Mortgage Rate Data Deluge – OCT 13 🏠📉🔒

Here is a deluge of mortgage rate data to start your week!

MARKET RECAP 📉

------------------

Last week was another snoozer, with the shutdown affecting data releases and nothing new revealed from the FOMC minutes.

The only excitement came on Friday when Trump threatened China with new tariffs, triggering a risk-off bond rally and a massive crypto liquidation event.

More on the crypto sell-off later this week, after we see how traders respond.

Prior to Friday, gold was performing far better than bonds as a risk-off hedge, something I discussed in this previous Substack post.

But after cresting the $4K level for the first time ever, gold lost some of its luster on Friday, giving bonds a welcome boost in an otherwise dull week.

However, things could get interesting next week, with the planned release of CPI inflation even amidst a continued shutdown.

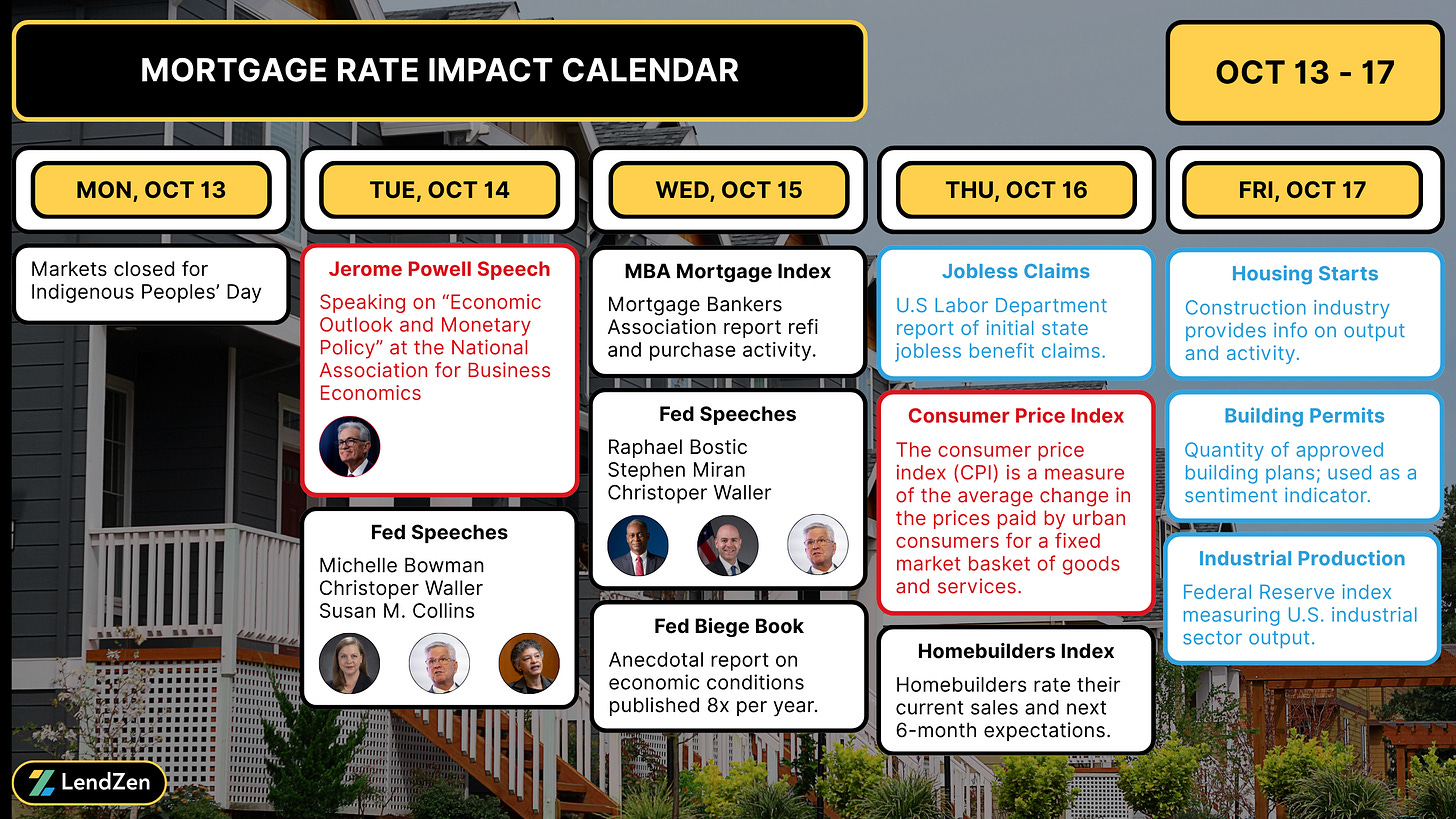

For more detailed coverage of the week ahead, including the latest Mortgage Rate Impact Calendar, check out yesterday’s Substack Post.

