Mortgage Rate Price Tracker 🏠📉🔍 (OCT 6 – 24)

Monitoring the change in price of specific mortgage rates

THE TRACKER 🔭

----------------

Most mortgages are sold into mortgage-backed securities (MBS) and the price of these bonds determines rates for all banks and lenders.

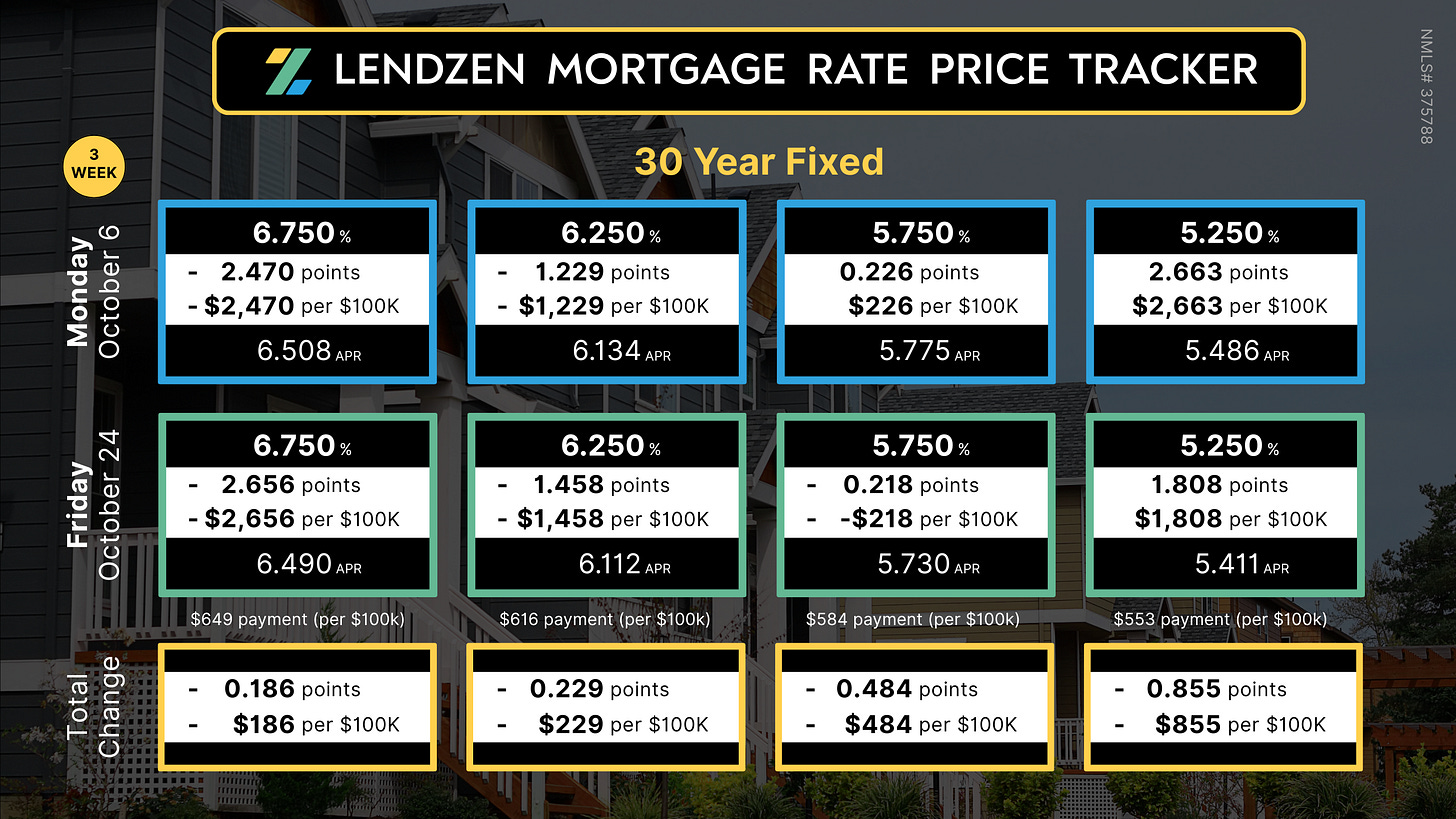

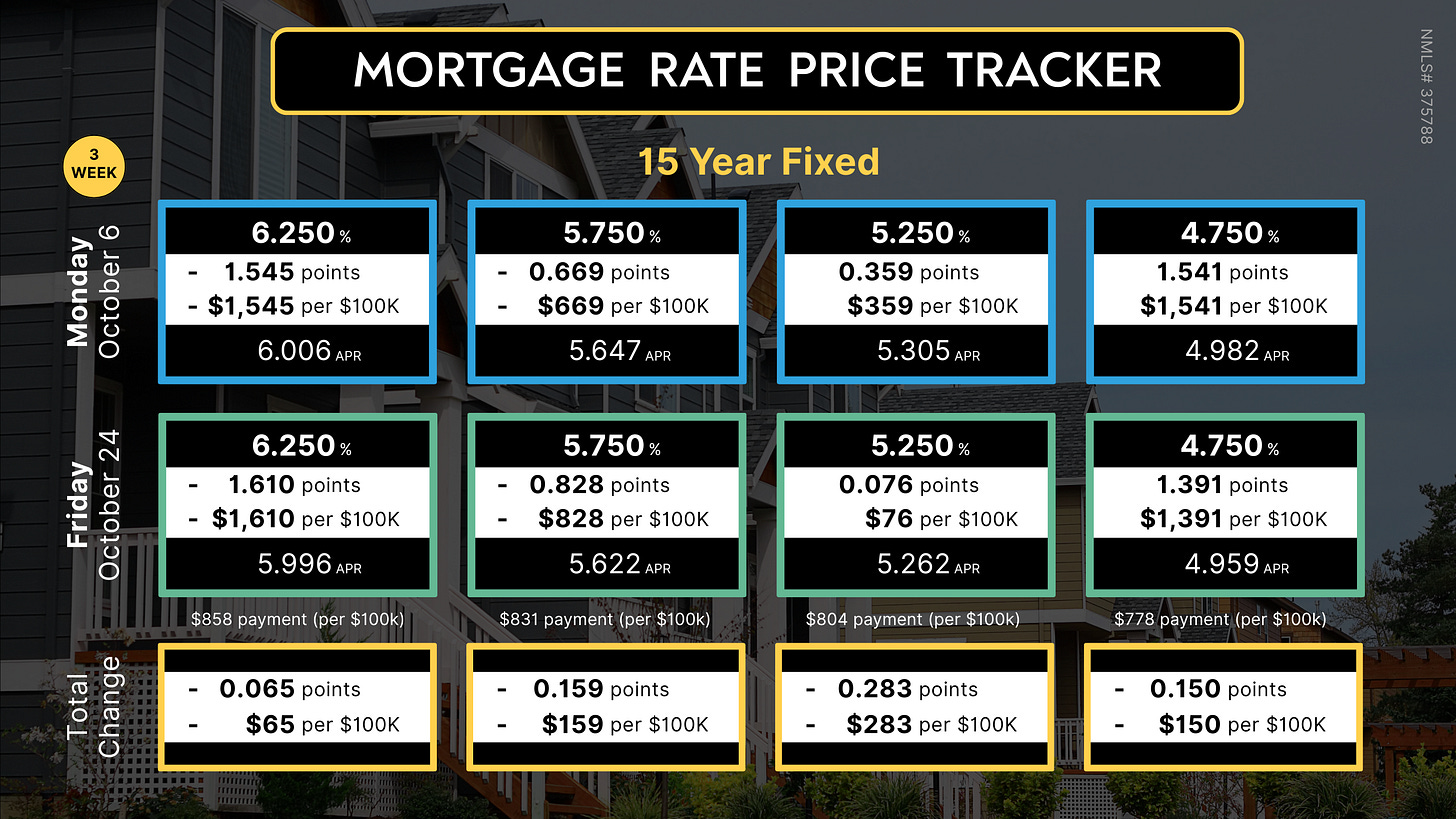

