Mortgage rates are on the run 🌬️🏃➡️📈

Midweek Market Update

THE STORYLINE – NOV 5

-----------------------------

Markets remain under pressure this week as the government shutdown drags on into its second month.

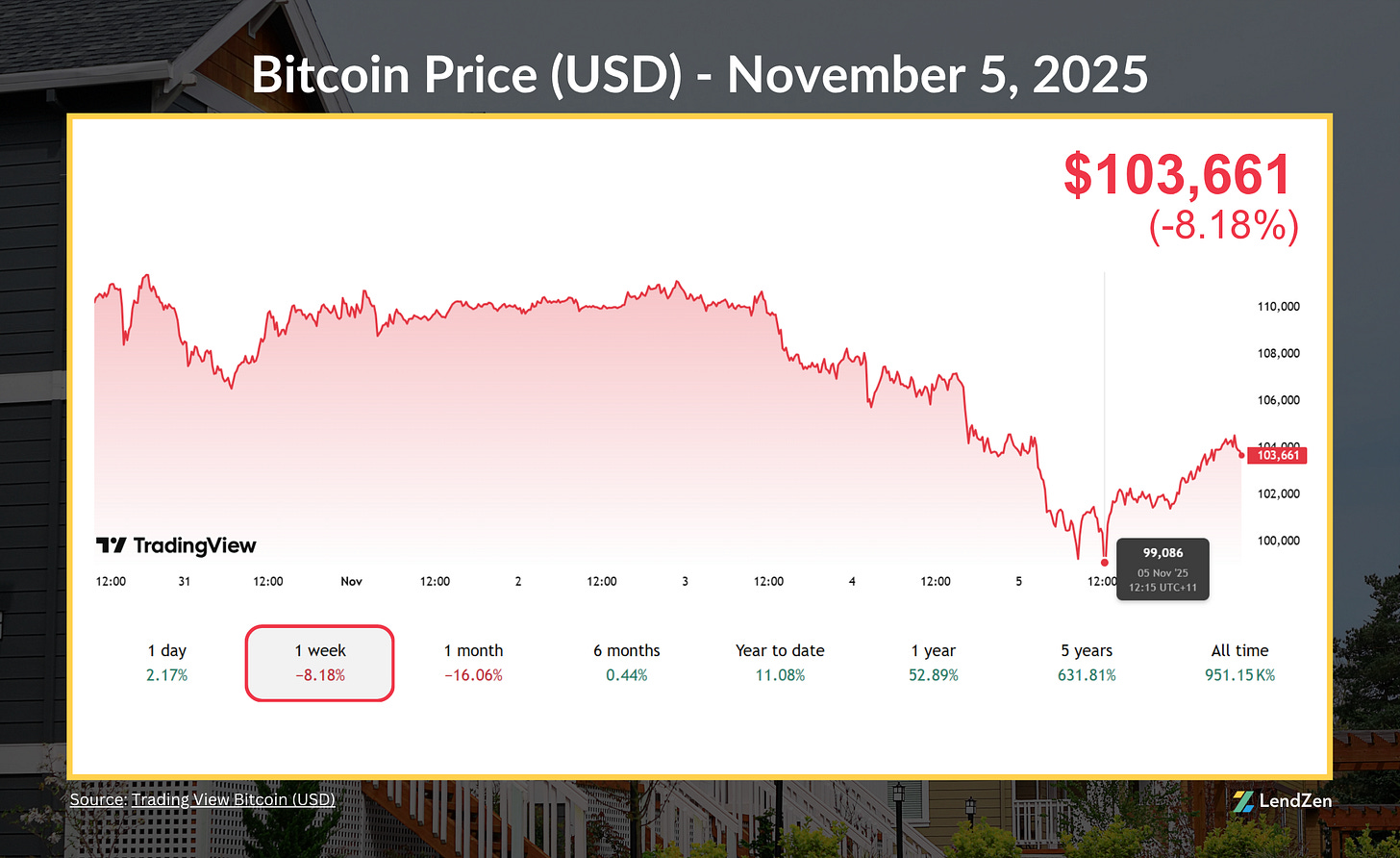

Equities and precious metals are sideways to down the last 5-days, while crypto looks shaky with Bitcoin dipping below $100K overnight.

