Mortgage Rate Price Tracker 🏠📉🔍 (DEC 1 – 26)

Monitoring the change in price of specific mortgage rates

Included in this post are the following:

THE TRACKER 🔭

----------------

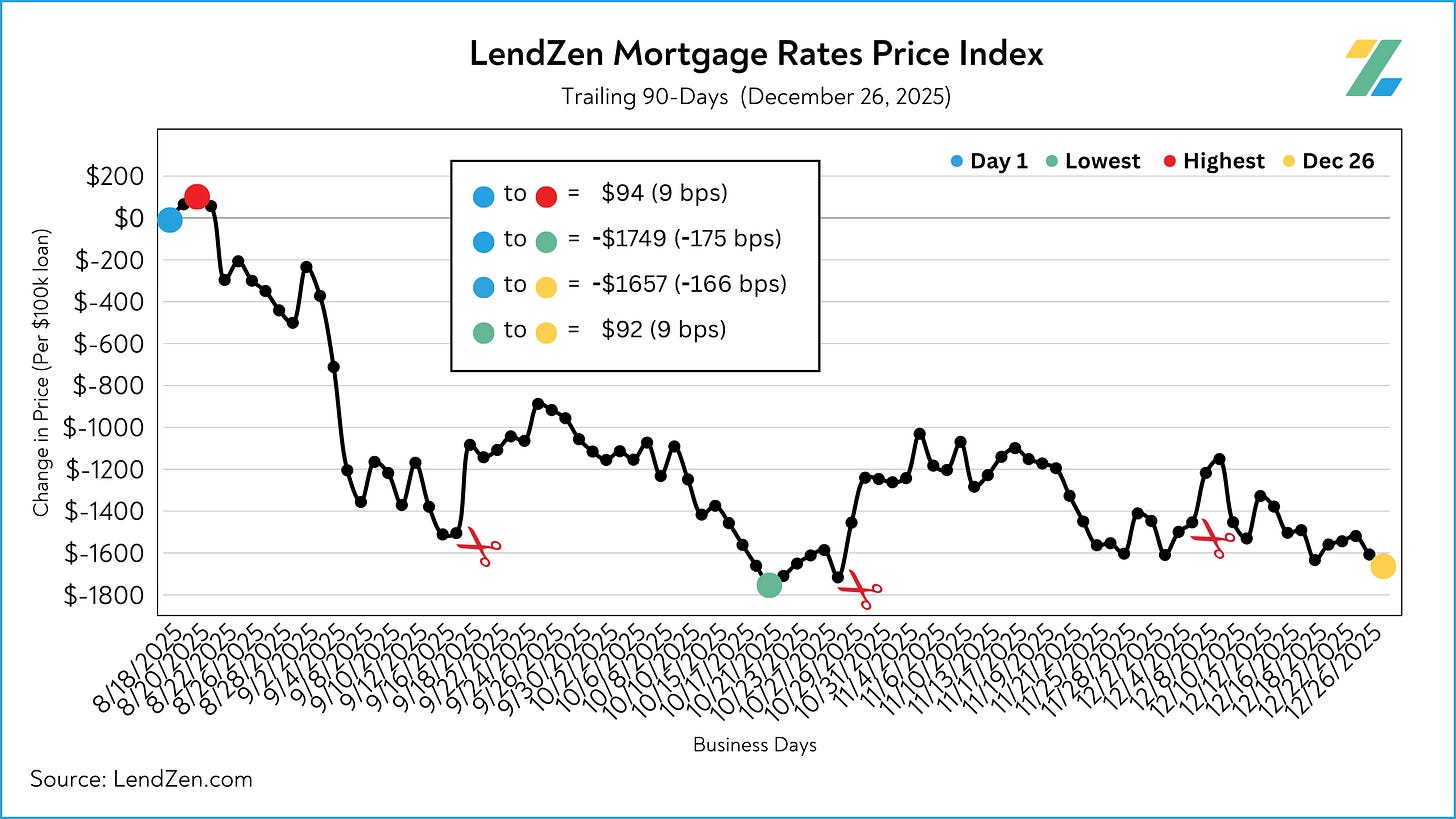

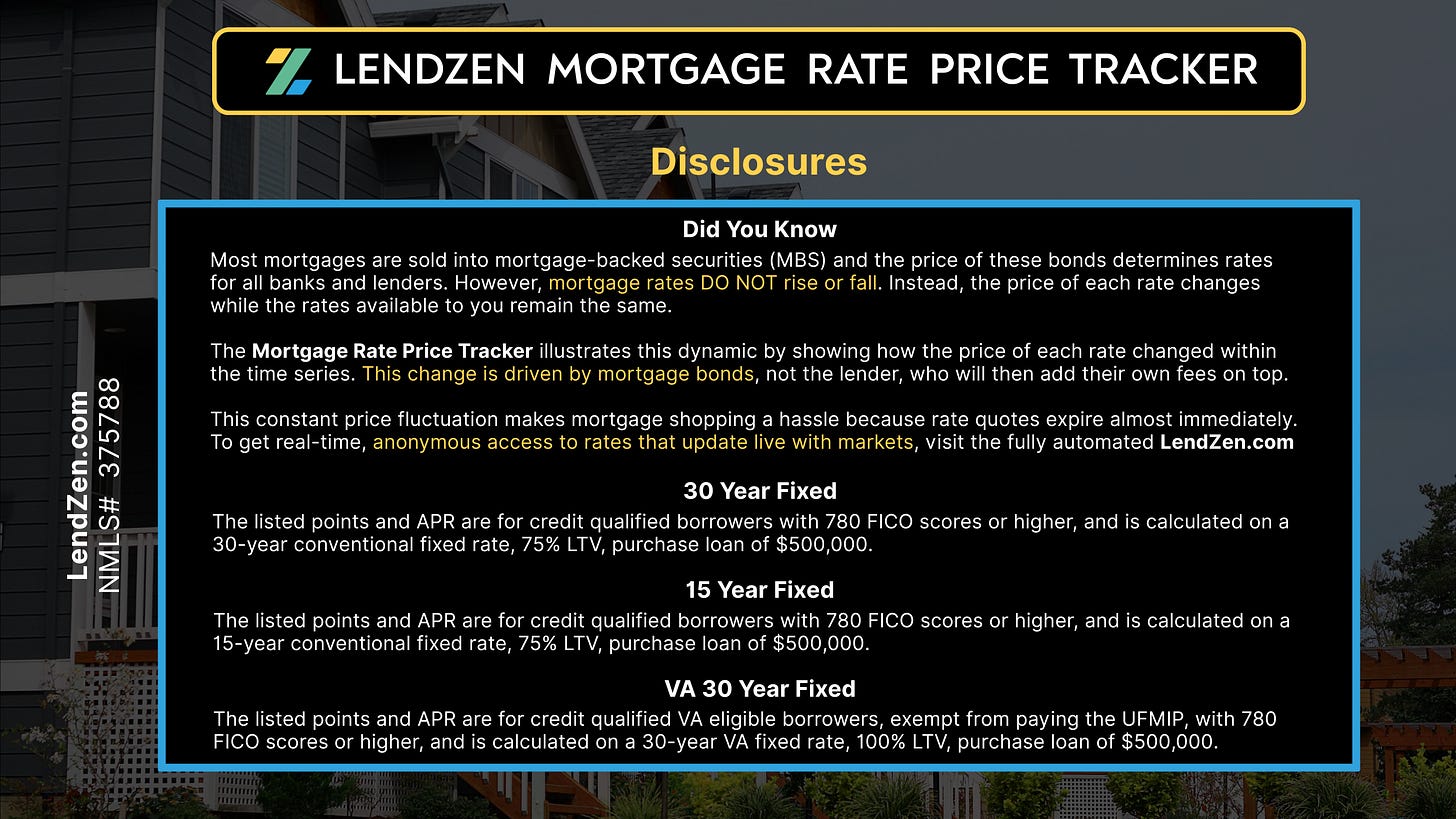

Most mortgages are sold into mortgage-backed securities (MBS) and the price of these bonds determines rates for all banks and lenders.

