Mortgage rates and markets take an early holiday snooze 🏠🥱🦃

Midweek Market Update

Welcome to the Midweek Update!

Included in this update are the following:

Shop real-time mortgage rates anonymously and get instant qualification results at LendZen.com

NOVEMBER 26 ⏪

-----------------

Quiet trading has defined the short Thanksgiving week.

Bonds found a mild boost on Tuesday after PPI didn’t have any surprises, while retail sales missed expectations on Wednesday.

The weekly ADP payrolls data reinforced the soft-labor narrative that has helped mortgage rates improve slightly since the first week of November.

Most sectors are slightly better on the week, with volatility absent and trading volume thinning into the holiday break.

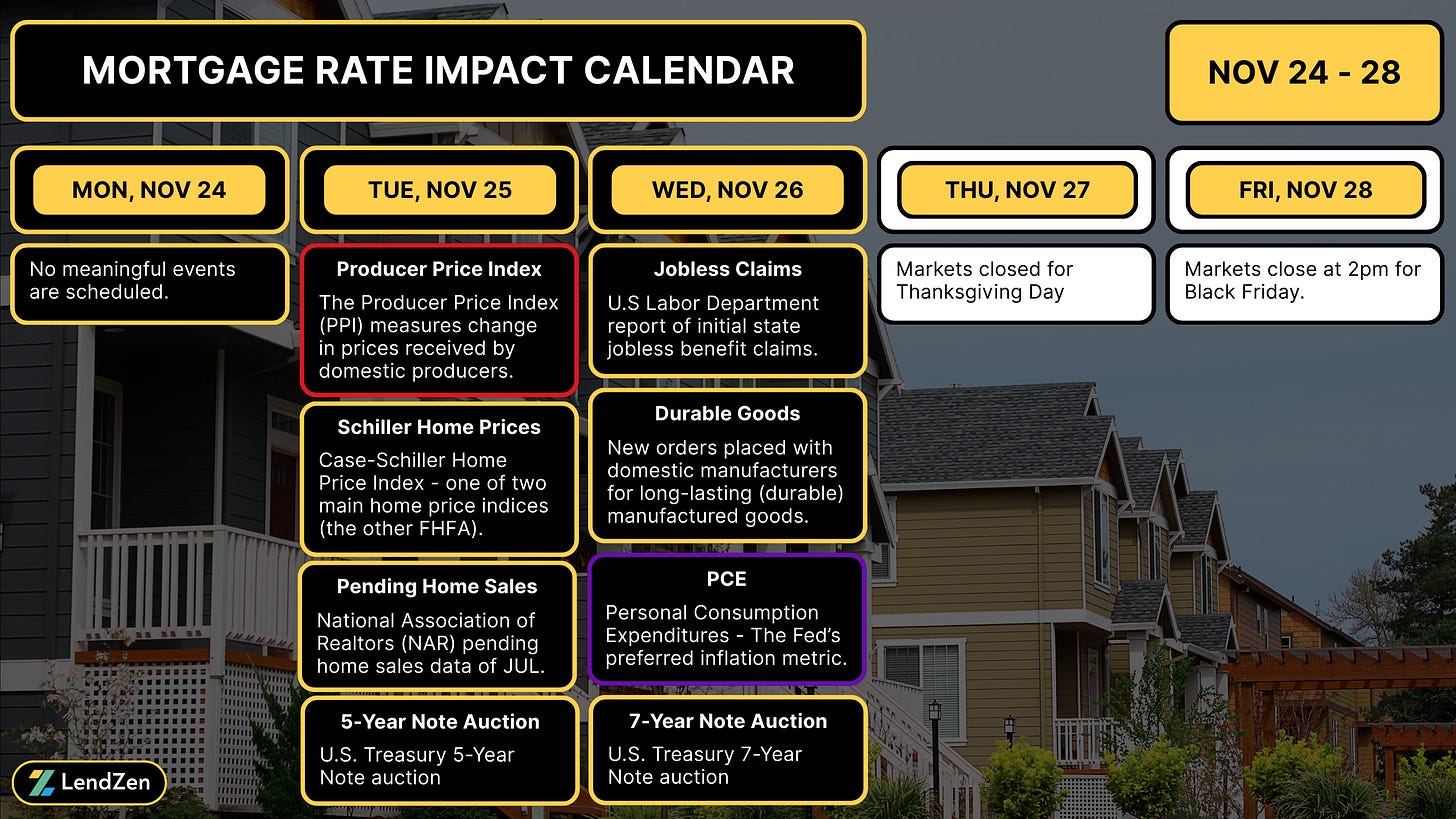

IMPACT CALENDAR 📅

-----------------------

Markets are closed tomorrow for Thanksgiving and will have a short day on Friday (2pm).

