Mortgage Rate Snapshot 📷📉🏠 (DEC 16)

Included in this post are the following sections:

STORYLINE 📰

-------------

The December Non-Farm Payroll report (November data) was originally due last week but was rescheduled to today (Tuesday).

Inflation, employment, and The Fed make up my “Big 3” market movers.

Inflation (CPI/PCE)

The Fed (FOMC/Minutes)

Employment (NFP/ADP)

Despite the hope that a softening labor market would push mortgage rates back to the October lows, today’s NFP data was a mixed bag that only nudged bond prices slightly higher.

The November new jobs number was soft (64k) but slightly better than expectations (50k) and markets trade on expectations, so this info was a headwind in the face of the increased unemployment rate.

Although the unemployment rate ticked up two-points from 4.4% to 4.6%, and to some extent validates the Fed’s rate cut, it wasn’t enough to completely overpower the better-than-expected survey data and stable Participation Rate (those actively looking for work).

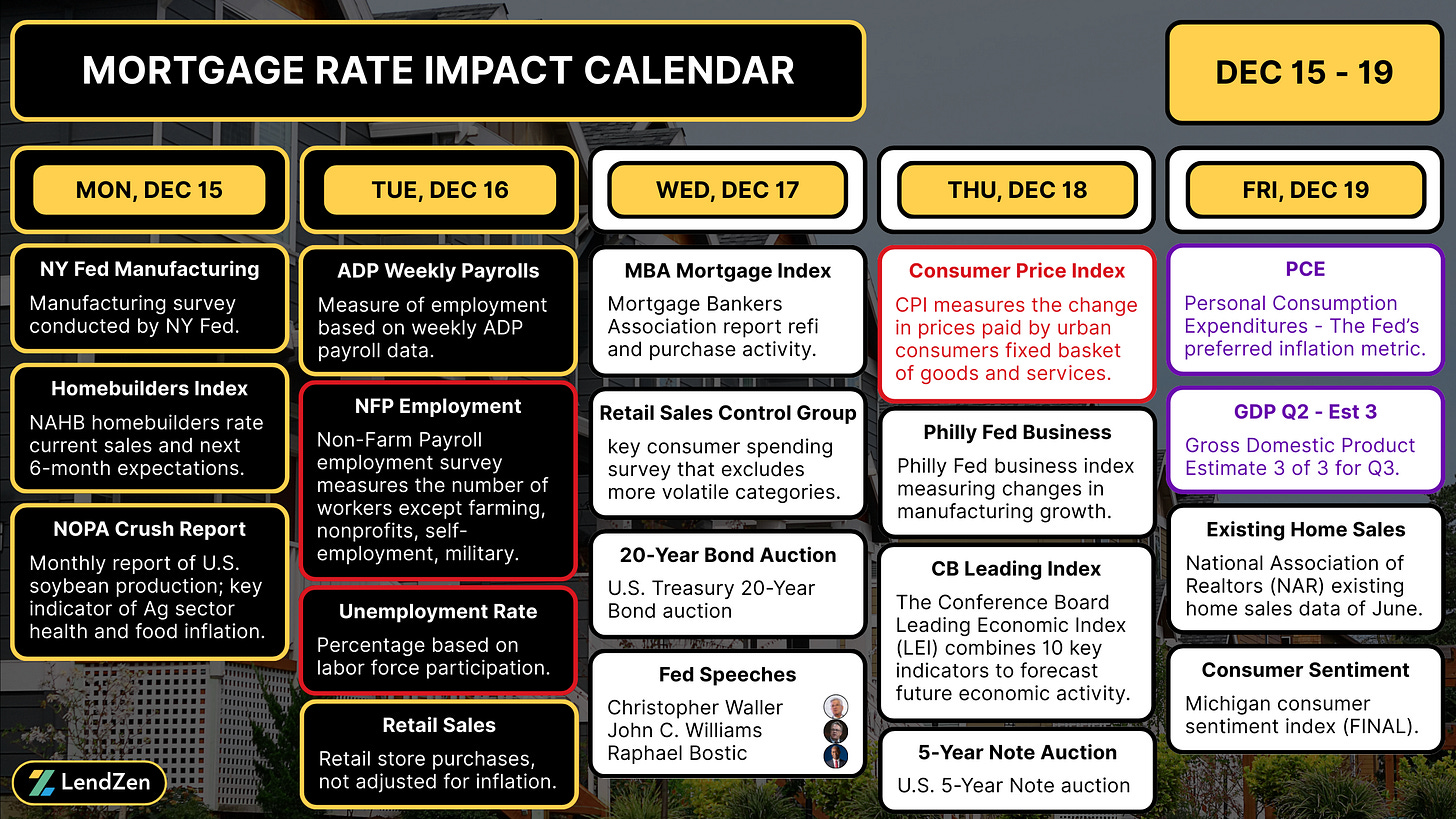

This is a double whammy week with another Big 3 data set on deck Thursday, the Consumer Price Index (CPI) inflation report.

Read more about the events impacting mortgage rates this week in Sunday’s “Week Ahead” Substack post.

RATE PRICE INDEX 📉

---------------------

Mortgage rates DO NOT rise or fall.

The full range of rates is always available, and instead the price of each rate changes based on the trading of individual mortgage bonds.

Learn how bonds influence mortgage rates in the MBS sections later in this post.

