Mortgage Rate Price Tracker 🏠📉🔍 (JAN 5 – 9)

Monitoring the change in price of specific mortgage rates

Included in this post are the following:

THE TRACKER 🔭

----------------

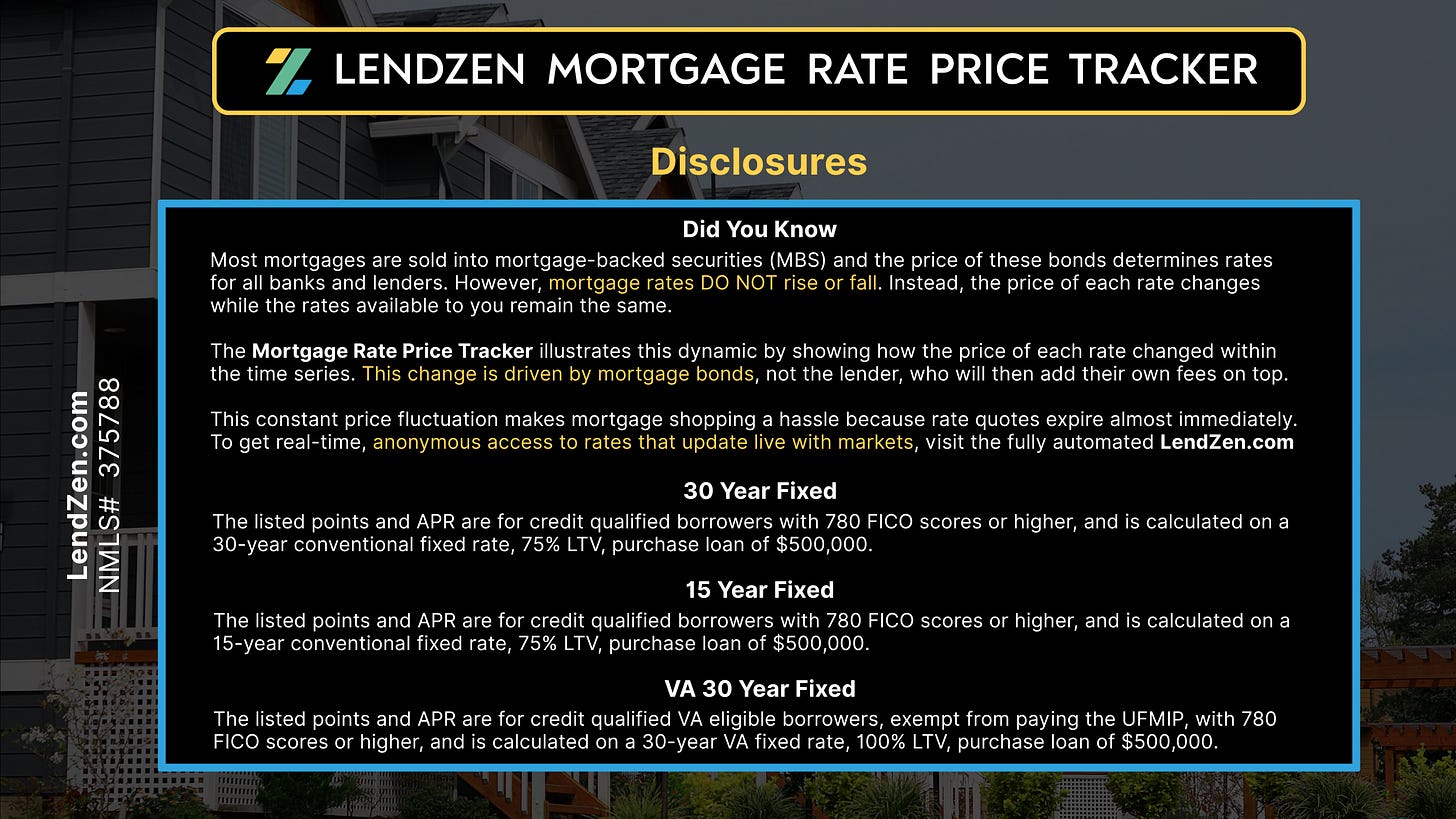

Most mortgages are sold into mortgage-backed securities (MBS) and the price of these bonds determines rates for all banks and lenders.

However, mortgage rates DO NOT rise or fall. Instead, the price of each rate changes while the rates available to you remain the same.

