Mortgage rates dip to multi-year lows as 2026 awaits 📉💰🎆

The Week Ahead

WEEK AHEAD 🗓️

----------------

Mortgage rates had a stellar year as mortgage bond prices have risen over 340 basis points in the last 12 months.

That means the cost of getting a $500k mortgage is $17,000 cheaper than this time last year.

December also looks poised to finish on a strong note.

After overcoming mid-month volatility, driven by rate cut uncertainty, mortgage rate PRICES are now within 10-bps of the low on October 21.

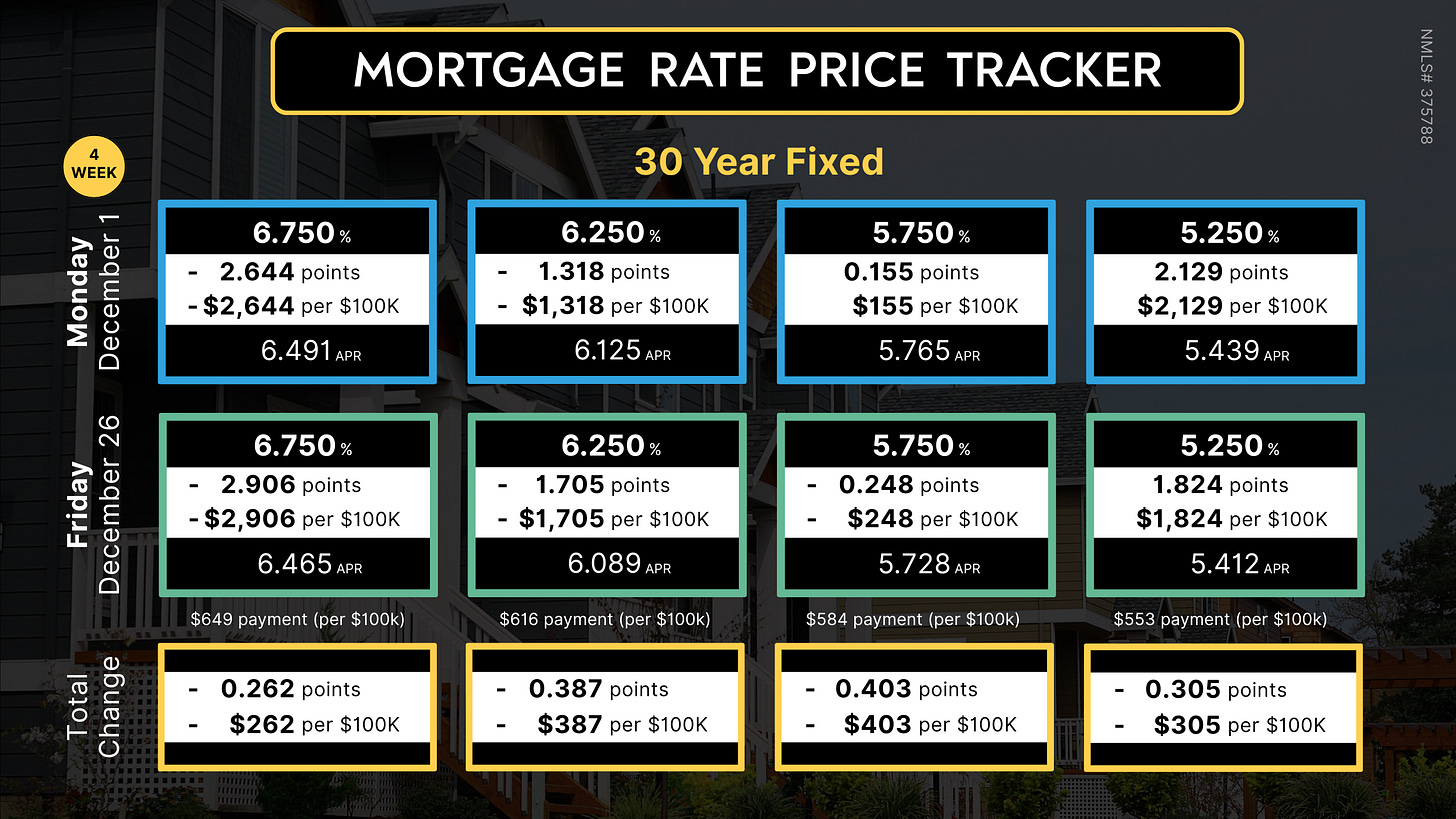

Learn more in Friday’s “Rate Price Tracker” Substack post.

