Mortgage Rate Data Deluge - OCT 6 🏠📉🔒

Here is a deluge of mortgage rate data to start your week!

MARKET RECAP 📉

------------------

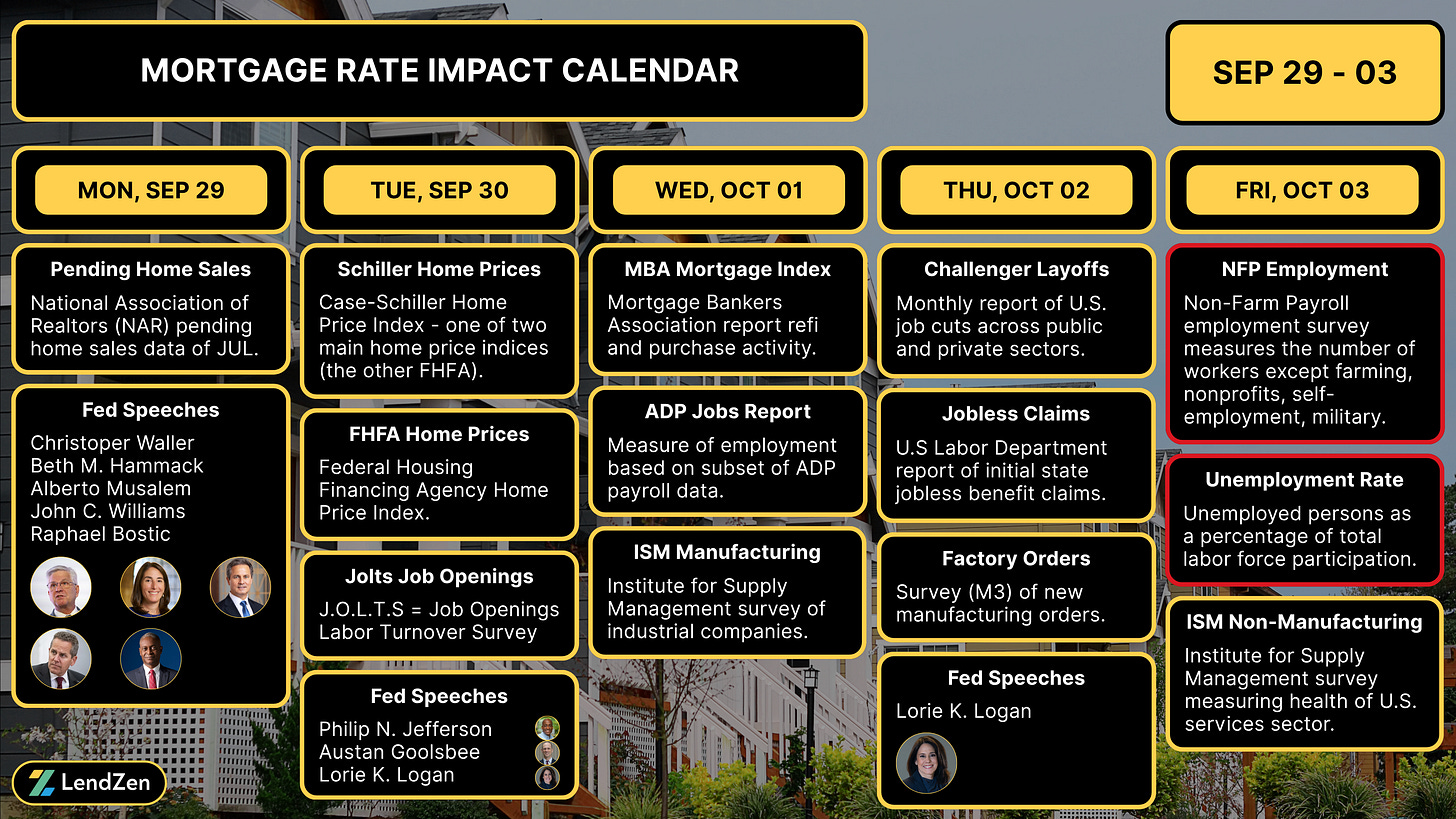

Last week was expected to be a major market mover with the Non-Farm Payroll employment data scheduled to be released on Friday.

In August the NFP was the biggest contributor to mortgage rate prices reaching levels not seen since the same time last year.