MORTGAGE RATE PRICES 📉

------------------------------

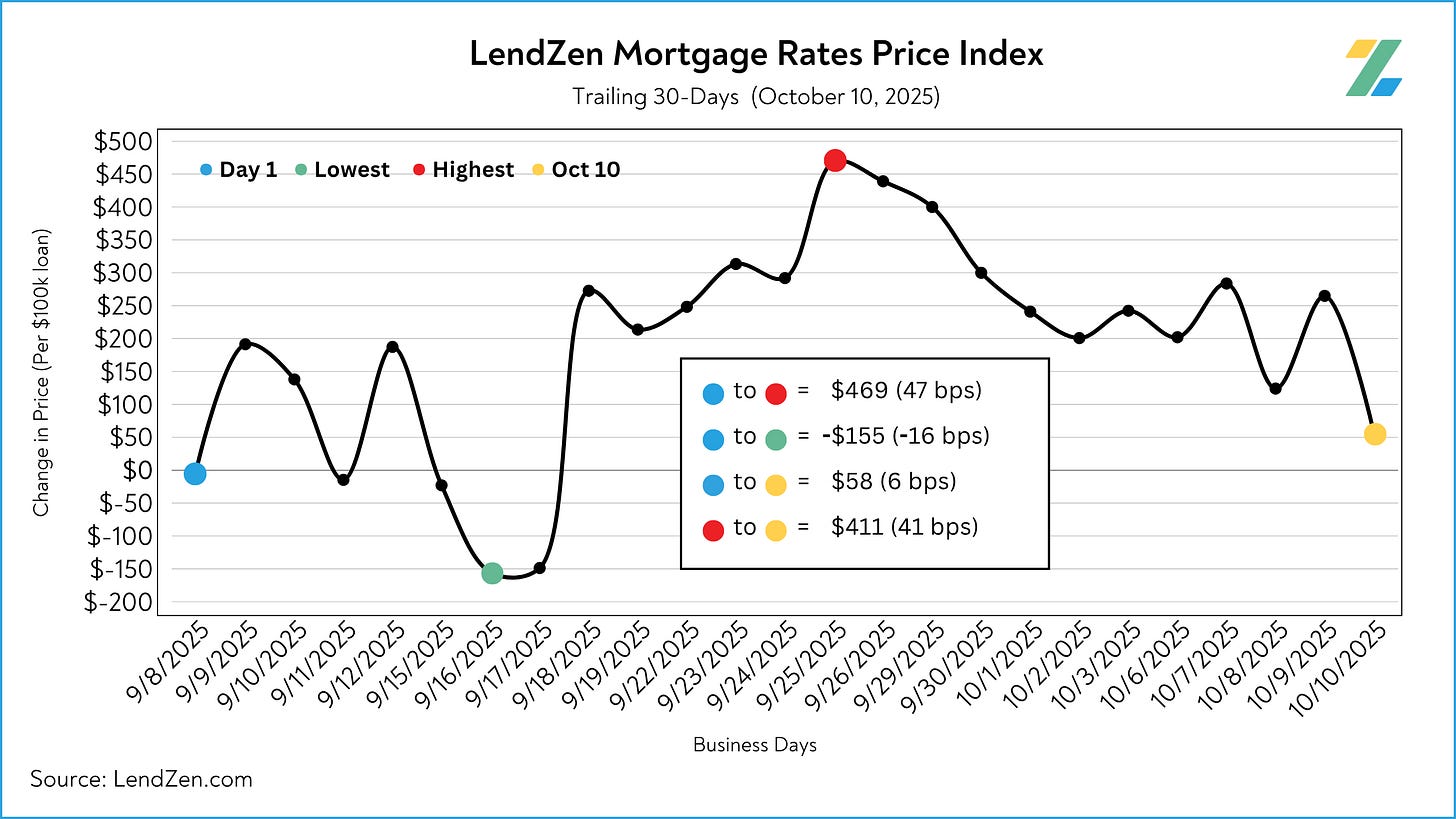

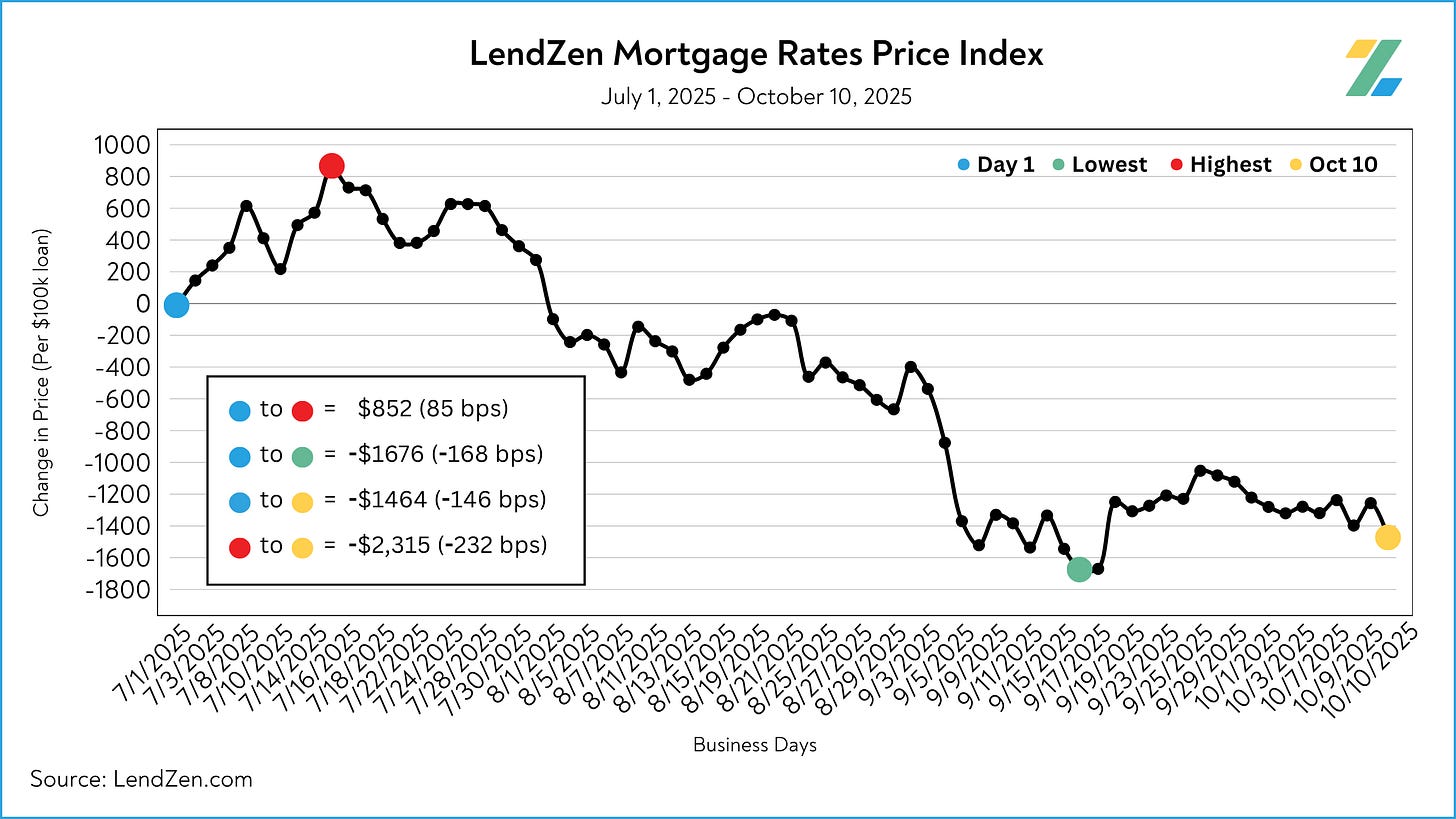

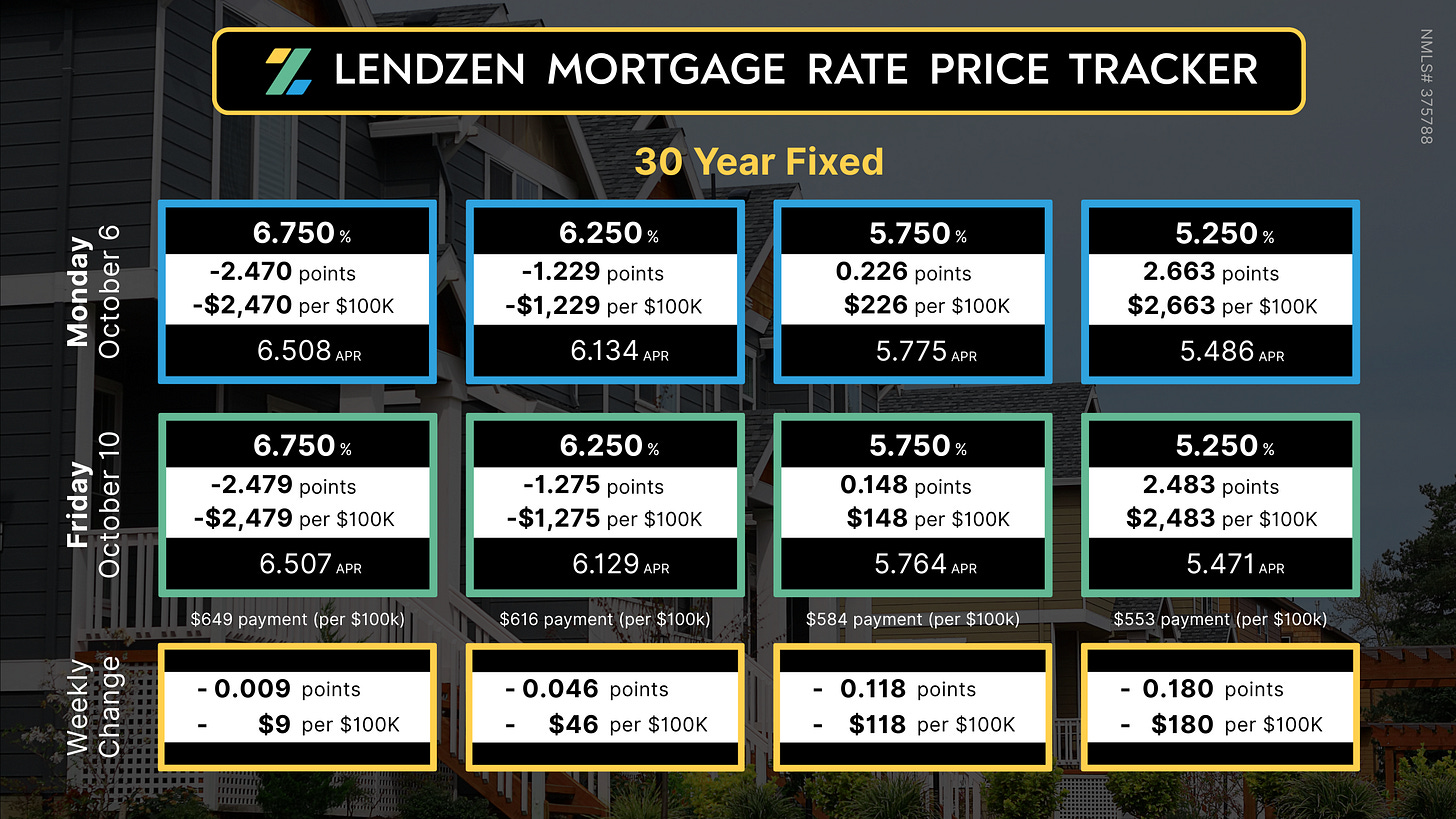

Mortgage rates do not rise or fall, instead the PRICE of rates change.

The LendZen Index calculates a daily change in the price of mortgage rates by tracking a spectrum of mortgage-backed securities (MBS).

This provides borrowers with a more specific measurement of how the cost to obtain a mortgage is changing, regardless of the lender, rate, or credit score.