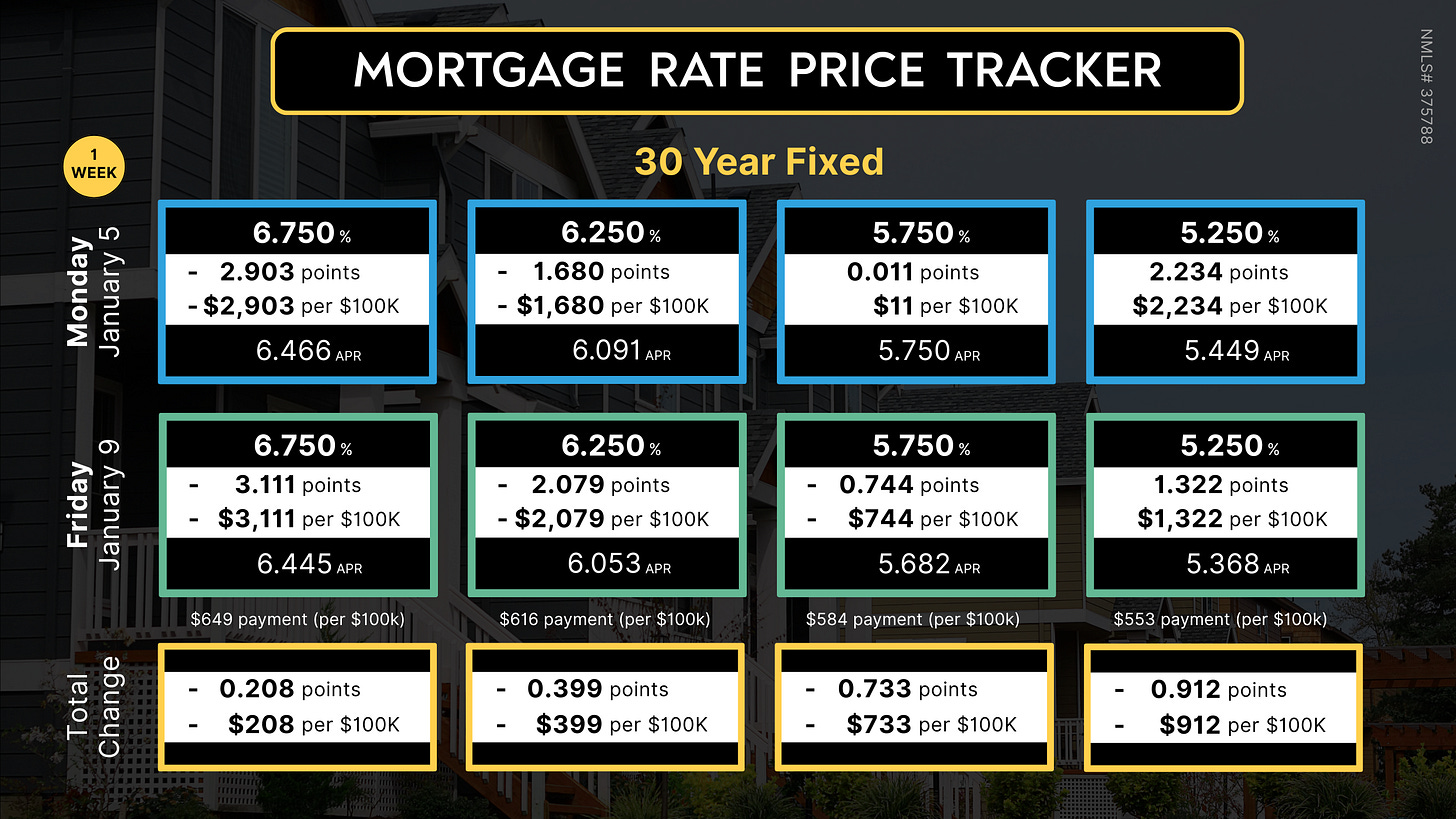

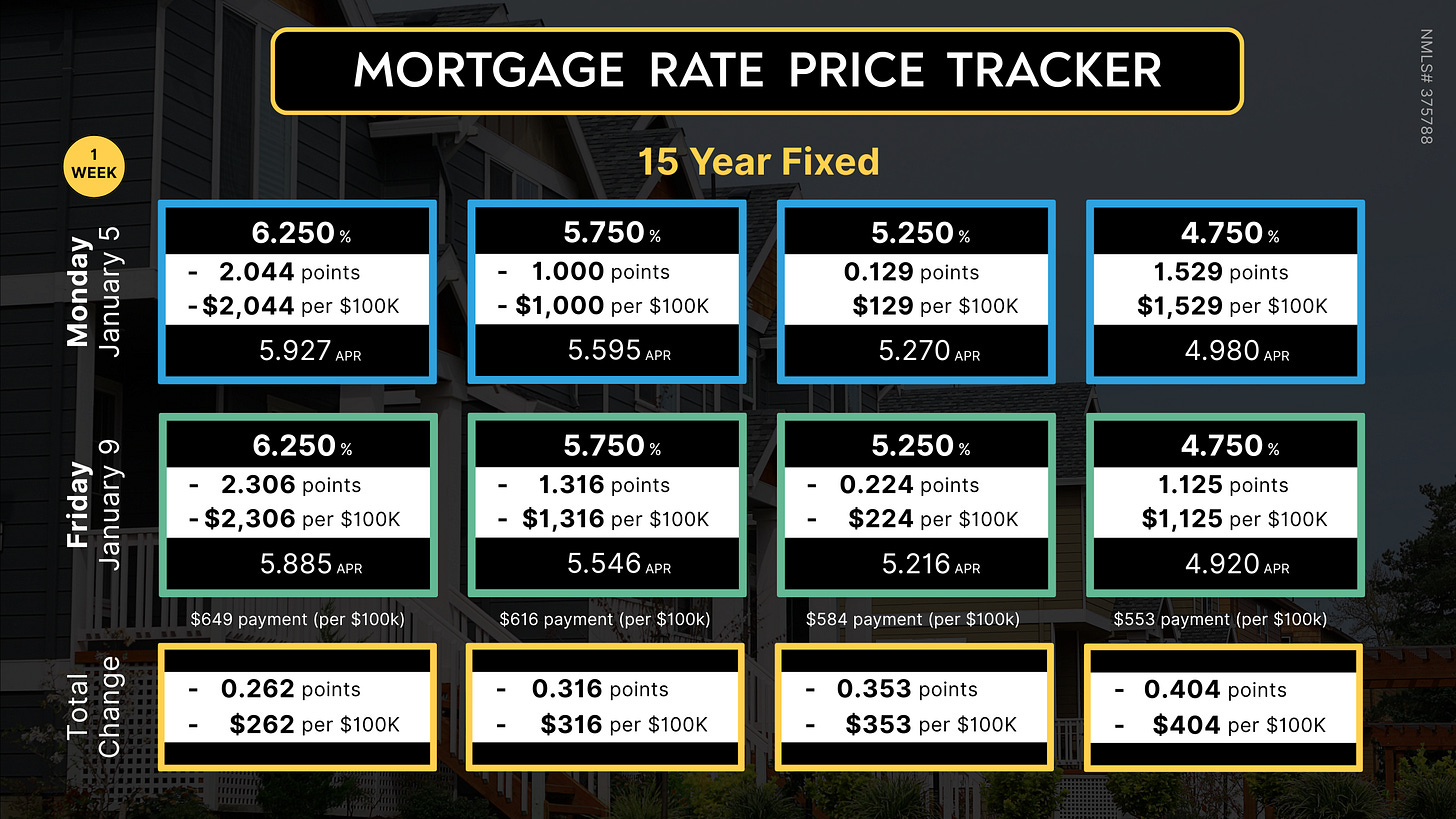

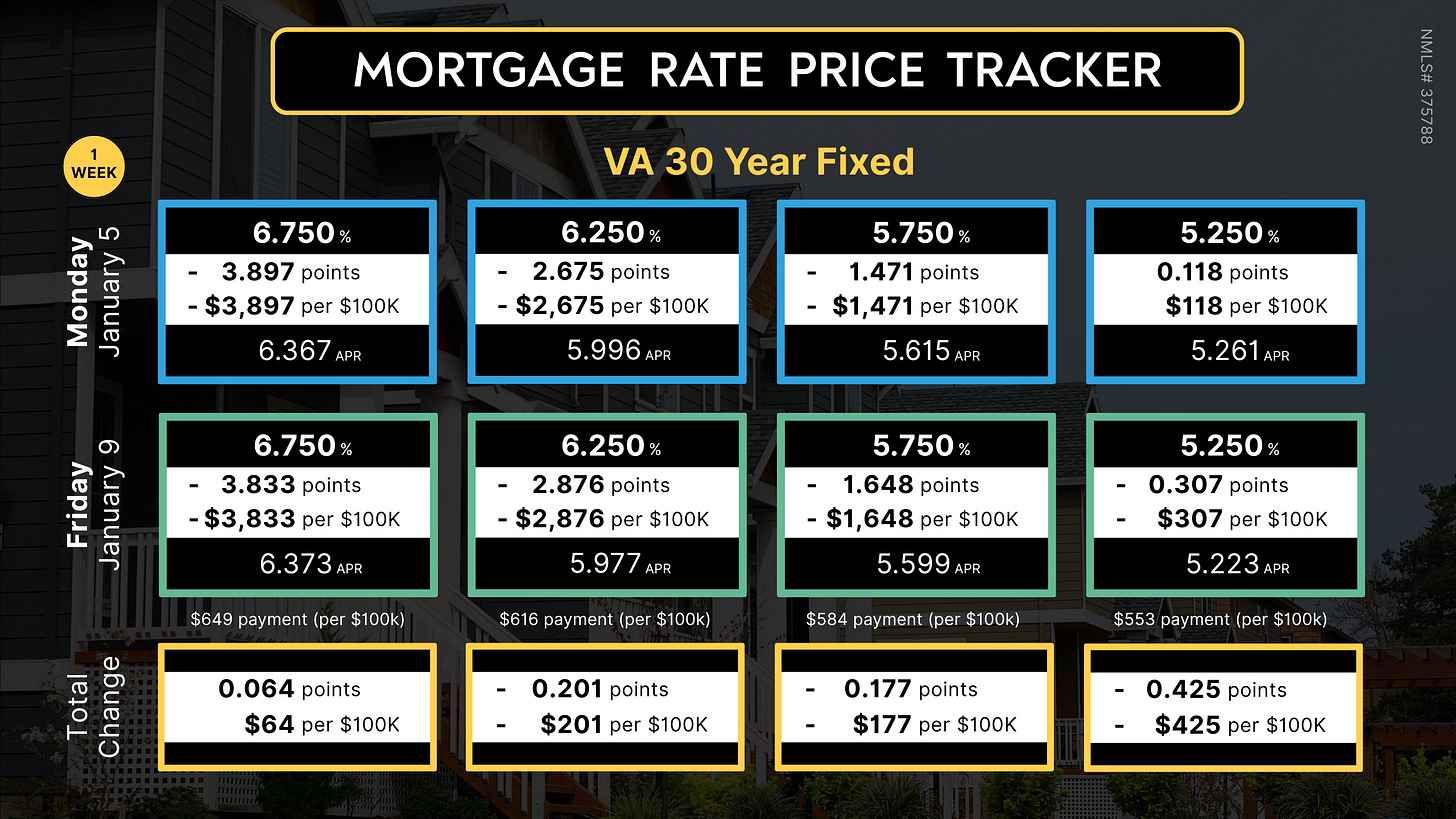

The Mortgage Rate Price Tracker (MRPT) illustrates this dynamic by showing how the price of each rate changed within the time series.

This change is driven by mortgage bonds, not the lender, who will then add their own fees on top.

The higher the rate, the lower the fee (points). Some higher rates pay a rebate; this is illustrated on the tracker with negative (-) points.

When the “total change” is negative it means a reduction in the price of the rate.

The MRPT is a more “rate and loan program” specific example of the LendZen Index, which monitors a much broader set of rates and mortgage bond coupons.

Both are effective for visualizing how the PRICE of mortgage rates has changed, while the LendZen Index is published daily at LendZen.substack.com

WEEK 1 📉

---------

Since the LendZen Index has a variety of time series, the MRPT will focus on just the current month’s activity.

Attached are the results for January Week 1.

You can also explore the final results for December Week 3 on this previous Substack post.

