Mortgage Rate Price Tracker 🏠📉🔍 (NOV 3 – 28)

Monitoring the change in price of specific mortgage rates

Included in this post are the following:

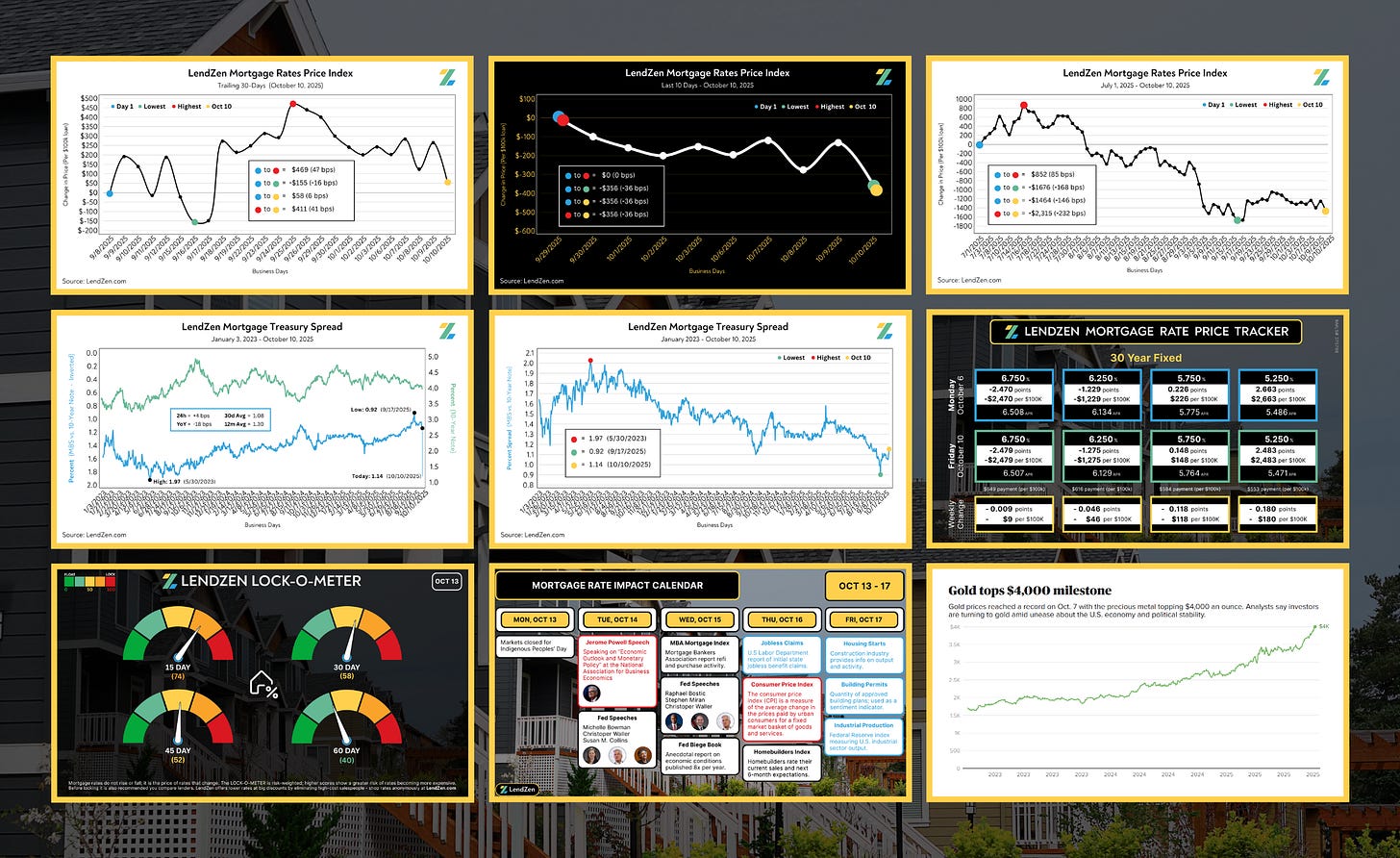

THE TRACKER 🔭

----------------

Most mortgages are sold into mortgage-backed securities (MBS) and the price of these bonds determines rates for all banks and lenders.

