Mortgage Rate Price Tracker 🏠 📉🔍 (DEC 1 – 5)

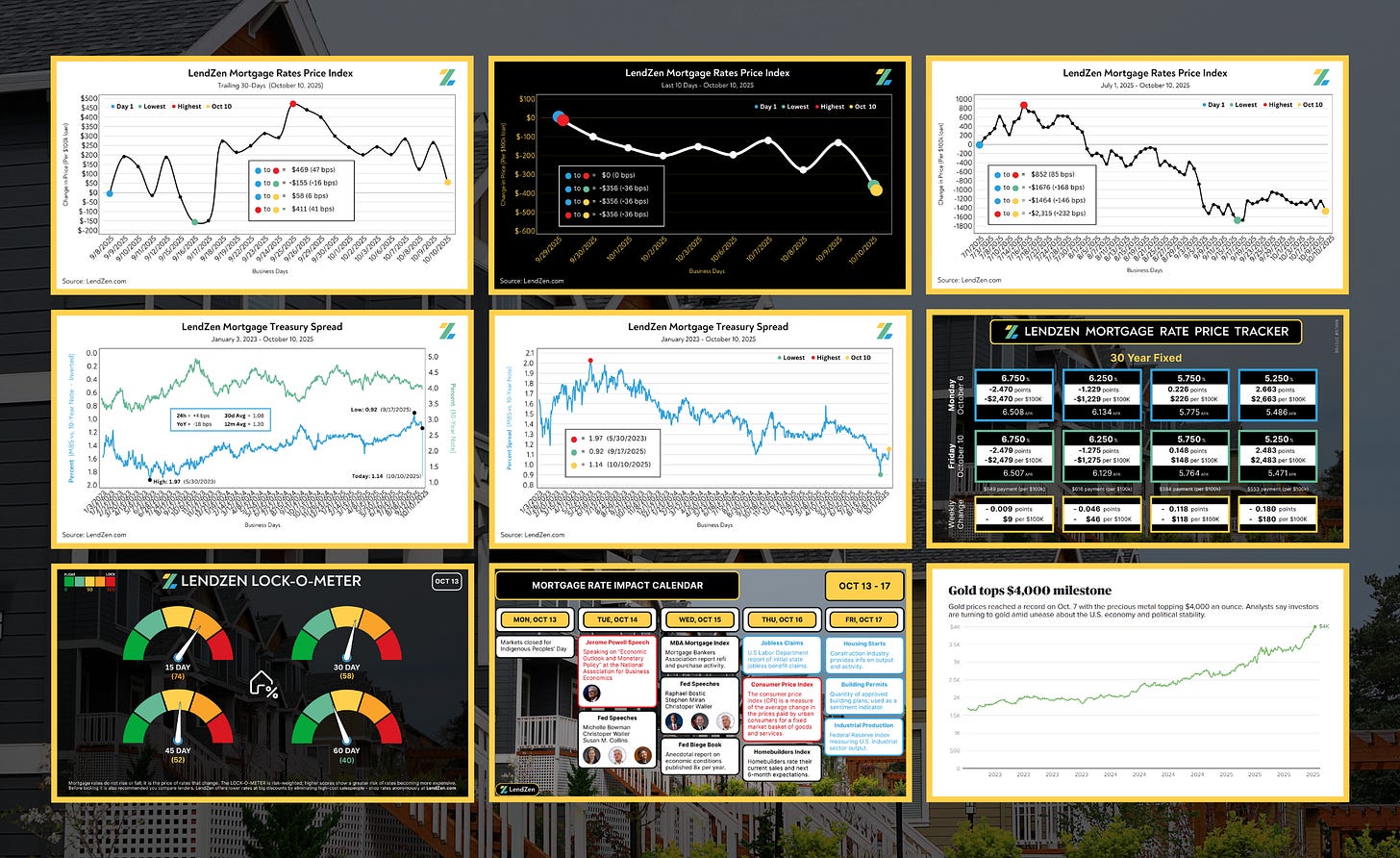

Monitoring the change in price of specific mortgage rates

Included in this post are the following:

THE TRACKER 🔭

----------------

Most mortgages are sold into mortgage-backed securities (MBS) and the price of these bonds determines rates for all banks and lenders.

