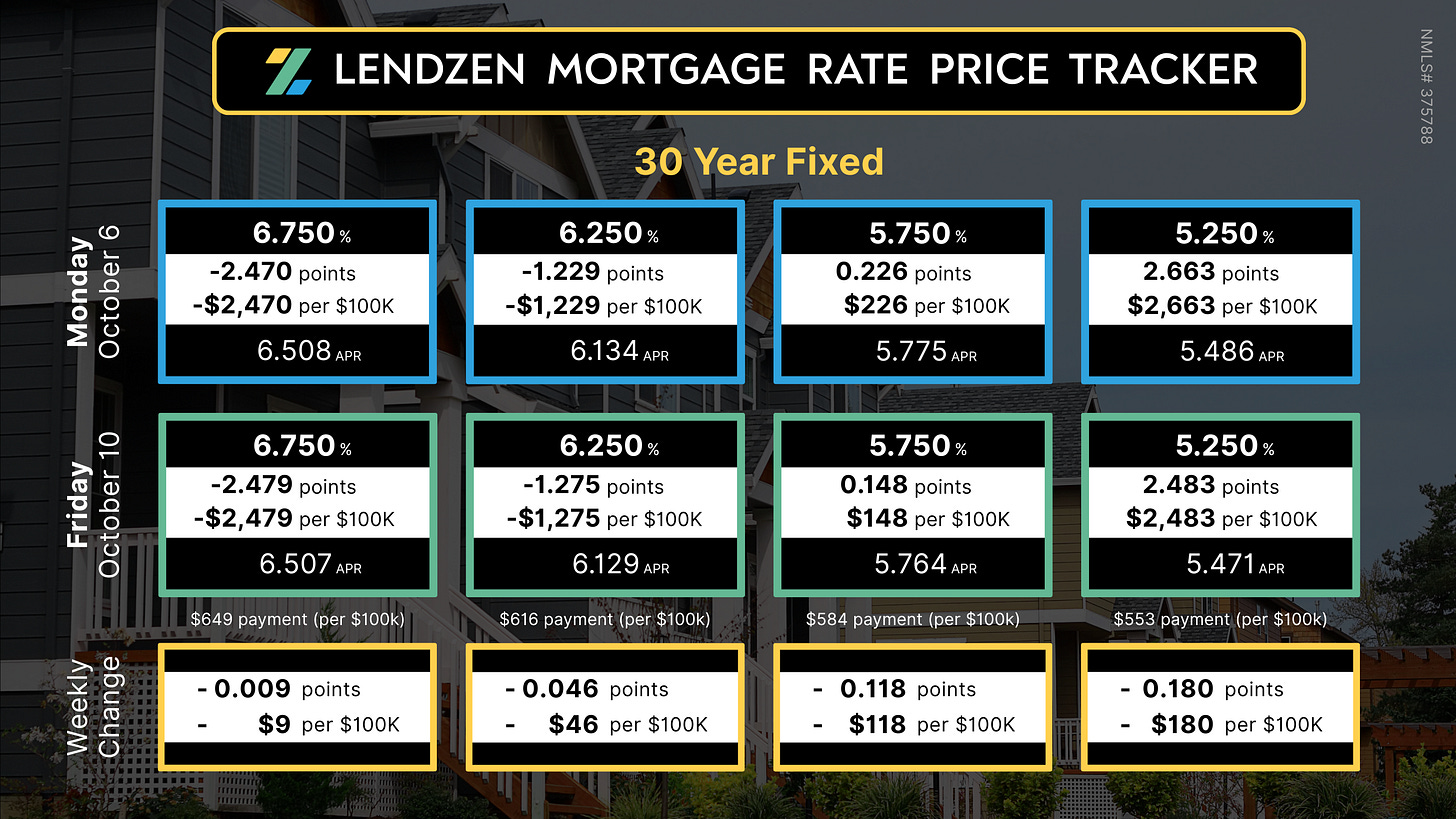

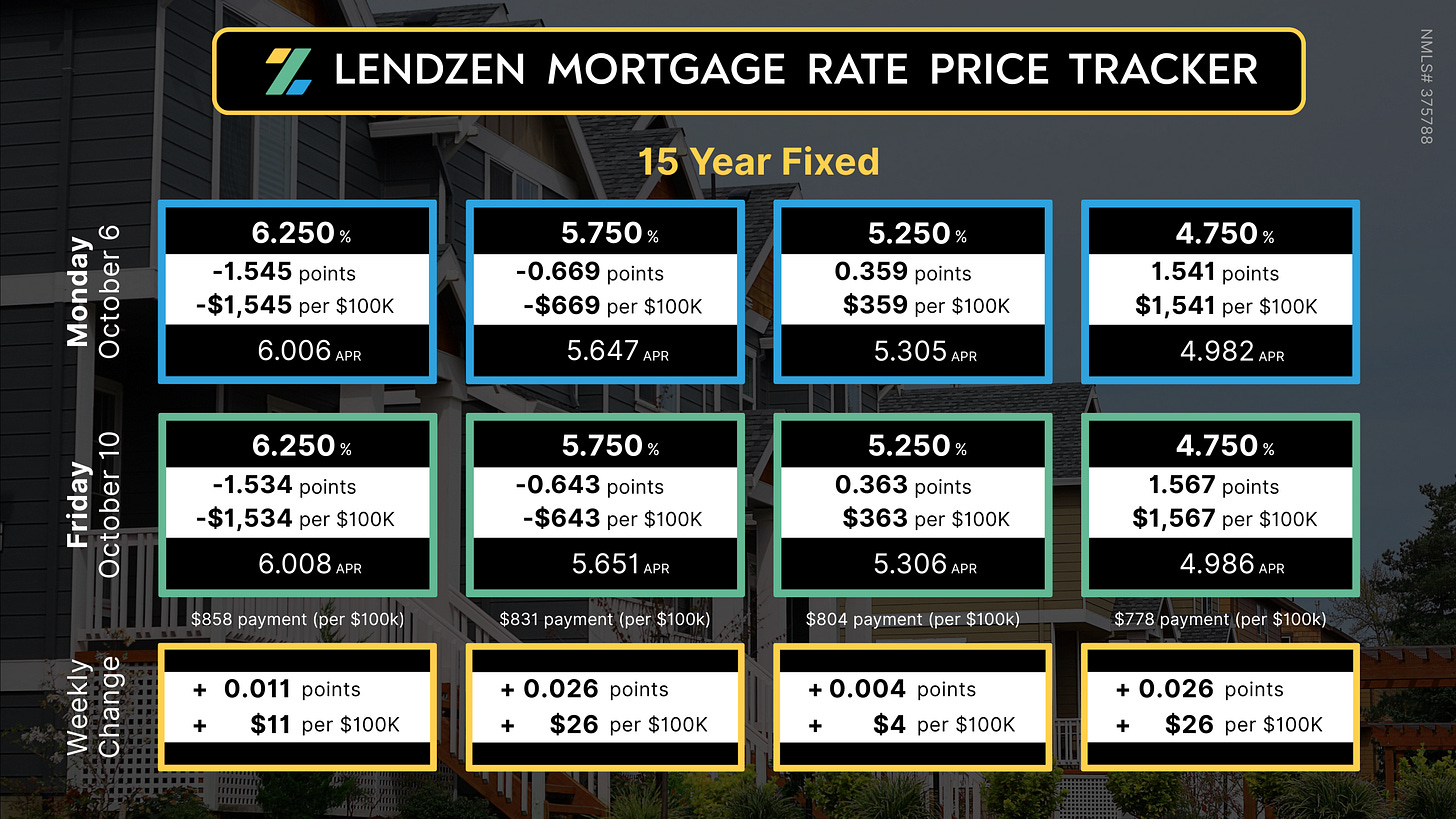

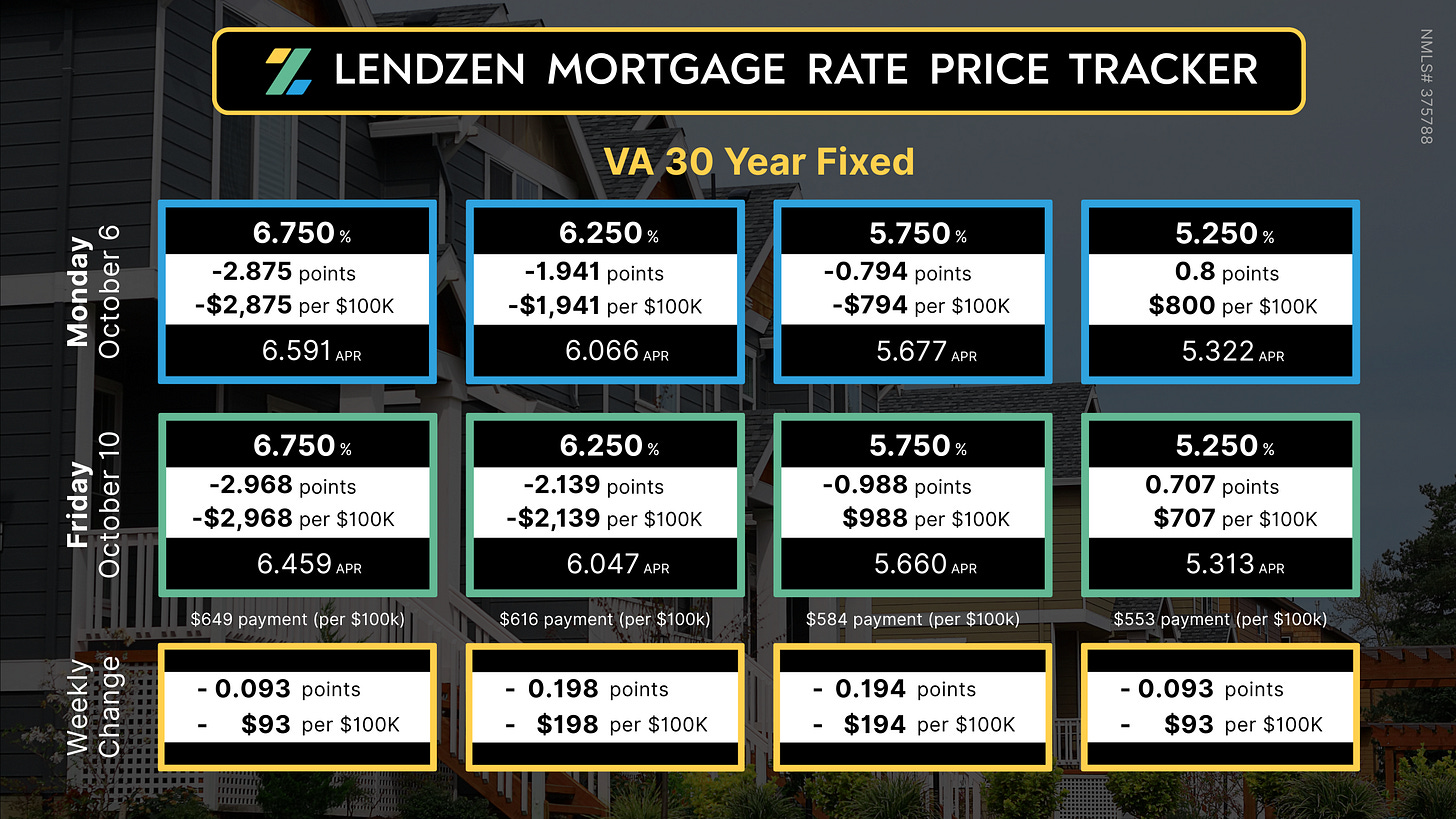

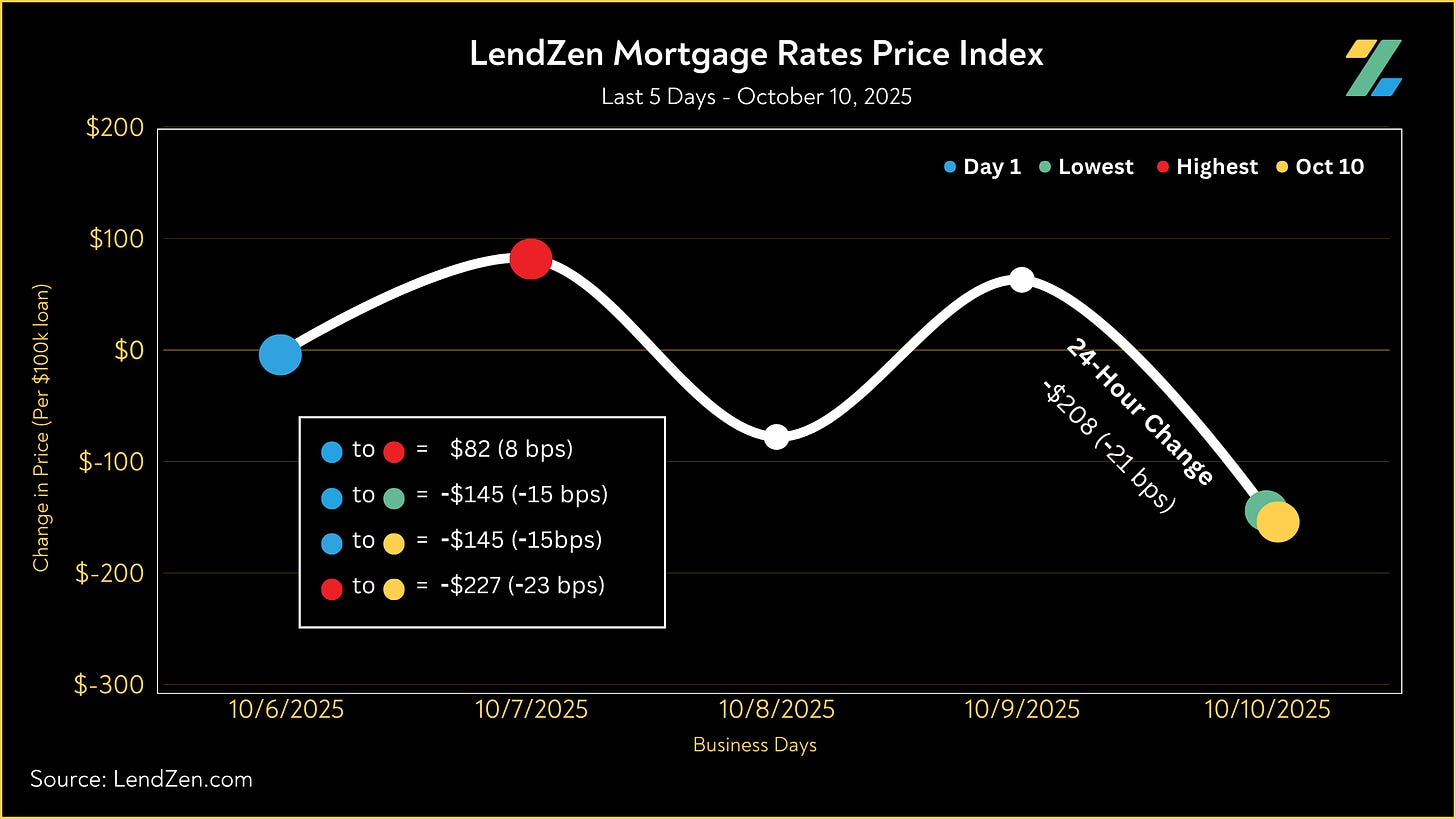

Mortgage Rate Price Tracker 🏠📉🔍 (OCT 6 – 10)

Monitoring the change in price of specific mortgage rates

Most mortgages are sold into mortgage-backed securities (MBS) and the price of these bonds determines rates for all banks and lenders.

However, mortgage rates DO NOT rise or fall. Instead, the price of each rate changes while the rates available to you remain the same.

The Mortgage Rate Price Tracker (MRPT) illustrates this dynamic by showing how the price of each rate changed within the time series.

This change is driven by mortgage bonds, not the lender, who will then add their own fees on top.

The higher the rate, the lower the fee (points). Some higher rates pay a rebate; this is illustrated on the tracker with negative (-) points.

Likewise, a negative “weekly change” means a reduction in the price of the rate.