Hopes were high that another bond friendly report could usher in a wave of refinance activity that had only just begun prior to the Fed’s September 17th rate cut.

That decision quickly added 50 bps to the price of rates, making breakeven timelines less attractive.

Learn more about why breakeven timelines influence refinance decisions in this Substack article.

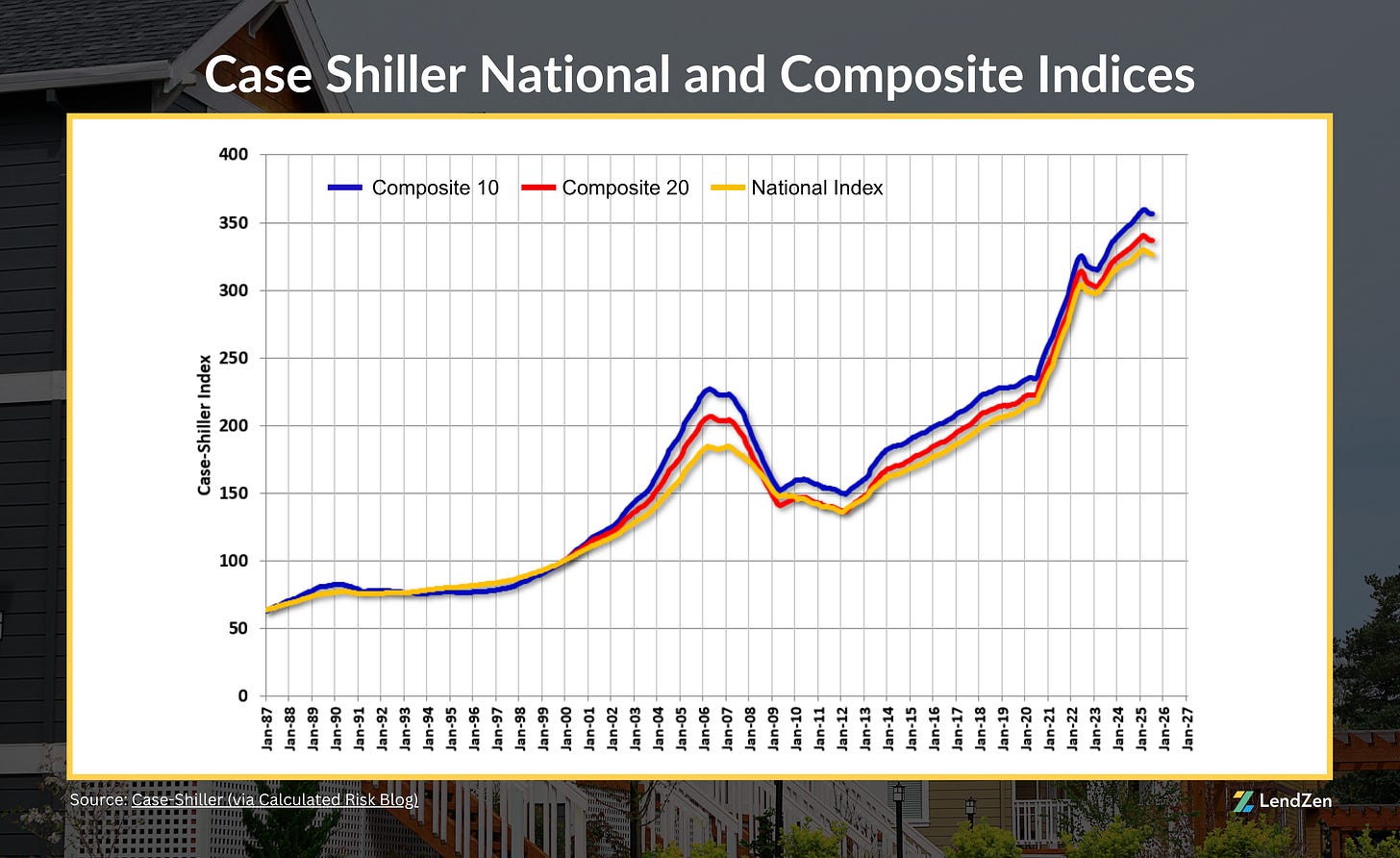

Prior to the shutdown we did receive home price data from the FHFA and Case-Shiller Home Price Indices.