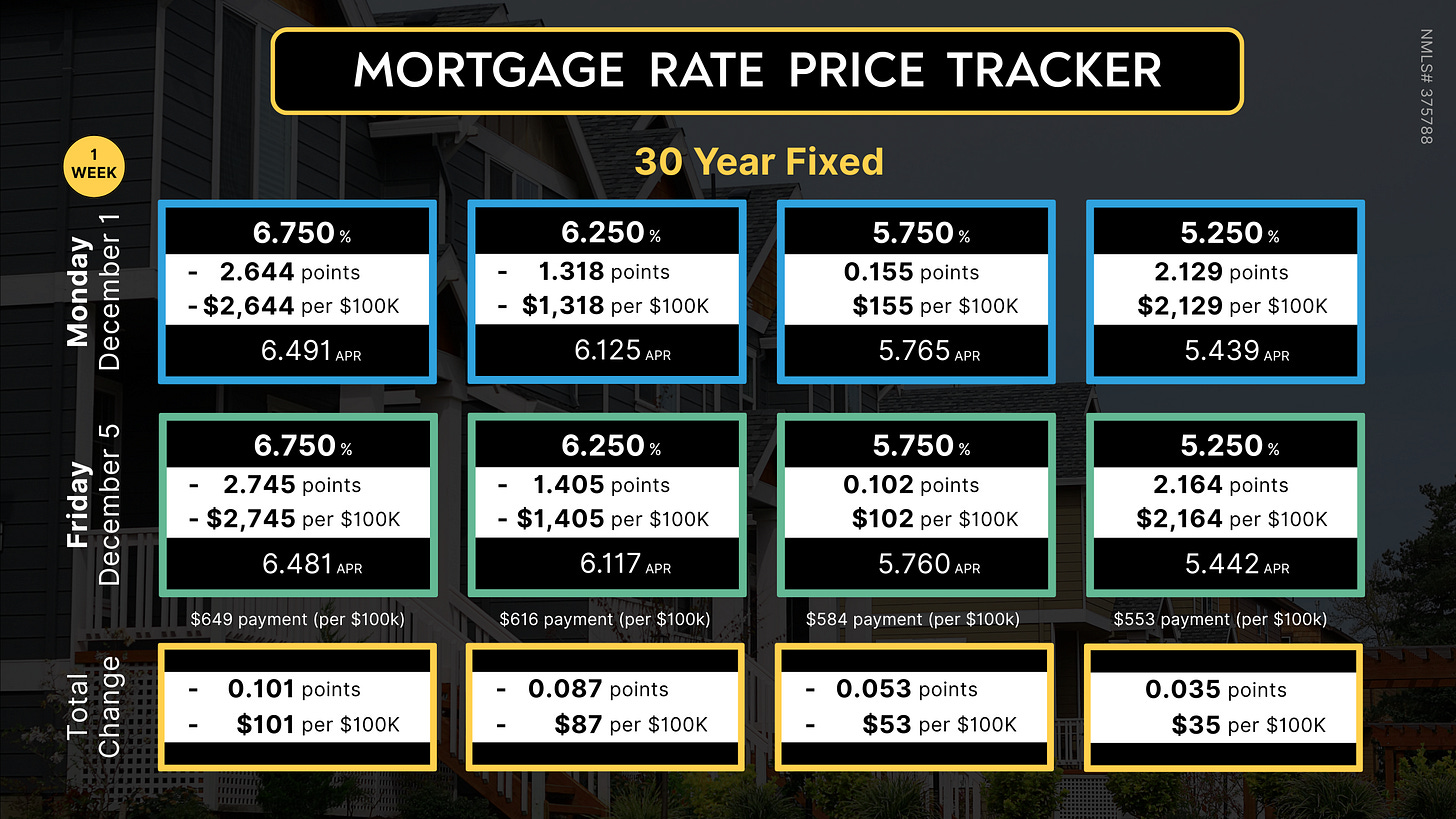

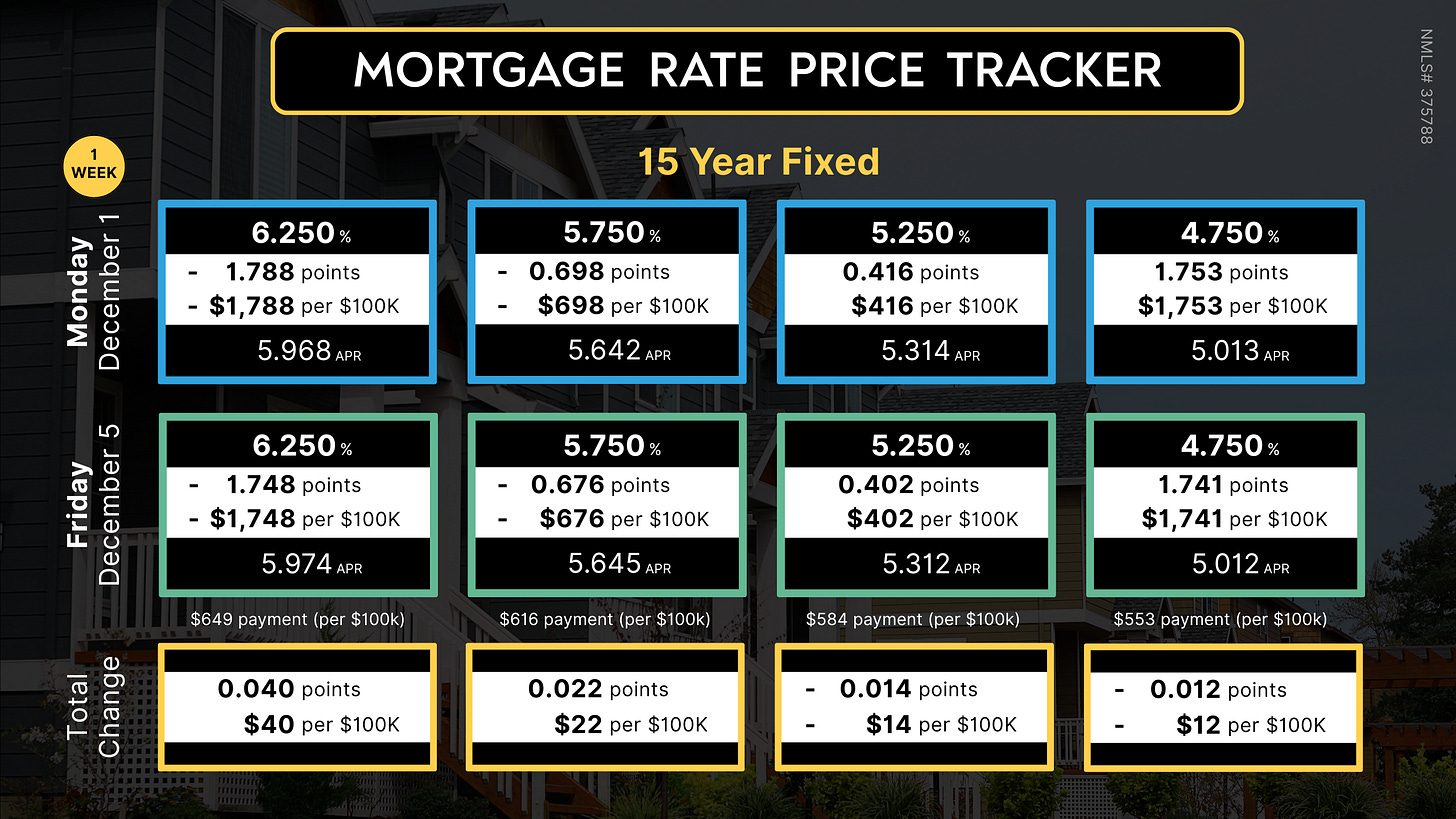

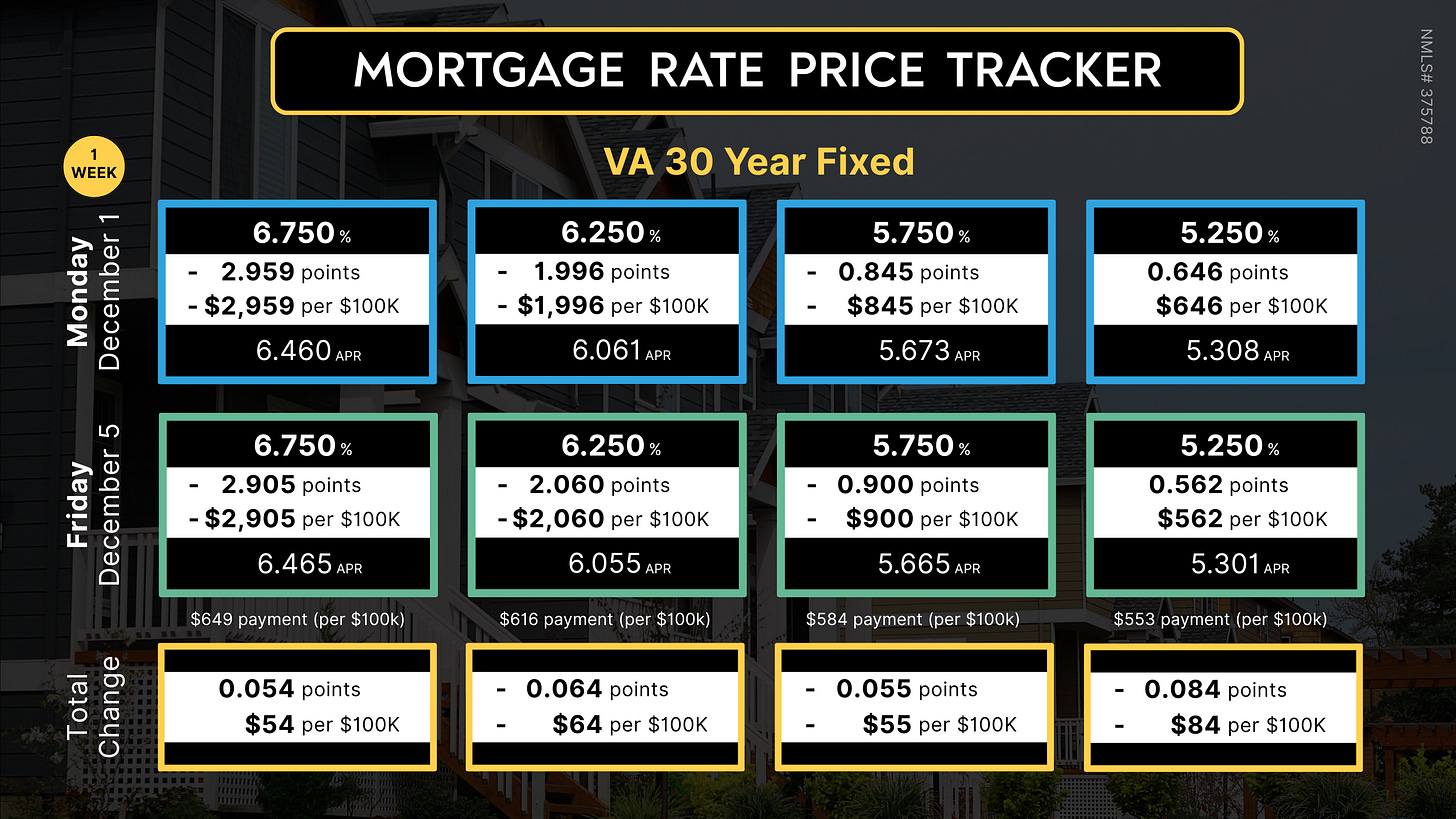

However, mortgage rates DO NOT rise or fall. Instead, the price of each rate changes while the rates available to you remain the same.

The Mortgage Rate Price Tracker (MRPT) illustrates this dynamic by showing how the price of each rate changed within the time series.

This change is driven by mortgage bonds, not the lender, who will then add their own fees on top.

The higher the rate, the lower the fee (points). Some higher rates pay a rebate; this is illustrated on the tracker with negative (-) points.

When the “total change” is negative it means a reduction in the price of the rate.