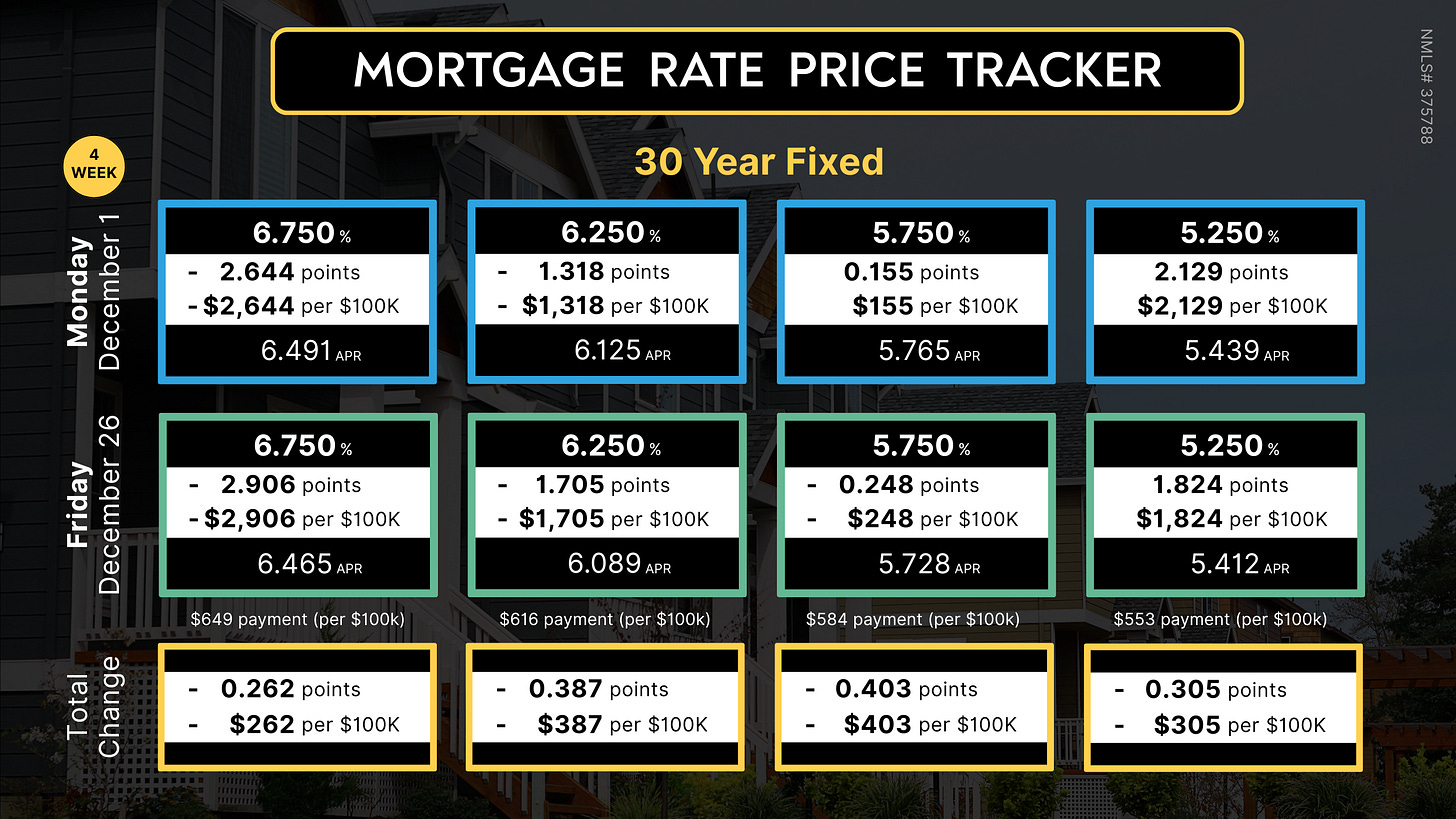

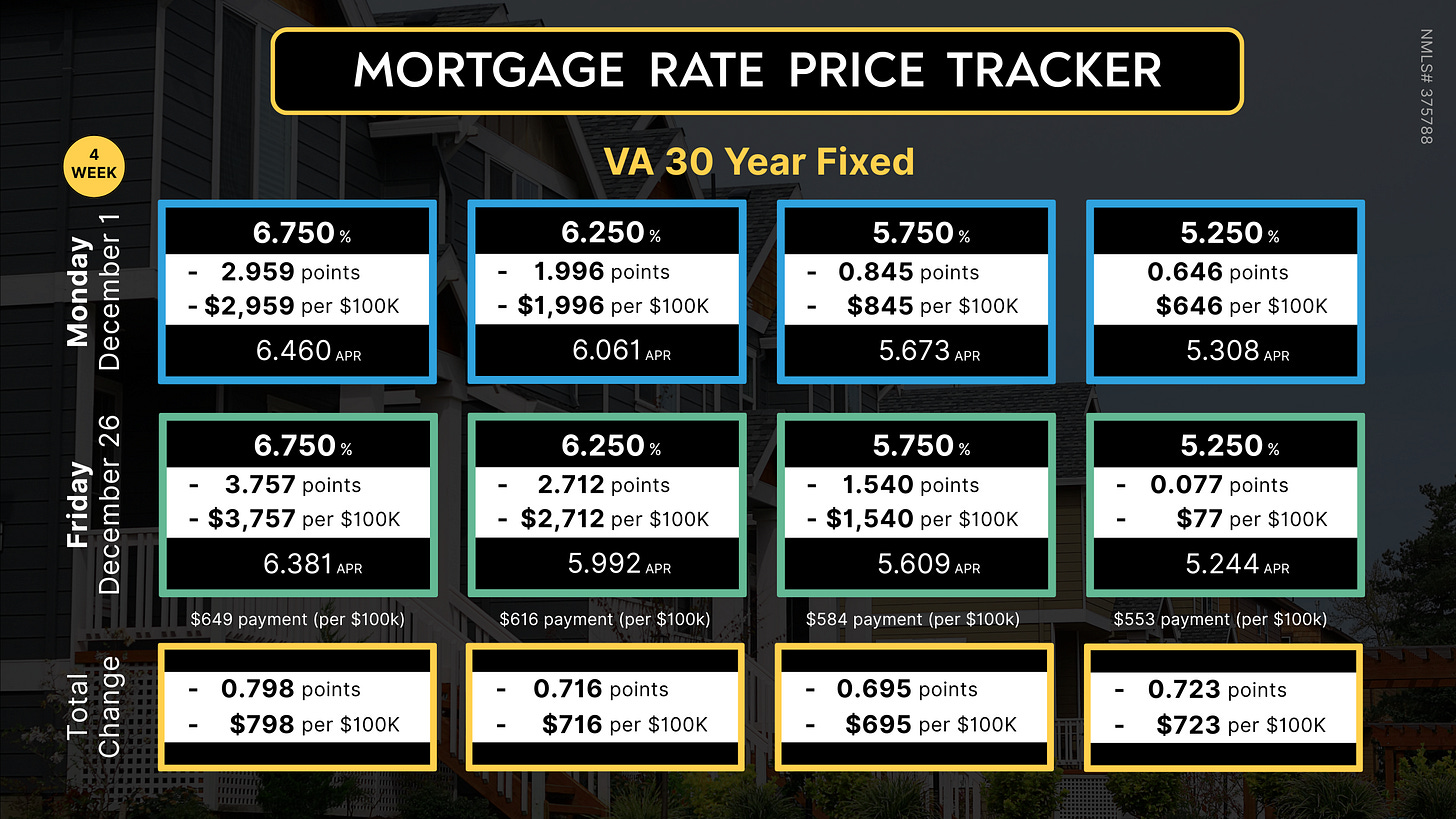

However, mortgage rates DO NOT rise or fall. Instead, the price of each rate changes while the rates available to you remain the same.

