Mortgage rates deliver holiday joy after record drop 📉🎄😁

The Week Ahead

WEEK AHEAD 🗓️

----------------

Mortgage bonds came through last week’s Double Whammy on the winning side of things.

The December Non-Farm Payroll report (Tuesday) did little to inspire bonds, but Thursday’s CPI inflation report finally helped nudge things in the right direction.

November inflation came in below 3% for the first time since August 2024, prior to that year-over-year inflation hasn’t been in the 2-handle since March 2021.

With the “Big 3” data (NFP, CPI, FOMC) out of the way, the rest of the year should hopefully be quiet.

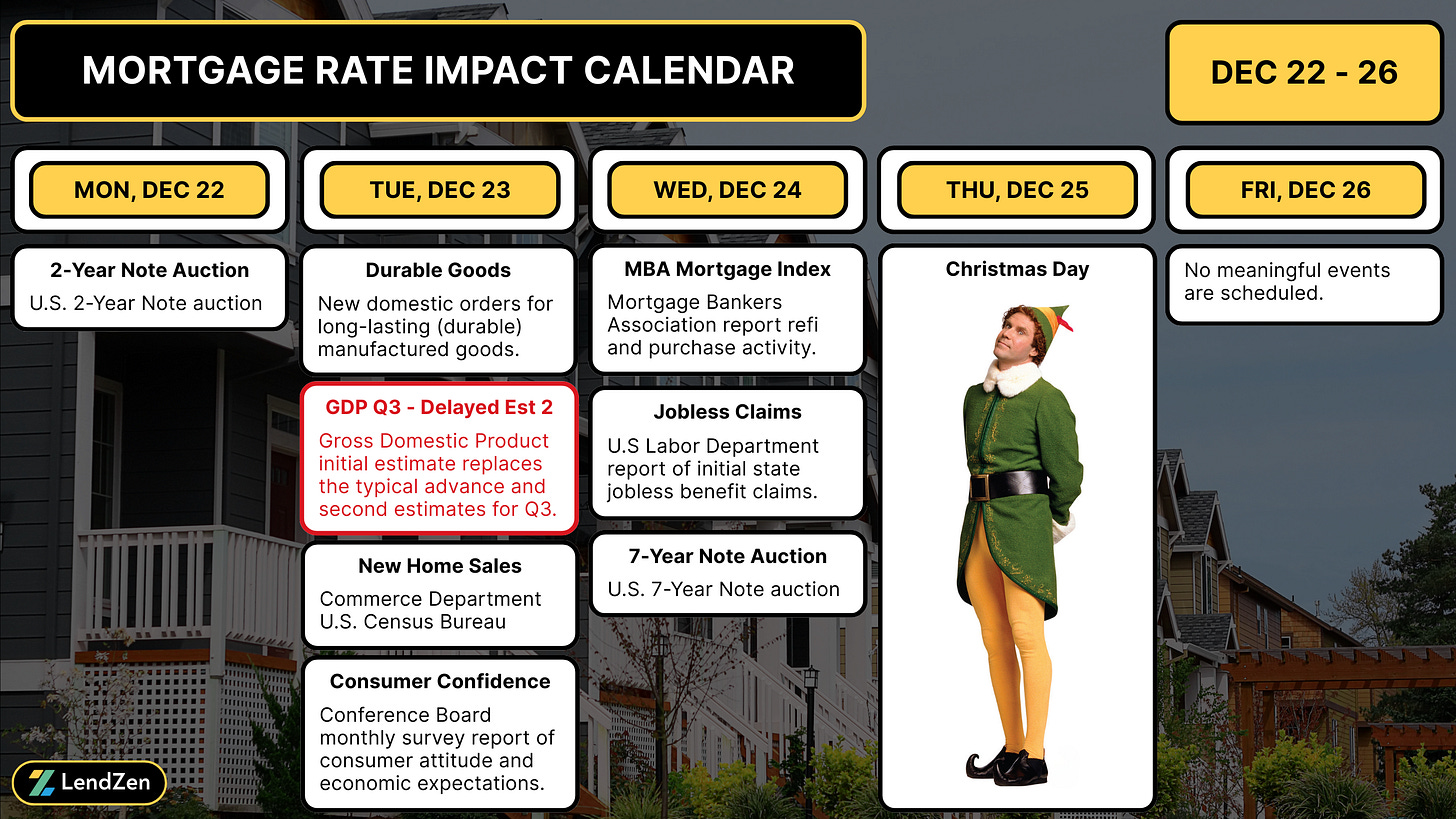

This is a short week with markets closed Thursday for the Christmas Holiday and nothing of importance on Friday.

