Mortgage Rate Price Tracker 🏠📉🔍 (NOV 3 – 21)

Monitoring the change in price of specific mortgage rates

Included in this post are the following:

THE TRACKER 🔭

----------------

Most mortgages are sold into mortgage-backed securities (MBS) and the price of these bonds determines rates for all banks and lenders.

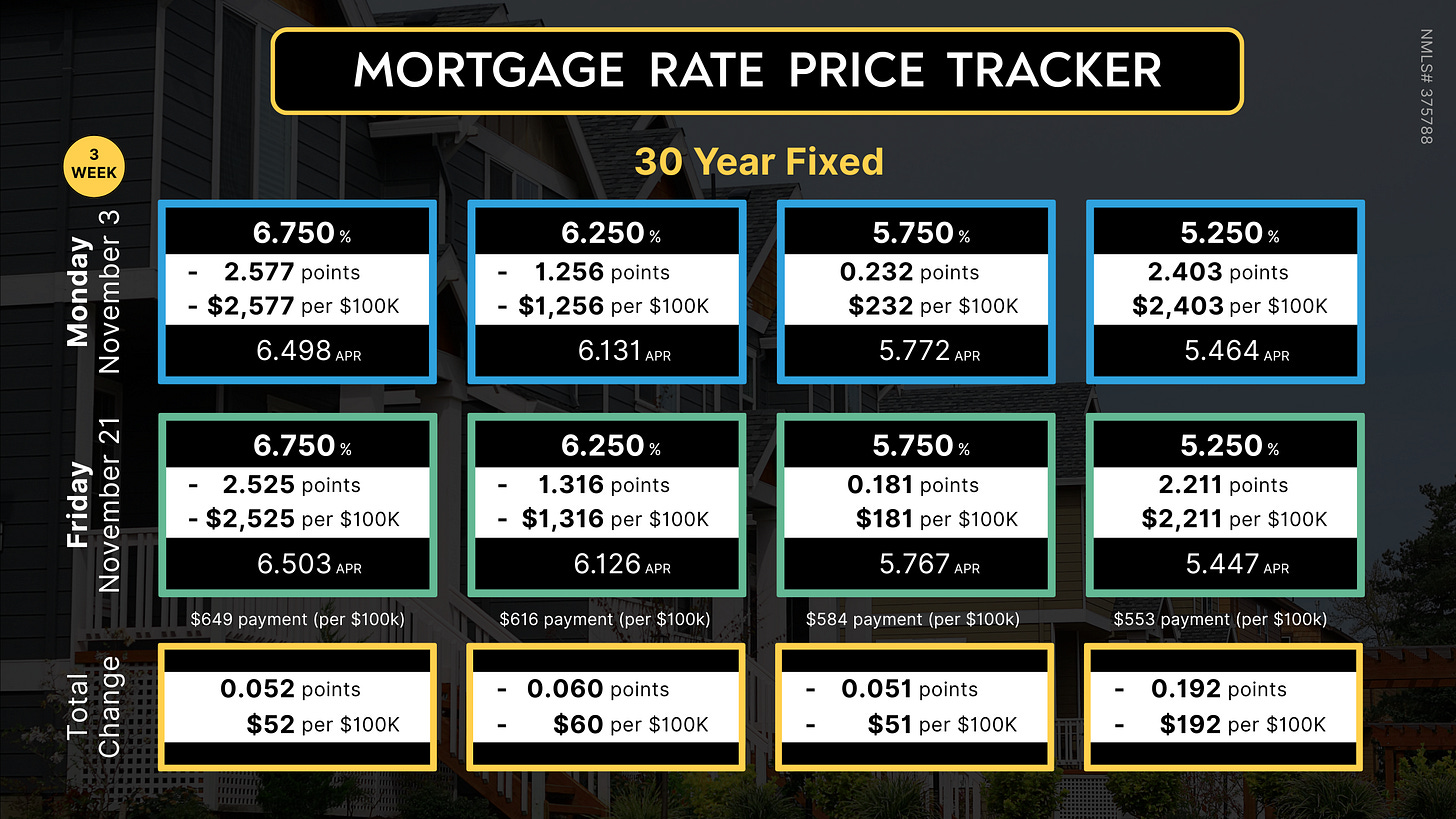