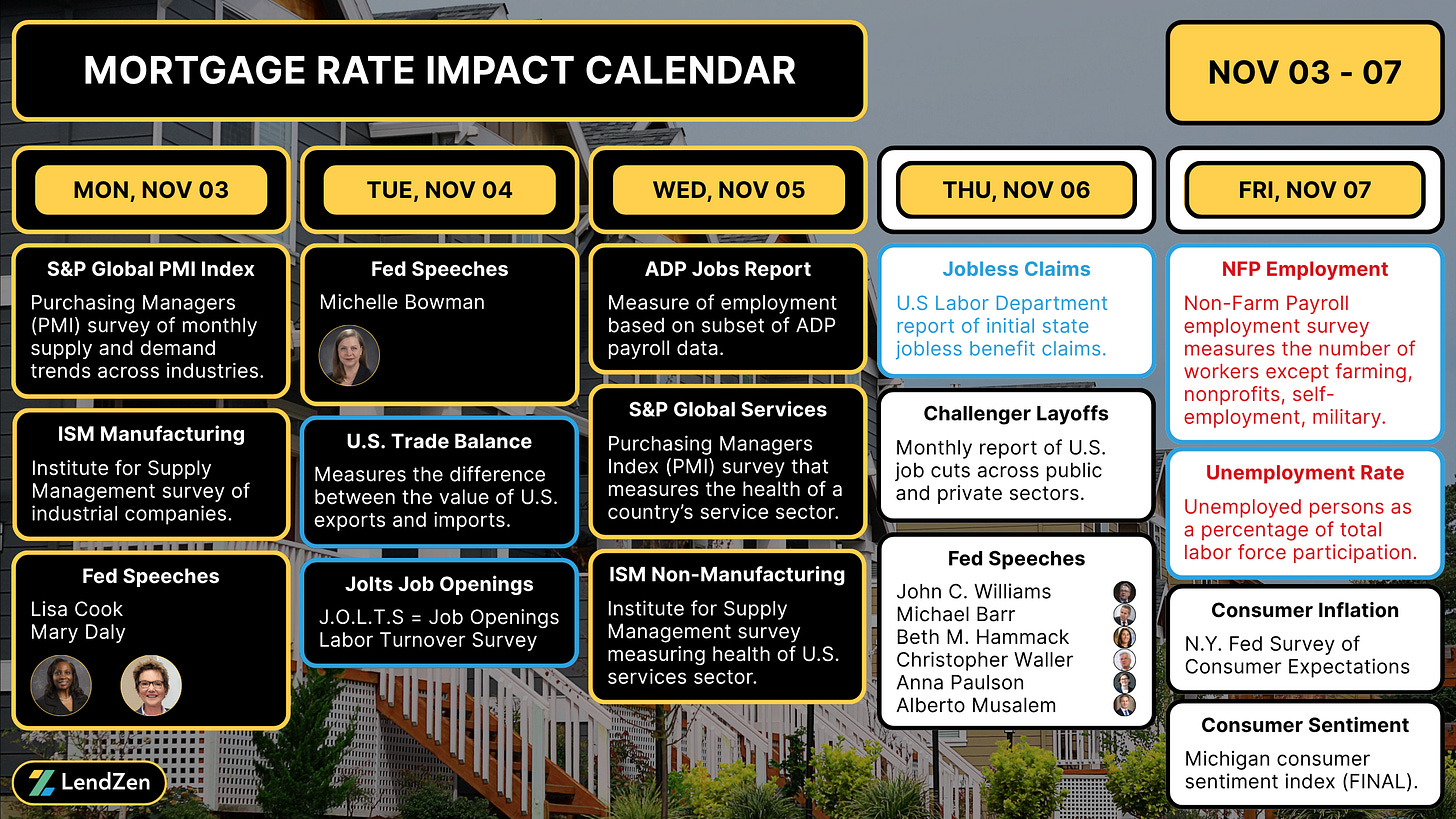

Today’s data included the ADP payrolls employment report and service sector surveys.

ADP was weak but slightly better than expected, creating some early selling in bonds.

Services data also beat expectations, accelerating the bond sell-off.