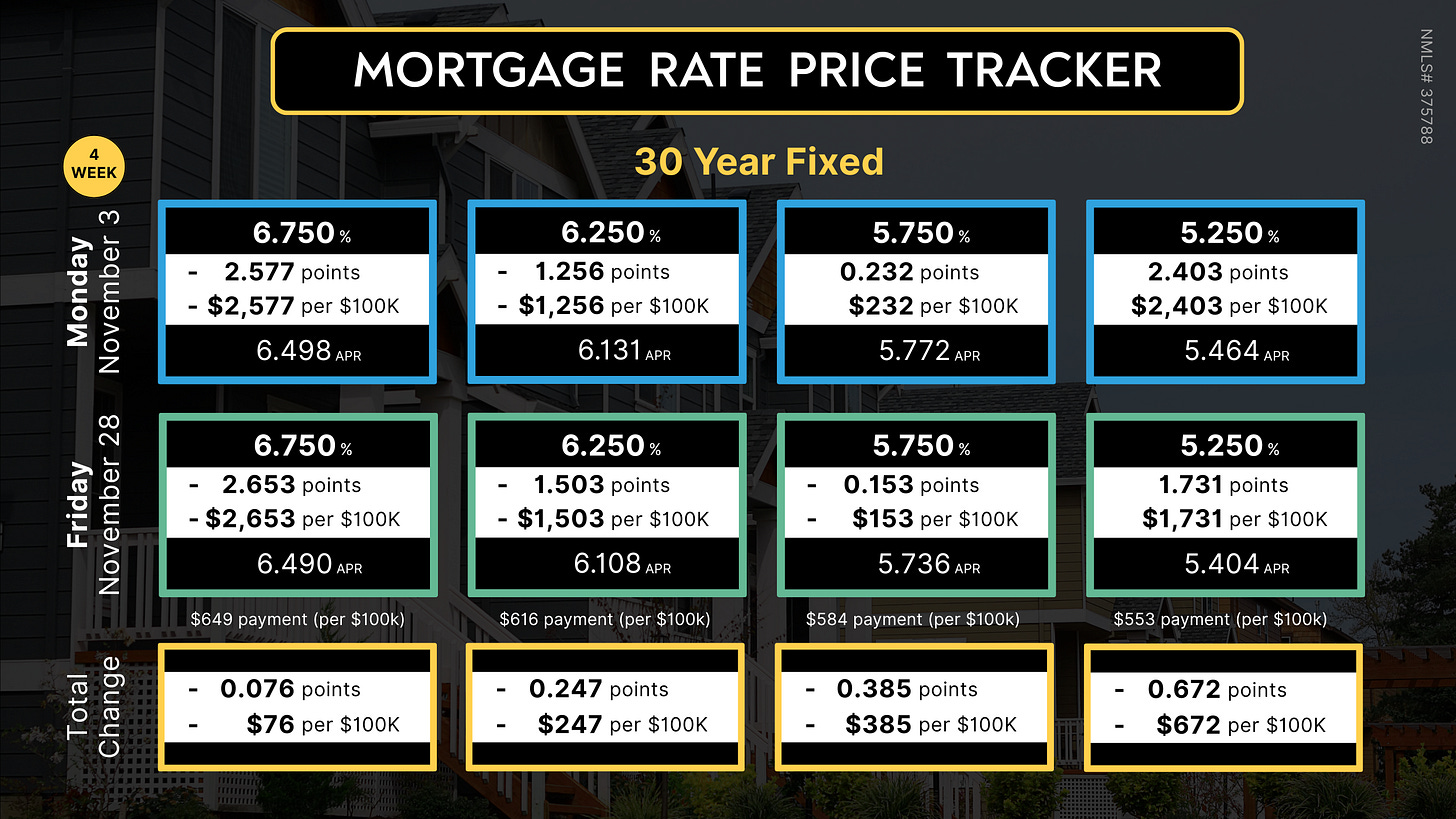

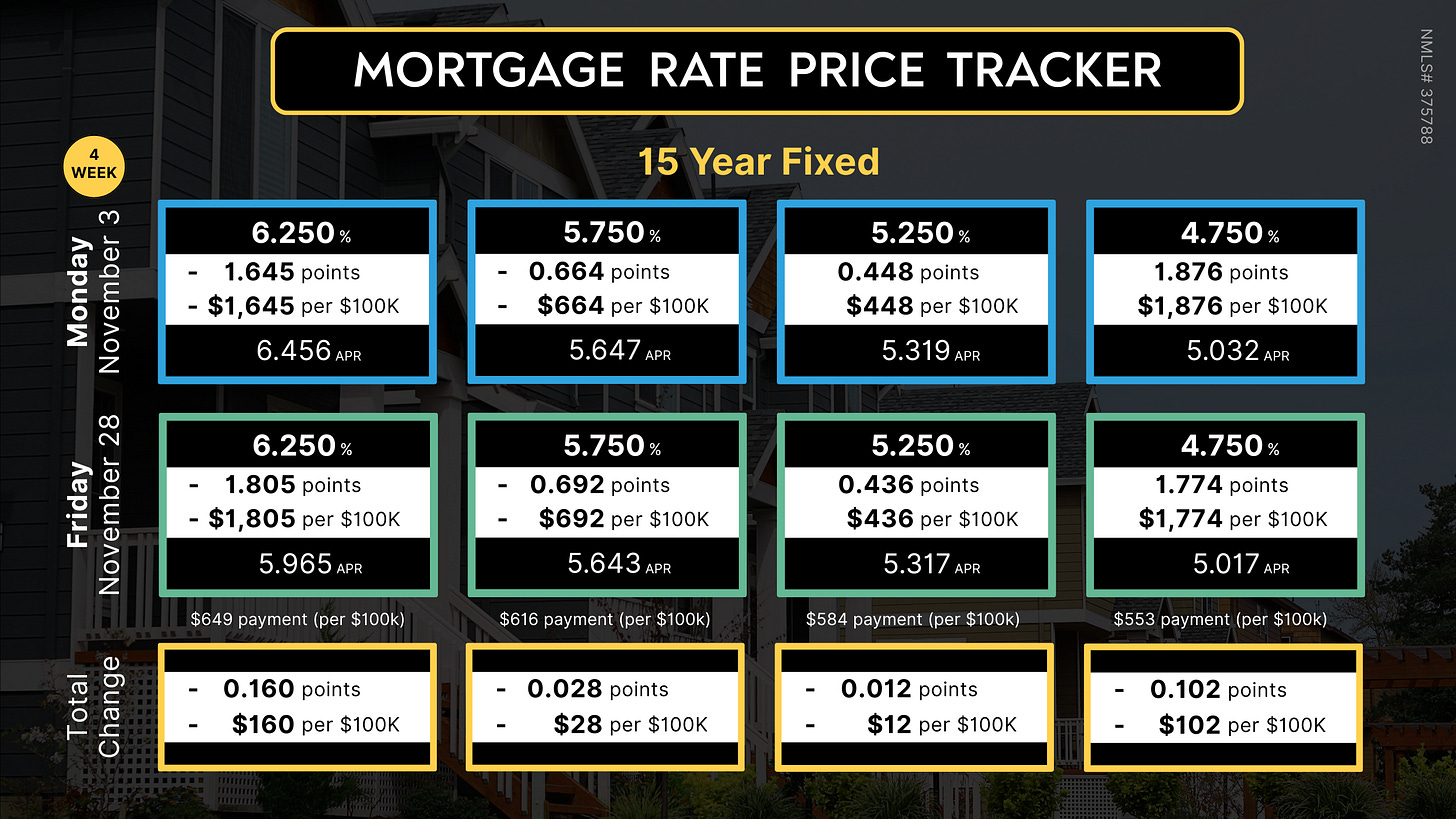

