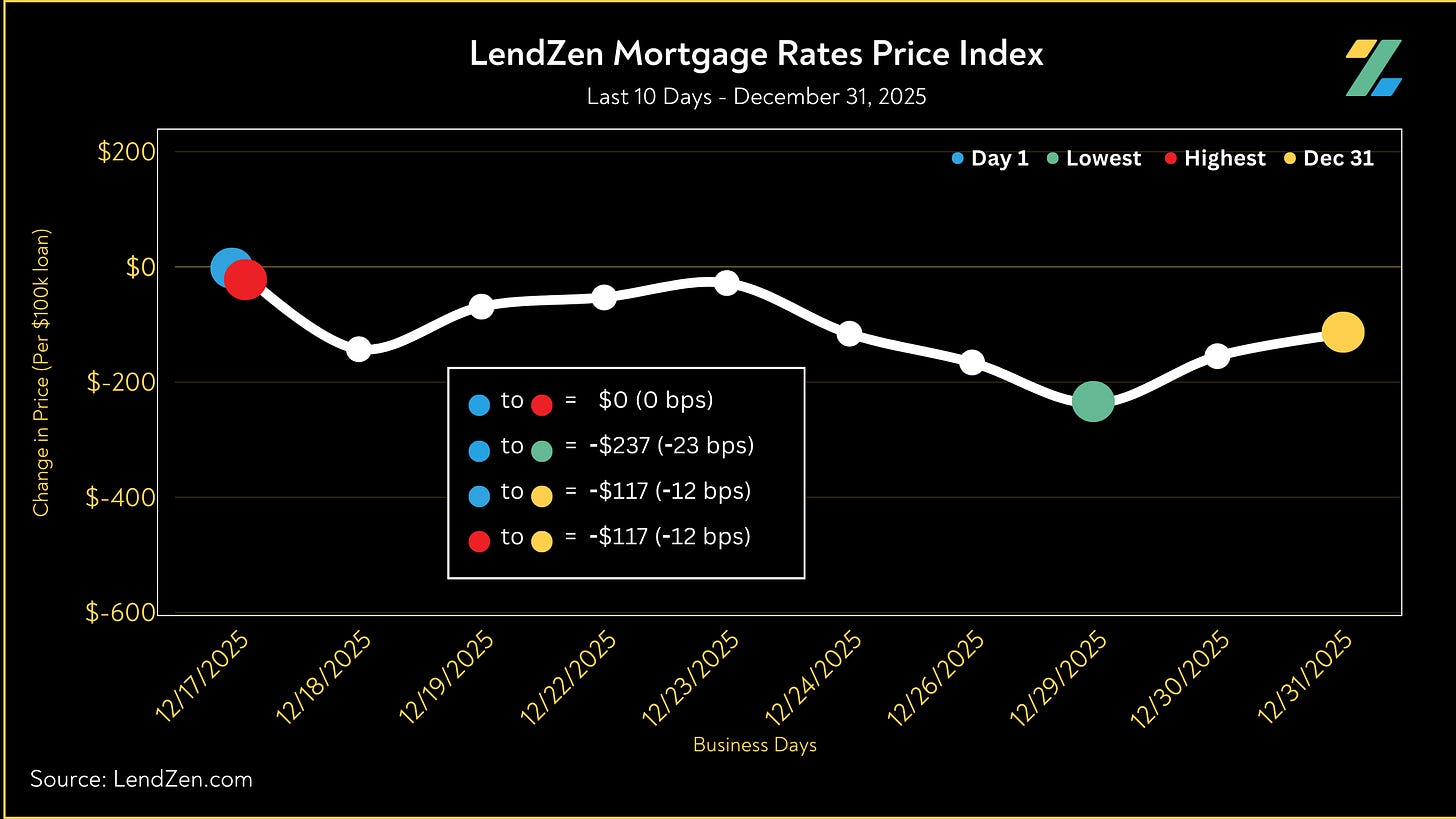

Mortgage rates DO NOT rise or fall.

The full range of rates is always available, and instead the price of each rate changes based on the trading of individual mortgage bonds.

The LendZen Index calculates a daily change in the price of mortgage rates by tracking a spectrum of mortgage-backed securities (MBS).