MBS PRICING 🏦

----------------

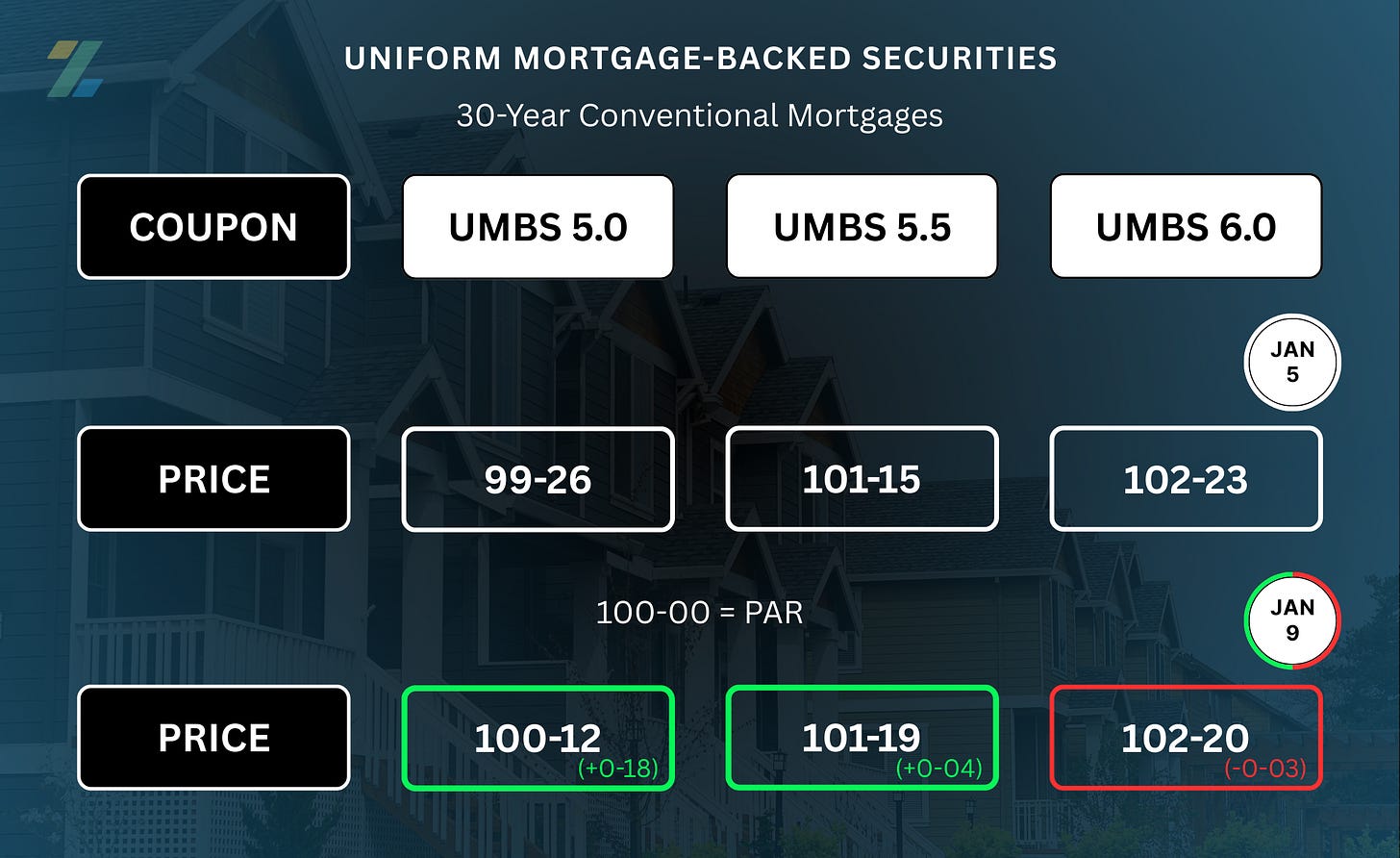

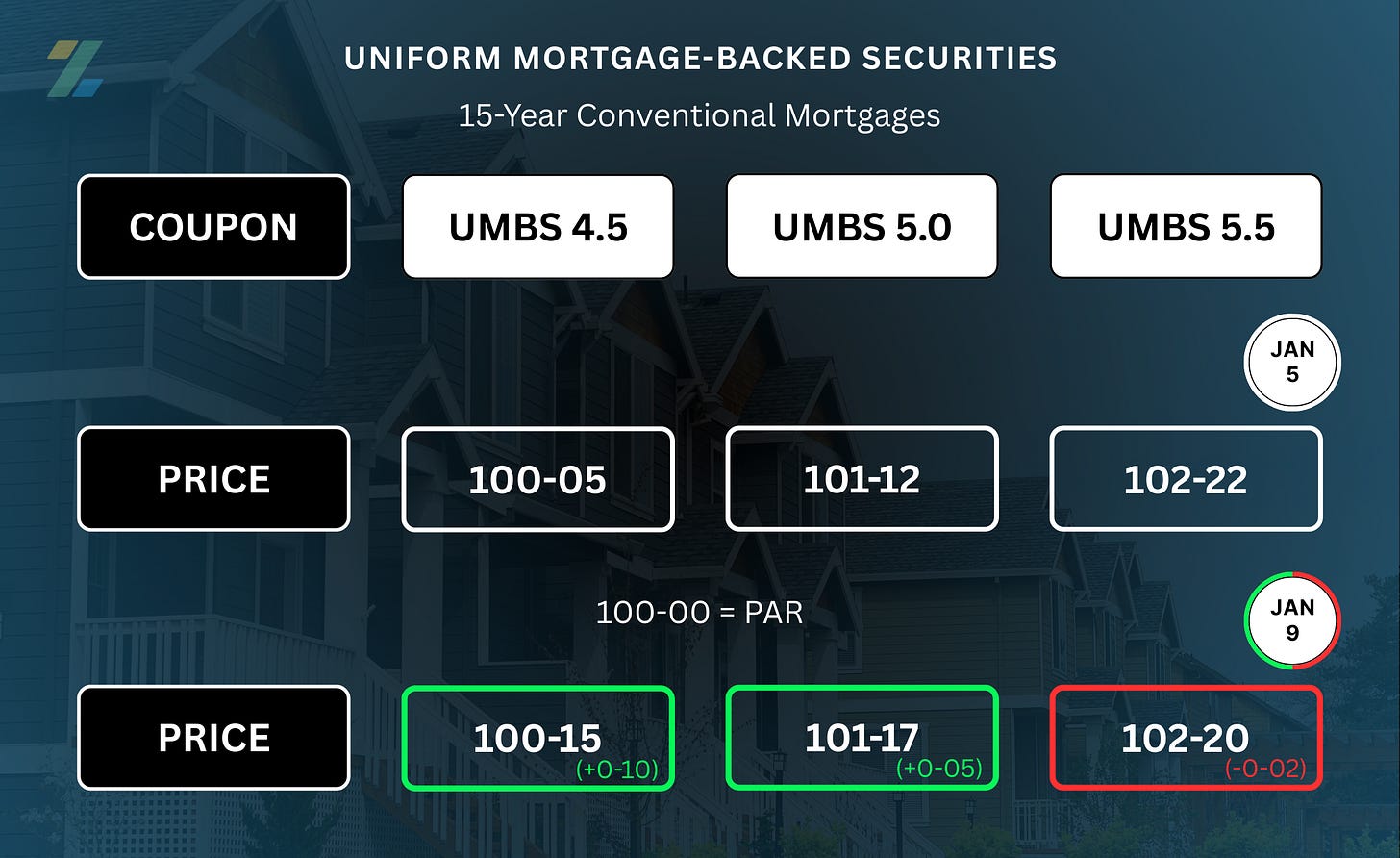

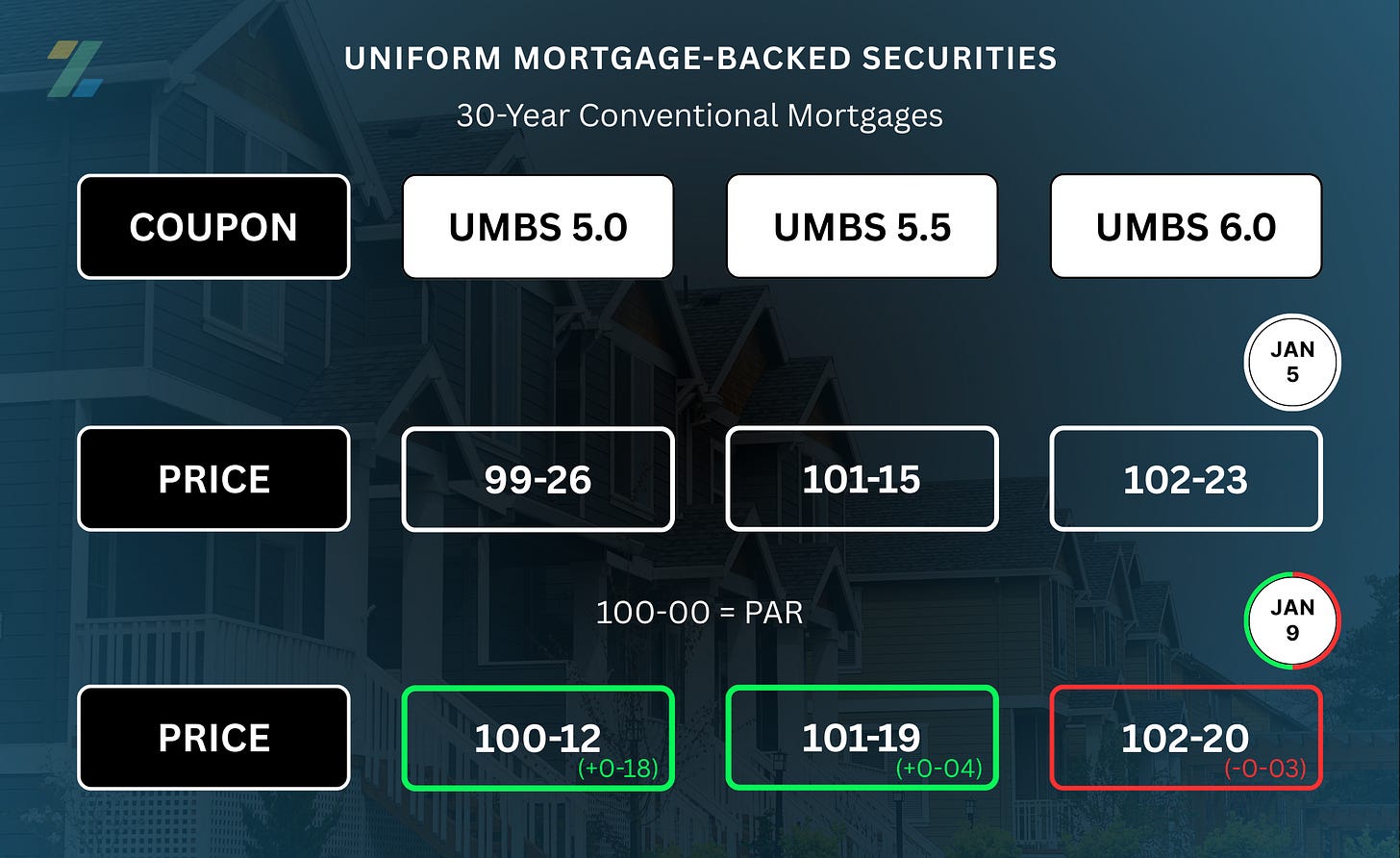

NEW to the Tracker are the current week’s MBS coupon price changes.

MBS coupons are sold at half-percent increments, while their price moves in 32nds (ticks).

ex. (0-04) = 4/32 = 12.5 bps

100-00 acts as the starting line, also referred to as PAR.

The higher the coupon price, the less expensive the rates will be that are sold into that security.

Therefore, an increase in the price of mortgage bonds is good for mortgage rates.

Learn more about the dynamics of MBS pricing and how it impacts your mortgage options in any of the bi-weekly “Rate Snapshot” Substack posts.

