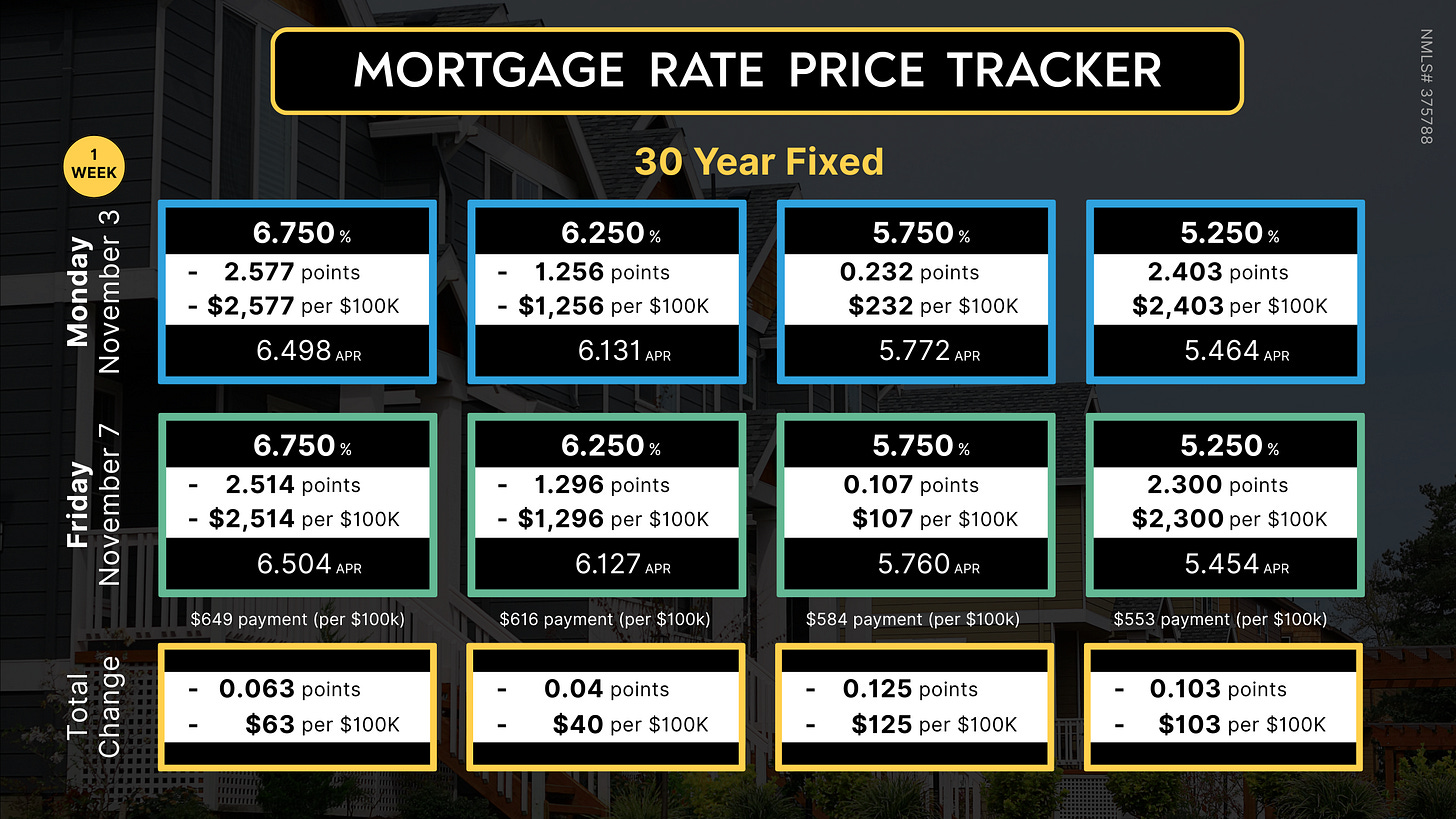

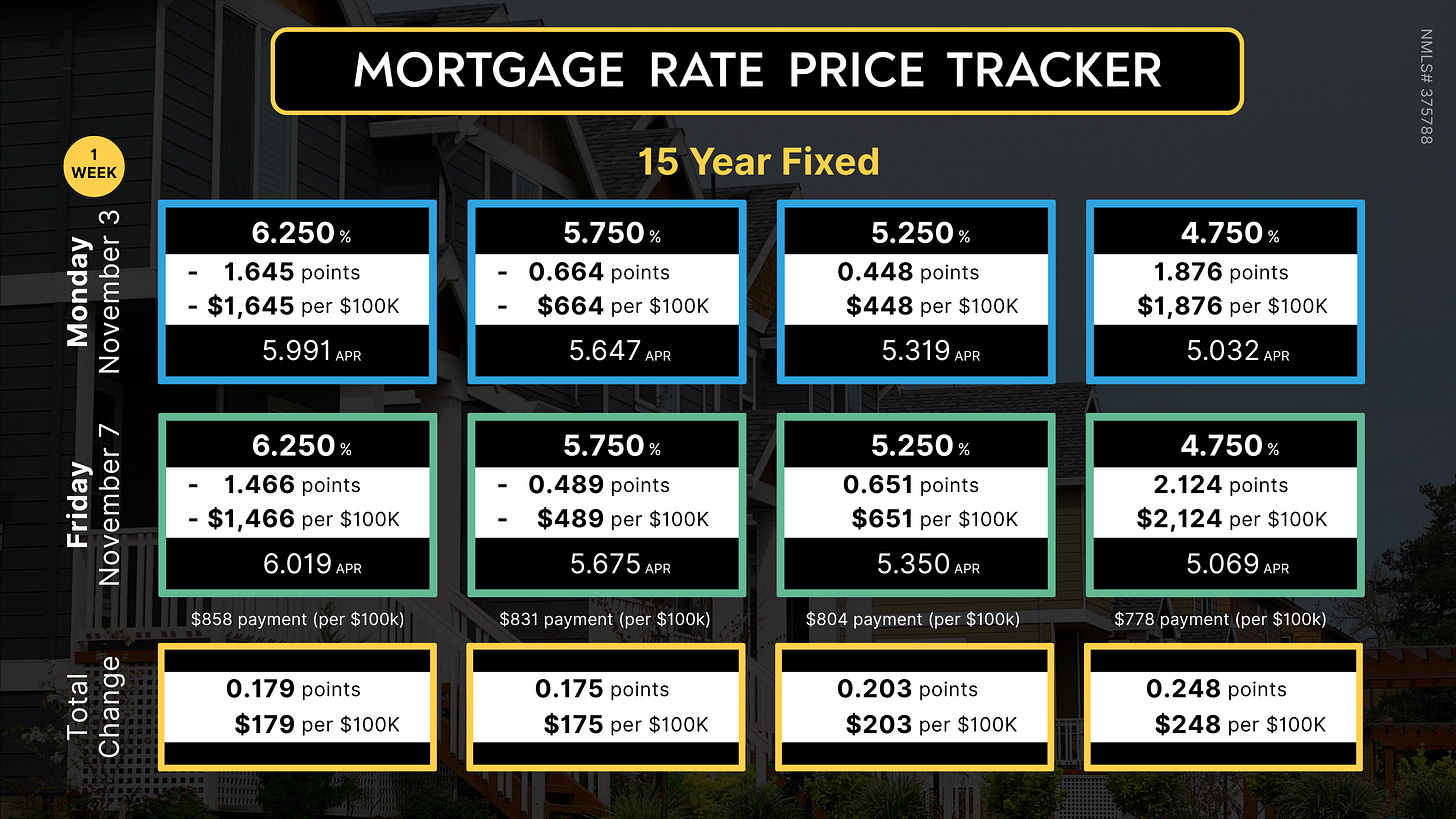

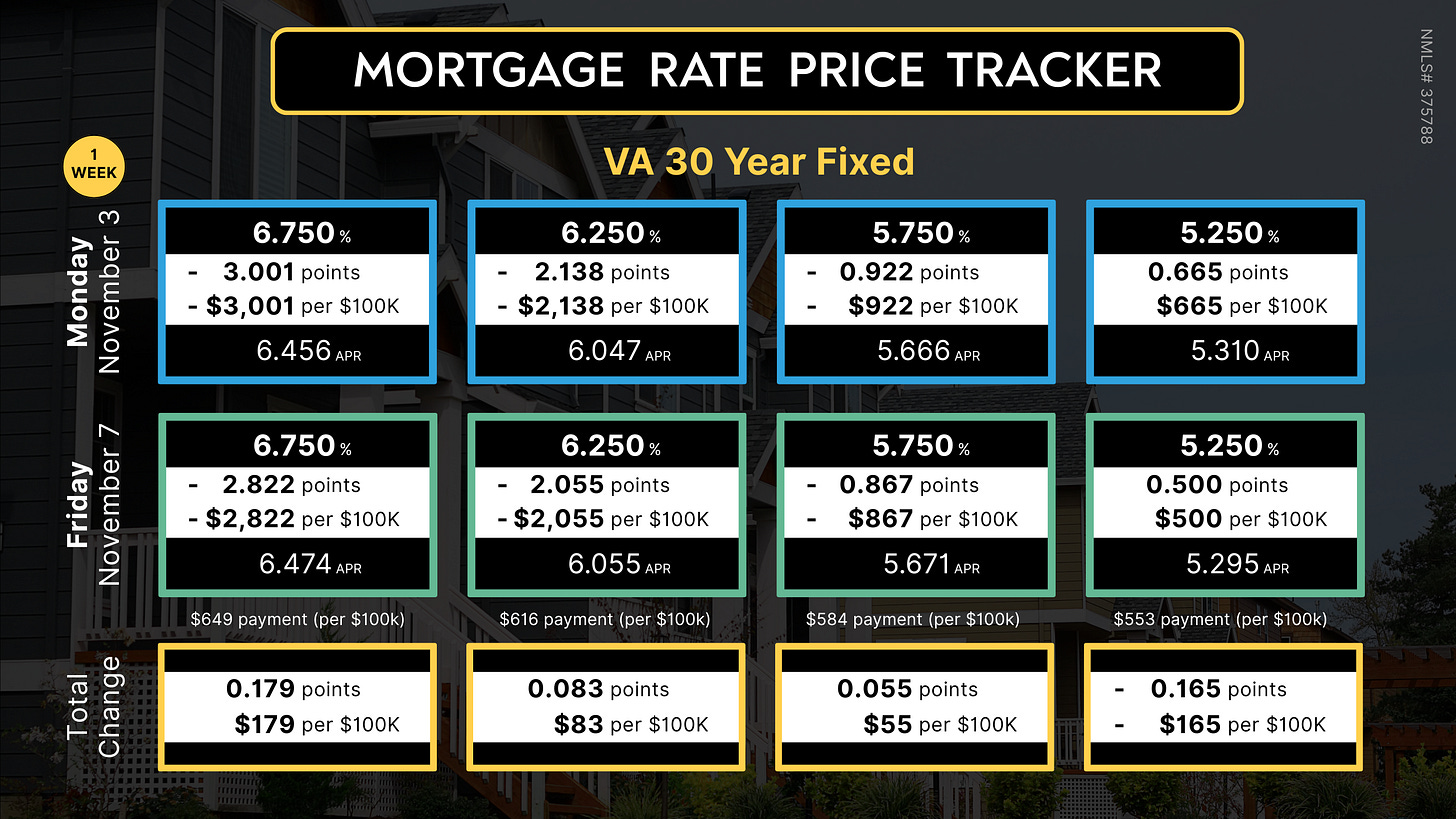

Mortgage Rate Price Tracker 🏠📉🔍 (NOV 3 – 7)

Monitoring the change in price of specific mortgage rates

THE TRACKER 🔭

----------------

Most mortgages are sold into mortgage-backed securities (MBS) and the price of these bonds determines rates for all banks and lenders.

However, mortgage rates DO NOT rise or fall. Instead, the price of each rate changes while the rates available to you remain the same.

The Mortgage Rate Price Tracker (MRPT) illustrates this dynamic by showing how the price of each rate changed within the time series.

This change is driven by mortgage bonds, not the lender, who will then add their own fees on top.

The higher the rate, the lower the fee (points). Some higher rates pay a rebate; this is illustrated on the tracker with negative (-) points.

When the “total change” is negative it means a reduction in the price of the rate.