-----------

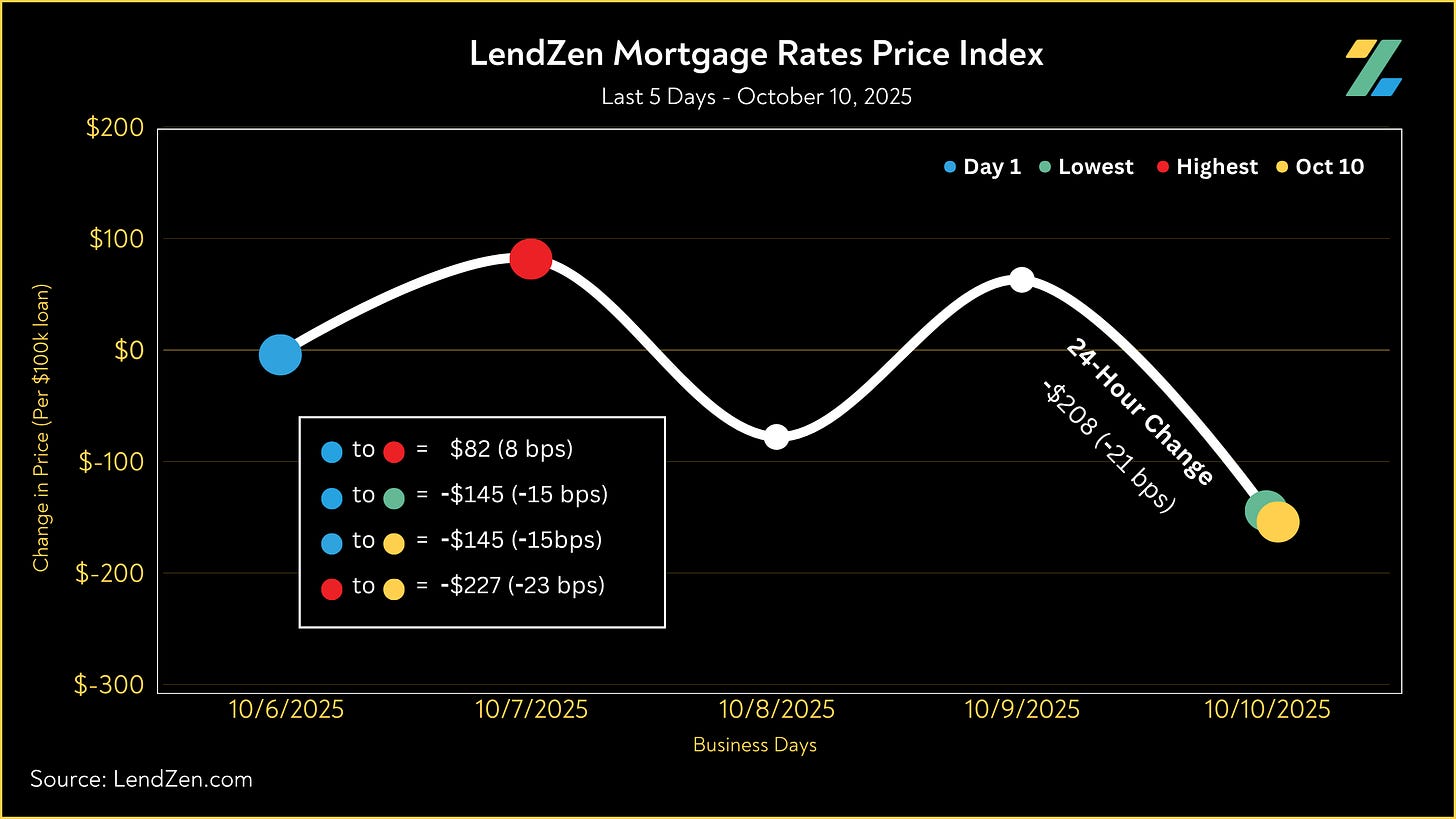

10/10/2025

-----------

24-Hour: -21 bps (-$208 per $100K)

5-Day: -15 bps (-$145)

10-Day: -36 bps (-$356)

30-Day: +6 bps ($58)

Since July 15: -232 bps (-$2,315 less expensive per $100K)

The Friday bond rally gave mortgage rate prices a 20 basis points improvement.

However, when we zoom out further, we can see this is just a round trip back to where we started a month ago.

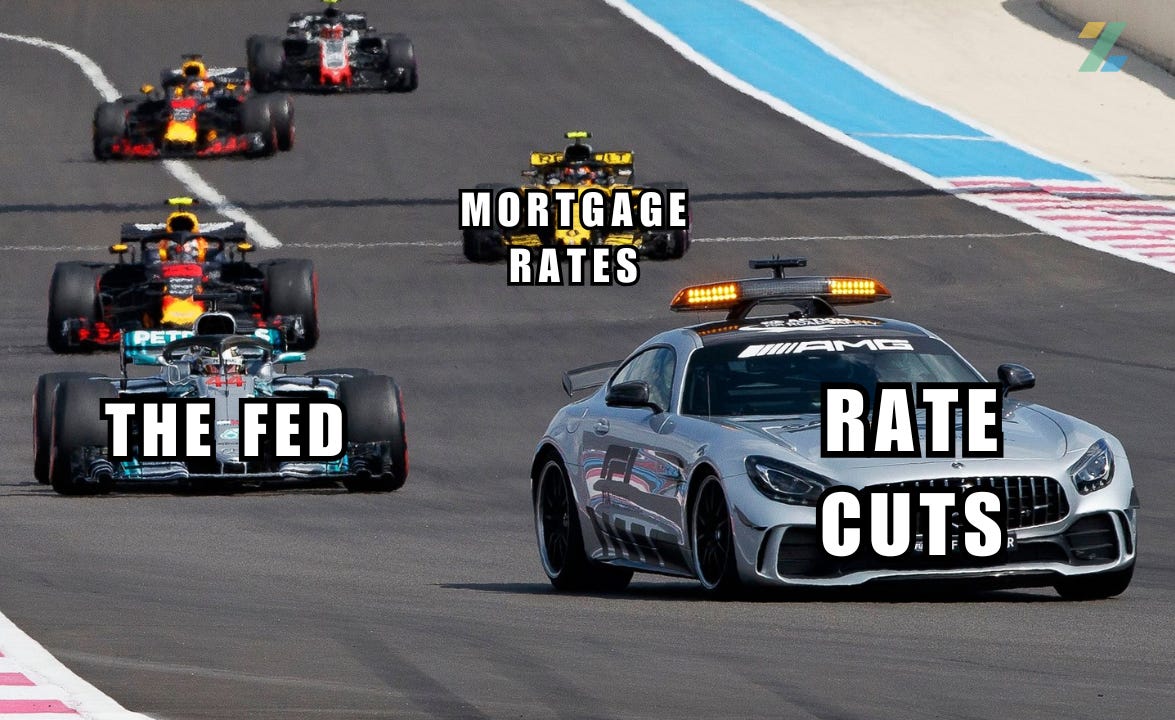

The good news is we finally retraced the sell-off that was initiated after the Fed announced their first rate cut of 2025 on September 17th.

