Mortgage Rate Price Tracker 🏠 📉🔍 (DEC 1 – 12)

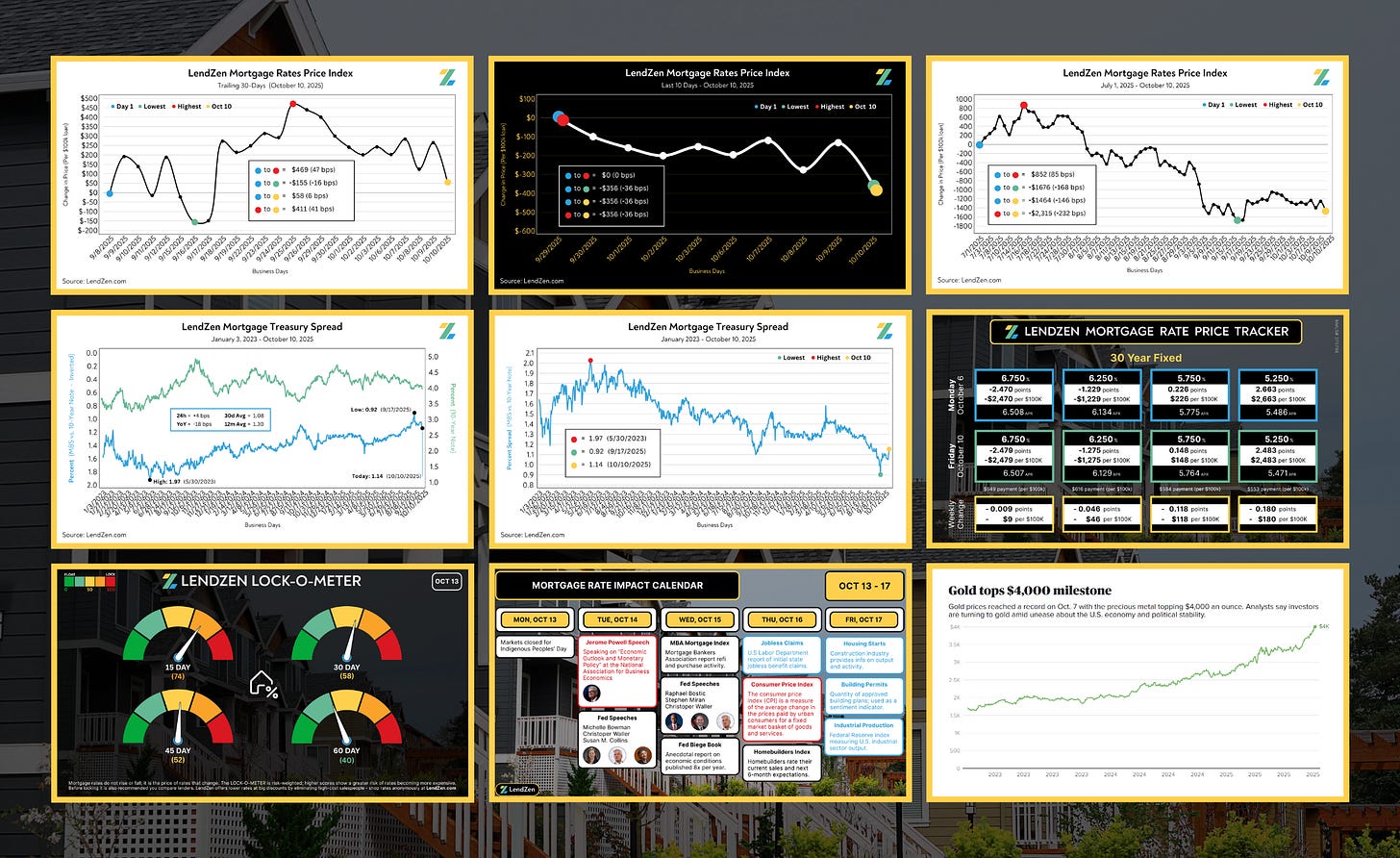

Monitoring the change in price of specific mortgage rates

Included in this post are the following:

