Mortgage rates exhale after Fed rate cut 😮💨✂️🏦

Midweek Market Update

Included in this update are the following:

Shop real-time mortgage rates anonymously and get instant qualification results at LendZen.com

MIDWEEK RECAP ⏪

-------------------

Early in the week bonds retreated in anticipation of the Fed meeting.

Tuesday’s JOLTS data added to the selling pressure, but a very strong 10-Year Treasury Note auction helped nullify some of the pain.

The last FOMC meeting of the year adjourned today, with the decision to cut the Fed Funds overnight lending rate by another 25-bps.

Jerome Powell reiterated in his press conference that the Fed remains data dependent, yet the committee is more divided than ever, with multiple Fed President’s preferring no rate cuts at all.

Overall, it was well received by bond markets, which is all that really matters at the moment for mortgage rates.

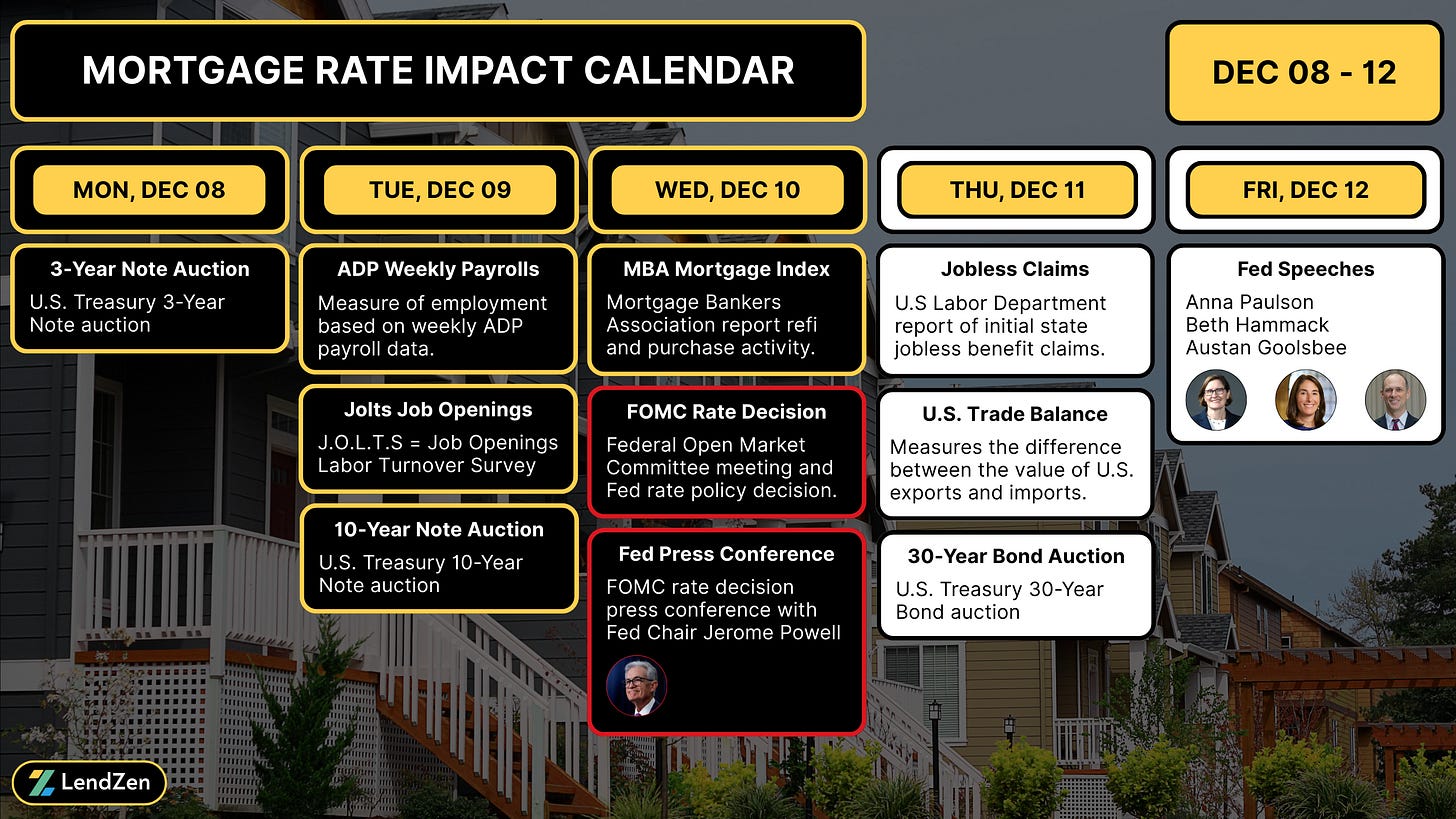

IMPACT CALENDAR 📅

-----------------------

Investors will continue to process today’s Fed rate decision heading into back half of the week, with jobless claims and a 30-Year Bond auction tomorrow.

Also, look for additional policy clarity from any of the Fed speeches scheduled for Friday.