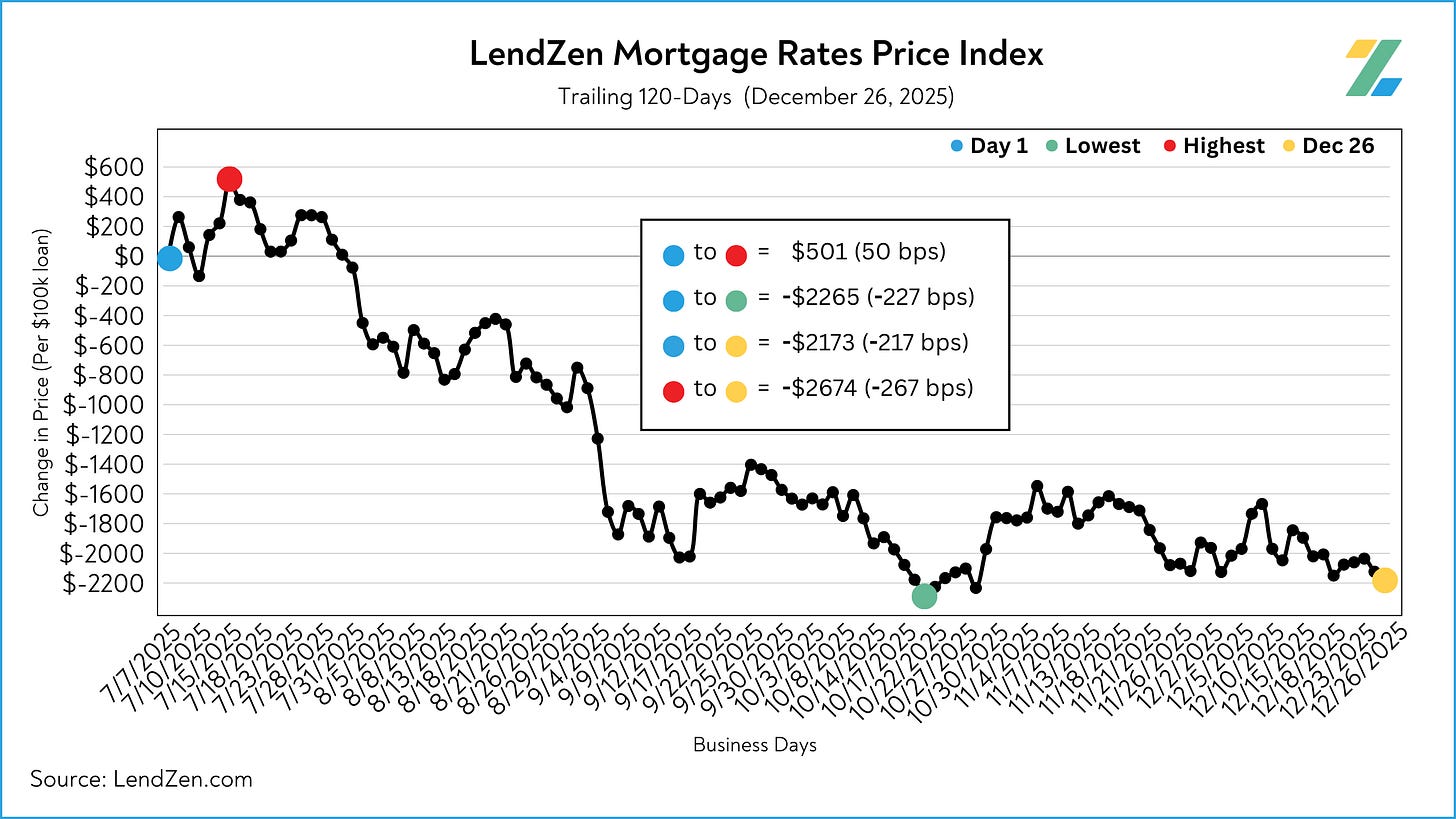

The Mortgage Rate Price Tracker (MRPT) illustrates this dynamic by showing how the price of each rate changed within the time series.

This change is driven by mortgage bonds, not the lender, who will then add their own fees on top.

The higher the rate, the lower the fee (points). Some higher rates pay a rebate; this is illustrated on the tracker with negative (-) points.

When the “total change” is negative it means a reduction in the price of the rate.

The MRPT is a more “rate and loan program” specific example of the LendZen Index, which monitors a much broader set of rates and mortgage bond coupons.

Both are effective for visualizing how the PRICE of mortgage rates has changed, while the LendZen Index is published daily at LendZen.substack.com