THE TRACKER 🔭

----------------

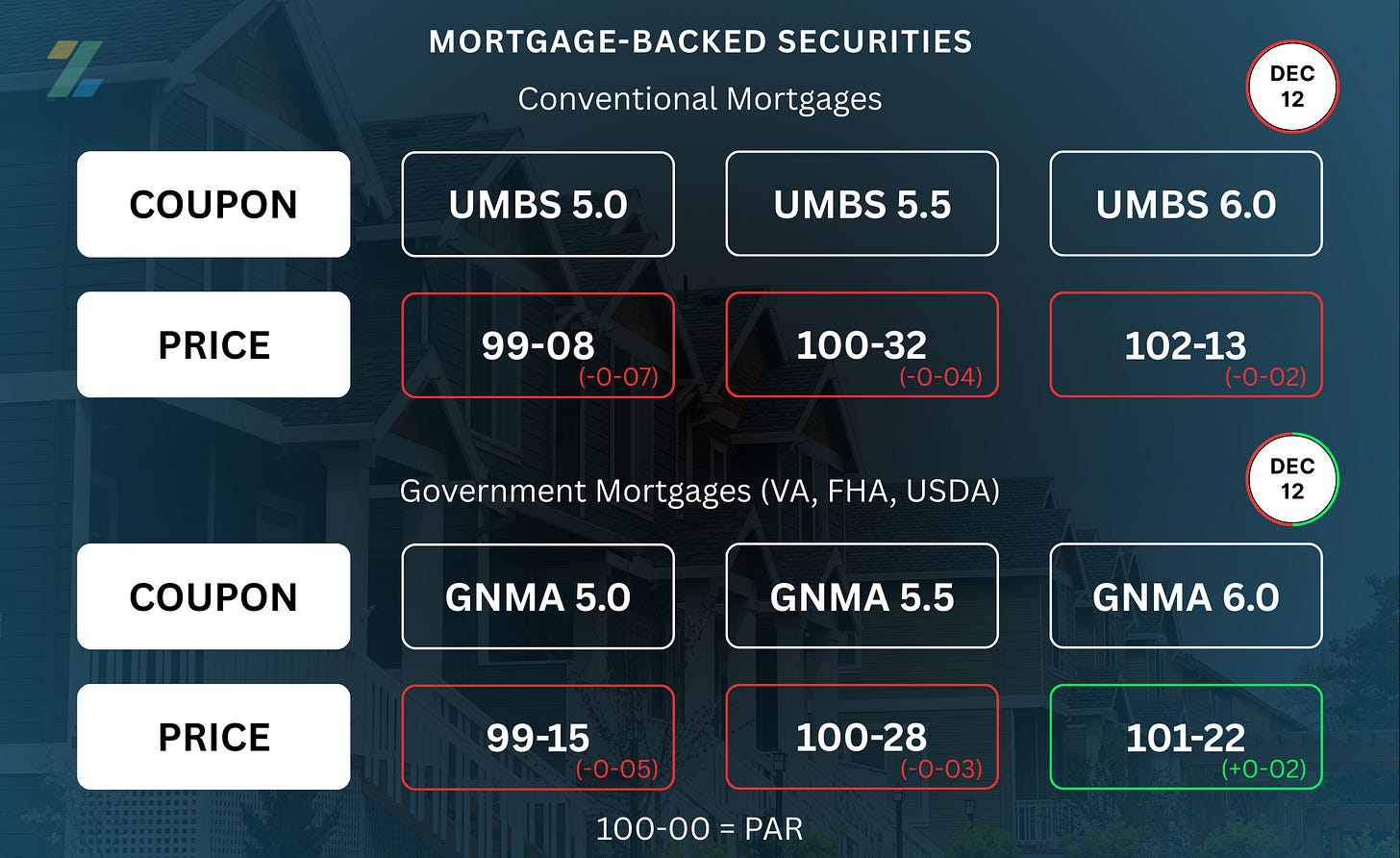

Most mortgages are sold into mortgage-backed securities (MBS) and the price of these bonds determines rates for all banks and lenders.