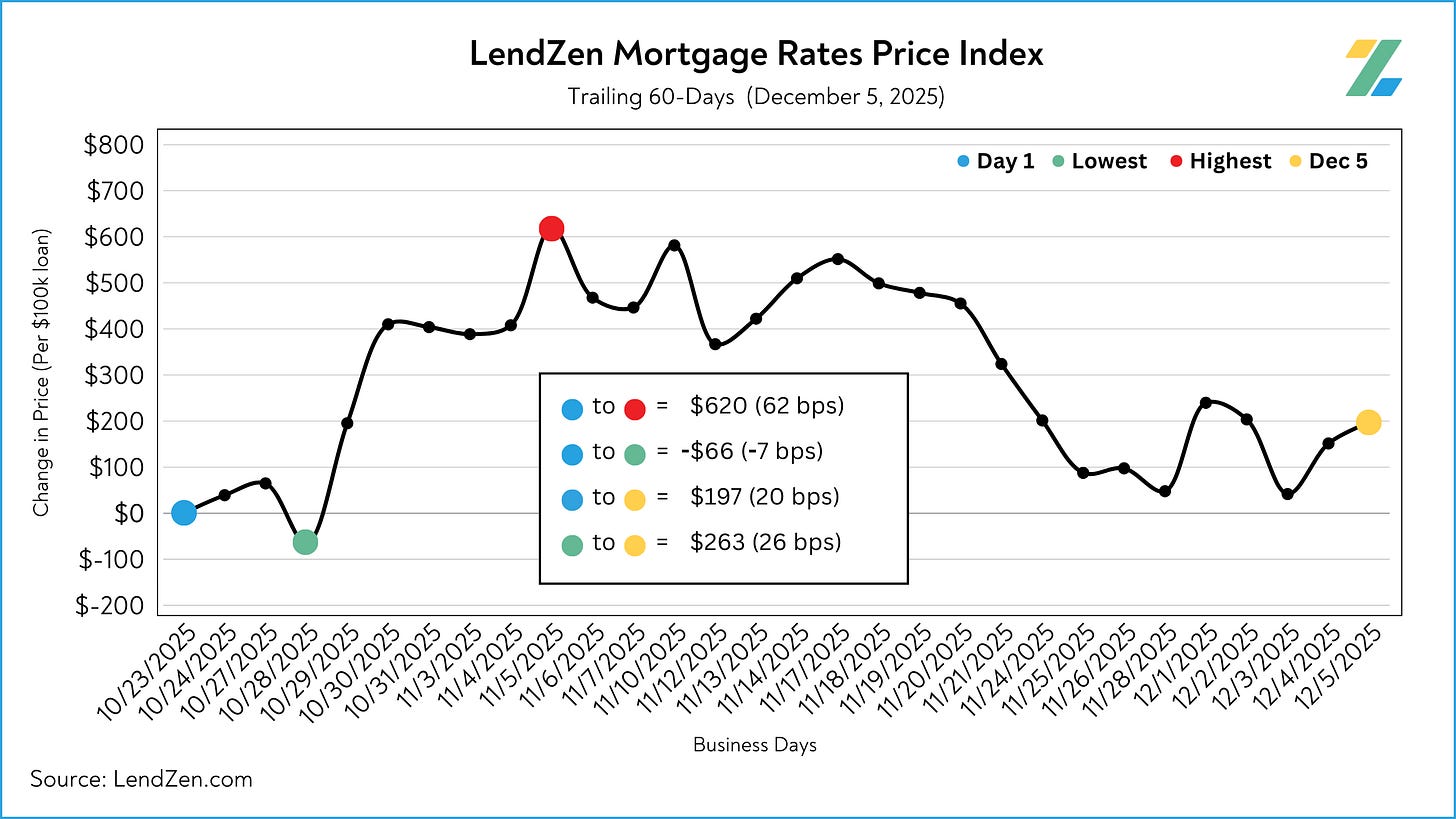

The MRPT is a more “rate and loan program” specific example of the LendZen Index, which monitors a much broader set of rates and mortgage bond coupons.

Both are effective for visualizing how the PRICE of mortgage rates has changed, while the LendZen Index is published daily at LendZen.substack.com