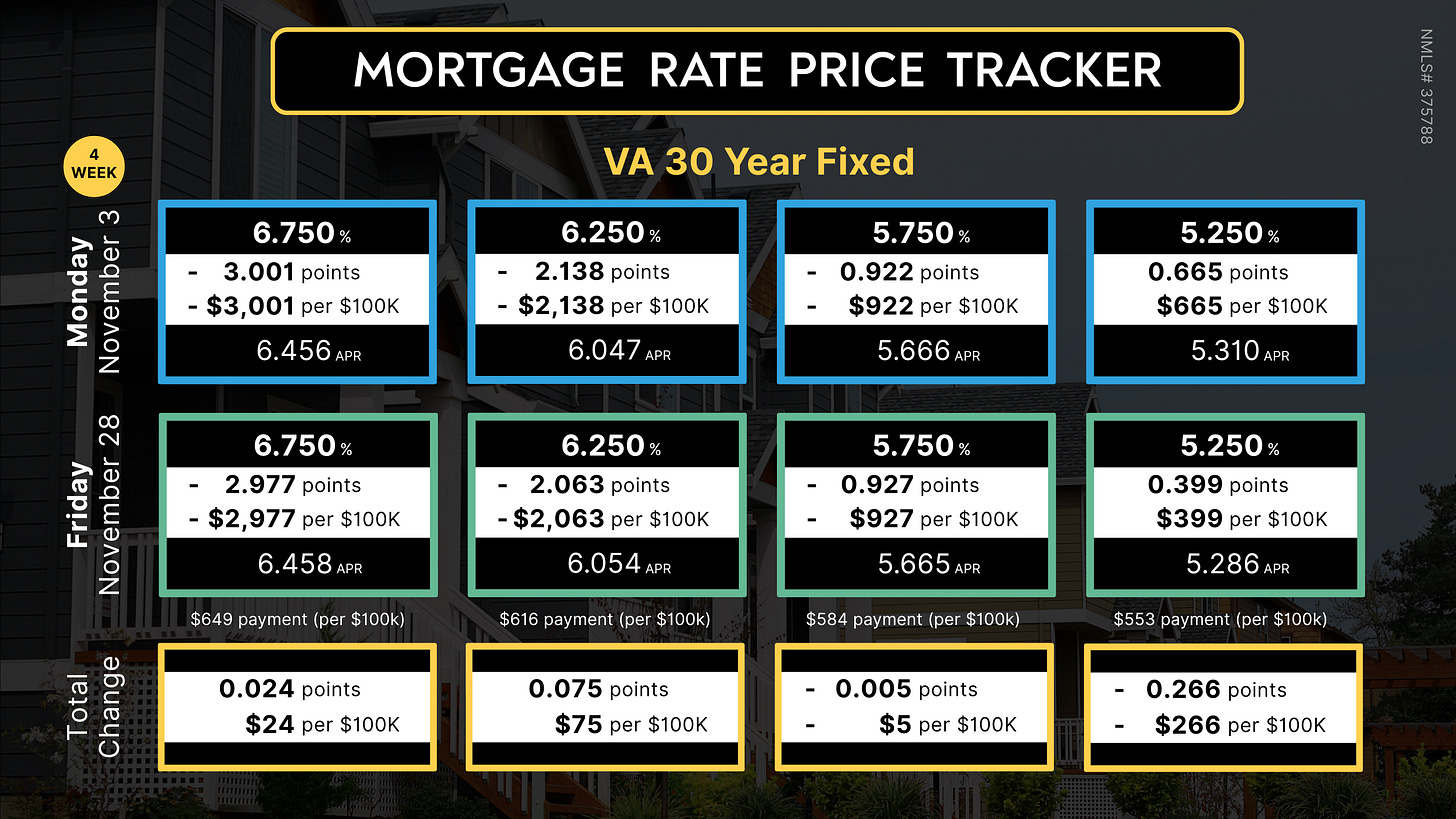

However, mortgage rates DO NOT rise or fall. Instead, the price of each rate changes while the rates available to you remain the same.