**Events marked blue could be delayed by the shutdown

And it’s gone …

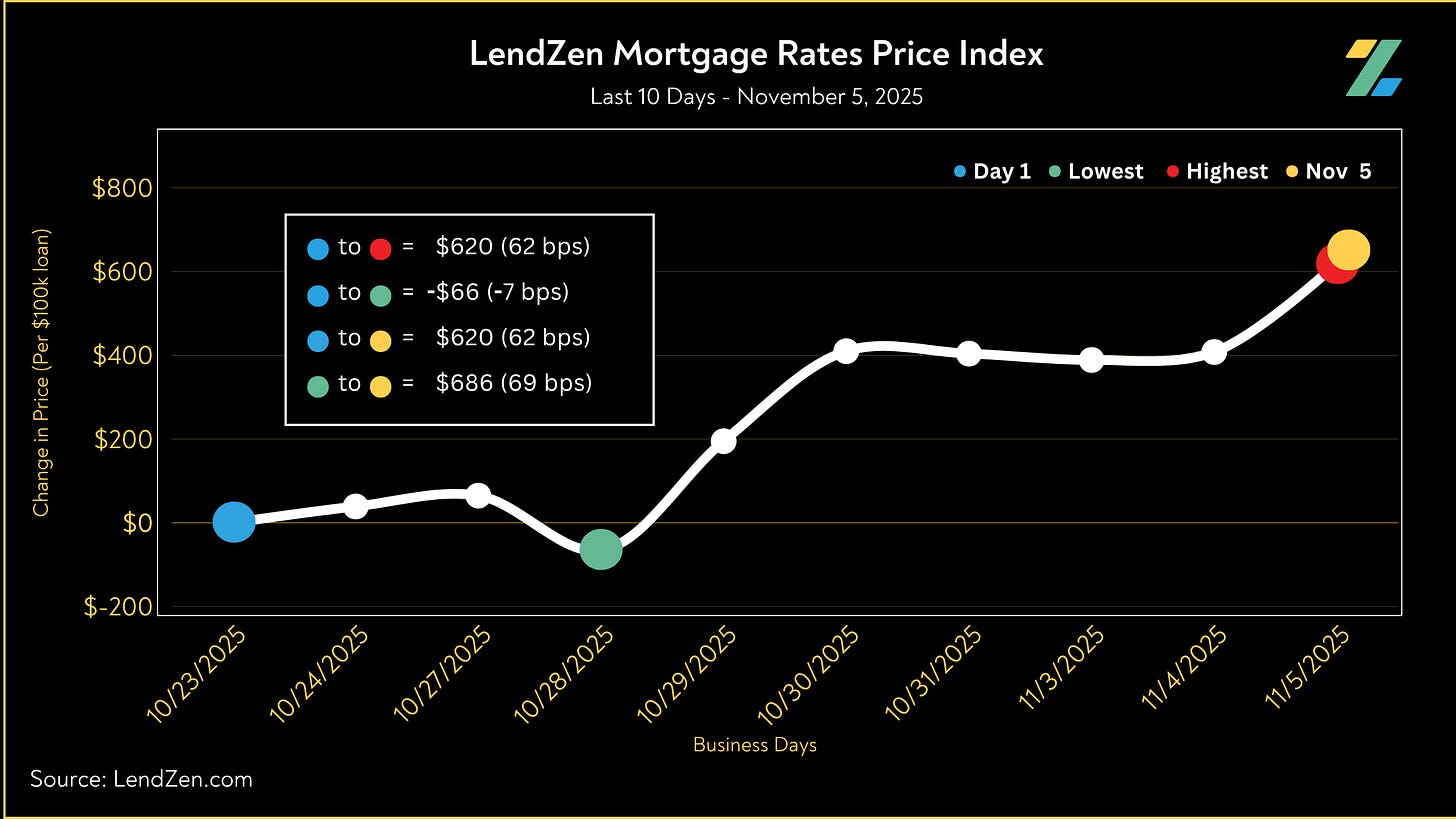