-----------

24-Hour: +4 bps (+$38 per $100K)

5-Day: +0 bps (-$1)

10-Day: -12 bps (-$117)

30-Day: -5 bps (-$45)

60-Day: -50 bps (-$494)

120-Day: -200 bps (-$1990)

Learn more about the LendZen Index and explore the full data series at LendZen.substack.com

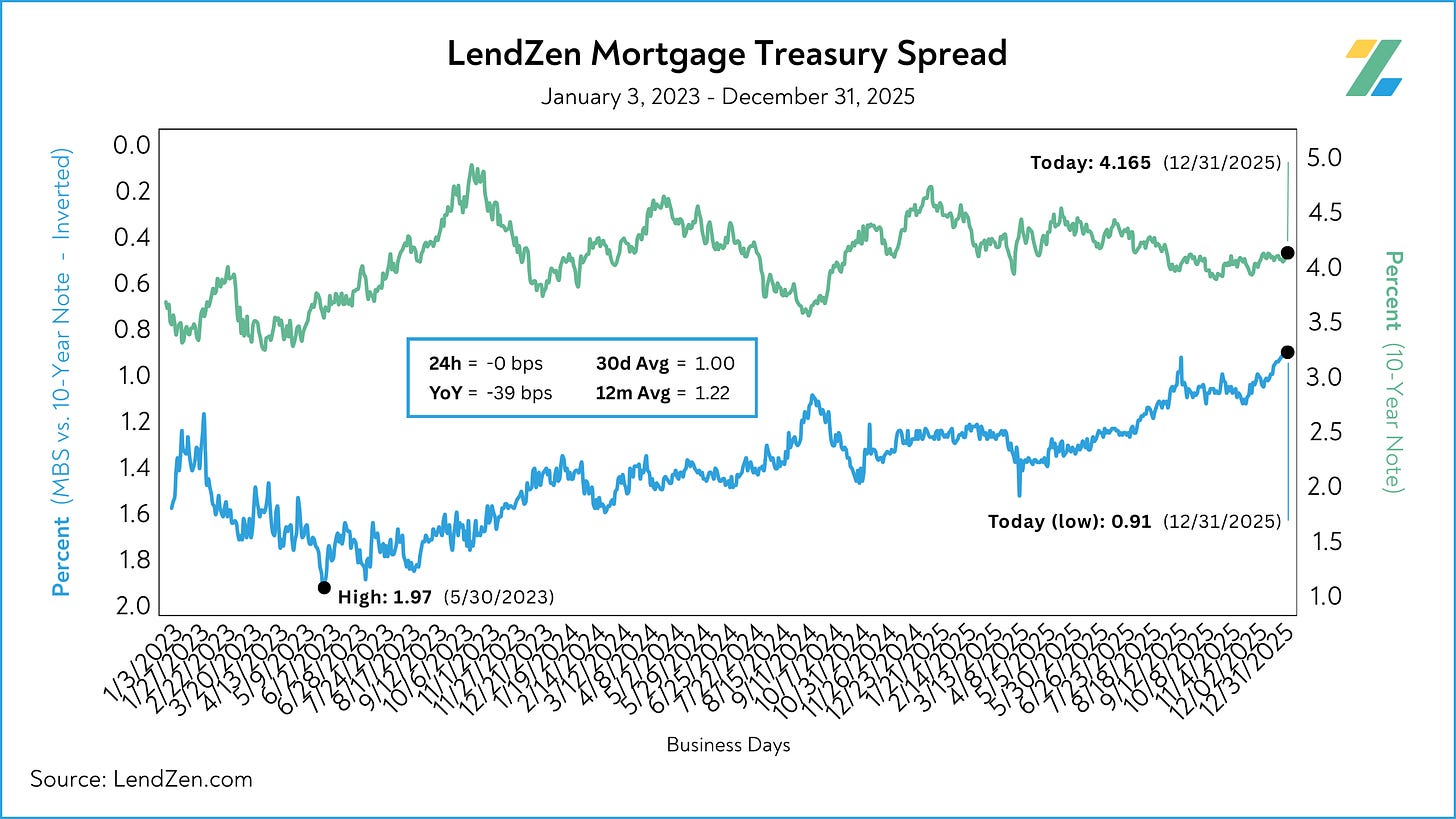

MORTGAGE SPREADS 🧈

-------------------------

Published daily with the LendZen Index is the LendZen Mortgage-Treasury Spread.

The LMTS uses actual bond yields to create a historically consistent, and reliable, data set.