WEEK 4 📉

---------

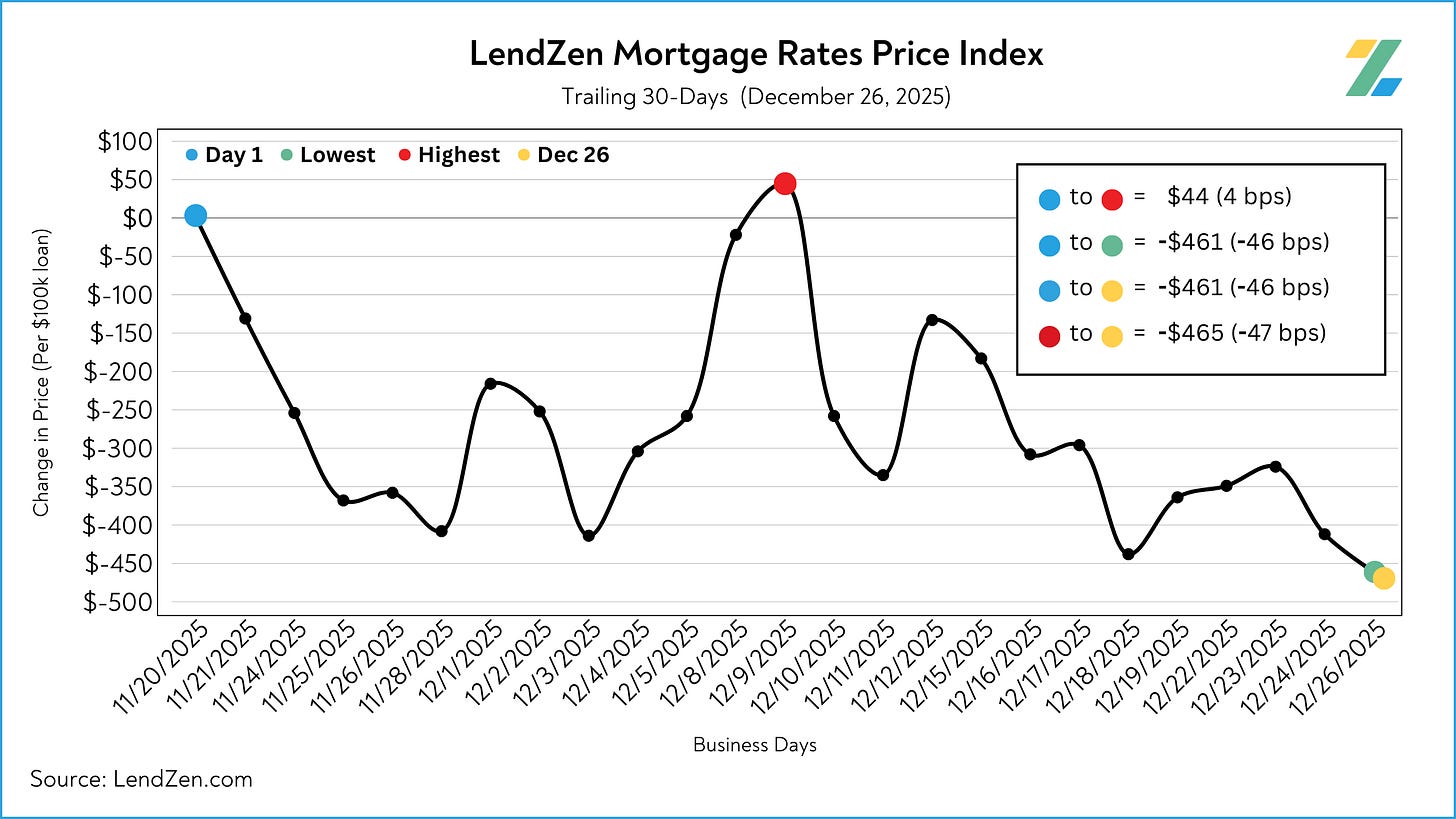

Since the LendZen Index has a variety of time series, the MRPT will focus on just the current month’s activity.

Attached are the results for December Week 4.

You can also explore the final results for Week 3 on this previous Substack post.