Both showed prices continued to soften with the Case-Shiller reporting a month-over-month decline of -0.06%.

Not significant on its own, but it makes the fifth consecutive MoM decline.

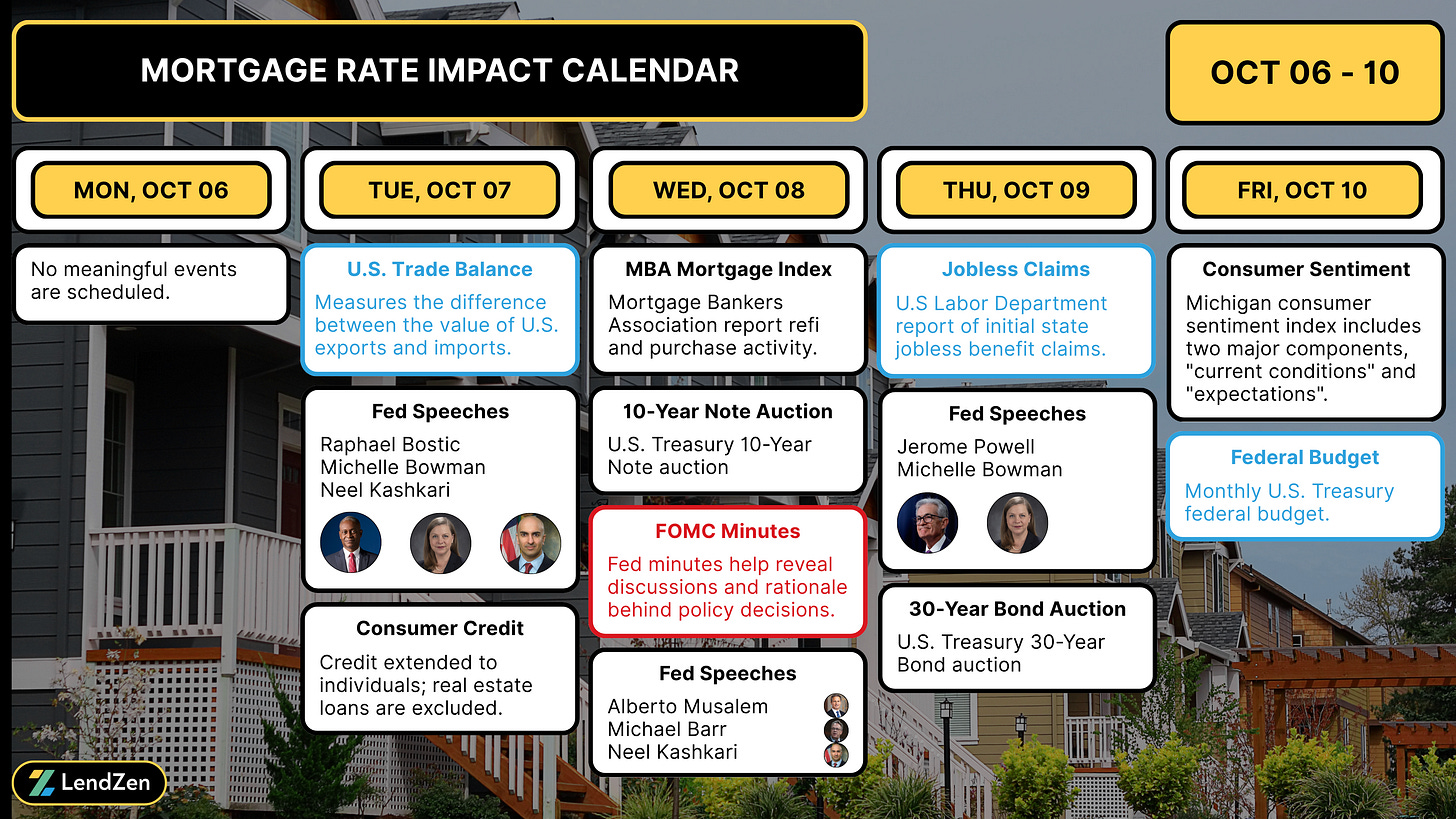

This week there are a number of scheduled events still worth watching even if the government shutdown continues.

See the attached Mortgage Rate Impact Calendar – events marked blue could be delayed by the shutdown.