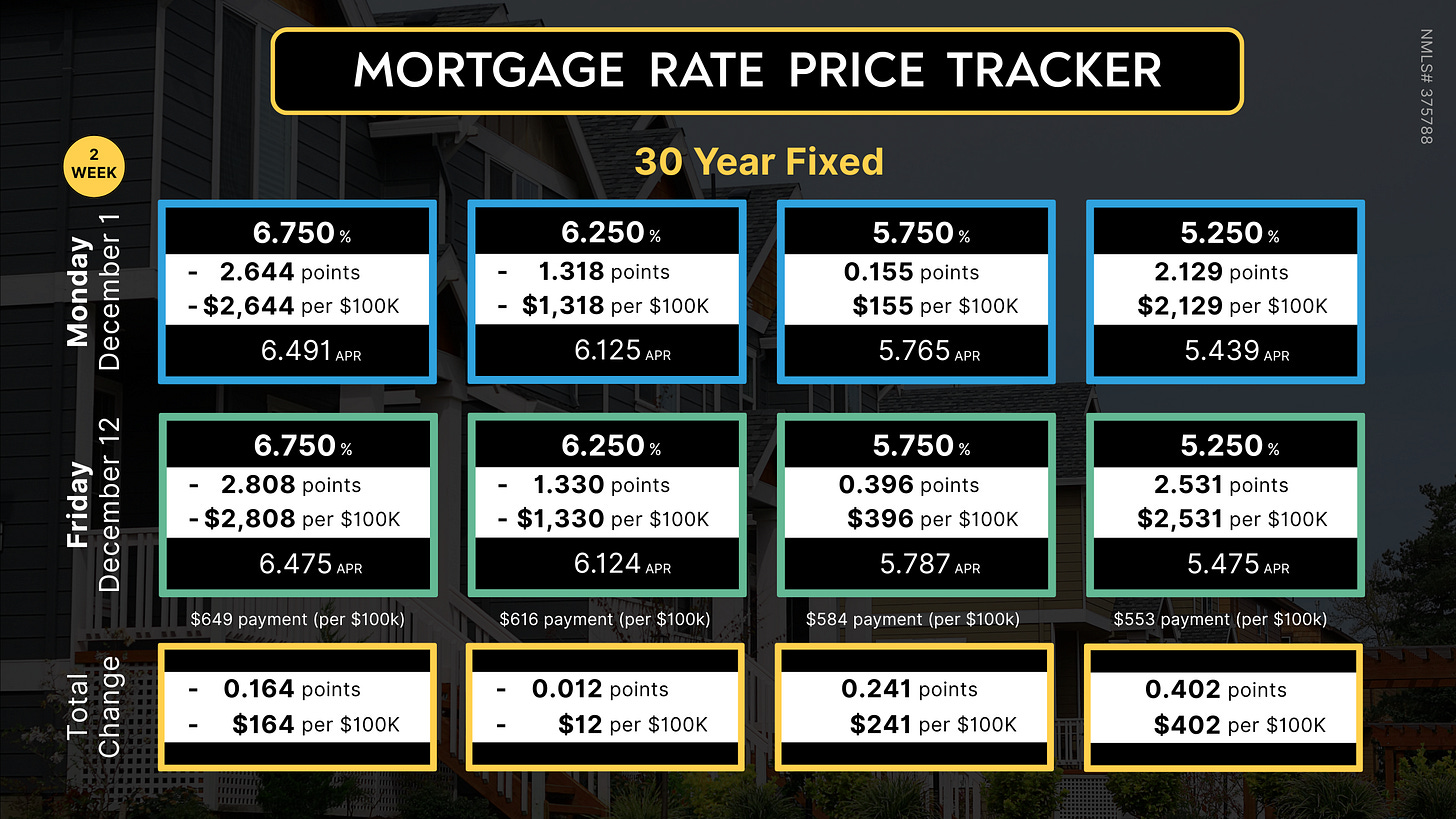

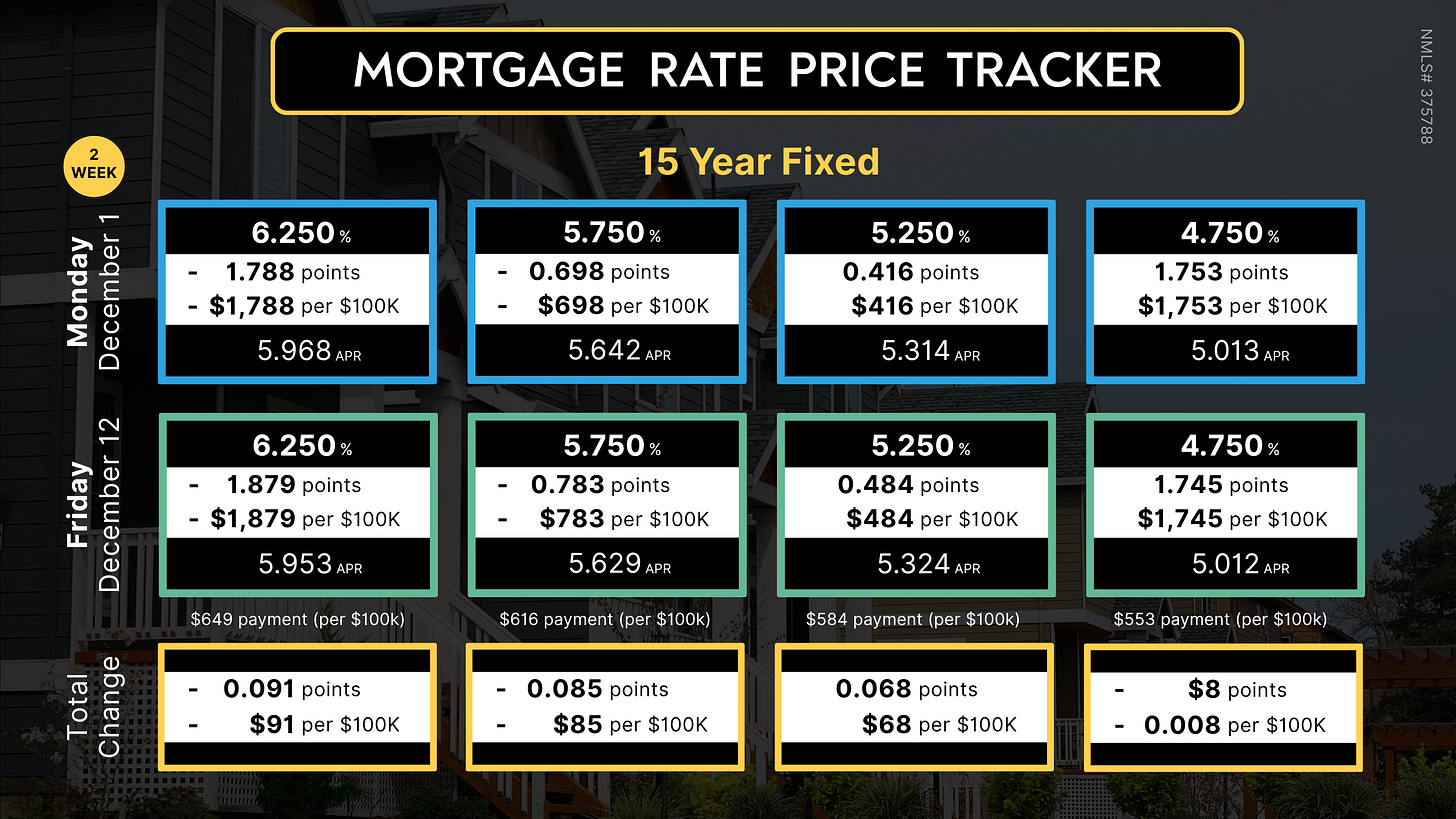

However, mortgage rates DO NOT rise or fall. Instead, the price of each rate changes while the rates available to you remain the same.

The Mortgage Rate Price Tracker (MRPT) illustrates this dynamic by showing how the price of each rate changed within the time series.

This change is driven by mortgage bonds, not the lender, who will then add their own fees on top.

The higher the rate, the lower the fee (points). Some higher rates pay a rebate; this is illustrated on the tracker with negative (-) points.

When the “total change” is negative it means a reduction in the price of the rate.