MBS PRICING 🏦

----------------

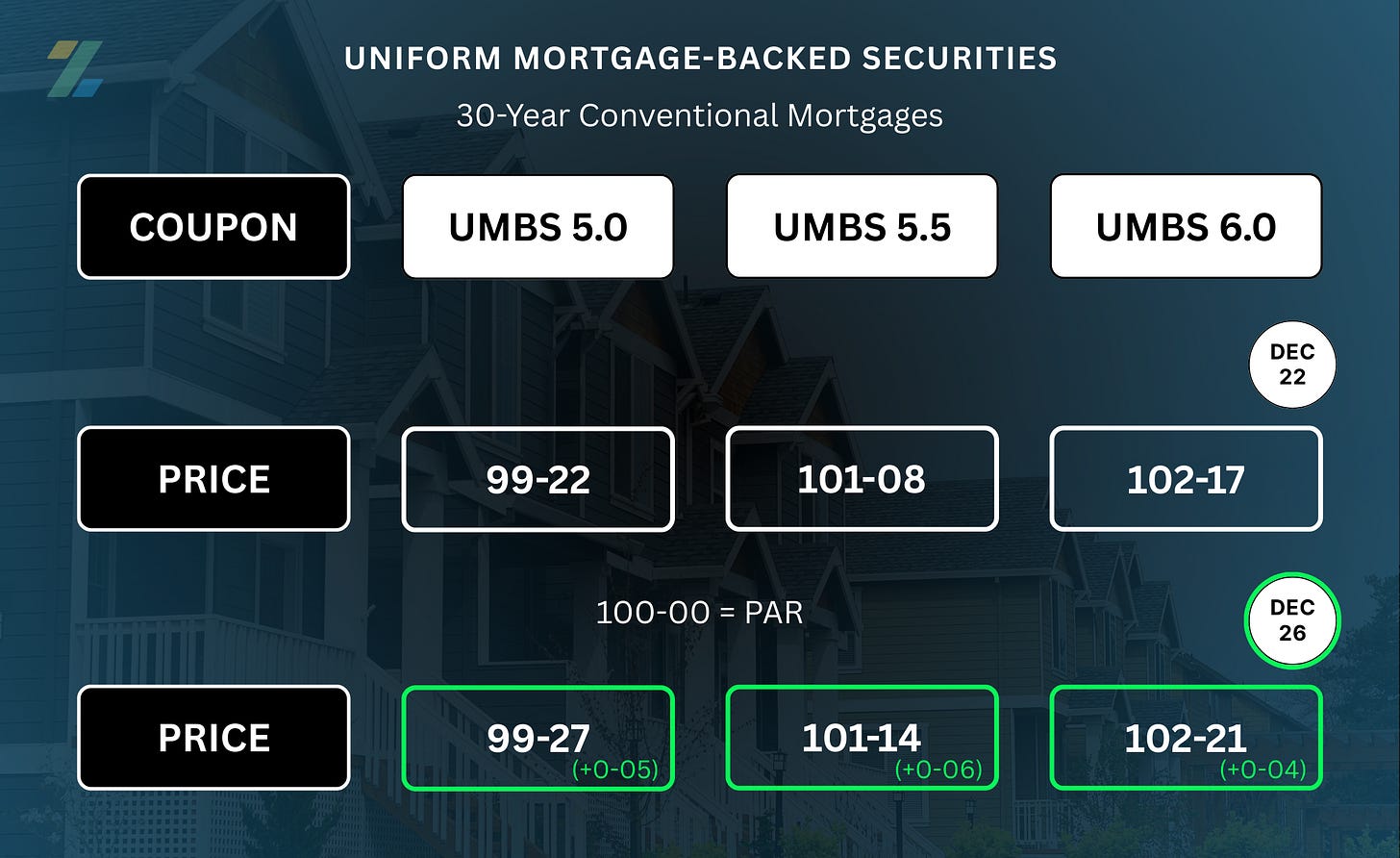

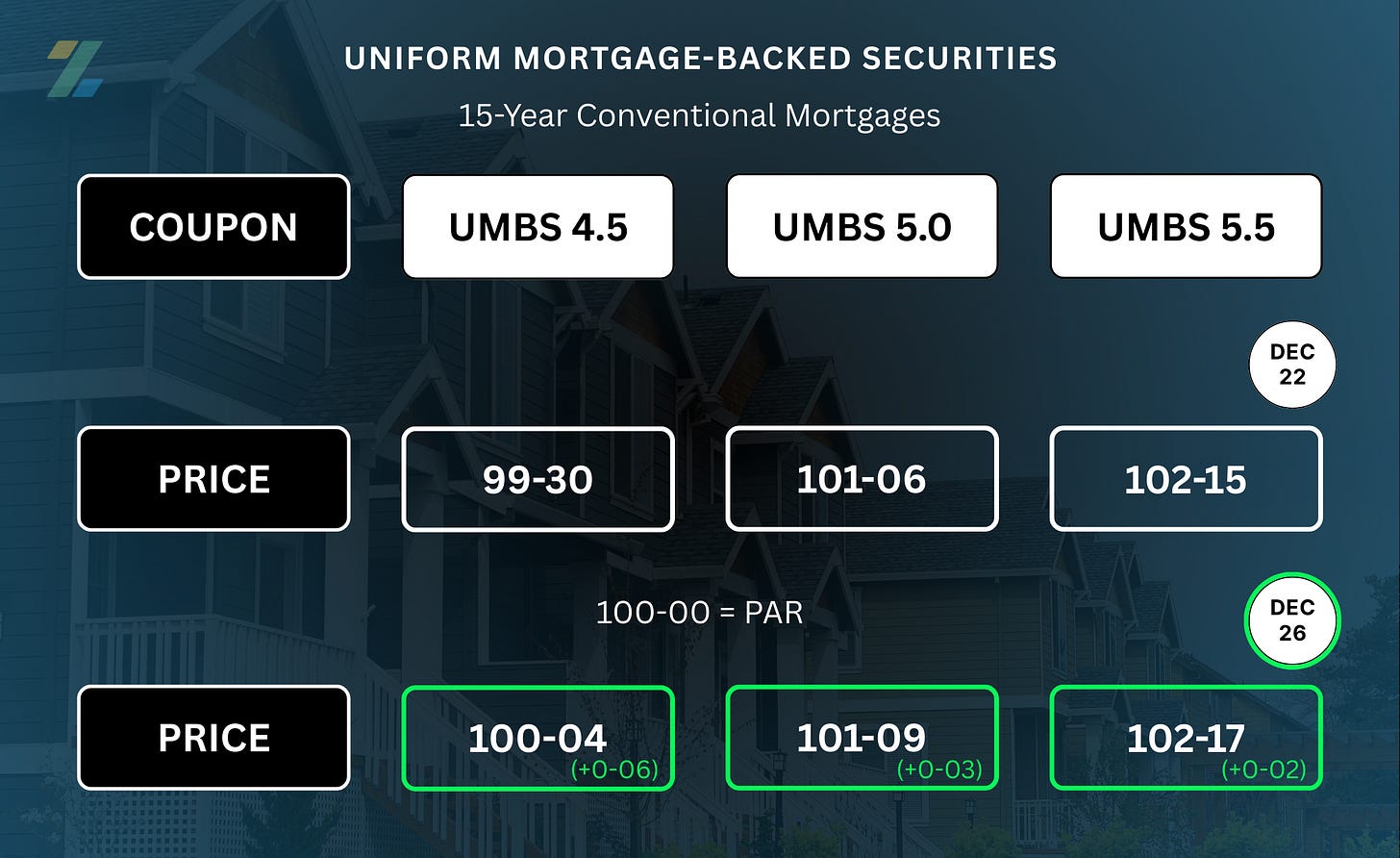

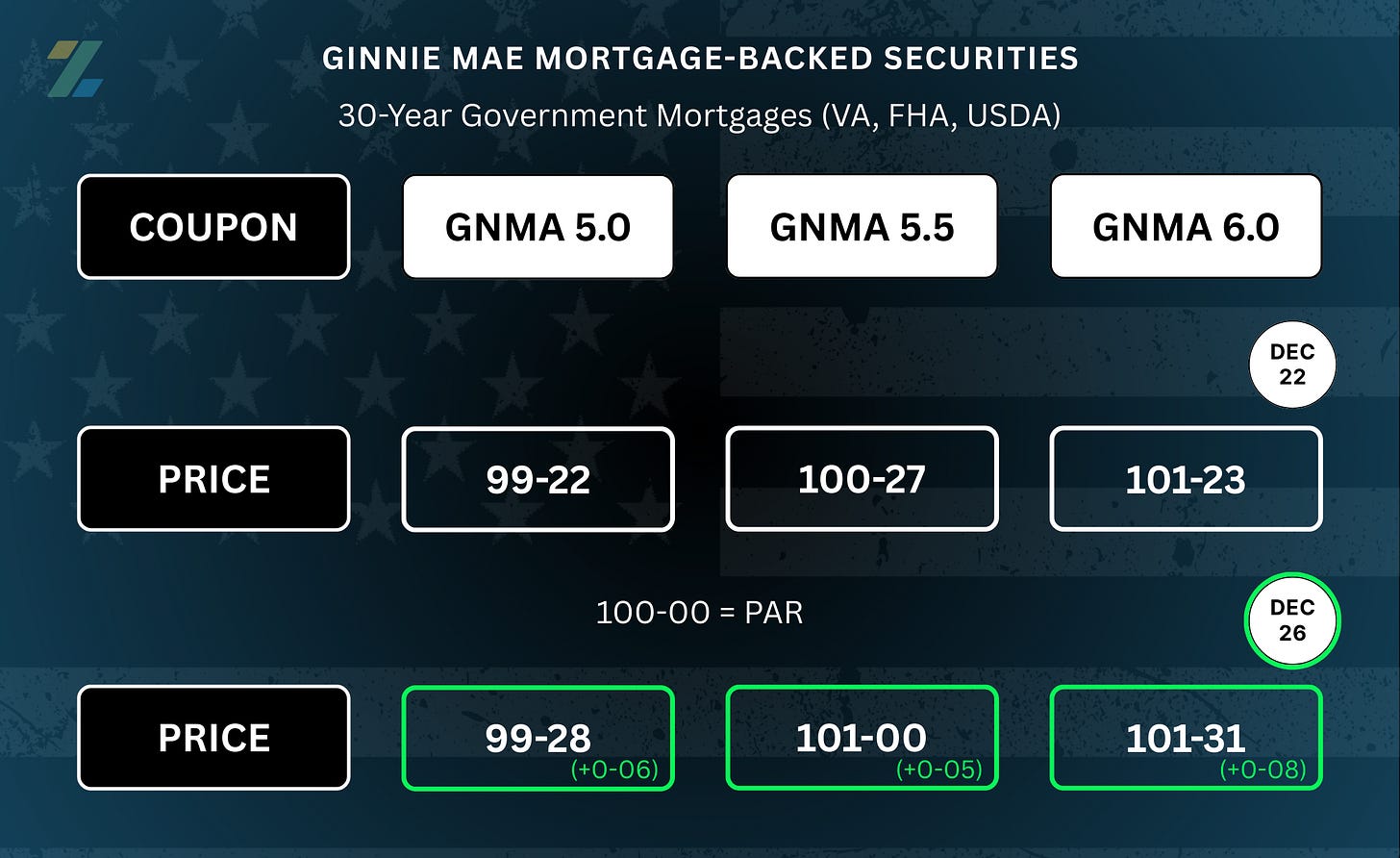

NEW to the Tracker are the current week’s MBS coupon price changes.

MBS coupons are sold at half-percent increments, while their price moves in 32nds (ticks).