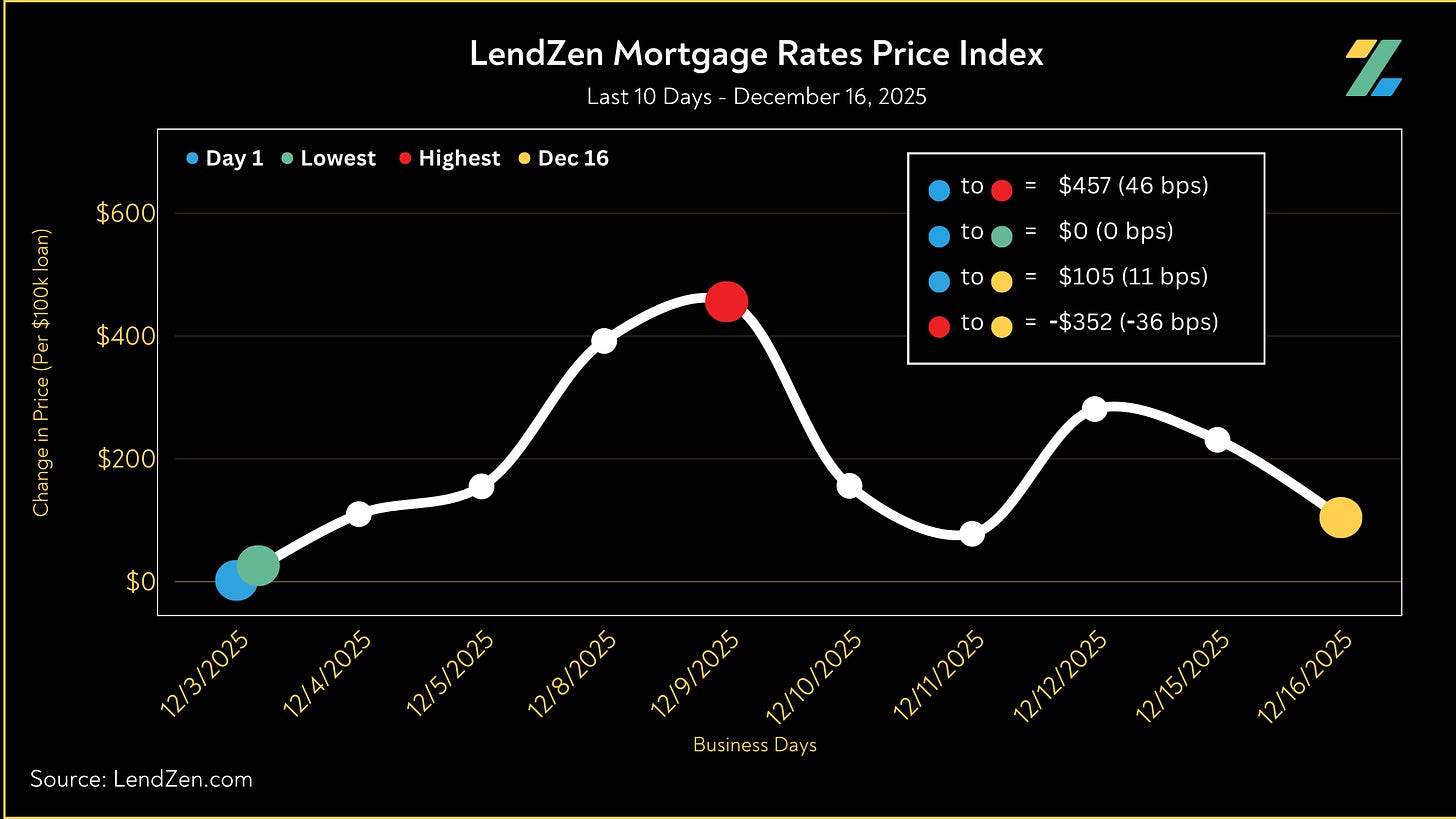

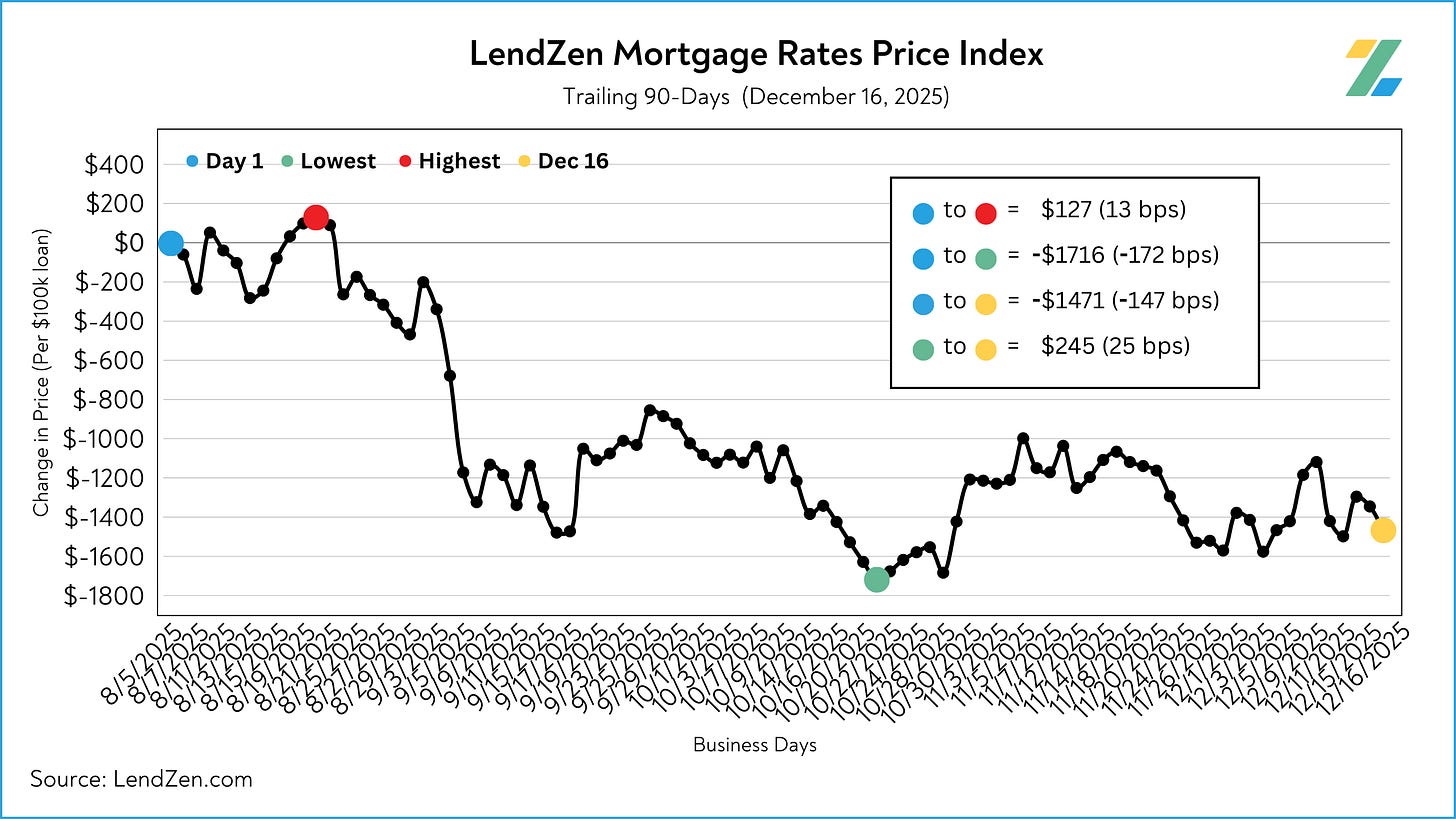

The LendZen Index calculates a daily change in the price of mortgage rates by tracking a spectrum of mortgage-backed securities (MBS).