The Mortgage Rate Price Tracker (MRPT) illustrates this dynamic by showing how the price of each rate changed within the time series.

This change is driven by mortgage bonds, not the lender, who will then add their own fees on top.

The higher the rate, the lower the fee (points). Some higher rates pay a rebate; this is illustrated on the tracker with negative (-) points.

When the “total change” is negative it means a reduction in the price of the rate.

The MRPT is a more “rate and loan program” specific example of the LendZen Index, which monitors a much broader set of rates and mortgage bond coupons.

Both are effective for visualizing how the PRICE of mortgage rates has changed, while the LendZen Index is published daily at LendZen.substack.com

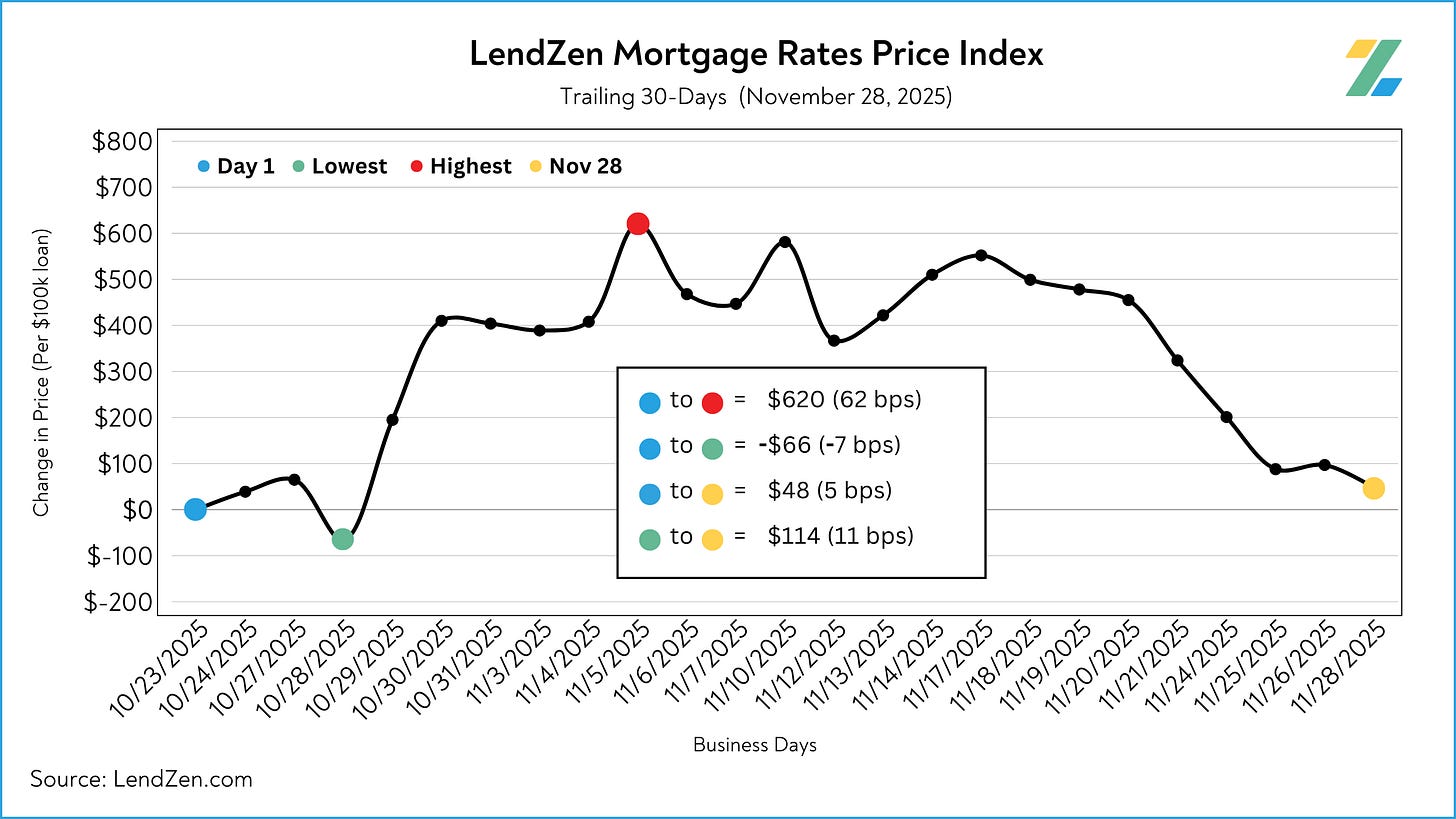

WEEK 4 📉

---------

Since the LendZen Index has a variety of time series, the MRPT will focus on just the current month’s activity.

Attached are the results for November Week 4.

You can also explore the Week 2 results on this previous Substack post.

RATE RECAP ⏪

--------------

Quiet trading defined the short Thanksgiving week, with bonds getting a mild boost from the sparsely scheduled econ data.

On Tuesday, the Producers Price Index (PPI), retail sales, and weekly ADP payrolls all helped mortgage rates.

After rising sharply following the Fed’s October 28 rate cut, and peaking 69 basis points above the October low, mortgage rate prices remained in a sideways pattern earlier in November but slowly recovered most of the losses in the final two weeks.

When mortgage bond prices rise, lower rates become more economical.