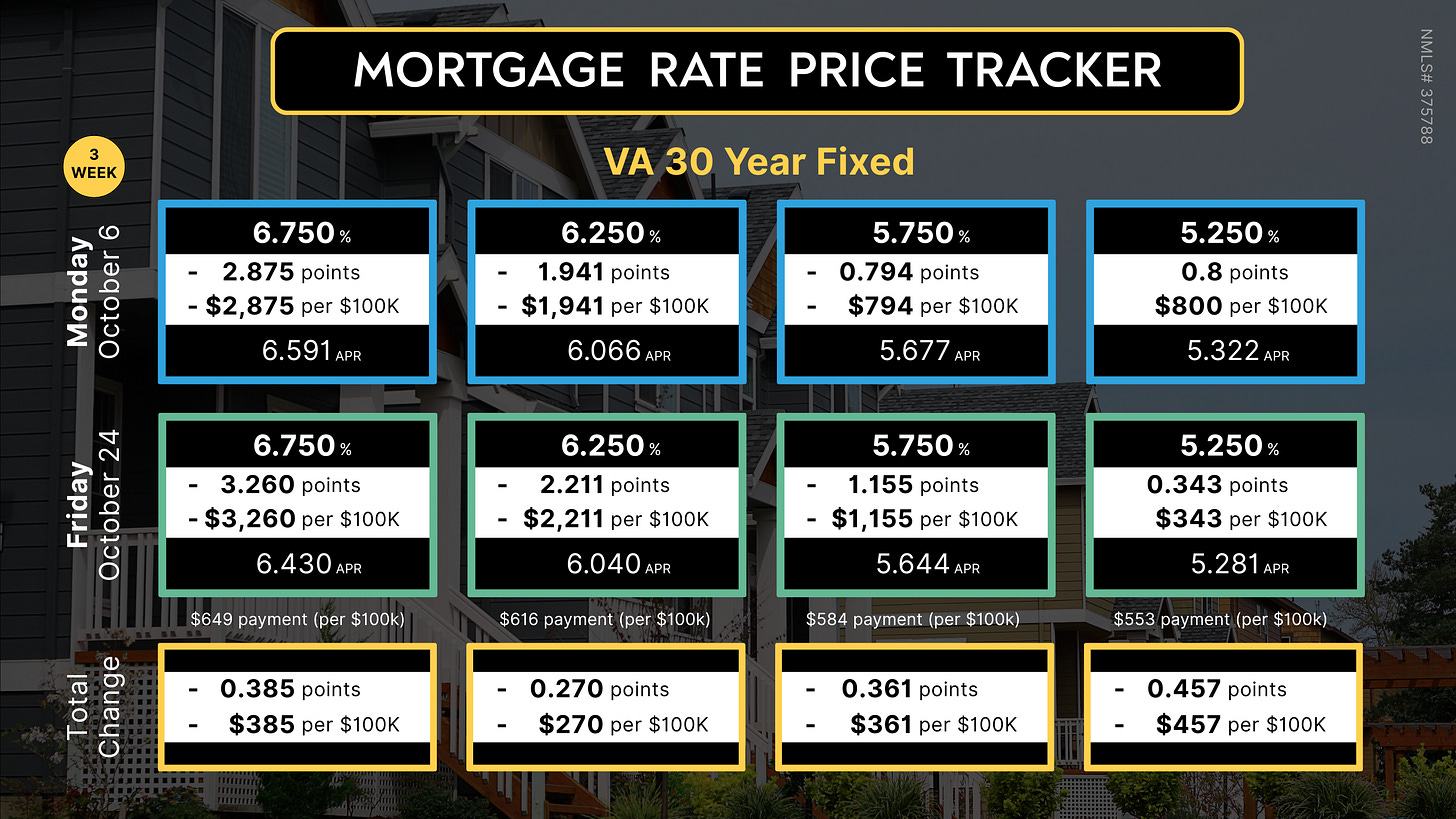

However, mortgage rates DO NOT rise or fall. Instead, the price of each rate changes while the rates available to you remain the same.