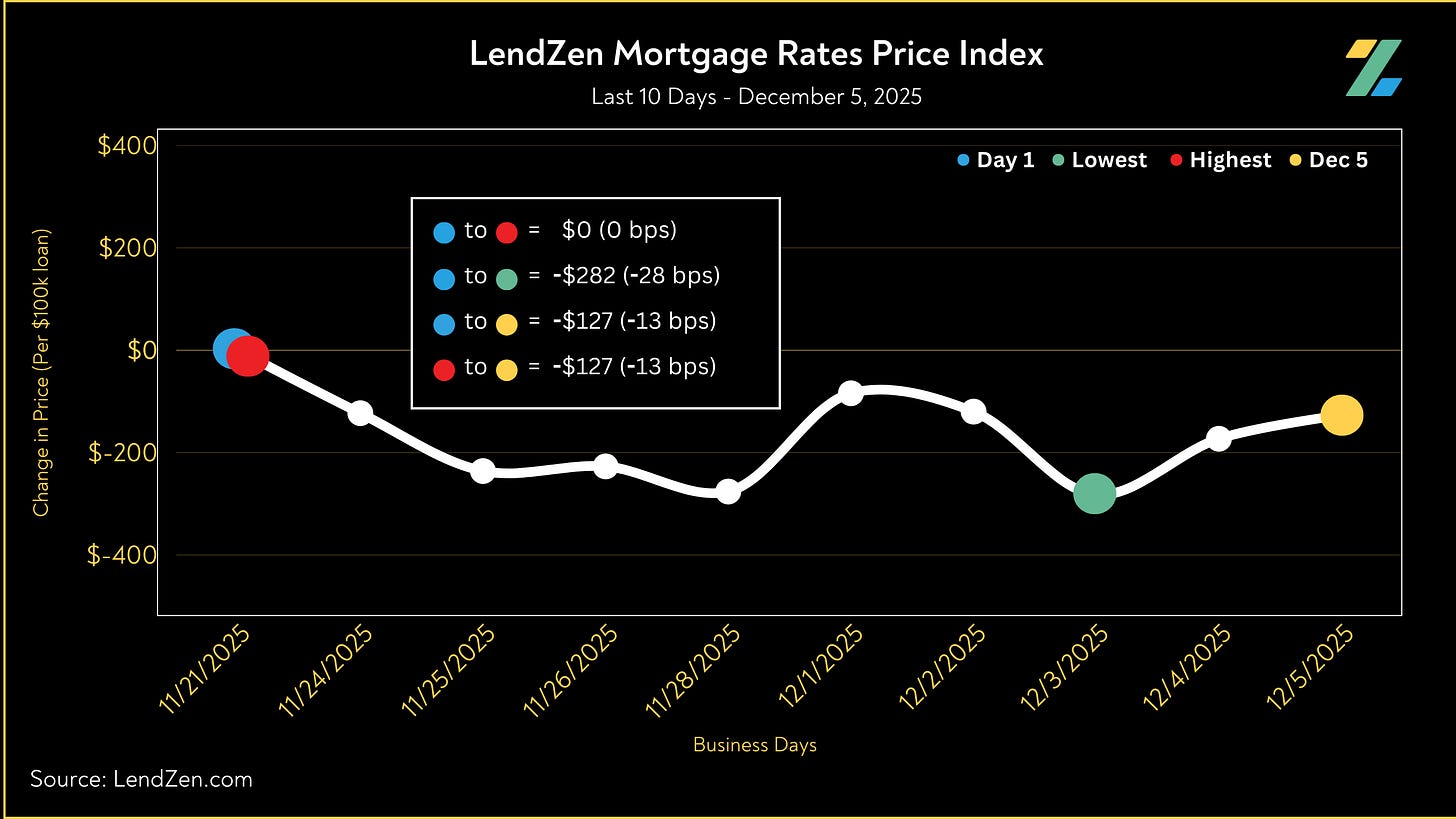

WEEK 1 📉

---------

Since the LendZen Index has a variety of time series, the MRPT will focus on just the current month’s activity.

Attached are the results for December Week 1.

You can also explore the final results for November on this previous Substack post.

RATE RECAP ⏪

--------------

It was a nothing burger week, following an uneventful end to November.

Markets are clearly “all eyes on the Fed” with expectations of another 25-bps cut.

Economic data was also mixed during the week creating a bit of choppiness.

Keep in mind markets trade based on expectations.

Without clear guidance from the Fed, and no major surprises either direction from inflation or employment data, current bond pricing seems to have already priced in one more rate cut.