Below are the 10-Day and 90-Day charts, but you can track the daily changes across a variety of time series at LendZen.substack.com

RATE SNAPSHOT 📷

-------------------

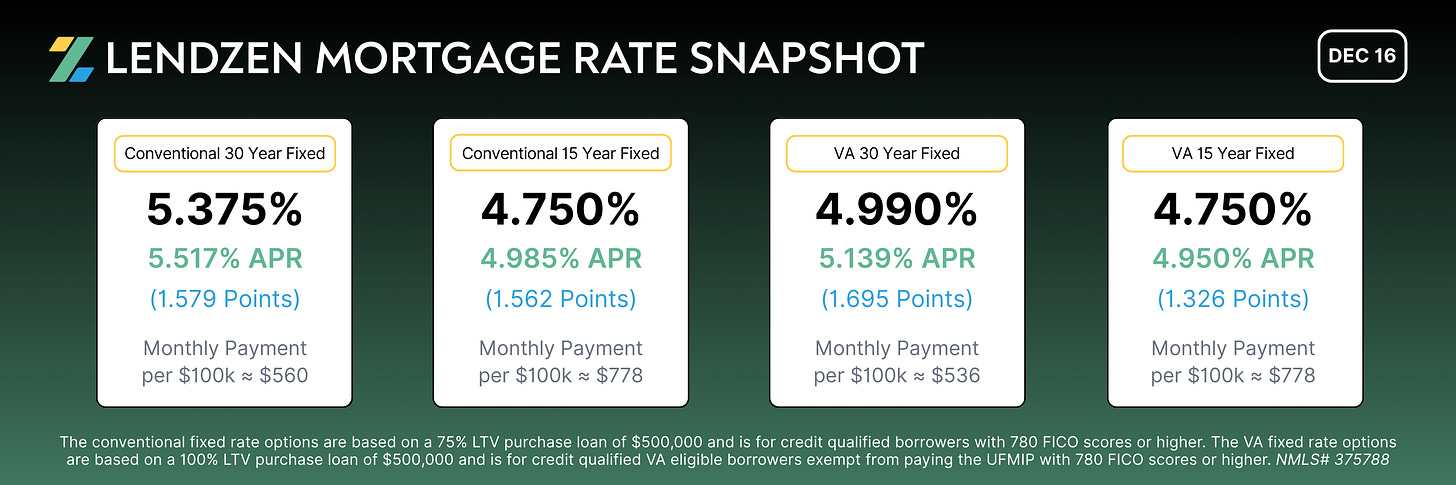

The mortgage industry thrives on a lack of pricing transparency, hence why most lenders only publish a single daily rate or nothing at all.