RATE RECAP ⏪

--------------

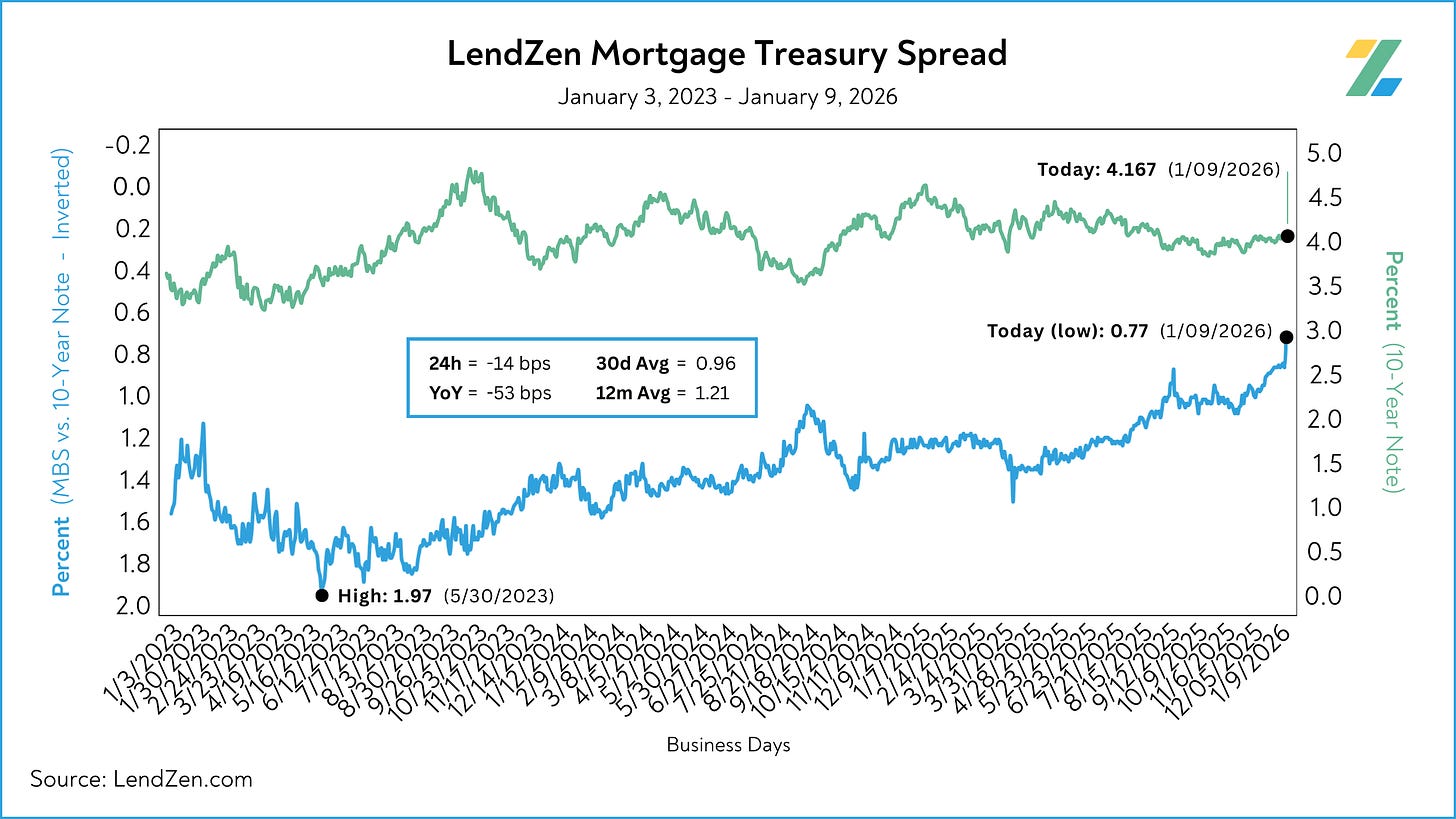

Mortgage rates looked a little sleepy to start the year and the bond market seemed content sitting on their hands until the Friday Non-Farm Payroll report was released.

That is, until Thursday afternoon when President Trump posted on his Truth Social that he was instructing Fannie/Freddie to spend their $200B cash pile on mortgage bonds.