This brings back into focus the longer-term trend we’ve enjoyed since the July 15th high.

The LendZen Index monitors the change in price across a broad set of rates and mortgage bond coupons, whereas the LendZen Mortgage Rate Price Tracker is more a rate and loan program specific example of how mortgage rates do not rise or fall but instead it is their price that changes.

See Friday’s price tracker results on this Substack Post.

MORTGAGE SPREADS 🧈

-------------------------

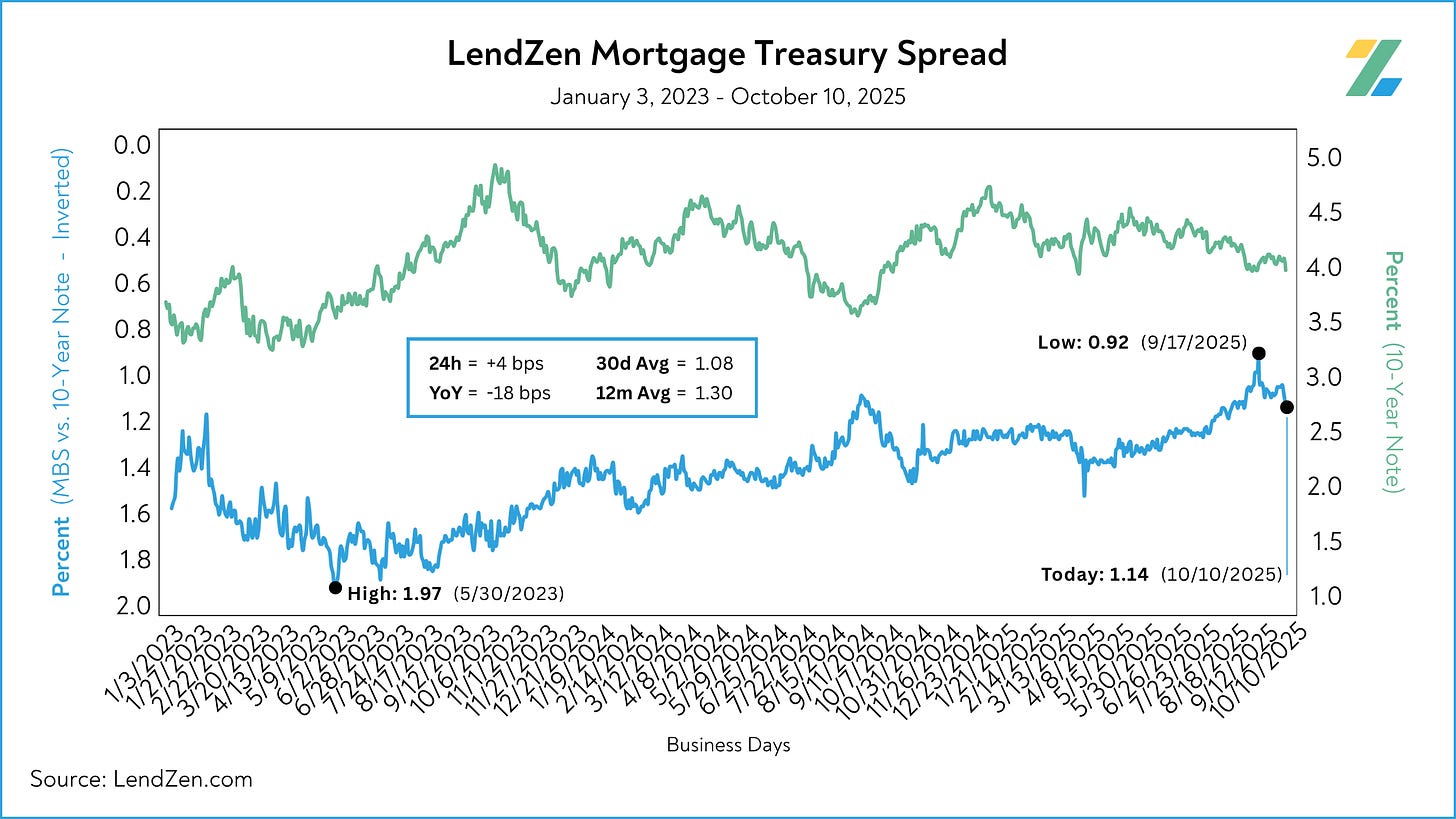

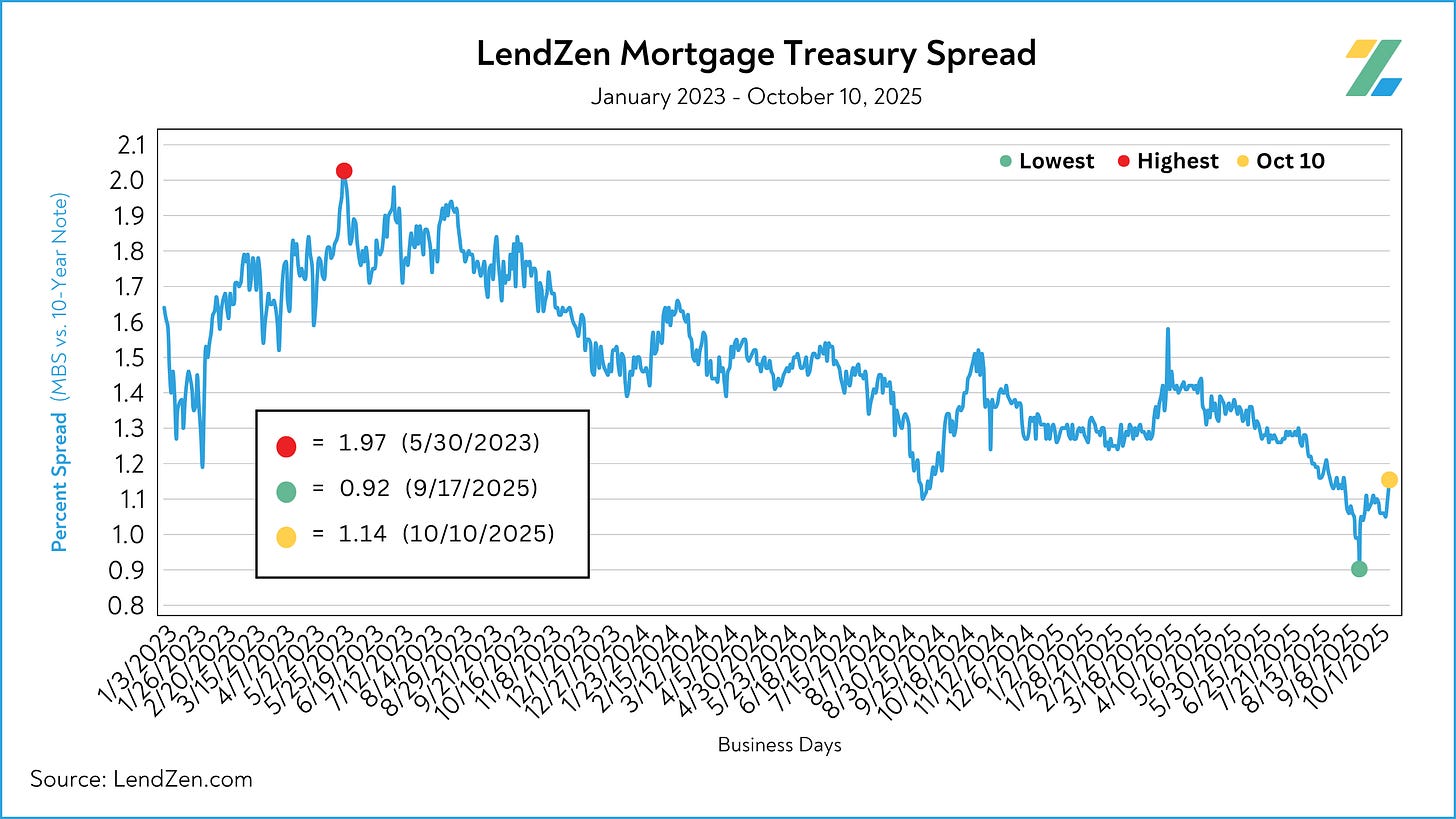

Published daily with the LendZen Index is the LendZen Mortgage-Treasury Spread.

The LMTS uses actual bond yields to create a historically consistent, and reliable, data set.

Learn more about the importance of accurately calculating spreads on this Substack post.

The spread between mortgage bonds and the U.S. 10-Year widened for the 2nd day in a row on Friday as the Treasury rally outpaced MBS.