ex. (0-04) = 4/32 = 12.5 bps

100-00 acts as the starting line, also referred to as PAR.

The higher the coupon price, the less expensive the rates will be that are sold into that security.

Therefore, an increase in the price of mortgage bonds is good for mortgage rates.

Learn more about the dynamics of MBS pricing and how it impacts your mortgage options in any of the bi-weekly “Rate Snapshot” Substack posts.

RATE RECAP ⏪

--------------

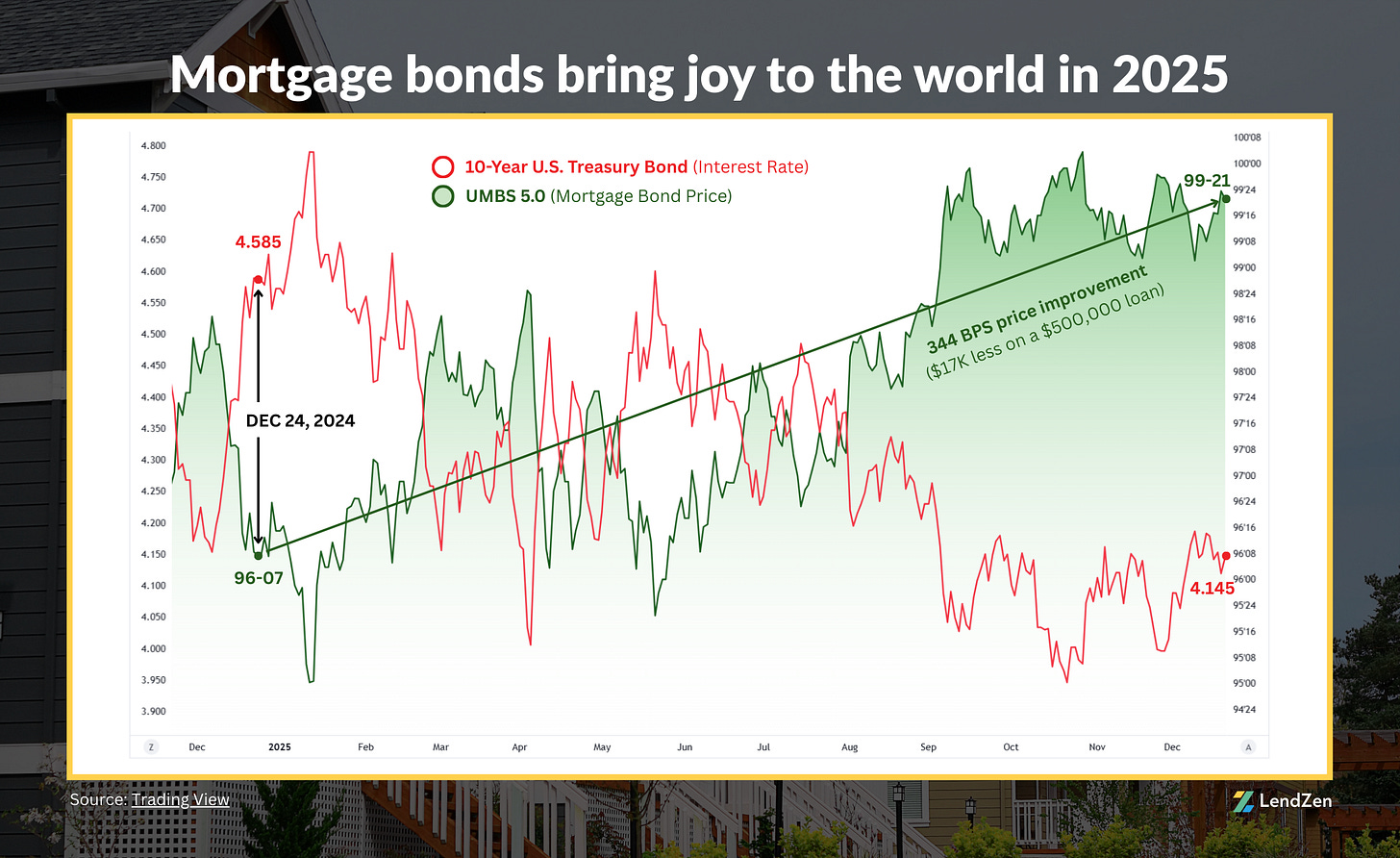

Mortgage rates had a stellar year, as mortgage bond prices have risen over 340 basis points in the last 12 months.