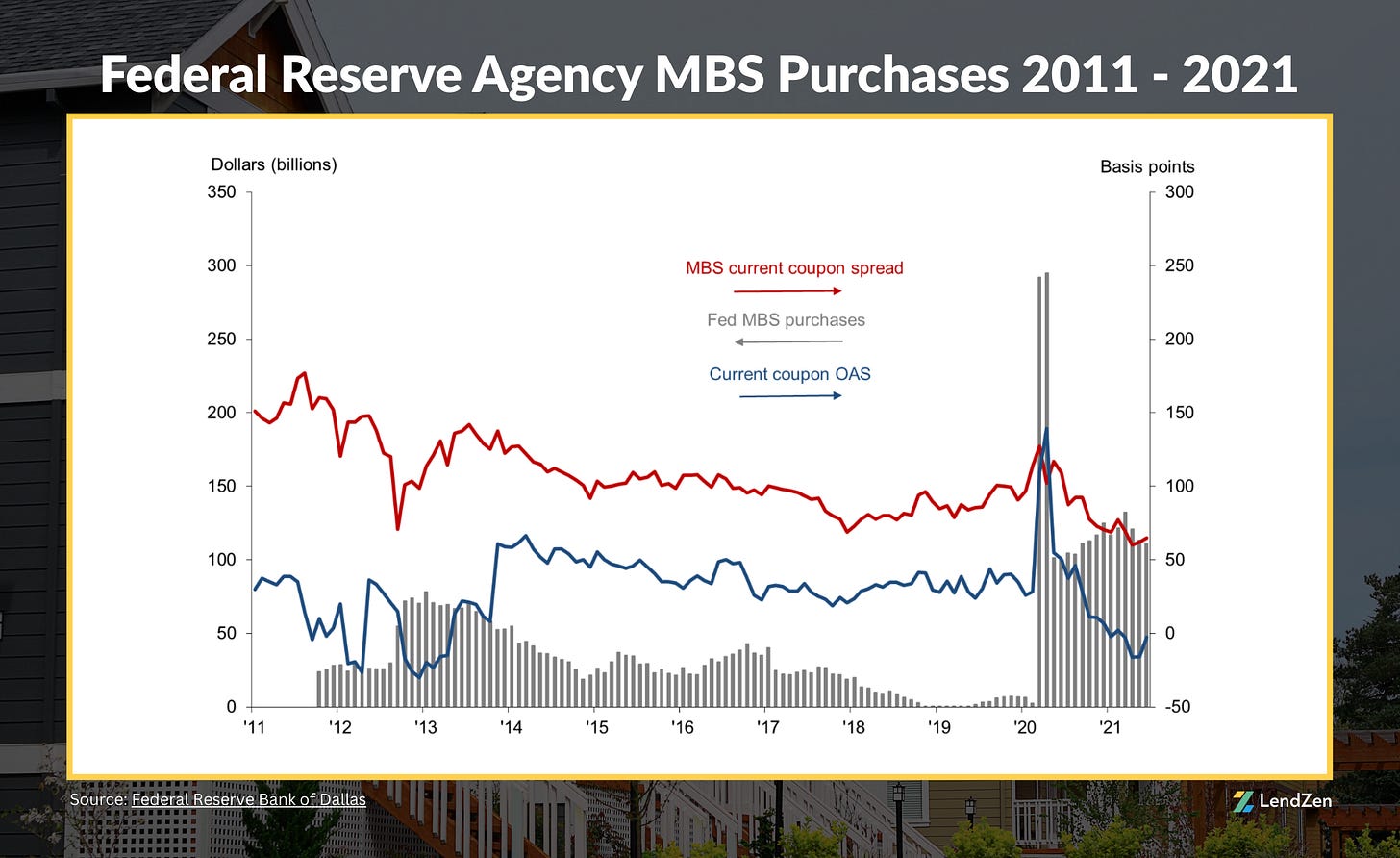

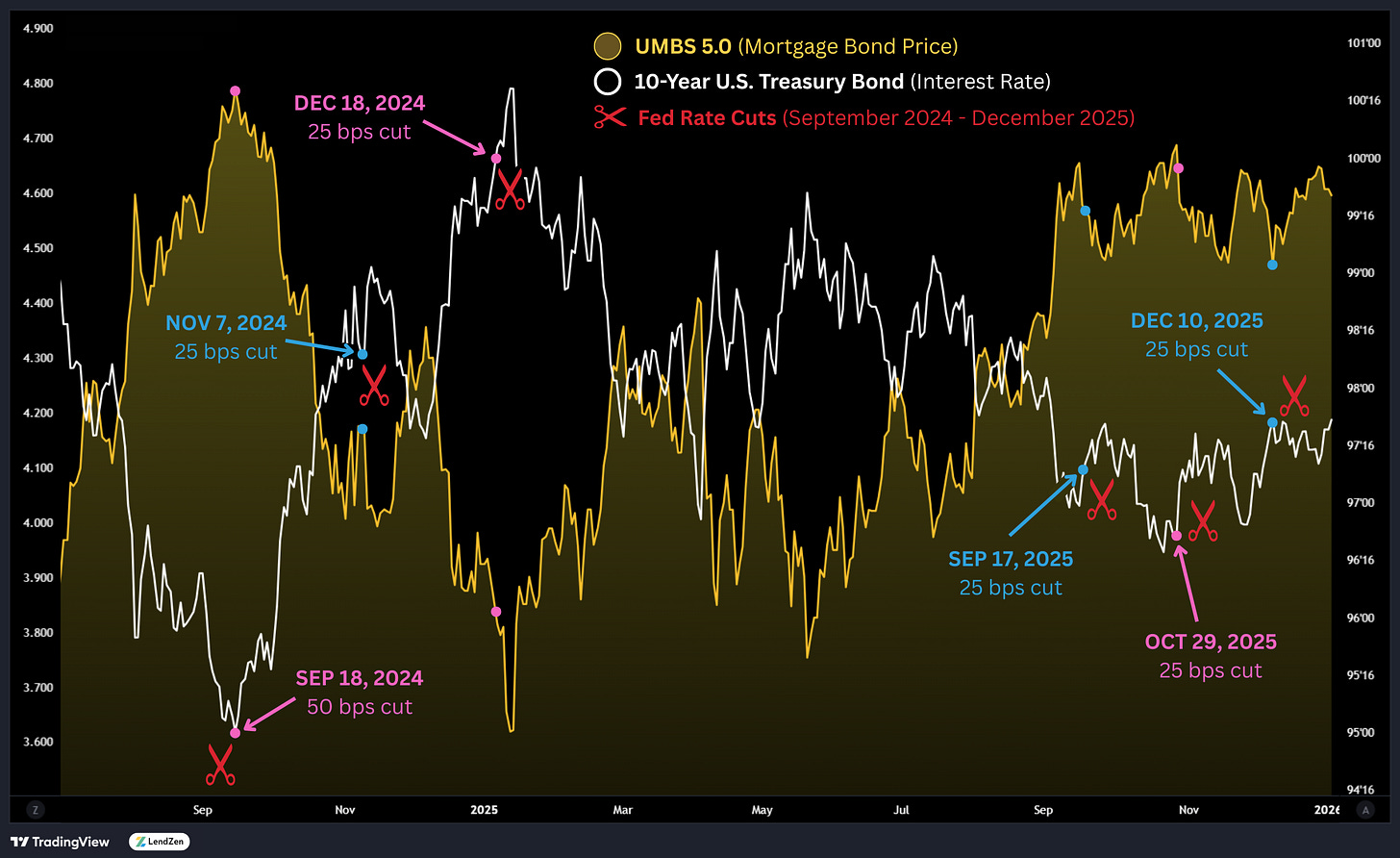

More on this as it unfolds, but keep in mind the Fed purchased a total of $580 billion in agency MBS during the two-month period of March - April 2020 and continued buying $40B per month for a full year after (June 2021).

Even $20B per month, half of what the Fed spent monthly, would exhaust those funds before the end of 2026.

In the short term, $200B would provide a stable buyer of MBS, further tightening spreads.

This was on display today.

The 10-Year Treasury didn’t budge but MBS prices soared, massively compressing the spread by 14 bps.

The announcement, combined with an uneventful NFP report, resulted in a big day for mortgage bonds.

