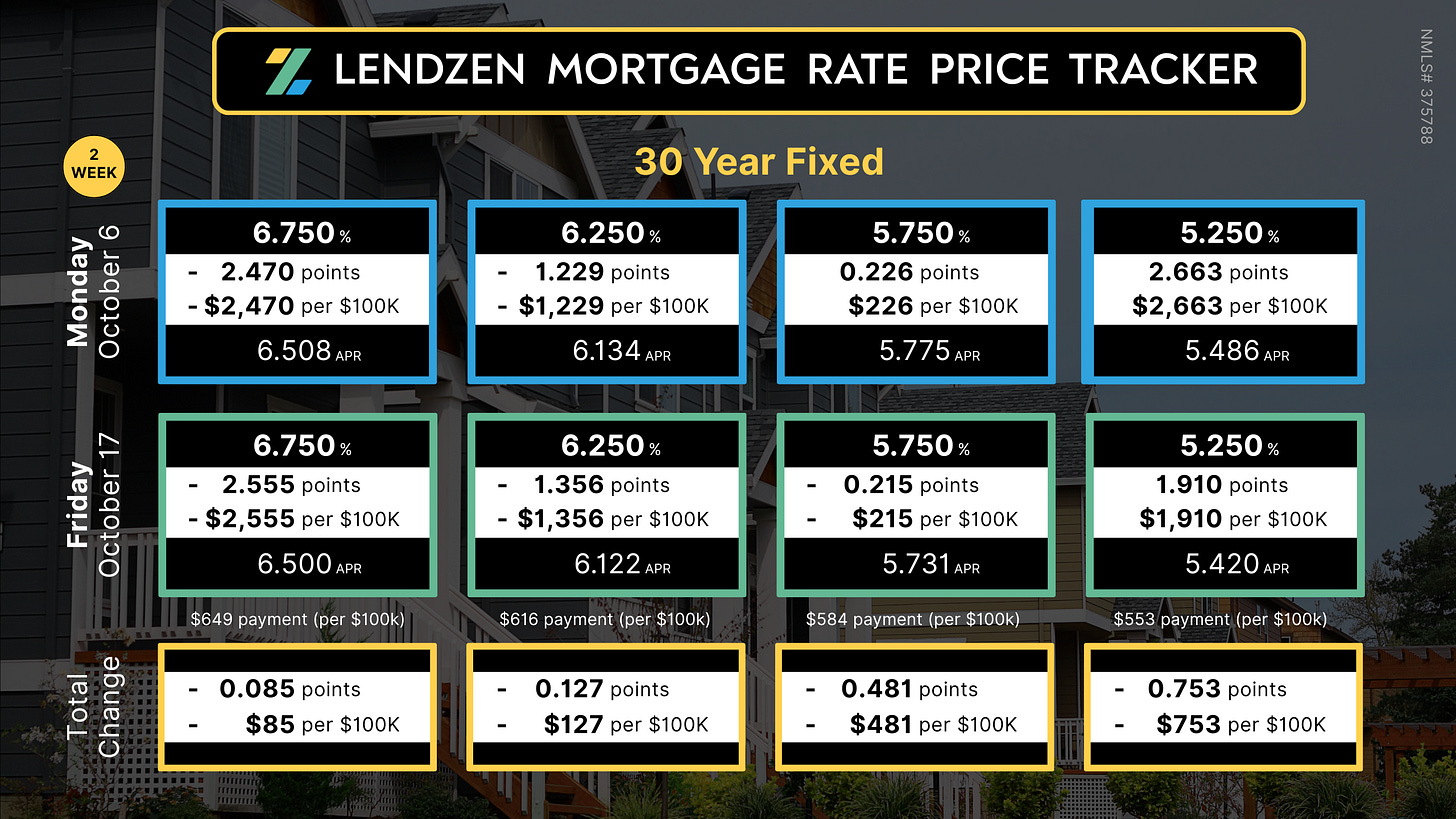

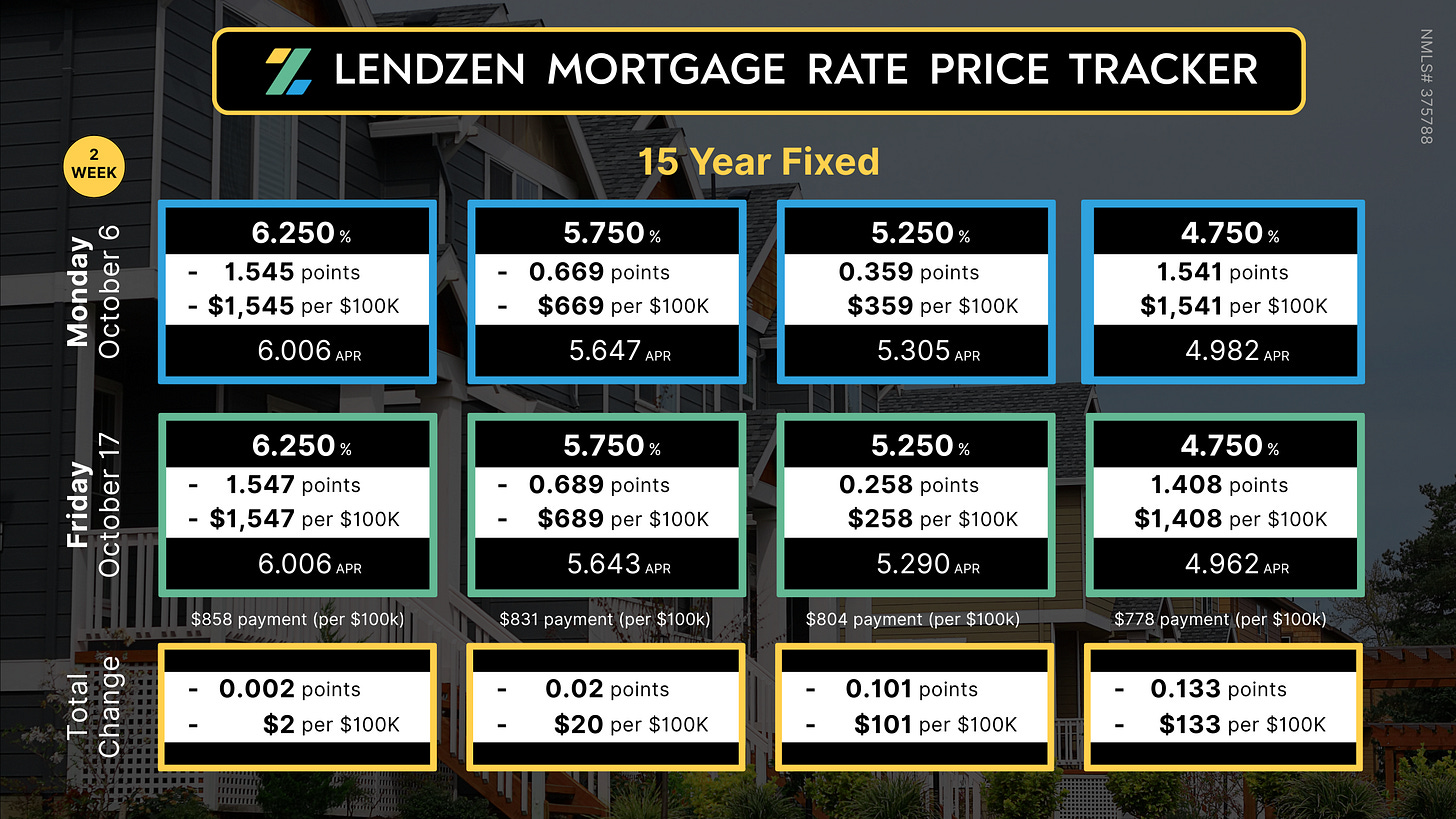

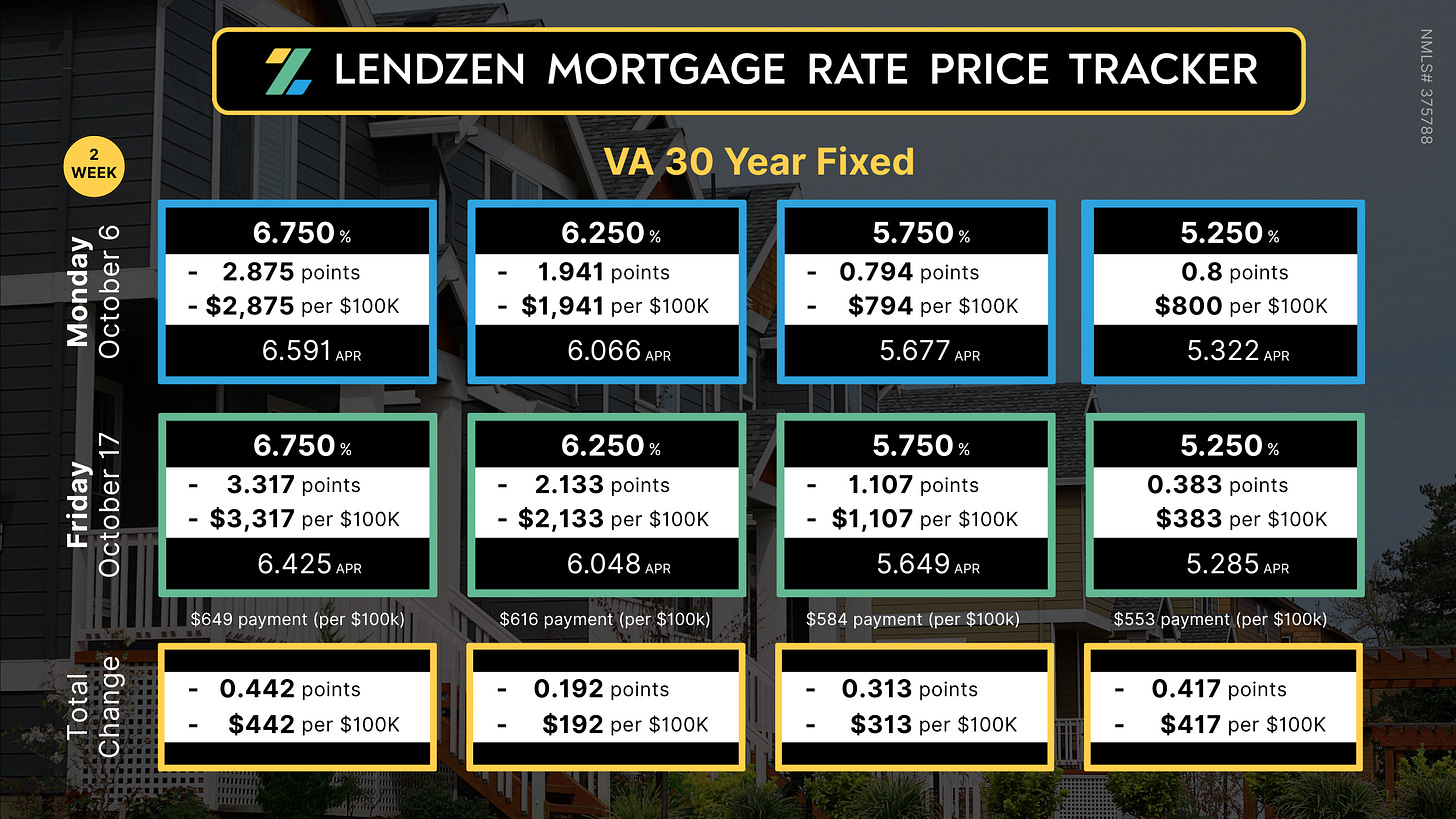

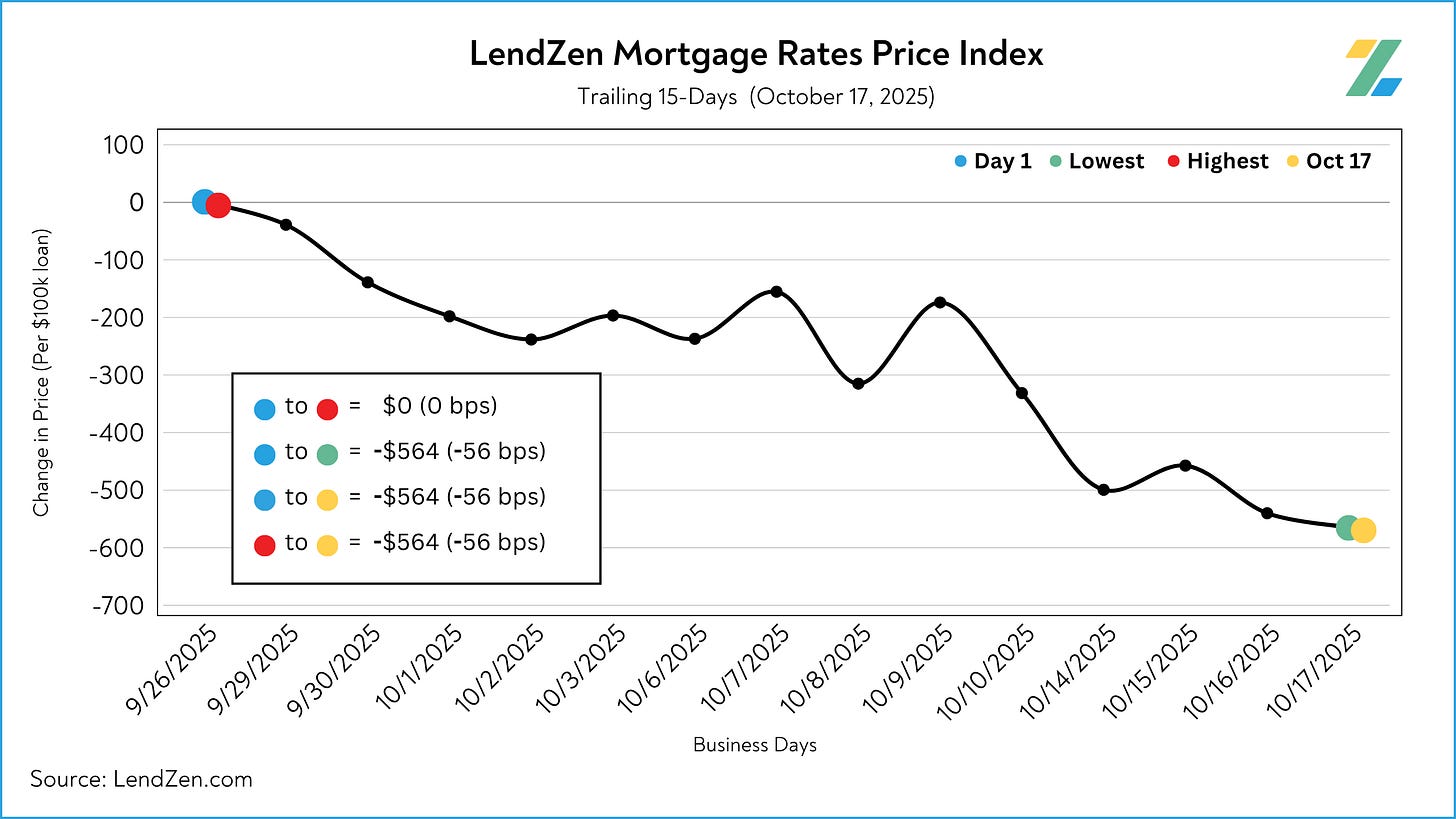

Mortgage Rate Price Tracker 🏠📉🔍 (OCT 6 – 17)

Monitoring the change in price of specific mortgage rates

Most mortgages are sold into mortgage-backed securities (MBS) and the price of these bonds determines rates for all banks and lenders.

However, mortgage rates DO NOT rise or fall. Instead, the price of each rate changes while the rates available to you remain the same.

The Mortgage Rate Price Tracker (MRPT) illustrates this dynamic by showing how the price of each rate changed within the time series.

This change is driven by mortgage bonds, not the lender, who will then add their own fees on top.

The higher the rate, the lower the fee (points). Some higher rates pay a rebate; this is illustrated on the tracker with negative (-) points.

When the “total change” is negative it means a reduction in the price of the rate.

The MRPT is a more rate and loan program specific example of the LendZen Index, which monitors a much broader set of rates and mortgage bond coupons.

Both are effective for monitoring how the price of mortgage rates has changed, while the LendZen Index is published daily at LendZen.substack.com

RATE RECAP ⏪

Quiet, calm, but consistently better – that’s the story of mortgage rates the last two weeks.

There has been a lot of unnecessary hype this week around U.S. 10-Year yields temporarily breaking 4.00%, something I will distill in a more meaningful way in a separate post.