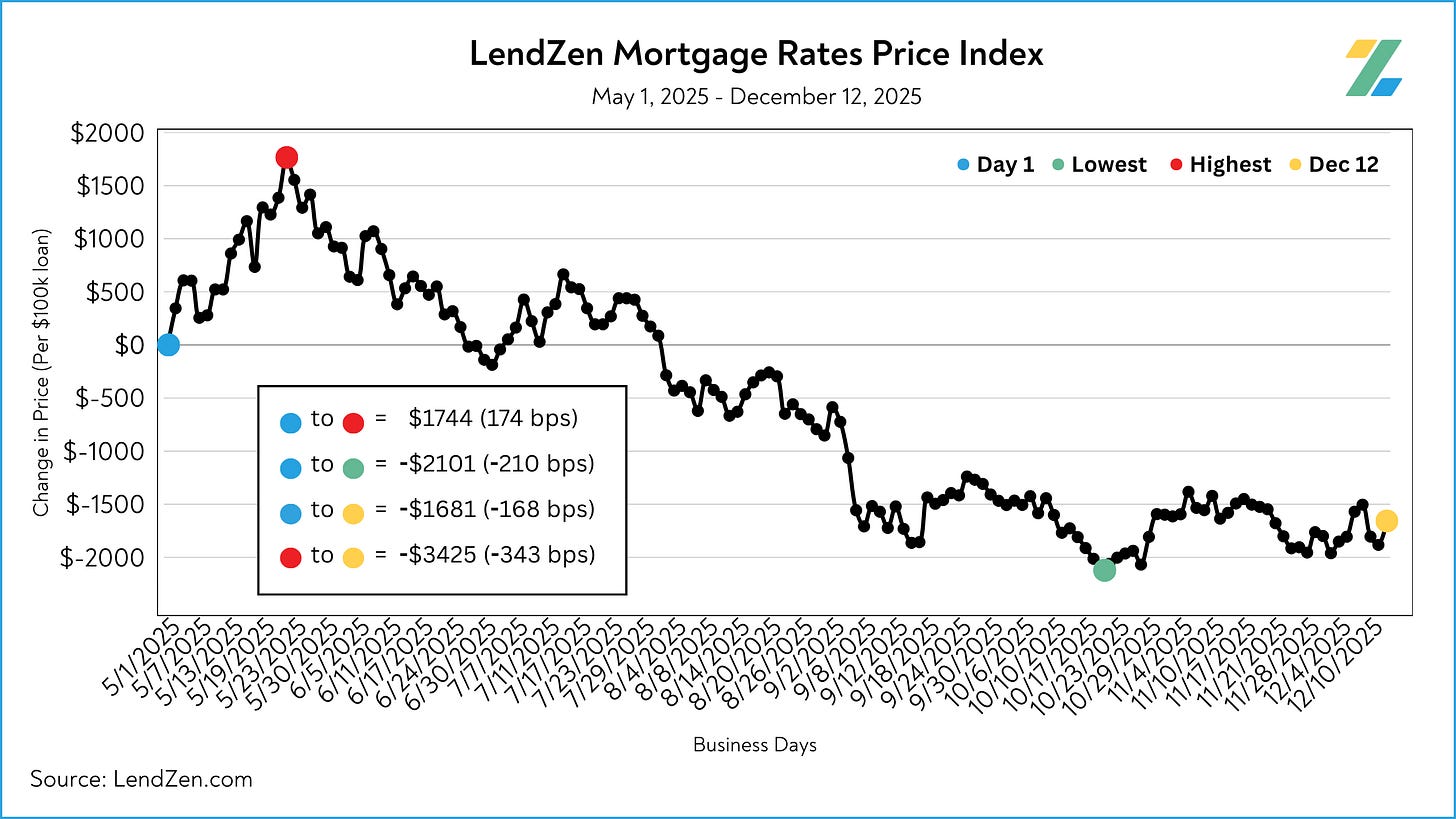

The MRPT is a more “rate and loan program” specific example of the LendZen Index, which monitors a much broader set of rates and mortgage bond coupons.

Both are effective for visualizing how the PRICE of mortgage rates has changed, while the LendZen Index is published daily at LendZen.substack.com

