Mortgage rates brace for CPI inflation report 😬 🤞

Bond markets have been breakeven in the previous 5 days, despite some selling pressure early last week.

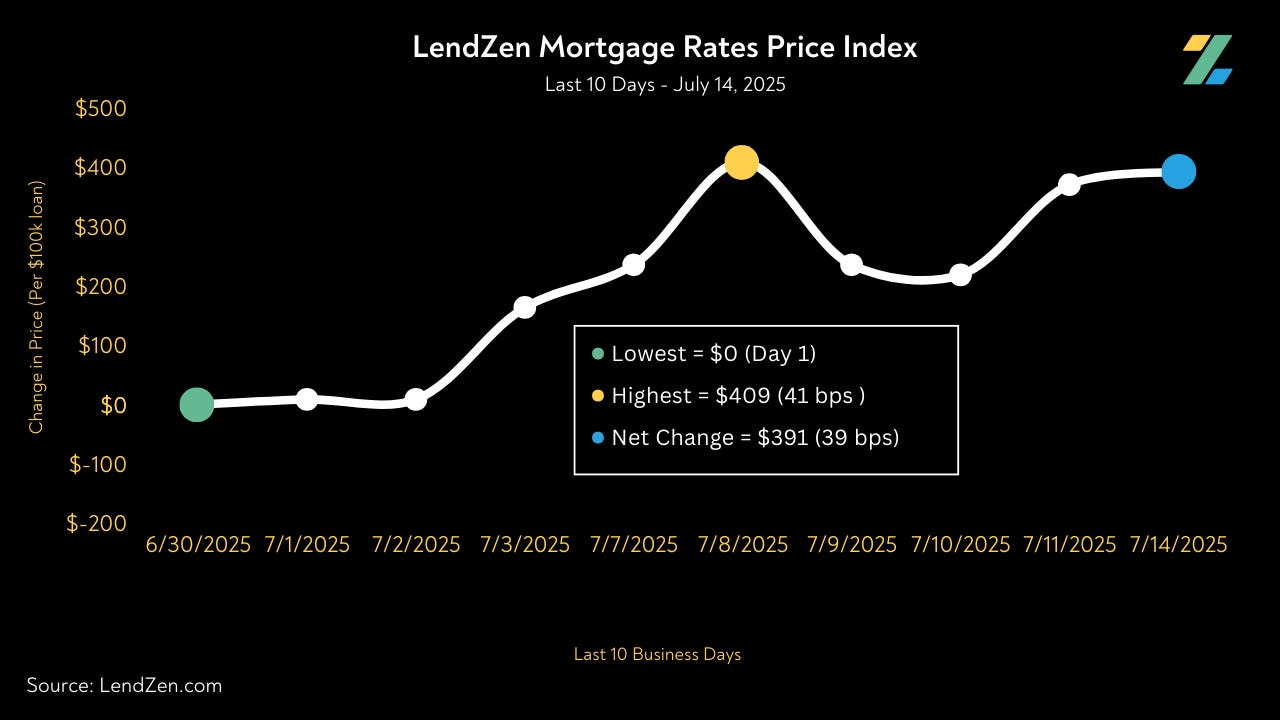

However, July has seen the price of mortgage rates slowly grind higher as shown in the 10-Day Chart of the LendZen Index below.

Since the end of June, the price of mortgage rates has increased 39 basis points, just shy of $2,000 on a $500,000 mortgage.

Mortgage rates do not rise or fall; the full range of rates is always available.

Instead, the price of each rate changes based on the price of mortgage bonds (MBS).

The LendZen Index tracks the price of rates across a spectrum of MBS.

This provides a clearer picture of how the cost to obtain a mortgage has changed, regardless of the lender, rate, or borrower credit score.

You can keep track of the index at LendZen.Substack.com

The change in mortgage prices has tightened in a narrow range recently as bond investors wait for tomorrow's Consumer Price Index (CPI) report.

This is also the first major June data release this month (July).

The report carries extra weight because it could reveal early signs of tariff-related inflation.

This risk is something several Fed officials has flagged as the reason for holding their interest rate policy unchanged, despite immense pressure from the Trump Administration to cut rates.