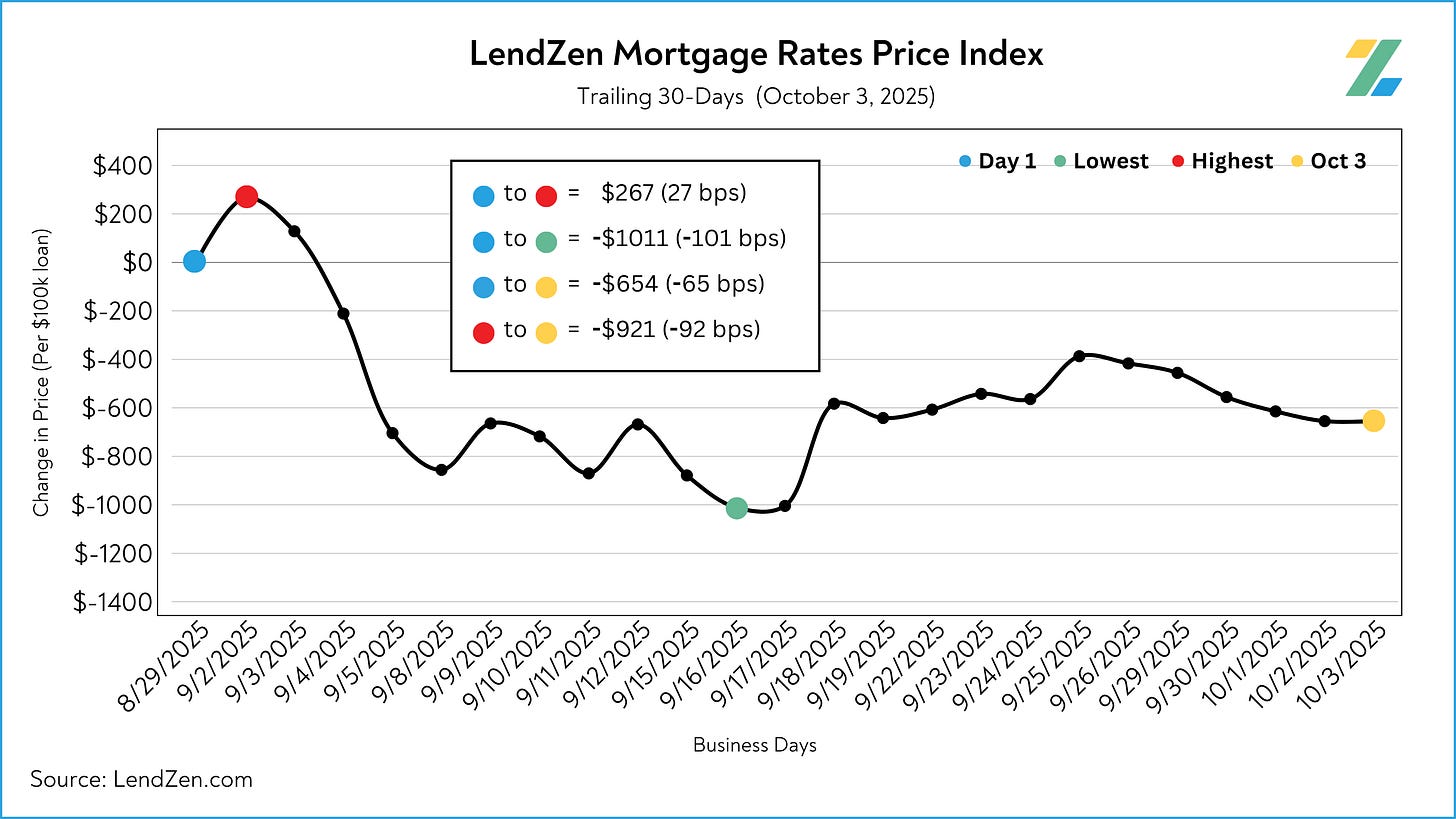

MORTGAGE RATE PRICES 📉

-----------------------------

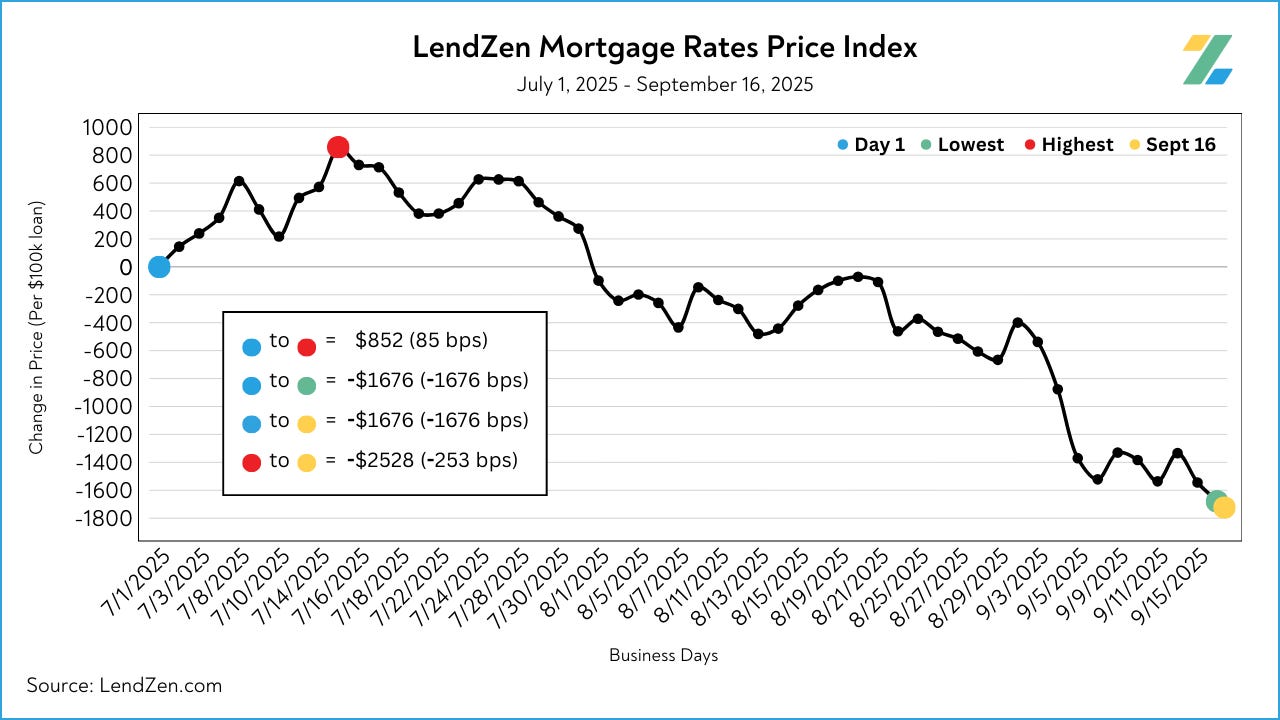

Mortgage rates do not rise or fall, instead the PRICE of rates change.

The LendZen Index calculates a daily change in the price of mortgage rates by tracking a spectrum of mortgage-backed securities (MBS).

This provides borrowers with a more specific measurement of how the cost to obtain a mortgage is changing, regardless of the lender, rate, or credit score.

-----------

10/03/2025

-----------

24-Hour: +1 bps ($6 per $100K)

5-Day: -19 bps (-$194)

10-Day: -4 bps (-$43)

30-Day: -65 bps (-$654 less expensive per $100K)

At one point mortgage rate prices declined over 250 basis points from the July 15 high but have given up about 35 bps of that since the Fed rate cut.

Fortunately, the 30-Day trend is still positive with the cost to obtain a $500K mortgage down $3,250 from a month ago.