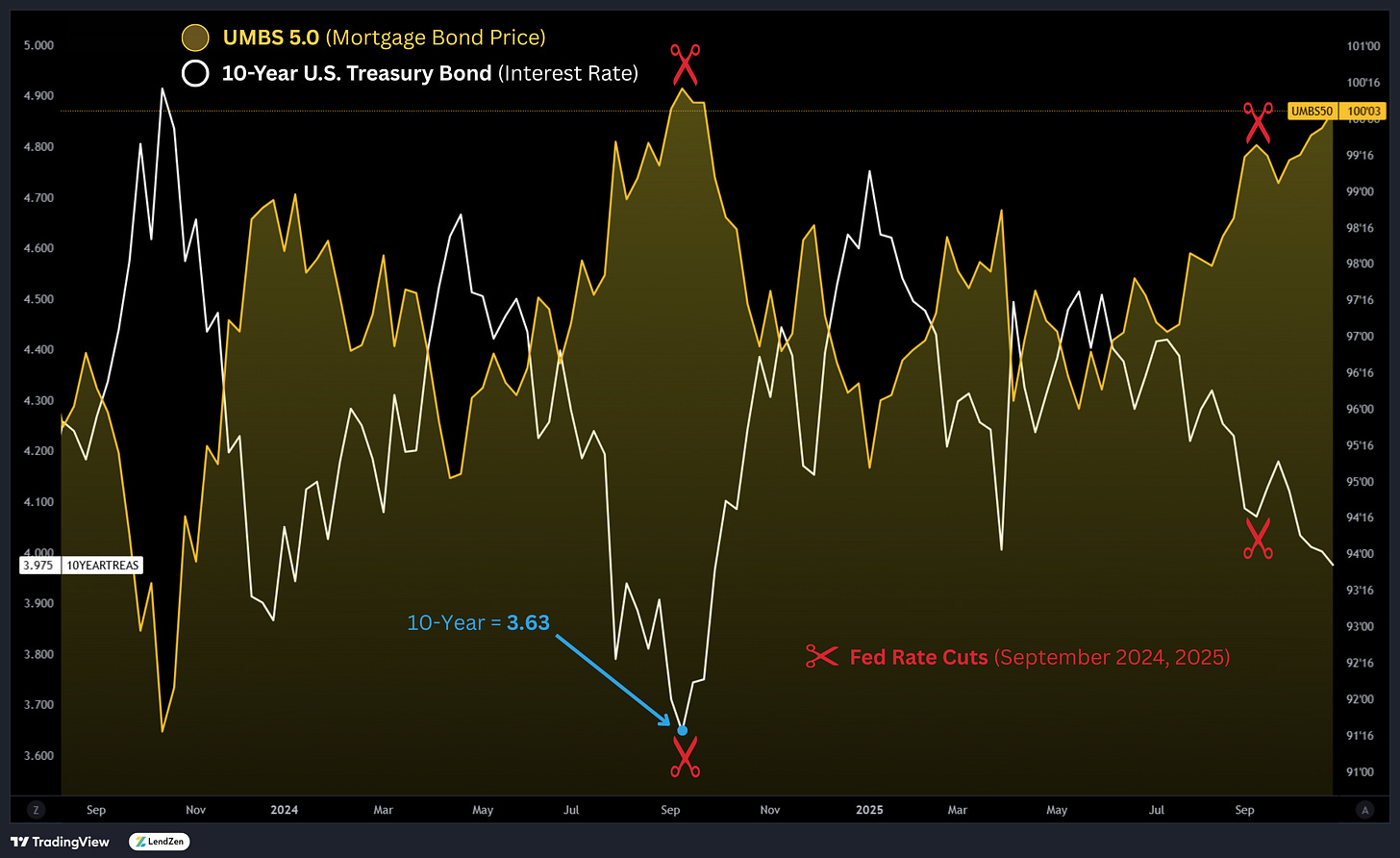

Mortgage rate prices are up 21 basis points after today.