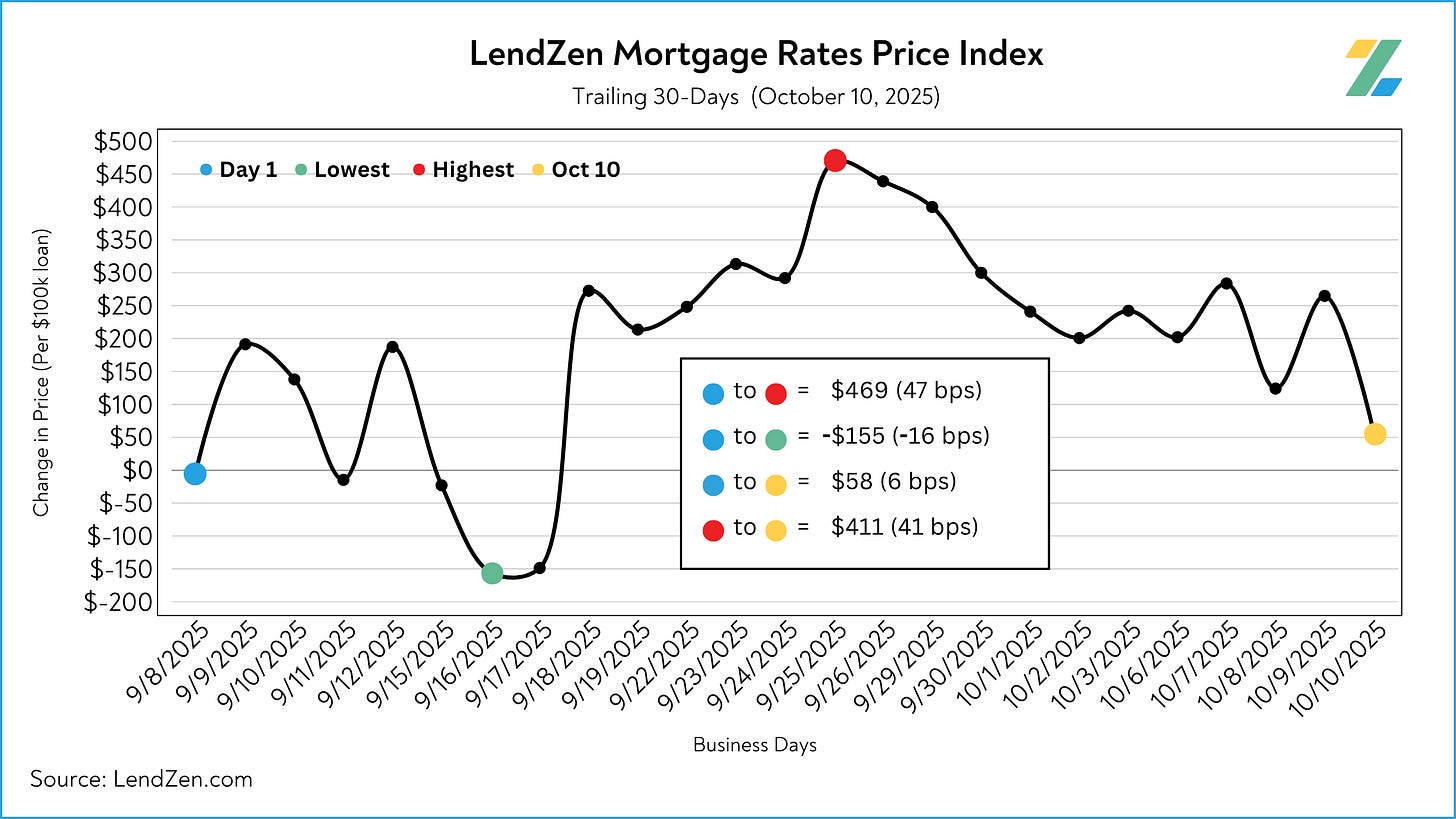

The MRPT is a more rate and loan program specific example of the LendZen Index, which monitors a much broader set of rates and mortgage bond coupons.

Both are effective for monitoring how the price of mortgage rates has changed, while the LendZen Index is published daily at LendZen.substack.com

It has been unusually quiet for mortgage rates lately, as discussed in this recent Substack post.

Although bonds ended the week on a positive note with a strong Friday rally, the price gains for rates over the 5-day span were insignificant.

Meanwhile, mortgage rates did a full round trip back to where they started a month ago, despite over 60 bps of swings along the way.

Stay tuned for a deeper dive on all the latest rate action, with a full stack of charts, in the upcoming Monday Data Deluge.

Thanks for reading.

If you are interested in more mortgage insights, then I suggest checking out this recent Substack article.