-----------

Dec 24: 0.93

Dec 31: 0.91

24h: -0 bps

5d: -2 bps

12m Avg: 1.22

YoY: -39 bps

Learn more about the importance of mortgage spreads on this Substack post.

Compared to last year, spreads were tighter by nearly 40-bps at various times throughout the last quarter of 2025, while holding a multi-year low the last 3-days.

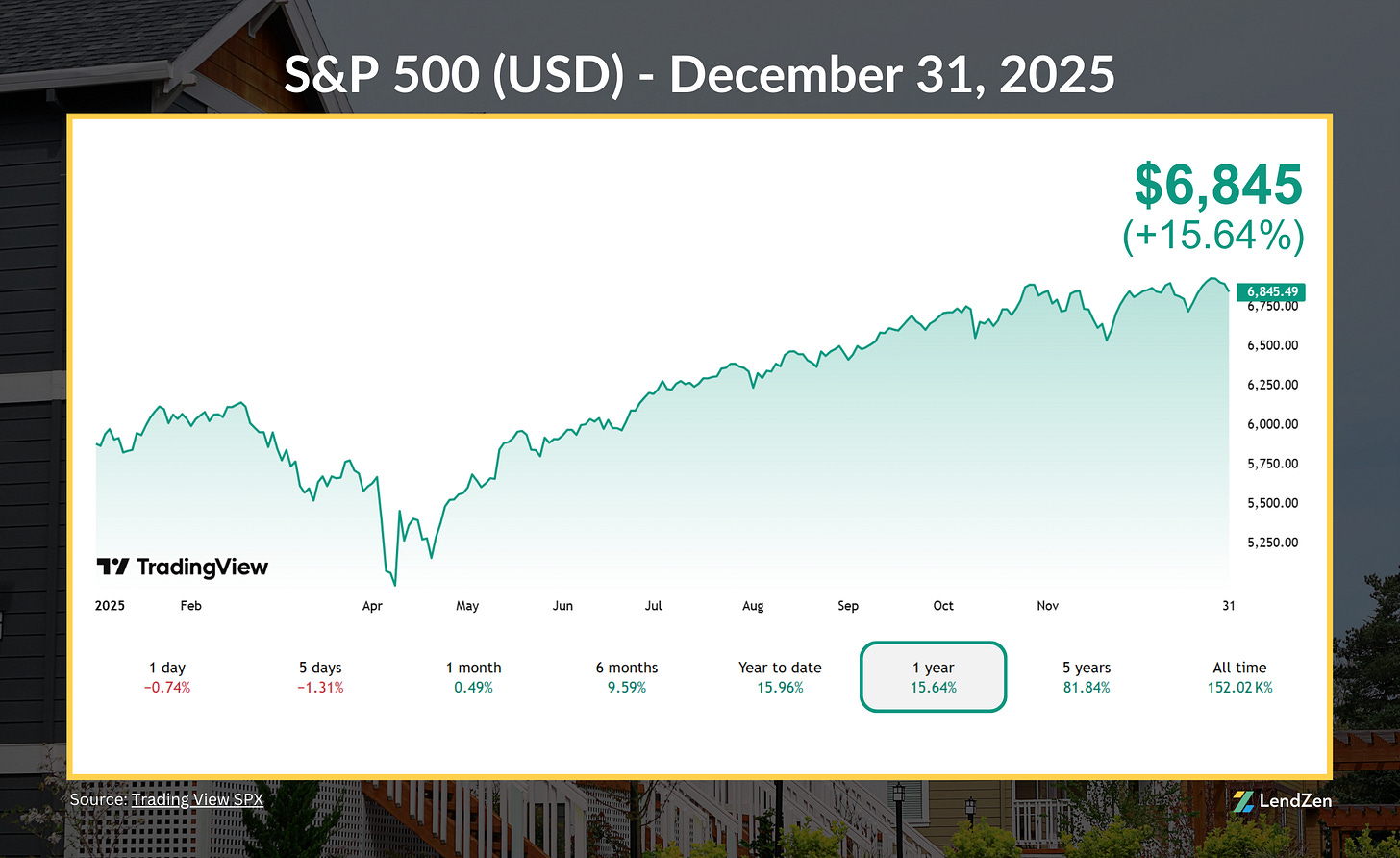

STOCK MARKETS (1-Year) 📊

-----------------------------

DJIA: 48,063 (+12.73%)

S&P 500: 6,845 (+15.64%)