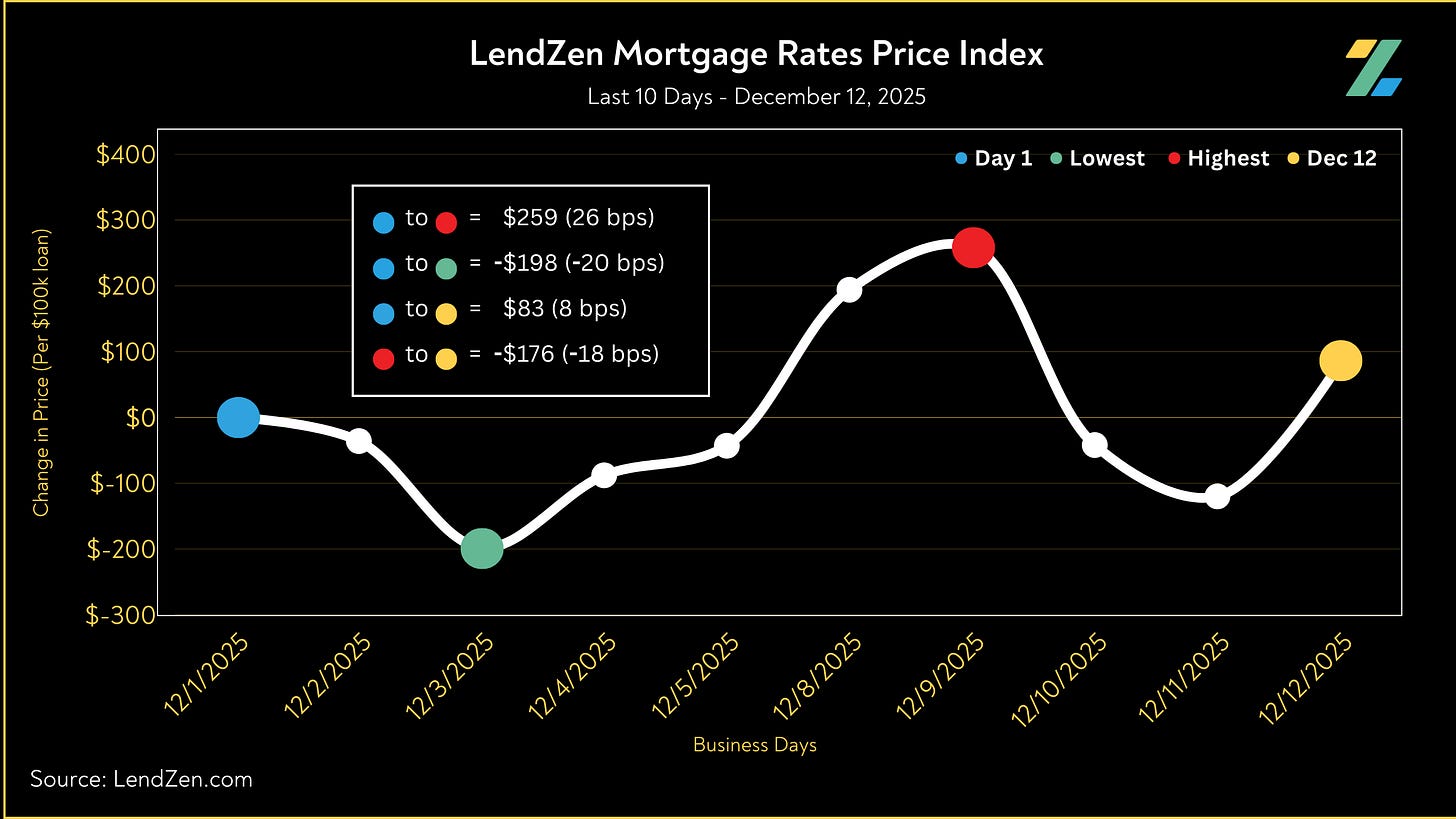

WEEK 2 📉

---------

Since the LendZen Index has a variety of time series, the MRPT will focus on just the current month’s activity.

Attached are the results for December Week 2.

You can also explore the final results for Week 1 on this previous Substack post.

RATE RECAP ⏪

--------------

Despite the anticipation and high hopes for a Fed rate cut fueled bond rally, nothing meaningful materialized.

Although the knee-jerk reaction on Wednesday was positive, with some spill-over into Thursday, the net-gain when combined with today’s slightly lower bond prices and the soft start to week, have left things mostly unchanged (to worse).

When we look at the total change in rate prices for the first two weeks of December, higher mortgage rates have held their ground, while lower rates didn’t fare as well.

This is because most of selling in MBS came on the lower coupons.

I explain in more detail the dynamics of MBS pricing, and the impact on specific mortgage rates, in my “Rate Snapshot” Substack posts.