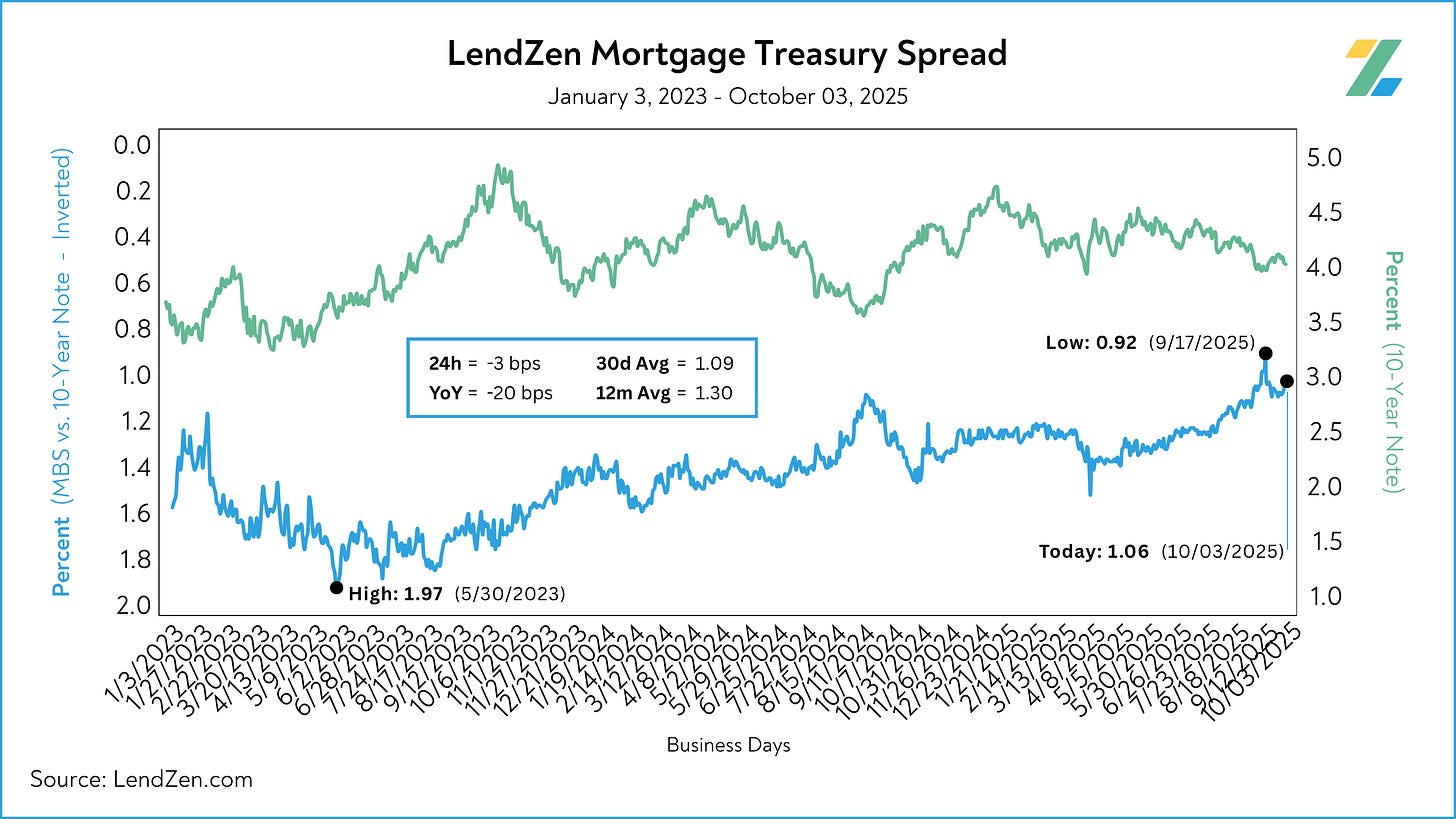

MORTGAGE SPREADS 🧈

-------------------------

Published daily with the LendZen Index is the LendZen Mortgage-Treasury Spread.

The LMTS uses actual bond yields to create a historically consistent, and reliable, data set. Learn more about the importance of accurately calculating spreads on this Substack post.

The spread between mortgage bonds and the 10-Year Note showed improvement, tightening 5 bps on the week.