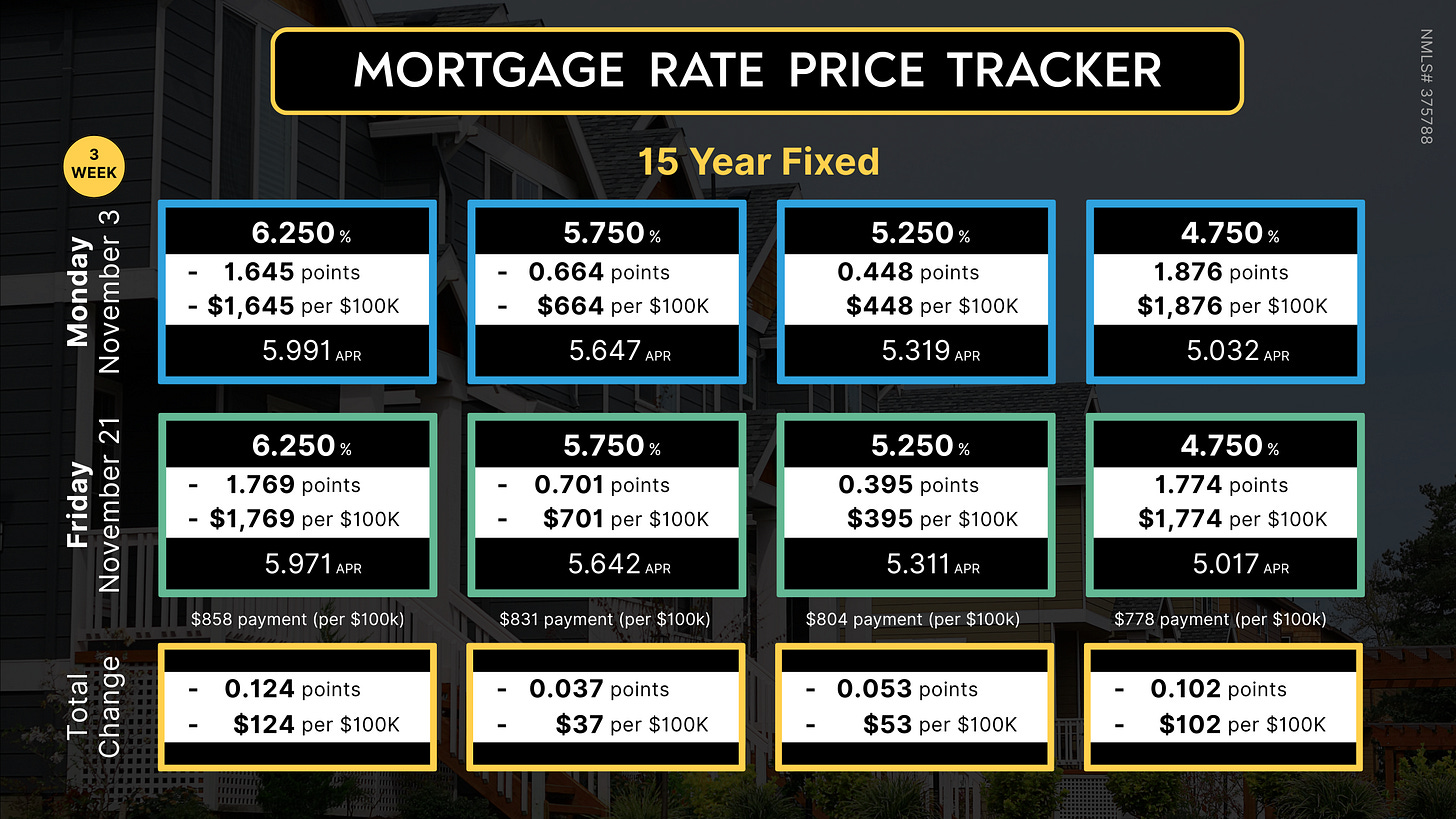

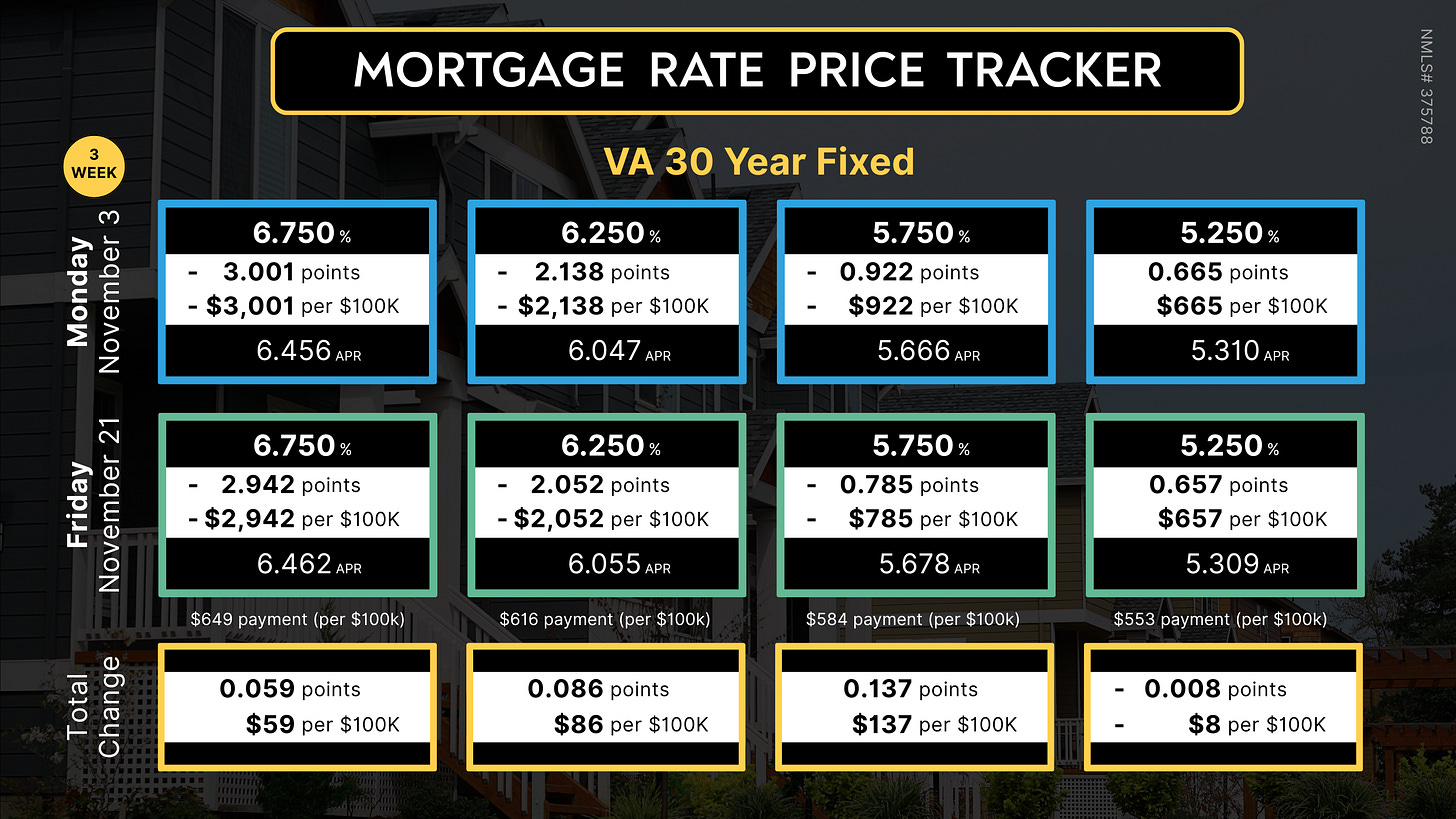

However, mortgage rates DO NOT rise or fall. Instead, the price of each rate changes while the rates available to you remain the same.

The Mortgage Rate Price Tracker (MRPT) illustrates this dynamic by showing how the price of each rate changed within the time series.

This change is driven by mortgage bonds, not the lender, who will then add their own fees on top.

The higher the rate, the lower the fee (points). Some higher rates pay a rebate; this is illustrated on the tracker with negative (-) points.

When the “total change” is negative it means a reduction in the price of the rate.