Fortunately, LendZen gives you anonymous access to ALL rate options that meet your criteria, with full transparency of costs upfront.

Below is a snapshot of a few different rate options available today.

When you customize a quote on LendZen, every available rate for that program is displayed in real-time.

There is no contact information required to explore your options and results are provided instantly.

You can also request an official Loan Estimate for the exact loan you created and save your scenario to revisit your rate options daily with one-click.

See for yourself at LendZen.com

COMPARE OFFERS 🔍

---------------------

Because rates are determined by the bond market, the companies offering you a mortgage merely add their fees on top.

You are not shopping for a lender using rate alone, instead your decision should be based on total costs for the same rate (same day).

This is why it is recommended you NEVER choose a mortgage company without first comparing Loan Estimates, each with matching loan criteria.

Learn more about the LE disclosure and how to find the best deal instantly on this Substack post.

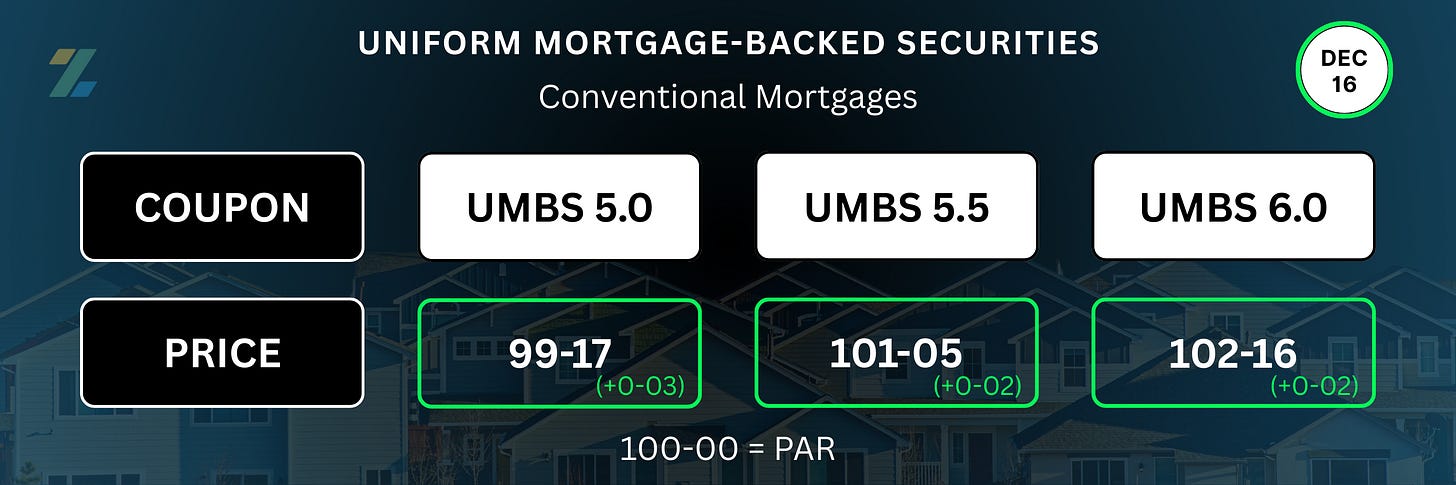

MBS PRICING 🏦

----------------

Most mortgages are sold into mortgage-backed securities (MBS) and the price of these bonds determines rates for all banks and lenders.