**Events marked purple were rescheduled as a result of the shutdown

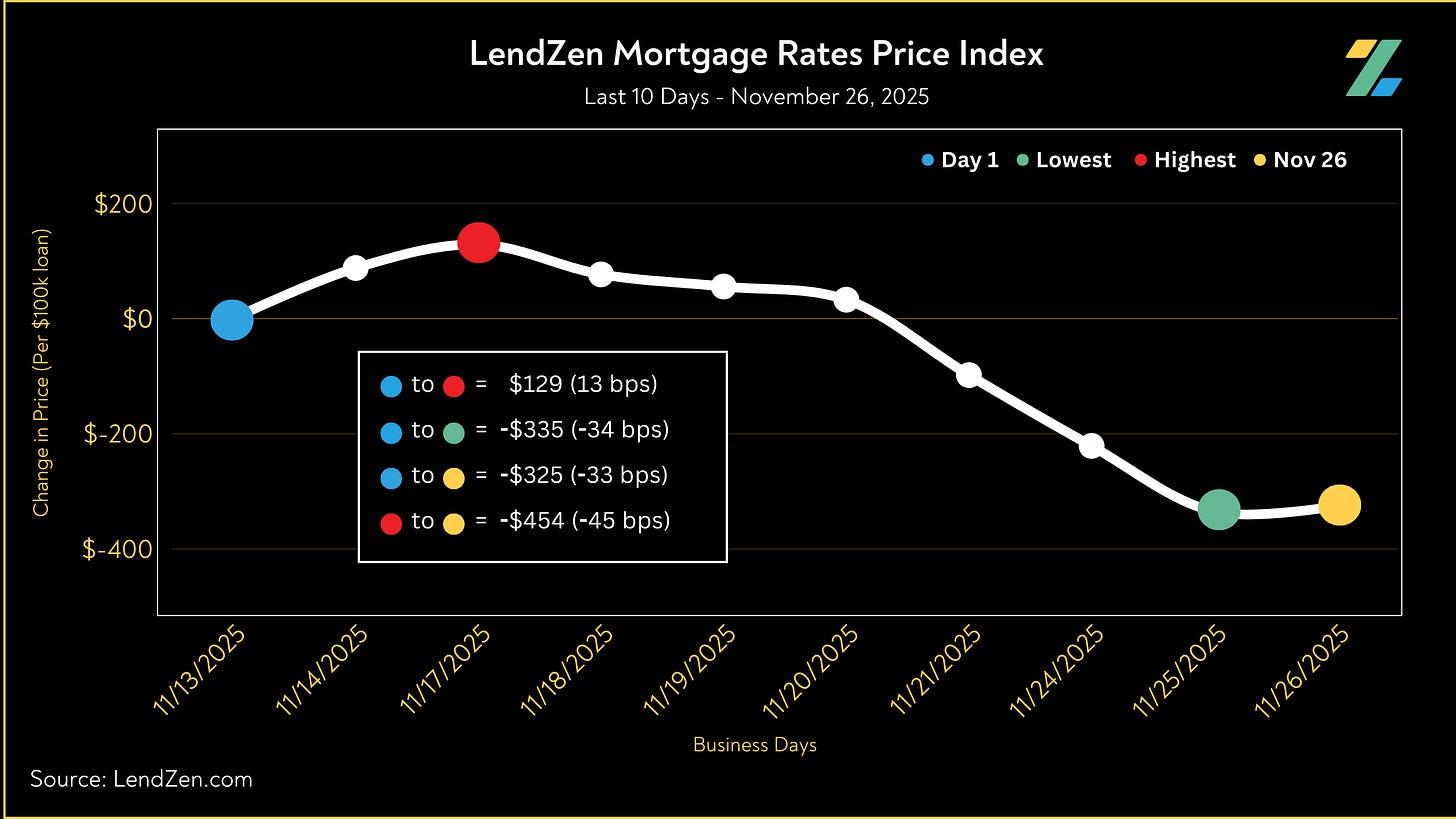

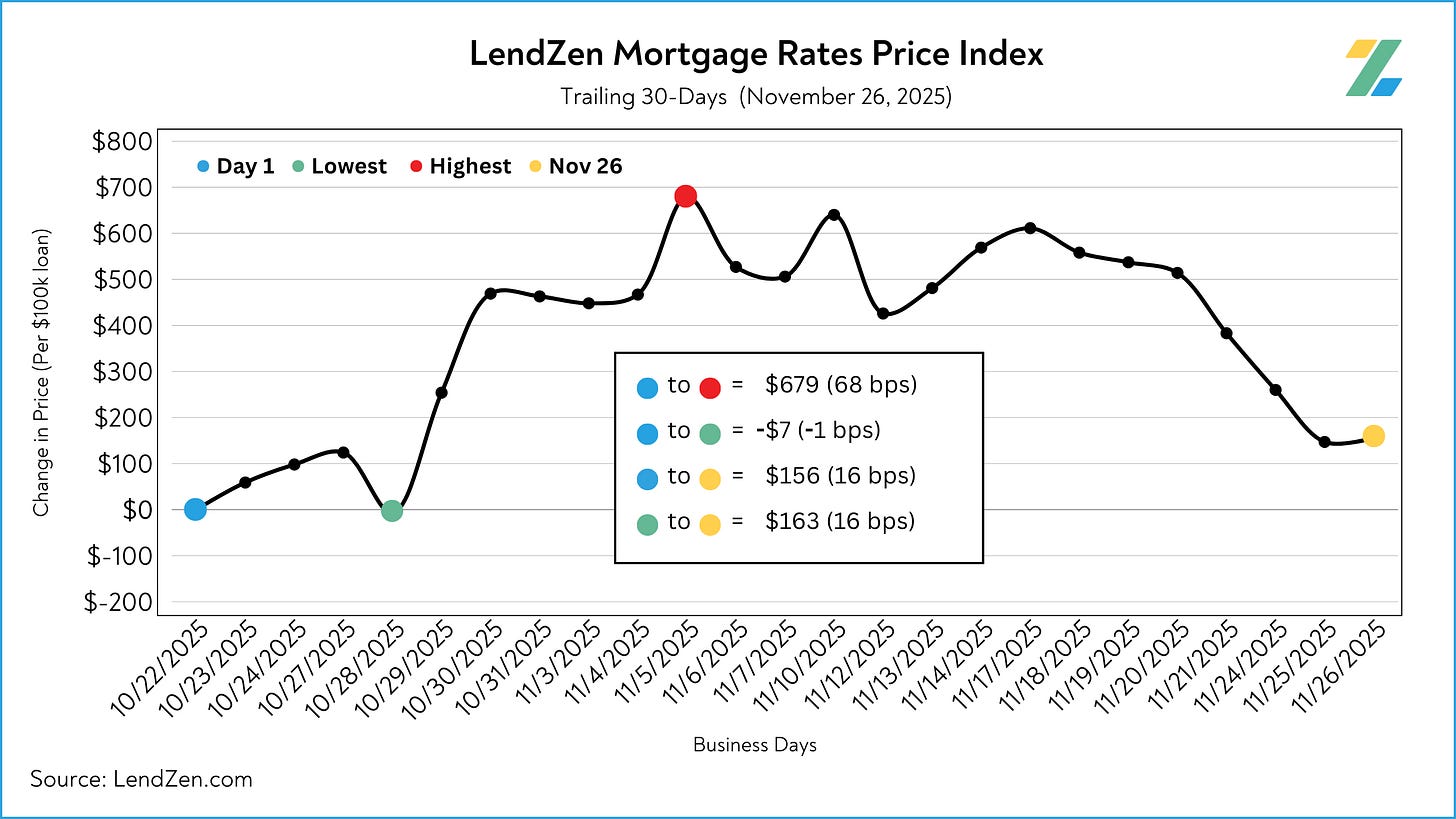

MORTGAGE RATE PRICES 📉

-----------------------------

Mortgage rates do not rise or fall, instead the PRICE of rates change.

The LendZen Index calculates a daily change in the price of mortgage rates by tracking a spectrum of mortgage-backed securities (MBS).

-----------

24-Hour: +1 bps ($10 per $100K)

5-Day: -36 bps (-$358)

10-Day: -33 bps (-$325)

30-Day: -18 bps (-$179)

60-Day: -132 bps (-$1,319)

Learn more about the LendZen Index and explore the full data series at LendZen.substack.com

