Mortgage rates enjoy a special combo as bonds rally 🍔🥤📉

With the government shutdown continuing to delay key market data, investors look for other signs of what lurks in the shadows of the U.S. economy.

Today, some investors may have been looking too hard as the rumor mill of regional bank stress sparked a welcomed risk off move for bonds.

Jefferies Bank is on the watch after concerns rose about the bank’s exposure to First Brands Group (auto parts) bankruptcy.

Meanwhile, deep in the trading pit chatrooms…

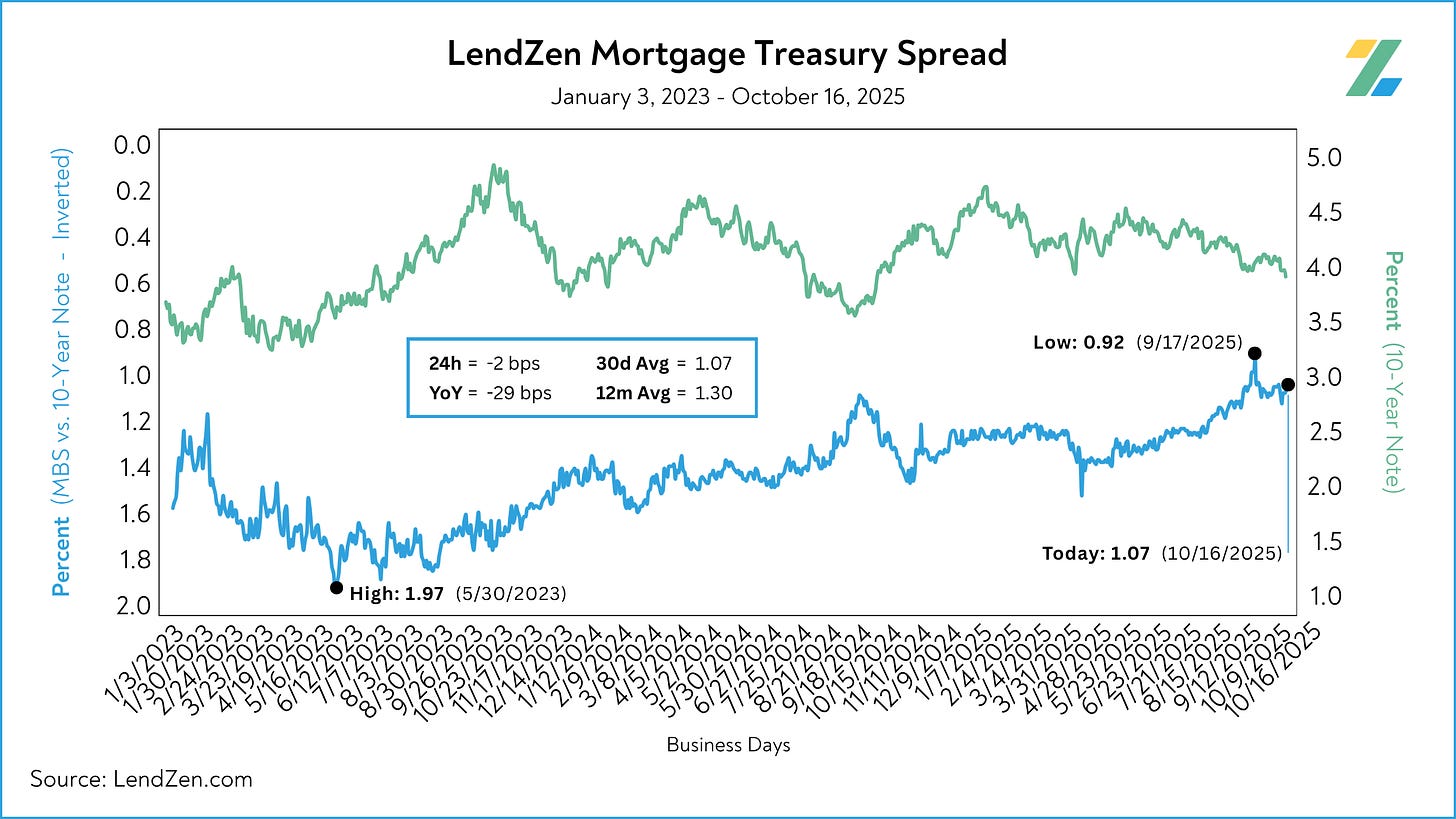

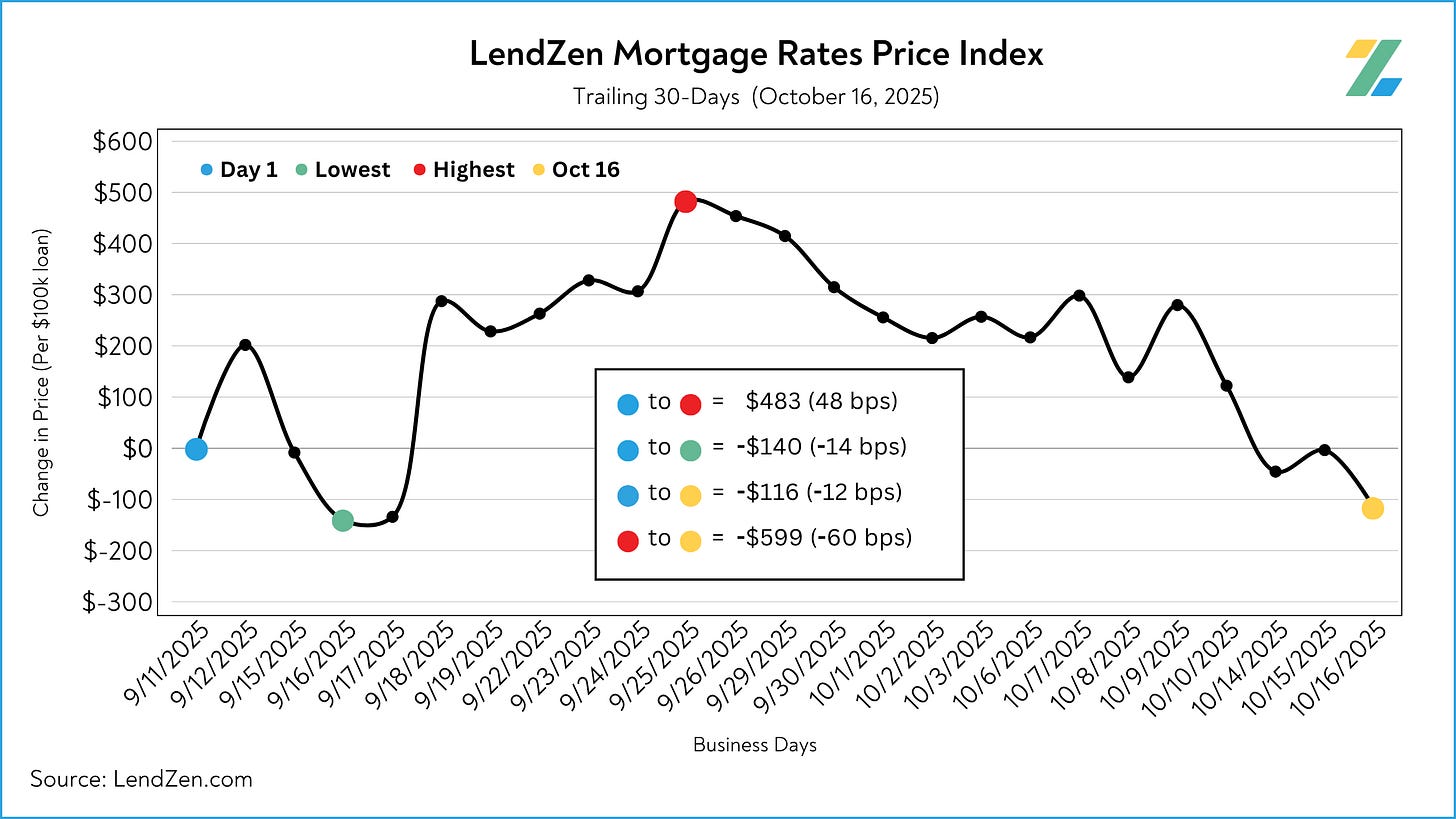

The benefit was not only the 10-Year U.S. Treasury Note closing under 4.00% for the first time in over a year, but also a tightening of mortgage spreads.

I explained the importance of accurately measuring mortgage spreads in this Substack post.

This drift lower in treasury yields, combined with tightening spreads, is a delightful combo platter.

However, given the fleeting nature of the risk-off headlines, and how markets often test key technical levels multiple times before a confirmed breakout occurs, today’s 2-for-1 special could be available for only a limited time.

Regardless, mortgage spreads holding near current levels with declining treasury yields will be good news for the price of mortgage rates.

If bond markets decide to continue serving up an extra side of tighter spreads, then mortgage rates will have an all you can eat buffet of refinance and home buying activity.