Tuesday has a delayed preliminary Q3 GDP report, but the actual third and final estimate has been postponed until Thursday, January 22, 2026.

Besides the initial GDP estimate, durable goods orders, and various Treasury bond auctions, there isn’t a whole lot that is expected to rattle markets.

Hopefully, Santa doesn’t have any off-script surprises for us, so we can enjoy a holiday weekend while basking in the best year for mortgage rates since 2020.

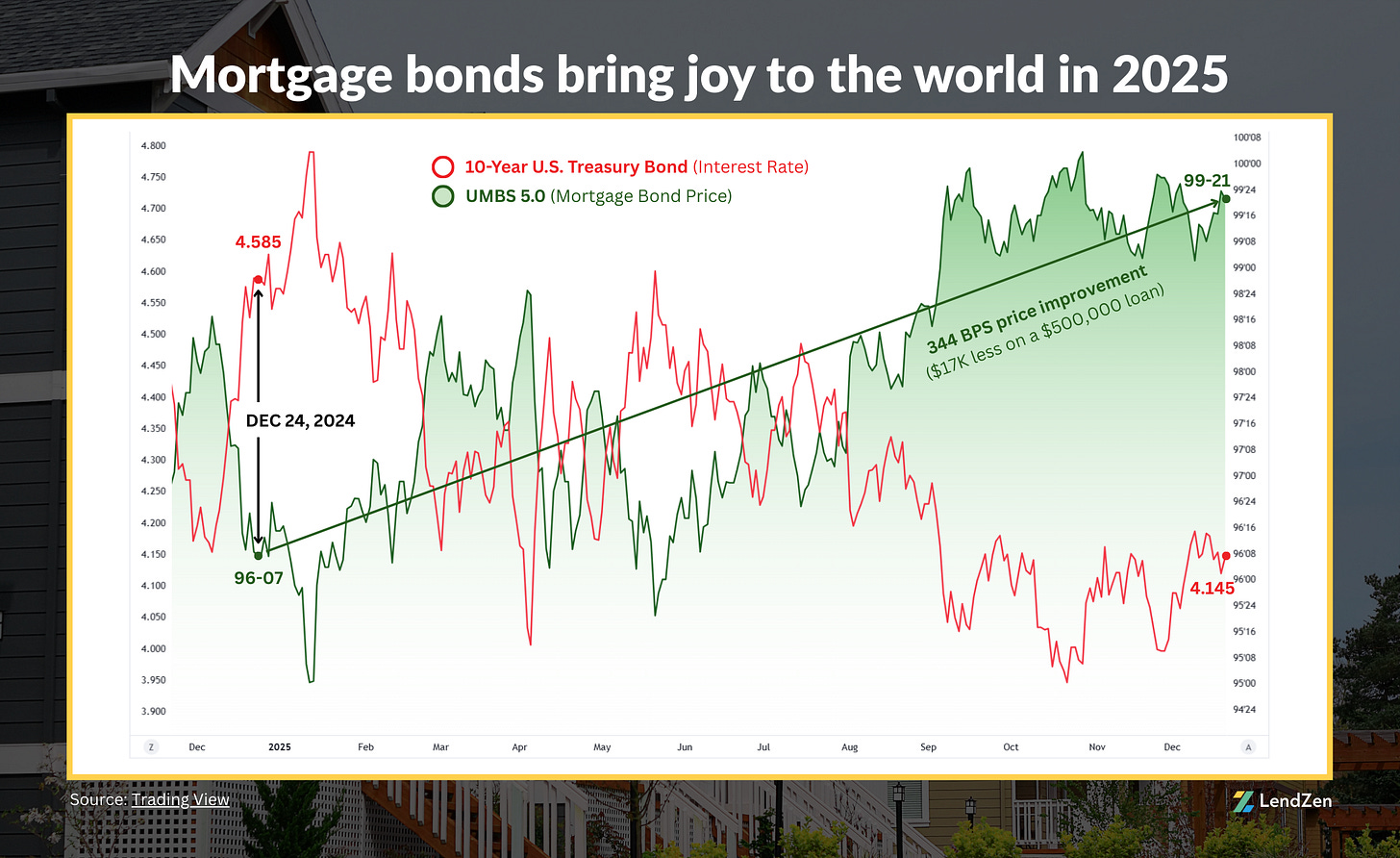

In the last 12 months, mortgage bond prices have risen over 340 basis points.