MORTGAGE SPREADS 🧈

-------------------------

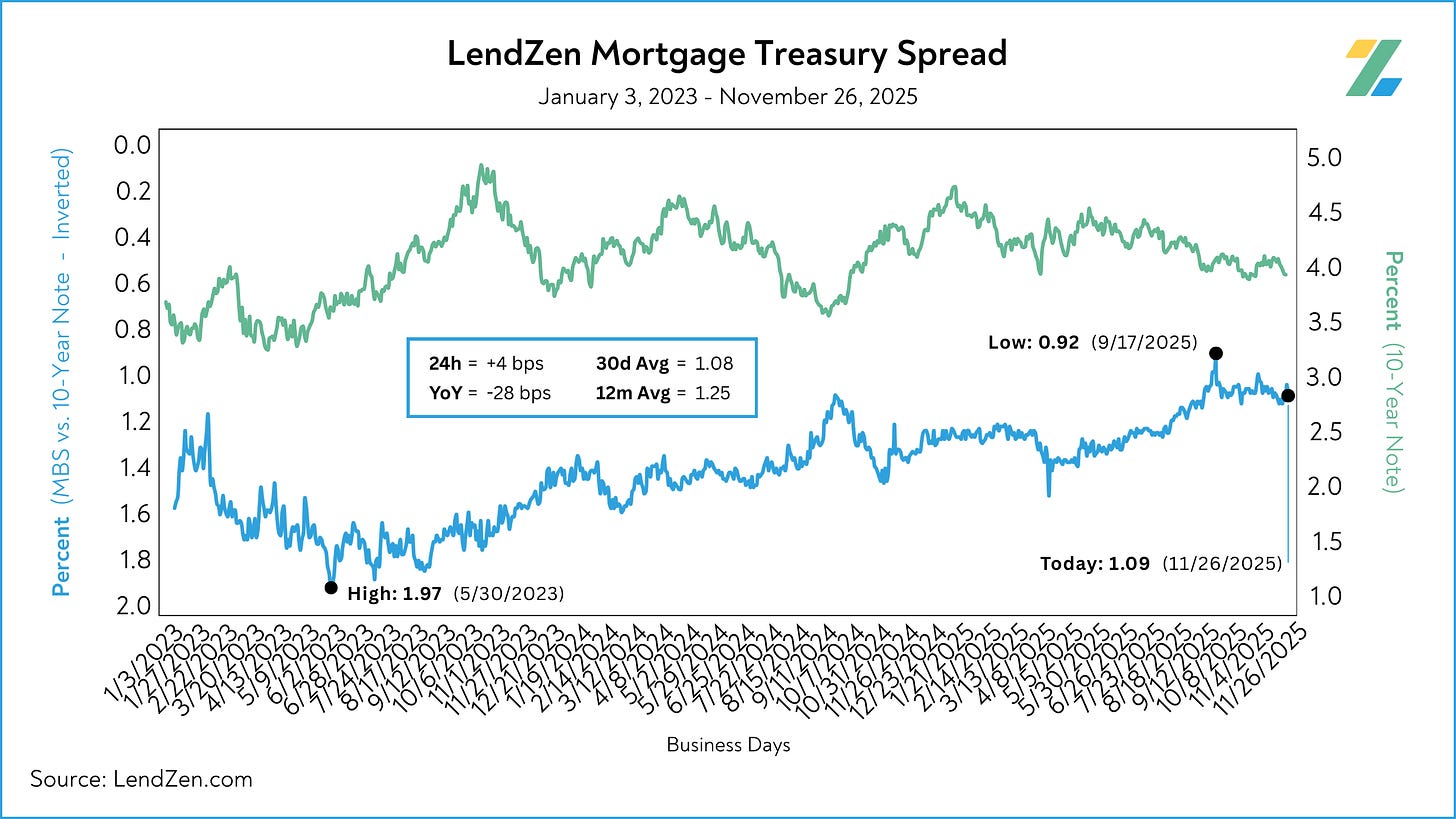

Published daily with the LendZen Index is the LendZen Mortgage-Treasury Spread.

The LMTS uses actual bond yields to create a historically consistent, and reliable, data set.

-----------

Nov 19: 1.12

Nov 26: 1.09

24h: +4 bps

5d: -3 bps

12m Avg: 1.25

YoY: -28 bps

Learn more about the importance of accurately calculating spreads on this Substack post.