If CPI shows no material impact, bond prices could improve on the news, helping to reduce the cost of mortgage rates.

But if inflation surprises to the upside, expect pressure on bond prices.

Volatility is likely regardless, and markets could react contrary to what the data suggests.

This is sometimes the case when markets react more to the details “under the hood” of the data versus the headline numbers.

Knee jerk moves can also correct fiercely in the days that follow.

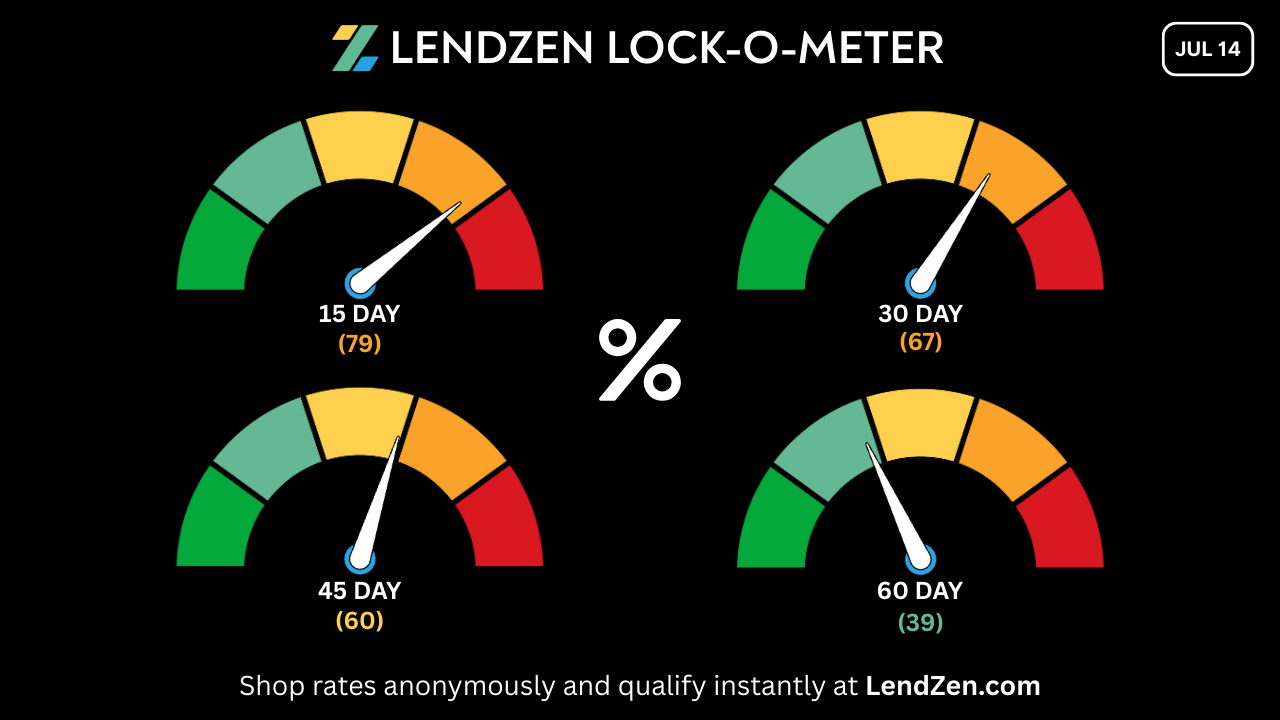

Keep your fingers crossed if you decided not to lock today and stay tuned for an update to the LendZen LOCK-O-METER tomorrow.

Today’s rate lock risk scores and weekly calendar was posted earlier today here:

Want to check customized, real-time mortgage rates instantly? 🧮

LendZen (NMLS# 375788) gives you real-time access to mortgage rates that update as bond prices change.

The detailed loan summaries have an interactive rate slider that shows all current mortgage rates and full transparency of costs upfront.

All information can be viewed anonymously and without any sign-up requirements or human interaction. This makes exploring the full range of rate options hassle-free.

See for yourself and customize your own loan scenario at LendZen.com