Oct 6 = 1.06

Oct 10 = 1.14

30d Avg = 1.08

12m Avg = 1.30

YoY = - 18 bps (1.32)

RATE LOCK GUIDE 🔒

---------------------

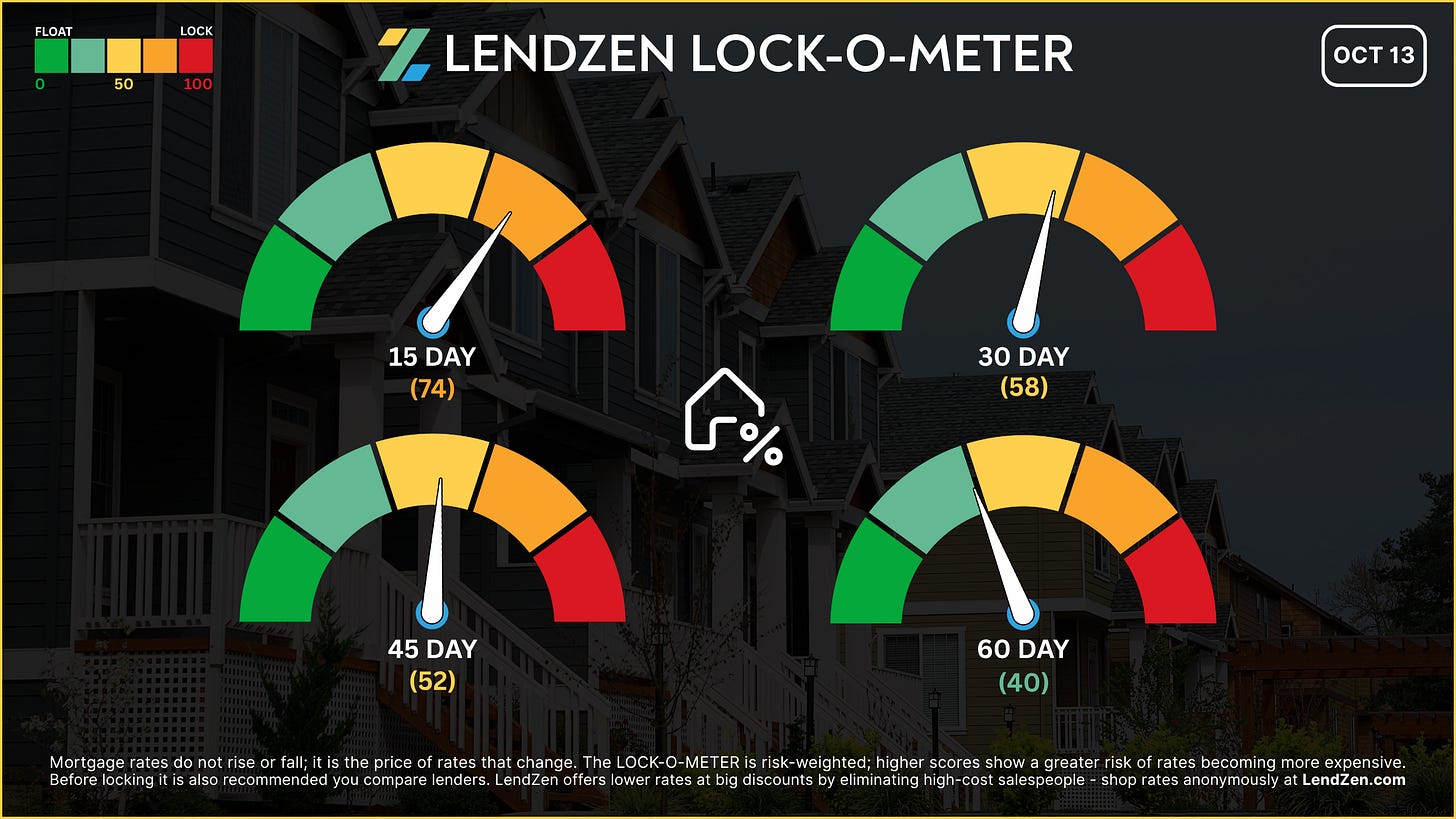

The LendZen LOCK-O-METER provides borrowers with a risk-weighted score based on how various macroeconomic events, including market data, central bank announcements, and geopolitics, each historically impacts the price of bonds.

higher risk scores = lean towards locking

------------------

Closing Window

------------------

[ 15 Days ] -- 74 🟠

Expect higher volatility from CPI report next week. Friday’s small win brings us back within mult-week lows, creating a strong case to lock although the possibility of a positive breakout exists if inflation is showing early signs of a winter chill.

[ 30 Days ] -- 58 🟡

Bond-friendly CPI could extend the rally, but risk of a “hot” surprise warrants caution. Equally floaters should closely monitor shutdown news and potential release dates of NFP employment data.

[ 45 Days ] -- 52 🟡

Although longer lock windows generally score lower, the potential for sizeable adjustments is possible in the weeks ahead, as there are a number of potential ticking time-bombs that could go either way for bonds.

[ 60 Days ] -- 40 🟢

The trend is still your friend, and the probable outlook is a slowing economy, but keep a close watch for the backlog of economic data that will be released once the government reopens.

If you are already in a strong position, locking makes the most sense since the focus should be on making a savvy rate choice based on your longer-term rate outlook.

I expand on this “long game” approach in this Substack article.

Thanks for reading.

If you are interested in more mortgage insights, then I suggest checking out this recent Substack article.