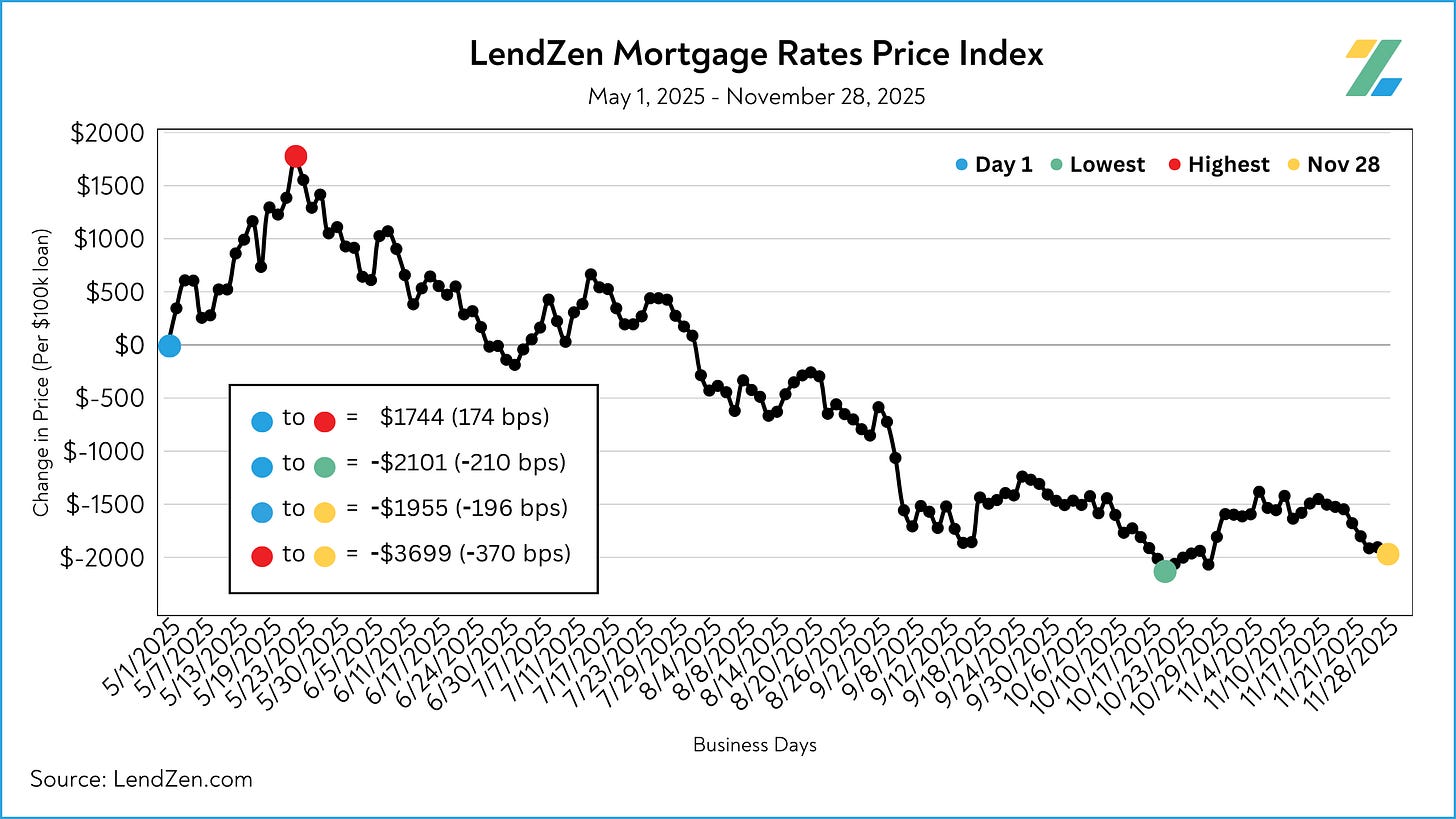

Since May 1 mortgage rate prices have improved significantly, down 370 basis points.

This means the cost of getting a $500,000 mortgage has DECREASED on average by $18,500!

As lower rates fall in price, borrowers refinance more quickly.

This increases the prepayment speed of mortgages and reduces the return (yield) investors get from higher mortgage bond coupons.

The result is less investment into higher coupons, which is why on the MRPT lower rates improved more than higher rates.