Sep 29 = 1.11

Oct 03 = 1.06

12m Avg = 1.30

YoY = - 9 bps

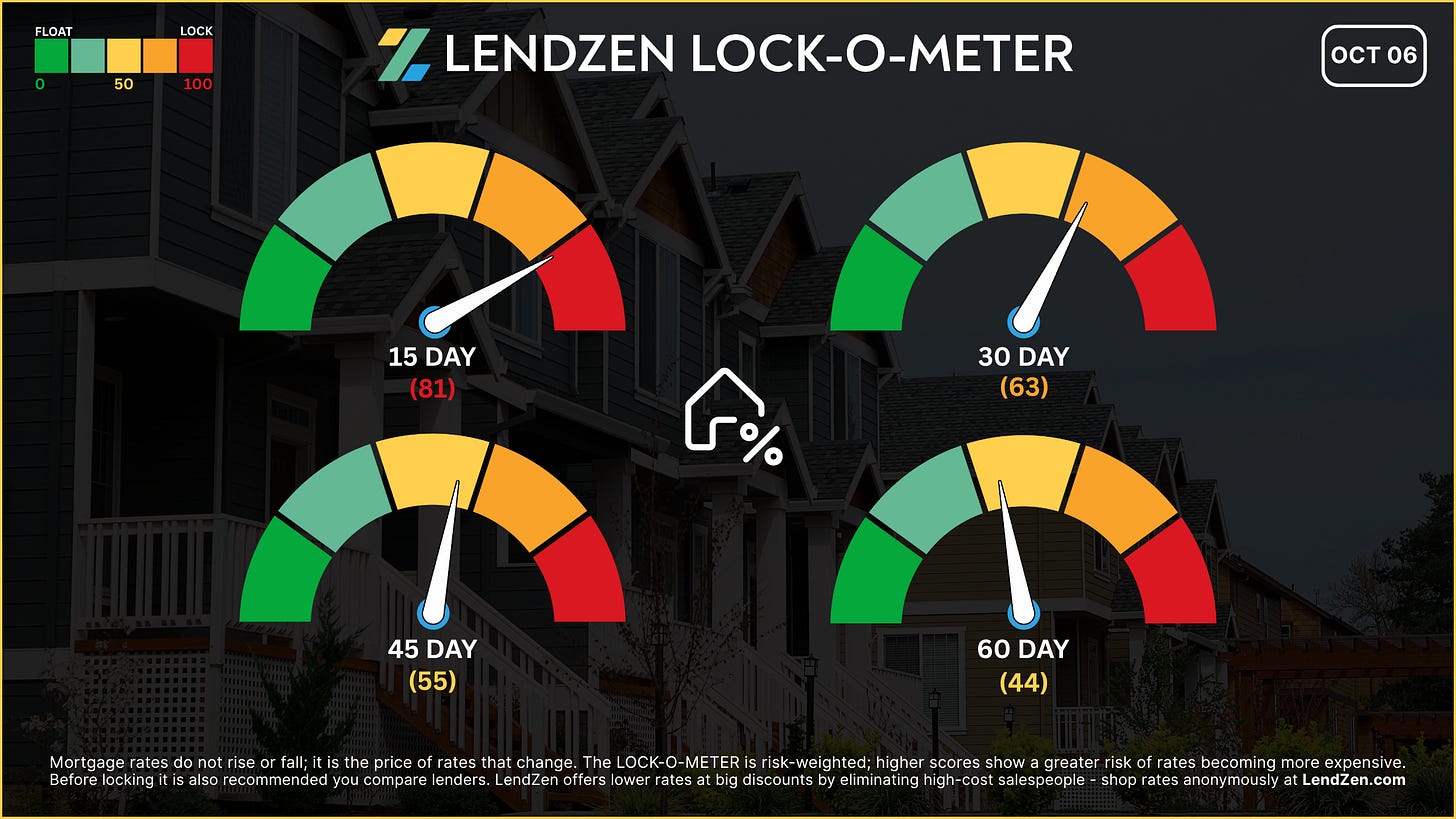

RATE LOCK GUIDE 🔒

---------------------

The LendZen LOCK-O-METER provides borrowers with a risk-weighted score based on how various macroeconomic events, including market data, central bank announcements, and geopolitics, each historically impacts the price of bonds.

higher risk scores = lean towards locking

------------------

Closing Window

------------------

[ 15 Days ] -- 81 🔴

Besides a potentially dovish Fed minutes, there is little that favors floating with lockdown volatility high.

[ 30 Days ] -- 63 🟠

Risk/reward is split. Until the release date for NFP becomes clearer short-term volatility will drive longer-term outlook.

[ 45 Days ] -- 55 🟡

Bond markets may get a double whammy of employment and inflation data release simultaneously depending on when the government shutdown ends.

[ 60 Days ] -- 44 🟡

Signs of economic weakness are showing up in key sectors like shipping. If the breadcrumbs lead to favorable inflation data, then long-term floaters could benefit.

If you are already in a strong position, locking makes the most sense since the focus should be on making a savvy rate choice based on your longer-term rate outlook.

I expand on this “long game” approach in this Substack article.

Thanks for reading.

If you are interested in more mortgage insights, then I suggest checking out this recent Substack article.