RATE LOCK GUIDE 🔒

---------------------

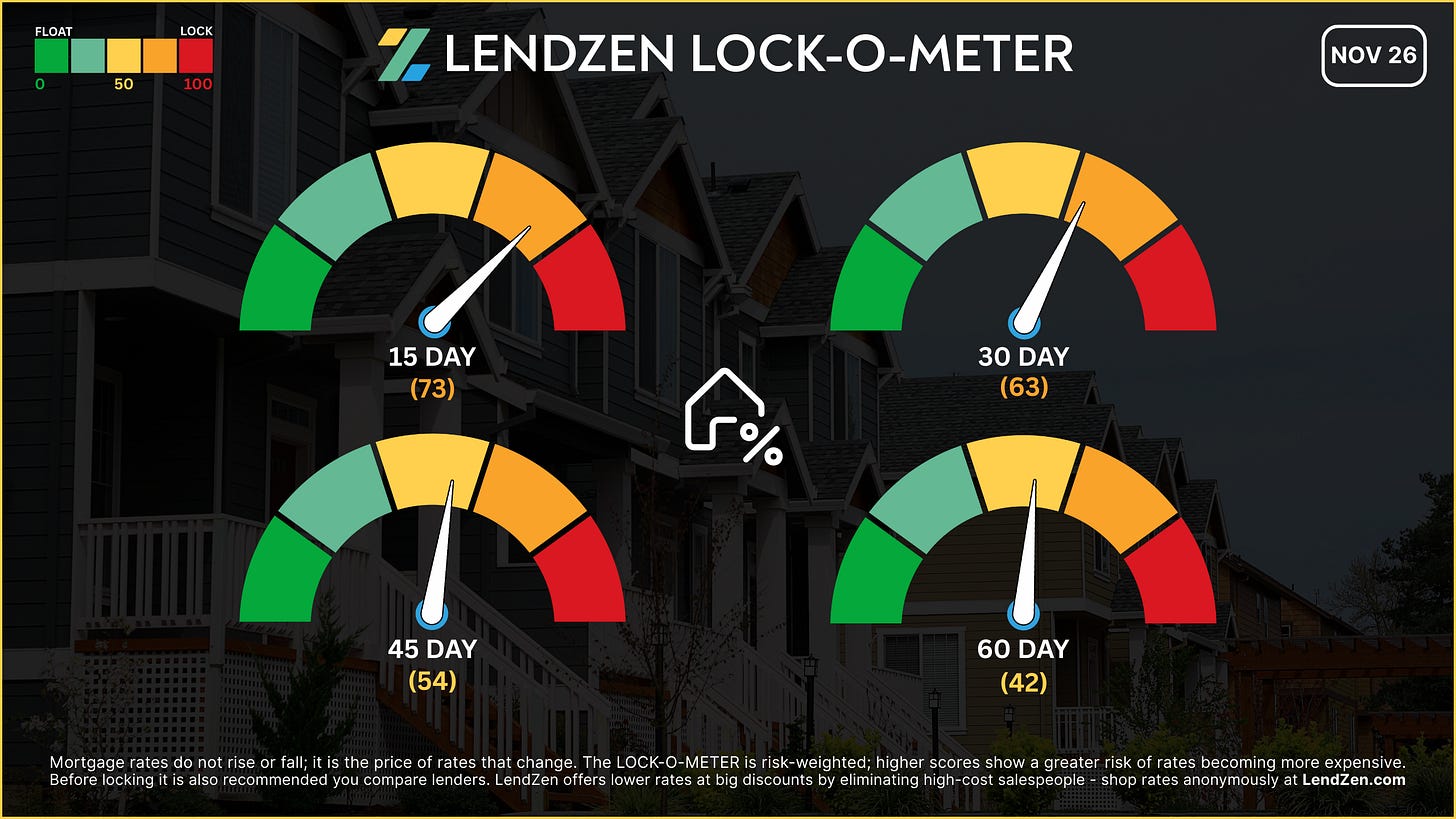

The LendZen LOCK-O-METER provides borrowers with a risk-weighted score based on how various macroeconomic events, including market data, central bank announcements, and geopolitics, each historically impacts the price of bonds.

higher risk scores = lean towards locking

------------------

Closing Window

------------------

[ 15 Days ] — 73 🟠

Holiday liquidity keeps risk tilted toward locking; any stray headline could trigger outsized moves in thin markets.

[ 30 Days ] — 63 🟠

It has been a steady, but fragile improvement, as bonds hold small weekly gains. December’s FOMC and NFP looming will be the next market movers to watch.

[ 45 Days ] — 54 🟡

December volatility risks fade slightly depending on the results of the FOMC and NFP. Revisit your lock strategy after markets process the Fed rate decision and November econ data.

[ 60 Days ] — 42 🟡

The longer view remains in float territory if econ data stays bond supportive and mortgage rate prices hold below the August NFP levels.

Learn more about the Lock-O-Meter and when to lock your rate in this Substack post.

STOCK MARKETS (5-Day) 📊

-----------------------------

DJIA: 47,418 (+3.53%)

S&P 500: 6,812 (+3.92%)

NASDAQ: 25,233 (+4.55%)

CRYPTO (1-Week) 🧮

--------------------

Bitcoin: $89,822 (-3.27%)

Ethereum: $3,019 (-3.31%)

Solana: $143 (+1.78%)