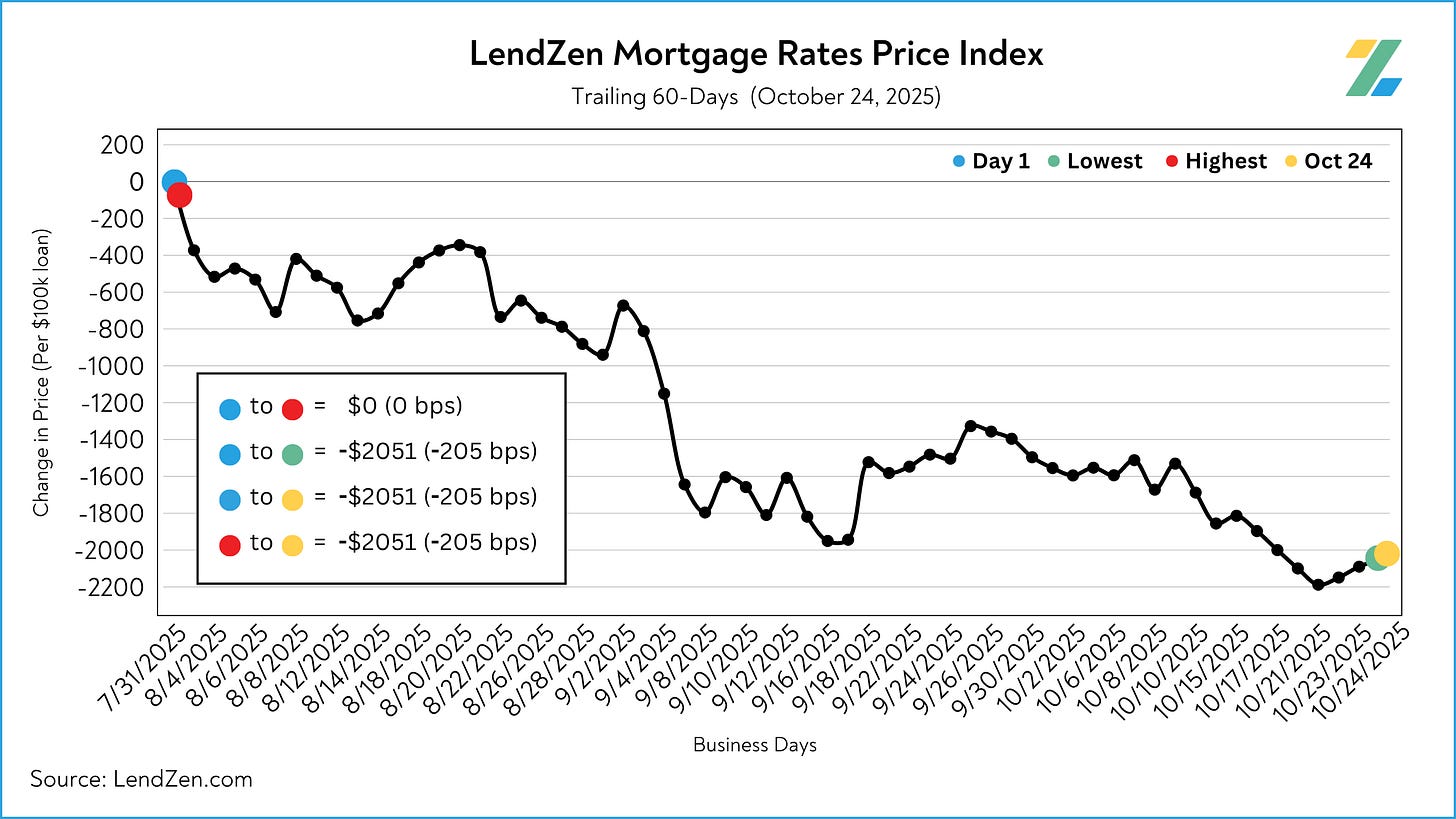

The Mortgage Rate Price Tracker (MRPT) illustrates this dynamic by showing how the price of each rate changed within the time series.

This change is driven by mortgage bonds, not the lender, who will then add their own fees on top.

The higher the rate, the lower the fee (points). Some higher rates pay a rebate; this is illustrated on the tracker with negative (-) points.

When the “total change” is negative it means a reduction in the price of the rate.