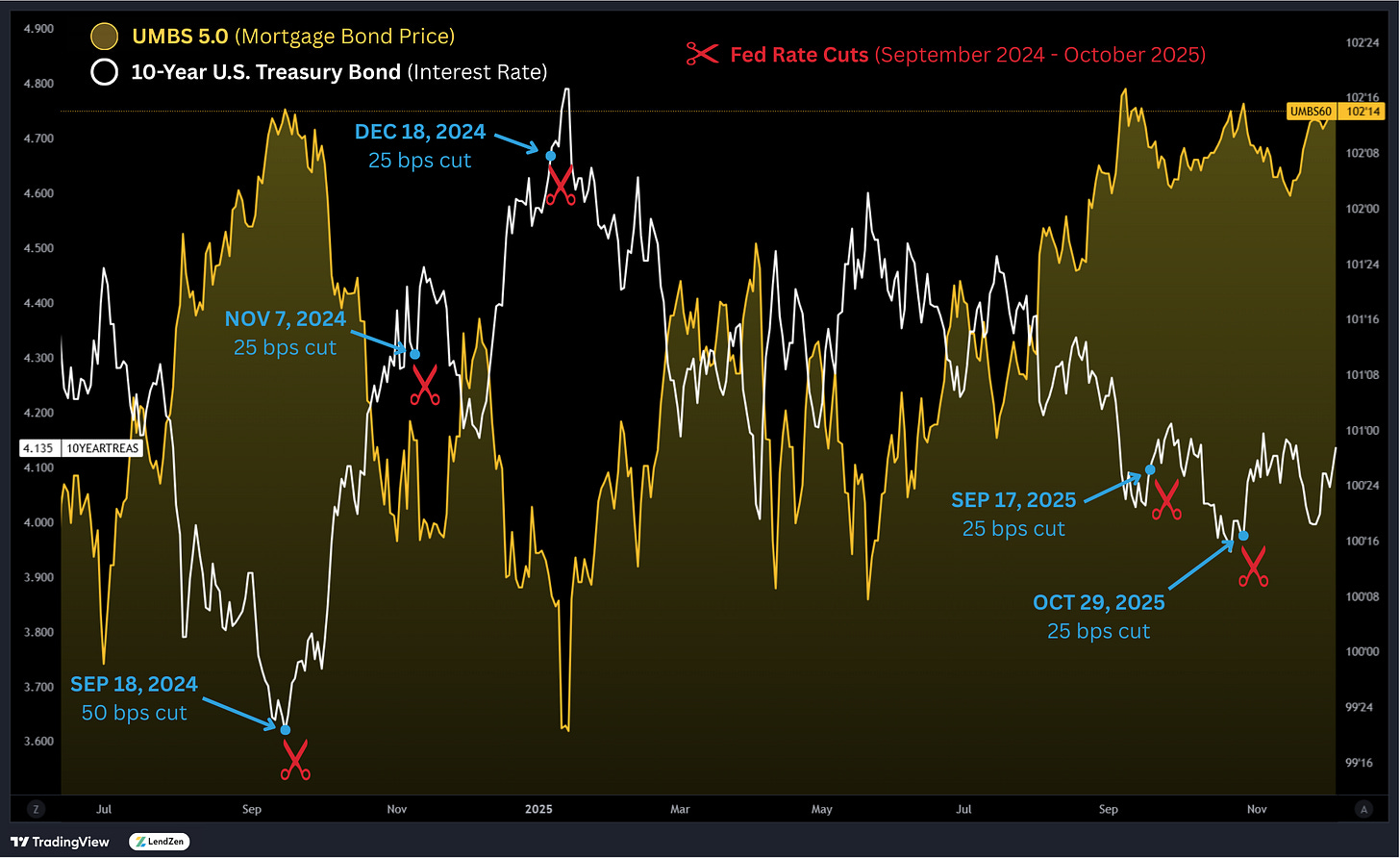

However, the last 5 rate cuts have all resulted in a bond sell-off (higher mortgage rate prices).

Although bonds have recently found some footing, just like after previous cuts, mortgage rates have not yet fully recovered from the October jump and are still 20-bps higher in price than 60 days ago.

This could leave bonds more vulnerable than previous FOMC rate decisions, and if the past is any indicator of the future the likely knee jerk reaction won’t be mortgage rate friendly.

UP NEXT 🗓️

----------

There is a rescheduled job openings report (JOLTS) on Tuesday, plus a 10-Year note auction.

Otherwise, this week is all about the Federal Open Market Committee’s rate decision on Wednesday.

Looking ahead to the following week, we will get a rescheduled Non-Farm Payroll employment report on Tuesday, December 16.

More insight into next week’s events, along with the latest Rate Impact Calendar, will be posted in Sunday’s Week Ahead.

Meanwhile, the latest Lock-O-Meter risk scores and detailed rate lock recommendations with be posted Monday in the Data Deluge.

Thanks for reading.

If you want to shop real-time mortgage rates and get instant qualification results without providing any contact information visit LendZen.com

LendZen provides a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront as bond prices change.

DISCLOSURES

LendZen Inc. is an equal opportunity mortgage lender, NMLS 375788.