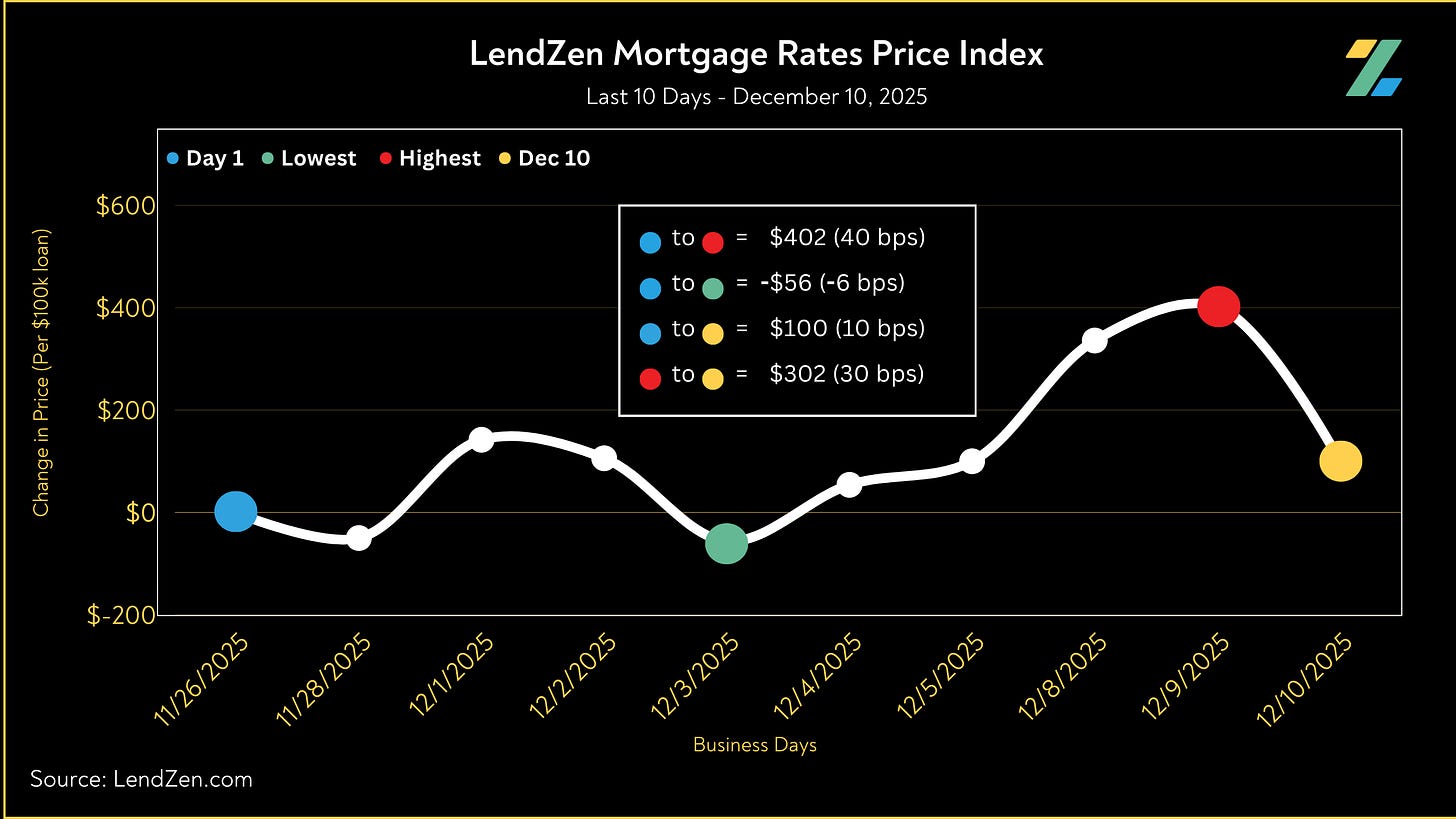

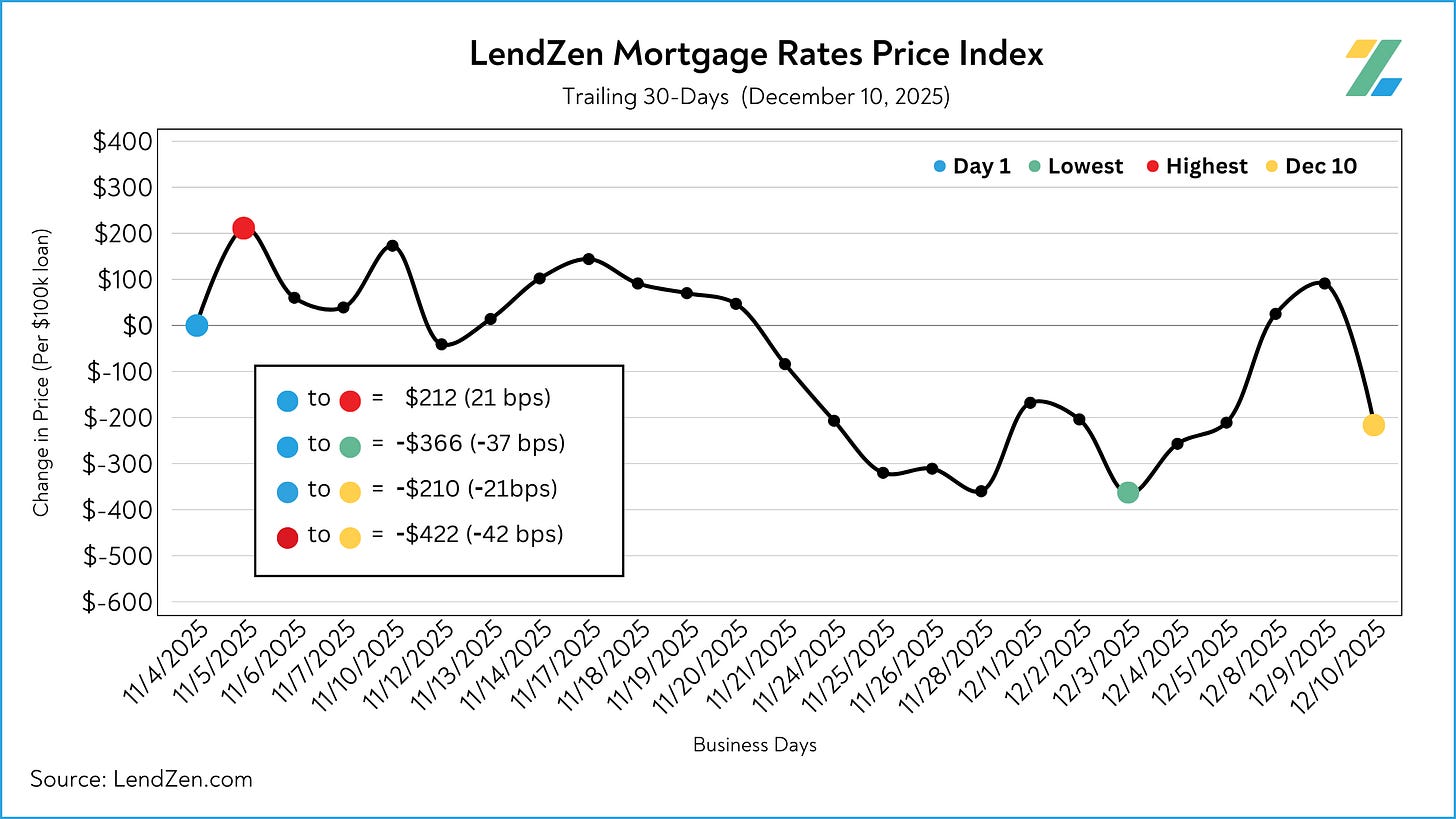

RATE PRICE INDEX 📉

----------------------

Mortgage rates DO NOT rise or fall.

The full range of rates is always available, and instead the price of each rate changes based on the trading of individual mortgage bonds.

The LendZen Index calculates a daily change in the price of mortgage rates by tracking a spectrum of mortgage-backed securities (MBS).

-----------

24-Hour: -30 bps (-$301 per $100K)

5-Day: +5 bps ($46)

10-Day: +10 bps ($100)

30-Day: -21 bps (-$210)

60-Day: +26 bps (+$263)

Learn more about the LendZen Index and explore the full data series at LendZen.substack.com