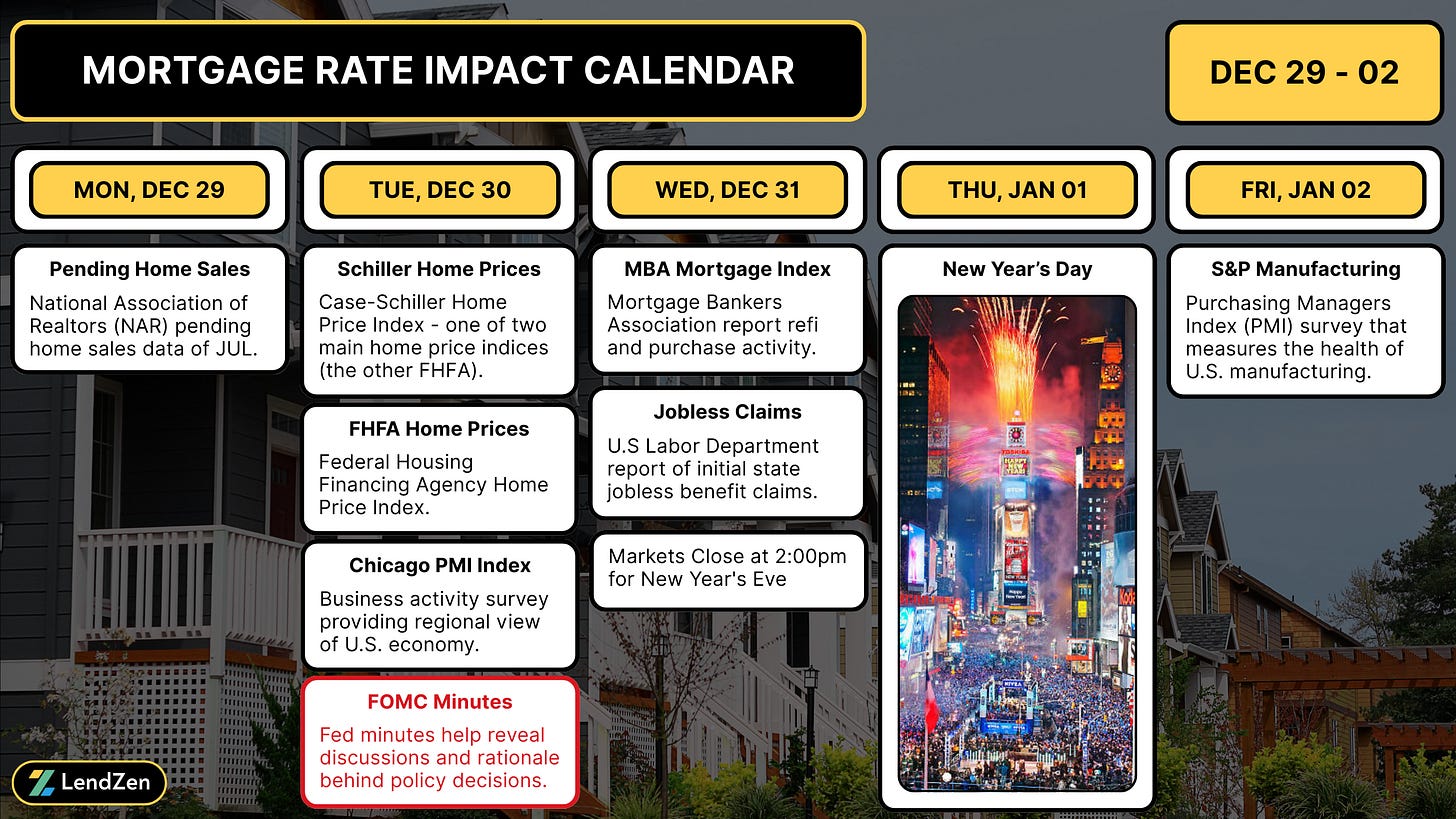

It’s another short week with New Year’s Day landing on Thursday and not much more than a hangover scheduled for Friday.

The early week data, which will be the last of 2025, includes the Chicago Business Barometer PMI, Home Prices, Fed Minutes from the December FOMC, and Jobless Claims.

Monday I will take a deeper look at how mortgage rate prices, bond spreads, and longer-term trends are unfolding in my Monday Data Deluge.

The latest Lock-O-Meter risk scores and rate lock recommendations will be posted with it.

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.