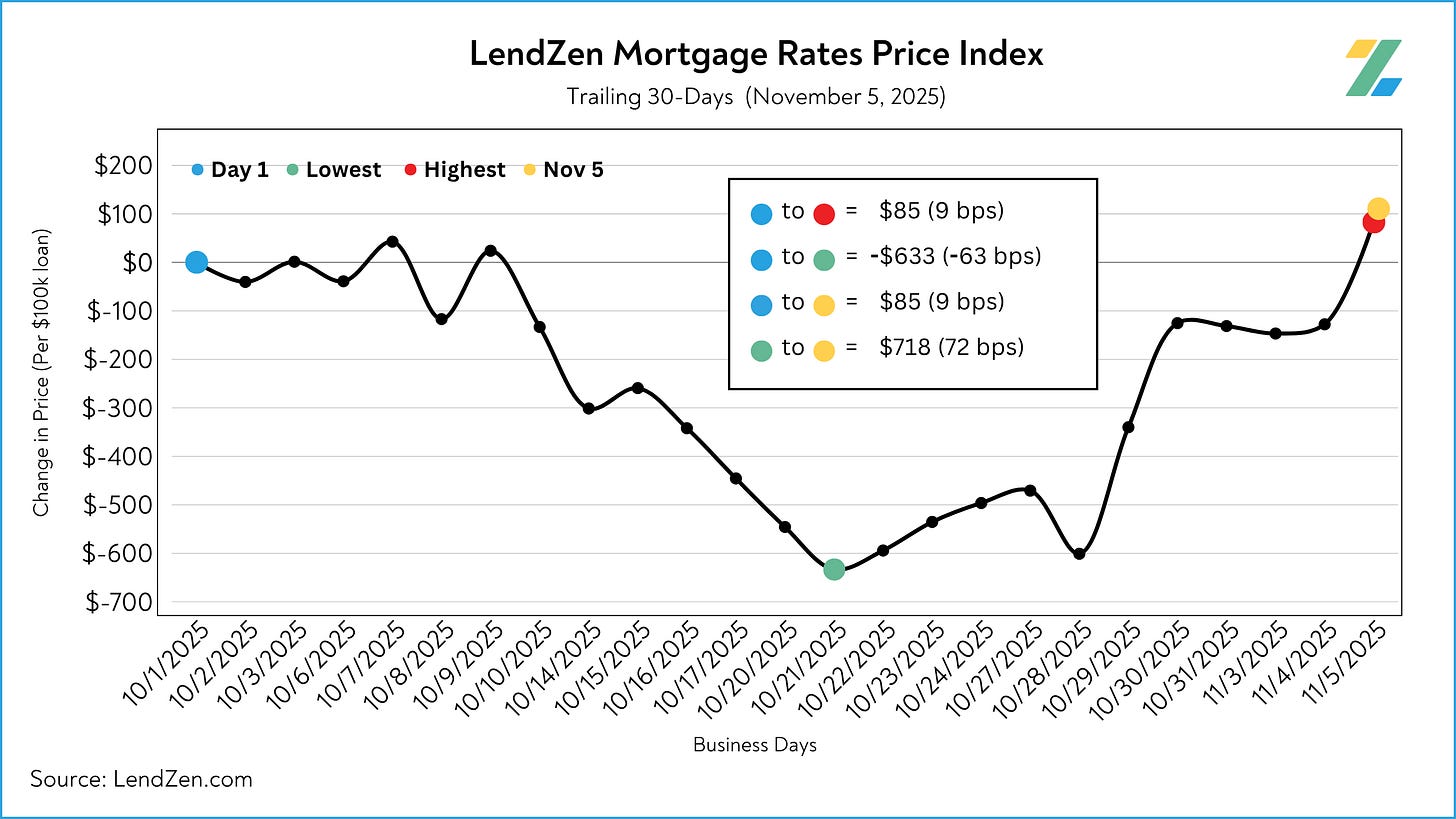

Combined with the post-FOMC sell-off, the 30-day trend has reversed - mortgage rate prices are now higher than a month ago, up 72 bps from October 21.

For a deeper look at how mortgage rate prices, bond spreads, and longer-term trends are unfolding read the Monday Data Deluge.

LENDZEN INDEX

-------------------

Learn more about the LendZen Index and explore the full data series at LendZen.substack.com