MORTGAGE SPREADS 🧈

-------------------------

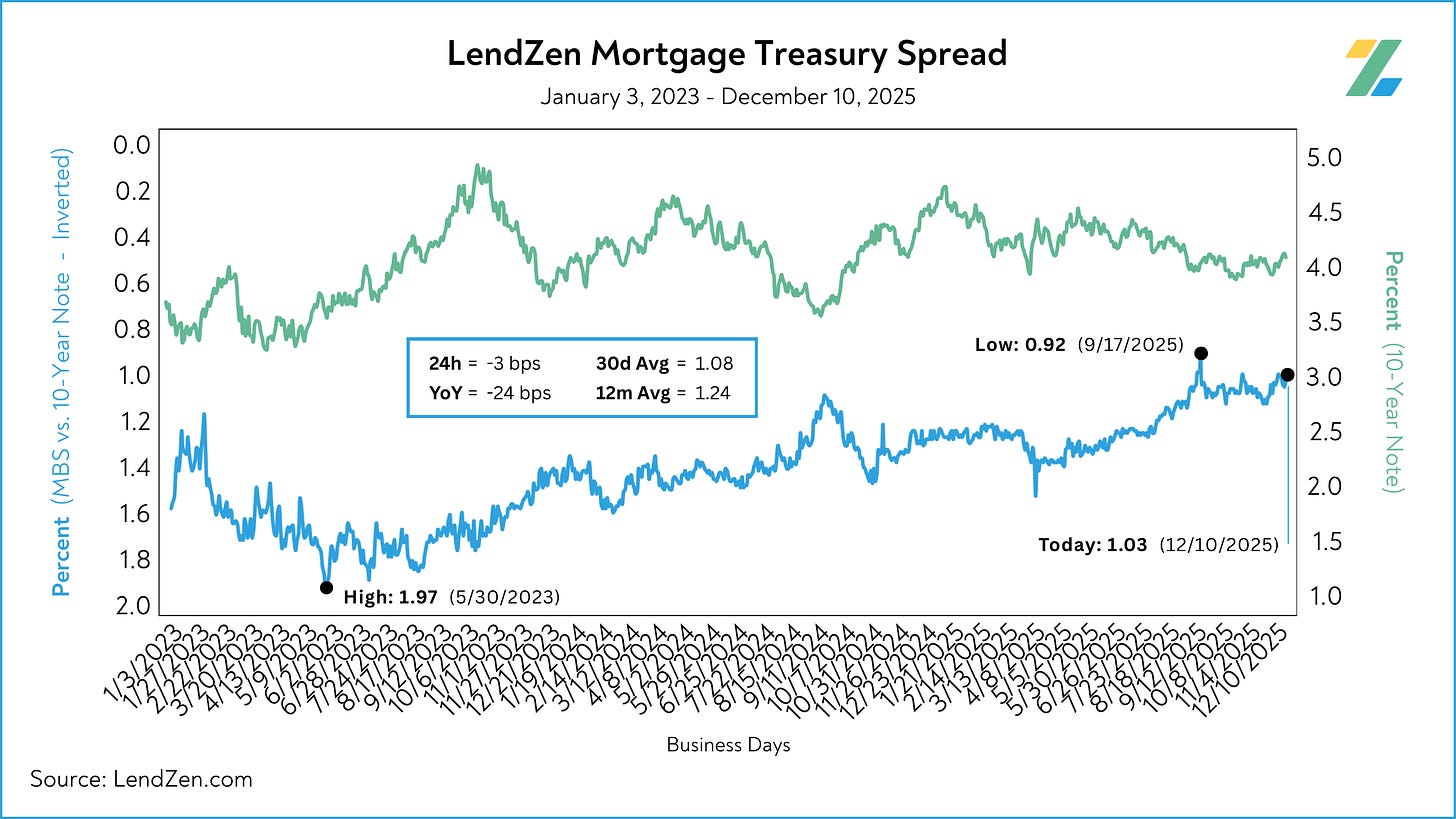

Published daily with the LendZen Index is the LendZen Mortgage-Treasury Spread.

The LMTS uses actual bond yields to create a historically consistent, and reliable, data set.

-----------

Dec 03: 1.00

Dec 10: 1.03

24h: -3 bps

5d: +3 bps

12m Avg: 1.24

YoY: -24 bps

Learn more about the importance of accurately calculating spreads on this Substack post.