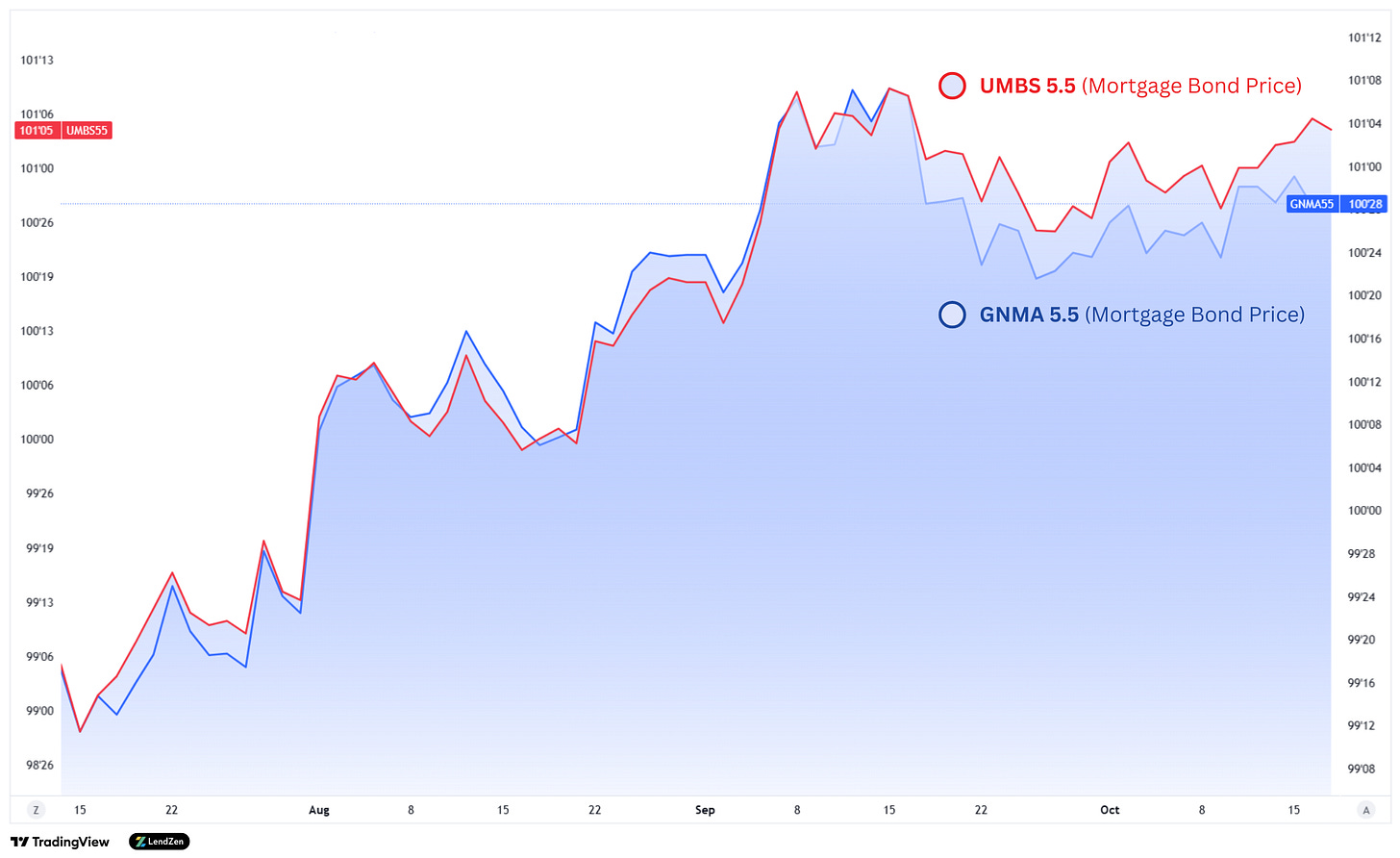

However, the reason mortgage rate prices are now closely reflecting both the best levels of 2025, and those not seen since pre-Fed rate cut 2024, is mostly because of the improvement in spreads.

This is something I touched on briefly this week in this Substack Post.

Regardless the why, the improvement is welcomed, although there are some unique aspects to this rally.

Specifically, UMBS bonds (conventional loans) are now trading higher than GMNA bonds (VA/FHA loans).

VA qualified borrowers should also consider their conventional loan options, specifically active-duty service members and those without a service-connected disability.

The conventional loan may be more cost effective, since these borrowers are required to pay an upfront mortgage insurance premium (VA Funding Fee).

UP NEXT 🗓️

Stay tuned for a deeper dive on all the latest rate action, with a full stack of charts, in the upcoming Monday Data Deluge.

This week should be more volatile with the CPI inflation report scheduled for Friday.

Buyers closing within 15-days are probably taking an unnecessary risk by remaining unlocked ahead of CPI, but refinance borrowers with room to wiggle might be emboldened to roll the dice.

The latest Lock-O-Meter risk scores and rate lock recommendations with be posted Monday in the Data Deluge.

Thanks for reading.

If you are interested in more mortgage insights, then I suggest checking out this recent Substack article.

DISCLOSURES

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.