NASDAQ: 25,249 (+18.79%)

CRYPTO (1-Year) 🧮

---------------------

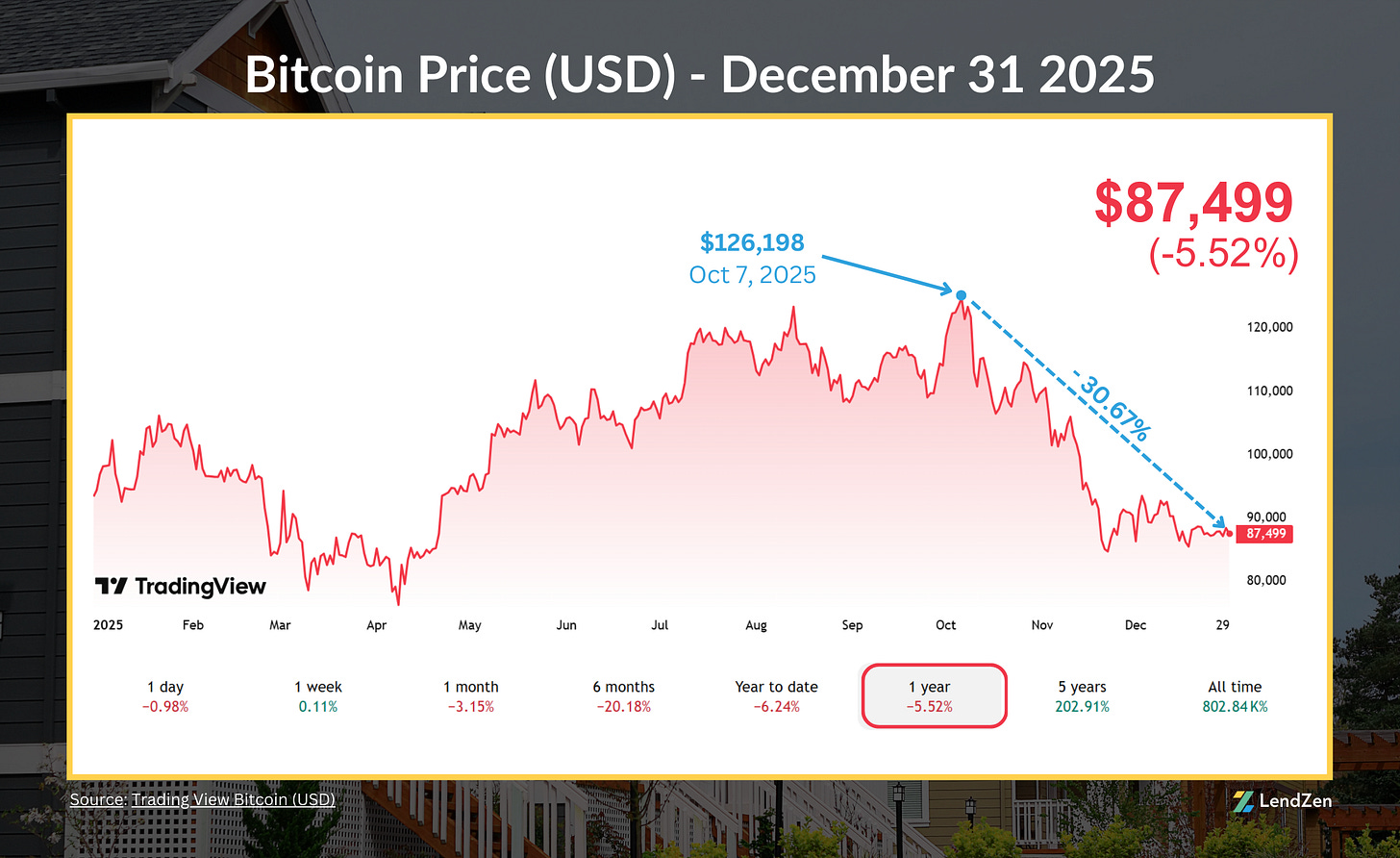

Bitcoin: $87,499 (-5.52%)

Ethereum: $2,966 (-11.63%)

Solana: $124.47 (-34.83%)

PRECIOUS METALS (1-Year) 🪙

-------------------------------

Gold: $4,322 (+65.87%)

Silver: $71.65 (+146.88%)

Platinum: $2,026 (+126.53%)

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.