That means the cost of getting a $500k mortgage is $17,000 cheaper today than during Christmas 2024.

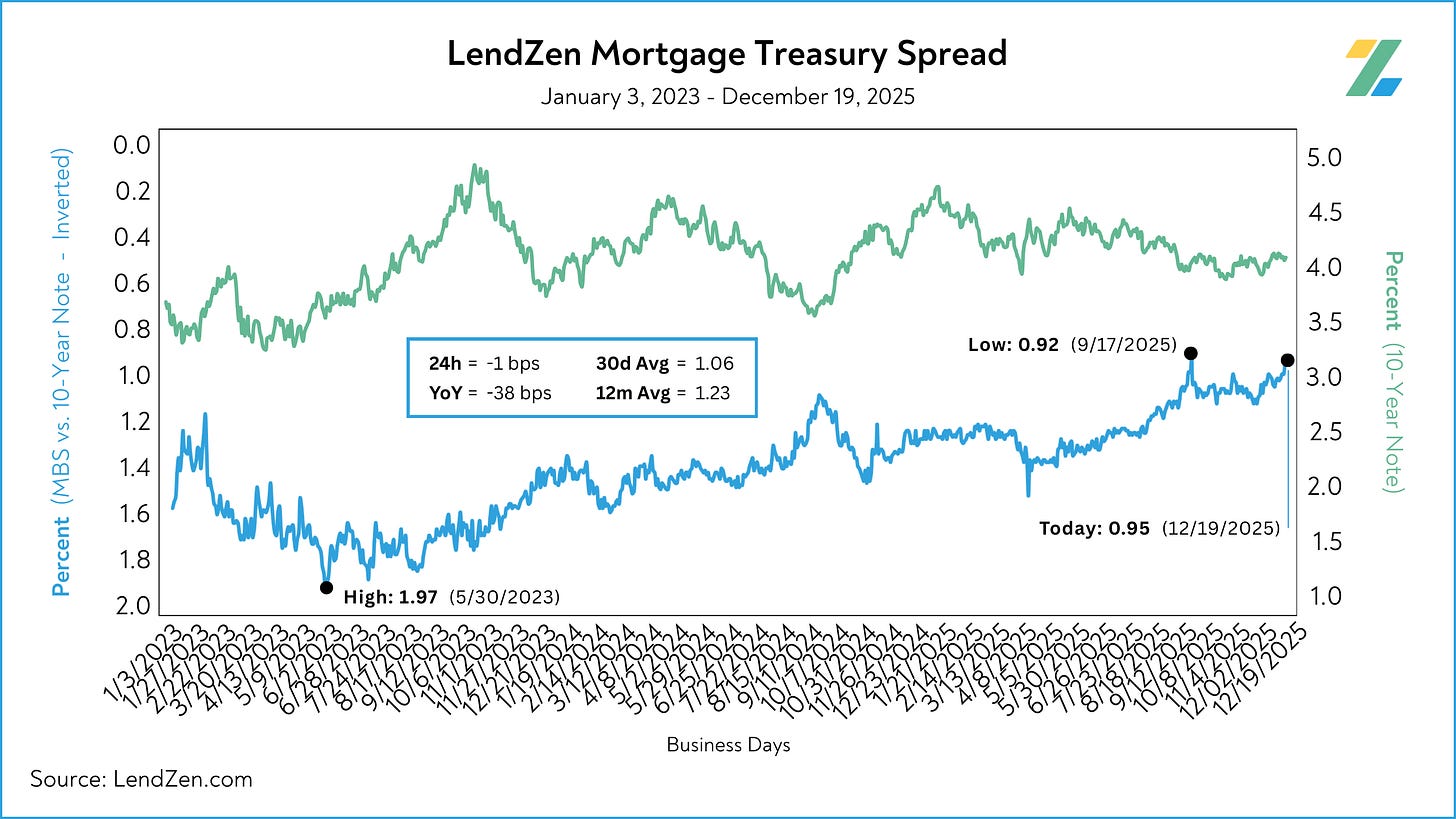

It is worth continuing to highlight that the spread between the 10-Year and MBS is within 3-bps of a multiyear low.

Spreads compressed over 30-bps since last year which is why mortgage rate PRICES are better now than the low in 2024, despite the 10-Year yield sitting 48-bps higher today (3.66 vs 4.14).

There will be no Data Deluge this week.

However, this past Friday’s Mortgage Rate Price Tracker was loaded with charts and should satisfy the holiday appetite of any data junky.

Stay tuned for a possible Midweek Update depending on how things unfold before the holiday begins.

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.