That means the cost of getting a $500k mortgage is $17,000 cheaper today than during Christmas 2024.

Most of the gains were realized in the back-half of 2025, with the August Non-Farm Payroll Data acting as the main catalyst for the surge in bond prices.

Longer timeframe charts of the LendZen Index illustrate why paying points for a lower rate is often discouraged.

The same rates quoted at 2.5 points back in July are now available for zero points.

As we left the summer months behind, and entered the final quarters of the year, there were a few scares along the way.

The biggest bond selloffs followed each of the Fed rate cut decisions (Sep 17, Oct 29, Dec 10).

This perfectly showcases how Fed policy, and their overnight lending rate (Fed Funds), does not automatically equate the same for mortgage rates.

Yet, December looks poised to finish on a strong note, as evident by the Week 4 Price Tracker data.

After overcoming mid-month volatility, driven by rate cut uncertainty, mortgage rate PRICES are now within 10-bps of the low on October 21.

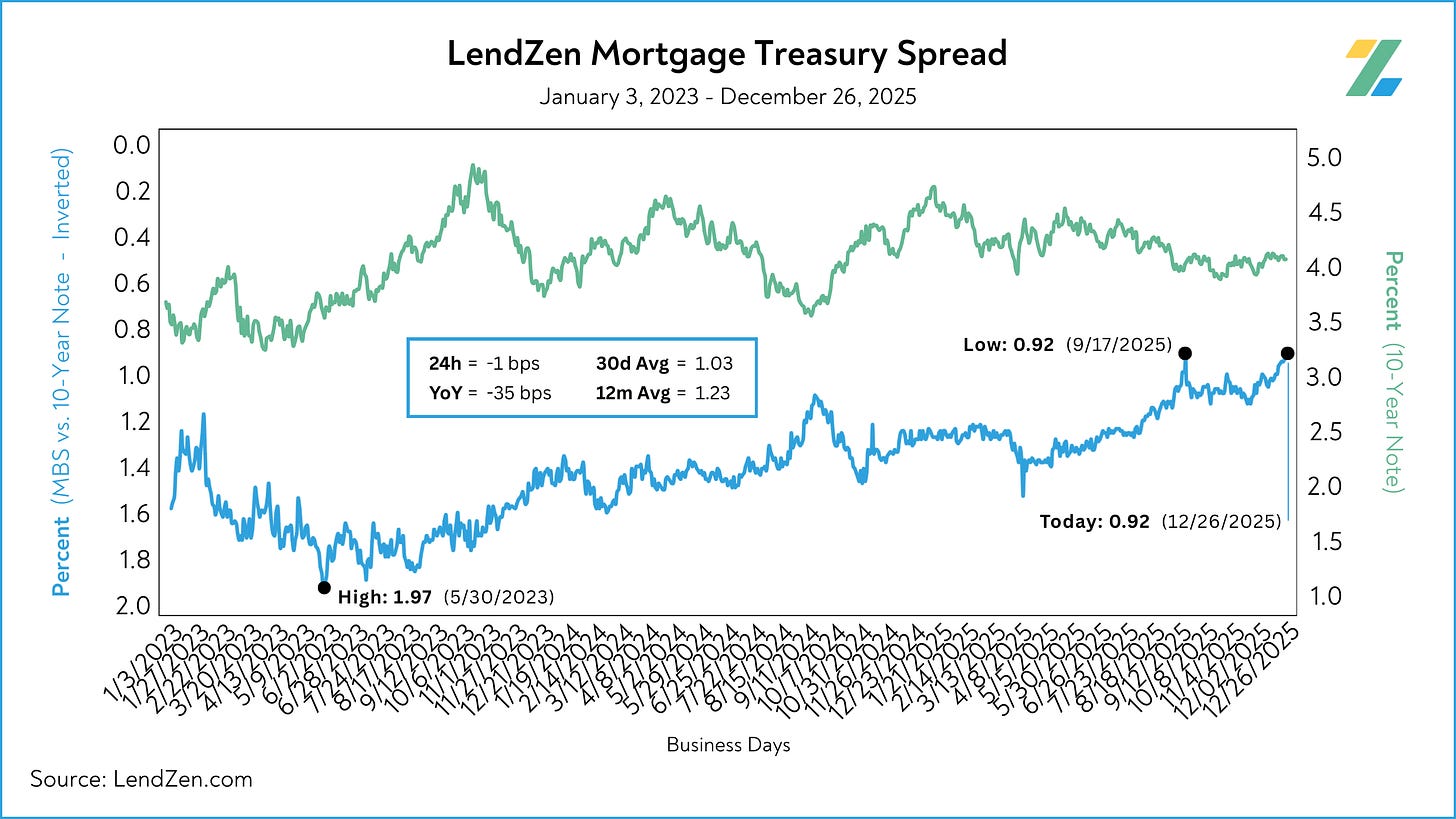

It was more than just a good month for bonds, the spread between MBS and Treasuries also tightened to a multi-year best.

Compared to the same time last year, spreads were tighter by nearly 40-bps at various times throughout the month.

This dramatic outperformance from mortgage bonds is why mortgage rate PRICES are better now than in 2024, despite the 10-Year yield sitting 47-bps higher (3.66 vs 4.13).

UP NEXT 🗓️

----------

It’s another short week with New Year’s Day landing on Thursday and nothing of significance scheduled for Friday, except a hangover.

The early week data, which will be the last of 2025, includes the Chicago Business Barometer PMI, Fed Minutes from the December FOMC, and Jobless Claims.

Otherwise, it should be a calm end to a wild year, with all hands-on deck for the start of 2026 come Monday, January 5th.

More insight into next week’s events, along with the latest Rate Impact Calendar, will be posted in Sunday’s Week Ahead.

Meanwhile, the latest Lock-O-Meter risk scores and detailed rate lock recommendations with be posted Monday in the Data Deluge.

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

DISCLOSURES

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.