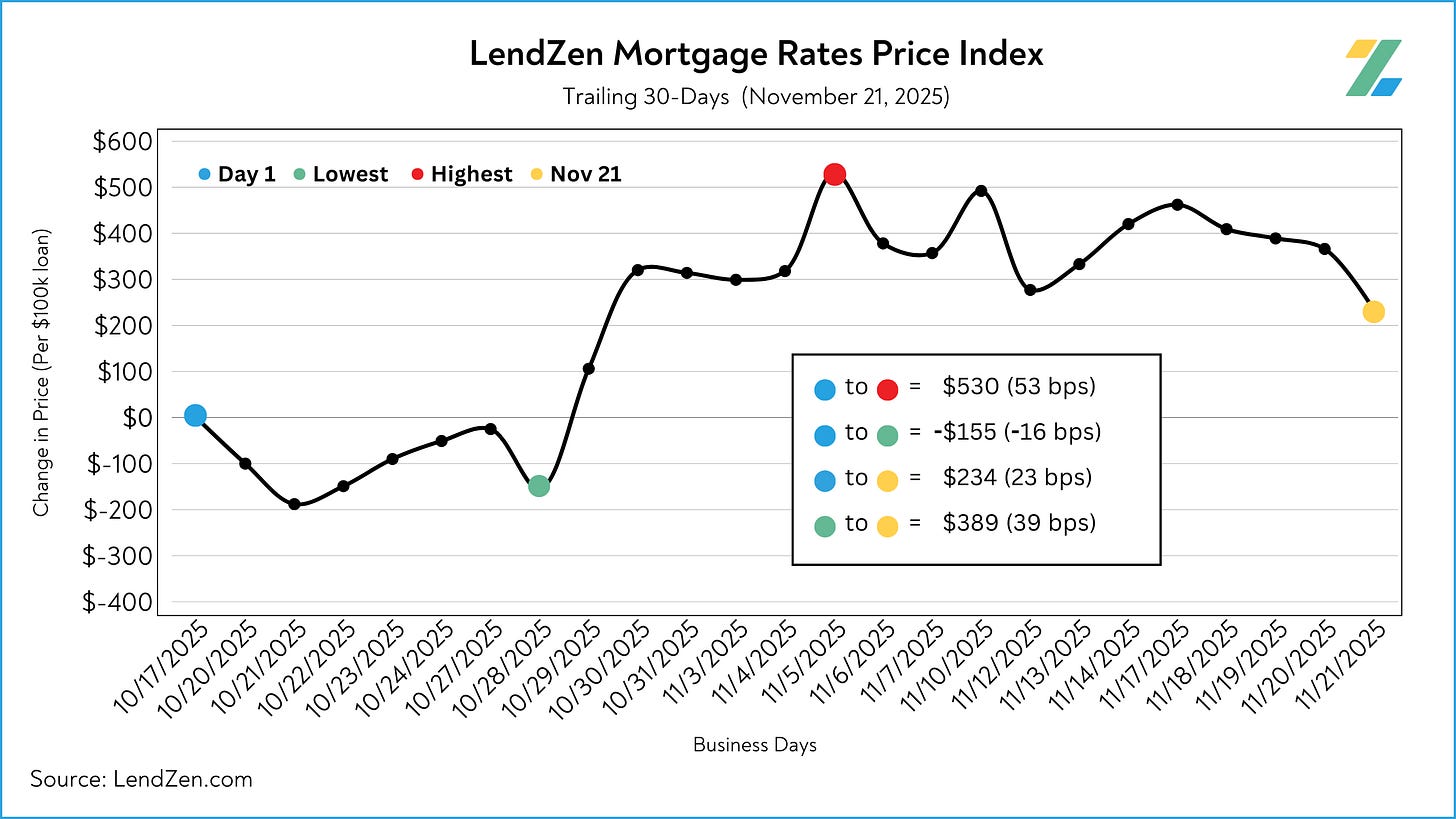

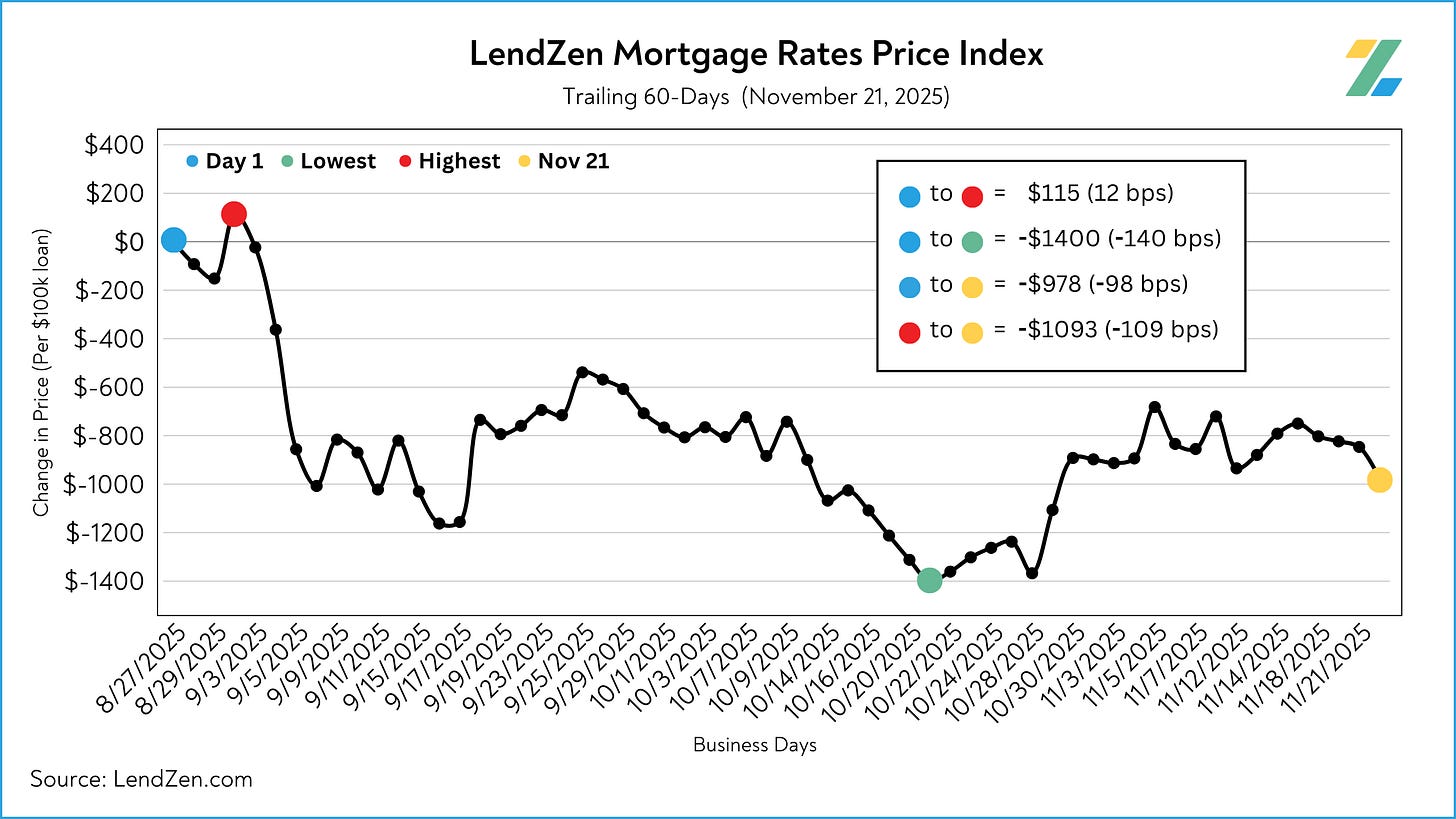

The MRPT is a more “rate and loan program” specific example of the LendZen Index, which monitors a much broader set of rates and mortgage bond coupons.

Both are effective for visualizing how the PRICE of mortgage rates has changed, while the LendZen Index is published daily at LendZen.substack.com

WEEK 3 📉

---------

Since the LendZen Index has a variety of time series, the MRPT will focus on just the current month’s activity.

Attached are the results for November Week 3.

You can also explore the Week 2 results on this previous Substack post.

RATE RECAP ⏪

--------------

With the government shutdown behind us, and the December rate cut “not a foregone conclusion”, markets hoped the backlog of economic data could tip the scales in one direction.

Unfortunately, the September Non-Farm Payroll employment report that was released Thursday (originally scheduled for October 3) gave mixed signals.

The headline number of new jobs added beat previous expectations, but the overall unemployment rate ticked up to 4.4%, due mostly to a small increase in the labor force participation.

Meanwhile, the previous month had a large revision downward.

All together it did little to quench the thirst for clarity.

On Friday, jawboning from NY President John Williams gave risk assets a boost as he suggested the weakening labor market was justification for lowering the Fed Funds Rate again.

The news was mostly stock friendly, stealing earlier bond market moment.

In the end it was another sideways week, which has been the story thus far in November.

UP NEXT 🗓️

----------

Markets are closed Thursday next week for the Thanksgiving holiday, but on Wednesday PPI and Retails Sales data could give markets something to chew on besides a turkey leg.

Since NFP employment data is a survey, the Bureau of Labor Statistics has cancelled the October report.

The BLS also announced that the November NFP, which was originally scheduled for December 5th, will now be released on the 16th.

This pushes the closely watched employment report until after the Fed’s December FOMC meeting (Dec 9 - 10).

Although PPI and ISM data provides some indication of inflation, markets will likely continue to grind sideways until the Fed rate decision and subsequent November payrolls data.

This doesn’t give mortgage rates much hope for a near-term recovery back to October’s best levels, but hovering at the base of the August bond rally isn’t awful either.

For now, let’s hope the bond market can deliver an early holiday present by mid-December.

More insight into next week’s events, along with the latest Rate Impact Calendar, will be posted in Sunday’s Week Ahead.

Meanwhile, the latest Lock-O-Meter risk scores and detailed rate lock recommendations with be posted Monday in the Data Deluge.

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

DISCLOSURES

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.