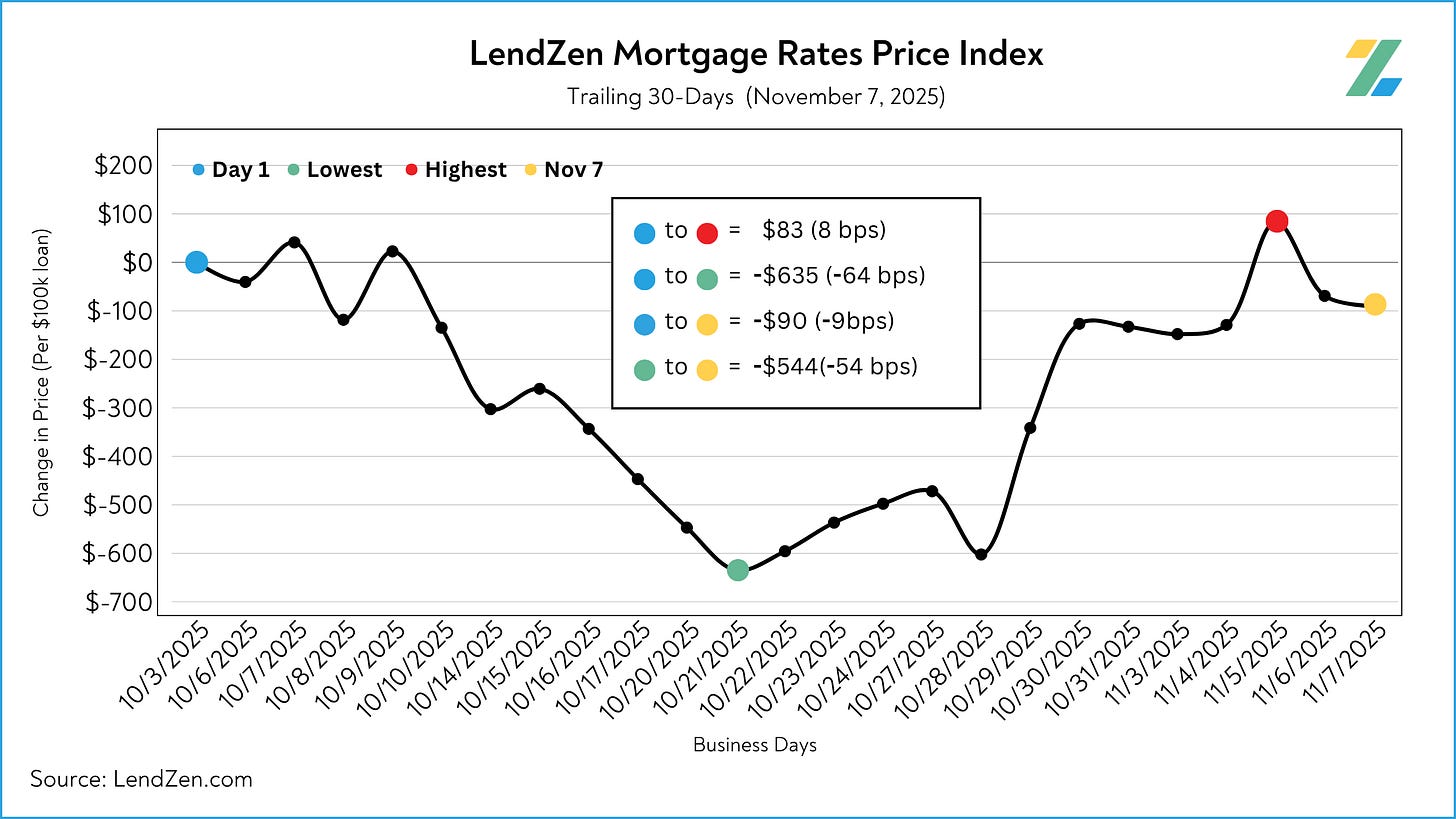

The MRPT is a more “rate and loan program” specific example of the LendZen Index, which monitors a much broader set of rates and mortgage bond coupons.

Both are effective for monitoring how the price of mortgage rates has changed, while the LendZen Index is published daily at LendZen.substack.com

RATE RECAP ⏪

--------------

The first week of November tried to find its footing after a disappointing end to the month of October.

The final week of last month saw the price of rates slide 20 – 60 bps. You can explore those results further in this Substack post.

In the shadow of that move, ending this week relatively unchanged is a welcomed result, especially after a scary midweek reaction to the ADP payrolls data.

Read more on the bond selloff in the Midweek Roundup and see the subsequent recovery in the LendZen Index chart below.

VA mortgage rates fared the best this week (Ginnie Mae bonds), while 15-Year mortgages continue to be the least loved.

UP NEXT 🗓️

----------

We ended another week without a resolution for the government shutdown.

If the standoff continues the short week ahead (Veteran’s Day) could be without key inflation data, with CPI and PPI both at risk of being delayed (again).

More on that in Sunday’s Week Ahead.

The latest Lock-O-Meter risk scores and detailed rate lock recommendations with be posted Monday in the Monday Data Deluge.

Thanks for reading.

If you are interested in more mortgage insights, then I suggest checking out this recent Substack article.

DISCLOSURES

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.