24-Hour: +21 bps

5-Day: +21 bps

10-Day: +62 bps

30-Day: +9 bps

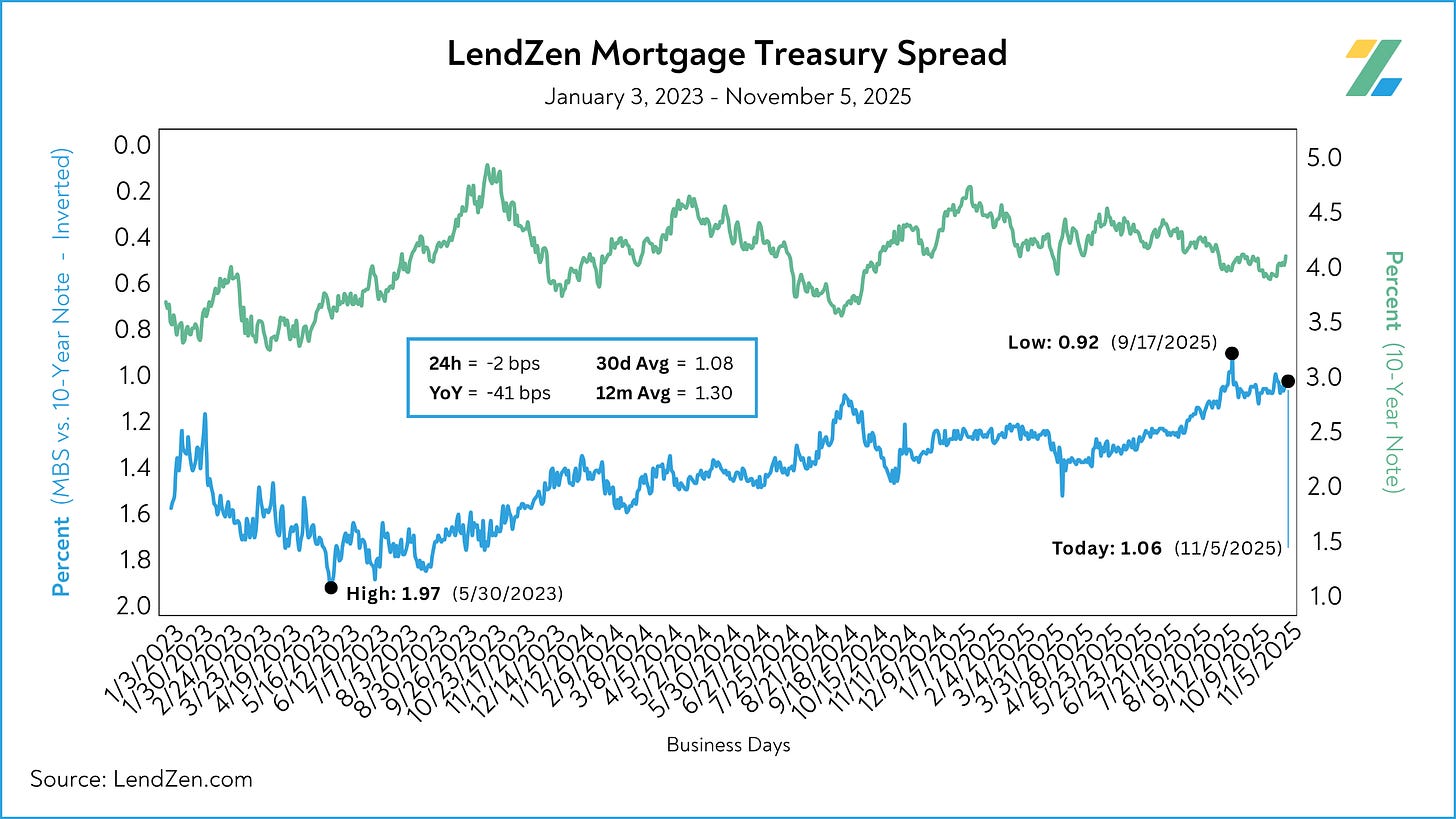

LENDZEN MORTGAGE-TREASURY SPREAD

----------------------------------------------

The LMTS is posted daily with the LendZen Index.