Particularly the UMBS coupons, since that is where the bond buying would most likely focus – after all it’s a Fannie/Freddie cash pile.

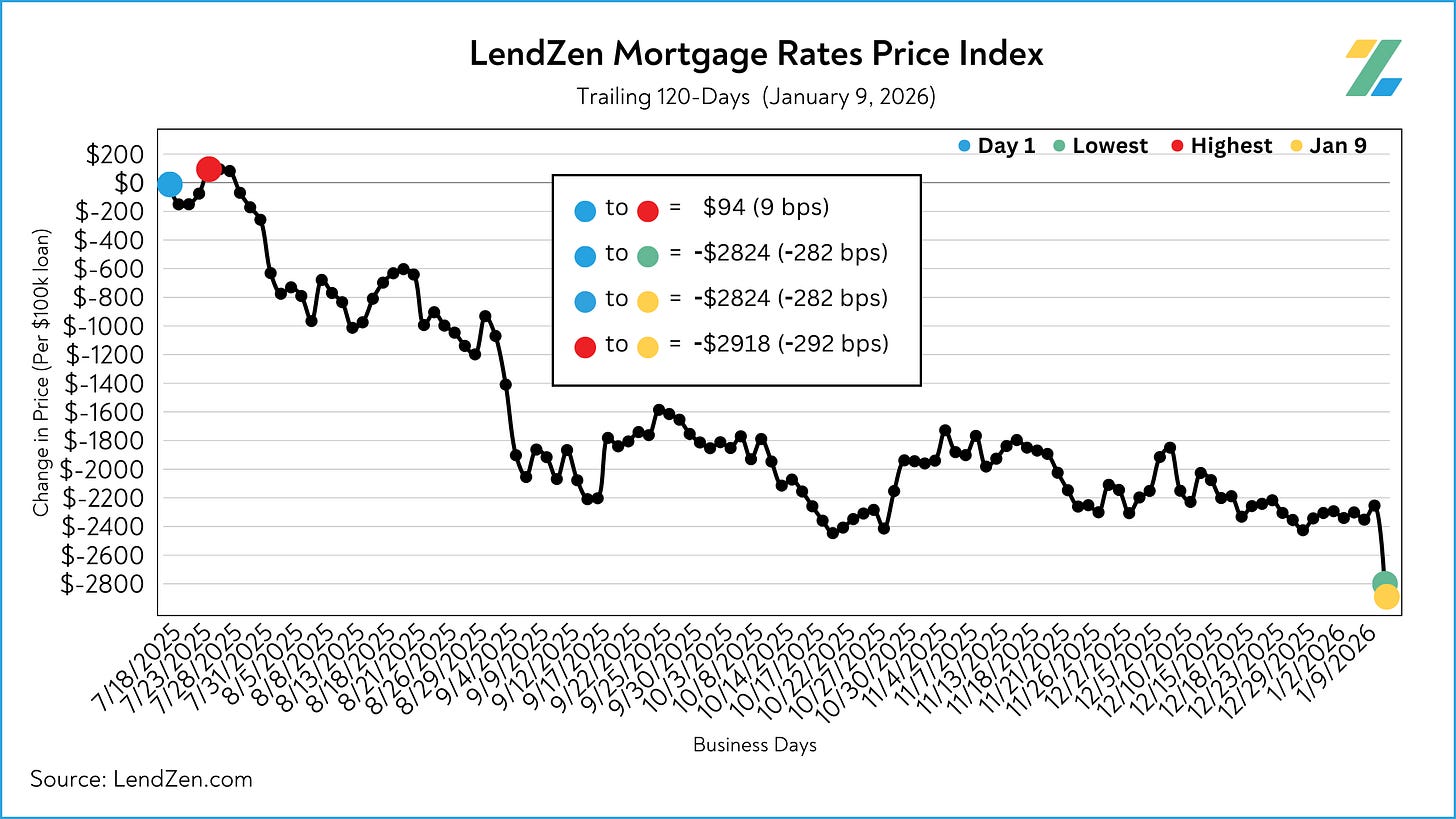

The price of mortgage rates improved significantly on the week, but it all happened in the last 24 hours.

The gains were also lopsided, with bond traders front-running lower coupons, since this type of liquidity injection will increase repayment speeds (refinancing) which makes higher coupons less attractive.

The last 6-months, and today especially, have been “baptism by fire” for most new homeowners when it comes to making savvy mortgage decisions.

Mortgage prices today reached the best levels since Covid, down 292 basis points from July.

That means the same rate a borrower would have paid 3-points for last summer is 0-points today.

In other words, the cost of getting a $500k mortgage is now $14,600 less expensive.

Anyone who paid points for a lower rate last year is likely regretting it, especially refinance borrowers who opted for a rate that had a multi-year breakeven.

Learn more about breakeven timelines and when to refinance by visiting this Substack post.

UP NEXT 🗓️

----------

There are some negative side effects to the type of “open market operation” proposed by Trump this week, especially while details of how it will be implemented remain unclear.

For one, it adds to market volatility as bond traders try to navigate the headlines.

As a result, rate sheets can become more unpredictable as wild day-to-day swings in MBS prices add to hedging costs.

This creates pricing distortions and makes it harder for borrowers to explore their options, as each lender will try to handle the “unknowns” differently.

Big improvements one day might suddenly evaporate the next, even if there is no significant change in MBS.

Trump has always been a tail-risk for markets, a single social media post can create shockwaves – but now he is directly engaging about MBS, so for the time being it will asymmetrically impact mortgage rates.

This ramps up volatility heading into next week’s Consumer Price Index inflation data.

Considering that today’s employment report (NFP) was neutral, or as expected, CPI will get extra attention as Fed rate cuts become a focus again.

Rate cuts are not necessarily good for mortgage rates and did more harm than good for bond prices last year.

More insight into next week’s events, along with the latest Rate Impact Calendar, will be posted in Sunday’s Week Ahead.

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

DISCLOSURES

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.