RATE LOCK GUIDE 🔒

---------------------

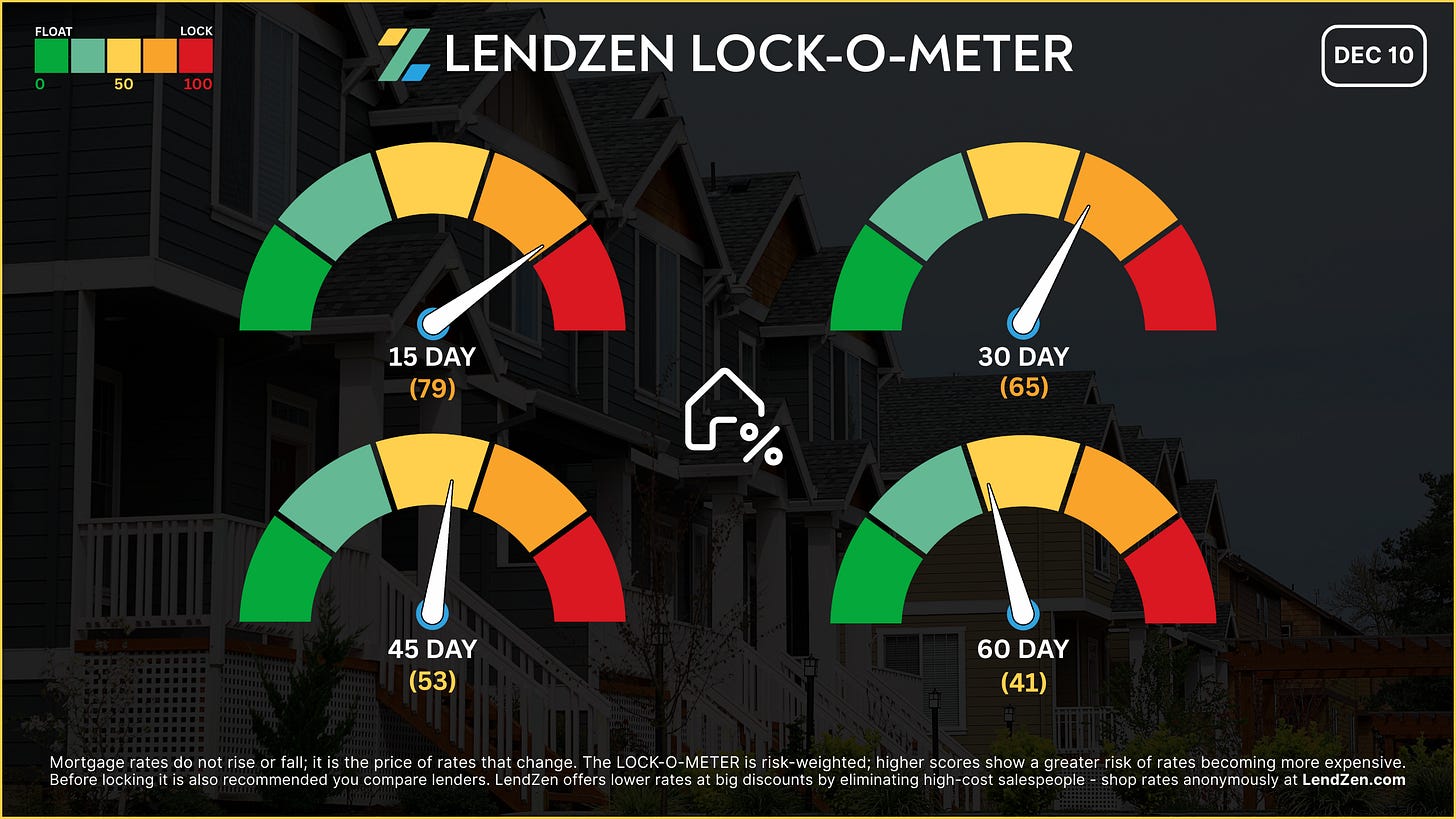

The LendZen LOCK-O-METER provides borrowers with a risk-weighted score based on how various macroeconomic events, including market data, central bank announcements, and geopolitics, each historically impacts the price of bonds.

higher risk scores = lean towards locking

------------------

Closing Window

------------------

[ 15 Days ] — 79 🟠

Post-FOMC relief trimmed immediate risk, though intraday swings could persist as traders digest Powell’s mixed message.

[ 30 Days ] — 65 🟠

A modest risk cooldown following the rate cut; still sensitive to next week’s inflation and Non-Farm Payroll employment data.

[ 45 Days ] — 53 🟡

Stability returns for mid-term closings. Bonds have regained footing after early-December weakness.

[ 60 Days ] — 41 🟡

Longer-term float conditions still remain favorable. Hopefully, the latest Fed policy decision, combined with ongoing forward guidance, plus next week’s employment data, can keep the positive bond trend intact as we begin 2026.

Learn more about the Lock-O-Meter and when to lock your rate in this Substack post.

STOCK MARKETS (5-Day) 📊

-----------------------------

DJIA: 48,054 (+0.37%)

S&P 500: 6,886 (+0.30%)

NASDAQ: 25,776 (+0.46%)

CRYPTO (1-Week) 🧮

---------------------

Bitcoin: $92,506 (+1.19%)

Ethereum: $3,365 (+12.23%)

Solana: $138.34 (-0.56%)

PRECIOUS METALS (5-Day) 🪙

-------------------------------

Gold: $4,225 (+0.37%)

Silver: $61.79 (+5.62%)

Platinum: $1,658 (+8.37%)

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.