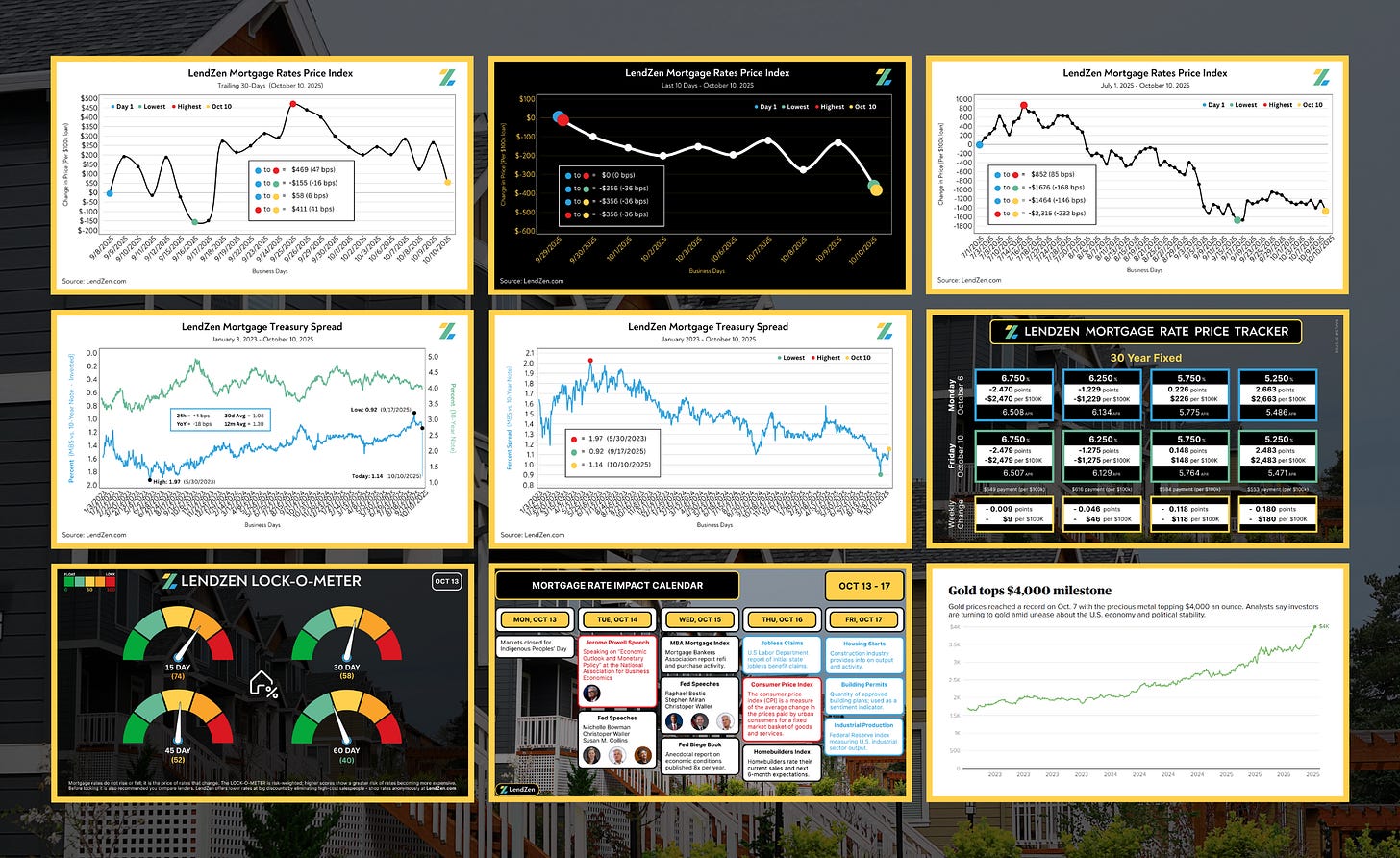

The MRPT is a more rate and loan program specific example of the LendZen Index, which monitors a much broader set of rates and mortgage bond coupons.

Both are effective for monitoring how the price of mortgage rates has changed, while the LendZen Index is published daily at LendZen.substack.com

RATE RECAP ⏪

--------------

After 3 full weeks of the U.S. government shutdown we finally got some worthy econ data on Friday, after the Labor Department was called back to release the CPI inflation report.

The highly anticipated data was within expectations and well received by bond markets with a decent rally in government bonds, while mortgage-backed-securities (MBS) showed less enthusiasm.

Surviving the day unscathed, the PRICE of mortgage rates are still hovering near the best levels of 2025 after fully recovering from the September 17th Fed rate cut.

UP NEXT 🗓️

----------

Stay tuned for a deeper dive on all the latest rate action, with a full stack of charts and a closer look at the inflation data, in the upcoming Monday Data Deluge.

Next week includes another FOMC meeting and Fed rate decision (Wednesday Oct 29).

Buyers closing within 15-days managed to escape last week without any damage, but no benefit either.

Doubling down this week by floating into an expected Fed rate cut feels even riskier - markets move on expectations, and any benefit of a Fed rate cut is likely already priced in.

Meanwhile, the last 4 rate cuts resulted in lower bond prices, which means the PRICE of mortgage rates increased.

The latest Lock-O-Meter risk scores and detailed rate lock recommendations with be posted Monday in the Data Deluge.

Thanks for reading.

If you are interested in more mortgage insights, then I suggest checking out this recent Substack article.

DISCLOSURES

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.