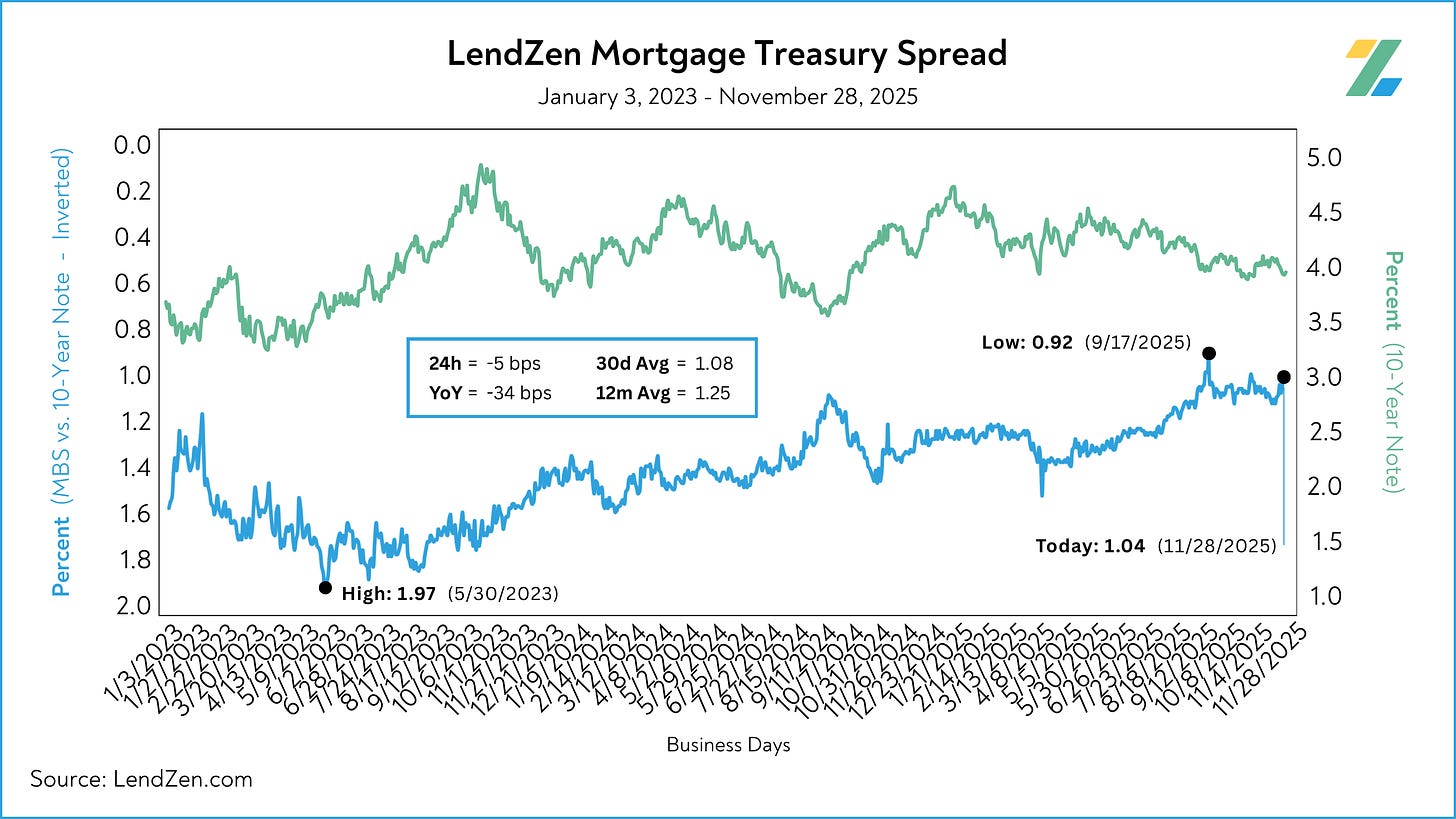

This is also why mortgage spreads should be measured based on actual MBS yields and not a made up “average rate” index.

Afterall, it is not the rates that change but the price of each.

UP NEXT 🗓️

----------

This past week the Chicago Business PMI, which emphasizes the manufacturing sector, had one of its worst results since Covid.

Meanwhile, the employment portion of the index fell to the lowest level since May 2009 – none of the PMI survey respondents reported that they added new jobs.

Markets shrugged it off, perhaps because of holiday distractions, or maybe because they are waiting for further confirmation from the more heavily weighted Institute for Supply Management PMI survey on Monday - more on this in an upcoming post.

Jerome Powell also has a scheduled speech Monday afternoon.

Midweek we get service sector PMI surveys and November auto sales, which is an industry under careful watch after subprime auto lender Tricolor, and auto parts maker First Brands, both filed for bankruptcy last quarter.

Finally, on Friday the latest PCE report is expected.

The Personal Consumption Expenditures is the Fed’s preferred gauge of inflation - the PCE data, along with Jerome’s Monday comments, could help provide some much-desired clarity surrounding next week’s FOMC rate decision.

More insight into next week’s events, along with the latest Rate Impact Calendar, will be posted in Sunday’s Week Ahead.

Meanwhile, the latest Lock-O-Meter risk scores and detailed rate lock recommendations with be posted Monday in the Data Deluge.

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

DISCLOSURES

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.