MBS coupons are sold at half-percent increments, while their price moves in 32nds (ticks).

100-00 acts as the starting line, also referred to as PAR.

The higher the coupon price, the less expensive the rates will be that are sold into that security.

Therefore, an increase in the price of mortgage bonds is good for mortgage rates.

Learn more about the dynamics of MBS pricing and how it impacts your mortgage options in the explainer at the bottom of this post.

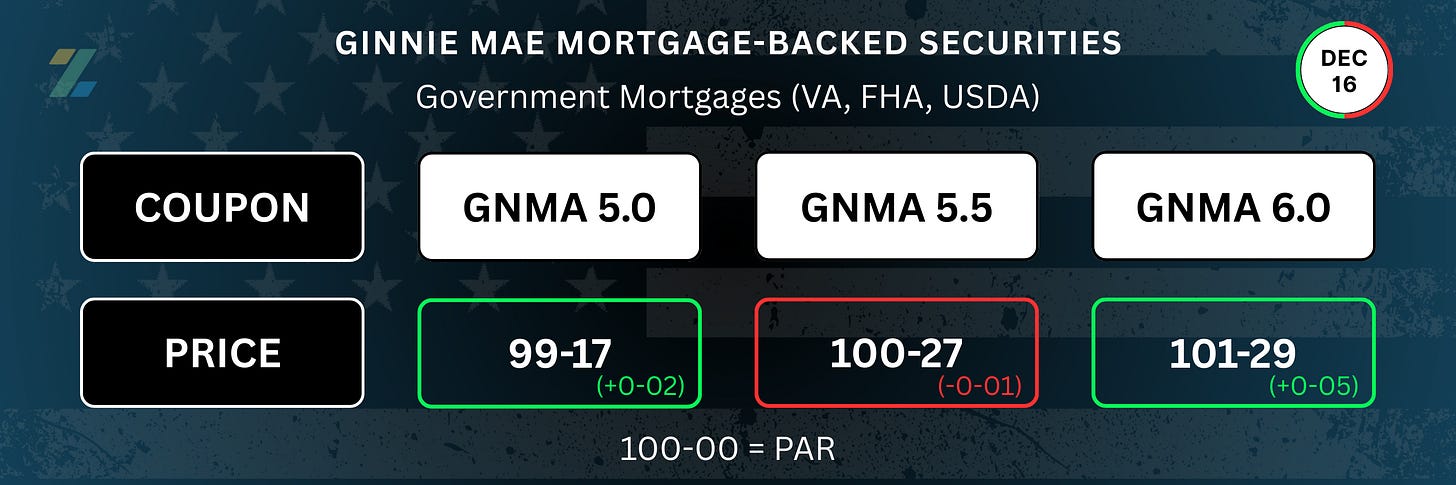

MBS EXPLAINER 📖

-------------------

Mortgage rates do not rise or fall, instead the PRICE of rates change.

How much a mortgage-backed security is priced below or above par determines the “price” of the mortgage rates packaged into that MBS coupon.

For example, the higher an MBS is priced above par the less expensive the rates will be that are sold into that security. (ex. 102-00 > 101-00)

The Note rates of each mortgage sold into a specific MBS typically range between 0.125 – 0.750 above the coupon rate, depending on the loan type. (ex. 6.125% – 6.750% rates ~ 6.00 MBS)

The spread between the mortgage Note rate and the coupon rate is retained as a servicing fee (minus guarantee fees). (ex. 0.125 – 0.750)

This is why a 6.00 note rate is not sold into a 6.00 coupon and is therefore priced based on lower coupons. (ex. 6.00% rate ~ 5.50 MBS)

As a result, when comparing a X.00% rate with a X.25% rate (or a X.50% rate with a X.75% rate) the shift between different coupons can disproportionality affect the PRICE of the lower Note rate despite the close proximity of the two rates.

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.