Nov 5: 1.06

24h: -2 bps

12m Avg: 1.30

YoY: -41 bps

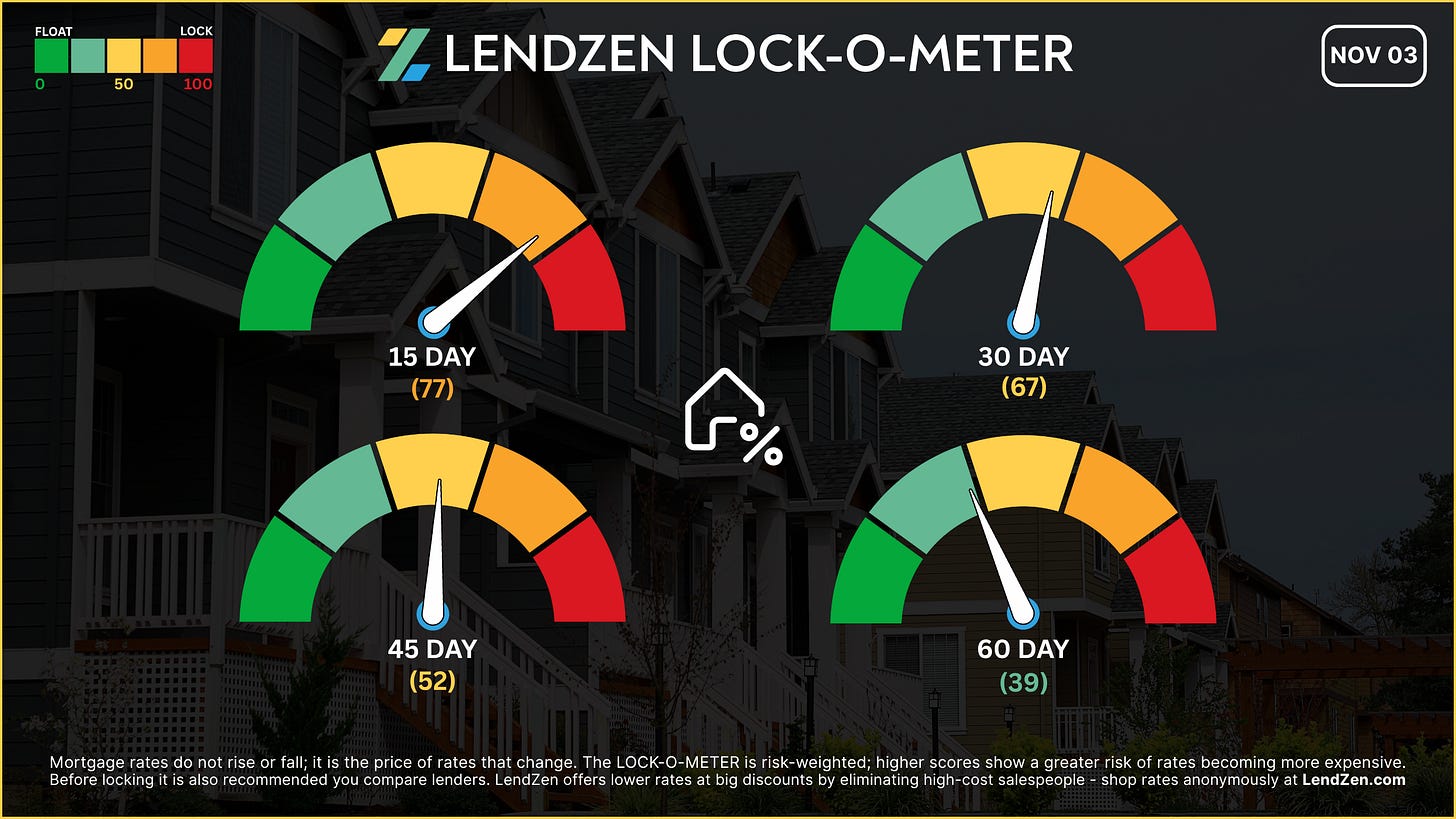

LOCK-O-METER

------------------

The +- changes are based on November 3 risk scores posted in the Monday Data Deluge.

[ 15 Days ] -- 79 (+2) 🟠

Short-term risk remains high as bond selling continues and Powell’s post-FOMC tone undermines rate-cut optimism. Mortgage pricing up another 20 bps adds to near-term lock pressure.

[ 30 Days ] -- 69 (+2) 🟡

The 30-day LendZen Index trend has reversed upward in cost, signaling deteriorating momentum. Meanwhile, data blackouts keep markets guessing. The elevated uncertainty and weaker sentiment warrant a mild uptick in risk scores.

[ 45 Days ] -- 53 (+1) 🟡

Longer windows are also feeling the impact of the trend shift, nudging the score a bit higher.

[ 60 Days ] -- 39 (+0) 🟢

The bond sell-off today was driven by slightly better than expected results, but the data was still weak - no change in score here as a result.

Learn more about the Lock-O-Meter and when to lock your rate in this Substack post.