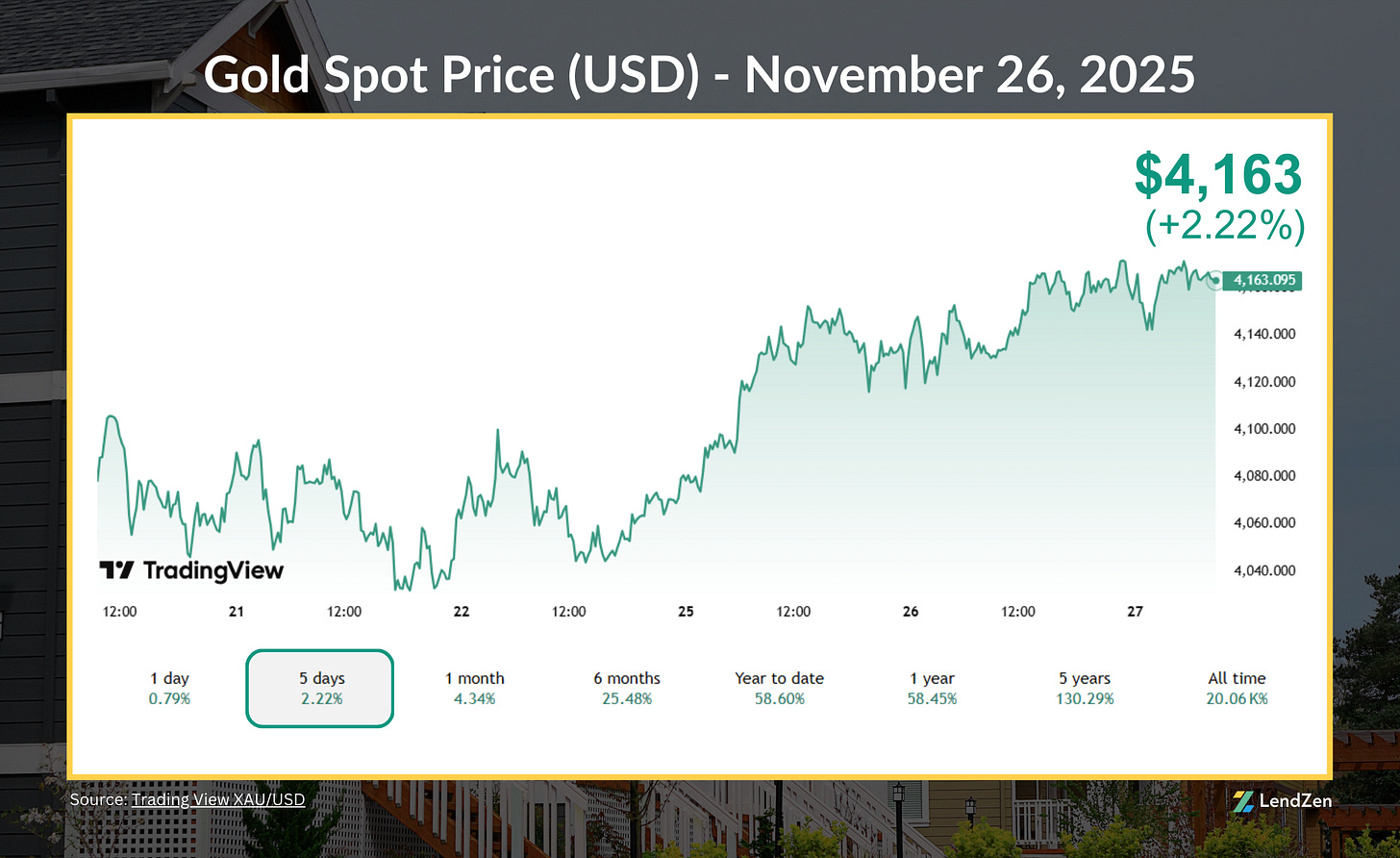

PRECIOUS METALS (5-Day) 🪙

-------------------------------

Gold: $4,163 (+2.22%)

Silver: $53.24 (+3.66%)

Platinum: $1,585 (+3.19%)

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.