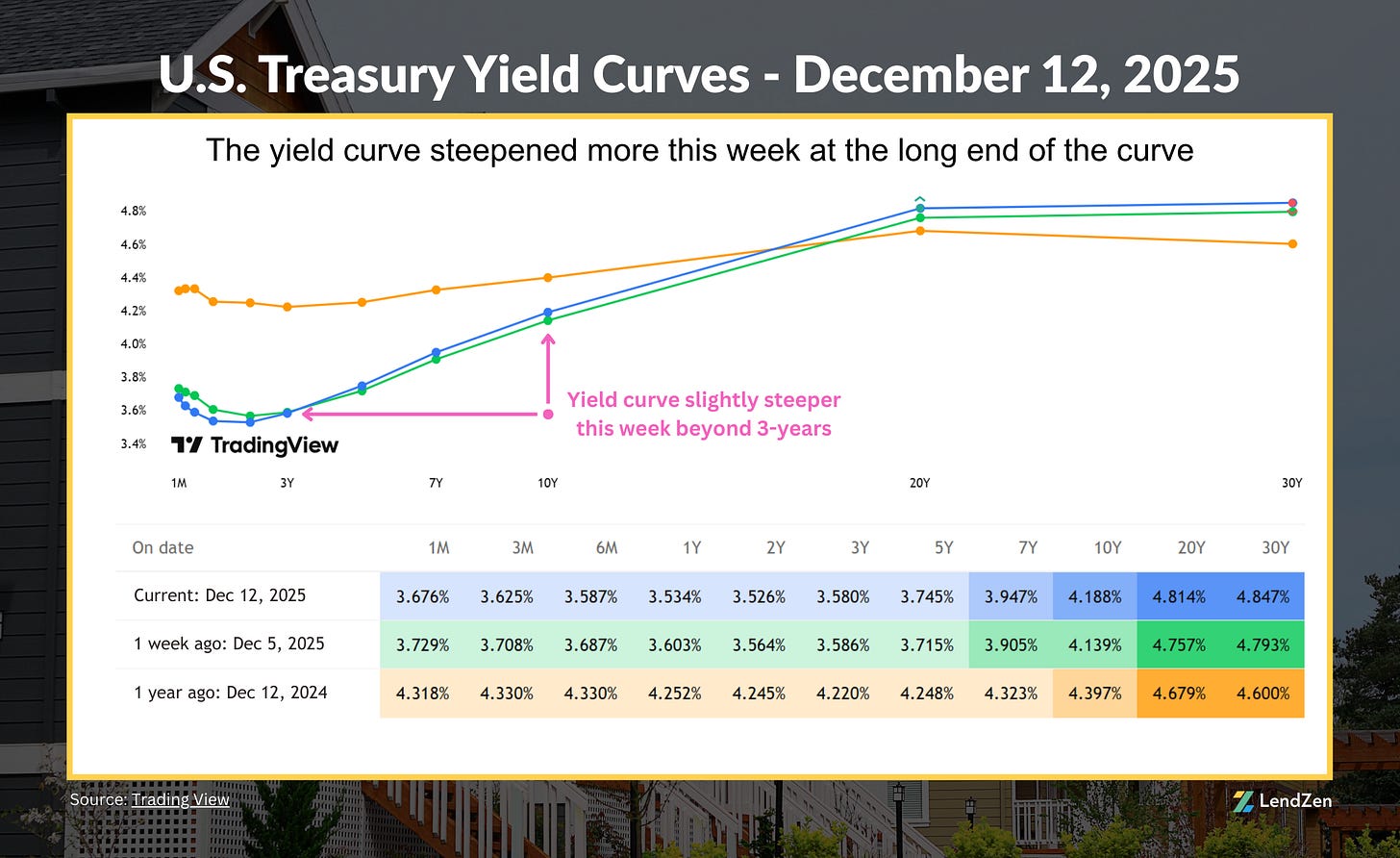

Unlike last month, 15-Year mortgage rates have performed best in the last two weeks.

This could partly be a result of recent yield curve steepening.

UP NEXT 🗓️

----------

The December Non-Farm Payroll report (November data) was originally due this week, but was rescheduled to Tuesday, December 16.

This is probably the last hope for mortgage rates to recover ground lost since the October 21 low.

However, even if we continue to trend sideways, this will still be the best year for mortgage rates since the bond meltdown first started in early 2022.

More insight into next week’s events, along with the latest Rate Impact Calendar, will be posted in Sunday’s Week Ahead.

Meanwhile, the latest Lock-O-Meter risk scores and detailed rate lock recommendations with be posted Monday in the Data Deluge.

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

DISCLOSURES

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.