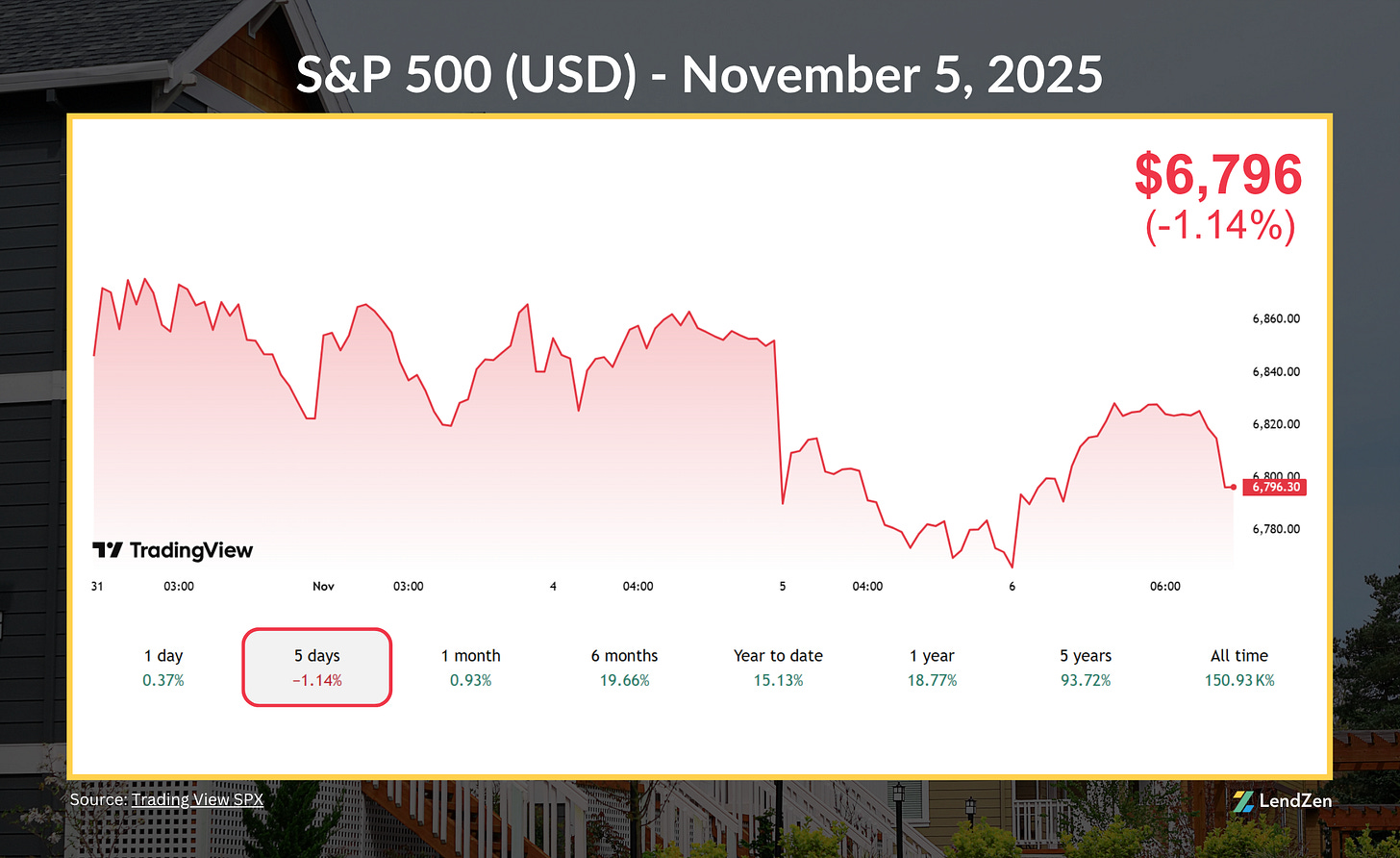

EQUITIES (5-Day)

----------

DJIA: 47,311 (-0.73%)

S&P 500: 6,796 (-1.14%)

NASDAQ: 25,660 (-1.46%)

CRYPTO (1-Week)

---------

Bitcoin: $103,661 (-8.15%)

Ethereum: $3,435 (-13.69%)

Solana: $161 (-16.73%)

PRECIOUS METALS (5-Day)

----------------------

Gold: $3,985 (-0.91%)

Silver: $48.03 (-0.98%)

Platinum: $1,549 (-1.07%)

Thanks for reading.

If you are interested in more mortgage insights, then I suggest checking out this recent Substack article.